GemForex Review 2025

|

|

GemForex is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to GemForex |

| GemForex Facts & Figures |

|---|

GemForex is a Japanese CFD and forex broker offering a curated selection of trading products. |

| Awards |

|

|---|---|

| Instruments | Forex, Commodities |

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | Yes (iOS & Android) |

| Payments | |

| Min. Trade | $0 |

| Regulated By | FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Yes - the first ever free EA service in Japan |

| Signals Service | Yes - MT4 |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade leveraged CFDs on indices and commodities. |

| Leverage | 1:1000 |

| FTSE Spread | Variable |

| GBPUSD Spread | Variable |

| Oil Spread | Variable |

| Stocks Spread | N/A |

| Forex | GemForex offers 33 currency pairs, including majors, minors and exotics. |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | 33 |

| Stocks | Trade on major stock exchanges including the FTSE, DAX and NASDAQ. |

GemForex is a CFD broker that accepts UK investors looking to trade currencies, commodities and indices. Clients can access markets using two leading platforms and will choose between a commission-free account or a raw spread account with commissions. This review will assess GemForex’s trading platforms, account types, additional supporting tools, bonus schemes and more.

Our Take

- Experienced forex traders will enjoy the tight spreads and high leverage available on GemForex’s Raw and Elite accounts

- The broker supports the powerful MT4 and MT5 platforms, making it a good option for both beginners and experienced traders using expert advisors

- The range of markets is weak compared to alternatives, with no stocks or cryptocurrencies on offer

- The broker’s offshore regulatory status is a key drawback for UK traders

Market Access

We feel GemForex’s asset list is a weak point. With fewer than 100 tradeable assets and no stocks, it offers far less than most rivals, including eToro and Eightcap. There is a sufficient selection of forex, but many competitors offer 60+ or 70+. We were also disappointed to find even fewer choices on offer from the alternative asset classes.

- Energies: Brent Crude Oil and WTI Crude Oil

- Metals: Gold, silver and platinum against the USD

- Forex: Over 50 major, minor and exotic currency pairs

- Indices: More than 10 global indices including the FTSE100, S&P500 and the NASDAQ100.

Fees

Spreads & Commissions

The trading fees you are charged by GemForex vary by account type, and generally, we found them to be relatively competitive.

The All-In-One and the Elite account types are charged through the spread – the difference between the lowest bid order and the highest ask order. There are no commissions for either account, and tighter spreads are available for Elite members who meet the $3,000 minimum deposit to qualify for this account type.

For the All-In-One account, spreads start from 1.3 pips, which is wider than many competitors such as XM (1 pip on major forex) and XTB (0.9 pips for the Standard account). The Elite account, however, is much more competitive with minimum spreads at 0.6 pips.

The Raw spread account adopts a different pricing model whereby you can trade on the raw spreads which can be as low as zero pips, but you must pay a commission. This is charged at a rate of $3 per trade, which will suit clients looking to trade larger volumes and capitalise on smaller price changes.

Other Fees

Additional trading fees include swaps, which are interest charges also known as rollover fees for positions held overnight. The amount you are charged will vary between assets and whether your position is long or short. For example, the USD/JPY has swaps at 6.38 for long and -15.2 for short. The AUD/NZD pair, on the other hand, sets swap fees at -7.55 for long positions and -1.97 for short positions.

I liked that GemForex does not generally charge for payments, but I did find it disappointing that clients who attempt to withdraw funds without having first satisfied the minimum trade requirements will be penalised. The requirement is two lots and four trades, and if you do not reach this limit, you will be charged a fee equal to 3.5% of the withdrawal amount. This is a major drawback compared to alternatives.

Finally, you should be aware that GemForex charges an inactivity penalty of €10. This is charged after just 90 days with no trades made or deposits, which is short compared to competitors. XTB, for example, has an inactivity period of 12 months before the first charge kicks in.

Accounts

Our experts were pleased with the account type offering at GemForex, which offers both a low spread, commission-based pricing model and a no-commission model with wider spreads. This supports varied trading styles, from beginners and long-term investors to scalpers and other high-frequency traders.

However, we were disappointed to find that only the All-In-One account is easily accessible to all, with the $3,000 minimum deposits for the Raw and Elite accounts pricing out most new traders.

Additionally, I was disappointed that there is no support for GBP as a base currency, meaning UK clients may need to pay a conversion charge.

Across all accounts, there is maximum leverage of 1:500, with a margin call at 50% margin level and then a stop out at 20%. We have pulled out the main differences between the three accounts below:

All-In-One

- $50 minimum deposit

- Minimum spreads of 1.3 pips

- No commission

Raw

- $3,000 minimum deposit

- Raw ECN spreads as low as zero pips

- $3 commission

Elite

- $3,000 minimum deposit

- Minimum spreads of 0.6 pips

- No commission

How To Open A GemForex Account

I found the process to register aligned with other brands and only took me a few minutes to complete:

- On the GemForex website, click on the ‘Open Live’ button

- Select the account type and provide registration details such as your email and country of residence

- After opening an account, you will need to verify your email using the link sent to your address

- Complete a questionnaire asking about your trading experience and funding

- Submit documentation showing proof of address and identity

- Once all submitted information has been accepted and reviewed by the GemForex team, you can begin trading

Funding Methods

Deposits

I felt that the funding methods for this broker were adequate, with clients having a few options to choose from. However, I would have preferred it if GemForex offered additional e-wallet services such as SticPay or PayPal.

There is no minimum deposit for credit cards, bank transfers and AstroPay, though the Instant Bank Transfer method requires deposits of at least $200, which is disappointing.

The following are the available methods and the expected processing time for UK clients:

- Mastercard or Visa credit card: Instant

- Wire transfer: 3–5 working days

- Instant bank transfer: Instant

- AstroPay: Instant

How To Deposit Funds To GemForex

I was happy with the speed and ease at which I could make a deposit. To do so:

- Log in to your account using the client portal on the website

- Under the ‘Wallet’ tab, click ‘Deposit’

- Choose your desired deposit method

- Input the deposit amount at or above the minimum requirement

- Enter the relevant payment information for your chosen payment method

- Confirm the deposit request and wait for the funds to appear in your balance

Withdrawals

GemForex supports the same methods for withdrawals as for deposits. For credit cards, AstroPay and instant bank transfers, withdrawals are processed immediately. If you use the wire transfer instead, you can expect to wait three to five working days, which is the industry standard.

We were also pleased to find that GemForex does not impose any minimum withdrawal limits.

Regulation

GemForex holds an offshore securities dealer license with the Seychelles Financial Services Authority with license number SD116. Unfortunately, the FSA will only offer weak, if any, client protection.

UK clients cannot expect the same protective measures that come with FCA-regulated brokers – for example, negative balance protection, separation of client and business funds and protection from the Financial Services Compensation Scheme.

For added security, GemForex allows clients to set up two-factor authentication. With 2FA enabled, you are asked to input a six-digit code using the Google Authenticator app to verify the sign-in request.

Trading Platforms

I liked that GemForex clients can use both the MetaTrader 4 and MetaTrader 5 platforms. This choice means customers can make use of high-quality software to develop a strategy, prepare trades and open and close positions. Unfortunately, GemForex does not offer direct support with other third-party tools such as TradingView.

You can download the MetaTrader platform apps on both Mac and Windows computers. Alternatively, you can access the platforms via the Web Trader on your browser.

MetaTrader 4

When we used GermForex, we found that these were the most noteworthy features of MetaTrader 4:

- 30 technical indicators included with thousands more accessible via the marketplace

- Expert advisors along with the MQL4 language to create your own

- Market execution and four pending order types

- In-house trading signals service

- Windows and Mac OS support

- 9 in-built time frames

- 23 analytical objects

MetaTrader 4

MetaTrader 5

In addition to many MT4 features such as the signals services, the MetaTrader 5 platform offers the following, making it the better option for experienced traders:

- MQL5 language used for designing indicators and algo traders

- More than 80 indicators and objects used for chart analysis

- 11 additional timeframes and support for creating your own

- Customisable workspace with unlimited charts

- Market execution and six pending order types

- Fundamental analysis

- Economic calendar

- EA VPS included

- Risk monitors

MetaTrader 5

How To Place A Trade

Placing a trade in the MetaTrader platforms is a seamless process and can be done directly from the chart interface:

- Click the ‘New Order’ button

- Select the asset from the ‘Symbol’ drop-down list

- Specify the trade volume

- Input the stop loss and take profit strike prices (if desired)

- Click ‘Sell’ or ‘Buy’ to confirm the order request

- The order will appear in the ‘Trade’ tab under the chart

- To close the trade, click the ‘X’ under the ‘Profit’ column

Mobile App

I would have liked to see a GemForex mobile app where clients can manage their accounts and process deposits and withdrawals, so it is a shame to find no dedicated app released by the broker.

With that said, both the MetaTrader 4 and MetaTrader 5 platforms have mobile apps for iPhones and Android devices, and these are excellent options for trading. You can find downlinks via the broker’s website or directly from the Apple Store or Google Play Store.

GemForex Leverage

GemForex offers high leverage up to 1:500 across all forex pairs as well as gold and silver. All indices are capped at 1:100 except JPXJPY, which has a maximum of 1:200. Platinum can be traded with leverage as high as 1:200 and the WTI and Brent crude oils have a limit of 1:100.

With leverage as high as 1:500, you can open a trade with an exposure equal to £1000 with just £2. With that said, such exposure also increases your potential risk.

Across all account types, margin calls trigger when your margin level drops to 50%. At this point, you cannot open any new positions until your margin raises above this level. If the margin continues to drop to 20%, GemForex will begin closing positions on your behalf.

Demo Account

I was very pleased to find that GemForex offers a free demo account to its clients, providing a risk-free way to practise trading on both MT4 and MT5 platforms using simulated funds.

It was also great to find that GemForex offers the choice of demo versions of each live account type so you can test the different trading conditions to see which is right for you.

How To Open A GemForex Demo Account

To open a demo, you first need to follow the live account registration steps and sign in to your client dashboard. Then:

- On the account dashboard, click the ‘Open Demo Account’ button under the ‘Accounts tab’

- Select the demo account type

- Specify the desired leverage limits, base currency and initial balance

- After confirming the request, GemForex will provide you with demo account login details

- Download the trading terminal and sign in to begin practising

Bonus Deals

At the time of testing, GemForex offers a 100% first-time deposit bonus that doubles the value of any initial deposit over $100 and up to $1,000.

You should be aware that this promo comes with the requirement of trading the bonus within the first 90 days. If you do not meet this requirement, the broker will cancel the promo and reclaim the rewarded funds. The amount that you need to trade depends on the bonus size, with a minimum limit of 20 lots for bonuses of $200 or less. This trading limit increases up to 200 lots for bonuses between $901 and $1,000.

We urge traders to read the bonus terms and conditions carefully before committing.

Extra Tools & Features

While GemForex does offer some services to support clients’ trading, we would have liked to see some additional tools. There is no education section offering useful tips and tricks for beginners or analysis tools such as a margin calculator or profit and loss calculator. This is disappointing since they are often offered as standard at most alternatives.

With that said, we did find an economic calendar and a social trading platform.

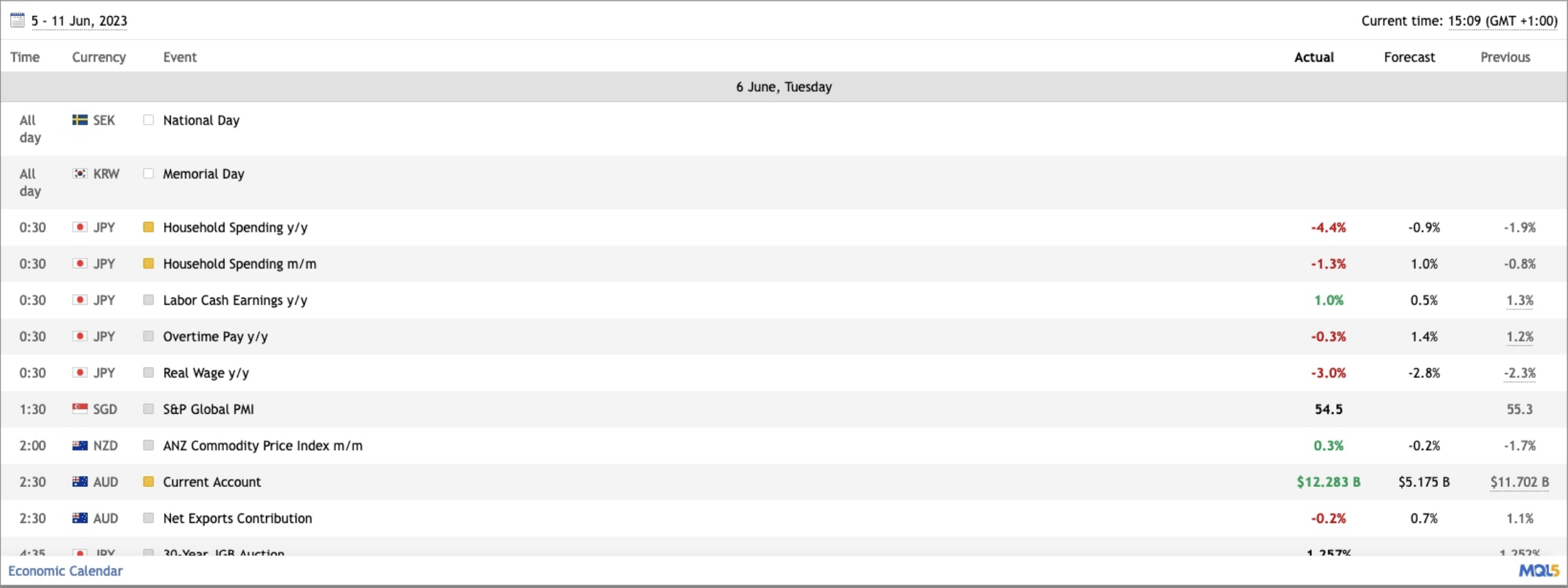

Economic Calendar

While using GemForex, we found this to be a useful tool that shows important upcoming global events. For each event, the calendar shows the forecasted result, the previous result and the actual result once the report is released.

This service can be accessed for free by all registered clients.

Economic Calendar

Social Trading

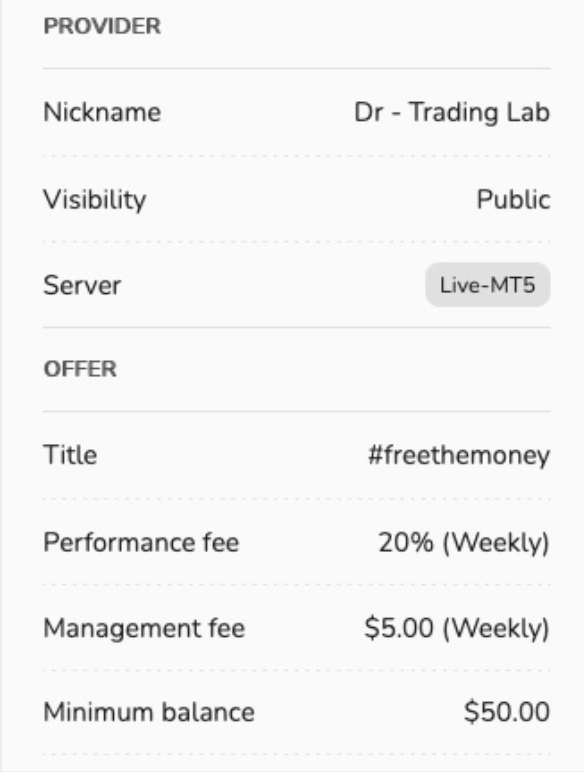

GemForex also facilitates a social trading platform that our experts found to be fairly straightforward upon testing. We liked that you can conveniently access the portal directly via the main login dashboard. From here you can register as a follower and select which user you would like to copy.

The interface displays the platform providers’ use, their costs and other vital information (as seen in the example image below). Once you have selected an expert, you will be alerted to the trades they make and can replicate their orders.

Copy Trading

Customer Service

Our team found the GemForex customer support adequate but not standout. We were disappointed that, despite claiming to be open 24/5, there were no instant methods to contact the support desk such as a live chat or a phone hotline. However, our team found that GemForex is fairly quick to respond over email, taking less than an hour to answer our queries.

GemForex’s customer service desk is available via a contact form on the broker’s website.

You can also follow the GemForex social media accounts on Facebook, Twitter, LinkedIn and YouTube, or find advice on the GemForex website’s FAQs section.

Company Details & History

GemForex Limited is an award-winning broker based in Seychelles and regulated by the country’s Financial Services Authority. The broker was launched in 2010 to make it easier for retail traders to access markets with commitments to transparency and fairness.

The brand has progressed well since then to amass 400,000+ clients by 2023. In 2021, the broker claimed they had partnered with David Beckham to be their brand ambassador, though the credibility of this claim cannot be confirmed.

Trading Hours

The GemForex trading hours across all markets are as follows:

- Forex: Open 10:10 pm on Sunday until the following Friday at 9:50 pm GMT with a 15-minute break each day between 9:55 pm and 10:10 pm

- Metals: Open Sunday from 11:10 pm until 9:45 pm GMT on Friday with a daily break between 9:50 pm and 11:10 pm

- Energies: Open from Sunday at 11:05 pm GMT until 9:10 pm on Friday with a break between 9:55 pm and 11:05 pm each day

- Indices: The majority of indices are open at similar times with trading commencing at 11:05 pm GMT on Sunday until the following Friday at 9:50 pm. There is also a daily break between 9:55 pm and 11:05 pm.

Should You Trade With GemForex?

GemForex is an average broker with a fairly competitive pricing model in its three account types. Clients can trade forex, indices, gold, silver, platinum and two energies through the world-leading MetaTrader platforms.

However, this broker does not have the widest selection of markets and we were particularly disappointed by the lack of stocks. The absence of any educational materials and FCA oversight is also a major concern. As such, as we recommend considering better alternatives.

FAQ

Is GemForex Trustworthy?

GemForex is an offshore broker with weak regulation from the Seychelles Financial Services Authority. This agency provides little, if any, client protection should they get into financial trouble. We therefore cannot score the broker highly in this area.

With that said, the broker does claim to segregate clients’ funds as well as provide negative balance protection.

Does GemForex Accept Amex For Deposits?

No, GemForex does not accept Amex credit cards for deposits. If you want to make a deposit, you must use a Visa/Mastercard credit card, bank wire transfers, instant bank transfers or the e-wallet AstroPay.

When you submit a deposit, you can expect the funds to be transferred immediately, unless you are using a bank wire transfer, which can take between three and five working days.

Does GemForex Offer Competitive Fees?

Our experts found the trading fees at GemForex average. Traders can expect spreads from 1.3 pips in the standard account (All-In-One) with no commissions, which is wider than some competitors. For those who can afford the $3,000 minimum deposit for the Elite account, spreads are more competitive at 0.6 pips on average with no commissions.

Does GemForex Offer A No Deposit Bonus?

GemForex does not offer a no-deposit bonus at the time of writing. However, in January 2023 there was a $50 welcome bonus scheme where clients could receive a $50 prize after registering an account without needing to first fund their account.

We recommend checking the website for any new bonuses.

Is GemForex Good For Beginners?

GemForex offers a decent demo account for free, which is ideal for new traders looking to practise using the MetaTrader terminals. However, the lack of an education section and a reputable license does not match up to competitors such as IG Index or XM, which offer top-tier regulation and excellent learning resources.

Article Sources

GemForex Seychelles FSA License

Top 3 GemForex Alternatives

These brokers are the most similar to GemForex:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

GemForex Feature Comparison

| GemForex | Swissquote | INFINOX | FP Markets | |

|---|---|---|---|---|

| Rating | 2.3 | 4 | 3.4 | 4 |

| Markets | Forex, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Forex, CFDs, Indices, Shares, Commodities, Futures | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $1 | $1,000 | £1 | $40 |

| Minimum Trade | $0 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SCB, FSCA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 | 1:30 (UK), 1:200 (Global) | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | GemForex Review |

Swissquote Review |

INFINOX Review |

FP Markets Review |

Trading Instruments Comparison

| GemForex | Swissquote | INFINOX | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | Yes | Yes |

GemForex vs Other Brokers

Compare GemForex with any other broker by selecting the other broker below.

Popular GemForex comparisons: