Kwakol Markets Review 2025

See the top 3 alternatives to Kwakol Markets or the best UK brokers list for options.

|

|

Kwakol Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Kwakol Markets |

| Kwakol Markets Facts & Figures |

|---|

Kwakol Markets appears closed and has triggered multiple complaints to Daytrading.com |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Demo Account | Yes |

| Min. Deposit | £250 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, FINTRAC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | CFDs are available on a breadth of underlying assets, including stocks, indices, commodities, forex and cryptos. High leverage up to 1:500 is available alongside a 0.01 minimum lot size and award-winning software. For the tightest spreads from 0 pips, opt for the Premium account. |

| Leverage | 1:1000 |

| FTSE Spread | 0.8 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 0.8 |

| Stocks Spread | 0.8 |

| Forex | Kwakol Markets offers a wider range of forex pairs than most competitors, with 90+ assets available. Users get fast execution speeds and competitive spreads through the ECN model. On the negative side, not all currency pairs are available on MT4. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.8 |

| Assets | 90+ |

| Stocks | Clients get commission-free exposure to US, EU, Asian and Russian stock markets on both the MT4 and MT5 platforms. Traders can also save time by utilizing the automated stock market insights in the AutoChartist scanning tool. |

| Cryptocurrency | You can trade cryptos against cryptos, fiat currencies, and even metals like gold. This separates the broker from many alternatives that only offer cryptos paired with the USD. Additionally, with high leverage up to 1:20, Kwakol Markets is a top choice for crypto traders. |

| Coins |

|

| Spreads | From 0.8 pips (Standard Account) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Kwakol Markets is a Nigerian-based, multi-asset broker. UK traders can invest in 1000+ financial instruments with spreads as low as 0 pips and leverage up to 1:1000. This Kwakol Markets review will cover how to sign-up and log in, account types, trading platforms, deposit and withdrawal methods, and more.

Kwakol Markets offers an excellent range of tradable assets with competitive pricing, beginner-friendly tools and copy trading. On the downside, the broker is not regulated by the FCA in the UK.

Company History & Overview

Kwakol provides research, technology, and financial services solutions, with a separate entity for its online brokerage. The mission of the company is “to promote customer-centric access to wealth-building opportunities enabled by technology innovations in global finance”.

Kwakol Markets Limited is registered in Saint Vincent and the Grenadines and is unregulated for UK traders. However, the broker does offer negative balance protection and has picked up multiple awards, including the Best Emerging Broker 2022 at the UF Awards.

Markets & Instruments

Kwakol Markets offers a wider selection of instruments than many alternatives, including cryptocurrency. In total, there are more than 1000 assets available:

- Indices – Invest in 10+ major stock indices including the FTSE 100, CAC 40, and GER 30

- Stocks – Trade 135+ popular US, Asian, European, and Russian company stocks via CFDs

- Forex – Trade 100+ major, minor and exotic currency pairs such as GBP/AUD, USD/GBP, and EUR/GBP

- Commodities – Trade the spot price of five precious metals vs fiat currencies and three energies including Gold vs GBP, Palladium vs GBP, and Brent Crude Oil

- Cryptocurrency – Speculate on the price of six major digital currencies vs alternatives and fiat money. This includes Ripple vs GBP, Ethereum vs Bitcoin Cash, and Litecoin vs GBP

The broker also boasts fast order executions with an average speed of 12ms and no requotes.

Kwakol Markets Platforms

Kwakol Markets offers three trading platforms; MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary Web Trader.

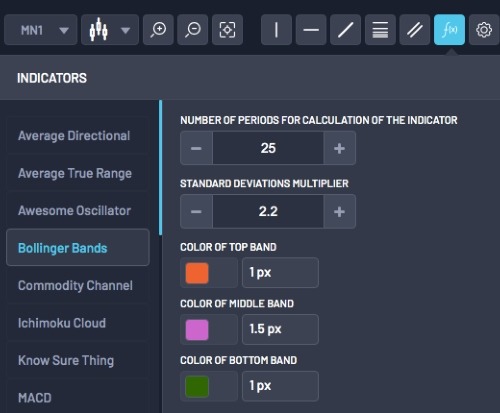

Web Trader

The broker’s bespoke web terminal features an intuitive layout with custom features. Our experts were pleased to see a modern design, unlike the relatively outdated feel of the MetaTrader terminals. You can filter by top market movers and popular assets. Symbols can also be organised into a favourites list.

The platform offers 20 in-built indicators including Bollinger Bands, Stochastic RSI, and Weighted Moving Average, plus nine charting timeframes, the same as MT4.

Web Trader

How To Place A Market Order

- Select an instrument from the symbols list in the left-hand side or search for an asset in the nav bar

- Click on ‘Create Order’ next to the symbol name

- In the order window use the ‘+’ or ‘-‘ symbols to increase/decrease the volume

- Add a ‘Take Profit’ and/or ‘Stop Loss’ price

- Review the spread/commission fee

- Select ‘Buy’ or ‘Sell’

Note, you can also open a pending order in the same window. Ensure the ‘Pending Order’ icon is selected at the top.

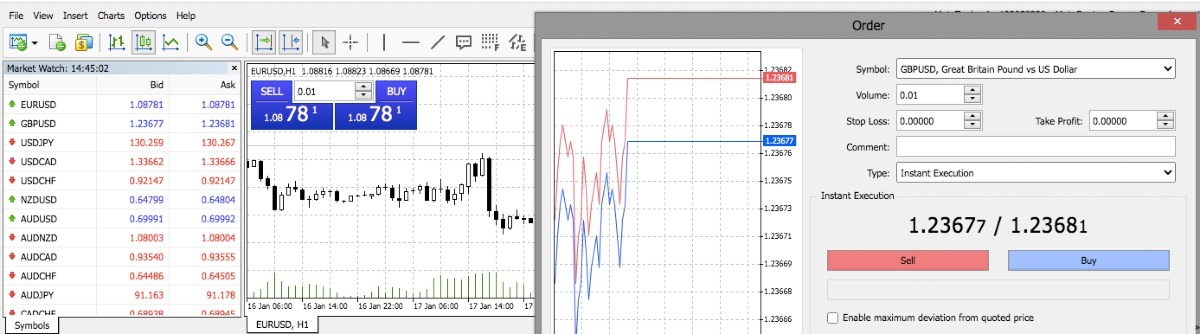

MT4 & MT5

MetaTrader 4 and MetaTrader 5 are multi-asset platforms with advanced features. Both solutions offer a wide range of technical analysis tools, full interface customisation, and automated trading services.

MT5 is the better fit for experienced traders, with more sophisticated features such as Market Depth, an integrated economic calendar, 21 chart timeframes, 38 technical indicators, 44 graphical objects, and a multi-threaded strategy tester.

MT4 offers everything you need to execute most short-term trading strategies, including four pending order types, 30 in-built technical indicators, 31 graphical objects, and nine charting timeframes. MT4 is particularly popular with forex traders.

MetaTrader 4

Fees & Charges

Kwakol Markets offers fairly standard fees unless you make a large deposit and qualify for a higher-tier account.

For beginners, we would recommend the Standard profile given that it has the lowest minimum deposit requirement (£250) whilst still offering competitive floating spreads from 0.8 pips.

The more advanced profiles, including Pro and Gold, offer tighter spreads from 0.01 pips, however, they come with a minimum deposit of £10,000 and £25,000, which will be too high for some aspiring investors. Commission fees are in line with most of the industry.

Kwakol Markets also charges overnight fees for all account types except for the Islamic profile. In addition, a £10 monthly charge applies to dormant accounts after six months.

Mobile App

Kwakol Markets does not offer a proprietary app, though its Web Trader terminal can be accessed via internet browsers on mobile and tablet devices.

When we used Kwakol Markets, we could still view charts and pricing information, though the zoom functionality did make analysis more challenging. Trades can be opened and exited with a few swipes and clicks.

MT4 and MT5 are available to download to Android devices only. Traders can stay in the loop of market movements and price changes while on the go. Both platforms benefit from the full functionality found on the desktop platforms, meaning market analysis, account management, and in-app support.

Payment Methods

Deposits

You can start trading with Kwakol Markets from £250 with the Standard account. This is notably higher than some competitors, including CMC Markets (no minimum requirement), AvaTrade (£100), and FP Markets (£100). The next account tier also has a significant minimum requirement of £10,000, which won’t be suitable for many traders just starting out.

The broker accepts a good range of payment methods, however, customers are only permitted to deposit in US Dollars or Naira. For UK investors, this means a currency conversion may be required.

Processing times vary by deposit method, though Kwakol Markets aims to process all requests within one hour. The broker does not charge fees for the majority of payments, including no fees for card payments up to $5000. With that said, third-party transaction charges may apply.

Accepted payment methods:

- Cryptocurrency

- Credit/Debit Cards

- Bank Wire Transfer

How To Make A Deposit

- Log in to the client dashboard

- Visit the ‘Funds’ page and select ‘Deposits’

- Click on the desired payment method

- Add the value to deposit

- Click ‘Proceed’

- Complete the required payment details

- Click submit

Note, some payment methods, including bank wire transfers, require a proof of successful transaction receipt to be uploaded in the client area.

Withdrawals

You must use the same payment method for both deposits and withdrawals.

The broker processes requests on the same working day, though the time for funds to be received back to your account varies by method.

A $25 fee applies for bank wire transfer withdrawals over $5000.

Demo Account

Kwakol Markets offers demo trading on all platforms including its proprietary terminal. Traders will receive 10,000 USD in virtual funds to practice trading risk-free.

As the Web Trader is bespoke to the broker, it could be worth spending some time learning what the platform has to offer before trading with real money.

Demo Trading – Indicators

How To Open A Demo Account

- Register for a Kwakol Markets account

- From the client dashboard toggle to the ‘Demo’ icon on the ‘Accounts’ page

- Select ‘Add New Account’

- Open the platform and login with the demo credentials

- Start trading risk-free

Bonuses

At the time of writing, the brand did not offer any bonuses to new or existing customers. For UK clients this is not uncommon as the ESMA bans regulated broker-dealers from using financial incentives to encourage higher trading volumes.

Instead, make use of Kwakol Markets’ educational content and free plug-in tools to give yourself a competitive edge.

UK Regulation

Kwakol Markets is not regulated or authorised by the UK’s Financial Conduct Authority (FCA). Retail investors from the United Kingdom will trade with the offshore entity, registered in Saint Vincent and the Grenadines. This is currently unregulated, which can be a red flag.

Having said that, all client funds are held separately from company money in top-tier banks. Additionally, investors benefit from negative balance protection, meaning you cannot lose more than you invest.

Our experts are confident that the broker is a legitimate and credible company. The Kwakol Markets Pty Limited entity holds a license from the Australian Securities and Investments Commission (ASIC), which is renowned for its stringent rules and requirements.

Note, UK traders will need to adhere to the broker’s KYC protocols. This means you will need to upload identity verification documents before trading with real money.

Leverage

As Kwakol Markets is not regulated by an EU financial authority, it is not restricted in terms of the leverage it can offer (typically 1:30 at FCA-regulated brokers).

Instead, the trading firm offers substantial leverage up to 1:1000, though this is only available to VIP account holders (minimum deposit of £1 million). The Kwakol Markets Standard account offers leverage up to 1:200 only.

Remember, although trading with a 200x leverage can boost profit potential, it can also amplify losses.

Kwakol Markets Accounts

Kwakol Markets offers seven retail accounts and one swap-free Islamic profile. This is considerably more than most brokers and it should make it easier for traders to find an account that suits their strategy and goals.

Trading conditions vary between account types, most notably the minimum deposit requirement. It is also worth reviewing the pricing conditions such as the spreads and leverage available as these vary significantly between profiles.

Standard Account

- Commission-free

- Leverage up to 1:200

- £250 minimum deposit

- Floating spreads from 0.8 pips

- Market execution, from 0.1-second processing

Pro Account

- Leverage up to 1:300

- Instant order execution

- No maximum order limits

- £10,000 minimum deposit

- Floating spreads from 0.01 pips

Gold Account

- Leverage up to 1:400

- £25,000 minimum deposit

- Floating spreads from 0.01 pips

- STP order model, from 0.3-second processing

Platinum Account

- Leverage up to 1:450

- £100,000 minimum deposit

- Floating spreads from 0 pips

- STP order model, from 0.3-second processing

Diamond Account

- Leverage up to 1:450

- £250,000 minimum deposit

- Floating spreads from 0 pips

- STP order model, from 0.3-second processing

Premium Account

- Leverage up to 1:500

- £25,000 minimum deposit

- Floating spreads from 0 pips

- STP order model, from 0.3-second processing

VIP Account

- Leverage up to 1:1000

- Floating spreads from 0 pips

- £1,000,000 minimum deposit

- STP order model, from 0.1-second processing

Swap-Free (Islamic) Account

- Commission-free

- £1 minimum deposit

- Leverage up to 1:1000

- Floating spreads from 1.6 pips

- STP order model, from 0.3-second processing

How To Open A Kwakol Markets Account

New users can open a Kwakol Markets live trading account in under five minutes. After following the ‘Visit’ button in this review:

- Complete the first page of the registration form including choosing an account type

- Add your personal details on pages two and three, including contact information

- Review and agree to the terms and conditions

- Select ‘Sign Up’

Once you have signed in, you can open an alternative account, or register for a demo profile.

Note, account verification is required to make a deposit and start trading. Click on the ‘Unverified’ icon in the top menu of the client dashboard. Here you can upload identity documents and proof of residency.

Extra Tools

Kwakol Invest

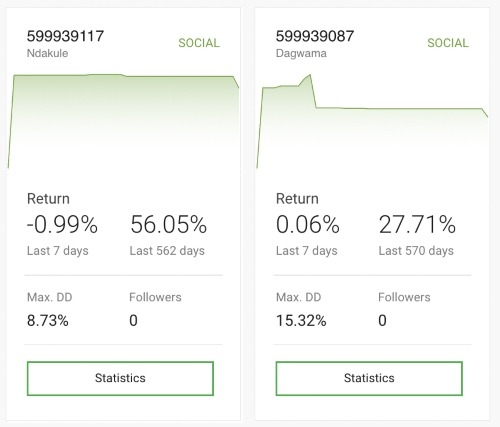

Kwakol Invest is the broker’s intuitive copy trading service. It can help beginners or those with limited market knowledge to earn money via professional traders.

As a copy trader, you retain full financial control, with the option to stop, pause or start copying at any time. A fee is paid to the professional trader only once a profit is generated.

It is worth spending some time researching potential traders to copy before investing your money. Although past performance is not a guarantee of future trading success, you should consider their attitude to risk and instrument-specific experience.

Copy Trading Leaderboard

Autochartist

Kwakol Markets offers the Autochartist MT4/MT5 plugin. This can be installed and used directly through either platform.

The Autochartist tool analyses market conditions, trends, and chart patterns to distinguish trading opportunities in real-time. The solution monitors the markets 24 hours a day, saving you hours of desk time.

You can also set alerts and receive signals to a mobile device or directly in the platform.

Acuity

Acuity is a simple-to-use tool that can help identify market opportunities. It uses a range of data sets, news publications, and market sentiment to present intuitive data displays with forward-looking predictions and potential openings.

Information can be visualised in simple charts and graphs to compute the market predictions of individual instruments within an asset class. You can also view market sentiment graphs with details of bullish and bearish activities.

On the downside, this tool is compatible with the MT4 terminal only.

Kwakol Academy

While using Kwakol Markets, our experts were impressed with the educational platform and online learning academy. The broker offers a range of free e-book downloads and access to live market news and research articles.

You will need to register for an account to access the Kwakol Markets courses. The dashboard enables users to sign up for specific training categorised by instrument, experience level, or learning style. Information includes virtual quizzes and guides, plus how to use the Autochartist and Acuity trade analysis tools. Although some of the content is beginner-level, experienced traders can still find something to develop their skills.

Some useful calculators can also be found on the broker’s website including a currency converter tool and Fibonacci trend movement analysis.

Opening Hours

Kwakol Markets follows standard market trading hours, which vary by instrument. For example, the UK stock market is open between 8 AM to 4:30 PM (GMT) Monday to Friday. Retail investors can trade cryptocurrencies over the weekend.

MetaTrader uses a global server so check the platform’s hours are reflective of the UK timezone.

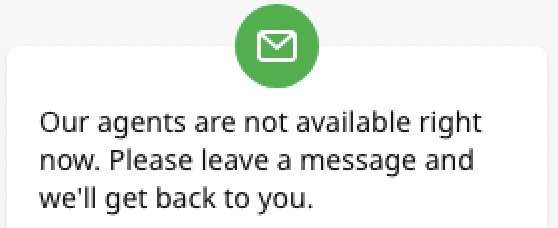

Customer Service

Kwakol Markets falls short in terms of customer support for UK traders. When we used the live chat service a handful of times, it was offline so we were unable to get responses.

Kwakol Markets does, however, offer plenty of support and guidance through its FAQ page and help centre. This can be accessed directly through the official website. You can find plenty of step-by-step user guides.

Contact details:

- Email: admin@kwakolmarkets.com

- Telephone: +(44) 2080891164 or +(44) 7862144547

Client Safety

All withdrawals require a one-time password (OTP) to confirm the legitimacy of the request. The MetaTrader brand is also renowned for its security features which include encrypted data transmissions and RSA digital signatures.

Our experts also liked the ‘Tools Status’ page which reports any errors or security concerns across the platforms and user areas in real-time and on past trading days.

Should You Register With Kwakol Markets?

Kwakol Markets is a decent broker for UK traders. We were pleased with the range of assets, trading platforms, and tools, plus demo accounts and copy trading services.

Having said that, retail investors with more capital are certainly favoured when it comes to trading fees. In addition, many UK traders will prefer to open accounts with FCA-regulated brokers.

FAQ

Is My Money Safe With Kwakol Markets?

Kwakol Markets holds client funds separate from company money. Additionally, the broker offers UK investors negative balance protection, meaning you cannot lose more than you deposit.

On the downside, the brokerage is unregulated, so access to compensation schemes and additional safeguards may be limited.

Is Kwakol Markets A Good Broker?

Kwakol Markets offers 1000+ instruments with high leverage, tight spreads, and a choice of account types with varying trading conditions. The proprietary terminal is also modern and user-friendly and UK investors can trade on the industry-recognised MT4 and MT5 platforms.

On the downside, the broker-dealer is unregulated in the UK which is a red flag.

Can I Learn To Trade With Kwakol Markets?

Kwakol Markets offers a range of educational content and an online academy suitable for beginners. Novice traders can make use of interactive quizzes, articles, and guidance to get started with the basics of investing.

Does Kwakol Markets Have A Low Minimum Deposit?

The minimum deposit requirement at Kwakol Markets is £250 with the Standard account. This is higher than many alternatives. Also, the broker’s premium account types require a much steeper investment (£10,000 to £1,000,000).

Is Kwakol Markets Suitable For Beginners?

Yes, Kwakol Markets is set up to cater to new traders. The firm offers a demo account, copy trading, training materials, plus user-friendly platforms and apps. New traders can also open a live account in less than five minutes.

Top 3 Kwakol Markets Alternatives

These brokers are the most similar to Kwakol Markets:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Kwakol Markets Feature Comparison

| Kwakol Markets | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 0.8 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | £250 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FINTRAC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Kwakol Markets Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Kwakol Markets | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Kwakol Markets vs Other Brokers

Compare Kwakol Markets with any other broker by selecting the other broker below.

Popular Kwakol Markets comparisons: