IFC Markets Review 2025

|

|

IFC Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to IFC Markets |

| IFC Markets Facts & Figures |

|---|

IFC Markets is an STP broker that was founded in 2006 and has since gained 200,000 clients and several awards. This broker has some of the most interesting and wide-ranging additional tools, elevating its clients' trading experience via portfolio quoting, personal composite instruments and extensive analytics. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds |

| Demo Account | Yes |

| Min. Deposit | $1, ¥100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | BVI FSC, SC, Labuan Financial Services Authority |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes (APIs) |

| Signals Service | Yes (Via Chartist Software) |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | IFC Markets clients can access CFDs across commodities, cryptos, indices and ETFs. I’m pleased to see that assets are all available on MT4, MT5 and NetTradeX with decent leverage rates of up to 1:400. |

| Leverage | 1:400 |

| FTSE Spread | 300 |

| GBPUSD Spread | 3 |

| Oil Spread | 12 |

| Stocks Spread | Variable |

| Forex | I like that there’s a decent range of 50+ major, minor and exotic forex pairs available at IFC Markets, with just a $1 minimum deposit. That said, spreads are fixed from 1.8 pips, which isn’t the lowest I’ve seen. |

| GBPUSD Spread | 3 |

| EURUSD Spread | 1.8 |

| GBPEUR Spread | 1.8 |

| Assets | 50 |

| Currency Indices |

|

| Stocks | For equity-focused investors, I think the small range of 100+ US, European and UK shares will not be sufficient to build a diversified stock portfolio. The selection of 12 global indices and 4 ETFs is also much smaller than most of the top brands I’ve reviewed. |

| Cryptocurrency | IFC Markets also boasts a good selection of 15 cryptocurrency CFD pairs and I’m particularly impressed to see Bitcoin futures on offer. The free demo account is an excellent place to start if you want to practice your crypto trading strategies. |

| Coins |

|

| Spreads | 50 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

IFC Markets is an established global brokerage, providing a good choice of instruments and tools for both beginner and experienced investors. Our review will give our unbiased opinion on the services available to UK retail clients. We have put the tools and platforms to the test, analysing the brand’s regulation, login security, trading terminal features, and more. We also explain how to sign up and open a live account.

Our Take

- IFC Markets offers unique trading opportunities including synthetic instruments, continuous commodity and index CFDs, and a bespoke trading platform with uBTC base currency

- The broker is a good choice for new traders with beginner-friendly accounts and a trading academy, as well as PAMM accounts

- The weak regulatory status and lack of investor protection are disappointing

- Account base currencies do not include GBP, which means UK traders may have to pay conversion fees

Market Access

IFC Markets’ instrument list is extensive, with 650+ popular products such as indices, stocks, and forex available, alongside synthetic instrument development opportunities on the NetTradeX terminal.

- Forex – 50+ major, minor, and exotic currency pairs such as EUR/GBP, GBP/AUD, EUR/JPY, and USD/CZK

- Stock CFDs – 100+ global company shares from major stock exchanges including the New York Stock Exchange (NYSE), Deutsche Boerse, and the London Stock Exchange (LSE)

- Commodity Futures And CFDs – 20+ precious metals, energy, and agriculture futures contracts such as Brent and crude oil, cocoa, wheat, gold, and copper

- Cryptocurrency Futures And CFDs – Bitcoin futures only and 15+ popular digital currency coins to trade as CFDs including Bitcoin, Ethereum, Litecoin, and Dogecoin

- Indices CFDs – 12 major global stock indices such as FTSE 100, DE 30, NASDAQ 100, and S&P 500

- ETF CFDs – Four exchange-traded funds such as the iShares 20+ Year Treasury Bond ETF and the SPDR Gold Trust ETF

Our expert’s favourite concept was the unique Personal Composite Instruments (PCI), available on the NetTradeX terminal. We cover this in more detail below, however, the benefits are interesting.

Fees

IFC Markets is transparent with its trading fees. Charges vary between account types with fixed or floating spread price models. We thought the fixed spread accounts weren’t particularly competitive, starting from 1.8 pips. The floating spread profiles offer tighter spreads, from 0.4 pips.

I did find that additional commission charges apply when trading stocks. For example, stocks listed on the London Stock Exchange (LSE) will have a 0.1% commission charge, with a minimum commission of $1 vs a $0.02 fee per stock traded on the New York Stock Exchange (NYSE). This is competitive, aligning with top brands like CMC Markets.

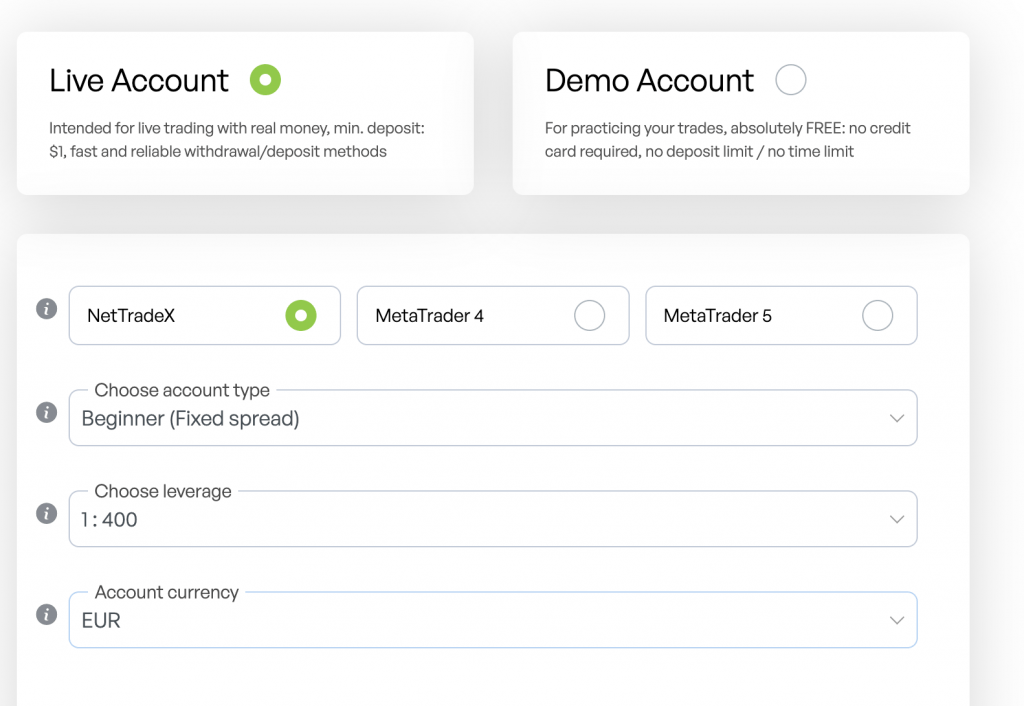

Account Types

We were pleased to see IFC Markets offers live fixed and floating real account types, available on all three trading platforms and suitable for retail investors of all experience levels and strategies.

We liked that the broker offers an account specific for beginners on the NetTradeX terminal, with a low minimum deposit of $1 which is competitive vs IC Markets at $200.

A swap-free Islamic account is also available upon request.

NetTradeX

Standard Fixed and Floating

- $1,000 minimum deposit

- Maximum leverage 1:200

- Fixed spreads from 1.8 pips

- Floating spreads from 0.4 pips

- Minimum order volume 10,000 units

Beginner Fixed and Floating

- $1 minimum deposit

- Maximum $5000 equity

- Maximum leverage 1:400

- Fixed spreads from 1.8 pips

- Floating spreads from 0.4 pips

- Minimum order volume 100 units

MetaTrader

Standard Fixed And Floating

- $1,000 minimum deposit

- Maximum leverage 1:200

- Fixed spreads from 1.8 pips

- Floating spreads from 0.4 pips

- Minimum order volume 0.1 lots

Micro Fixed

- $1 minimum deposit

- Maximum $5000 equity

- Maximum leverage 1:400

- Fixed spreads from 1.8 pips

- Minimum order volume 0.01 lots

Micro Floating

- $1 minimum deposit

- Maximum $5,000 equity

- Maximum leverage 1:400

- Floating spreads from 0.4 pips

- Minimum order volume 0.01 lots

I also found improved trading conditions available to high-volume retail investors. The ‘VIP Trading Account’ is available to traders with an initial $50,000+ deposit. The perks are good, including free access to a VPS, deposit, and withdrawal fees waivered, access to a personal account manager, and potential improved trading fees.

How To Open An IFC Markets Account

Our experts found it very easy to register for an IFC Markets account.

- Complete the online application (name, email, country of residency, mobile number and create a password)

- Click ‘Register’

- Confirm your email address via the verification link sent to your registered email

- From the side menu of the client dashboard, choose ‘My Accounts’ and then ‘Open Live Account’

- Choose a trading platform from the top icons and then use the dropdown menus to select an account type, leverage, and account base currency

- Review and accept the T&Cs by selecting the tickbox

- Select the ‘Open Account’ icon to complete the registration and then proceed to make a deposit

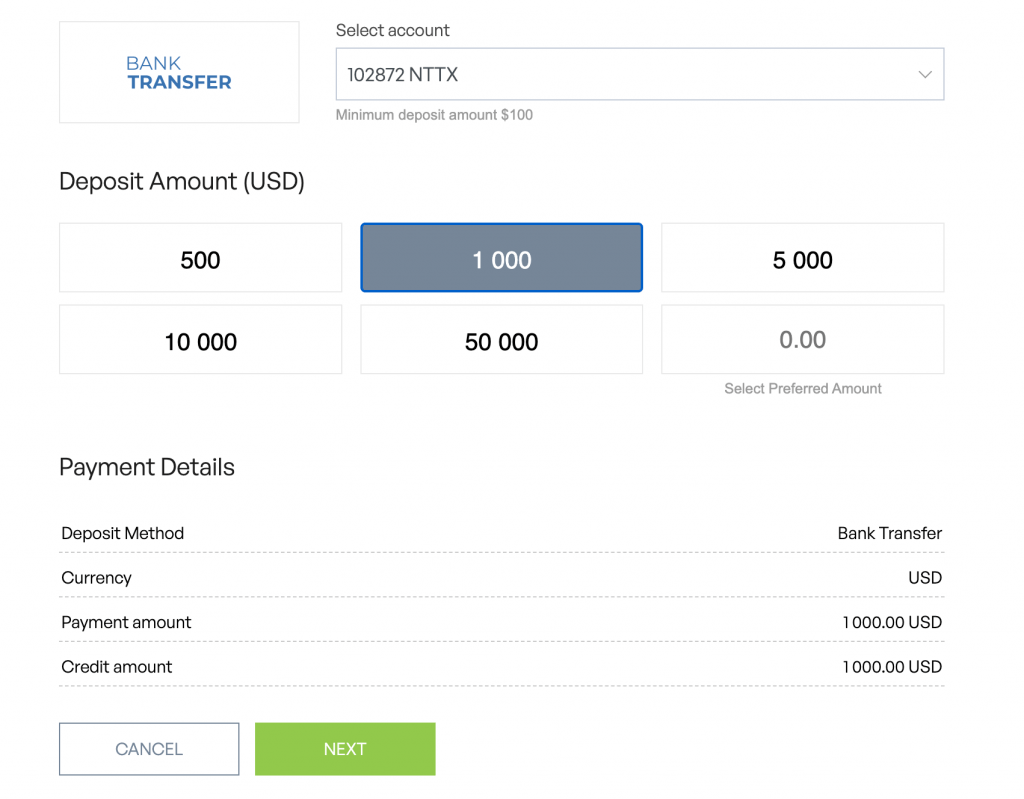

Funding Methods

IFC Markets accepts plenty of deposit methods. Our team found all payment types have a minimum deposit requirement, though this does start from as little as $1.

It was a shame to see fees apply for some payment methods, though credit/debit cards, bank wire transfers, and cryptocurrency are fee free from the broker’s side. WebMoney payments are very expensive, with a 20% fee applicable.

I was disappointed to see that IFC Markets does not accept GBP as an account base currency. USD, EUR, or JPY are accepted only, therefore you will be required to convert your funds.

You can be reassured that all payment methods offer instant account funding, except for wire transfers which can take up to three days for funds to clear.

- Bitwallet – Minimum deposit $10, no fees

- Cryptocurrency – Minimum deposit $100, no fees

- WebMoney- Minimum deposit $1, 20% deposit fee

- ADVCash Minimum deposit $1, maximum deposit $5000, no fees

- Bank Wire Transfer – Minimum deposit $100, bank charges may apply

- Fasapay- Minimum deposit $1, maximum deposit $5000, 0.5% deposit fee

- Credit/Debit Card – Minimum deposit $100, maximum deposit $5000, no fees

- Perfect Money – Minimum deposit $1, maximum deposit $5000, 0.5% – 1.99% fees

You must withdraw funds back to the original payment method. We were pleased to see that IFC Markets has the capacity for fund withdrawals on weekend dates too, though you may experience delays if this is not reflective of your chosen payment method too.

It was a shame to see that withdrawal fees apply for all methods including a $20 charge for bank wire transfers, a 0.8% fee to use WebMoney, and a 0.5% fee for Fasapay withdrawals.

How To Make A Payment

- Log in to your IFC Markets account dashboard

- Choose ‘My Money’ from the side menu and then ‘Deposit’

- Select the green ‘Deposit’ icon next to a payment method (in this example we choose wire transfer)

- Choose the account to deposit from the dropdown menu

- Select a deposit value from the options or type an amount and choose ‘Next’

- Initiate the payment using the bank details displayed on the following screen (you will need to add your trading account number in the reference)

Trading Platforms

IFC Markets offers three trading platform choices; a proprietary terminal NetTradeX, as well as popular third-party brands MetaTrader 4 (MT4) and MetaTrader 5 (MT5). We were pleased to see that you can have an account open on all platforms.

NetTradeX was not available as a web terminal unlike the MetaTrader terminals, instead, this is available for free download to desktop devices including Mac.

In terms of usability, we found the platforms quite similar, with plenty of customisation available to make the terminals work better for you. All offer advanced functionality, yet can be stripped down enough to suit the needs of beginners.

One of my favourite qualities of the bespoke terminal is the option to display multiple instruments on the same chart. This is ideal when planning Personal Composite Instruments (PCI) using the Portfolio Quoting Method.

We would recommend testing all the terminals in demo mode, before investing your own money. I explore some of my favourite features below:

NetTradeX

- Access to your full trading history for performance evaluation

- Drag and drop window placement outside of the main terminal interface

- Complex order types available including one cancels the other (OCO) and activated orders

- Integrated market sentiment data and fundamental analysis via the Thomson Reuters news feed

- Several custom alert choices that can be set for multiple instances including order execution, price change, profit/loss level reached, or trailing stop triggering

MetaTrader 4

- Four pending order types and three order execution forms

- Pre-installed technical indicators with a library of additional to download

- Customisable charts with nine timeframe views from one minute to one month

- Access to Expert Advisors (EAs) trading bot functionality with single-thread backtesting

- MetaQuotes programme language (MQL4) to write custom indicators and bespoke financial scripts

MetaTrader 5

- Six pending order types

- Integrated economic calendar with real-time news and events

- Access to Market Depth data, real-volumes traded, and tick volumes

- Access to Expert Advisors (EAs) trading bot functionality with multi-thread backtesting

- 38 in-built technical indicators and 44 drawing tools with a library of additional to download

- Advanced MetaQuotes programme language (MQL5) to write custom indicators, scripts and strategies

How To Make A Trade On NetTradeX

- Sign in to your IFC Markets account and launch the NetTradeX terminal

- Double-click on the instrument you want to trade from the ‘Market Watch’ window

- The ‘Meal Deal’ order screen will pop out, here you can add trade parameters (volume and stop loss/take profit values)

- Choose ‘Buy’ or ‘Sell’ to initiate the order

- Select ‘Ok’ on the following order approval screen

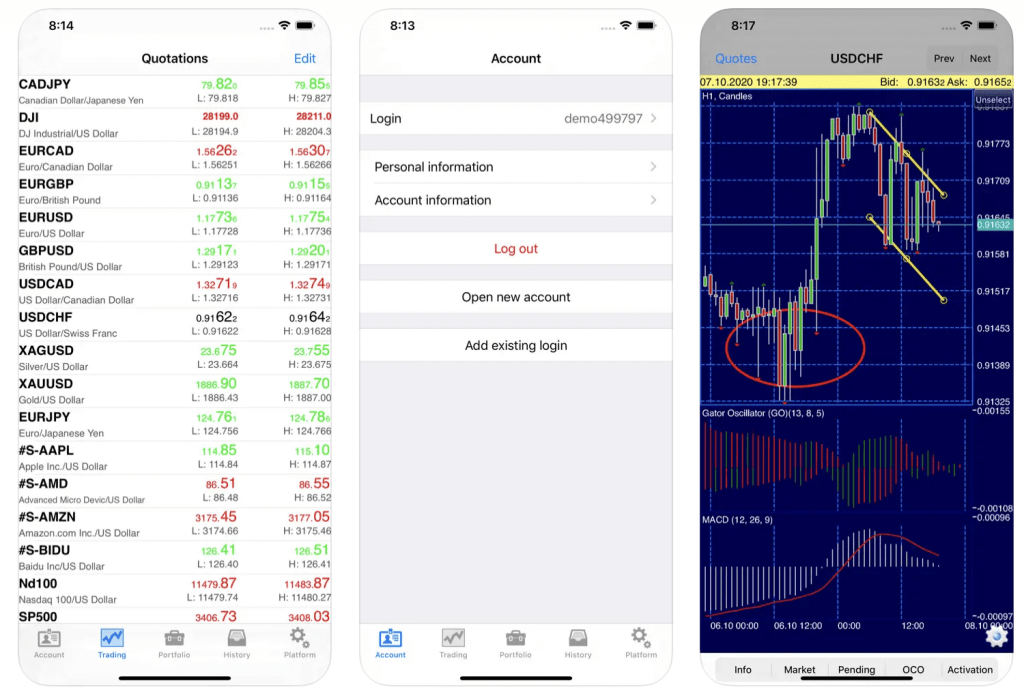

IFC Markets App

We were satisfied to see that all three trading platforms had mobile app compatibility. You can download MT4 and MT5 to iOS and Android (APK) devices, and NetTradeX has the added benefit of Windows phone access.

I found all three apps were easy to use, offering full account management features and access to the suite of analysis tools and charting. All have bottom menu navigation functionality, with the option to switch between screens instantly. You can open and close positions, view full order history and access live price quotes while on the go.

NetTradeX

Leverage

IFC Markets offers high leverage up to 1:400. However, we found maximum ratios vary between trade platforms and account types.

The Standard profile offers the lowest leverage amounts, up to 1:200 only. Stock CFDs are restricted to a maximum 1:20 leverage on all terminals, and commodity CFDs are limited to 1:40 for MT4 and MT5.

Margin is flexible, and you can change this at any time from your profile settings.

All accounts have a 10% stop-out level.

Demo Account

You can practise trading risk-free on the IFC Markets free demo account. We were pleased to see the paper trading profile is available for all three platforms, with no maximum expiry time.

You can choose to leverage up to 1:400 and an initial virtual balance of $10,000. On the negative side, I was disappointed that there was no GBP account denomination.

How To Sign Up For A Demo Account

- Select ‘Demo Account’ from the IFC Markets website homepage

- Complete the online registration form (name, email, country of residency, mobile number and create a password)

- Click ‘Register’

- Confirm your email address via the verification link sent to your registered email

- Automatic dashboard login will be initiated

- From the side menu, select ‘My Accounts’ and then ‘Open Demo Account’

- Choose your platform to test, leverage, virtual balance and account currency

- Select ‘Open Account’

UK Regulation

IFC Markets regulation is disappointing. UK account holders will be registered under the IFCMarkets.Corp entity which is licensed with the British Virgin Island Financial Services Commission (BVIFSC).

This is not a particularly reputable financial authorisation due to relaxed joining requirements. You won’t be protected by all the financial safeguarding initiatives of firms overseen by the Financial Conduct Authority (FCA).

Having said that, we felt reassured to see that IFCMarkets.Corp does have inclusion with AIG Professional Indemnity Insurance. Additionally, we were pleased to see that funds are held segregated from business money, but a downside is the lack of negative balance protection.

Bonus Deals

As IFC Markets is not regulated by the Financial Conduct Authority (FCA), it has the flexibility to offer financial incentives. When we used IFC Markets, our experts were offered a 50% deposit bonus with entry to a product prize pool. There is a minimum deposit requirement of $250 to participate, and you must trade a volume of at least 0.5 lots within the first 30 days of account opening, which we thought was reasonable.

The broker also runs a friends-and-family referral programme with financial rewards based on your referral’s trading volume. You can earn up to $50 per referral, though eligibility requirements are strict, and your friend must trade at least 5 lots within 90 days of registration to achieve. The lowest $20 reward tier still requires your friend to trade 2 lots in 90 days.

Extra Tools & Features

Education

IFC Markets offers a detailed education academy, free to all registered customers. I was impressed with the content, as well as a certification upon completion and a 15% bonus reward for your first deposit made after completing a course.

We liked that the courses are specific to experience levels Beginner, Intermediate, and Expert, with topics ranging from ‘what are CFDs?’ to ‘using fundamental analysis’.

We feel confident the online materials can get you comfortable with trading the live markets, regardless of your previous knowledge. There are plenty of integrated YouTube videos, a glossary of keywords, and e-books.

Analytics And Insights

Market analysis is where IFC Markets really stands out for us. There is a wealth of information available to aid with investment decisions and trading ideas.

You can view historical price data by instrument, access an economic and commodity market calendar, review market opportunity suggestions with top gainers/losers for the week, and access IFC Markets expert analyst weekly roundups.

Although useful, I would say that some of the content is very text-heavy, which did make it difficult to pick out some of the key takeaways, especially for beginners.

We rated the new ‘Trade Ideas’ function, which offered a snapshot view of new position suggestions and price movement predictions. These are posted daily. IFC Markets also offers plenty of trade support calculators including a margin calculator and a profit and loss calculator.

Portfolio Quoting

A unique service offered by IFC Markets is their Portfolio Quoting Method. The tool allows users to create bespoke financial instruments, determining the value of an asset in relation to another. This can be across asset classes, for example, Gold vs GBP or Google stocks vs Euro.

The opportunity is only available on the NetTradeX terminal, but the advantages are clear. You can create new products to hedge against risk and maintain stability in times of significant volatility.

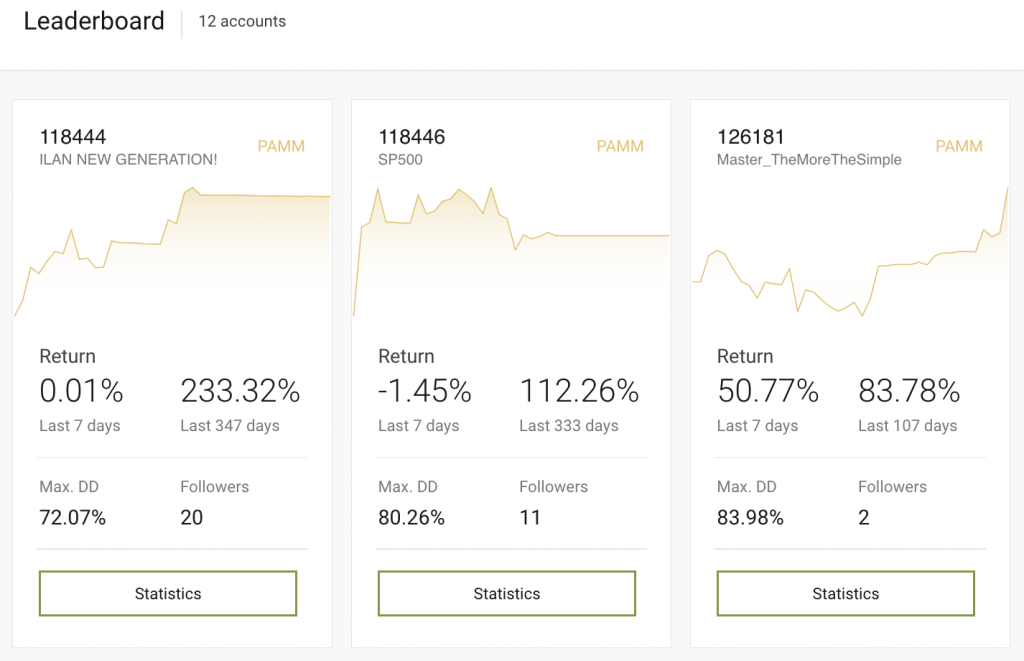

PAMM Account

For beginners, or those with restricted time, the IFC Markets PAMM account may be a good place to start. You can invest your funds with an experienced money manager, whilst maintaining full flexibility to change and monitor your investments.

I liked that you can view the full trading statistics of the money managers, including their maximum drawdown, average profitable days, and current open positions.

Fees will vary by the fund manager you choose. I found these typically range from 10% to 50% of the profits, plus a small volume charge per lot. This information is available before you choose a PAMM account to follow.

PAMM Leaderboard

How To Get Started

- Register for an IFC Markets account

- From the dashboard, select ‘Leaderboard’ from the menu along the top

- Use the filters above the list of accounts to source by aspects most important to your strategy

- Scroll to review the options and click on ‘Statistics’ to review past performance in detail

- Click the ‘Invest’ icon from the leader board screen or via the statistics page

- Review the terms and conditions of the PAMM account

- Select ‘Subscribe To A Master Account’

IFC Markets Customer Service

Our experts were impressed with IFC Market’s customer support. The brand offers several contact options, including a UK telephone number, which is nice to see. Help is available from 6:00 am to 7:00 pm Monday to Friday. We liked that weekend support is also accessible between 7:00 am and 3:30 pm Saturday and Sunday (CET).

- Email: support@ifcmarkets.com

- UK Telephone: +44(20)39661649

- Postal Address: AGP Chambers, 84 Spyrou Kyprianou Avenue, 4004 Limassol, Cyprus

You can find links to alternative contact methods such as live chat, Facebook Messenger, Skype, and WhatsApp via the broker’s ‘Contact Us’ webpage. We tested the live chat function and received a response almost instantly which is reassuring.

Company Details & History

IFC Markets was founded in 2006, with a mission to build a trusting and efficient user experience for retail investors. The brand values itself as accessible, innovative, and transparent.

The IFCM Group is the umbrella firm for three global entities; IFCM Cyprus Limited, IFCMarkets Corp and Nettradex Limited. UK retail traders will be registered under the IFCMarkets.Corp subsidiary, which is regulated offshore, with licensing from the British Virgin Island Financial Services Commission (BVIFSC).

The broker has over 200,000 registered customers benefiting from instant execution via an STP pricing model. IFC Markets has been recognised with several global industry awards including the Best Forex Broker Service in Malaysia at the Gazet International Awards 2023 and the Most Customer-Centric Forex Broker In Indonesia at the Global Business Review Magazine Awards 2022.

Trading Hours

Trading hours vary by instrument, with CFDs typically available to trade during the opening of the world stock exchange markets. The IFC Markets server operates with a CET offset.

We liked the trading hours tool. You can filter by day of the week, and local time zone to view the open hours by instrument including GMT local time (UTC +1). London Stock Exchange-listed stocks, for example, are available to trade between 8:00 am and 4:30 pm (GMT), whereas the S&P 500 index can be traded from 1:00 am to 9:00 pm (GMT).

Should You Trade With IFC Markets?

We were pleased with the tools and services offered by IFC Markets. With an extensive instrument list, a unique component creation tool, expert analysis, education, and more, we feel confident most bases are covered for retail investors of all experience levels. A choice of fixed or floating spreads provides decent trading opportunities for all strategies.

Although the broker is not licensed by the most reputable regulator, we feel assured IFC Markets is not a scam. To improve its rating further, we would like to see FCA oversight for UK traders.

FAQ

Is IFC Markets Safe And Regulated?

IFC Markets is a relatively secure broker-dealer with no history of major scams. Despite the offshore regulation, the brand has a 17+ year global presence, with a solid history of online trading services. With that said, be cautious of the lack of negative balance protection.

Does IFC Markets Have A Low Minimum Deposit Requirement?

Yes, you can start trading with as little as a $1 minimum deposit on the NetTradeX terminal. This is ideal for beginners or those with limited capital when getting started with trading.

Does IFC Markets Offer A Good Trading Platform?

While using IFC Markets, you will have the choice of the proprietary NetTradeX platform, and third-party terminals MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are all powerful trading platforms, with plenty of advanced analysis features and customisable interfaces.

Is It Easy To Sign Up For An IFC Markets Account?

We managed to sign up for an IFC Markets account in just a few minutes. The online application form is basic, with personal detail and password creation requirements.

Is IFC Markets Suitable For Beginners?

Our experts found that IFC Markets is suitable for beginners. As well as an MT4, MT5, and NetTradeX demo account available for all platforms, there is educational content, a specific beginners account on the NetTradeX terminal with a $1 minimum deposit and a hands-off PAMM profile option.

Article Sources

Top 3 IFC Markets Alternatives

These brokers are the most similar to IFC Markets:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Admiral Markets - Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

IFC Markets Feature Comparison

| IFC Markets | FP Markets | IC Markets | Admiral Markets | |

|---|---|---|---|---|

| Rating | 2.9 | 4 | 4.8 | 3.6 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting |

| Minimum Deposit | $1, ¥100 | $40 | $200 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | BVI FSC, SC, Labuan Financial Services Authority | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:400 | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (EU), 1:500 (Global) |

| Visit | ||||

| Review | IFC Markets Review |

FP Markets Review |

IC Markets Review |

Admiral Markets Review |

Trading Instruments Comparison

| IFC Markets | FP Markets | IC Markets | Admiral Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | Yes | Yes | Yes |

IFC Markets vs Other Brokers

Compare IFC Markets with any other broker by selecting the other broker below.

Popular IFC Markets comparisons: