InvestEngine Review 2025

|

|

InvestEngine is #115 in our rankings of UK brokers. |

| Top 3 alternatives to InvestEngine |

| InvestEngine Facts & Figures |

|---|

InvestEngine was founded in 2019 by the founders and CEOs of Gumtree and Ramsey Crookall, a successful independent wealth management firm. The company is regulated in the UK by the FCA and has planted itself as a strong competitor within the retail stock trading space, offering managed and DIY investment portfolios and access to more than 550 global ETFs. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | ETFs |

| Demo Account | No |

| Min. Deposit | £100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Commodities |

|

| Stocks | InvestEngine offers access to 550+ ETFs with exposure to index-tracking stocks. There are no commissions and the ETFs offer excellent diversification opportunities. |

InvestEngine is a UK-based ETF platform that provides an all-in-one solution for investors to flexibly trade in funds, open an ISA account or access managed account services. This review will evaluate InvestEngine’s fees, main features and more, as well as explaining how to register for an account. Our team also share their verdict on InvestEngine.

Our Take

- InvestEngine is a good option for traders seeking a hands-off approach to ETF investing

- The brand is trustworthy with multiple awards and authorisation from the UK’s FCA

- Investors interested in stocks, forex and commodities will need to look elsewhere

- There is no demo account and the minimum deposit is high vs alternatives like Interactive Investor

Market Access

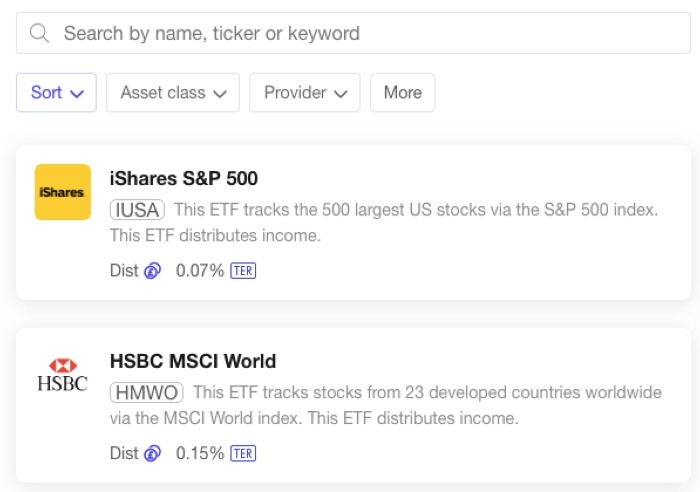

InvestEngine is primarily an ETF-based brand, offering 550+ products that can be weighted to create a competitive portfolio. These funds are built with a mix of international stocks and bonds. Popular examples include the iShares S&P 500, HSBC MSCI World, Vanguard FTSE 250, and WisdomTree Artificial Intelligence.

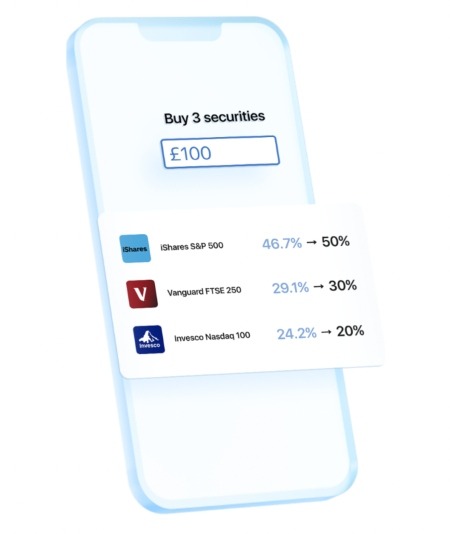

We were pleased to see that fractional trading is available, meaning you can invest in ETFs with as little as £1. This is a great advantage for casual investors who want to access the financial markets but are on a budget.

On the negative side, we felt the range of assets on offer is a little light compared to competitors who also offer share dealing and other asset classes. It is certainly a good selection of ETFs, but considering that firms like Fidelity offer 2500+ funds as well as US shares, and brokers like eToro have thousands of stocks, forex and other assets besides hundreds of ETFs, you will find more flexibility elsewhere.

Fees

InvestEngine is competitive when it comes to trading fees. The brand does not charge a fee to open a trading account or ISA, or require a commission per trade. Instead, you only have to pay a low-cost ETF fee for each fund. We particularly like that the broker is fully transparent with these charges, which are readily available within the ETF product list.

The fees start from 0.05% under the DIY portfolio, but are cheaper at an average of 0.15% for inclusion in a Managed Account portfolio. The Vanguard FTSE 250 ETF, for example, is offered with a 0.10% fee vs the iShares UK Dividend ETF at 0.40%.

The minimum initial investment is also low at £100. We found the Do-It-Yourself Account has no brokerage fee, with just the ETF costs applicable as outlined above. However, Managed Account services charge a 0.25% annual fee in addition to the fees for ETFs. Importantly, these are competitive vs alternative brands such as Vanguard, which charges up to 0.78% for managed individual funds, and Nutmeg, with a 1% annual charge for their Fully Managed service.

We did also find a market spread applies, which is the difference between the buy and sell price of an asset. The good news is that it amounts to an average charge of 0.07% per year when trading with InvestEngine so shouldn’t take away too much from your topline profits.

InvestEngine Accounts

InvestEngine offers retail investors two account types: an Individual Savings Account (ISA) or a General Account. We were pleased to find that both provide access to the same investment products, meaning the only differences are in the maximum investment amounts and tax payments. On the downside, we could not open a SIPP/pension account so you will need to find an alternative provider if this is important to you.

A Stocks & Shares ISA is a way for UK investors to maximise the benefits they get from investments by shielding their portfolio from capital gains tax. The UK government set up this account type to encourage investment, and allows each account holder to save up to £20,000 per year. As such, any profits made from the assets in a Stocks & Shares ISA will be completely tax-free.

- General Account – No maximum investment limit per year, up to £2000 tax relief on dividends, £12,000 allowance on capital gains, commission-free investing (ETF costs apply)

- Stocks & Shares ISA – Maximum £20,000 investment per year, no tax applicable on dividends and capital gains, free ISA transfers from alternative providers, no account fees

There are essentially two investing styles available; DIY or Managed. We like that the Managed account maintains competitive fees at just 0.25% per year, as it means beginners or those with limited time available can benefit from expert investment oversight without having to pay exorbitant costs.

DIY Account

The DIY profile is suitable for experienced investors or those looking for full investment control, and we appreciate that it offers this flexibility as well as providing the full range of assets and features on offer from managed accounts. You can purchase, sell and manage your ETF portfolio, while still having access to the brand’s technology such as one-click rebalancing.

Our team found it easy to get started with the DIY account:

- Choose Your Investments – Browse the list of 500+ exchange-traded funds

- Review The ETF Products – Review the sectors, companies, and regions included in each fund to see if this fits your interests

- Customise Your Portfolio – Set investment weightings of each ETF in your portfolio or leave as equal amounts

- Place Your Order – Once happy with the weighting and product inclusion, select ‘Invest’ to initiate the order

- Monitor – Consider using the ‘Rebalance’ tool to comply with the technology’s market weighting suggestion

Managed Account

Despite its name, we were pleased to see the Managed Account offers full portfolio transparency and access to a performance dashboard so you can easily track all of the companies and sectors you’re invested in.

For this profile type, a portfolio is designed by the team’s experts based on a questionnaire to determine your risk appetite and goals. This includes ready-made growth and income portfolios. We like that the minimum investment amount remains at £100 as with the DIY profile, making managed accounts just as accessible as the self-invested option.

When we used InvestEngine, our experts found that the main advantage of the Managed Account compared to the DIY account is having access to auto-rebalancing and portfolio fine-tuning to maintain relevant product allocations. The brand uses top-class technology to lead its investment philosophy and achieve competitive market exposure for customers. This can be a huge time-saver and potentially increase profits as you will not need to consistently check markets and rebalance.

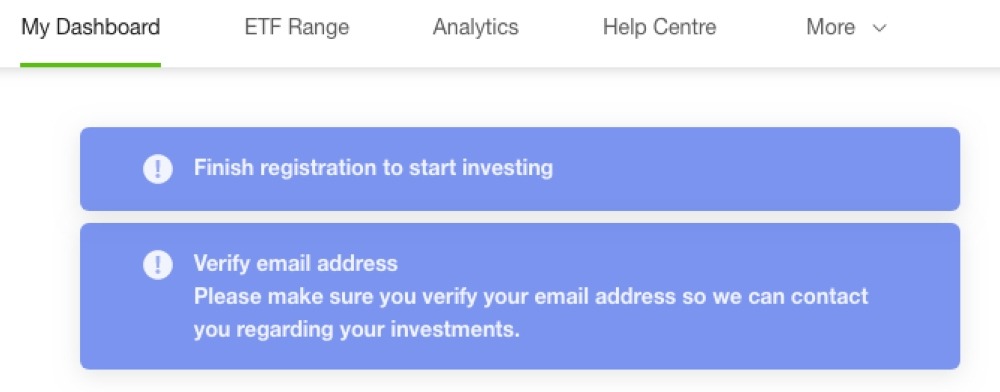

How To Open A Live Account

- Choose ‘Get Started’ under the Individual Account icon

- Add your email address and select ‘Continue’

- Create a password, agree to the T&Cs, and choose ‘Save And Continue’

- From the dashboard choose from the two message boxes highlighted in blue to complete the registration and verify your email address

You will need to provide personal details such as an address, mobile number, and proof of ID, and you will also need your National Insurance number to hand.

Funding Options

Deposits

We were disappointed by the payment methods available from InvestEngine, which only accepts bank wire transfers. This is limited compared to other brands which typically accept debit/credit card payments and sometimes also accept e-wallets such as PayPal.

We did, however, like that a direct debit option is available, meaning that regular investments of up to £5000 investment can be made on a specific day of each month. This is useful for those seeking a hands-off approach to investing.

The minimum investment amount to open an account is £100, which is about average among investing platforms but high compared to some fintech options such as Interactive Investor with zero minimum funding. On a lighter note, there are no minimum deposit requirements after this, except for direct debits at £50.

How To Make A Deposit

You can use either the manual wire transfer method or instant banking. We would recommend the latter, as it uses a secure payment facility via TrueLayer, an FCA-authorised payment institution.

To make a payment:

- Log in to your InvestEngine account and select ‘My Dashboard’ from the top menu

- Select the ‘Options’ icon under your portfolio balance

- Select ‘Add Cash’ from the menu and choose your registered bank account from the ‘Instant Transfer’ list

- You will be redirected to your bank website where you can add a value to deposit

- Initiate the transfer by approving the transaction in your bank window

We like that this method allows you to keep full control of payments, and means you don’t need to input your bank passwords and login details on the broker’s website.

Withdrawals

You can withdraw funds at any time back to a nominated bank account, and we were pleased to see InvestEngine does not charge any withdrawal fees.

Processing times vary depending on your portfolio type. The Managed Account has the longest expected time, which can take up to four days to close your position, plus an estimated two days to be transferred back to your bank account. While a tad slow, this is similar to competitors.

To make a withdrawal:

- Log in to your InvestEngine account and select ‘My Dashboard’ from the top menu

- Select the ‘Options’ icon under your portfolio balance

- Select ‘Withdraw Cash’ from the menu

- Input the value to withdraw (refer to the balance available under this box)

- Review the bank account details and select ‘Withdraw’

Eligible dividend payments will be paid directly into your portfolio. You can then choose to withdraw or re-invest this money.

InvestEngine Platform

We were big fans of the InvestEngine trading platform, which is modern and sleek with simple navigation. We found the proprietary software to be very user-friendly, particularly for beginners looking for an easy investment interface. The dashboard provides clear account balance tracking and an ETF search function.

However, we are not so impressed by the charting functions and technical analysis features on offer, which are very basic compared to platforms offered by other brands. You can access individual pricing charts per ETF, plus a visual overview of your overall portfolio performance.

There is some flexibility with timeframe views, which range from one week to MAX (the total time your portfolio has been open), but it would have been useful to also be able to access historical price data from the months or years before you opened your account.

Mobile App

InvestEngine offers a free mobile app available for download on iOS and Android devices, and we feel this app stands up well in the market by providing similar functions to the web-based terminal. It is a good solution to monitor your portfolio performance and make account amendments while on the go.

The application is rated a decent 4.2/5 from 600+ reviews on the Google Play app store. We were also pleased to see 2FA and biometric login functions can be added to the app for additional security.

Demo Account

InvestEngine does not offer a demo account, which is a shame and ranks the brand down considerably vs alternatives.

Moreover, since the minimum deposit is £100, you are not able to explore the platform without an outlay, unlike with a brand like Interactive Investor that has no minimum deposit.

Is InvestEngine Regulated?

InvestEngine (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA), license number 801128. This is one of the most reputable watchdogs in the world thanks to its strict member guidelines and customer protection protocols, so you can feel confident that complaints will be processed through the independent Financial Ombudsman Service.

We feel assured that the brand safeguards all client funds correctly, with customer money held in segregated bank accounts with NatWest Bank Plc and your investments in a pooled client account at CREST (operated by Euroclear UK and Ireland).

You are protected with investment compensation to the value of £85,000 from the Financial Services Compensation Scheme (FSCS), in the case of business insolvency.

Our InvestEngine review also found that the platform operates with SSL 256-bit encryption, protecting your personal information and data transmissions.

Bonuses

We rate that InvestEngine offers a refer-a-friend scheme with investment bonuses of up to £50 available for both the referrer and referee.

You must have at least £100 invested in a portfolio to participate. When we reviewed the terms and conditions we were pleased to see you can refer up to 25 friends, though any bonuses received must be held in an investment fund for at least 12 months before it can be withdrawn.

Regulatory restrictions prevent InvestEngine from offering further promotions such as a welcome bonus or deposit-based incentives.

Extra Tools & Features

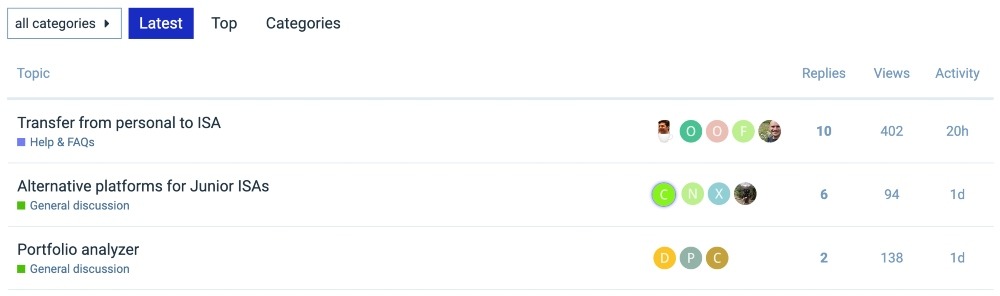

Though we are a bit disappointed that there is no educational platform or learning content, you should not feel completely out of the loop when it comes to decision-making, thanks to the InvestEngine community forum, a discussion platform for registered customers to share ideas and ask questions to other users.

We like that these are usefully categorised into topics such as ‘general discussion’, ‘insights’, or ‘general FAQs’, but it was a shame that there was no search navigation bar to filter by keyword.

Another useful feature offered by the brand is the Insights portal. This page has market commentary, company news, and investment ideas. This also includes integrated YouTube videos and user guides – we found the ‘Investing 101’ category the most suitable for beginners.

Customer Service

Unfortunately our experts found that InvestEngine customer support is limited, with no contact number or email address provided. Instead, you can contact the broker only through their live chat service or an online ticket-based system.

It was a shame to find that the live chat option was automated, without any human agent. To receive a response from an actual staff member you will need to submit an online ticket. We received a response to our registered email address in 20 minutes, which is adequate, but a little slow for the instant support sometimes needed. Use the ‘Help’ logo on the bottom right of the website to access.

InvestEngine also has a FAQ section containing step-by-step guides and imagery to help with account and trading queries.

Company Background

InvestEngine is a UK-based investment platform founded in 2016, with services launched in 2019. The company was launched by the co-founder of Gumtree with the vision to provide investors with easy access to ETF portfolios using top-class technology.

The brand had over 23,000 registered customers with £150 million in assets under management (AUM). A successful second-round crowdfund saw over £2.5 million raised from over 1000 investors.

InvestEngine has also been recognised with several industry awards and expert recognition including a 5* rating from The Times Money Mentor and shortlisted in their Best Stocks & Shares ISA category at the 2022 awards.

The brand is incorporated as a private limited company on Companies House, registration number 10438231. The firm’s head office is located in London.

Trading Hours

InvestEngine trading hours work differently from standard broker-dealer brands. Rather than full flexibility to trade as and when desired, the firm executes positions once per day (Monday to Friday). The trading window is 2 PM to 7 PM with order execution at approximately 3:15 PM. We found that to ensure same-day execution, you must submit an order before 2 PM.

Your trades will take around two days to settle (T+2).

Should You Trade With InvestEngine?

InvestEngine is an intuitive trading platform that is most suitable for beginners, providing a choice of DIY or managed profiles which are ideal to get involved in the financial markets.

Advanced traders may feel restricted when it comes to the terminal and investment product choices. Having said that, the fees are competitive and the brand is reputable and trustworthy, making it a solid choice.

FAQ

Is InvestEngine Legit Or A Scam?

InvestEngine is a legitimate investment platform. The brand is authorised and regulated by the Financial Conduct Authority and provides flexible ETF investment portfolio building through DIY accounts or fully managed profiles. The award-winning company is widely respected and trustworthy.

Does InvestEngine Have A Minimum Deposit Amount?

New clients can get started with an InvestEngine account with a £100 minimum investment amount. This applies to both the DIY and Managed Accounts. This makes the firm accessible for beginners but it is steeper than the minimum deposit at rival firms, including Interactive Investor.

How Can I Fund My InvestEngine Account?

InvestEngine accepts deposits via bank wire transfer only, though traders can also set up a direct debit for regular payments. This is a drawback as some alternatives offer a wider range of payment methods.

Is InvestEngine Safe?

We are confident InvestEngine is a relatively safe brokerage. The company is regulated by the Financial Conduct Authority (FCA) and registered with Companies House. InvestEngine also complies with top-tier security features including 256-bit data encryption and 2FA login protection.

Is InvestEngine A Good Broker?

InvestEngine is a good investment platform, but the terminal is basic and investments are limited to ETFs only. There is no option to trade individual equities, forex, commodities, and more. Having said that, you can trade on your own with the fully flexible DIY account or use the brand’s technology with a fully managed profile. Fees are also competitive with no account opening charges or commission fees.

Article Sources

Top 3 InvestEngine Alternatives

These brokers are the most similar to InvestEngine:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

InvestEngine Feature Comparison

| InvestEngine | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4 | 4.7 |

| Markets | ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | £100 | $0 | $1,000 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | InvestEngine Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| InvestEngine | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

InvestEngine vs Other Brokers

Compare InvestEngine with any other broker by selecting the other broker below.

Popular InvestEngine comparisons: