IC Trading Review 2025

|

|

IC Trading is #9 in our rankings of CFD brokers. |

| Top 3 alternatives to IC Trading |

| IC Trading Facts & Figures |

|---|

IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | iOS & Android |

| Trading App |

IC Trading provides a range of powerful apps that let you trade from a variety of devices. There’s no proprietary app – which may be a red flag for beginner traders – but MetaTrader 4/5 and cTrader apps are available for mobile devices. These industry-proven apps let you access advanced charting tools, execute trades swiftly, and conduct in-depth market analysis on the move. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | IC Trading specializes in CFD trading with over 2,250 tradable assets spanning sought-after markets including forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and cutting-edge bridge technology, the broker provides excellent trading conditions for short-term traders looking for leveraged derivatives. |

| Leverage | 1:500 |

| FTSE Spread | 2.133 |

| GBPUSD Spread | 0.23 |

| Oil Spread | 0.028 |

| Stocks Spread | Variable |

| Forex | IC Trading delivers remarkably narrow forex spreads across 60+ currency pairs, particularly on key forex assets like EUR/USD. This renders it an outstanding choice for forex traders in pursuit of superior pricing with top-tier execution speeds. High-volume traders also stand to gain significant advantages, with rebates reaching up to $2.50 per forex lot. |

| GBPUSD Spread | 0.2 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.3 |

| Assets | 60+ |

| Stocks | IC Markets supports stock trading on over 2,100 equities, including those in the US and Australia, alongside over 20 prominent indices with zero commissions and tight spreads from 0.4 points. However, fractional shares are not supported, which would provide a more accessible entry point for newer stock traders. |

| Cryptocurrency | You can trade over 20 of the most popular cryptos with leverage up to 1:200 seven days a week, although direct trading of the underlying asset like purchasing Bitcoin or Ethereum is not facilitated. The selection of tokens also trails Eightcap, which picked up our 'Best Crypto Broker' award, offering 100+ crypto derivatives. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

IC Trading is part of the IC Markets group. It is designed for serious traders with tight spreads, fast execution, and advanced tools. However, it’s registered offshore in Mauritius, offering high leverage under light regulation.

Our team of UK-based traders and brokerage experts have thoroughly evaluated IC Trading, examining its key features, trustworthiness, and trading environment to gauge how well it meets the needs of UK traders.

Our Take

- IC Trading is regulated by the FSC in Mauritius, not the FCA in the UK. That means fewer protections, like no negative balance protection or FSCS cover. It’s a trade-off between flexibility and safety.

- You can fund your account in GBP, helping you dodge conversion fees. Deposits are free and fast, and there’s a decent range of methods—cards, bank transfers, e-wallets, and even crypto.

- IC Trading is super competitive when it comes to pricing. Spreads on major pairs like EUR/USD can go as low as 0.0 pips on the Raw Spread account, plus there are low commissions. This is great for scalpers and day traders who want to keep costs down.

- Unlike FCA-regulated brokers limited to 1:30 for retail traders, IC Trading offers leverage up to 1:500. Good for those who know how to manage risk, but it’s not for beginners—it cuts both ways.

- You get access to MT4, MT5, and cTrader—all solid, powerful platforms with loads of tools. There is no simplified proprietary platform, though, and no direct TradingView integration, which is a bit of a letdown for fans of social charting.

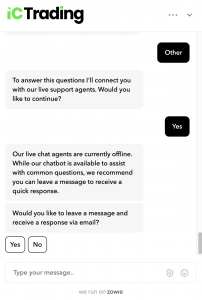

- There’s no UK phone line, live chat is hit-and-miss, and email replies are slow at best based on our tests. IC Trading needs to improve its support if it wants to keep UK clients happy.

Is IC Trading Regulated In The UK?

IC Trading operates as a separate entity under the umbrella of Raw Trading Ltd—the same parent company behind the well-established IC Markets. However, the two brands differ significantly regarding regulatory oversight and investor protection.

While IC Markets is regulated by several top-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), IC Trading is licensed exclusively by the Financial Services Commission (FSC) of Mauritius.

We view the FSC as a lower-tier regulator, particularly when compared to the standards expected by UK traders. This regulatory gap means IC Trading is not subject to the same stringent compliance checks or client protection protocols that brokers under more robust regimes must follow, such as the UK’s Financial Services Compensation Scheme (FSCS), which ensures your deposits up to £85,000 if the broker becomes insolvent.

A red flag is that IC Trading does not provide negative balance protection. Without this safeguard, you are fully responsible for any losses incurred, even if they surpass the funds available in your account. If market conditions cause significant losses, you could owe more than your initial deposit.

Accounts

Live Accounts

IC Trading offers two main account types, each catering to different trading needs while sharing core features such as micro-lot trading (from 0.01 lots) and leverage of up to 1:500.

- Standard: This is a commission-free account where trading costs are built into slightly wider spreads. It’s a straightforward option for beginner and intermediate traders who prefer predictable pricing without extra fees per trade.

- Raw Spread: This account features ultra-tight spreads and charges a small commission per trade. It’s best suited to scalpers and active traders who prioritise lower trading costs and execute a high volume of trades.

Both accounts are backed by IC Trading’s true ECN execution, which provides direct access to a deep liquidity pool sourced from up to 50 global providers, including investment banks, hedge funds, and dark pool venues.

This setup offers institutional-grade pricing, fast execution, and a no-dealing-desk environment—key benefits for UK traders who value transparency and minimal interference.

IC Trading offers Islamic, swap-free accounts for those who require Sharia-compliant trading conditions.

However, the platform does not cater to PAMM account structures, which may be a disadvantage for professional traders or asset managers aiming to handle several client accounts under a single management system.

On the positive side, IC Trading supports VPS hosting, enabling more stable and low-latency trading—particularly beneficial for algorithmic traders and those running automated strategies.

Demo Account

IC Trading’s demo account allows you to practice and refine your strategies in a risk-free environment.

What stands out is that IC Trading offers a fully functional demo account that works with the MetaTrader 4/5 and cTrader platforms, allowing you to choose the platform you are most comfortable with.

Many other brokers offer demo accounts, but some may limit the features or platforms in their demo versions. This level of flexibility at IC Trading provides a more comprehensive simulation of live trading conditions, which can be crucial when preparing for real market scenarios.

Funding Options

Deposits

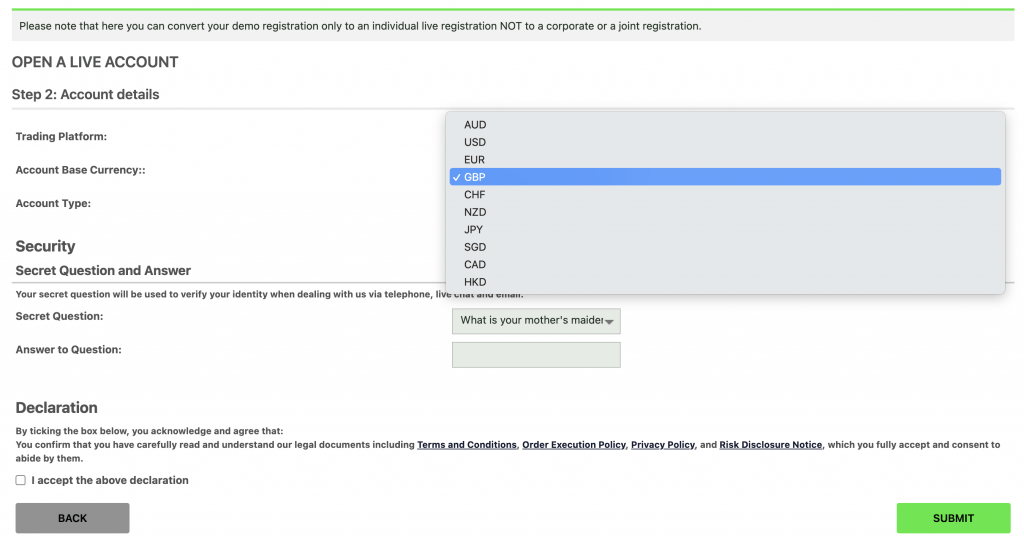

IC Trading offers deposit options in 10 different currencies, including GBP.

Having the flexibility to select your preferred base currency helps you avoid unnecessary conversion fees when funding or withdrawing your accounts.

Popular deposit methods at IC Trading include credit cards, debit cards, cryptocurrencies (ETH, USDT), PayPal, Neteller, Skrill, SticPay, and bank wire transfers.

In my experience, deposits are processed almost instantaneously, even using different currencies or payment methods.However, withdrawals can be slower, and funds can only be transferred to accounts in your name using the same method as the deposit unless the initial deposit has been exceeded.

Regarding account accessibility, IC Trading keeps its entry point fairly reasonable, requiring a minimum deposit of $200 to get started. This makes it accessible to those trading with limited initial capital.

That said, beginners should be aware that other brokers—such as FP Markets—offer lower entry barriers, with minimum deposits starting from just $100.

Withdrawals

IC Trading allows you to withdraw any amount from your account without imposing a minimum withdrawal limit. The key requirement is that the funds must be available as free margin, not tied up in active trades.

This flexibility is a significant plus if you prefer to manage your capital in smaller increments. It’s also helpful if you are testing the platform and want to withdraw partial profits without having to meet specific thresholds.

Market Access

IC Trading is a forex and CFD broker, which means it doesn’t provide access to certain traditional investment products such as physical stocks, exchange-traded funds (ETFs), or options.

This may be a limitation for UK traders looking for long-term, buy-and-hold investment vehicles or income-generating assets.

However, the broker offers a broad CFD product lineup that caters well to active traders. This includes over 60 forex pairs, ranging from major to minor and exotic currencies—on par with many industry-leading platforms.

Over 20 assets are available for commodities, including gold, silver, oil, and agricultural products like sugar and cotton. IC Trading also gives access to 25+ global indices, such as the FTSE 100, DAX, and Dow Jones, offering opportunities to speculate on macroeconomic trends.

The platform further extends into CFDs on more than 2,100 stocks, though it focuses mainly on US and Australian-listed companies, with no exposure to UK or EU equities. This is a drawback for UK traders who prefer access to familiar, locally listed firms.

On the plus side, IC Trading offers something not commonly found on retail trading platforms—CFDs on government bonds. You can speculate on bond price movements from UK, US, Eurozone, Japan and Italy issuers. This feature provides diversification and can serve as a hedge during periods of stock market volatility.

Cryptocurrency coverage is also competitive, with over 21 digital assets available, including popular names like Bitcoin, Ethereum, and Ripple. This exposes you to one of the most volatile and potentially high-growth sectors.

Unlike platforms such as eToro and XTB, which offer interest on unused cash balances, IC Trading does not provide any mechanism for earning returns on idle funds. This might be a missed opportunity for UK traders who want to make the most of every pound in their accounts.

Leverage

IC Trading offers a range of leverage options that vary depending on the asset class, giving you the flexibility to scale your exposure based on strategy and risk appetite.

For forex pairs, leverage is highest at 1:500, particularly for majors and minors, which is ideal for those looking to trade with a small margin. Commodities like gold and silver also offer up to 1:500, while soft commodities are typically capped at 1:100.

Leverage can reach up to 1:200 when trading global indices and bonds, and for individual stocks, the maximum available is 1:20. Cryptocurrency leverage is just 1:5.

It’s worth remembering that high leverage can amplify both profits and losses. That’s why the FCA in the UK limit retail traders’ leverage to 1:30 to reduce the risk of significant losses.

Pricing

IC Trading’s cost-conscious model is well-suited for those prioritising fast execution, leveraging flexibility, and minimal overhead.

For instance, on the Raw Spread account, spreads on major pairs like EUR/USD can start from 0.0 pips, with a competitive commission of $3.50 per side per standard lot ($7 round trip).

Even average spreads—around 0.1 pips on EUR/USD—remain highly favourable if you rely on precision and speed.

Platform choice and account type can influence spreads slightly, but the cost structure remains transparent and trader-friendly.

For stock index CFDs like the FTSE 100, fees are built directly into the spread, helping to streamline trade calculations. Overnight swap rates are also relatively low, which benefits swing traders or those holding positions longer than a day.

In addition to its low trading costs, IC Trading charges no fees for deposits or withdrawals, which is a notable advantage compared to brokers who add transaction costs.

There’s also no inactivity fee, so you don’t have to worry about being penalised during market downtime or personal breaks—something not all brokers can promise.

Trading Platform

IC Trading doesn’t offer a proprietary trading platform, which may be a drawback for beginner traders who prefer a simplified setup.

Unlike its parent company, IC Markets, it doesn’t support TradingView, a popular platform known for its user-friendly design and social trading capabilities.

That said, IC Trading compensates with full support for three of the industry’s most respected third-party platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader.

MT4 and MT5 are the go-to choices for experienced traders thanks to their powerful technical analysis tools, custom indicators, Expert Advisors (EAs), and back-testing capabilities. MT5 also introduces more order types and faster processing than its predecessor, making it a slightly more advanced option.

For traders seeking a more polished and intuitive experience, cTrader is a standout. It offers sleek visuals, rapid order execution, and built-in features like an intuitive economic calendar and depth-of-market tools. cTrader also includes integrated copy trading, appealing to those interested in replicating the trades of more experienced traders.

cTrader

IC Trading also supports ZuluTrade, a third-party social trading platform that allows you to follow and automatically copy the trades of high-performing traders. This can be particularly useful for beginners or those who prefer a more passive approach to trading.

While ZuluTrade adds valuable functionality—especially given the absence of in-house copy trading tools or proprietary platforms—it comes with its own limitations. Performance can vary depending on your chosen signal providers, and additional fees may apply.

Unlike platforms such as eToro, which integrate social and copy trading into a seamless native experience, ZuluTrade is a separate system that requires linking your IC Trading account externally.

While the lack of a proprietary or TradingView-compatible platform is a missed opportunity, IC Trading still delivers a strong platform lineup—especially for intermediate and advanced traders who can leverage these tools to their full potential.

Extra Tools

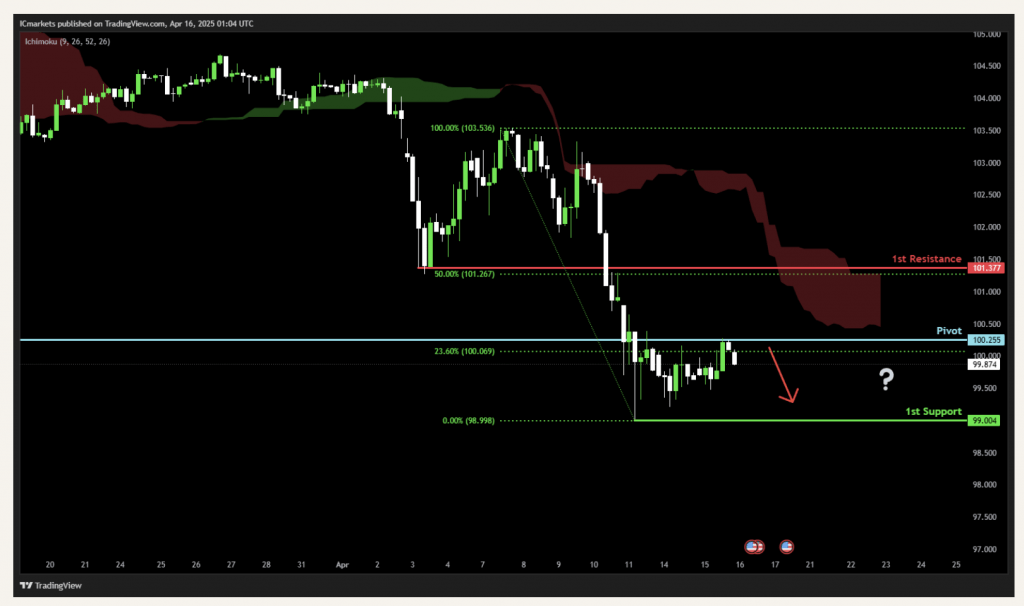

IC Trading offers a solid range of research tools, particularly through integrations with Trading Central and Autochartist.

These third-party services provide automated technical analysis, trade ideas, and pattern recognition directly within supported platforms like cTrader, allowing you to act on setups with just a few clicks, including setting take profit and stop loss levels.

The broker also maintains a dedicated blog that publishes regular market updates, technical forecasts, and trading tips. While the blog content helps you stay informed about major market events and trends, it lacks the depth, interactivity, and variety found with leading brokers.

One area where IC Trading falls short is educational support. No structured courses or beginner guides are available, which may make it less appealing for newer traders looking to build foundational knowledge.

More comprehensive education—ideally accessible directly from the account dashboard—would significantly enhance the platform’s appeal to a broader range of users.

Customer Service

IC Trading falls short when it comes to customer support, especially compared to top-tier brokers serving UK traders.

One of the most significant drawbacks is the lack of a UK-based phone line. This means that any urgent issues require contacting the broker’s office in Mauritius, which isn’t practical for most clients in the UK due to time zone differences and potential call costs.

Live chat support is also inconsistent. Despite being advertised as available 24/7, it often redirects to emails with messages saying no agents are available.In my experience, even email queries went unanswered, which raises concerns about reliability and responsiveness.

While some brokers like ActivTrades, Pepperstone or CMC Markets offer prompt, multi-channel support—including UK call centres, live chat, and even local offices—IC Trading has a lot of ground to cover in this area.

For UK traders who value responsive, accessible help, particularly during volatile markets, IC Trading’s limited support may be a serious disadvantage. Addressing these gaps would go a long way toward building trust and credibility with its UK client base.

Bottom Line

IC Trading offers a compelling option for those who prioritise low-cost, high-speed trading across a wide range of CFDs. It is particularly notable for including bond CFDs, which many brokers overlook.

The broker offers tight spreads, no deposit or withdrawal fees, and support for advanced trading platforms like MT4, MT5, and cTrader. Account types are straightforward, and leverage can be high.

However, there are trade-offs. The FSC regulates IC Trading in Mauritius, which doesn’t offer the same level of protection as UK-based FCA-regulated brokers. There’s also no negative balance protection or investor compensation scheme, which may concern risk-averse traders.

Overall, IC Trading could suit cost-conscious, experienced traders comfortable with offshore regulation. However, it may not be ideal for those seeking more regulatory safeguards or long-term investing features.

FAQ

Can You Invest In GBP With IC Trading?

Yes, you can invest in GBP with IC Trading. The platform supports GBP as one of its 10 base currency options, alongside others like USD, EUR, AUD and JPY.

This means UK traders can open and fund their accounts in pounds sterling, helping to avoid unnecessary currency conversion fees when depositing, withdrawing, or trading GBP-denominated instruments.

While IC Trading primarily focuses on forex and CFDs rather than long-term investments, the ability to transact in your local currency adds a layer of convenience and cost-efficiency for UK-based traders.

Is IC Trading Safe For UK Traders?

IC Trading can be considered reasonably safe regarding trade execution and fund segregation but lacks key protections UK traders typically expect.

It’s regulated by the FSC in Mauritius—a lower-tier authority—so it doesn’t offer FCA protections like the FSCS compensation scheme or guaranteed negative balance protection.

While it uses segregated client accounts and offers transparent ECN pricing, traders who prioritise strong regulatory oversight may prefer an FCA-regulated broker.

Does IC Trading Offer A Mobile Trading App?

IC Trading doesn’t offer a proprietary mobile trading app but fully supports mobile access through the MT4, MT5 and cTrader platforms. All three are free apps for iOS and Android, offering real-time charting, order execution, account management, and trading tools on the go.

The mobile experience on all platforms is smooth based on tests, with fast execution and full account access. This makes it easy to manage trades from your phone or tablet—invaluable for active UK traders who need flexibility during market hours.

Can You Invest In Cryptocurrency With IC Trading In The UK?

Yes, UK traders can trade cryptocurrencies with IC Trading, but it’s essential to understand that you’re trading crypto CFDs, not buying the actual coins. This means you’re speculating on the price movements of cryptocurrencies like Bitcoin, Ethereum and Ripple without owning the underlying asset.

IC Trading offers over 21 cryptocurrency CFDs, allowing you to go long or short, depending on market conditions. This can appeal to traders looking to capitalise on crypto volatility without dealing with wallets, exchanges, or direct crypto storage. While leverage is available, trading crypto CFDs carries significant risk due to price swings and fast market movements.

Article Sources

- IC Trading Website

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Commission (FSC)

- Financial Services Compensation Scheme (FSCS)

Top 3 IC Trading Alternatives

These brokers are the most similar to IC Trading:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

IC Trading Feature Comparison

| IC Trading | IC Markets | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 4 | 4.8 | 4 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $200 | $200 | $40 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | ||||

| Review | IC Trading Review |

IC Markets Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| IC Trading | IC Markets | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | Yes | Yes |

IC Trading vs Other Brokers

Compare IC Trading with any other broker by selecting the other broker below.