Just2Trade Review 2025

|

|

Just2Trade is #85 in our rankings of CFD brokers. |

| Top 3 alternatives to Just2Trade |

| Just2Trade Facts & Figures |

|---|

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Stocks, ADRs, ETFs, Futures, Options, Commodities, Bonds |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, NFA, FINRA, Bank of Russia |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Lime Financial |

| Signals Service | Yes - by subscription |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | With CFDs on 20+ Polish and 30+ US stocks, as well as energies and seven global stock indices covering US, UK, European, Australian and Japanese markets, Just2Trade offers a superb selection of global assets. |

| Leverage | 1:20 |

| FTSE Spread | 0.0 |

| GBPUSD Spread | 0.0 |

| Oil Spread | 0.0 |

| Stocks Spread | Variable |

| Forex | Traders can access a decent range of 60+ major, minor and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders. |

| GBPUSD Spread | 0.0 |

| EURUSD Spread | 0.0 |

| GBPEUR Spread | 0.0 |

| Assets | 50+ |

| Stocks | As well as Just2Trade's 50+ stock CFDs, traders can access a huge variety of thousands of stocks traded on US and international exchanges. The chance to build an investment portfolio and benefit from dividends sets Just2Trade apart from most CFD brokers. |

Just2Trade is an online broker that accommodates the needs of both beginner and experienced investors. The firm boasts a wide range of assets, including stocks, forex, futures and cryptocurrencies, all of which can be found on the MetaTrader 4 and MetaTrader 5 platforms. This 2025 review will explore Just2Trade’s services in more detail, including the price per trade, deposit and withdrawal options, and UK customer service quality.

With a fee structure that will be attractive to high-volume traders and regulation by the ESMA, Just2Trade provides a top-end, competitive investing service. New traders can also get started with a low minimum deposit of $100.

Company History & Overview

This broker was established in 2007 and now operates in 130 countries with over 155,000 clients. Its registered address is in Limassol, Cyprus but with offices around the world in Europe and Asia, this is a global broker. Just2Trade has also won multiple awards, including the worldfinance.com award for Best Customer Service 2022.

We were pleased to see that the company’s online website is owned by LimeTrading (CY) Ltd, which is regulated by the reputable Cyprus Securities and Exchange Commission (CySEC). This means that the level of oversight and supervision on this brokerage is likely to be greater than that of an offshore and unregulated firm.

On the downside, the company doesn’t hold a license with the UK’s Financial Conduct Authority (FCA).

Trading Platforms

Just2Trade offers a range of trading platforms to support the needs of investors with varying abilities and trading volumes. A 100G network helps ensure fast trade execution. Our experts tested and reviewed each trading platform in more detail below.

MetaTrader 4

- Nine timeframes

- 23 analytical objects

- Financial news and alerts

- Trading signals and copy trading

- Algorithmic trading using expert advisors (EAs)

- 30 technical indicators (more available on the MetaTrader Market)

- Create your own indicators with the MQL4 programming language

- Windows, Mac, iOS (not currently available on the App Store), Android and web trading

MetaTrader 5

- VPS support

- 21 timeframes

- Trading signals and copy trading

- 80+ indicators and analytical tools

- News reports and economic calendar

- Algorithmic trading using expert advisors (EAs)

- Additional indicators available on the MetaTrader Market

- Create your own indicators with the MQL5 programming language

- Windows, Mac, iOS (not currently available on the App Store), Android and web trading

How To Make An Investment With MetaTrader 5

- Once you have opened a Just2Trade account and deposited capital, choose your preferred MT5 terminal interface (web, desktop, mobile)

- If you prefer the desktop or mobile platforms, download the toolset from the broker’s website or the relevant app store

- Log in to MetaTrader 5 with the provided login and server details

- With the platform open, select the asset list icon (far left of the toolbar) and navigate to your desired instrument to open its price chart

- If you wish to place a market order, you can simply adjust the order size parameter and click or tap the red and blue buttons (for buy and sell, respectively)

- For pending orders or extra risk management features, such as stop-loss orders, you can open the New Order screen (white page icon on the toolbar) and fill in the details there

MetaTrader 5 One-Click Trading

CQG

There are several different release versions of the CQG platform. The desktop version is free but the QTrader, Integrated Client and Trader versions all have different monthly fees and varying features. Some of CQG’s main features are as follows:

- Historical data

- Automated trading

- Clear and high-quality market data

- Futures, options and their combinations

- Access to more than 40 global exchanges

- Supports connections and integration including FIX, API and Excel

Sterling Trader Pro

This is a platform designed for professional traders and includes the following features:

- Basket trading

- Advanced charting

- Real-time scanning tools

- Level II order entry system

Lightspeed Trader

Just2Trade’s final platform is Lightspeed Trader, which is also focused towards professional traders, offering the following features:

- Level I quotes

- Optimised API

- Ultra-low latency

- Integrated charting

- Level II quote messaging

In addition to these platforms, there is also ROX, which provides access to US stocks and options exchanges.

Markets & Assets

Just2Trade has an excellent range of assets and investment products when compared with other brokers. The instruments offered include:

- 30,000+ stocks in 20 markets (including LSE, NYSE & Nasdaq)

- CFDs (stocks, commodities and indices)

- Bonds (corporate and public)

- Four precious metals

- 20 cryptocurrencies

- 90,000+ options

- 5,000+ futures

- 64 forex pairs

- ETFs

Fees & Account Types

Trading charges on Just2Trade vary depending on the account type.

In addition to commission and spreads, swap rates may apply for positions held overnight. These can be positive or negative, depending on the asset and whether it is a long or short position.

Exchange and clearing fees may also apply to specific positions.

MT5 Global

This is an MT5 access account that offers metals, stocks, futures, bonds, oil, index CFDs, stock CFDs and 50 forex instruments. The minimum deposit is £100.

- Spreads from zero pips

- CFD commission ≤ £3 per lot

- Commission on forex and metals is £2 per lot

- Overnight commission on stocks is 0.025% per day

- Commission on bonds is 0.128% of the transaction amount (minimum £10)

- Standard commission on stocks (NYSE and Nasdaq) is £0.006 per share (£1.50 minimum per trade)

- Commission on US equity options is £2.50 per contract of 100 shares (charged for entering and exiting a position)

- Standard commission on futures (customers may be eligible for a promotional discount) is £1.50 per contract and £1 for micro contracts

Global Futures

This account is for futures and options trading on the MT5 and CQG platforms.

- £1.50 per contract per side

- Exchange, clearing, regulatory, data and other fees are paid separately

Forex & CFD Standard

This account is on the MT4 platform with a £100 minimum deposit. It provides metals, oil, index CFDs, US stock CFDs and 48 forex instruments.

- Spreads from 0.5 pips

- Zero forex commission

Forex ECN

This account is also on the MT4 platform and provides access to metals, oil, index CFDs and 47 forex instruments. The minimum deposit is £200.

- Spreads from 0 pips

- Higher execution speeds

- Forex commission ≤ £3 per lot

Forex ECN Pro

This is a professional trading account on MT4 with a $100,000 minimum deposit. Traders have access to metals, oil, index CFDs and 47 forex instruments.

- Spreads from 0 pips

- Forex commission is ≤ £2 per lot

- High order execution speed and access to detailed stats

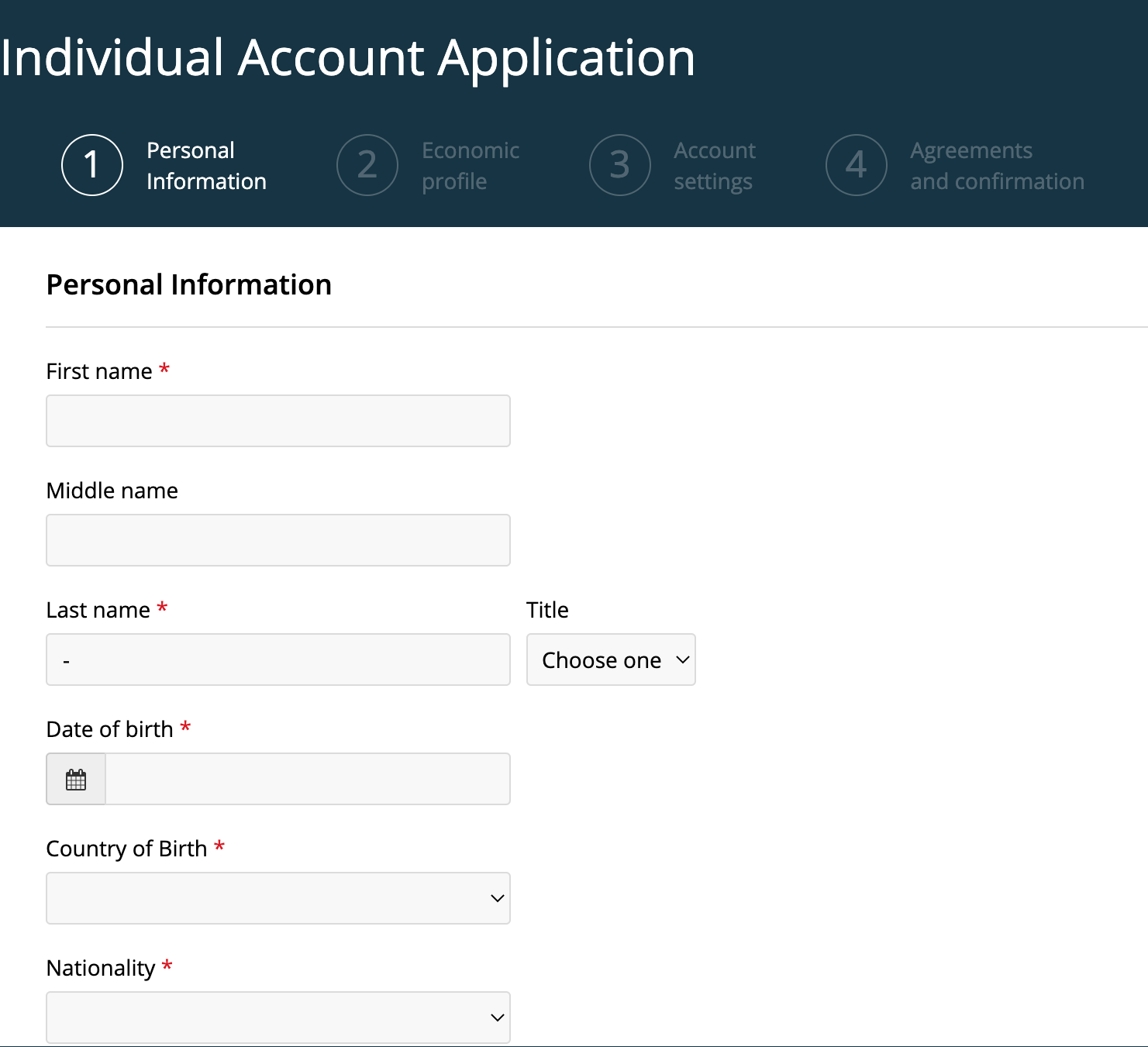

How To Open A Just2Trade Account

- Begin the individual account application (this includes filling in your address, tax number, financial details, employment status, trading knowledge and confirming whether or not you are a resident of the USA)

- As part of the application, choose your desired account type and base currency

- Upload proof of identity and address to the portal

- Deposit funds using one of the supported methods

- Download the trading platform (unless using an online web browser) and login

Account Application Window

UK Leverage

Although leverage up to 1:500 is available for professional traders, most retail clients will only be able to access leverage on Just2Trade up to 1:30. Leverage rates also vary depending on the market. CFD stocks have a maximum leverage of 1:5 for retail clients.

Importantly, 1:30 leverage is in line with the limits imposed by FCA-regulated brokers, protecting UK traders from the risk of significant losses.

Mobile Trading

MetaTrader and CQG have intuitive mobile apps that Just2Trade clients can access for free. These provide many of the same features you would find on the desktop and web versions but they allow traders to invest from wherever they are in the world. Sterling Trader also has a dedicated mobile application. Each of these apps can be downloaded for free from the Apple App and Google Play Stores.

Deposits

UK investors can access a range of deposit methods to fund their Just2Trade accounts, including traditional payment solutions and cryptos. As a result, Jus2Trade scores highly in terms of payment options.

- Klarna

- PayPal

- Neteller

- Credit Card

- Bank Wire Transfer

- Skrill (Moneybookers)

- Cryptos (Bitcoin, Ethereum, Ripple, Litecoin and Tether USDt (TRC20)

There are usually no deposit fees but banks may charge a third-party fee for wire transfers. Deposits to the ECN account may also be charged a commission of up to 3% (apart from Litecoin deposits, which remain at zero commission). Currency conversion fees may apply if the currency in your bank account or on your card is different from the base currency of your Just2Trade account.

Deposit times are instant apart from bank transfers, which typically take 2-3 business days.

The minimum deposit for professional traders is £5,000. For retail investors, it is £100. Although there are companies with lower minimum deposits, this is still a reasonable amount.

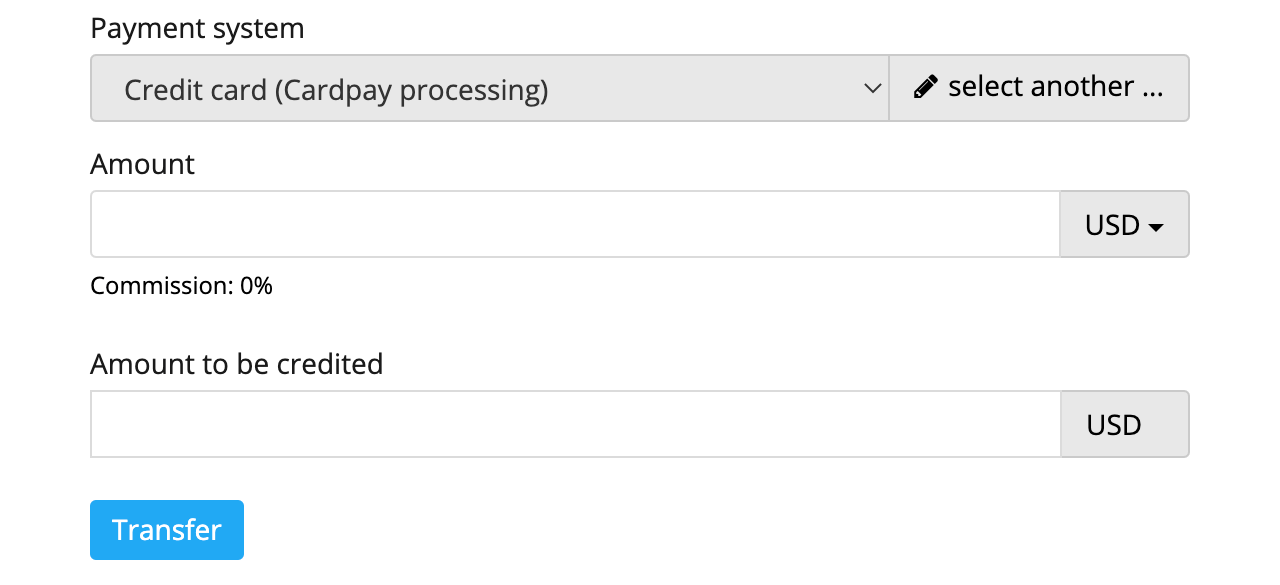

How To Make A Deposit On Just2Trade

- Login to the client area

- Click on Fund

- Choose your desired deposit method

- Choose the amount (ensure you meet the minimum deposit requirement otherwise it will not be possible to proceed to the next step)

- Click Transfer to complete the deposit

Deposit Portal

Withdrawals

Commissions for withdrawals vary depending on the account type. We have listed the key charges on withdrawals from the MT5 Global account below:

- PayPal – 2% commission

- Neteller – 2% commission

- FINAM Bank – zero commission

- Skrill (Moneybookers) – 2% commission (1 USD/EUR minimum)

- Bank Transfer – EUR transfers are free (charges apply for USD and RUB)

- Credit Card – 2.5% commission (1 EUR/1 USD/50 RUB minimum)

Note that, for credit card withdrawals from the MT5 Global account, a commission is not charged when refunding to the same card.

Credit card withdrawals usually take 5-10 minutes, though some other withdrawal methods can take up to three days. Minimum withdrawal amounts also apply to certain processing methods. For bank transfers, the minimum is £20. Importantly, these times and minimum requirements are in line with most of the industry.

While using Just2Trade, we noted that some withdrawal methods are only available if you deposited using this method and/or are using the same card.

How To Make A Withdrawal From Just2Trade

- Log in to the client area

- Click on Withdraw

- Choose a withdrawal method

- Enter the amount and complete the withdrawal

- Input any security code or on-screen prompts from the payment provider

Demo Account

Just2Trade provides access to a free demo account that facilitates risk-free investing practice. The sign-up process for the demo account is much faster than the live account registration.

Virtual accounts are excellent for beginner investors, as well as more experienced clients looking to test a new trading strategy.

Bonuses & Promotions

There is currently an MT5 Global special promotion on Just2Trade that offers discounted commissions on futures from £0.50 per contract (compared to the standard $1.50 per contract).

In addition, professional traders can benefit from a bonus of up to £2,000 when topping up funds in their accounts.

We were unable to find details of a no-deposit welcome bonus. European regulators have taken a tougher stance on these types of promotions in recent years.

Just2Trade Regulation

Lime Trading (CY) Ltd – the owner of Just2Trade – is regulated by CySEC and subject to oversight from the European Securities and Markets Authority (ESMA). The company is also a member of the Investor Compensation Fund (ICF), which provides compensation to eligible clients if the firm is unable to meet its obligations. Compensation is limited to £20,000.

While it is disappointing to see the company isn’t regulated by the FCA, the CySEC is still a trusted financial agency and its license is a promising sign that Just2Trade is legit.

Additional Features

Although the educational materials on offer is limited (no webinars or tutorials), we found a large amount of market news and data on individual assets when we used Just2Trade. This is useful for traders using both technical and fundamental analysis. In addition, investors can access an economic calendar and subscribe to daily and weekly forex analysis/forecast releases. The financial terms glossary is also there to assist clients in accessing definitions for trading jargon.

Investors on Just2Trade can put money into investment funds that are managed by other users. The service is called J2T Copy. Clients must allocate a minimum of £100 to take advantage of this feature. There are also robo-advisor and individual investment portfolios, where traders can determine the profitability potential of each position and limit any losses on their investments. Online APIs, such as REST API, support the integration of additional features to the standard broker experience.

Those with uninvested crypto can also deposit this to earn interest payments through staking and lending.

Trading Hours

Trading hours with Just2Trade depend on the market in question. Forex hours are generally Sunday evening until Friday evening, whereas stock markets are often only open during the day, Monday-Friday. Crypto, on the other hand, is active 24/7 due to its decentralised nature.

Customer Support

Just2Trade customer support is available 24/7. Our experts undertook a review of the available customer support options on the website and found the following:

- Customer service number (+357 25 030 442)

- Trading desk number (+357 96 370 242)

- Email (24_support@just2trade.online)

- Online message

Client Safety

Trading platforms often have their own security features. For example, MT5 is protected using data encryption, server authentication and more. Personal account security on Just2Trade is strengthened by two-factor authentication (2FA). The broker can also restrict account access if it believes security has been breached.

Should You Invest With Just2Trade?

Just2Trade is a competitive broker that is regulated by a reputable body and offers an impressive range of assets that includes cryptos, options, CFDs and equities. The broker’s fee structure definitely favours high-volume traders but there is a clear focus on professional-grade tools and functionalities that are still accessible to all clients. Moreover, there are several strong additional features and a free demo account, which makes the firm more accessible for less experienced traders.

FAQ

Is Just2Trade A Safe Broker?

Just2Trade is owned by Lime Trading (CY) Ltd, which is regulated by CySEC and ESMA. It is also a member of the Investor Compensation Fund, which provides additional protection to customers should the broker be unable to meet its obligations. On the downside, the brokerage isn’t licensed by the FCA.

Is Just2Trade A Good Broker?

Just2Trade has a wide range of markets to invest in, including various securities and derivatives. Traders placing a high volume of positions will also find the fees very reasonable.

Should I Open An Account With Just2Trade?

We recommend that high-volume traders consider Just2Trade. The firm may also be suitable for other types of investors due to the range of different trading platforms, although beginners will likely find cheaper deals elsewhere.

What Is The Minimum Deposit At Just2Trade?

The minimum deposit at Just2Trade is £100. However, some account types, such as the Forex ECN account, have higher minimum deposits (£200 in this case). The minimum deposit for professional traders is £5,000.

Do I Need To Download Software To Trade on Just2Trade?

No. Many of the available trading platforms like MT4 and MT5 have a web platform, which runs through a browser and does not require any downloads. That being said, there are sometimes desktop versions available for which a download would be required.

Top 3 Just2Trade Alternatives

These brokers are the most similar to Just2Trade:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Just2Trade Feature Comparison

| Just2Trade | IG Index | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 1.5 | 4.7 | 4 | 4 |

| Markets | Stocks, ADRs, ETFs, Futures, Options, Commodities, Bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $0 | $1,000 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, NFA, FINRA, Bank of Russia | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:20 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Just2Trade Review |

IG Index Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| Just2Trade | IG Index | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Just2Trade vs Other Brokers

Compare Just2Trade with any other broker by selecting the other broker below.

Popular Just2Trade comparisons: