ICE Markets Review 2025

|

|

ICE Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to ICE Markets |

| ICE Markets Facts & Figures |

|---|

ICE FX is a global STP broker with access to MetaTrader 4 and CFD trading in four major asset classes: forex, crypto, precious metals and energies. The offshore brokerage offers competitive trading fees, 24/5 customer support and a loyalty scheme for active investors. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $30 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | Labuan FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| CFDs | 75 CFDs are available on foreign exchange, UK and US oil, precious metals and cryptocurrencies. You can trade CFDs with STP execution and a low minimum order size of 0.01 lots. |

| Leverage | 1:300 |

| FTSE Spread | N/A |

| GBPUSD Spread | 1.0 |

| Oil Spread | 0.5 |

| Stocks Spread | N/A |

| Forex | Trade 36 major, minor and exotic currency pairs with ICE FX. Leverage up to 1:300 is available and spreads start from 0.0 pips on popular currency pairs. |

| GBPUSD Spread | 1.0 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 1.3 |

| Assets | 36 |

| Cryptocurrency | Trade five crypto CFD contracts 24/7 including the BTC/USD and ETH/USD. Leverage up to 1:10 is available alongside floating spreads. On the downside, the range of digital currencies trails the top crypto brokers. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

ICE Markets is an online trading broker with a strong focus on copy trading and community development. The firm has account options suited to independent retail investors and those looking for hands-off social investing. This review of ICE Markets will examine the broker’s instruments, customer support and general trading conditions to inform UK investors looking to open an account.

Our Take

- ICE Markets’ privilege system rewards high-capital and loyal clients

- Spreads are competitive and compare well to popular forex brokers in the UK

- ICE Markets is not regulated by a reputable body, so there will be less client protection in place than with an FCA-regulated firm

- The broker lacks a variety of asset classes and any educational content with no trading on stocks or indices

Market Access

UK clients can access a total of 45 instruments at ICE Markets and, while there is a decent range of forex pairs, our team was disappointed by the lack of depth in other asset groups. Major brokers like eToro and Plus500 have several thousand investment products available to clients.

The absence of stocks and indices with this firm is particularly notable. There are also no options or futures at this broker.

- Five cryptocurrencies including Bitcoin (BTC)

- 36 forex pairs including EUR/GBP and GBP/USD

- Two CFD commodities consisting of WTI and Brent crude oil

- Two spot metals consisting of XAU/USD and XAG/USD

While there are currently five cryptocurrency assets on offer, the firm plans to make another 31 tokens available in the near future.

ICE Markets Fees

When we used ICE Markets, we found average commission charges to be quite low, although specific rates are dependent on the instrument group and account type. On the STP account, forex and spot metal products have a commission of 0.0025%, while CFD commodities have a commission of 0.005%.

Spreads are reasonable and in line with many other brokers, such as XM. The average spread across our time on the platform was 1.1 pips for EUR/GBP, rising to 1.4 pips for GBP/USD.

Positions held overnight may be liable for swap fees, which is another cost that traders may need to account for.

Those using the investment account at ICE Markets will likely have to pay a performance fee to the manager of that account if a profit is made. Fortunately, no performance fee is applicable if the manager makes a loss and we were pleased to see that this remains the case until the manager has compensated for those losses.

Account Types

Our experts found that all of the broker’s accounts are STP with no-dealing desk (NDD) intervention. This means that instead of ICE Markets being a counterparty in any trade, they pass client orders to liquidity providers. This removes any potential conflict of interest between the client and broker.

On the negative side, investors should note that all account types are in USD, which is disappointing for UK traders, who may incur currency conversion fees when depositing funds in GBP.

The key differences between the accounts are as follows:

STP

- £24 minimum deposit

- Includes all instruments

- 1:1-1:300 floating leverage

- Commission ranges from 0.0025-0.25%

- Designed for standard traders

STP-MA

- £240 minimum deposit

- Includes all instruments

- 1:1-1:100 floating leverage

- Commission ranges from 0.004-0.006%

- Hybrid of PAMM, LAMM and MAM technologies

- Designed for the management of investors’ funds (copy trading)

Privileges

In addition to the account types above, our team found that ICE Markets has a privilege status hierarchy designed to incentivise high-capital and loyal clients.

Some of the statuses depend on the deposit amount, whereas others focus on the length of time the user has been active with the broker. It is possible to have more than one status, such as a Premium and Loyal status. If this is the case, the status with greater privileges applies.

Although these privileges are attractive to high-capital traders, they are not as relevant to low-capital or beginner investors..

Premium

- Free VPS server

- Must deposit more than £40,000

- Up to 2% interest per annum on the average deposit amount

- Full compensation for deposit commissions related to third-party payment systems

VIP

- Free VPS server

- Priority withdrawal requests

- Must deposit more than £80,000

- Additional demonstration of hedging

- Withdrawal confirmation via phone call

- Can instantly withdraw up to £4,000 per day

- Up to 3% interest per annum on the average deposit amount

- Full compensation for deposit commissions related to third-party payment systems

Elite

- Free VPS server

- Priority withdrawal requests

- Must deposit more than £200,000

- Withdrawal confirmation via phone call

- Can instantly withdraw up to £8,000 per day

- View hedging of positions without any restrictions

- Up to 4% interest per annum on the average deposit amount

- Full compensation for deposit commissions related to third-party payment systems

Loyal Junior

- User has been with the broker for over one year

- Deposit should remain at more than £4,000 during the year

- Full compensation for deposit commissions related to third-party payment systems

Loyal

- Priority withdrawal requests

- Additional demonstration of hedging

- Withdrawal confirmation via phone call

- Can instantly withdraw up to £4,000 per day

- User has been with the broker for over two years

- Deposit should remain at more than £4,000 during the two years

- Full compensation for deposit commissions related to third-party payment systems

Loyal+

- Priority withdrawal requests

- Withdrawal confirmation via phone call

- Can instantly withdraw up to £8,000 per day

- Demonstration of hedging with no restrictions

- User has been with the broker for over five years

- Up to 4% interest per annum on the average deposit amount

- Deposit should remain at more than £4,000 during the five years

- Full compensation for deposit commissions related to third-party payment systems

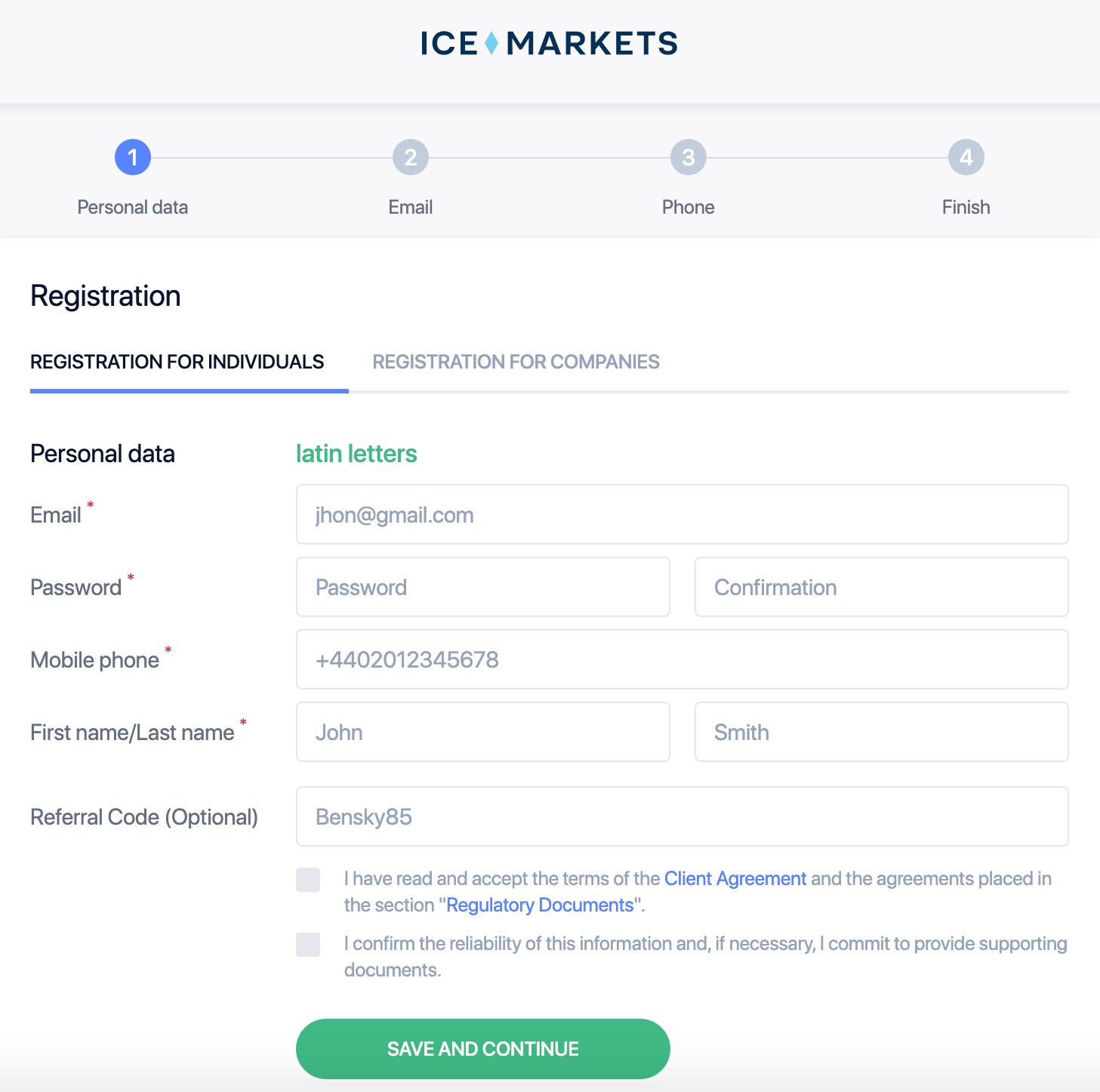

How To Sign Up For An Account

I appreciated the simple registration process, making it straightforward for new traders to activate their account:

- Click the Sign-Up button

- Complete the registration form (including verification of email and phone number)

- Make a deposit using an accepted payment method (listed below)

- Choose your trading account in your personal account area

- Install MetaTrader 4

ICE Markets Registration Form

Funding Methods

Deposits

The minimum deposit is £24 for a trading account and £8 for a managed/investment account. We think these are impressively low minimum deposits compared to many other brokers, such as City Index ($100), making ICE Markets accessible to beginners and low-capital traders. On the downside, many deposit methods have higher minimum limits than this.

Although deposit fees are usually reimbursed to the client in the form of a bonus, there are restrictions on the withdrawal of this bonus. Our experts would prefer to see no deposit fees at all. This is. serious drawback vs alternatives.

For managed accounts at ICE Markets, deposits can be made during open trading hours, which run from 00:05 EET on Monday to 23:50 EET on Friday. The same is true for withdrawals from managed accounts.

Our experts have reviewed the deposit options, fees and processing times:

- Skrill – 4.2% fee, instant processing time and £40 minimum deposit

- Bitcoin – 3% fee, instant processing time and £48 minimum deposit

- Neteller – 5% fee, instant processing time and £40 minimum deposit

- Ethereum – 3% fee, instant processing time and £40 minimum deposit

- Bank Transfer – fees may vary, 3-7 working days processing time and £400 minimum deposit

- USDT Direct Transfer – 0% fee (network fee may apply), one working day processing time and no limits on minimum or maximum transactions

Note that crypto can be bought using a credit/debit card through a third-party website like Binance.

How To Deposit Directly With USDT

While testing ICE Markets, we found the account funding process intuitive:

- Navigate to the Deposit/Withdrawal/Transfer section

- In the Direct Transfer block, select USDT

- Enter the deposit amount and note the wallet address

- Make the transfer using only ERC20 (ETH) or BEP20 (BSC) networks

- Enter the transaction hash code and click Continue

Withdrawals

Withdrawals must usually be made using the same method used to deposit, which is fairly standard among brokers as an anti-money laundering (AML) measure. However, there are some exceptions at ICE Markets and privileged client statuses have no withdrawal method restrictions.

We were disappointed to see that investors are only allowed one free withdrawal (via bank transfer) per month, with all other withdrawal methods incurring a fee. This is a shame as many top brokers like Pepperstone and AvaTrade offer free withdrawals with low to zero restrictions.

The list of withdrawal methods at ICE Markets is:

- Payeer – 1.5% fee, up to three working days processing time and £8 minimum transaction

- Perfect Money – 2.5% fee, up to three working days processing time and £8 minimum transaction

- USDT – 1% fee (£20 minimum), up to three working days processing time and £84 minimum transaction

- Skrill – 1% fee (£5.10 minimum), up to three working days processing time and £8 minimum transaction

- Neteller – 1% fee (£0.80 minimum), up to three working days processing time and £8 minimum transaction

- Bank Transfer – one commission-free withdrawal per month (subsequent withdrawals charged 1%), 3-7 working days processing time and £400 minimum transaction

Note that the above withdrawal fees are indicative – the exact commission and compensation will be displayed in your personal account area when completing the transaction.

Regulation

ICE-FX Markets Ltd is regulated by the Labuan Financial Services Authority (Labuan FSA), though our experts would prefer to see monitoring by a top-tier regulator like the Financial Conduct Authority (FCA) as this would provide much greater protection to traders.

Although brokers without top-tier regulation are not uncommon, we much prefer those that are regulated by the likes of the FCA, based in London, as the agency has robust monitoring procedures and strong compensation schemes for UK traders.

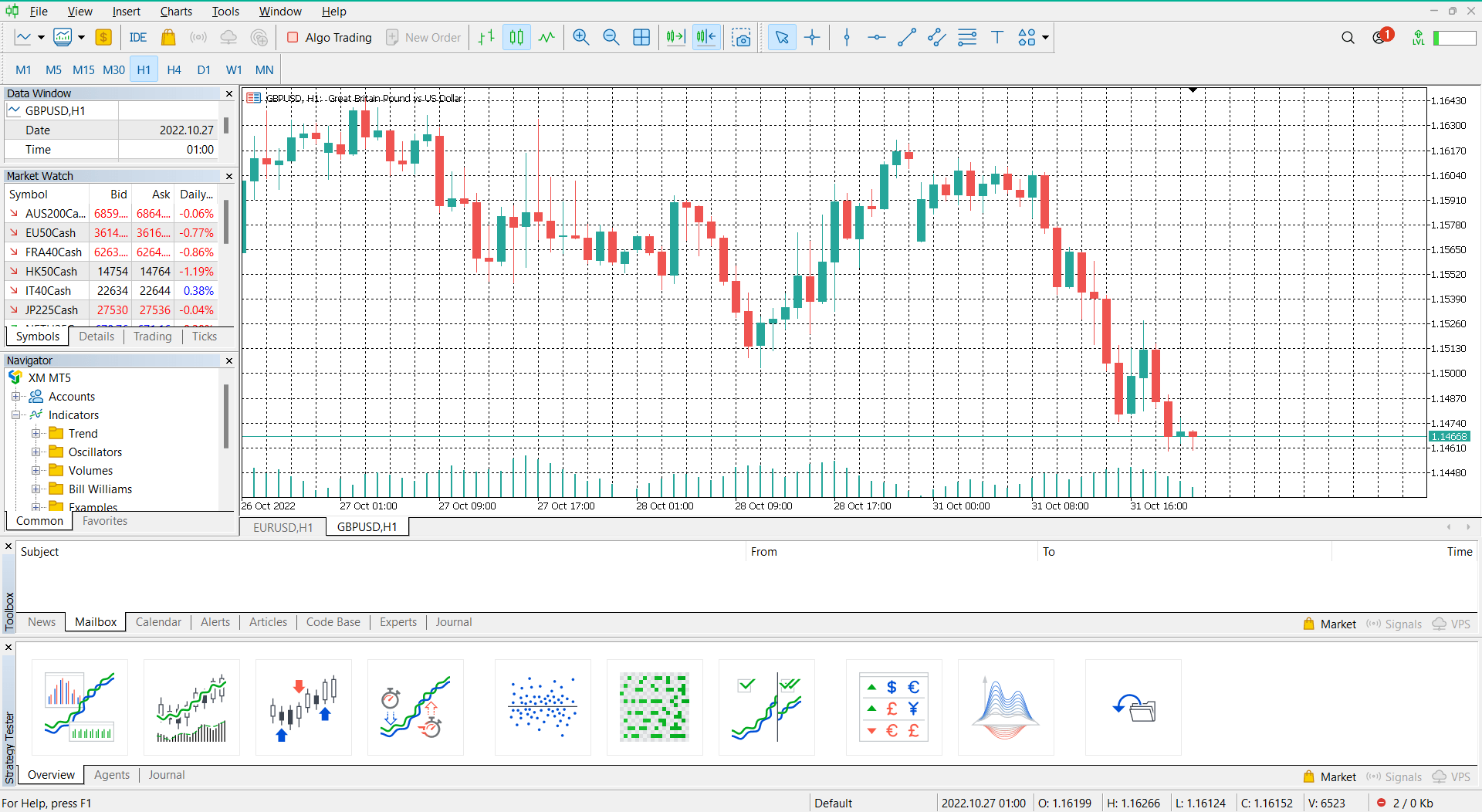

Trading Platforms

Although we prefer to see investors given a choice of trading platforms, we were pleased to see that ICE Markets integrates with one of the industry’s leading platforms: MetaTrader 4 (MT4).

This platform has built its reputation with rich technical analysis features, including dozens of built-in indicators, as well as automated trading capabilities. However, some investors may find that other brokers like Ninjatrader and IG Index have more user-friendly proprietary platforms than MT4.

Our experts have listed some of their favourite features of MT4:

MT4

- Nine timeframes

- 31 analytical objects

- Expert Advisors (EAs)

- 30 technical indicators

- Copy trading capabilities

- Four pending order types

- Operates on Windows and MacOS

MetaTrader 4

How To Open A Position On MT4

It isn’t complicated to make a trade on MetaTrader 4. To do so:

- Right-click on your chosen instrument on the list of assets on the left

- Click New Order

- Complete the information in the pop-up window including volume and, if relevant, your stop loss and take profit

- Click Sell by Market or Buy by Market to complete the order

We rate that one-click trading is also available. This can be enabled in the Options tab.

Mobile App

MT4 has a mobile application that is available on iOS and Android devices. We like that it includes many of the same features as the desktop version but allows investors to speculate from wherever they are in the world.

That being said, it can be challenging to undertake complex technical analysis on a small phone screen, so we don’t recommend making this your primary place to conduct chart analysis.

Leverage

We found that ICE Markets offers leverage rates of up to 1:300 depending on the account type and instrument group. This is higher than UK-regulated brokers, which are usually limited to 1:30, though it is important to note that high leverage carries significant risk.

While this broker uses margin calls and stop-out levels to protect those using leverage, sudden and significant movements in the market and gaps in price after the weekend can still result in investors holding a negative balance.

The FX main group of currency pairs, which includes forex majors, has leverage between 1:50 and 1:300 (floating) on the STP account. Cryptocurrency leverage is more limited, sitting at 1:10.

Leverage on the STP-MA account at ICE Markets is limited to 1:100, although this still represents a sizeable level of trading power.

Demo Account

ICE Markets has a demo account that runs on MT4 and is very useful for beginners to familiarise themselves with the platform. We found that the same instruments on the live accounts are available to practise with and leverage is fixed at 1:100.

On the negative side, we were disappointed to see that demo account users are limited to 30 orders per group of instruments. Many other brokers impose no such limits on the use of demo accounts.

In addition, users should note that trading results on the demo account are not necessarily indicative of results on the live accounts. Therefore, our experts recommend that the demo account be used as a means to understand how the platform and markets work, rather than to build and then replicate a specific trading strategy.

How To Open A Demo Account

- Download the MT4 platform

- In the trading platform, click File and then Open Account

- Choose the IceFX-Server and click Next

- Select New Demo Account and click Next

- Complete the required fields and click Next

- Note your account information and click Ready

Demo accounts can also be created in your personal area.

Bonuses Deals

In addition to the compensation of deposit fees, ICE Markets also offers commission rebates that depend on account deposit amounts and commission rates, ranging between 5-25%.

The broker may also cover the costs of transferring funds from another company, in addition to providing preferential client status for doing so. These are generous promotions, although our team did not find any details of deposit or no-deposit welcome bonuses.

Extra Tools & Features

Education & Market Analysis

While using ICE Markets, we were very disappointed by the lack of educational resources and analysis of market news. It is rare for a broker not to have educational guides, video tutorials or webinars.

This particularly harms beginners, who often rely on such materials to make informed investment decisions and learn the ropes, although traders using managed accounts will not be affected to the same extent.

Trading Support

On a more positive note, our experts were impressed by ICE Markets’ strong focus on managed accounts and copy trading. Lots of traders lack the skills or time to analyse the markets and make profitable investment decisions effectively. Accounts like these help many to overcome that problem.

The broker’s strong emphasis on risk management was also pleasing to see; investors can establish loss limits and there are Multi Managed Accounts, which consist of multiple accounts under one manager with different degrees of speculative aggression.

Furthermore, the risk management system ensures trading limitations cannot be changed instantly, which protects investors from acting on emotions rather than rationality.

In addition, those that do not qualify for a free VPS need not worry as all clients can pay for a VPS. Fees vary from £12-£20 per month.

Company History & Overview

ICE Markets was established in 2015, although it was known as ICE FX before July 2022.

While the broker is not regulated by a top-tier authority, we were pleased to see that details of its senior management are available to view on the website. This includes the CEO, Vladimir Kondrashov. Our team appreciates brokers that provide details of their senior management as it demonstrates greater transparency and honesty. The number of clients and its trading volume, however, is unclear.

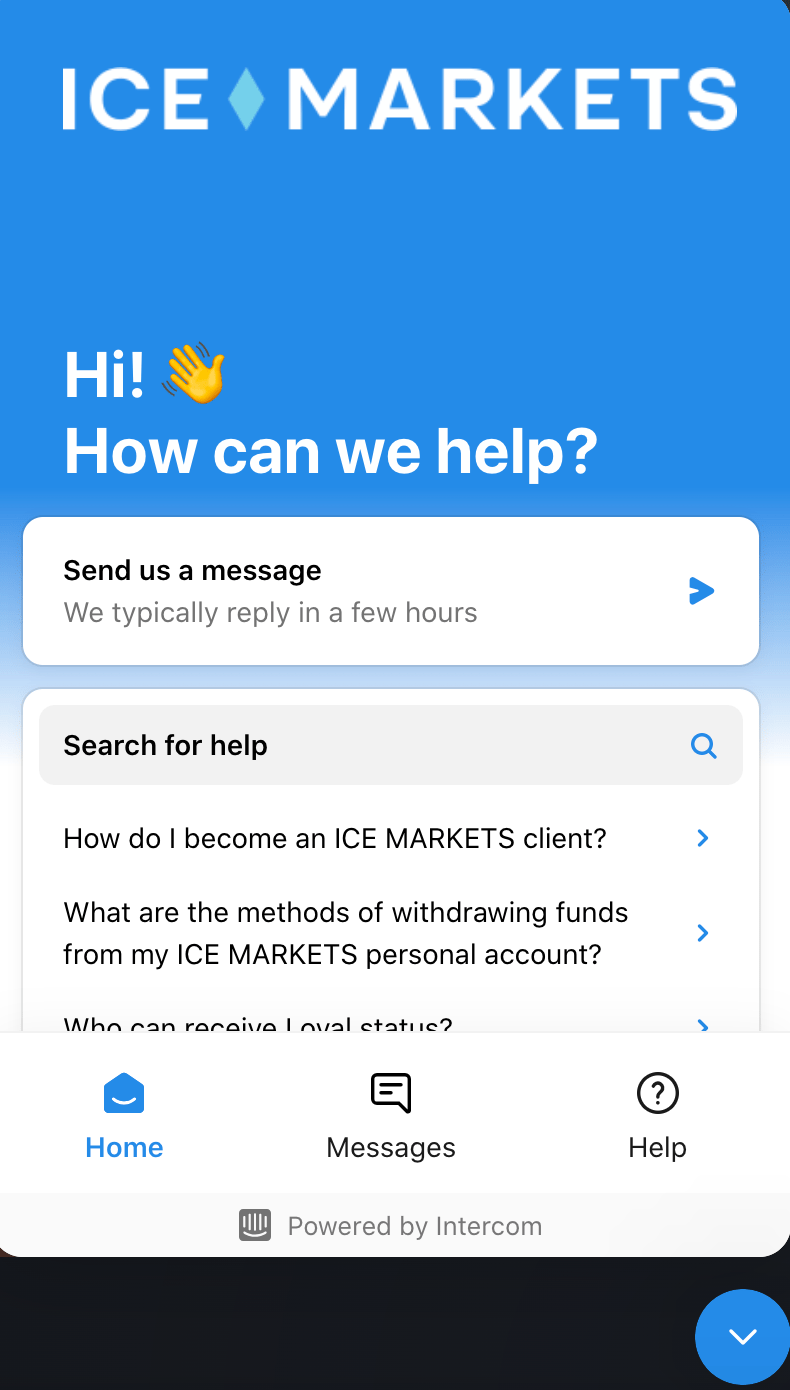

Customer Service

Our experts were happy with both the range of customer support options at ICE Markets and the operational hours of the customer support team.

Live chat is available 24 hours a day from Monday to Friday, as well as 08:00-23:00 EET on Saturdays and Sundays. Telephone hours are 08:00-22:00 EET daily.

The customer contact options are:

- Skype

- Live Chat

- Phone: +44 20 8089 7867

- Email Address: support@ice-markets.com

Although the broker has a social media presence, we were concerned that its Facebook page only has ten followers.

ICE Markets Customer Service

Trading Hours

The time zone of the trading terminal at ICE Markets is Eastern European Time (EET), which is GMT+3 in the summer and GMT+2 in the winter.

Trading hours vary from market to market. Cryptocurrency CFDs are available to trade 24/7 with a break on Saturday from 12:00-15:00 EET. This is because cryptos do not trade on a centralised exchange within specified hours. Forex covers most of the Monday-Friday period.

Security

ICE Markets operates a 100% A-book model, where client positions are hedged with external counterparties. Clients can request to see the hedging of such positions, although there may be some restrictions in doing this for certain traders.

Brokers that adopt the B-book model can carry a greater risk of insolvency as they take the opposite position in client trades. This means that should the client make a profit, the broker may make a loss.

We were pleased to see that this broker uses segregated accounts to keep client money separate from money belonging to the firm. This is standard among reputable brokers.

The MT4 trading platform also has its own security measures in place, including encryption to protect user data.

Should You Trade With ICE Markets?

Our experts do not think ICE Markets is a good choice for beginner investors, despite the firm’s low minimum deposit limit and copy trading capabilities. With seriously lacking educational material, low-level regulation and a limited range of assets, the broker’s services do not hold up against competitors. We also found the broker to be disappointing when considering more adept users, with limited diversification opportunities, restricted loyalty benefits and poor demo account support.

Our team recommends that UK investors look towards FCA-regulated brokers with good educational content and trading products.

FAQ

Is ICE Markets Legit?

ICE Markets is regulated by the Labuan Financial Services Authority and there are details of its senior management on the website. However, UK investors should always approach brokers that are not regulated by the FCA with more caution. They do not hold the same level of credibility and reliability.

Is ICE Markets Good For UK Traders?

ICE Markets has competitive fees, copy trading software and a demo account. However, it lacks educational material, is not regulated by a top-tier body and does not allow direct credit/debit card deposits. Moreover, accounts are only supported in USD, so UK traders must convert from GBP to deposit with the firm.

Is ICE Markets Regulated?

ICE Markets is regulated by the Labuan Financial Services Authority (Labuan FSA). This is a regulatory body established in Malaysia. Importantly, it is not as well-regarded as the UK Financial Conduct Authority (FCA).

Is ICE Markets Accessible To Beginners?

ICE Markets has low minimum deposits, a free demo account and copy trading capabilities, which all appeal to beginners. However, less experienced users will be disappointed by the lack of educational material and market analysis. Overall, there are better brokers for beginners.

Does ICE Markets Have A Demo Account?

Yes. ICE Markets provides a demo account that runs on the MT4 trading platform. It only took us a couple of minutes to sign up for a simulator account and get started on MT4.

Article Sources

Top 3 ICE Markets Alternatives

These brokers are the most similar to ICE Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

ICE Markets Feature Comparison

| ICE Markets | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4.7 | 4.8 |

| Markets | CFDs, Forex, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $30 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | Labuan FSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:300 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | ICE Markets Review |

Swissquote Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| ICE Markets | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

ICE Markets vs Other Brokers

Compare ICE Markets with any other broker by selecting the other broker below.

Popular ICE Markets comparisons: