GO Markets Review 2025

GO Markets is a multi-award-winning online ECN brokerage that offers a quality trading platform and dedicated service to both beginner and experienced investors. Clients can access over 60 CFD instruments, including forex, indices and commodities, across major global markets. Our experts’ 2025 review explores GO Markets’ services and tools, helping prospective investors decide whether this CFD provider will suit them when looking to start or grow their portfolio.

Company Details

GO Markets was founded in 2006 in Australia and is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC). The broker is well recognised by its green logo of a ribbon in the shape of a rounded square.

The online broker made a partnership with Chelsea FC in 2020, highlighting its drive for growth and to deliver best performance across its platform. GO Markets is committed to providing stand-out customer support and ensuring a high-quality trading experience, illustrated by its “Investment Trends” excellence award for Customer Service assigned two years in a row.

This leading CFD provider has also been rated No. 1 for Education Materials/Programmes by Investment Trends three years in a row, reflecting the success of its education hub, which provides an extensive range of resources to all its clients.

Trading Platforms

GO Markets boasts several trading platforms for financial speculation, appealing to all forms of investing enthusiasts and novices. The three main platforms offered are MetaTrader (MT4), MetaTrader (MT5), GO Webtrader and the firm’s shares trading platform.

MetaTrader 4 (MT4)

Since the inception of MT4 into the forex and CFD trading markets, the platform has become the most popular option in the industry. Its reliability, adaptability and sought-after features are key to this popularity.

Notable features of MT4 are:

- Nine timeframes

- One-click trading

- Up to 99 concurrent charts

- Algorithmic trading via MQL4

- Comprehensive set of chart types

- 53 built-in technical indicators and analytical tools

GO Markets clients can download MT4 for Windows and Mac PCs.

GO WebTrader

With GO WebTrader, the broker’s proprietary platform, there is no need to download a MetaTrader platform package. This web-based toolset, which our experts found to be intuitive and suitable for traders at all levels.

Markets

Our review team has found the ECN forex broker to offer an impressive choice of tradable CFD assets, including:

- Commodities – Brent and WTI crude oil spot and futures products

- Metals – gold and silver spot and USD pairs

- Indices – Trade on 12 leading global indices, including the FTSE 100, CAC 40, US 500 and ASX 200

- Forex – 50+ major, minor and exotic currency pairs, including the EURUSD, USDJPY, USDAUD and GBPUSD. Metal pairs, XAGUSD and XAUUSD are also available to customers

Spreads & Commissions

While using the broker, we found that clients with a GoPlus+ account pay rate a low commission on standard lots of just £2.00 per side, with ultra-low spreads from 0.0 pips. On a standard account, clients can expect spreads from 1.0 pips with zero commission.

GO Markets investors can expect varying levels of spreads on forex CFDs. An average spread of 0.1 pips can be found on AUD/USD and EUR/USD, whilst GBP/USD has an average spread of 0.3 pips. Users can trade from a minimum of 0.1 pips on popular index instruments, such as the FTSE 100.

Leverage

UK clients are limited in terms of leverage rates due to EU and FCA regulations. Therefore, the maximum rate of 1:500 offered by the firm is not available to UK traders. Instead, leverage limits for each asset class are as below:

- Forex: 1:30

- Indices: 1:20

- Commodities: 1:10

Mobile Apps

Go Markets offers mobile-friendly trading for both Android and iOS devices. Clients can download the mobile trading platform for free using the respective app stores. The app allows users to access the same analytical tools and features available through the desktop platform, wherever there is an internet connection. There is also a mobile version of the MetaTrader 4 platform, available for Android and Apple users.

Payment Methods

Go Markets boasts several deposit and withdrawal options with zero transaction fees.

- Poli

- Visa

- Skrill

- BPAY

- Fasapay

- Neteller

- Mastercard

- Bank Wire Transfer

It should be noted that all payment methods process transactions instantly, excluding wire transfers and BPAY, which can take 1-3 business days. The accepted currencies for each payment method vary and you may be subject to withdrawal fees, depending on your bank.

Demo Account

Traders can familiarise themselves with the GO Markets platform by opening a demo account. Demo users are given access to all the account types and platforms to practise investing with a starting figure of £50,000 in virtual funds. When we used this risk-free environment, we could execute and test strategies with access to over 80 technical analysis tools and 24/5 support. It is an invaluable way to learn before entering the live market.

Opening a demo account is straightforward, select the ‘Try free demo’ button on the broker’s website, GoMarkets.com, fill in the required information and submit. Users can then login to their accounts and begin investing with digital funds.

Deals & Promotions

GO Markets offers a complimentary monthly virtual private server (VPS) subscription to all its customers who have managed to trade a minimum volume of $1m per calendar month. Unfortunately, this broker offers no deposit bonus schemes.

Regulations & Licensing

Our regulation review identified that GO Markets Ltd is registered in the Cyprus Companies Registry and regulated by the Cyprus Securities Exchange Commission. The firm’s Australian operation, Go Markets Pty Ltd, based in Melbourne, is regulated by the Australian Securities and Investment Commission (ASIC).

The award-winning broker is authorised and regulated in the UK by the Financial Conduct Authority (FCA) as a private limited company, with its office based in London. GO Markets Limited has also recently expanded into Dubai, obtaining a UAE broker license.

Additional Features

Our expert review team were pleased to find a range of extra features and tools for GO Markets clients:

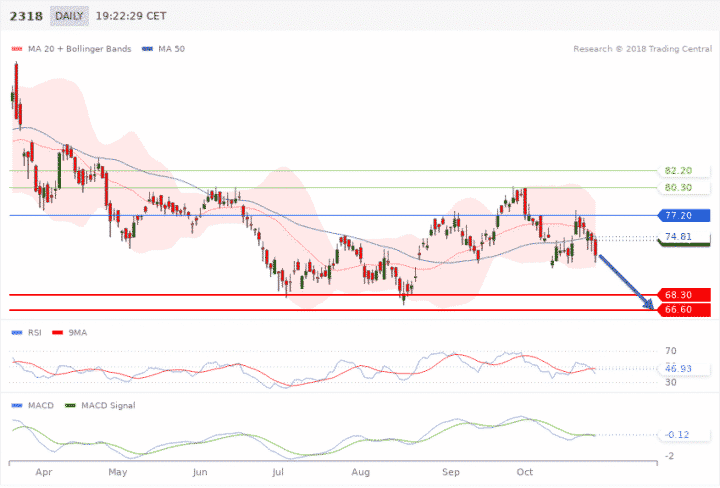

- Trading Central activation, which enables 24-hour multi-asset coverage

- VPS that provides users with direct access to global liquidity in the forex market

- a-Quant activation, which provides access to trading products based on algorithms developed specifically for brokers

- An economic calendar that presents the previous, consensus and actual result of each event on the same line, as well as indicating the market’s volatility

- The education hub provides access to group coaching, MT4 video tutorials and tailored courses for investors of varying levels of experience, such as ‘First Steps in Forex’ for beginners.

Trading Central

Account Types

While using the brokerage, we found GO Markets to offer two retail and one professional account type to suit investors of all levels.

- Standard Account – Suited to both new and experienced traders who are looking for direct access to the global market with zero commission fees. The minimum deposit is £100, there are no commissions and spreads start from 1.0 pips.

- Go Plus+ Account – This account is directed more toward high-volume and algorithmic traders, with dedicated support from an account manager. The minimum deposit is £100, commissions are £2 per side and spreads start from 0.0 pips.

- Go Markets Professional – Designed for professional clients, applicants must undergo an eligibility assessment comprising several asset/trading experience criteria, of which you must meet two of the three listed. As a professional client, you are not entitled to negative balance protection, though you are not restricted to leverage rates of 1:30.

Benefits Of GO Markets

- ECN model

- MT4 access

- FCA regulated

- Education hub

- Complimentary VPS

- Zero commission account

- Multi-award winning broker

Drawbacks Of GO Markets

- Limited CFDs

- Limited account options

- No cryptocurrency assets

Guide To Getting Started With GO Markets

1. Create An Account

To begin trading with Go Markets, navigate to the top right-hand corner of the page and click on ‘Open CFD Account’. This will prompt you to input your first and last name, email address, phone number and create a password.

2. Add Funds

Once your account has been created you can sign into the client portal area of the broker’s website. From here, you can initiate the process to fund your account via your preferred deposit method. Bear in mind that GO Markets only accepts EUR, USD and PLN currencies, so there may be a conversion cost if you deposit in GBP.

3. Open A Trade

When you have money in your account, you can start using it to speculate on the financial markets available. To do so, login to the desired trading platform, MT4 or GO WebTrader and navigate to the symbol charting section. Select the asset you wish to trade from the list of symbols to bring up its price chart. From here you can apply technical analysis approaches in line with your strategy and open a long or short position based on which direction you think the asset’s value will move in.

5. Closing your position

To close your position, head to the open orders section of the trading platform and navigate to the position you wish to close. Select “close” and the outcome of the trade will automatically be credited to or debited from your account capital.

Trading Hours

GO Markets trading hours are Monday through Friday, 00:00 to 24:00 (GMT+3) for forex assets. Those for stocks and indices vary depending on the listed exchange.

Market trading hours are subject to change due to public holidays, which customers can find on the broker’s webpage.

Customer Support

If you seek customer support for guidance on how to navigate MetaTrader 4, open an account, withdraw funds or just have a general enquiry, this broker will not disappoint. GO Markets boasts a multilingual client support team which is personalised to you. You can reach out to the customer service team via:

- Live Chat – found in the bottom right of the website

- Cyprus Telephone Contact Number – +44 25023910

- Email – support@gomarkets.eu or newaccounts@gomarkets.eu

- Ticket Enquiry – found on the ‘Contact Us’ page. This will require you to fill in your name, email address and phone number

The customer support team is available 24/5. Clients with any issues that arise outside these hours can navigate to the FAQ section, which covers general, technical and trading queries. The FAQs are found in the banner at the top of the page.

GO Markets also has several active social media platforms, where customers can keep up to date with the latest news. These include Twitter, LinkedIn, YouTube, Instagram and Facebook.

Safety & Security

Legal documents have been made available for all investors to review, including the company’s privacy policy which states that all personal data is highly protected to ensure no unauthorised access. The broker’s multi-regulated status with some of the more stringent financial watchdogs in the world also goes a long way to reassure us of its security.

GO Markets Verdict

GO Markets is a legitimate FCA-regulated broker with tight spreads and award-winning educational resources and customer support, making it suitable for investors of all levels. The Global Forex Awards 2022 saw GO Markets win the Best Forex Fintech Broker Global, Most Trusted Broker EU and Best Trading Support Asia. Offering access to industry-leading MT4 and MT5 platforms with zero commission on positions, this broker is an attractive choice for thousands of customers.

FAQs

Does GO Markets Allow Scalping?

GO Markets does allow scalping for both the standard and Plus+ account types, allowing traders to profit off of small price changes.

Does GO Markets Offer A PAMM Account?

PAMM (percent allocation management module) accounts are not available at GO Markets.

Does GO Markets Offer An FX Lite Account?

GO Markets does not currently offer a forex lite account.

Are Binary Options Available At GO Markets?

Our review found that binary options are not available with this broker, nor is there access to a binary options plugin or demo.

Is GO Markets Suitable For Beginners?

GO Markets Group has been rated No. 1 for Education Materials/Programmes by Investment Trends, boasting an extensive resource library and education hub. We found that the hub provides a solid, in-depth introduction to forex for beginners, outlining key features of forex trading, swap rates and rollover rates.

Top 3 GO Markets Alternatives

These brokers are the most similar to GO Markets:

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

GO Markets Feature Comparison

| GO Markets | IC Markets | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 4.6 | 4.8 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $0 | $200 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, CySEC, FSC, FSA | ASIC, CySEC, CMA, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 72% of retail investor accounts lose money when trading CFDs |

|||

| Review | GO Markets Review |

IC Markets Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| GO Markets | IC Markets | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | No | No | No |

| ETFs | Yes | No | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

GO Markets vs Other Brokers

Compare GO Markets with any other broker by selecting the other broker below.

Popular GO Markets comparisons:

|

|

GO Markets is #20 in our rankings of CFD brokers. |

| Top 3 alternatives to GO Markets |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC, CySEC, FSC, FSA |

| Trading Platforms | MT4, MT5, cTrader |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Copper, Gold, Natural Gas, Oil, Silver, Soybeans, Wheat |

| CFD FTSE Spread | 2.3 |

| CFD GBPUSD Spread | 0.5 |

| CFD Oil Spread | 0.038 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.4 |

| Assets | 50+ |

| Crypto Coins | AAVE, ADA, ALGO, APT, ARB, ATOM, AVAX, AXS, BCH, BNB, BTC, COMP, DOGE, DOT, EOS, ETC, ETH, GALA, HBAR, ICP, INJ, LINK, LTC, NEAR, ONDO, OP, POL, PYTH, RENDER, SAND, SOL, SUI, TIA, TON, TRUMP, TRX, UNI, XLM, XRP |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |