Hankotrade Review 2025

|

|

Hankotrade is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Hankotrade |

| Hankotrade Facts & Figures |

|---|

Hankotrade is an offshore broker with high leverage, low fees and a welcome bonus. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Speculate on rising and falling prices using highly leveraged CFDs |

| Leverage | 1:500 |

| FTSE Spread | From 0.0 pips |

| GBPUSD Spread | From 0.0 pips |

| Oil Spread | From 0.0 pips |

| Stocks Spread | NA |

| Forex | Trade major and minor currency pairs 24/5 |

| GBPUSD Spread | From 0.0 pips |

| EURUSD Spread | From 0.0 pips |

| GBPEUR Spread | From 0.0 pips |

| Assets | 62 |

| Stocks | Go long or short on popular stock indices, including the Nasdaq |

| Cryptocurrency | Trade leading cryptos against the US Dollar |

| Coins |

|

| Spreads | From 0.0 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Hankotrade is a forex and CFD broker that supports online trading in over 80 instruments. Investors have a good choice of reliable trading platforms and accessible account solutions. This 2025 review will examine the brokerage’s trading tools and fees, alongside outlining how to fund an account, place a trade and more. Our UK team also share their opinion on trading with Hankotrade.

Our Verdict

We found that Hankotrade is an unregulated broker with a restrictive crypto-only deposit policy. This raised concerns for us about the firm’s safety and legitimacy. The tough withdrawal restrictions on the welcome bonus and limited payment methods are also noticeable drawbacks.

Ultimately, UK investors may prefer to trade with established, FCA-regulated brokers.

Market Access

We were pleased to see a good range of forex pairs and major indices offered by the firm. And although the cryptocurrency offering is small, many UK brokers do not offer crypto pairs at all.

However, our experts were disappointed to see no stocks provided, which may be a blow to longer-term investors. Also, the firm doesn’t come close to the range of markets provided by many alternatives.

The instruments on Hankotrade are broken down as follows:

- 3 Crypto CFDs: BTC/USD, ETH/USD and LTC/USD

- 62 Forex CFD Pairs: including EUR/USD, GBP/USD and EUR/GBP

- 8 Commodities CFDs: including gold, silver and Brent Crude Oil

- 11 Indices CFDs: including the FTSE 100, Dow Jones (US 30) and Nasdaq (NAS 100)

Hankotrade is a no-dealing desk (NDD) broker, meaning that orders are settled with liquidity providers. The broker does not act as a counterparty in any trades, reducing the potential for conflicts of interest.

Hankotrade Fees

Fees at Hankotrade are in line with alternatives and depend on the account type.

Commission-free trading is available with the STP account, whilst the ECN and ECN Plus accounts offer lower spreads with either a £2 per side per £100k traded commission or a £1 per side per £100k traded commission rate, respectively. When we used the broker, we were pleased to find competitive spreads of just 0.2 pips for EUR/USD.

We also appreciated that no deposit or withdrawal fees are charged by the firm. Although many other brokers waive deposit fees, withdrawal costs are charged by some firms.

Investors holding positions overnight should also be aware of swap fees. These do not apply to Islamic accounts where they are replaced with an admin fee. Longer-term investors should note that swap fees can add up to a considerable amount over time. Currency conversion charges may also be applicable.

Accounts

We appreciated the selection of account types available, which will meet the needs of various traders and strategies.

Three account types are available (STP, ECN and ECN Plus), with an Islamic swap-free alternative to each. Whether you choose the STP or ECN accounts, there is no dealing desk intervention from Hankotrade.

The main difference between the ECN vs ECN Plus accounts is that the latter has a higher minimum deposit but a lower commission rate. We recommend this profile for high-volume traders. This account range sits somewhere in the middle of those offered by other brokers, though it is good to see both STP and ECN account support.

Our team have highlighted the key features and differences between the accounts:

STP Account

- Zero commission

- Spreads from 0.7 pips

- £10 minimum deposit

- 0.01 lot order size

- Swap-free Islamic account option available

ECN Account

- Spreads from 0.0 pips

- Margin call set at 70%

- £100 minimum deposit

- 0.01 lot order size

- Swap-free Islamic account option available

- Commission is £2 per side per £100k traded

ECN Plus Account

- Spreads from 0.0 pips

- Margin call set at 70%

- £1,000 minimum deposit

- 0.01 lot order size

- Swap-free Islamic account option available

- Commission is £1 per side per £100k traded

How To Register For An Account

I found it straightforward to open a Hankotrade account. To get started I followed these steps:

- Navigate to the sign-up form

- Input your personal details, including phone number and email address

- Agree to the terms and conditions and the General Risk Disclosure

- Click Sign Up

- Verify your email address using the code sent to you

Registration Form

Funding Methods

Deposits

We liked that there are no deposit fees on any payment options and the minimum deposit for traders is just £10 with the STP account, which is low compared to many brokers.

However while using Hankotrade, our experts found that only crypto deposits are allowed. This is disappointing; many investors are still unfamiliar with crypto and we would have preferred to see other funding methods like wire transfer, debit/credit cards and electronic payment solutions, as with most reputable firms.

On a lighter note, the broker’s deposit times are instant, although because they involve cryptocurrencies, they are somewhat dependent on blockchain traffic.

The full list of eligible cryptos for deposits is as follows:

- USDC

- Tether

- Bitcoin

- Litecoin

- True USD

- Dogecoin

- Ethereum

- Bitcoin Cash

How To Deposit On Hankotrade

- Sign in to the client portal

- Click Deposit on the left panel

- Select Cryptocurrency in the upper panel

- Select the relevant trading ID and deposit method

- Click Proceed

- Deposit to your account using the wallet address provided

Withdrawals

Hankotrade’s decision not to charge withdrawal fees is welcome and will help reduce costs for investors. That said, this broker does have a higher minimum withdrawal than we would expect, sitting at £50. Withdrawals under this amount can be made but this incurs a fee, which we felt is harsh towards beginners that just want to try online trading.

Withdrawals are processed within one working day by the broker on business days, although overall withdrawal times are dependent on blockchain congestion. Still though, these timelines are quick compared to alternative brokers.

Withdrawal methods must be the same as that which was used to deposit, apart from any profits, where the payout can be made using any method in the trader’s name if they request Hankotrade to do this.

How To Withdraw Money From Hankotrade

- Login to the client portal

- Click on Withdrawals

- Enable two-factor authentication (2FA)

- Follow the instructions to complete the withdrawal

UK Regulation

We were disappointed to see that Hankotrade is an unregulated broker. This comes with more risk compared to those regulated by the likes of the FCA and CySEC.

The lack of a license means less scrutiny and independent monitoring of the firm, as well as potentially no access to investor compensation schemes should the company go into insolvency. As a result, investors should approach such brokers with caution.

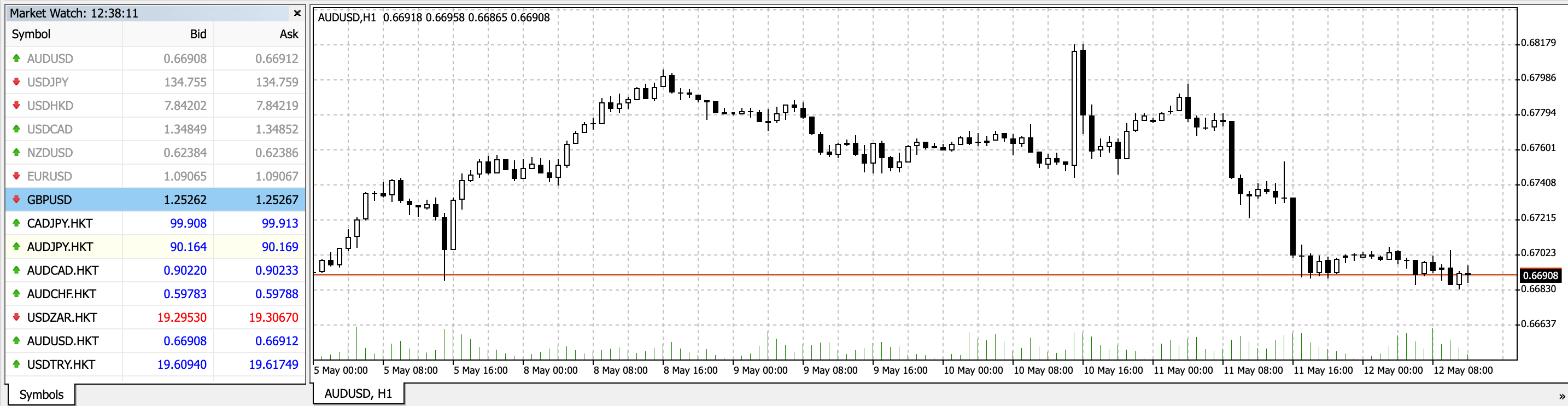

Trading Platforms

Our team appreciated that Hankotrade offers several leading platforms, including the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5). ActTrader is also provided as an alternative to the popular MetaQuotes platforms.

Although there is no access to TradingView or cTrader, our experts were pleased to see a good selection of stable platforms offered and more than some other brokers, many of whom rely solely on proprietary set-ups.

Hankotrade investors must download the MT4 and MT5 platforms to access the more sophisticated desktop solutions, though web versions are also available that operate through a browser for free.

The supported base currencies are EUR, USD and CAD for MT4 and MT5, with the addition of BTC on the ActTrader platform. Unfortunately, our experts found that GBP is not a supported base currency, limiting the firm’s viability for UK investors.

We have pulled out our favourite platform features:

MT4

- Nine timeframes

- Algorithmic trading

- 23 analytical objects

- Three execution modes

- Customisable workspace

- 30 built-in technical indicators

- Trading signals and copy trading

- Available on Windows, Mac, WebTrader, iOS and Android (APK)

MetaTrader 4

MT5

- 21 timeframes

- Algorithmic trading

- 44 analytical objects

- 38 technical indicators

- Customisable workspace

- Trading signals and copy trading

- Windows, Mac, WebTerminal, iOS and Android (APK)

ActTrader

- One-click trading

- Market analysis sources

- Customisable workspace

- Instant hedging capabilities

- Integrated technical indicators

- Desktop, web, iOS and Android (APK)

- Place trades into multiple accounts simultaneously

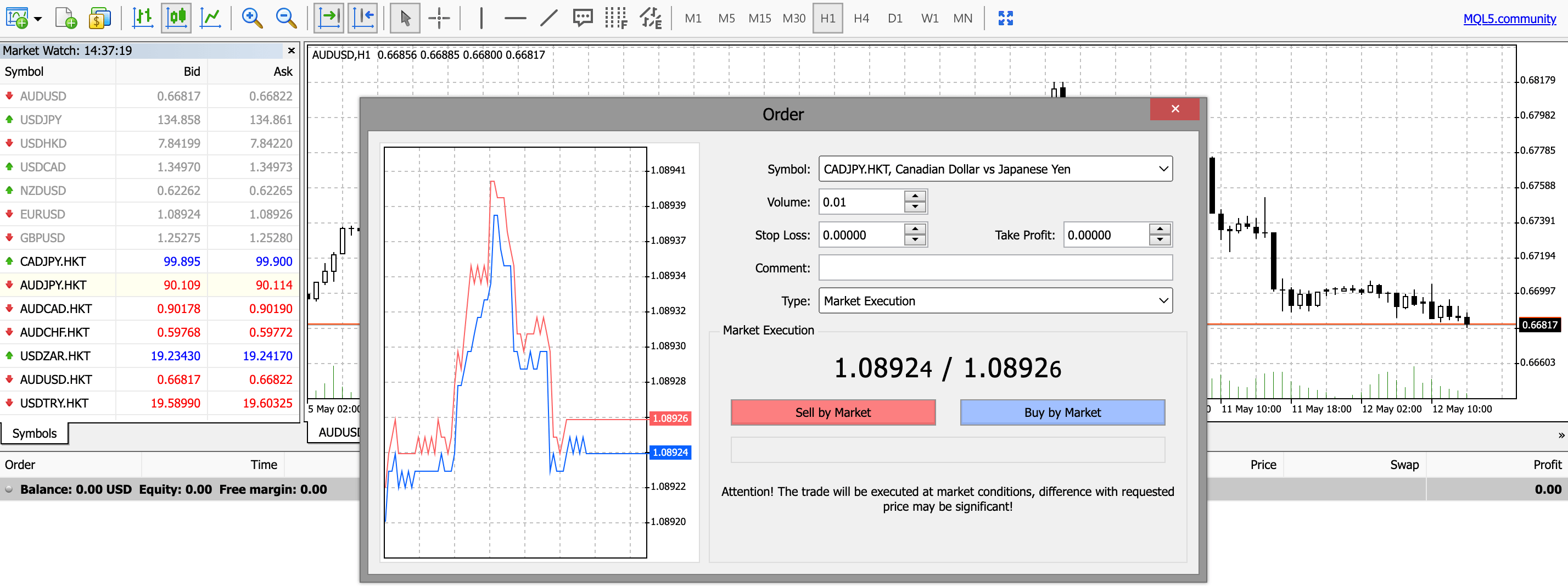

How To Open A Position On MT4

- Right-click your chosen instrument on the list of assets on the left

- Click New Order

- Complete the information in the pop-up window including volume and, if relevant, desired stop loss and take profit levels

- Click Sell by Market or Buy by Market to complete the order

Order Screen

One-click trading is also available. This allows positions to be opened directly from the price chart and can be enabled in the Options tab.

Mobile App

Hankotrade has no mobile app of its own but MT4 and MT5 have mobile apps that investors can download from the App Store and Google Play. These are intuitive, provide many of the functions available on the desktop versions and are excellent platforms that enable investors to trade on the go. However, many traders find it easier to look at charts on a laptop or computer where the screen is larger.

Hankotrade Leverage

The freedom of being unregulated means Hankotrade can offer leverage up to 1:500 for retail clients (the limit is usually 1:30 at European-regulated brokers). This is the case for all account types.

We did appreciate that traders can choose their desired leverage ratio in the client portal, at the same time as choosing their trading platform and base currency. We were also pleased to see that this broker has negative balance protection, despite its lack of regulatory obligation. That being said, investors should still be mindful of the risks involved with trading on margin in case the market moves against you.

Demo Account

Like most brokers, Hankotrade provides a demo account through which beginners can familiarise themselves with the available trading tools and more seasoned investors can test and develop their strategies. Importantly, trading conditions are the same as on the live accounts, providing a realistic experience.

We also like that investors can contact the customer support team if they wish to change the balance on their demo accounts.

How To Open A Demo Account

- Register for an account

- Login to the client portal using your email and investor password

- On the dashboard, click Add Demo Account

- Input the relevant information

- Click Open Account

Bonuses & Promotions

Unregulated brokers that are not subject to the same restrictions as those regulated by the likes of the FCA have the freedom to offer more enticing promotions. Although Hankotrade currently only provides one promotion (other unregulated brokers may offer several simultaneously), it is fairly appealing. The deal is a 100% deposit welcome bonus when you open a new account.

The deposit has to be a minimum of £100 and the maximum deposit bonus is £25,000. However, check the terms and conditions carefully, particularly the volume that needs to be traded before the bonus can be withdrawn, as these terms often catch out the unwary.

Extra Tools & Features

Unfortunately we found no educational resources such as tutorials or market analysis reviews at Hankotrade. This is disappointing as most brokers these days have some form of learning section to assist traders. There was also no glossary to help newer investors comprehend trading jargon. Ultimately, this means the brand isn’t the best fit for beginners.

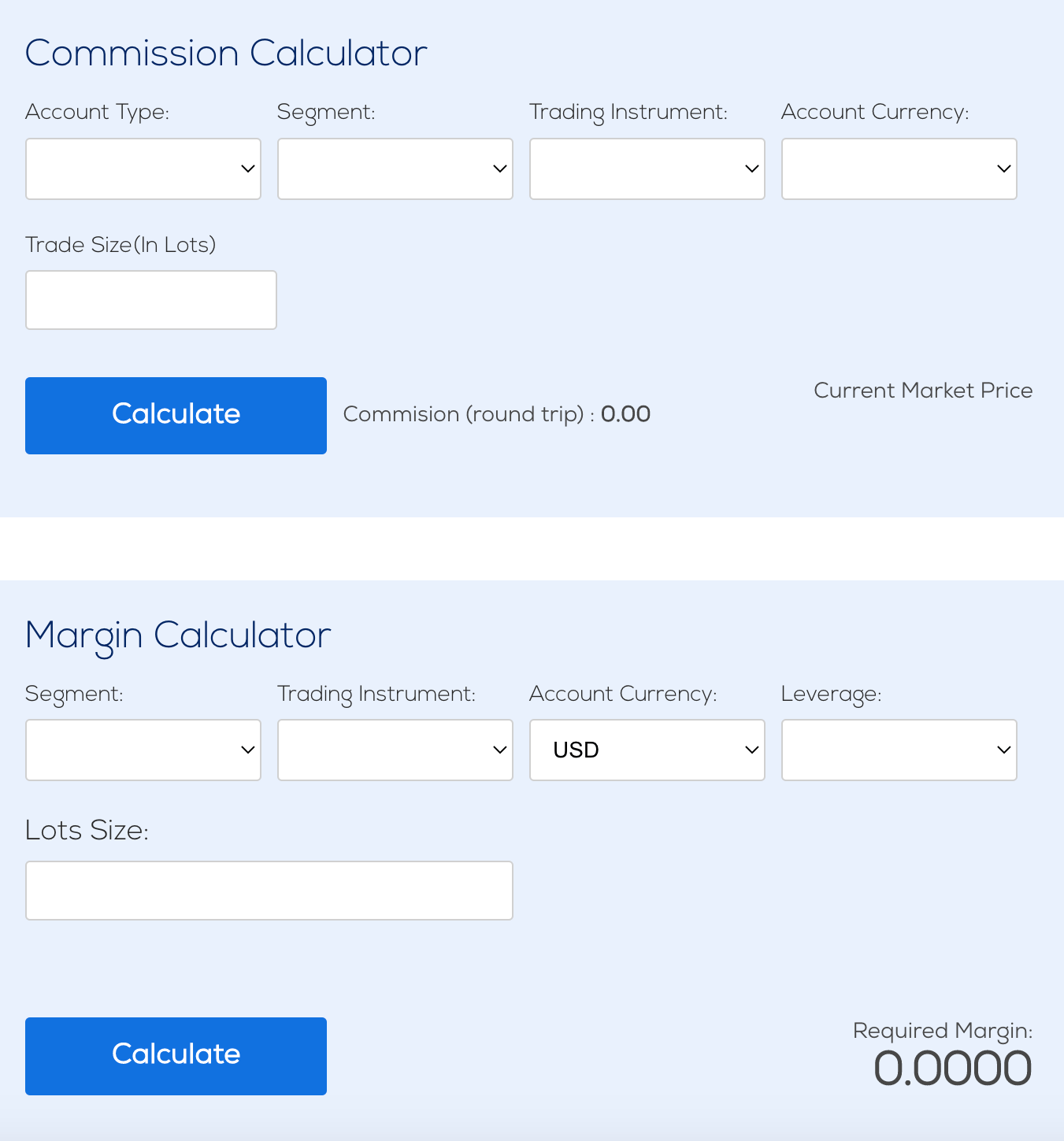

We were only able to find forex calculators (including a commission, pip and margin calculator) and an economic calendar for identifying upcoming events and announcements that could have an impact on the markets.

It is also possible to be a PAMM/MAM account manager, where experienced traders invest on behalf of clients.

Forex Calculators

Company Background

When we used Hankotrade, we were concerned to see limited information about the company’s background and the team behind it. Hankotrade is an offshore and unregulated broker and, while many firms, especially crypto-focused ones, are offshore and unregulated, the lack of information about this company is a concern.

The broker was founded in 2019 and so is relatively new to the industry. It has a physical address in Dubai and another address (possibly the location of its registered headquarters) in Mauritius.

Customer Service

Hankotrade offers a decent mix of customer support options, which are open 24/5.

Our experts found the live chat to be very responsive, only taking a few seconds to receive an answer. There is also an FAQs section for more standard enquiries like how to change the settings on your demo account and whether you can delete your Hankotrade account. However, this is less comprehensive than the FAQs written by some other brokers and does not deal with questions like how to change leverage on the platform.

Contact methods include:

- Skype

- Live chat

- Online Contact Form

- Phone Number: +971 565872509

- Email Address: contactus@hankotrade.com

Security

We were pleased to find that crypto funds are kept in cold wallets with no online linkage. This reduces the risk of successful cyber attacks on funded accounts as online/hot wallets are more susceptible. These cold wallets are also segregated from the company’s accounts, leaving client funds available only for investing.

All data transfers between the user and the crypto solutions are encrypted. No withdrawal requests at Hankotrade can be made until two-factor authentication has been enabled. Note that deposits over £100,000 in a single transaction require KYC checks, which usually involve ID verification.

As for the trading platforms, MetaTrader is trusted by brokers and investors across the world by providing a reliable terminal with secure encryption. With that said, investors should still be mindful of any external scams and ensure they keep their account information safe.

Trading Hours

Hankotrade is open for trading 24 hours a day from Monday-Thursday and up to 12:00 (GMT+2) on Friday. There is no weekend trading and individual market hours may vary. The server time zone is GMT+2 during the winter months and GMT+3 during the summer season.

Sadly, these opening times are quite restrictive compared to other firms and the trading times of the markets themselves. Forex markets are generally open until the end of the day on Fridays, while cryptocurrency products should be available 24/7, as the markets never close.

Should You Invest With Hankotrade?

Hankotrade is a basic broker when compared to some of the top UK trading firms, most of whom have more comprehensive education sections and greater levels of trust. Although this brand has a good choice of trading platforms and low spreads, the crypto-only deposit and withdrawal options, its unregulated status and the lack of online company information are serious red flags for us.

FAQ

Is Hankotrade A Good Broker?

Although Hankotrade has low spreads and a good choice of trading platforms, it has limited deposit options, a lack of educational material and is unregulated. As a result, it is not a top choice for UK traders.

Is There A VPS On Hankotrade?

Yes, investors with Hankotrade can apply for a VPS, which can increase trade execution efficiency and reduce slippage. A VPS can also allow a system to continue running without having the device on all the time.

Is Hankotrade A Regulated Broker?

No, Hankotrade is an unregulated broker, which, although giving the freedom to offer more generous promotions and increased leverage, means less monitoring of the company’s activities and less consumer protection. We generally recommend choosing an FCA-regulated brokerage for top-tier security.

Can You Use Hankotrade In The UK?

Yes, UK-based investors can open a Hankotrade account and begin trading in its available products.

Where Is Hankotrade Located & Based?

Hankotrade has a physical office in Dubai, as well as another registered address in Mauritius.

Is Hankotrade Legit & Trustworthy?

Hankotrade is a relatively new broker that is offshore and unregulated. In addition to this, the lack of background information relating to the company means investors should approach it with caution. We recommend a regulated broker that is more established in the industry, especially for newer investors.

How Long Does A Withdrawal Take From Hankotrade?

Withdrawals are processed by the broker within one working day on business days. However, overall withdrawal times may vary with blockchain traffic. Overall though, Hankotrade offers fast payment timelines.

What Is The Difference Between STP Vs ECN Accounts At Hankotrade?

Both STP and ECN accounts offer a no-dealing desk experience, where orders are routed directly to liquidity providers. The STP account is where the Hankotrade connects the investor to the liquidity providers and usually adds a markup on the spread. With ECN accounts, there is no markup on the spread but there is a commission.

Article Sources

Top 3 Hankotrade Alternatives

These brokers are the most similar to Hankotrade:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Hankotrade Feature Comparison

| Hankotrade | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4 | 4.8 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $10 | $1,000 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Hankotrade Review |

Swissquote Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| Hankotrade | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Hankotrade vs Other Brokers

Compare Hankotrade with any other broker by selecting the other broker below.

Popular Hankotrade comparisons: