Golden Brokers Review 2025

|

|

Golden Brokers is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Golden Brokers |

| Golden Brokers Facts & Figures |

|---|

Golden Brokers is a Malaysian headquartered forex and CFD broker established in 2016. The brand is regulated offshore by the Labuan Financial Services Authority. Retail traders can speculate on 700+ products via the MT5 platform with no commission and a choice of international payment methods. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Commodities |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | LFSC |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Signals Service | MT5 integrated |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade 700+ products as CFDs on the powerful MetaTrader 5 platform. Access leverage up to 1:100 on major forex pairs with a 50% stop-out level on the standard account. |

| Leverage | 1:100 |

| FTSE Spread | 5 |

| GBPUSD Spread | 3 |

| Oil Spread | 0.1 |

| Stocks Spread | Variable |

| Forex | Speculate on 60+ major, minor and exotic currency pairs such as EUR/AUD, USD/JPY and EUR/GBP with leverage up to 1:100. Fees are not the most competitive, with average spreads of between 3 and 5 pips for major forex pairs. |

| GBPUSD Spread | 3 |

| EURUSD Spread | 3 |

| GBPEUR Spread | 4 |

| Assets | 62 |

| Stocks | You can speculate on the price of hundreds of shares spanning US, EU and Asian markets. On the negative side, the $20 minimum commission is higher than the best stock brokers. |

Golden Brokers is a CFD broker offering the popular MetaTrader 5 platform, thousands of instruments and a mediocre mobile app. In this review, we will explore whether UK traders should invest with Golden Brokers, assessing its market access, fees, regulation and more.

Our Take

- We think Golden Brokers has a strong selection of assets, with over 1,500 products, including many UK shares

- However, the firm has weak regulation and poor customer service with concerning reports about client funds being blocked

- We recommend that UK traders look for FCA-regulated brokers with a strong track record and competitive trading conditions

Market Access

Our team is pleased with Golden Brokers’ impressive offering of 1,500+ CFD instruments. These are split into five asset classes: commodities, forex, indices, stocks and ETFs. We like that Golden Brokers offers such a large selection of assets as it means there will likely be something for every trader.

Assets include:

- Commodities – 15+ commodities, including popular products like Brent Crude Oil, Cocoa and Gold

- Indices – 14 different stock indices, such as the UK’s FTSE 100, as well as international indices like the Nasdaq and DAX

- Forex – Over 60 forex pairs, including all majors, many minors and some exotics. Popular pairs include GBP/USD, GBP/SGD and EUR/GBP

- Shares – Over 1,000 CFDs in equities are supported, including 200+ UK stocks. Clients also have access to shares from Spain, the Netherlands, Germany, the USA, France, Hong Kong, UAE and Saudi Arabia

- ETFs – 30 ETFs, including many themed baskets like The Cannabis ETF and iShares Global Clean Energy ETF

Fees

The bulk of Golden Brokers’ fees lies in the spread of assets, barring share CFDs.

However, we weren’t impressed by the fees we were charged for equity products, with stock CFDs all including a commission of 0.5% of the volume traded, with a minimum fee of £15. We see lower costs and commission rates at other popular brokers, such as XTB.

Spreads on other assets also come in wider than many alternatives, especially for forex.

Typical spreads for popular assets are given below:

- Aviva – 0.2 pips

- Tesco – 0.2 pips

- Greggs – 0.2 pips

- FTSE 100 – 5.0 pips

- GBP/USD – 3.0 pips

- EUR/GBP – 4.0 pips

- Brent Crude Oil – 0.1 pips

There is also a fixed administrative fee of £78 charged when a trader’s account is left inactive for one month. This is significantly higher than most alternatives and a serious drawback for casual traders.

Golden Brokers charges swap fees on positions held overnight, varying depending on the assets and market conditions. However, Islamic swap-free accounts are available for those of the Muslim faith. This account allows users to hold positions swap-free for up to 20 calendar days. Positions open for longer than this will incur swap charges.

Accounts

Golden Brokers keeps things simple by only offering a single live trading account option (with a swap-free, Islamic variation). This account gives clients access to all the assets supported by the firm, as well as the MetaTrader 5 platform.

When we used the account, we were disappointed to see that clients are restricted to a base currency of USD, while deposits in other currencies will automatically be converted into USD (albeit charging a foreign exchange fee).

Unfortunately, GBP is not an available currency for funding Golden Brokers accounts, making life harder for UK investors. The account has a minimum deposit of £79 and orders are placed in full lot sizes.

We found that the firm offers leverage of up to 1:100 with a 100% margin call and 50% close-out level.

Unfortunately, not all investing strategies are accepted; those detected to be using arbitrage systems may have their accounts terminated. However, general hedging approaches are allowed.

How To Open An Account

- Click the Start Now button

- Fill in the Registration form, including your name, email address and phone number

- Send the form to open your account. You will be redirected to the client portal

- Go to your email address and activate your account, you will also receive your client portal account details in your emails

- Log into the client portal and fill in the KYC details (including your personal information, address, income and document verification)

- When your identification has been accepted (passport, driver’s license, etc.) you will need to head to the Account section

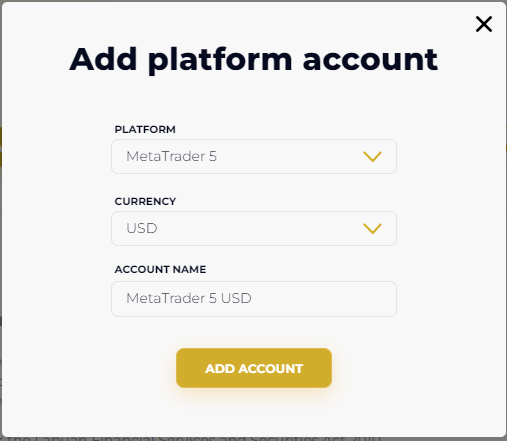

- Click Add Account and choose to open a live account

- Here, you can select your platform, currency and account name (although only one platform and currency is available)

- Click Add Account and your trading account will be opened

- Download the MetaTrader 5 platform from the Golden Brokers website and login with the details sent to your email address

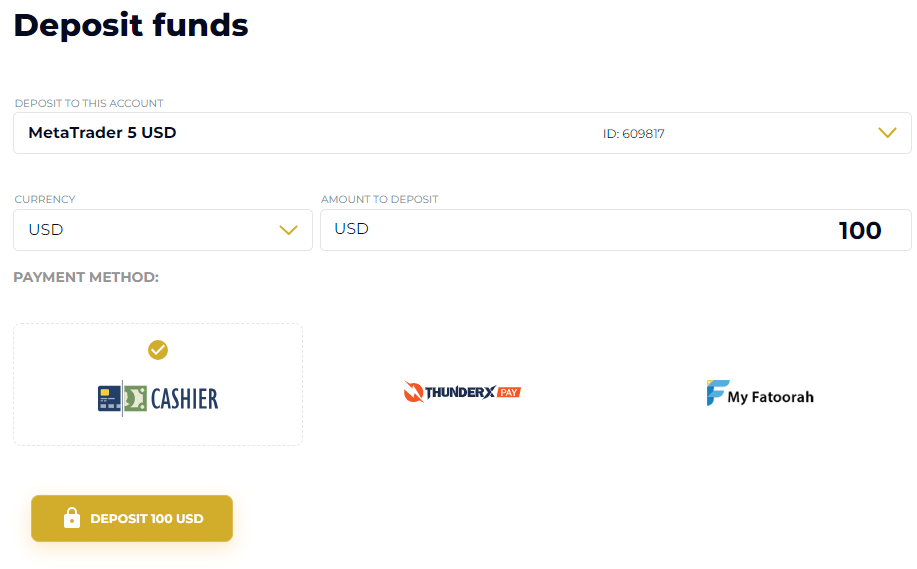

- Deposit funds into your account, load up MetaTrader 5, log in with your details and start investing

Account Registration Form

Funding Options

The deposit methods offered vary by currency, with most supporting bank cards (debit and credit) and wire transfers.

Some alternative methods, such as ThunderX Pay and My Fatoorah, are also available, although these are not widely used, especially in the UK. Note that there is also a minimum deposit size of £79.

Overall, we are disappointed by the limited funding methods offered by Golden Brokers. Not only is GBP not supported but many popular options, such as Neteller, Skrill and cryptocurrency transfers, are not offered, making this broker much less competitive for British traders.

Deposit Methods Summary

UK Regulation

We are not satisfied that Golden Brokers provides enough regulatory assurance and security to its UK clients.

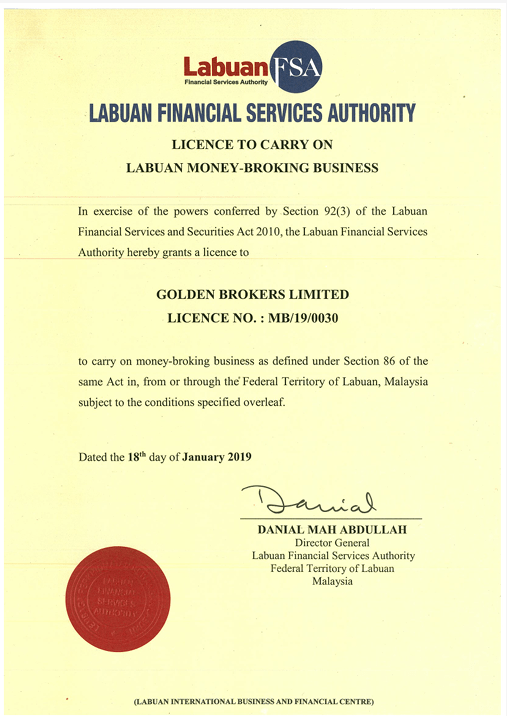

The firm is licensed and regulated by the Labuan Financial Services Authority (LFSA) under license number MB/19/0030. Our team do not consider the LFSA to be a reputable financial regulator, although some rules and guidelines are enforced to protect traders.

These restrictions include the separation of clients’ funds from the firm’s and a series of KYC protocols. Unfortunately, the overall quality of regulation from this entity is not as high as for the FCA, making this broker riskier to trade with.

Our fears are further stoked by the lack of protections like a compensation scheme or negative balance protection.

We generally recommend that UK traders invest with brokers that are regulated by the FCA to ensure the best protections are in place for their money.

Golden Brokers Licence

Trading Platforms

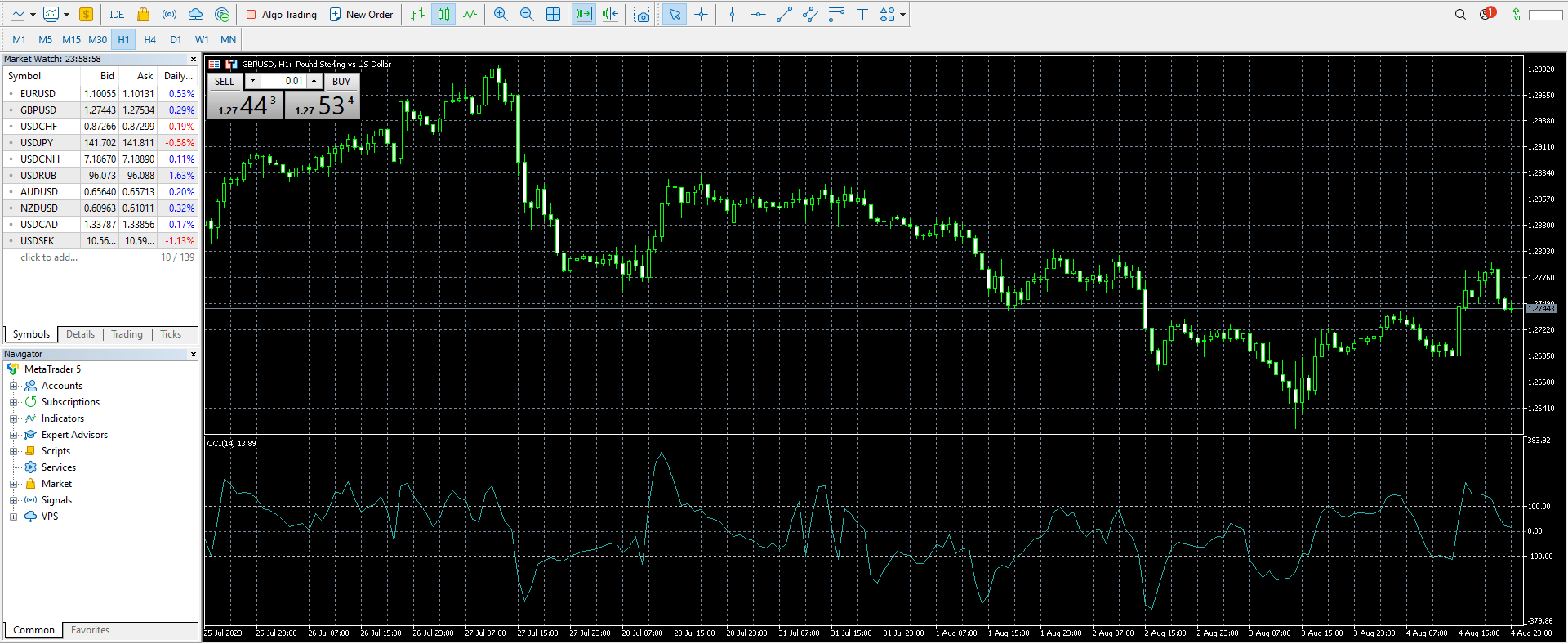

Our team liked that Golden Brokers offers the popular MetaTrader 5 platform, though we would point out that not all investors like this style of platform.

While this is one of the most popular online trading tools, building on its predecessors’ stock features to provide a highly customisable and powerful investing experience, our team prefer to see a wide range of options. Many top, FCA-regulated firms like AvaTrade and FXCC support a wide array of software packages.

MetaTrader 5

MetaTrader 5 (MT5) is a powerful, yet easily accessible, trading platform. It comes packed with lots of built-in features out-of-the-box, access to automated trading (Expert Advisors) and a huge number of free online resources.

Features include:

- Webtrader

- Six order types

- 21 timeframes

- One-click trading

- Mobile trading app

- 44 graphical objects

- Depth of market data

- 38 technical indicators

- MQL5 programming language

- Automated trading bots (Expert Advisors)

- Hundreds of free and paid add-ons on the market

MetaTrader 5 can be accessed through its desktop application, a mobile app or the browser-based web trader. You can download and open any of these directly from the Golden Brokers website.

MetaTrader 5

Overall, we are glad that MetaTrader 5 is available as it is one of the most effective and accessible online trading platforms. It is a great software package for new and experienced traders to invest with due to the range of built-in tools and customisable add-ons.

However, we would have liked other platforms to supplement MT5 and provide a greater range of support.

How To Place A Trade On MT5

- Log into your Golden Brokers MetaTrader 5 account

- Choose the asset you would like to open a position on from the asset list on the left

- Perform your analysis of the asset’s price movement to identify the best time to trade

- When you are ready to place your order, open the order menu by pressing New Order from the top hotbar

- In the Order window, input the details of your desired trade (asset, volume, stop loss, take profit, order type, etc.)

- Finally, click the Buy or Sell button to place the trade in your desired direction

Mobile App

We like that Golden Brokers offers clients a dedicated mobile app, which incorporates a proprietary trading platform with a sleek, modern and intuitive design. The application features seven timeframes, three technical indicators and two chart types. Users can also assess market sentiment, place orders and monitor price movements.

Unfortunately, we were disappointed by the functionality of the platform, finding it to be very barebones, paling in comparison to the MetaTrader 5 mobile app.

MetaTrader 5 itself has a mobile application. This platform is available to download on Android and iOS mobile devices from their respective app stores. The mobile version provides many of the same features as the desktop and web trader apps.

Users can monitor markets, set up alerts, chart price movements, access news, perform analysis and place trades. The app also has a sleek design, making it easy to navigate and use. Overall, the MetaTrader 5 app would be our pick.

Leverage

Golden Brokers supports trading on margin with leverage up to 1:100. UK and European regulated brokers restrict their leverage rates to 1:30 for retail traders, though we have used offshore firms that offer rates into the thousands.

With that said, we do not think that high leverage limits are always a good thing as they can encourage users to take on unmanageable levels of risk, especially given the lack of negative balance protection at this firm.

The broker will issue a margin call if your margin falls below 100% and will perform a stop-out, closing any open positions, at 50% margin.

Demo Account

Users can easily open demo, paper trading accounts with Golden Brokers directly through the client portal. In the account section, clients can choose to either open a live or demo MT5 account. The demo options offer USD as a base currency and an initial simulated deposit of £78,000.

We have found that the demo account gives access to all the assets offered by Golden Brokers, providing an opportunity for users to directly develop their investing strategies before committing funds to a live account.

Our experts often recommend that traders open a demo account before investing in a live account to become accustomed to the cost structure, market conditions and platform features.

Bonus Deals

Our team could not find any bonus promotions, deals or financial incentives offered by Golden Brokers. In our experience, many unregulated brokers offer promotions like no deposit bonuses, demo trading competitions and welcome rewards.

However, we do not see this as a problem, considering that financial incentives have been banned by top regulators for a reason. Bonus deals are often predatory in nature and can have unreasonable terms and conditions, locking real funds away from you.

Extra Tools & Features

Several extra tools and features are offered by Golden Brokers. In the client portal and mobile app, users can see the investor sentiment of all supported assets, assisting strategy decisions and market approaches.

Furthermore, several educational and research resources are also offered to help newer traders learn the ropes and support more experienced speculators in developing their knowledge and capabilities.

New clients are offered an introductory MetaTrader 5 tutorial. This is a four-part video series that covers key information from how to install MetaTrader 5 to closing your first position. This is a useful tutorial for beginners. However, those looking for more comprehensive education, such as how to implement different analysis tools, will have to look elsewhere.

Several series of news articles are also offered by Golden Brokers, including a blog, technical analyses, market and general news and a weekly review. Clients can also keep up to date with key financial events using the economic calendar provided.

When we read through these articles, we were impressed by both their depth and breadth of content. Each article is detailed and the full series covers a wide range of topics, which we think will help users to get the most out of the broker’s services.

Overall, we were impressed by the firm’s research tools, market analysis reports and extra services, providing users with a consistent stream of important information and insight.

However, I think that the educational support leaves a lot to be desired, providing nothing more than a simple platform demonstration. This is something that could limit the early success chances of beginners.

Company History

Golden Brokers Limited (Ltd) is a CFD broker that was founded in 2018, with a head office in Labuan.

The broker has been regulated by the LFSA since 2019 and has won several awards in its short existence. These include the Fast Growing Forex Broker award from the Forex Traders Summit in Dubai 2022, as well as third place in Trader Magazine’s Best Online Broker poll.

Customer Service

Golden Brokers offers 24/5 customer support, which is available through a variety of contact avenues.

The broker has several offices around the world, located in Labuan, Dubai and Kuala Lumpur. Unfortunately, there are no offices in the UK, making direct contact difficult.

However, the broker can be contacted in other ways:

- Email Address – support@goldenbrokers.my

- New Account Phone Number – +60 154-600 0373

- General Support Phone Number – +60 154-600 0374

Traders can also contact the brokerage through an online form available on the firm’s contact page. Our experts tested this service and found response times to be relatively unreliable. We sent three different queries, with one response arriving within an hour, one arriving within one day and one not receiving a response for over three days.

In our opinion, this is unacceptable as there may be occasions where you need rapid access to support whilst your money is at risk.

Security

Golden Brokers is regulated by the LFSA, though our experts stress that this is not a particularly reputable entity. Despite this, we realised while using the firm that Golden Brokers does employ some safety features to protect its clients. All associated sites (the main site, webtrader and client portal) are encrypted with updated certificates, protecting user data.

Furthermore, the MetaTrader 5 trading platform is heavily encrypted, protecting transaction details. The broker also ensures that client funds are separated from the firm’s operating funds, which means that all capital should be returned in the case of the firm defaulting.

While several safety features are in place, there are many other systems we would like to have seen that are offered by key competitors, such as eToro and Plus500. These include two-factor authentication (2FA), negative balance protection and access to an investor compensation scheme.

Trading Hours

Available hours for the firm’s assets vary with the asset type and underlying market. For example, forex and some commodity markets are open 24/5, making them easily accessible to all traders.

Other assets, such as shares and indices, are only available when their underlying markets are open. For example, UK assets are available from 07:00 to 15:30 GMT, Monday through Friday.

Full details for all assets are available on the broker’s instruments page.

Should You Trade With Golden Brokers?

We liked Golden Brokers’ wide range of assets, simple account selection, powerful trading platform, and good research tools. However, there are several key points that we find worrying, such as reports of blocked withdrawals, weak regulation and unresponsive customer service. Moreover, UK clients are held back by a lack of GBP support and a poor selection of popular payment options.

We would recommend that UK traders look for an FCA-regulated broker with greater support for British clients, such as CMC Markets.

FAQ

Is Golden Brokers A Good Broker For UK Traders?

Golden Brokers offers a wide range of assets and a powerful platform. However, many negatives make this broker difficult to recommend to UK investors. The lack of support for GBP (base currency and deposits), its weaker regulation and the poor contact methods lead me to suggest that there are better, FCA-regulated brokers that offer a more comprehensive, reliable and safe experience.

Can You Invest In UK Shares With Golden Brokers?

Golden Brokers offers more than 200 UK equity products, including many popular companies. Clients can invest in William Hill, Vodafone, Money Supermarket, Lloyds and JD Sports, to name a few.

How Much Leverage Does Golden Brokers Provide?

Golden Brokers clients have access to leverage rates of up to 1:100 when investing in its account. This comes with a 100% margin call and a 50% stop-out level.

Is Golden Brokers Legit?

We have found Golden Brokers to be a mixed bag in terms of reliability and client security. While the broker is regulated, it is a relatively lax regulator, meaning that the broker may get away with some foul play without repercussions. We have even found several reports of the broker harassing users or providing ill advice, leading to financial losses.

As with all poorly regulated brokers, we urge investors to be wary and vigilant if they decide to open an account, though we would recommend otherwise.

Article Sources

Top 3 Golden Brokers Alternatives

These brokers are the most similar to Golden Brokers:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Golden Brokers Feature Comparison

| Golden Brokers | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | LFSC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:100 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Golden Brokers Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| Golden Brokers | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Golden Brokers vs Other Brokers

Compare Golden Brokers with any other broker by selecting the other broker below.

Popular Golden Brokers comparisons: