ICM Capital Review 2025

See the top 3 alternatives to ICM Capital or the best UK brokers list for options.

|

|

ICM Capital is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to ICM Capital |

| ICM Capital Facts & Figures |

|---|

ICM Capital is an FCA-regulated brokerage that offers professional traders multi-asset trading. Pro traders can choose between MetaTrader 4 and ICM's proprietary platform to access commission-free and tight-spread account options. ICM Capital does not accept amateur traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, stocks, commodities, futures |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Leveraged contracts for difference can be used to take positions on major financial markets with fast execution speeds. On the negative side, the suite of CFDs is narrow, with commodities and indices only. |

| Leverage | 1:30 (Retail), 1:200 (Pro) |

| FTSE Spread | 2.0 |

| GBPUSD Spread | 1.8 |

| Oil Spread | 2.0 |

| Stocks Spread | Variable |

| Forex | A decent portfolio of currencies are available at ICM Capital. Trade majors like the EUR/SUD with spreads from 0.0 pips. You can speculate on forex using MT4 with expert advisors (EAs) supported. |

| GBPUSD Spread | 1.8 |

| EURUSD Spread | 1.3 |

| GBPEUR Spread | 1.3 |

| Assets | 50+ |

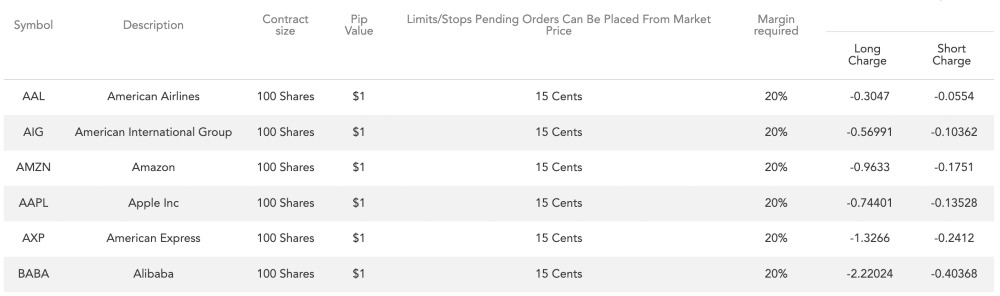

| Stocks | ICM Capital offers CFDs on a good range of US stocks, including large companies like Apple, Google and Pfizer. Traders cannot directly buy and own shares. |

ICM Capital is an ECN broker offering trading on forex, commodities and CFDs with competitive spreads to UK investors. In this review, we assess all the services offered, from trading fees to account types and regulatory oversight, helping you decide whether ICM Capital could be the right broker for your needs. We also unpack our experience with ICM Capital.

Our Verdict

ICM Capital gets a high trust score due to its FCA oversight. We also liked that there was access to the reliable MetaTrader 4 platform with 1:200 leverage and a choice of fee structures.

However, only professional traders can open an account and the broker does not match rivals in terms of market research and additional trading tools. As a result, it will only appeal to a select group of UK investors and does not match the offering from many competitors.

Market Access

With 65+ instruments across several asset classes, I felt that ICM Capital’s offering is diverse but spread thin compared to alternatives, some of which offer thousands of tradable assets. In particular, the selection of metals and energies is limited and there are no UK stocks.

ICM Capital’s instruments include:

- Forex – trade 34 major, minor and exotic currency pairs including GBP/EUR, EUR/AUD, and USD/JPY. Spreads start from 0 on EUR/USD and are generally competitive

- Metals – trade spot silver or gold with no minimum

- Shares – trade stocks and shares on popular names such as Google Inc, Sony Corp and Twitter

- Futures – trade futures on global indices such as Dow Jones, Nasdaq and S&P 500

- Cash CFDs – trade cash CFDs on a range of assets indices including Brent oil, crude oil and UK 100

Micro lots are offered, with a minimum trade size of 0.01 lot. I was also pleased to see no restrictions on strategies, with hedging and scalping permitted.

US Stocks

Fees

I found the pricing structure reasonable for ICM Capital account holders, although the fees do vary between profiles.

ICM Direct account holders will not have to pay any commission on trades, as fees are built into the spreads. Spreads for the EUR/GBP start from 1.3 pips, which is in line with competitors, though tighter spreads on this currency pair are available at other forex brokers.

ICM Zero account holders will have to pay a $7 per round lot on all trades, though spreads are much tighter with the EUR/GBP pair starting from 0.1 pips. Again, these fees are reasonable but not the cheapest around.

It is also worth noting that positions left open overnight or on weekends are subject to swap charges. Rollover is at 20:00 GMT. The rate varies by instrument and between long and short positions. Specific rates can be viewed through the MT4 platform under the Specification tab.

ICM Capital Accounts

Traders can choose between two accounts on ICM Capital: ICM Direct and ICM Zero. The key difference between the two is that ICM Direct offers commission-free trading whilst ICM Zero charges a $7 fee for each trade placed in exchange for tighter spreads. There is no difference between the tradeable instruments or leverage available.

I like that all accounts allow Expert Advisors for automated trading, a real-time news feed, charting and tools for analysis. As such, they provide the basic features I need to speculate on popular financial markets.

I was also pleased to find an Islamic account offered on request. You just need to contact a member of the customer support team for help setting one up.

The key thing to call out is that you must qualify as an elective professional. Retail traders are not accepted.

To qualify as a professional trader you must satisfy at least two of the following:

- Have carried out large trades on relevant markets, and at least 10 per quarter over 4 quarters

- Have worked or currently work in a relevant role in financial services

- Have a portfolio of at least €500,000

A notable bonus for me is that ICM Capital has taken the unusual step to provide negative balance protection to pro traders, a measure not usually offered with professional accounts.

Payment Methods

I found that ICM Capital offers a reasonable range of payment methods, though some traders may prefer to see more e-wallet options and even crypto deposits.

Supported funding options include:

- PayPal

- Bank transfer

- ICM Prepaid card

- Skrill and Neteller

- Credit and debit cards

The minimum deposit for an ICM Capital account is £200, which is high compared to alternatives like OANDA with no minimum deposit or XM with £5. However, it shouldn’t deter traders from applying for a professional account.

My main gripe is that ICM Capital charges fees for all funding methods except bank transfer, which for me is a major black mark against this broker. Most other brokers allow free deposits, so the rates from 1.9% for Skrill up to 3.75% for PayPal seem expensive.

The ICM Capital prepaid MasterCard charges a £1.95 top-up fee, and usage charges and limits do apply, so even this payment method strikes me as expensive.

Deposits are processed within one working day. The prepaid card is also widely accepted beyond the ICM Capital platform and can be used in-store and at ATMs.

Withdrawals

Withdrawals are usually processed in 3–5 working days, which is fairly standard, but again I feel the broker lets itself down with the withdrawal charges on some payment methods, which can be hefty.

Fortunately, there are no charges associated with withdrawals made via credit or debit cards or Neteller, but the fees on the other payment methods are as follows:

- Skrill – 1%

- PayPal – 2%

- Bank transfer – £15

- ICM Prepaid card – £1.95

Trading Platforms

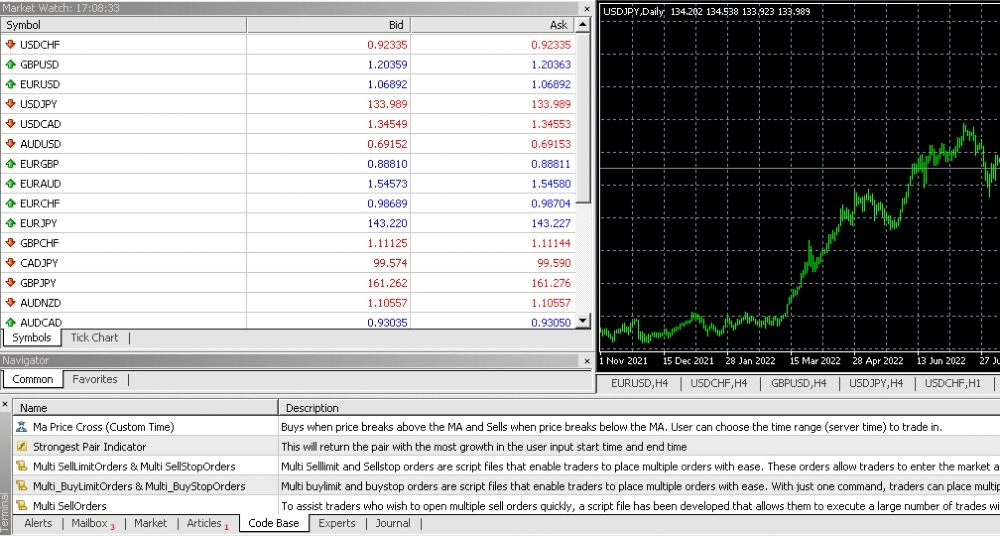

ICM Capital offers the popular MetaTrader 4 (MT4) – a versatile platform that is well-regarded in the industry. I rate MT4 because it offers various trading features, technical analysis tools, automated trading, and a seamless user experience. Key benefits for me are:

- 2000 + indicators

- 24 analytical objects

- Multiple timeframes

- Expert Advisors (EAs)

- Intuitive charting tools

- Historical databases and import/export facility

MetaTrader 4

MT4 is available for desktop or mobile, with its free app compatible with both Android and iOS devices. To download MT4, head to the ICM Markets platform or go directly to the Apple App Store or Google Play.

Yet while MT4 offers a seamless user experience and various features, the latest iteration from MetaQuotes, MetaTrader 5 (MT5), is arguably a better pick for pro traders. MT5 offers faster processing, more order types, plus extra technical indicators and drawing tools.

I was also frustrated by the lack of an alternative third-party or proprietary platform, which is often provided by other brokers, particularly given that MT4 is nearly 20 years old and some brokers offer new and sleek alternatives.

How To Place A Trade

I found making a trade with ICM Capital a simple process, as you would expect from the MT4 platform.

- Open the MT4 terminal and sign in to your account

- Find the asset to trade in the “Market Watch” window

- Right-click on the instrument you want to trade and select “New Order” from the menu that appears

- Enter the parameters in the “Order” window that appears, including any volume, stop loss and take profit orders

- Click on the “Sell by Market” or “Buy by Market” button, depending on whether you want to sell or buy the instrument

- After clicking the button, your trade will be executed, and you should see a confirmation message with the details of the trade

Mobile App

I was disappointed to see that ICM Capital does not offer its own trading app, but clients can access the trading platform via the MT4 app.

The trading solution offers a stable interface, though it is a shame the app does not offer full functionality. For example, custom indicators and EAs are not currently supported on the mobile app. Nor is it possible to place a trailing stop.

ICM Capital Leverage

Professional investors can qualify for higher leverage than the 1:30 typically available to retail traders at FCA-regulated brokers. As such, clients can access leverage up to 1:200.

This flexible leverage can be used to bolster returns on positions, though losses are also amplified so risk management is required.

Demo Account

I was pleased to see that ICM Capital offers all prospective clients a chance to try before they buy via their free demo account, which mirrors real market conditions in a risk-free simulated market.

However, I was less impressed that I can only make use of this feature for 30 days, as it can be a great tool for testing new strategies. This is frustrating as I like to try new setups alongside a live account.

How To Set Up A Demo Account

For those new to the MT4 platform, I would recommend setting up a demo account before jumping into live trading. To get started:

- Sign up for an ICM demo account

- Download the MT4 platform onto your laptop or mobile

- Launch the programme and follow the installation steps as prompted

- Enter the registration details

- Select “Finish”

Note, first-time users will be required to fill in an application form.

UK Regulation

I am comfortable that the broker is trustworthy and relatively secure.

ICM Capital Limited is an FCA-regulated broker under licence number 520965. The Financial Conduct Authority is the UK’s leading financial agency and adherence to rules and guidelines ensures a minimum level of legitimacy, compliance and security for clients.

Client funds are held in segregated accounts with major banks which is a good sign. ICM Capital traders are also protected by the Financial Services Compensation Scheme, which insures up to £85,000 of their funds in the event of business failure.

Bonuses

In accordance with FCA regulations, ICM Capital does not offer any welcome or deposit bonuses to UK clients. This might feel like a drawback but I prefer brokers to focus their incentives on market-leading tools that can improve my trading experience.

Extra Tools & Features

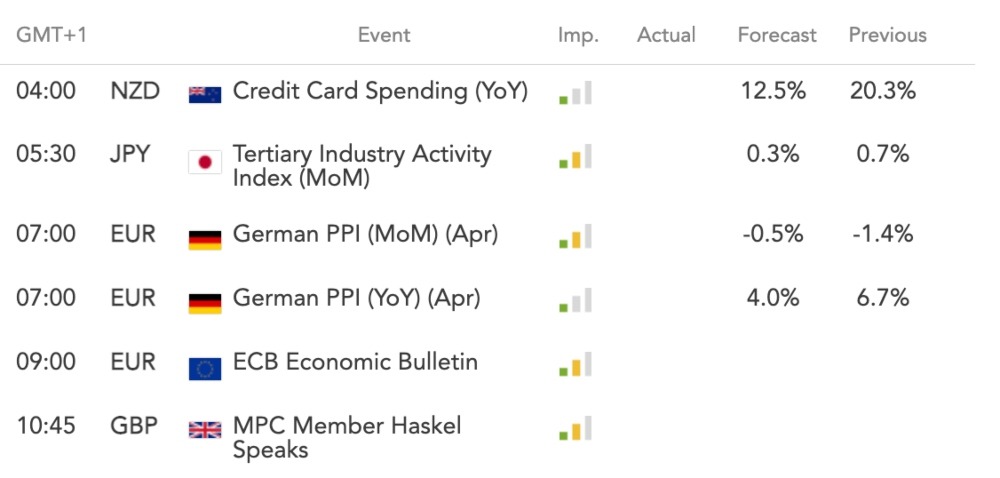

Although it is great to see Trading Central analysis included free of charge, I was generally disappointed by the additional resources offered by ICM Capital, which are limited to a few basic materials like an economic calendar and a mediocre news feed.

The news tabs on the broker’s website only update once in a while, and the opt-in SMS news service which sends daily updates direct to mobile is also somewhat limited. Updates primarily cover EUR, CHF, JPY, oil and gold.

The other basic materials provided include a pip calculator, a pivot calculator and a glossary, but I would like to see more educational resources.

When compared to competitors like eToro, which offers a great selection of training and educational materials, ICM Capital lags far behind.

Economic Calendar

Trading Central

On a more positive note, I was impressed by the Trading Central technical analysis package offered, which provides a daily market report, an MT4 indicator and a news portal. High-quality analysis is available across multiple asset classes including forex, stocks, commodities and indices.

The advanced analysis ultimately helps traders spot opportunities whilst regular market updates ensure that traders have a good grasp of current market movements.

Trading Central is available in English, Arabic and Chinese.

Customer Service

I found the support options on offer to be adequate, with assistance available via telephone, live chat or email Monday – Friday, from 6:00am – 18:00pm. I particularly appreciated that there is tech support available via telephone 24/7.

Support is also available in multiple languages including English, Spanish, Portuguese, Thai and Arabic.

To get in touch with the ICM Capital customer support team:

- Phone: +44 207 634 9770

- Email: support@icmcapital.co.uk

- Live chat: broker’s website

- UK Address: ICM Capital Limited, Level 17, Dashwood House, 69 Old Broad St, London, EC2M 1QS

Company History & Overview

ICM Markets is a UK-based ECN broker offering multi-asset trading to investors.

Established in 2009, ICM Capital Ltd is a subsidiary of ICM Holding SARL. Other branches of the ICM Holding SARL group include ICM APAC and ICM Capital Ltd Mauritius and Saint Vincent.

The broker has won numerous awards for its services including Fastest Growing Global Multi-Asset Broker awarded by the Global Business Magazine Awards, 2022, in addition to several awards for its online trading services in the Middle East.

Security

ICM Capital is not as forthcoming regarding the security measures in place as some of its competitors, and I would like to have seen greater transparency from the broker in this key area.

However, as an FCA-regulated broker, ICM Capital operates in line with industry regulations that I am confident will provide cover in various situations. All client funds are held in segregated accounts and are protected by FSCS, and the company needs to meet a list of other stringent standards.

The MT4 platform is also an industry-leading platform with robust security measures in place. Two-factor authentication can be activated upon login and all data exchanges are encrypted behind powerful firewalls.

Trading Hours

ICM Capital offers 24/7 access to markets, though specific assets’ trading hours vary.

A detailed list of trading hours for all assets can be found under the ‘Specifications’ tab on the MT4 trading platform or ICM website.

Should You Trade With ICM Capital?

ICM Capital is a reputable broker offering access to a range of global markets through the MT4 platform, and I like the two account types, both of which have competitive spreads starting from as low as 0 pips on EUR/USD.

However, I do feel the limited asset list, lack of alternative trading platforms, and a small number of additional features are notable drawbacks.

All in all, ICM Capital is a better choice for experienced traders looking to invest via the MT4 platform, but it lags far behind many alternatives in some key areas.

FAQ

Who Owns ICM Capital?

ICM Capital is the UK subsidiary of ICM Holding SARL. Shoaib Abedi is the company’s current CEO and board member. The company has a presence in 170 countries worldwide.

Is ICM Capital A Good Broker?

ICM Capital is a reputable broker with over a decade’s experience offering trading services to investors in the UK and further afield. The company offers a good range of tradeable assets in addition to the popular MT4 trading platform and reliable customer support.

On the downside, only professional traders can open an account and the brand offers less market research than other brokers.

Does ICM Capital Offer A Low Minimum Deposit?

The minimum deposit to open an ICM Capital account is 200 USD or equivalent in a supported base currency, for example GBP. Each subsequent deposit minimum is also 200 USD. This is a reasonable starting deposit and should be within budget for most active traders.

Is ICM Capital A Legitimate Broker?

Yes, ICM is an FCA-regulated broker that offers multi-asset trading at competitive rates. The broker has been in operation for over a decade with limited reports of scams or financial foul play.

Does ICM Capital Offer A Demo Account?

Yes, ICM Capital offers a free demo account, though I was disappointed to find that it only remains active for 30 days. On a brighter note, the demo account is quick and easy to set up and is available to all. It closely mirrors live market conditions and offers a good range of tools and features.

Article Sources

Top 3 ICM Capital Alternatives

These brokers are the most similar to ICM Capital:

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

ICM Capital Feature Comparison

| ICM Capital | INFINOX | IronFX | Swissquote | |

|---|---|---|---|---|

| Rating | 2.3 | 3.4 | 3.8 | 4 |

| Markets | Forex, CFDs, stocks, commodities, futures | Forex, CFDs, Indices, Shares, Commodities, Futures | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $200 | £1 | $100 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, SVGFSA | FCA, SCB, FSCA | CySEC, FCA, FSCA, BMA / Bermuda | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:200 (Pro) | 1:30 (UK), 1:200 (Global) | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | 1:30 |

| Visit | ||||

| Review | ICM Capital Review |

INFINOX Review |

IronFX Review |

Swissquote Review |

Trading Instruments Comparison

| ICM Capital | INFINOX | IronFX | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | No | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | Yes |

ICM Capital vs Other Brokers

Compare ICM Capital with any other broker by selecting the other broker below.

Popular ICM Capital comparisons: