Highlow Review 2025

|

|

Highlow is #11 in our rankings of binary options brokers. |

| Top 3 alternatives to Highlow |

| Highlow Facts & Figures |

|---|

Based in Australia, HighLow offer a superior binary options experience. Regulated by ASIC, the firm run an honest and transparent service with a great platform. |

| Instruments | Cryptos |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS, Android and Windows |

| Payments | |

| Min. Trade | $1 |

| Regulated By | ASIC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | HighLow offer cryptocurrency trading via binary options with daily expiries across 5 cryptos. Trade crypto with fixed risk. |

| Coins |

|

| Spreads | Binary spreads |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | As an ASIC regulated broker, HighLow are one of the most trustworthy Binary options brokers. Customer service is also a clear strength and sets them apart from rival firms in the sector. |

| Payout Percent | 200% |

| Ladder Options | No |

| Boundary Options | No |

HighLow are fully regulated broker based in Sydney Australia. Regulated by the Australian Securities and Investment Commission (ASIC). They deliver high payouts and offer a ‘no deposit, no sign up’ binary options demo account – great for beginners, or anyone developing strategies.

With a slick trading platform, quick withdrawals, a well though out mobile trading app and full regulation – HighLow offer a great choice of broker for both novice traders, or more advanced trading veterans.

Overview

In an industry which has been receiving a lot of bad press recently, it is refreshing to see a few companies have managed to rise above the furore in the binary options trading industry. Owned and managed by an Australian holding company called HighLow Markets Ltd, HighLow has become one of today’s leading binary options broker.

With their corporate headquarters located in Sydney, Australia, HighLow is one of the few remaining binary options brokers that are still going strong. Since its inception in 2010, HighLow has been serving clients from all over the world. And over the years, the broker has earned a reputation of being a transparent and trustworthy broker. It is one of the handfuls of binary options brokers in the world that does not have a call centre operation. In other words, this broker does not pursue aggressive marketing tactics for its products and services.

Regulation & Reputation

As mentioned earlier, HighLow has earned a reputation among binary traders in the online trading community as being one of the few brokers that is trustworthy and transparent. While the bulk of the binary options brokers around the world have opted to shift their operations to a tax haven country in the Caribbean, HighLow has chosen to remain in Australia under the jurisdiction of the Australian Securities and Investments Commission (ASIC). ASIC is one of the few financial regulatory bodies in the world that is highly regarded in the financial industry as being strict, as well as professional. In other words, HighLow is able to offer its clients the peace of mind that their money will be safe with the broker.

Trading Platforms

For access to the financial markets, HighLow has opted to adopt the white labeled trading platform provided by Markets Pulse. While the trading platform does not have as many features as the popular SpotOption binary trading platform, it is well designed to suit the needs of traders who are just beginning to take up online trading.

The trading platform allows its users to trade the binary options market with 5 different types of option contracts namely High/Low options, High/Low spreads, Turbo options and Turbo spreads options. The main difference between the normal option contracts and the spreads options contracts is the fact that the expiry for the latter is extended to cover a range of prices rather than a single price level.

As for turbo options and the High/Low options, the expiry time for the former are from 30 seconds to 5 minutes while the expiry time for the latter is on an intraday basis.

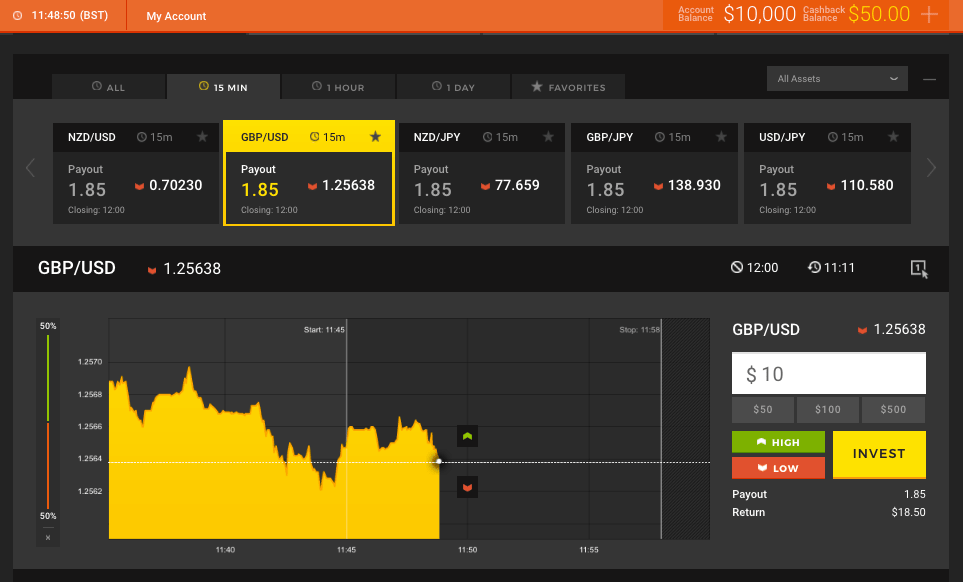

HighLow Login and Trading Platform

The main price chart area will update once an asset is selected. It will reflect the latest market prices. It also shows the trader sentiment, payout and the countdown to expiry. There is also a vertical line showing when a trade must be placed by.

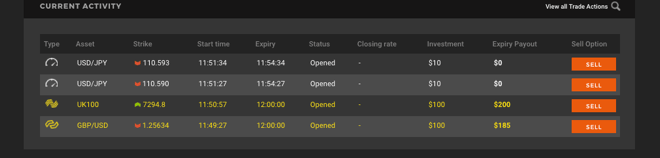

The trading buttons are on the right of the trading area. You can amend trade size, select the direction of the trade (high or low) – and press the ‘Invest’ button to confirm. Active trades immediately appear in the ‘Open Positions’ window. This sits beneath the price chart. You can select ‘1-click’ trading if desired. This gets rid of the invest button, but creates larger High and Low buttons. These will open a trade immediately in ‘1-click’ mode.

The trading platform is clear and simple to use. The price graph also highlights which direction the markets needs to move in order for a trade to win. This reduces the amount of trader mistakes. The firm use ‘High’ and ‘Low’ on the trading buttons (rather than Up/Down or Call/Put) – which should not be a surprise!

A negative of the trading area is the charts. There is little flexibility, features or options for technical analysis. This is a common fault among among binary brokers. Traders keen on technical analysis would be better off using separate charting software such as MT4 (MetaTrader4).

Mobile Trading

Apart from the web-based platform which is accessible through any web browser, High/Low has also ensured that traders who are unable to trade from their desktop trading terminal can also trade from their smartphones and mobile devices, by downloading a mobile trading app. Traders can also check out their account status and keep themselves updated with a live news feed that is streamed through the mobile trading platform. The mobile app is free can be downloaded from Google Playstore or Apple App Store.

Trading Accounts Offered

In terms of trading accounts, HighLow has opted to depart from the binary options industry’s traditions of providing traders with a choice of several different types of trading accounts. With HighLow, there is only one standard type of trading account which anyone can open by completing the registration form and making a minimum deposit of $/£/€50. For traders in Australia, a token sum of AUD$10 is required.

As for traders who are unsure of whether to commit to a signing up with HighLow, they can actually opt for the demo account first. The demo account is provided free of charge by HighLow and does not even require you to register.

Bonuses & Promos

As for bonuses, HighLow offers a free cash back offer of $50 for all trading accounts which have been approved.

Instruments

While the services at HighLow are exceptional, we noticed that they are a little lacking with regards to the list of available underlying assets. Their asset list is not as extensive as what most binary brokers are offering in the industry. Currently, HighLow has only 43 different types of assets. Nevertheless, the available assets are able to cover different asset classes such as currencies, commodities, and market indices.

Customer Support

Customer support is another area which HighLow is sorely lacking. At present, you can only contact their support team through email and the telephone. As for telephone support, the service is only available on weekdays from 09:00 to 04:00 (AEDT/AEST time).

Deposit & Withdrawal

For the convenience of their traders, HighLow has provided support for a wide array of payment methods. Fund transfers can be made through bank wire transfer, credit cards or ewallets. All major credit cards such as VISA and Mastercard are supported. For eWallets, HighLow accepts transfers through Neteller, Poli, Sofort, PaysafeCard, GiroPay and soporpay. Withdrawals can be done through the above mentioned methods as well. But it should be noted that there is a minimum withdrawal amount of $50. The typical withdrawal processing time takes one day, if the request is made before the 2pm cutoff time.

Are HighLow Best For Day Trading?

As a day trader, you are looking for a broker that can provide you with the ability to open and close trades within a short span of time. This is possible with binary options as the expiry time can be as short as 30 seconds. In other words, HighLow is a suitable broker for a day trader.

FAQ

What is the minimum deposit requirement to open a trading account?

For Australian based traders, the minimum deposit requirement is merely AUD$10. As for international traders, the minimum deposit requirement is $/£/€50.

How fast can my withdrawal request be processed?

Withdrawal requests at HighLow are processed on an intraday basis if the request is submitted before the 2 pm cutoff time.

Is HighLow a reliable broker?

Yes. HighLow is a reliable broker as they have been operational for a few years. In addition, the broker is regulated by the Australian Securities & Investments Commission.

What kind of trading platform does HighLow have?

HighLow uses the white labeled trading platform supplied by Markets Pulse.

What is the maximum leverage available at HighLow?

With binary options trading, there is no leveraging of trades. As such, HighLow does not offer their traders any form of trade leveraging.

Top 3 Highlow Alternatives

These brokers are the most similar to Highlow:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Highlow Feature Comparison

| Highlow | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | - | 4.8 | 4.8 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $50 | $0 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | - | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Highlow Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Highlow | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Binary Options | Yes | No | No | No |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Highlow vs Other Brokers

Compare Highlow with any other broker by selecting the other broker below.

Popular Highlow comparisons: