Golden Capital FX Review 2025

|

|

Golden Capital FX is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Golden Capital FX |

| Golden Capital FX Facts & Figures |

|---|

Golden Capital FX offers multi-asset trading using an STP execution model. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Indices, Metals, Energies |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | No |

| Commodities |

|

| CFDs | Leveraged CFDs are available with variable STP spreads. |

| Leverage | 1:500 |

| FTSE Spread | 3.0 (Standard) |

| GBPUSD Spread | 1.5 (Standard) |

| Oil Spread | 0.3 (Standard) |

| Stocks Spread | NA |

| Forex | Trade major, minor and cross currency pairs on the MT4 platform. |

| GBPUSD Spread | 1.5 (Standard) |

| EURUSD Spread | 1.5 (Standard) |

| GBPEUR Spread | 1.1 (Standard) |

| Assets | 45 |

| Stocks | Trade on popular global indices with spreads from 3.0 pips on the Average account. |

Golden Capital FX is an online broker offering forex, indices and commodity trading through the MT4 platform. Operating an STP model, the brand offers UK investors direct market access alongside competitive spreads, though we have concerns regarding the licensing and unresponsive customer service. This review will examine Golden Capital FX’s services from assets to platforms, fee structure and security to provide traders with the broker’s advantages and disadvantages.

Our Take

- Golden Capital FX could be suitable for experienced traders looking to trade a range of forex pairs on the MT4 platform

- Minimum deposits start from $100 with spreads from 1.5 pips, although there are high barriers to entry for more competitive spreads

- The broker’s legitimacy and regulatory status has been called into question and the lack of transparency around pricing is a red flag

- There have been some scam reports and withdrawal issues

Market Assets

We found that Golden Capital FX’s list of 240+ instruments across four asset classes is relatively lightweight. The brand mainly deals in forex and has a good, but not outstanding, selection of 60+ pairs. It also does not have an extensive list of alternative assets and, notably, stock and cryptocurrency trading is not supported.

- Forex – trade 60+ major, minor and exotic currency pairs including GBP/USD, GBP/JPY and EUR/USD

- Indices – 12 indices major global indices including UK100, Dow Jones and NASDAQ

- Precious Metals – diversify your portfolio and trade gold or silver

- Commodities – trade US Crude Oil and UK Brent Crude Oil

The broker has added to its asset offering in recent years, specifically increasing the number of forex pairs, however, we would like to see greater numbers of assets in existing classes as well the introduction of stocks.

Fees

The broker’s fees are built into the spread, and we think the prices on offer are satisfactory in the Standard account, where fees are broadly in line with the industry average. With that said, spreads in the Premium and VIP accounts are not competitive, considering the high barriers to entry.

Spreads start from 1.5 pips on the EUR/USD for the Standard Account. This drops to 1.2 pips for the Premium account and 1 pip for the VIP account. A similar trend is seen across other forex pairs. These rates will struggle to compete with the leading brands. For example, Pepperstone offers tight spreads from 0.0 pips in their Razor account, and 1 pip in their Standard account for the same pair.

Spreads on indices range between 3 pips and 1 pip for Standard and VIP profiles.

I was pleased to see that the broker charges no inactivity or management fees.

Accounts

We think Golden Capital FX’s flexible account options are typical of brokers who reward users with a more favourable fee structure for depositing more funds, though we do think the requirements for a VIP account is exceptionally high. We are also disappointed to see that Golden Capital FX does not offer an Islamic account.

There are three different account types to choose from:

- Standard – $100 minimum deposit; variable spread

- Premium – $5,000 minimum deposit; variable spread

- VIP – $50,000 minimum deposit; variable or fixed STP spread

How To Open An Account

We found opening a Golden Capital FX live account straightforward and it can be completed in a few simple steps:

- Select ‘Register’ in the top right corner of the broker’s website

- Choose the ‘Real’ account from the drop-down menu

- Enter your details including name, registered email address, phone number and address

- Complete the form and click ‘Create Account’

- Make the required deposit and then start trading

Funding Options

We were satisfied with Golden Capital FX’s supported funding methods, which include:

- Skrill

- Credit/debit cards

- Bank wire transfer

- Cryptocurrency deposits: Bitcoin (BTC) and Tether (USDT)

This is a good selection of payment methods, though I would like to see the integration of additional e-wallets for greater flexibility, especially PayPal.

Payments are generally processed within 24 hours, but this may be longer during weekends or bank holidays. Golden Capital FX does not charge a fee to make a deposit or withdrawal, but third parties such as banks or payment processing platforms may apply an additional fee.

Deposits

We think the minimum deposit requirement of $100 is a little high considering that some competitors allow traders to open live accounts for a few pounds or even with no deposit. There are no ongoing deposit minimums once an account has been set up.

The $5,000 minimum for the Premium account is also on the high side, though it will be within reach for some traders. I wasn’t thrilled to see that the most favourable conditions are available only to VIP customers who deposit at least $50,000.

It is possible to transfer deposits to a third-party account, however, the account must be in the account holder’s name.

Deposits are usually processed within 24 hours.

Withdrawals

Our experts were disappointed to see that other traders have reported issues with making withdrawals, citing long processing times and in some instances, not receiving withdrawals at all. This is cause for concern and we would hope to see Golden Capital FX take steps to address these concerns.

The broker states that withdrawals can take up to five days to be processed. They can be made via bank or credit card, bank wire transfer or supported cryptocurrencies.

Trading Platforms

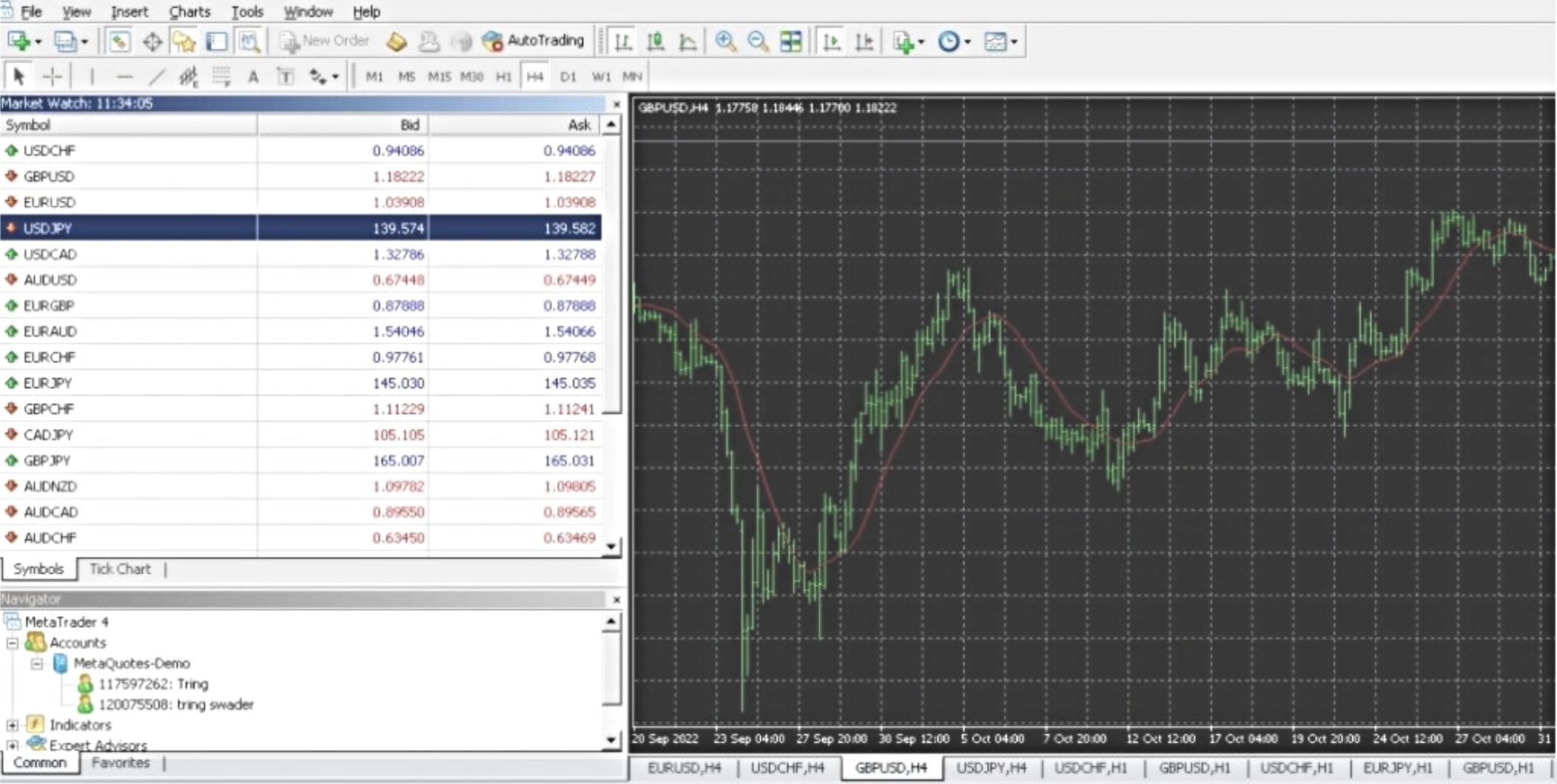

Traders at Golden Capital FX can trade on the hugely popular MetaTrader (MT4) platform, which we are always glad to see, though I would have preferred to see it alongside additional options.

MT4 is an industry-leading platform with advanced capabilities, simple navigation and a comprehensive range of tools and features. Among the best features are:

- 8 order types

- Expert Advisors

- Unlimited charting

- 3 execution modes

- Multiple time frames

- 50+ technical indicators

- A proprietary coding language (MQL4)

Golden Capital FX also offers the opportunity to manage multiple accounts through MT4. It’s a shame that copy trading isn’t also offered.

MT4 is a cutting-edge platform, favoured by traders around the world. As a sole trading platform, it is a great option and we are always happy to recommend trading on MT4.

MetaTrader 4

How To Place A Trade

Placing an order on the MT4 platform is straightforward. Simply:

- Select ‘New Order’ on the toolbar

- Enter the order information

- Select the asset you wish to trade

- Input the volume you wish to trade

- Add stop-loss or take-profit levels if desired

- Choose the order type – this will be instant (market execution) or delayed (pending order)

- Finally, select ‘buy’ or ‘sell’

Mobile App

Golden Capital FX does not offer a proprietary mobile app but we are confident the MT4 app provides everything customers will need to trade on the go.

The app is available for free on iOS and Android devices and offers a good range of features, full trading history and fast execution. The application also supports multiple timeframes, trading signals and analytical objects.

Leverage

Our experts were concerned with the lack of transparency around leverage limits. We would only recommend utilising leverage if you have the relevant knowledge and understanding to do so. Leverage can increase profits but also losses. It should only be used alongside a robust risk management strategy.

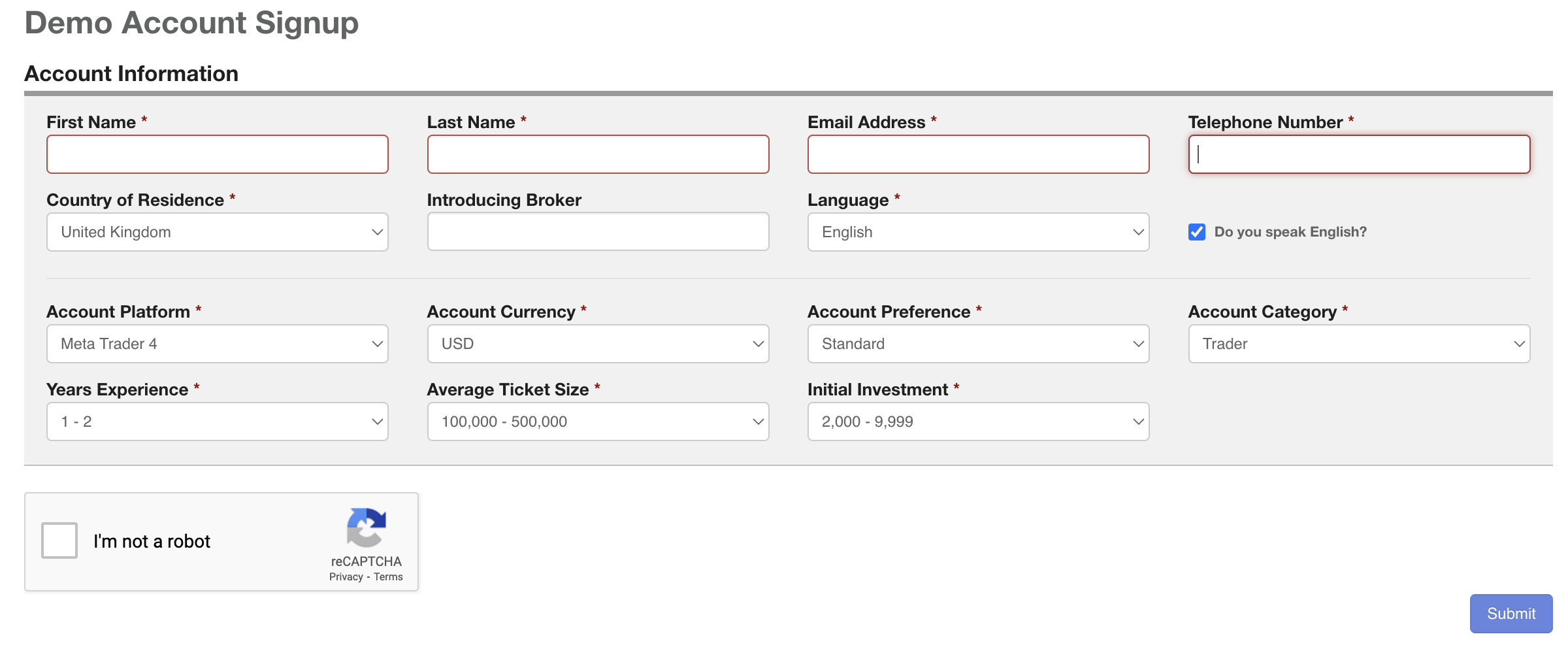

Demo Account

We are pleased to find that Golden Capital FX offers a demo account credited with 50,000 in virtual funds to all prospective and existing customers, as these are a great way to try before you buy. They offer a simulated trading experience without risk.

However, we are sorry to see that demo accounts have a 30-day cap, as these are a good way to continue practising strategies even after you sign up with a broker. I was also disappointed to see that the only available base currency is USD.

To sign up for a demo account, there is a short registration form to complete on the broker’s website.

Demo Account Registration

UK Regulation

Our experts have some concerns regarding the safety of this broker. Golden Capital FX is registered by the Financial Services Authority in the offshore jurisdiction of St Vincent and the Grenadines. This authority is not a top-rated financial regulator and therefore does not oversee any forex brokerage activities.

Additionally, there are several scam warnings surrounding the broker, citing concerns regarding its operations.

It is never a good sign to see this type of warning online, so traders should proceed cautiously, especially if they sign up with the offshore branch.

Bonuses

We were not offered any promotional or welcome bonus deals at Golden Capital FX. We do not expect this to change in the near future.

Extra Tools & Features

Golden Capital FX has a few additional tools and features for traders, but overall I think the standard is poor and does not add any value for traders.

There is a range of free educational content under the ‘Learn’ tab on the broker’s website, as well as occasional on the website or YouTube channel. UK traders should note that the webinars are held in Spanish.

Besides that, a blog is updated occasionally, but not regularly, and there is a basic economic calendar. This is very disappointing compared to the comprehensive offerings from other brokers, such as IG Index or FxPro.

Customer Service

Our team were very disappointed with Golden Capital FX’s customer support outfit, as there is no dedicated section on the website and no indication of opening hours.

There is a live chat function on the site, but it was unresponsive when I tested it.

The three avenues to contact the broker are:

- Phone: (+511) 748 2277

- Email: info@goldencapitalfx.com

- Registered UK Address: 27, Old Gloucester St, London, WC1N 3AX

We were also disappointed to see a limited FAQ section on the broker’s website, covering just a few, basic topics. We would like to see this expanded in the future.

Company History & Overview

Golden Capital FX is a brokerage with headquarters in Lima. It was founded in 2016 by Daniella Lucia Cervantes Alvarez. Over more than seven years, the broker has built up a steady client base. Today, it connects 300k+ traders in 70+ countries with global markets.

Golden Capital FX operates an STP execution model, allowing clients to access the market directly with no dealing-desk intervention.

Golden Capital FX is an unregulated broker, operating offshore in St Vincent and the Grenadines. As such, the broker’s activities have been called into question.

Security

It appears that Golden Capital FX takes the security of client funds seriously with several measures in place to ensure that funds are safe, including SSL certification, data encryption and 2-factor authentication to login.

However, we would like to see some more details regarding the specific security measures in place. Greater transparency is needed.

Trading Hours

Trading hours vary and are specific to the asset traded.

In the UK, forex trading is available 24/5. Check the website for specific opening and closing hours.

Trading hours for commodity trading may be more limited. Indices trading is linked to the opening hours of the exchange the underlying assets are listed.

For a detailed list of trading hours, visit the trading portal.

Should You Trade With Golden Capital FX?

With a minimum deposit of $100, no management fees and flexible account and funding options, we do think that Golden Capital FX has potential. However, the broker’s asset portfolio is limited and we have some concerns regarding the legitimacy of its operation. Traders have also reported issues with withdrawing funds.

Overall, we would not recommend Golden Capital FX to traders given the number of trustworthy and reliable brokers on the market.

FAQ

Does Golden Capital Accept PayPal?

No, Golden Capital FX does not currently offer PayPal. Clients can, however, make deposits via credit/debit cards, bank wire transfers, Skrill and Bitcoin and Tether.

What Trading Platforms Does Golden Capital FX Offer?

Clients can trade on the award-winning MetaTrader 4 (MT4) on desktop, tablet and mobile. Unfortunately MT5 is not currently supported.

Is Golden Capital FX Trustworthy?

Golden Capital FX is an unregulated broker. The firm is registered to operate in the offshore jurisdiction of St Vincent and the Grenadines, by the Financial Services Authority. As such, traders will get limited financial protection. Where possible, we recommend opting for an established, regulated brokerage.

Does Golden Capital Offer Cryptocurrency Trading?

No, Golden Capital FX does not currently offer cryptocurrency trading. Clients can however make deposits and withdrawals using Bitcoin (BTC) and Tether (USDT).

Is Golden Capital FX Legitimate?

Golden Capital FX appears to be a legitimate company on the surface. However, following some background checks and live testing, we do have some concerns regarding the broker’s transparency in business operations. Scam warnings have also been issued online, along with other negative client reviews.

Article Sources

SVGFSA List of Registered Entities

Top 3 Golden Capital FX Alternatives

These brokers are the most similar to Golden Capital FX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

Golden Capital FX Feature Comparison

| Golden Capital FX | Swissquote | IG Index | INFINOX | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 4.7 | 3.4 |

| Markets | Forex, Indices, Metals, Energies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Shares, Commodities, Futures |

| Minimum Deposit | $100 | $1,000 | $0 | £1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SCB, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5 |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (UK), 1:200 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Golden Capital FX Review |

Swissquote Review |

IG Index Review |

INFINOX Review |

Trading Instruments Comparison

| Golden Capital FX | Swissquote | IG Index | INFINOX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Golden Capital FX vs Other Brokers

Compare Golden Capital FX with any other broker by selecting the other broker below.

Popular Golden Capital FX comparisons: