Global Prime Review 2025

|

|

Global Prime is #69 in our rankings of CFD brokers. |

| Top 3 alternatives to Global Prime |

| Global Prime Facts & Figures |

|---|

Global Prime is a multi-regulated trading broker offering 150+ markets. Traders can get started with a $200 minimum deposit and trade with leverage up to 1:100. The firm also has a high trust score and a good reputation with a license from the ASIC. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, indices, commodities, cryptocurrencies, shares, bonds |

| Demo Account | Yes |

| Min. Deposit | A$200 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, VFSC, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Global Prime offers CFD trading opportunities on 150+ global markets including forex, indices, commodities, cryptocurrencies and bonds. Spreads are tight with a raw ECN account available starting from zero. |

| Leverage | 1:200 |

| FTSE Spread | 0.84 |

| GBPUSD Spread | 0.64 |

| Oil Spread | 1.6 |

| Stocks Spread | Variable |

| Forex | Global Prime traders can access 48 forex pairs including majors, minors and exotics with tight spreads from 0.9 with no commission or from 0 with a $7 round turn. Forex is traded via the leading MT4 platform, micro lots are available and latency is low via a New York-based server. |

| GBPUSD Spread | 0.75 |

| EURUSD Spread | 0.16 |

| GBPEUR Spread | 0.85 |

| Assets | 48 |

| Stocks | Global Prime traders cannot speculate on individual stock prices, but they can trade 12 global stock index CFDs with tight spreads, including the Dow Jones, UK 100, NASDAQ and S&P 500. |

| Cryptocurrency | Global Prime crypto CFDs cover a good range of 35 tokens with impressive commissions of 0.1% and leverage available in some jurisdictions. The tokens include Bitcoin, Ethereum and other popular choices as well as smaller tokens like Sandbox and Avalanche. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Global Prime is an international forex and CFD brokerage that provides low-commission ECN market access to its clients. Alongside a focus on transparency, the company promises market-leading execution speeds, competitive leverage rates and the freedom to implement any desired trading strategies. This 2025 Global Prime broker review covers key platform features, including fees, commission, supported markets, minimum deposit and withdrawal amounts and regulation.

About Global Prime

Founded in 2010 as an exclusively MT4-based forex provider, Global Prime has since expanded its services to cover several CFD markets, including indices, crypto and even government bonds. Today, over 10,000 traders trust the broker with their financial speculation and the company ranks highly in several broker rankings on client review websites.

While the broker is proudly 100% Australian owned and operated, the group’s activities are split across a network of three entities. These are Global Prime Pty Ltd in Australia, Global Prime FX Ltd in Seychelles and Gleneagle Securities PTY Limited in Vanuatu. Through this network, the firm can provide trading services across almost 200 countries, including the UK, Australia, Malaysia and most of Canada.

Trading Markets

Global Prime supports CFD speculation across six asset types: forex, crypto, indices, stocks, bonds and commodities.

Forex CFDs

Global Prime offers a substantial forex market, including all five major pairs, 22 minor pairs and 22 exotic pairs. Values are tracked at up to five decimal places, while the minimum trade amount is 0.01 lots.

Crypto CFDs

Clients can also trade CFDs on five crypto tokens: Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash. These appear in USD pair format and price movements are tracked between two and five decimal places.

Indices CFDs

Indices trading is a popular way to speculate on the overall financial health of a nation’s economy or specific industry. Global Prime provides 16 cash and two futures indices, including the S&P 500 (US), FTSE 100 (UK), Nikkei 225 (Japan) and VIX 75 (volatility). The broker uses native currencies for global indices, such as the JPY, HKD and NOK.

Commodities CFDs

An impressive 23 commodities markets are also available through Global Prime, with a range of currencies facilitated. Both spot and futures CFDs are offered on precious metals, energies and soft commodities assets, including gold, silver, Brent crude oil, coffee and wheat.

Stocks & Shares CFDs

All equities listed on the ASX, NYSE and Nasdaq can be speculated upon, providing you with thousands of stocks. While clients can trade the two US exchanges in minimum order sizes of 0.01 lots, the ASX has a minimum one lot trading level. Trading hours on each exchange correspond to local market opening times.

Bonds CFDs

Seven government bonds CFDs are offered, including the UK Gilt, Euro Bund and two US Treasury notes. These derivatives trade on local market hours for each domestic government and values are tracked to three decimal places.

Trading Platforms

Global Prime provides three primary electronic communications network (ECN) solutions, API integration and two social trading platforms to ensure that there is something for everyone. Additionally, the firm offers virtual private server (VPS) facilities for clients whose trading relies on a dependable, round the clock connection.

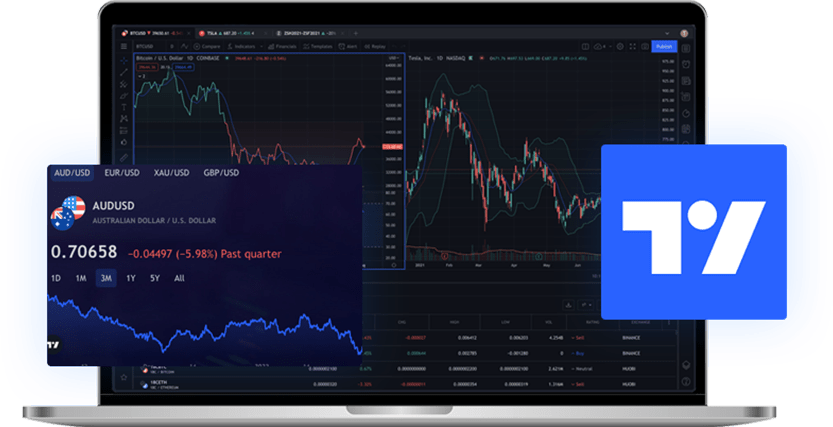

TradingView

Most know TradingView as a charting and monitoring solution, complete with a significant arsenal of indicators, drawing tools, customisable alerts and live order books. However, Global Prime has integrated the TradingView and TraderEvolution platforms to open and close positions directly from the TradingView platform.

TradingView Platform

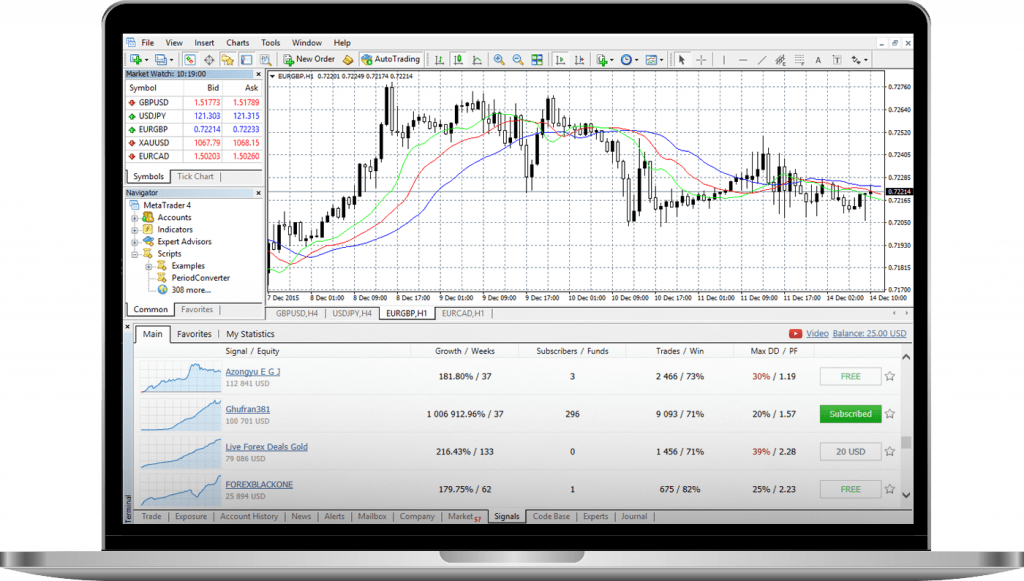

MetaTrader 4

Since the broker’s inception in 2010, it has supported the MetaTrader 4 (MT4) software package. MT4 has been a firm industry favourite for forex and CFD trading for over 15 years.

In addition to its wealth of technical analysis tools and indicators, MetaTrader 4 features extensive automated trading support through expert advisors (EAs) and a marketplace full of user-developed add-ons. Available for download on Mac, Windows and Linux desktop systems and Android and iOS devices, MT4 boasts exceptional accessibility.

MetaTrader 4

The firm currently has no plans to add MetaTrader 5 (MT5) to its supported platforms.

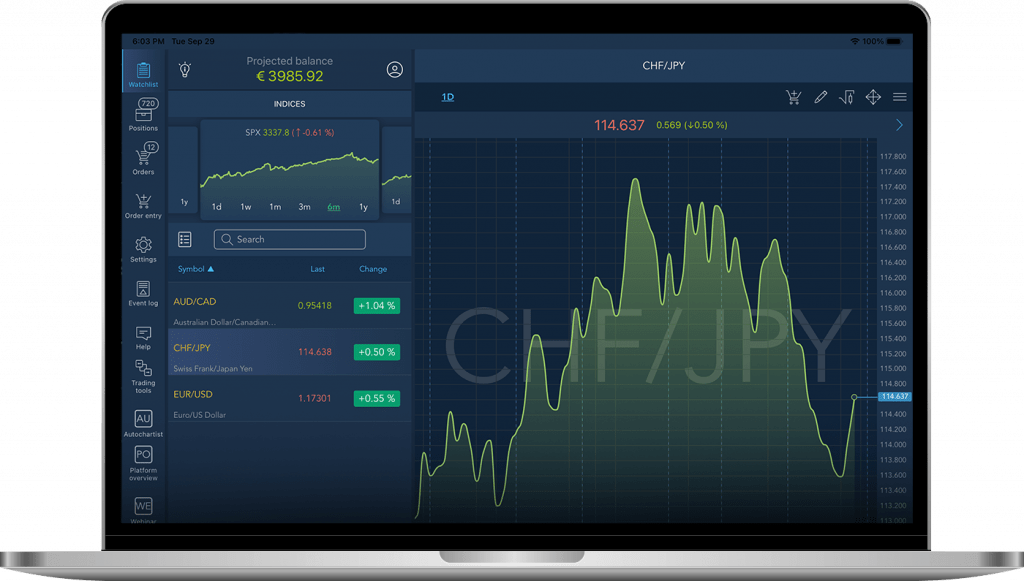

TraderEvolution

The final trading platform offered by Global Prime is TraderEvolution. This was designed with professional and institutional trading in mind and features advanced charting tools, significant customisation and algorithmic trading support. TraderEvolution can be downloaded on Windows, iOS and Android mobile devices.

TraderEvolution

FIX API

Global Prime employs a Financial Information exchange (FIX) API system for clients that wish to directly implement algorithmic trading strategies. This service benefits from lower latency than algorithmic operations through a trading platform. However, the FIX API carries a minimum account deposit requirement of $25,000 or equivalent, in addition to a minimum of $2,000 in commissions per month.

Copy Trading

Two copy trading platforms are supported by Global Prime: ZuluTrade and MyFXBook. In exchange for an extra commission, clients can follow and mirror the positions of successful traders. Both platforms feature complex systems that help you select the most profitable and consistent traders.

Global Prime Account Types

Global Prime offers two live account types, facilitating both those that desire the lowest spreads through a traditional ECN model and those that prefer zero-commission trading.

ECN Account

The Global Prime ECN trading account provides highly competitive spreads, from 0.0 pips, and execution speeds as low as 1 ms. Commission stands at AUD 7 per round turn lot and all markets are supported.

The ECN account operates with an AUD 200 minimum initial capital deposit, though there are restrictions on subsequent deposits. This account is available as an individual, joint, trust or corporate variant, catering for casual and professional traders.

Zero Commission Account

Global Prime has recently created an account for traders that favour a zero-commission, higher-spread fee structure. This account is equipped with the same markets, features and trading speeds provided in the ECN account. However, spreads start from 0.4 pips.

Demo Account

For traders that wish to try out the Global Prime platform before committing to a full, paid account, the firm offers a free demo account for paper trading. This account is also helpful for trying new trading strategies or gaining risk-free experience in a new market. MT4 and TraderEvolution are both supported on the demo account.

Payment Methods

Due to the international scope of Global Prime’s operations, the broker supports a significant range of funding options. Six major currencies can be used to deposit into a trading account: GBP, AUD, USD, EUR, SGD & CAD.

Deposits

Deposits can be made via more than 15 methods, including PayPal, Mastercard, Visa, Skrill, Neteller and wire transfers. After an initial deposit of AUD 200, the subsequent minimums start at $1.

Most payment methods are processed instantly, though you may have to wait up to three days for international wire transfers. There are no funding fees and Global Prime covers Skrill and Neteller charges.

Withdrawals

Withdrawal options are slightly more limited, as clients can only choose between Mastercard, Visa, wire transfer and Neteller. Mastercard and Visa withdrawals take between one and ten business days to process, while Neteller transactions often process instantly. There is no withdrawal fee levied by Global Prime, though intermediary bank charges may apply for some wire transfers.

Fees & Spreads

Global Prime markets its brokerage as offering “radical transparency” to its clients. This concept extends to its fee structure and typical spreads. As a non-dealing desk (NDD) ECN broker, Global Prime makes money from traders via commissions, marked up spreads and overnight swaps. The company does not take the other side to any client trades, meaning that it does not make money from your losses.

Commissions are levied at AUD 7 per round turn lot on the ECN account, while spreads start at 0.0 for major assets. Indicative spreads are as low as 0.16 pips on EUR/USD and 0.12 on XAU/USD. These spreads are variable and will often be higher for traders with a zero commission account.

Global Prime swap rates are derived from the interbank forex network and are highly competitive. These rates are updated twice a week to ensure traders receive the most accurate interest pricing on financing fees.

Margin & Leverage

The leverage rates that clients can access depend on their location. This is because ASIC regulations limit available margin rates for Australian traders. Non-Australian traders can utilise leverage rates of up to 1:100 on forex pairs, commodities, indices and bond CFDs, 1:20 on shares and 1:1 on crypto. These rates are lower than many other international brokers, though more than high enough for many traders.

Global Prime also offers a margin calculator for forex markets so that clients can preview position requirements and fees.

Advantages Of Global Prime

- Regulated

- Copy trading

- Demo account

- Crypto trading

- ECN execution

- Range of platforms

- Competitive spreads

- VPS & FIX API access

- Transparent fee structure

- Trading mentor programme

- Free deposits and withdrawals

- Lots of markets and asset types

Cons Of Global Prime

- High initial deposit

- Limited leverage rates

- No negative balance protection

Safety & Regulation

The three branches of Global Prime all hold regulatory licenses within their respective jurisdictions of Australia, Vanuatu and Seychelles.

Australian clients can rest assured knowing that the stringent regulations of ASIC are followed and that client money is protected from brokerage collapse. However, the regulation offered to international traders by VFSC and the Seychelles FCA is not as rigorous, with client funds allowed to be used for hedging and no fund protection schemes in place.

Traders may be further disappointed to discover that Global Prime does not offer negative balance protection. As a result, if your account dips below zero, you will be required to deposit additional funds to cover your losses.

Customer Support

Whether you are having issues with the Global Prime client portal login, have a question about trading assets or want to learn more about a trading platform, the customer support team is available 24/5 via live chat, email or phone.

- Email: support@globalprime.com

- Phone: +61(2) 8379 3622

Moreover, the website has a sizeable FAQ section in which common queries regarding account details, deposit and withdrawal options and company policies are answered.

Education

Global Prime operates a trading mentor program in which, in exchange for a monthly fee, a market professional will guide new and intermediate traders through market analysis, fundamental concepts and platform features. The broker runs an exclusive trading discord in which these academy sessions occur, and clients can connect to a community of fellow traders.

Global Prime also runs a YouTube channel on which videos regarding market updates, platform how-tos and company news updates are posted regularly.

Trading Hours

The Global Prime platform operates 24/5, allowing round the clock forex market trading during the week. Indices and shares are restricted to the trading hours of their specific exchanges, though the brokerage supports out-of-hours trading.

Global Prime Verdict

Global Prime is an international broker that provides low-commission, ECN CFD trading on a wide range of financial markets, including forex, crypto, equities and commodities. The brokerage boasts transparent pricing and comprehensive services, encompassing algorithmic trading via FIX APIs and VPSs, three advanced trading platforms and two copy trading tools. However, the broker lacks slightly in regulation, with no negative balance protection or rigorous international oversight.

FAQ

Does Global Prime Offer A Deposit Bonus?

No, there is no deposit bonus available from this broker.

Who Are The Global Prime Liquidity Providers?

Global Prime uses over 26 liquidity providers to provide its clients with the best possible rates.

How Much Commission Does Global Prime Charge?

Global Prime charges a commission of AUD 7 per round turn lot on its traditional ECN account. However, traders can open a zero-commission account in exchange for spread markups.

Does Global Prime Allow Traders To Invest For The Long Term?

As a forex and CFD broker, Global Prime does not deal in the underlying assets and is therefore not suitable for long term investors.

Does Global Prime Offer Negative Balance Protection?

Unfortunately, negative balance protection is not offered by the broker.

Top 3 Global Prime Alternatives

These brokers are the most similar to Global Prime:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Global Prime Feature Comparison

| Global Prime | Pepperstone | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 3.8 | 4.8 | 4 | 4 |

| Markets | Forex, indices, commodities, cryptocurrencies, shares, bonds | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | A$200 | $0 | $40 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, VFSC, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Global Prime Review |

Pepperstone Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| Global Prime | Pepperstone | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | Yes | No | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Global Prime vs Other Brokers

Compare Global Prime with any other broker by selecting the other broker below.

Popular Global Prime comparisons: