Hantec Markets Review 2025

|

|

Hantec Markets is #79 in our rankings of CFD brokers. |

| Top 3 alternatives to Hantec Markets |

| Hantec Markets Facts & Figures |

|---|

Hantec Markets was established in Hong Kong in 1990. Initially, the company concentrated solely on the Chinese and Taiwanese markets. In 2008, the broker rebranded and expanded its presence in the UK, Australia, Japan, and various other countries, before enhancing its footprint in Latin America in 2022. Hantec now stands as a multinational brokerage with 18 offices across Europe and Asia. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Indices, Stocks, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Trading App |

Hantec Markets doesn’t offer a proprietary trading app. Instead, clients can use the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile apps, which are accessible for both Apple and Android devices and mirror the desktop version’s functionality. The lack of a bespoke app means that traders who are looking for more integrated solutions might find the mobile trading experience lacking, especially since there’s no support for TradingView or cTrader either. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Traders have the opportunity to engage in CFD trading across a broad spectrum of assets, including currency pairs, stocks, commodities, bullion (gold and silver), indices, and cryptocurrencies. Experienced traders can access high leverage up to 1:1000 in certain jurisdictions. However, a notable downside is the restriction of scalping strategies which may deter experienced traders. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 0.5 |

| Oil Spread | 0.05 |

| Stocks Spread | Variable |

| Forex | Hantec Markets offers a limited range of 30+ forex pairs – less than most top brands, including Pepperstone with 100+. That said, market execution is rapid based on tests, and spreads are competitive starting at just 0.2 pips. This, combined with access to the popular MT4 platform with 30+ technical indicators, ensures a relatively complete trading experience for short-term currency traders. |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.7 |

| Assets | 300 |

| Stocks | Hantec Markets offers more than 1,800 stock CFDs from exchanges in Europe, the UK, and the US. Additionally, the broker offers access to major indices including the S&P 500 and FTSE 100, allowing traders to gain a comprehensive perspective on global financial markets. On the downside, there is no option to invest in real stocks or factional shares, available at XTB. |

| Cryptocurrency | CFD trading is available across a diverse selection of cryptocurrencies. This range includes not only leading cryptos like Bitcoin and Ethereum but also extends to smaller tokens such as Polkadot. These digital assets can be traded against a variety of global currencies, including the USD, JPY, and MXN, as well as precious metals like gold and silver, marking Hantec out from the majority of brokers who only offer cryptos paired with the USD. |

| Coins |

|

| Spreads | 0.008 - 6.4 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Hantec Markets is an online broker which offers CFD trading on forex, commodities and other assets and supports popular MetaQuotes platforms MT4 and MT5. The brokerage is known for its strong tools and additional features, including copy trading and educational resources.

This Hantec Markets review shares insights for UK traders into the broker’s spreads, minimum deposits, demo competitions, FCA regulation, account types, and other trading conditions.

Hantec Markets is a good broker for beginners with a $10 minimum deposit, copy trading, plus a user-friendly learning hub. The brokerage also holds a license with the UK’s Financial Conduct Authority.

Company History & Overview

The broker’s parent company, Hong Kong-based Hantec Group, was founded over 30 years ago in 1990. In 2008 the group released Hantec Markets with its headquarters initially in Sydney, Australia before moving to London, UK in 2010.

Hantec Markets’ CEO, Bashir Nurmohamed, has been at the helm since the move to London and has led the broker’s expansion which now boasts 11 offices across the globe.

The brokerage is heavily regulated by financial institutions in most of its office locations, including through the UK Financial Conduct Authority (FCA), the Jordan Securities Commission (JSC), and five other reputable regulatory bodies.

Markets & Instruments

Hantec Markets specialises in CFDs (contracts for difference). These allow traders to speculate on the price movements of underlying assets without owning them – rather, they enter an agreement with the broker that means they will either earn the difference between the asset’s price at the open and close of the contract if their prediction comes good, or if not pay the difference to the broker. CFDs are also available with leverage, magnifying the potential profit and loss of each trade.

Hantec Markets traders have the option to trade CFDs on a relatively decent range of assets, including:

- 20+ stocks including Amazon, Apple and other world-leading companies

- 130+ forex pairs including all major pairs and a range of minors

- 15 cryptocurrencies including Bitcoin and Ethereum

- Bullion gold and silver denominated in USD

- 13 commodities including UK Oil

- 7 indices including the FTSE100

It is worth noting, however, that many competitors offer a wider range of instruments, with access to more stocks and indices, in particular. Spread betting is also not available at Hantec Markets.

Trading Platforms

MetaTrader 4

Hantec Markets offers access to MetaTrader 4. This platform is a staple in retail trading and can be used by both new and veteran UK traders. While it is probably most popular amongst forex traders, it supports all the asset classes available with Hantec Markets.

Traders can use the MT4 platform online, download it to Mac, Windows or directly to their mobile app (either to iOS or Android devices). Regardless of how you access the platform, the user experience will be the same.

Key components of the platform include:

- Rapid trade execution

- Library of historical price data

- Multi-frame view for monitoring more than one position

- API functionality with price alerts and automatic stop losses

- Highly sophisticated protection and security of data with all trades encrypted

Hantec Markets also provides access to the Multi-Account Manager where traders can manage several MT4 accounts at once.

MetaTrader 5

MetaTrader 5 has the same functionality as the MT4 platform but takes the experience to the next level with more advanced features. Key components include:

- One-click execution

- Trade up to 20 different time frames

- Real-time data analytics and visualisation

- Customisable trading statements and reports

- Alerts on key economic news events relating to your positions

- Advanced price monitoring and forecasting with suggested cashouts

How To Place A Trade

- Access MT4 or MT5 via Hantec Markets’ website or on the desktop or mobile app

- Head to the main menu. Under the sub-section ‘tools’ click ‘new order’

- A new window will pop out where inputs are required to place a trade

- Assets available to trade with Hantec Markets should appear in the asset drop-down menu. Both the asset name and its market symbol will show

- Select the asset, then enter the volume for the trade

- Add stop losses and other risk-management tools before executing the trade

Mobile Trading

Hantec Markets does not offer its own bespoke trading app – instead customers can trade via the MetaTrader 4 mobile application which is available in the Apple and Android store and has the same functionality as the desktop software.

With that said, Hantec Markets does offer an app that facilitates account and card management which includes the trading account. Most leading brokerages offer a comprehensive mobile app as trading on the go has become a necessity in today’s digital world and therefore it is disappointing that Hantec Markets has not followed suit.

In addition, any traders not using the MT4 platform will also miss out on trading on the go as Hantec Markets does not offer its accounts on the MT5 mobile app.

Hantec Markets Fees

Hantec Markets is transparent with its fee structure. The spread and commission on CFDs are the only charges applicable when trading. Typically, the standard account offers more favourable spreads, starting from 0.1 pips on popular assets. Spreads start at 1.2 pips on the Cent account. Ultra-fast trade executions also help clients secure a good price and reduce the change of slippage.

The broker charges no fees for signing up, depositing or withdrawing, however, fees will be incurred when traders exchange currencies or hold open positions overnight.

Account Types

Hantec Markets offers two types of accounts, the Cent account and the Standard account.

The Cent account is marketed toward new traders who are wary of trading large sums of cash early in their trading career, so the minimum deposit is much lower than the standard account.

Another difference between the accounts is the Trading Central feature, which only Standard account holders can access. Trading Central is a one-stop-shop for enhancing traders’ potential with its AI analytics, support from market experts and high-end interface. Here traders can analyse, improve and excel with better strategies and knowledge of the financial markets.

Cent Account

- Copy trading – No

- Spreads from – 1.2

- Initial deposit – $10

- Demo account – No

- Leverage up to – 1:100

- Number of asset classes – 5

- Access to Trading Central – No

Standard Account

- Copy trading – Yes

- Spreads from – 0.1

- Demo account – Yes

- Initial deposit – $100

- Leverage up to – 1:500

- Number of asset classes – 7

- Access to Trading Central – Yes

A professional account is also available to traders that can demonstrate sufficient experience and capital. However, users sacrifice negative balance protection and do not benefit from segregated client accounts.

An Islamic, swap-free profile is also available.

How To Set Up A Hantec Markets Account

New users need to input the usual basic personal information such as name, email, and phone number. All Hantec Markets retail traders will also have to select “individual” as their client type to ensure they are taken to the correct portal. Once traders have completed the first sign-up page they are taken to a client registration process with five mandatory steps:

- Personal Details – Customers must provide their personal details including date of birth, nationality, set up a password and security question as well as provide full address details

- Financial Details – Hantec Markets asks traders for their current employment status, place of work, level of education, annual income, level of savings, funds available to trade and other financial information

- Employment And Investing Experience – Traders must detail their level of trading experience in 6 different categories: CFDs, forex, equities, futures, options and commodities

- Document Submission – Here traders must provide a copy of their proof of address and proof of identity

- Terms and Conditions – When trading with Hantec Markets, traders are bound by their terms and conditions and therefore the broker requires traders to read and accept the T&Cs

Hantec Markets may issue an appropriateness warning if they deem the responses received in the sign-up process indicates that it may not be appropriate for customers to start risking their capital. If this is the case users will have to pass a short financial market quiz in order to carry on with the sign-up process.

This is a fairly rigorous registration process and traders can sign up with other brokers in a few minutes and with fewer details. The downside is that they may not be as legitimate or robust as Hantec Markets.

Demo Account

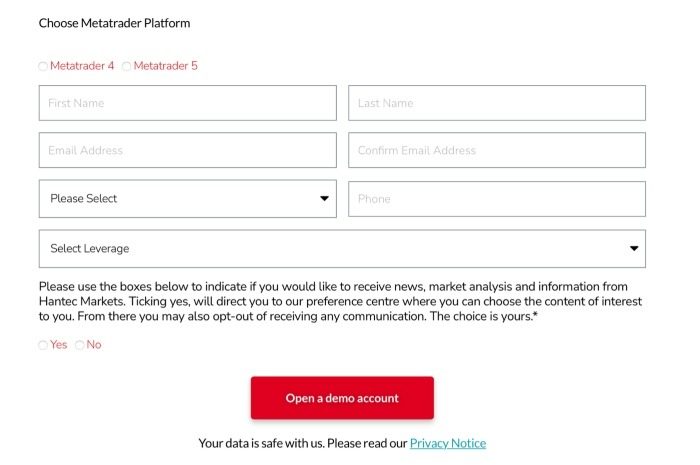

Hantec Markets offers a demo account on both the MetaTrader MT4 and MT5 platforms. Here traders can develop and practice their strategy by trading up to $10,000 of virtual funds without risking their own capital. Customers can also start to familiarise themselves with the different functions and tools that the platforms offer. On the downside, the Hantec Markets Cent account does not support a demo profile.

Registering for a demo account on the Hantec Markets website is simple and straightforward, requiring only your basic personal information, and a choice of which trading platform and the amount of leverage you wish to use.

Payment Methods

Deposits

Hantec Markets offers four different ways to fund your account; credit/debit cards (Visa, Maestro, UK Debit Cards) Skrill, Neteller, and China UnionPay. All deposits must be denominated in GBP, USD, EUR or NGN.

No payment methods are subject to deposit fees, and funds will show in the trading wallet once the request has been reviewed and approved. Most online payment methods process within minutes, so there should not be any long delay before the funds reach your account.

The minimum deposit amounts for the Cent account and Standard account are $10 (£8.20) and $100 (£82) respectively.

Withdrawals

All withdrawal requests must be made via the same payment method as deposits. The process for requesting a withdrawal requires traders to fill out a quick and straightforward withdrawal form.

Requests made before 15:00 GMT will be processed that day; anything afterwards will be completed the next working day. Funds will show in the customer’s bank account or credit card statement in 2–5 working days. Whilst some brokers do offer faster withdrawal times, these timelines are fairly typical in the industry.

FCA Regulation

Hantec Markets Limited is registered with the Financial Conduct Authority in the UK under the registration number: FRN 502635. This regulatory body is the pinnacle of financial regulation, and therefore the broker must adhere to strict financial guidelines.

This should provide traders with an assurance that they are protected when trading with Hantec Markets. Furthermore, brokers regulated by the FCA are also protected by the Financial Services Compensation Scheme (FSCS), which means that if the broker goes into administration, account balances up to £85,000 would be protected.

Hantec Markets also offer their traders negative balance protection and keep their clients’ deposits in segregated accounts. Negative balance protection gives traders security that any losses will not exceed the account balance. Hantec markets’ use of segregated accounts means that clients’ funds are stored securely across different leading banks such as Barclays, Natwest and BMO Harris Bank.

Overall, the broker’s FCA oversight is a promising sign that the broker is legit and trustworthy.

Bonuses & Promotions

Hantec Markets regularly offers its customers the chance to enter a demo account competition where winners will be rewarded with small amounts of real funds to trade with.

However, in line with FCA/ESMA regulations brokers are not permitted to offer hefty welcome bonuses to UK traders. British investors can sign up with offshore providers to find bonus deals, but users may not be able to withdraw profits until strict wagering requirements have been met.

Hantec Markets Leverage

Hantec Markets offers leverage on both the Cent account and the Standard account up to 1:100 and 1:500 respectively. Since the Cent account is marketed toward beginners, the leverage offered is lower to protect new traders from the risk that comes with leverage.

Professional accounts come with even higher leverage, but users sacrifice negative balance protection and do not benefit from segregated client accounts.

Note, UK retail traders may be capped to a maximum rate of 1:30 to comply with rules set out by ESMA and the FCA.

Additional Tools

The broker offers an excellent range of additional features to support the user trading experience. These are particularly useful for beginners.

Educational Resources

Hantec Markets offer various educational materials to help traders when investing their capital. The Hantec Academy Webinars are a popular asset. Here, customers will find a range of different YouTube videos covering a variety of topics tailored towards beginners and more experienced investors.

The broker also provides a glossary of terms, articles on many different trading topics and many other features.

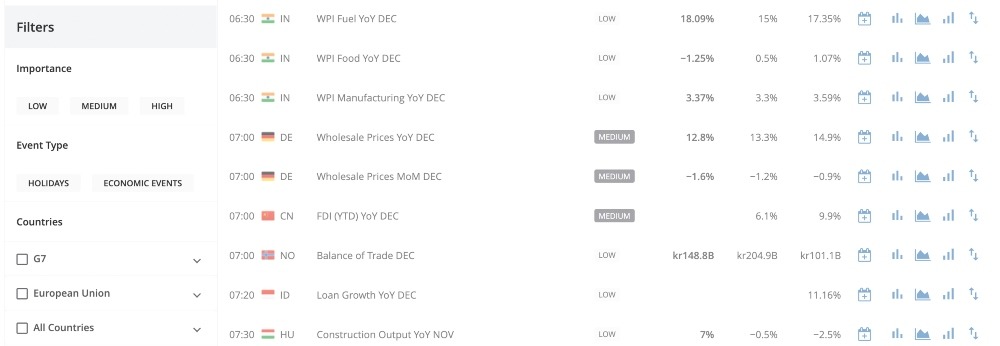

Calendars

The broker provides an economic calendar to help traders access key information which could impact their position.

In addition to this, Hantec Markets publishes information regarding market holidays, though our research found that this feature did not show a full calendar year of public holidays.

Economic Calendar

Copy Trading

For new traders or less active investors, copy trading lets others do the work for you. Users can analyse the success and portfolio of other traders and opt to copy their moves. This significantly reduces the amount of market research and planning required.

How To Set Up Copy Trading

When using the MT4 platform the process for setting up copy trading is simple:

- Log into your MetaTrader account with Hantec Markets

- If you haven’t already, register for an MQL5 account. This will allow traders to add new signals to their screens

- In the platform, go to the toolbox section and click on the signals tab

- A list of copiable traders will appear; some will be free, and others require payment to copy. Expand the tab to review trading statistics and portfolio performance

- Click subscribe. You can then select the parameters and conditions in which you want to trade

- After this, you can view the strategy in my statistics tab and on your chart

Pros

When we used Hantec Markets, our experts found several advantages:

- MT4 and MT5 trading platforms

- Multiple payment methods

- $10 minimum deposit

- Demo competitions

- Educational tools

- FCA oversight

- Copy trading

Cons

While using Hantec Markets, our traders also noted some drawbacks:

- Limited asset range vs competitors

- 24/7 customer support not provided

Opening Hours

Hantec Markets aligns its opening hours with the instruments it offers. Since the broker offers forex, indices and commodities, markets are open on weekdays for these asset classes.

Cryptocurrencies which are also offered by the broker are available 24/7 and can be traded on the weekends. Despite this, the broker’s customer support is open throughout the week but not on weekends.

Customer Support

The level of customer support that Hantec Market Limited offers is impressive with a range of different contact methods and 24/5 customer service hours. The broker provides dedicated support teams in multiple locations including a London office.

Traders can contact the brokerage through the following:

- Live chat

- Contact form

- Email – info-uk@hmarkets.com

- UK phone number – +4420 7036 0850

Before submitting a query with the chat service, customers must provide their name, email, brief description of their query and choose which location they wish to speak to. Whilst testing the United Kingdom live chat service, responses were quick, informative and from a human customer service agent.

Note: For UK residents living in Dubai, Bangkok, Nigeria, Ghana or Mauritius, customers can contact the broker’s office based in those locations directly.

Should You Trade With Hantec Markets?

Hantec Markets is a solid broker which offers a range of different assets on two industry-leading platforms in MT4 and MT5. The broker does not have an expensive fee structure and its standard account has a minimum deposit requirement of $100, which should be affordable for most traders. On the other downside, the broker’s website is not user-friendly and has some faulty pages, and Hantec Markets also has a disappointing lack of mobile app functionality.

Overall though, the FCA oversight, low minimum deposit, plus reliable tools like copy trading mean Hantec Markets is a good fit for aspiring traders.

FAQ

Is Hantec Markets A Good Broker?

Yes. Our expert review concludes that Hantec Markets is a good broker. Although the firm has some faults, the brokerage has many positives; strong regulation, market-leading platforms (MT4 and MT5), good customer service, a low fee structure, plus many additional features like copy trading.

Who Is The Owner Of Hantec Markets?

In 2010, Bashir Nurmohamed was appointed as CEO of Hantec Markets. He is also one of the founders. Nurmohamed has led the trading firm since it launched in the UK and has overseen its global expansion.

Does Hantec Markets Offer Reliable Trading Tools?

The broker provides access to market-leading platforms in MT4 and MT5. These are both favourites among retail traders with multiple charts, indicators, drawing tools, and order types. Trading signals are also available, alongside mobile trading functionality.

Is Hantec Markets Trustworthy?

Yes. UK traders should feel safe trading with Hantec Markets as it is regulated by the FCA. Clients also benefit from negative balance protection and segregated client funds. This means that traders cannot lose more than their account balance and that company and client capital are kept separate.

Is Hantec Markets A Good For Broker For Beginners?

Hantec Markets has a low minimum deposit, copy trading and decent educational materials, making the brokerage a good option for new traders. The Cent trading account has a $10 minimum deposit whereas the standard trading account’s minimum deposit is $100.

Top 3 Hantec Markets Alternatives

These brokers are the most similar to Hantec Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Hantec Markets Feature Comparison

| Hantec Markets | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4 | 4.8 | 4 |

| Markets | Forex, CFDs, Indices, Stocks, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Hantec Markets Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| Hantec Markets | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Hantec Markets vs Other Brokers

Compare Hantec Markets with any other broker by selecting the other broker below.

Popular Hantec Markets comparisons: