INFINOX Review 2025

|

|

INFINOX is #78 in our rankings of CFD brokers. |

| Top 3 alternatives to INFINOX |

| INFINOX Facts & Figures |

|---|

Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures |

| Demo Account | Yes |

| Min. Deposit | £1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, SCB, FSCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MQL4 & MQL5 |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, commodities and indices with tight spreads and leverage limited to the FCA-sanctioned maximum of 1:30. Infinox traders benefit from lightning-fast execution speeds and a choice between STP and ECN pricing, making this a flexible option for beginner and serious traders. |

| Leverage | 1:30 (UK), 1:200 (Global) |

| FTSE Spread | 0.9 |

| GBPUSD Spread | 0.4 |

| Oil Spread | 0.06 |

| Stocks Spread | 0.02 USD |

| Forex | Trade 45 major, minor and exotic forex pairs. This is an average range, but the broker offers attractive and very competitive tight floating spreads from 0.3. Useful features including a news feed set the broker apart from many rivals and can help plan forex strategies. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.3 |

| Assets | 45+ |

| Currency Indices |

|

| Stocks | Trade 750 stock CFDs sourced from eight exchanges from the US, EU and UK. Leverage up to 1:10 is available, commissions start from $6 and overnight fees are the LIBOR rate +/-3.5%. This represents a very competitive suite of stocks from a range of international markets covered by few competitors. |

INFINOX Capital Ltd is a London-based forex and CFD broker. The UK entity is authorised and regulated by the FCA and offers 900+ trading instruments to clients on the MT4 and MT5 platforms. The broker also offers their proprietary IX Exchange terminal with 20,000+ instruments.

This 2025 review of INFINOX will cover the broker’s trading platforms, deposit and withdrawal methods, account types, login security, and any scam warnings. Find out if INFINOX is a good option for UK traders.

INFINOX has no minimum deposit, competitive fees with STP & ECN pricing, plus a choice of trading platforms, making it a solid option for both beginners and experienced traders.

Company History & Overview

INFINOX is a global brand, established in 2009, with a presence in 15+ countries.

The broker strives to offer premium client services alongside competitive trading conditions via ECN and STP pricing models. Traders can access a variety of instruments including global stocks, currency pairs, commodities, and futures.

INFINOX’s achievements span several awards including the Best Forex Broker for Long-Term Trading.

The UK subsidiary has a head office presence in London.

Instruments & Markets

INFINOX offers UK traders 900+ assets:

- Currency Pairs – Speculate on 45+ forex pairs five days a week with tight spreads. Symbols include GBP/USD, EUR/GBP, and GBP/JPY

- Indices – Trade 16 major world indices and trade the performance of an entire sector. Available indices include the FTSE 100, GER 40, and FRA 40

- Commodities – Speculate on the spot price of soft and hard commodities, plus precious metals and energies. This includes coffee, natural gas, wheat, UK oil, and cocoa

- Stocks – Invest in 750+ company shares via contracts for difference (CFDs). A £0.02 commission fee applies per share traded. Stocks include Google, Facebook, Amazon, and Apple

- Futures – Trade CFD futures contracts on seven select markets including the Dow Jones 30, S&P 500, and NASDAQ 100

On the downside, cryptocurrency trading is not available.

Leverage

INFINOX offers leverage up to 1:30 for UK investors. Although this is capped due to ESMA regulations, the broker still provides enough margin to boost trading power and increase position sizes.

- Forex – Up to 1:30

- Indices – Up to 1:20

- Equities – Up to 1:10

- Commodities – Up to 1:10

The margin call is 80% and the stop-out level is 50%.

Spreads, Commissions & Fees

Trading fees vary between account types with the exception of stock CFDs. These securities are available with competitive commission charges starting from 0.10% of the value of the trade, or £0.02 per share traded.

The STP account offers commission-free investing, with all costs integrated within spreads. These spreads average 0.9 pips. When we used INFINOX, the FTSE 100 index was offered at 0.9 pips and gold futures contracts from 2.8 pips.

The ECN profile offers deep liquidity from top-tier providers. A commission fee of £5 per round lot turn applies. However, spreads are tighter than the STP account, starting from 0.2 pips. Our traders were offered spreads of 0.3 pips on EUR/GBP and 0.6 pips on GBP/USD upon testing. Although this is tight, some major brokers do offer spreads from 0 pips on popular forex assets.

Swap fees apply for positions held overnight. Long positions will incur a £2.50 fee and short positions at -£1.20 per lot (FX). There is a triple charge on Wednesdays for currency pairs.

Note, equity-based instruments subject to dividend payments and corporate actions will be re-valued to adjust for these payments, rather than a payment or deduction being taken.

Trading Platforms

INFINOX offers UK traders a good selection of trading platforms. Clients can access MetaTrader 4, MetaTrader 5, and IX Exchange.

All platforms can be downloaded to desktop devices or opened as web traders.

IX Exchange

IX Exchange is the broker’s proprietary platform which launched in October 2022. It provides users with 20,000+ instruments on 50+ global exchanges. This includes options, ETFs, bonds, and more, many of which are not available on MT4 and MT5.

The functionality of the platform is intuitive and there are several features designed to make trading easier:

- Portfolio Tracking – View your live account balance, profit & loss, margin, open positions, and order history in one place

- Basket Trader – Create a unique index of individual instruments and trade them as one. Group together symbols of interest or similarities, or a completely random list

- Option Board – Review a full list of option contracts and expiries with implied volatility. Analyse opportunities with the bid, ask and strike price data all in one place

- Performance Review – View portfolio performance over a day, week, month, or year. Filters can be used by asset class and instrument to identify successes and future opportunities

- Trade Ticket – Plan entry and exit to the market and place limit orders at the best possible price via trade tickets. There are also plenty of risk-management tools including stop-loss and take-profit parameters

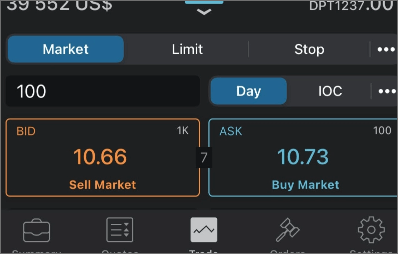

New Order

The IX Exchange terminal does feel a little cluttered at initial login, however, after some window organisation, it can provide some useful functions. The interface is fully customisable so users can set the windows most important to trading in constant view, and hide those not needed.

MetaTrader

MetaTrader 4 (MT4) is a leading online trading platform developed by MetaQuotes Software in 2005. It is the best fit for beginner traders looking for a decent mix of basic and advanced tools. MetaTrader 5 (MT5) is the next-generation platform, designed for multi-asset trading.

MetaTrader 4

- Live news stream

- Execute positions using one-click trading

- Dynamic price charting with nine timeframes

- Automated trading via Expert Advisors (EAs)

- Access to thousands of third-party trading indicators and 30 in-built tools

MetaTrader 5

- Integrated economic calendar

- Advanced market depth and netting system

- Dynamic price charting with 21 timeframes

- 38 in-built technical indicators including RSI, MA, and MACD

- Automated trading via Expert Advisors (EAs) and MQL5 programming language

MetaTrader 4

How To Get Started

- Open an INFINOX account (individual or joint)

- Select a preferred trading platform (MT4, MT5, or IX Exchange)

- Complete the account verification requirements including ID upload and proof of address

- Deposit funds (£50 minimum deposit)

- Download the platform or open it via the web trader or mobile app

- Connect with the INFINOX server and start trading

INFINOX Mobile App

All trading platforms offer mobile app compatibility. Traders can monitor portfolios and positions at the click of a button. Investors can download the apps to iOS and Android mobile and tablet devices.

Our experts rate MetaTrader 4 as the simplest application for beginners getting started with mobile trading. The interface is intuitive and users can set up one-click trading directly from charts. The app also syncs automatically with desktop accounts.

Payment Methods

Deposits

The minimum deposit to open an INFINOX account is £50. However, once account verification is complete, traders can start investing with as little as £1.

Accepted deposit methods:

- Skrill

- Neteller

- Bank wire transfer

- Broker-to-broker transfers

- Visa, Maestro & Mastercard credit/debit card

All payments are processed quickly, however, the time taken for funds to clear can vary between methods. E-wallet solutions and credit/debit cards are often the quickest.

The broker does not charge any fees to fund a live INFINOX account.

Withdrawals

Withdrawals must be made back to the same method used for deposits.

There are no minimum or maximum limits or fees charged by the broker, which is an advantage over some competitors. INFINOX also offers same-day withdrawal processing, though fund clearance varies between methods.

How To Withdraw

- Login to the INFINOX Client Area using your registered credentials

- Select ‘My Account’

- Choose ‘Withdraw Funds’

- Complete the online request form including the value and payment method

- Select ‘Confirm’

Live Accounts

INFINOX offers two account types; STP and ECN. The profiles offer different pricing models and trading conditions. Our experts would recommend beginners sign up for the STP profile for increased price transparency.

Both accounts offer access to MT4 and MT5 and have a minimum trade size of 0.01 lots. Investors are permitted to open up to five live accounts in the same name, which may be of use to clients wanting to trade in a currency other than GBP.

Joint accounts are also available to retail investors.

How To Open A Live Account

The sign-up process for a new INFINOX account is relatively quick, however, it does take longer than one minute as suggested by the brand.

Users will need to select the trading platform and account currency, plus provide basic personal details including an email address and phone number. The next steps require submitting financial background information, trading experience, and proof of residential address.

Once the account is verified by INFINOX, traders will receive access to the client portal to deposit funds and start trading.

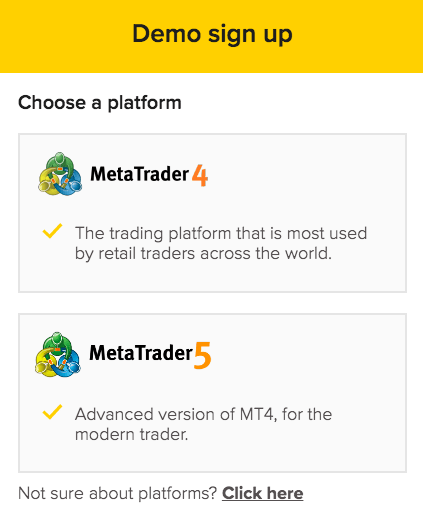

Demo Account

Users can access a free demo account on the MT4 or MT5 terminals only. Trade risk-free with virtual funds. Demo traders can access all the same tools and features, including technical indicators, graphs and charts, plus live price quotes.

These practice profiles are useful for beginners looking to learn the steps involved in CFD trading, or for experienced investors seeking to test a new strategy or instrument.

On the downside, INFINOX’s proprietary platform is not available in the demo environment, which may deter potential users.

How To Open A Demo Account

- From the broker’s main webpage, select the ‘Demo Account’ icon

- Choose the MetaTrader platform (MT4 or MT5), account currency, and preferred language

- Name, email address, country of residency, and mobile number are required

- Click ‘Create Account’

- Credentials will be displayed on the next window

- Download or open the respective MetaTrader terminal to get started

Note, a demo profile does not provide access to the client portal.

Bonuses & Promotions

As an FCA-regulated broker, INFINOX UK is not permitted to offer bonus incentives to new or existing customers.

In 2016, the European Securities Markets Authority (ESMA) banned all promotions tied to trading volumes, highlighting the impact of financial rewards on an individual’s trading behaviour.

UK Regulation

INFINOX Capital Ltd is a UK-registered company. It is authorised and regulated by the Financial Conduct Authority (FCA), under registration number 501057. Our experts confirm authorised status was gained in September 2009.

Retail investors benefit from access to The Financial Ombudsman Service and the Financial Services Compensation Scheme (FSCS) in the case of business failure or wrongdoing. Other FCA rules include providing negative balance protection and segregating client funds in third-party institutions.

Note, the brand name has been the subject of an investigation following its association with trading scams. Following this, INFINOX Bahamas no longer accepts UK investors. INFINOX Capital Limited (the FCA-regulated UK company) maintained there was no wrongdoing or dishonesty in the promotion of high-risk trading schemes. The UK entity claims that it cooperated with the rules set by the Financial Conduct Authority.

Our experts found additional investor insurance was taken out by the brand under QBE Writing Limited for a period between 1st December 2021 and 30th November 2022. This covered individuals with a value of up to £500,000 in losses due to firm failure.

Extra Trading Tools

INFINOX Intel

The broker’s educational platform provides market analysis and insights to improve trading decisions. This includes key term glossaries, articles, and platform guides. Although useful, it would be beneficial for information to be split into categories by experience level.

Our INFINOX review also found a broken link referring to an ‘IX Social’ function, a copy trading tool. There is no information published on the associated page for UK investors so we cannot confirm that copy trading is still available.

VPS

INFINOX offers retail investors access to low-latency VPS servers, compatible with the MetaTrader 5 terminal.

With 24-hour connectivity and support, the broker has partnered with 4XSolutions for the best infrastructure access. This means customers can run robots without disruption and ensure orders are executed with no delay.

Opening Hours

INFINOX trading hours vary by market. Forex, for example, is available to trade 24/5.

Upcoming market closure dates by instrument, including UK public holidays, are published on the broker’s website and reflected in the trading platforms.

Customer Service

INFINOX customer support is available 24/5, Monday to Friday. This includes via live chat, email, and telephone.

- Phone – +44(0)20 37134490

- Email – support@infinox.co.uk

- Live Chat – Icon bottom right of the broker’s website

- Online Contact Form – Found on the broker’s ‘Contact Us’ page

- UK Address – INFINOX Capital Ltd, Birchin Court, 20 Birchin Lane, London, EC3V 9DU, UK

There is also a basic FAQ section on the broker’s website, though this is not as comprehensive as those found at other leading brokers.

Client Security

As an FCA-regulated broker, INFINOX complies with AML and KYC requirements. The broker also has strict data privacy protocols in place, meaning personal and financial details are used for transaction purposes only.

The MT4 and MT5 platforms use industry-standard security measures such as Secure Sockets Layer (SSL) encryption to protect data transactions between network servers and traders.

Should You Trade With INFINOX?

INFINOX is a legitimate broker. The choice of trading instruments, platforms, and pricing models is appealing. And although there are some historical scam concerns, the brand maintains a license with the Financial Conduct Authority and has put additional insurance in place to reassure investors.

FAQ

Is INFINOX A Good FX Broker?

INFINOX offers a good range of instruments, a choice of platforms, and STP or ECN execution models. Traders can also be assured of responsive customer support and competitive pricing.

Is INFINOX A Scam?

The Financial Conduct Authority license gives INFINOX Limited credibility. It is one of the strictest regulatory authorities in the world with rigorous rules and joining requirements.

However, following scam concerns in 2021 (which INFINOX denies), we would recommend keeping an eye on the official watchdog’s website for the latest company news and warnings. There are also remain some negative user reviews online.

Is The INFINOX IX Exchange Platform Good?

The INFINOX IX Exchange was launched in October 2022 allowing customers to invest in 20,000+ instruments across 50+ global exchanges. The platform may be more suited to experienced traders given the number of advanced features and functions. However, it does offer a fully customisable interface so beginners can choose exactly what they need.

Is INFINOX A FCA Regulated Forex Broker?

Yes, INFINOX Capital Ltd is regulated by the Financial Conduct Authority (FCA), registration number 501057.

Can I Practise Trading With INFINOX Before Opening A Live Account?

Yes, INFINOX offers a free demo account to new and existing clients. However, investors can practise trading on the MetaTrader 4 and MetaTrader 5 terminals only. There is no practice profile for the proprietary IX Exchange.

Top 3 INFINOX Alternatives

These brokers are the most similar to INFINOX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

INFINOX Feature Comparison

| INFINOX | Swissquote | FP Markets | Vantage FX | |

|---|---|---|---|---|

| Rating | 3.4 | 4 | 4 | 4.7 |

| Markets | Forex, CFDs, Indices, Shares, Commodities, Futures | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Minimum Deposit | £1 | $1,000 | $40 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, SCB, FSCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, FSCA, VFSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:30 (UK), 1:200 (Global) | 1:30 | 1:30 (UK), 1:500 (Global) | 1:500 |

| Visit | ||||

| Review | INFINOX Review |

Swissquote Review |

FP Markets Review |

Vantage FX Review |

Trading Instruments Comparison

| INFINOX | Swissquote | FP Markets | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | No | No |

| Options | Yes | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

INFINOX vs Other Brokers

Compare INFINOX with any other broker by selecting the other broker below.

Popular INFINOX comparisons: