IMMFX Review 2025

|

|

IMMFX is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to IMMFX |

| IMMFX Facts & Figures |

|---|

IMMFX is an online CFD broker offering several asset classes including forex, stocks, and commodities. The broker offers STP accounts with no dealing desk intervention, leverage up to 1:500 and transparent pricing with spreads from 0 pips. The broker is regulated offshore in the Marshall Islands. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Commodities |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | GLOFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | I found a comparably small range of 200+ CFDs including forex, stocks, indices and crypto on the MT4 terminal. That said, I appreciated the low spreads from 0 pips, alongside 24/7 customer support. |

| Leverage | 1:200 |

| FTSE Spread | Floating |

| GBPUSD Spread | Floating |

| Oil Spread | Floating |

| Stocks Spread | Floating |

| Forex | I like that IMMFX offers a decent list of 60+ forex pairs with raw spreads and low latency execution. I found that you can trade with leverage up to 1:500 on major pairs with a minimum volume of 0.01 lots. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.5 |

| Assets | 60+ |

| Stocks | I am disappointed to find only 60+ US and EU stocks at IMMFX, including Amazon, Procter & Gamble and McDonald’s. Stocks can be traded via CFDs with a 10% margin and low commission fees of 0.8%. |

| Cryptocurrency | I think IMMFX scores better when it comes to its crypto offering, with 30+ crypto/crypto and crypto/fiat pairs such as ETH/BTC, BTC/USD and DASH/USD. Cryptos can be traded 24/5 with a 20% margin on popular tokens. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

IMMFX is an international forex and CFD broker offering a range of markets and competitive STP/ECN spreads on the MetaTrader 4 (MT4) platform. This review covers everything you need to know about IMMFX, including its UK regulation, typical fees, trading hours and how to open an account with the broker.

Our Take

- As well as two live accounts, IMMFX offers a demo account ideal for trialling the brokers’ trading conditions before committing to a full account

- There is no GBP account option for investors – deposits and withdrawals must be made in US dollars or crypto, which will incur unwanted forex fees for UK traders

- The lack of FCA oversight is concerning and British clients will not benefit from strict fund protection measures

Market Access

While IMMFX claims to offer over 200 trading products, our team only found 134 available markets upon testing, which is disappointing. The selection of shares is particularly narrow, so the broker is not a good pick for stock traders.

On a more positive note, we were impressed by the broker’s decent range of forex pairs and crypto CFDs.

Investors can trade:

- Indices: 13 major global index CFDs including the FTSE 100 and US Dollar Index

- Forex: 63 forex products, spanning major, minor and exotic currency pairs

- Cryptocurrency: 34 crypto CFDs, including fiat pairs and cross pairs

- Stocks: 6 major EU stock CFDs and 10 popular US equity CFDs

- Commodities: 5 metal CFDs and 3 energy CFDs

IMMFX Fees & Commissions

I found spreads competitive across the range of products, with ECN spreads from 0.0 pips and STP spreads from 0.6 pips. In the Prime account, I was offered a spread of 0.1 pips for the EUR/USD pair, which is comparable to low-cost brokers such as Pepperstone.

With that said, I did find that some of their commissions for certain markets were excessive. When trading through the low-spread Prime account, investors face reasonable commissions of £6.50 per round traded lot on forex, but less competitive charges of £10 per round traded lot on indices and commodities CFDs.

The broker opts for a percentage commission model for single stocks and cryptos, with an 0.8% commission applied to trades.

I was impressed by the swap-free trading conditions available to all traders. However, the broker does say that for investors with no active trading on a symbol over an extended period, it may apply charges.

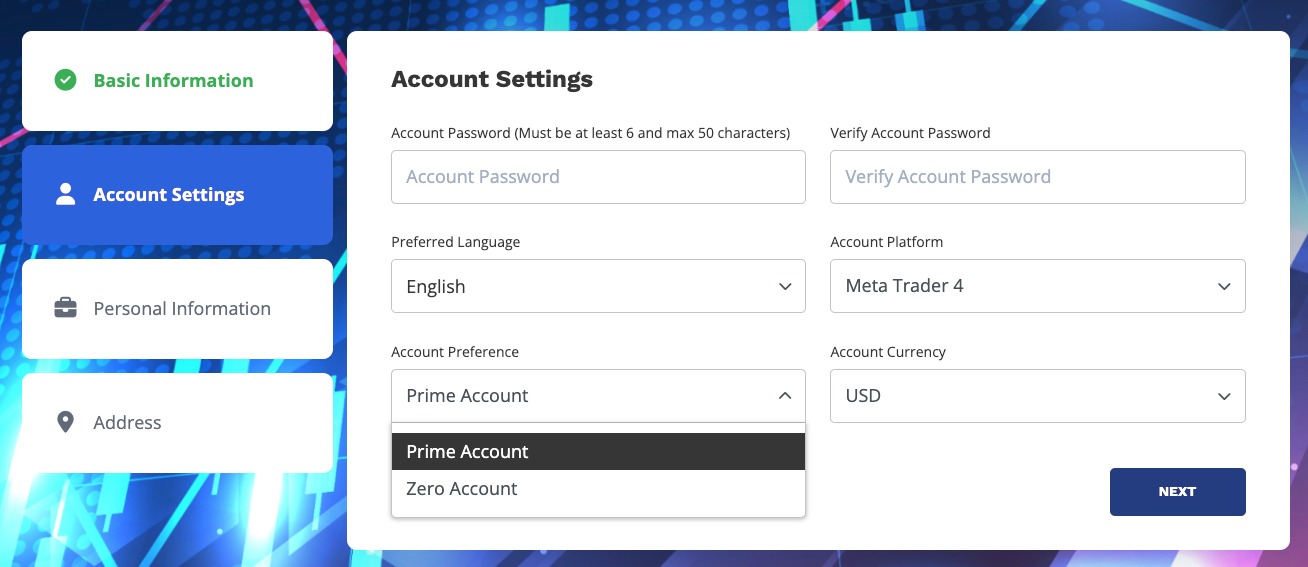

Account Types

There are two accounts available through IMMFX, catering to trades that favour low spreads and those that prefer zero-commission trading.

Zero Account

The aptly named Zero account offers access to major and minor forex pairs, metal CFDs, energy CFDs and index CFDs with zero commission. Spreads start from 0.6 pips and investors can utilise flexible leverage of up to 1:500 when trading.

To open a Zero account, clients must make a minimum deposit of £80 but are free from swap fees when short-term trading. Margin calls are made at the 100% level while stop-outs are enforced at 30%. A maximum of 100 open and pending orders are allowed.

I was pleased to see that expert advisors are permitted on the MT4 platform for this account type plus free intraday market updates.

Prime Account

In the Prime account, we found a wider range of products, spanning major, minor and exotic currency pairs plus metal, energy, index, stock and crypto CFDs. Spreads start from 0.0 pips and fixed leverage of up to 1:500 can be used when trading.

Commissions of £6.50 per round traded lot are applied to forex trades, while a substantially higher fee of £10 per round traded lot is levied on index and commodity CFD trades. A 0.8% commission is applied to single stock and cryptocurrency CFD trades.

As with the Zero Account, there is an £80 initial minimum deposit but no swap fees for short-term trades. Margin calls are also made at the 100% level while stop-outs are enforced at 30%, though we noted that clients benefit from a higher maximum of 250 open and pending orders.

As with the Prime account, expert advisors are fully supported on MT4.

How To Open A Live Account

IMMFX makes creating a full account a straightforward process:

- Fill in your personal information and select the type of account you would like to open. Investors must select MT4 as their trading platform and USD as their account currency

- Enter your passport, driver’s licence or government ID details to verify your identity, as well as your address and employment status

- Await verification before making your first minimum deposit

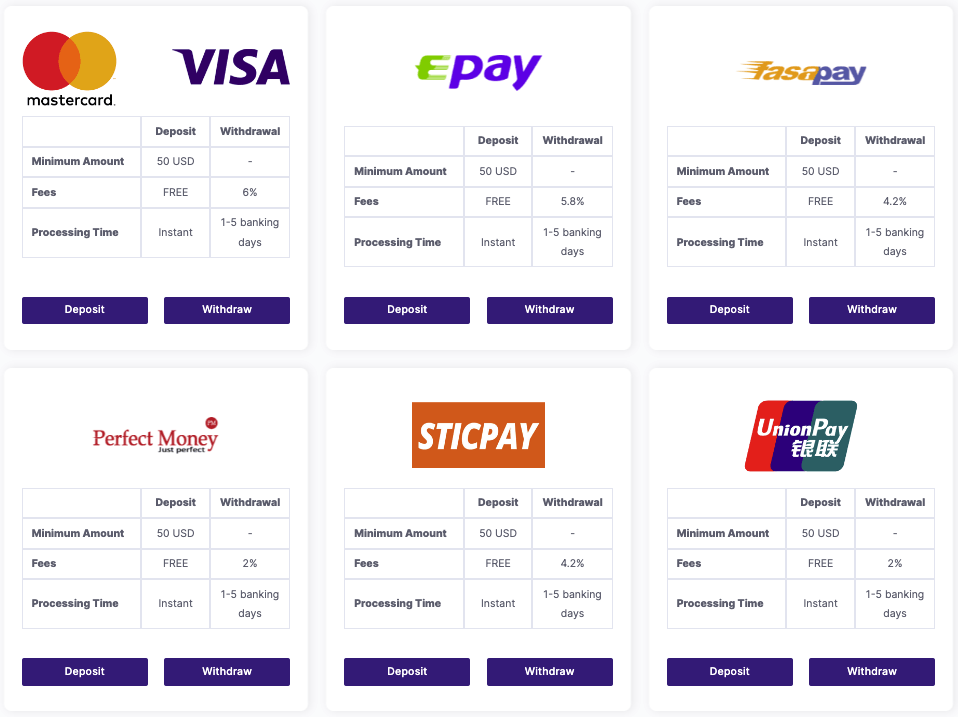

Funding Options

While I was pleased that IMMFX supports a good range of funding options, UK investors will be disappointed to discover that payments must be made in USD or crypto tokens. There are also huge withdrawal fees for many supported methods, reaching up to 8.8%.

UK investors can choose from fiat payment methods like MasterCard and Visa, Western Union, bank wire transfers or PayPal, to name a few. Crypto funding is also available through Bitcoin, Ethereum, Litecoin or Tether.

I was disappointed that minimum deposits range from $50 to $100 and must be made in USD, often incurring additional forex fees for UK banks and payment providers. And while deposit fees are waived or covered by IMMFX, withdrawal charges range from 2% up to a very uncompetitive 8.8%.

Many forex brokers such as CMC Markets and Pepperstone offer commission-free deposits and withdrawals, as well as GBP accounts. Compared to these, IMMFX is not the best suited to UK traders.

IMMFX Leverage

IMMFX is well-suited to high-leverage traders, with a rate of up to 1:500 available to UK investors on all available account types.

This margin is far higher than that available at FCA-regulated brokers, making it an attractive option for some UK traders. However, traders should be aware that high leverage can lead to heavy losses.

Trading Platforms

IMMFX only supports one trading platform, though it is a service that many forex traders will be familiar with: MetaTrader 4 (MT4).

MT4 is considered the industry standard for forex trading platforms due to its balance of advanced tools and accessible interface.

With features such as strategy backtesting, expert advisor (EA) integration and custom alerts, MT4 is still the go-to platform for forex over 15 years after its launch.

Traders can use an impressive 9 time frames, 30 indicators and 31 graphical objects, which investors can add to with custom indicators and trading tools from the MQL4 marketplace.

The platform is free to download on Windows, Mac and Linux operating systems. MT4 is also available through the browser-based WebTrader platform and as a mobile app for Android and iOS devices.

MetaTrader 4

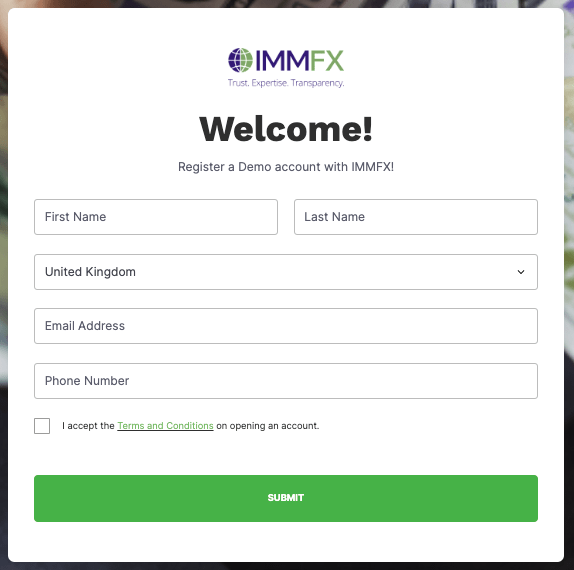

Demo Account

We were pleased to discover that IMMFX offers a demo trading account with up to $100,000 in paper funds.

Traders can get unlimited access to the MT4 terminal to experience real market conditions and test out their strategies before depositing real money.

How To Open A Demo Account

To request a demo account:

- Navigate to the broker’s home page, scroll down to ‘Trading Platforms’ and select ‘request a demo’ under MetaTrader 4

- Next, fill in the form with your name, email address and phone number

- You will be emailed a MetaTrader 4 login to begin demo trading

Tools & Education

With several educational videos, a regularly updated blog and daily summaries of signals on major assets, our experts were happy with the breadth of up-to-date education and analysis IMMFX provides to clients.

I liked the blog section, which contains global news reports directly from DailyFX. There is also a range of educational pieces ranging from forex tips to personal finance.

To compete with leading brands, it would be nice to see some more organic market insights from the broker’s own industry experts, as well as some live webinars or forex courses.

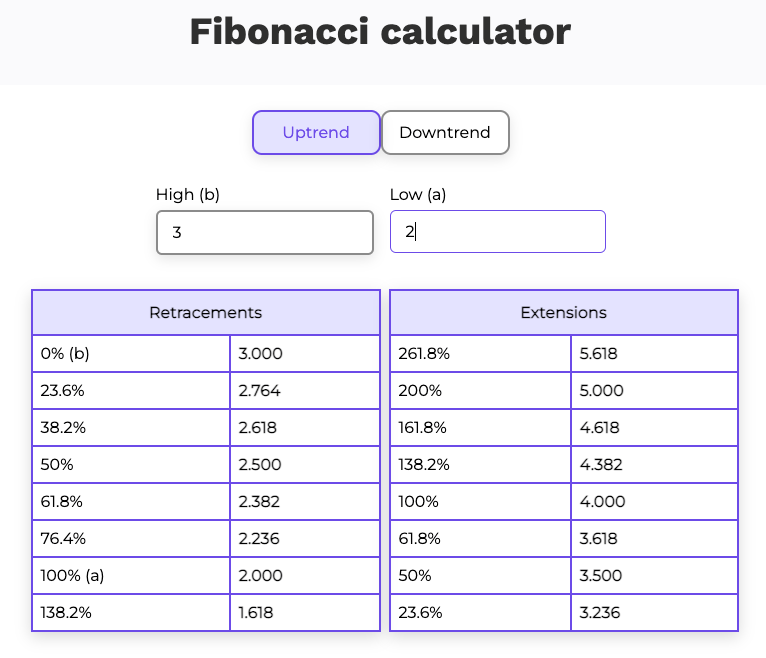

In terms of trading tools, I was impressed to see a range of helpful calculators and converters, including a Fibonacci and CFD profit/loss calculator. There is also an economic calendar supplied by TradingView, as well as daily signals on popular instruments.

Fibonacci Calculator

UK Regulation

IMMFX is registered offshore with the loose oversight of the Marshall Islands Financial Services Authority (GLOFSA).

While the broker claims to take several measures to protect clients, their funds and their data, we recommend considering an FCA-regulated broker for maximum peace of mind.

We did find that IMMFX helps to protect client funds through an Automated Robotic Risk Management System (ARMS), which issues early warning alerts if a client’s account is close to reaching a negative balance. In addition, the broker segregates client funds and holds them in tier-one bank accounts.

However, the Republic of the Marshall Islands Financial Services Authority (GLOFSA) does not have a fund protection scheme, so clients are not protected in case of broker insolvency.

It is also concerning to find that, unlike most other global regulators, there is no directory of licensed companies available to view on the GLOFSA website.

Bonuses Deals

When we used IMMFX, we found a recurring bonus when you add funds to a trading account. However, as expected from an offshore broker, the terms of this bonus are concerning.

Bonus funds are credited as 20% of funds added to a trading account, up to $4,000 (£3,200). Investors can continue to receive this bonus as they add more funds to their trading accounts.

However, to convert bonus funds into withdrawable credit, investors must make $100,000 (£80,000) worth of trades per $1 (£0.80) of bonus. Any withdrawals made before all bonus funds are converted will void the remainder of the bonus.

Traders should read the terms of any bonuses carefully, as they are often designed to discourage you from withdrawing.

Customer Service

British traders will be pleased to discover that IMMFX support has a UK telephone hotline, as well as a website live chat and email addresses for support.

The broker’s team is available from Sunday 7:00 pm GMT/GMT+1 to Friday 8:00 pm GMT/GMT+1.

- UK phone line: +44 20 3695 0059

- WhatsApp support: +44 20 4586 3730

- General support email: info@immfx.com

- Technical support: support@immfx.com

Company Details & History

Established in 2014, IMMFX offers UK traders access to forex and CFD markets through the MetaTrader 4 (MT4) platform.

The broker operates a non-dealing desk (NDD) model and offers both STP and ECN execution-type accounts to pass on trades to liquidity providers.

Based in Micronesia, the broker holds a regulatory licence from the Republic of the Marshall Islands Financial Services Authority (GLOFSA) and has won several awards, including commendations for its rates and trade execution.

Trading Hours

While using IMMFX, we found that the broker follows standard forex opening hours and closing times, running 24/5. Note that this means that crypto markets are not available for trading over the weekend.

For UK traders, the forex markets open at 10:00 pm GMT/GMT+1 on Sunday and then close at 9:00 pm GMT/GMT+1 on Friday.

Should You Trade With IMMFX?

IMMFX offers a solid range of assets, including crypto CFDs, with competitive spreads from 0.0 pips and high leverage up to 1:500. Negative balance protection, UK-based customer service and support for the popular and capable MT4 platform are also positive aspects.

However, the lack of a GBP account currency, significant withdrawal fees and high commissions for non-forex markets count against the broker. Our team also couldn’t overlook the lack of authorisation from the FCA.

FAQ

Is IMMFX Suitable For UK Traders?

IMMFX could be a good option for investors looking for unrestricted offshore trading conditions, such as high leverage and crypto CFDs. IMMFX also covers all deposit fees, however the 8.8% withdrawal charge, plus the unavoidable USD-to-GBP exchange fees will be problematic for UK clients.

Is IMMFX A Trustworthy Broker?

IMMFX’s GLOFSA license is obtained in an offshore jurisdiction and therefore does not offer the same protections as other agencies. The broker does, however, claim to take client safety seriously, implementing real-time monitoring to prevent user accounts from falling below zero. Client funds are also segregated, which does boost this broker’s trust score.

Does IMMFX Offer Competitive Spreads?

We found very reasonable spreads at IMMFX, starting from 0.0 pips with the ECN account and from 0.6 pips with the commission-free STP account. The 0.1 pips for the EUR/USD pair that we were offered is also in line with competing brokers such as IC Markets.

Is IMMFX Good For Beginners?

IMMFX could be a choice for beginners, with a decent range of payment methods and the beginner-friendly MetaTrader 4 platform. Traders can also use a demo account to access the platform before opening a live profile and make use of the educational content.

However, the lack of FCA oversight and fund protection measures is a major downside for new traders who may want more peace of mind.

Article Sources

Top 3 IMMFX Alternatives

These brokers are the most similar to IMMFX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

IMMFX Feature Comparison

| IMMFX | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $50 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | GLOFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:200 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | IMMFX Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| IMMFX | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

IMMFX vs Other Brokers

Compare IMMFX with any other broker by selecting the other broker below.

Popular IMMFX comparisons: