GCI Review 2025

|

|

GCI is #92 in our rankings of CFD brokers. |

| Top 3 alternatives to GCI |

| GCI Facts & Figures |

|---|

GCI offers online trading in 300+ tradable assets with up to 1:400 leverage. |

| Awards |

|

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities |

| Demo Account | Yes |

| Min. Deposit | $500 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade in multiple online financial markets. |

| Leverage | 1:400 |

| FTSE Spread | 3 |

| GBPUSD Spread | 2 |

| Oil Spread | 4 |

| Stocks Spread | Variable |

| Forex | Trade dozens of leading online forex pairs. |

| GBPUSD Spread | 2 |

| EURUSD Spread | 1 |

| GBPEUR Spread | 2 |

| Assets | 40+ |

| Stocks | Trade online shares in global companies, including Facebook and Sony |

GCI Financial is an offshore forex and CFD broker based in Saint Lucia and established in 2002. The broker offers over 300 tradable assets and two powerful trading platforms, although its regulatory status and trust score has been called into question by our experts. This review will cover GCI’s safety and security features, plus market access, fee structure, account types, how to open an account, and more.

Our Take

- GCI Financial offers free deposits and zero-commission trading in its MetaTrader and ActTrader accounts

- The limited funding options and $500 minimum deposit make the broker less accessible for new traders

- The broker’s educational resources and trading tools are sub-par compared to alternatives

- The lack of FCA regulation and fund protection measures makes it hard to recommend this broker

Market Access

GCI offers five different asset classes with a total of over 300 tradable CFD instruments. This isn’t the widest selection compared to leading brands like XTB and CMC Markets, but would still offer good opportunities to diversify a beginner’s portfolio. We also like that the broker offers futures contracts.

- Forex: 40+ forex pairs can be traded, including GBP/USD, AUD/JPY and EUR/CAD

- Futures: 7 currency futures available, including GBP, EUR, JPY, CHF, AUD, CAD, and NZD

- Shares: 180+ US, EU and Asia-Pacific stocks are on offer, including Nissan, Vodafone and Amazon

- Indices: Trade 17+ popular stock market indices, including the S&P 500, Nasdaq 100 and FTSE 100

- Commodities: 11 energies and metals can be traded, including crude oil, spot gold, spot platinum and natural gas

Fees

We were pleased to see that GCI offers zero-commission trading, though this does mean that spreads are wider.

When we tested the platform, we were offered 2 pips for the GBP/USD pair, and 1 pip for EUR/USD. This is in line with popular brokers such as AvaTrade and Axi.

I was also happy to find that GCI does not charge deposit or withdrawal fees, though external bank or third-party fees may still apply.

As expected, swap rates do apply for the standard account types, with overnight rollover fees varying depending on the asset’s trading conditions. Islamic accounts, however, do not charge swap fees or earn interest.

GCI Financial Accounts

GCI offers two main investing accounts depending on the chosen trading platform: ActTrader or MetaTrader 4.

Both accounts require a $500 minimum opening deposit, which is high compared to most other brokers and may be inaccessible for beginners. For example, XM lets you start with just a $5 minimum deposit.

Nonetheless, I did like that you get a free Forex e-book upon registration and receive 4% interest paid on the account balance.

MetaTrader Account

- 100,000 currency units per lot (with fractional lots available)

- ECN or traditional execution

- All available assets

ActTrader Account

- 10,000 currency units per lot

- Identical or tighter spreads on most assets

- 12 fewer tradable forex pairs than the MetaTrader account

Overall, whilst the minimum deposit may be frustrating for some, we feel the accounts should appeal to both new traders and more experienced investors.

For example, ActTrader’s user-friendly interface and low transaction sizes would be an excellent choice for beginners, whilst the robust charting tools, larger lot sizes and wider product range could entice more accomplished investors.

Requests for swap-free Islamic accounts can also be made for each trading platform.

How To Open An Account

- Complete the 4-step registration form, including account type, personal details, trading information, disclosures and agreements, and funding information

- Email your identification (such as a national ID card or driving license) to the broker

- Once accepted, fund your account and begin trading

Funding Options

I was disappointed to find that GCI Financial only offers funding via bank wire transfer or Perfect Money. The lack of flexibility will be limiting for traders since most brokers like XTB offer bank transfers, credit cards, and a range of e-wallet payments including Skrill or PayPal.

To make matters worse, GCI will only offer its bank transfer option to qualified traders who are looking to deposit amounts greater than EUR 2,000. A request must be made by emailing funding@gcitrading.com. You can then expect the bank deposit to be processed in 1 – 3 business days.

For faster deposits, we recommend opting for Perfect Money, which will typically process your deposit within 1 business day.

We found that withdrawing funds is equally as tedious. To request a withdrawal, you must email a permission form to payments@gcitrading.com. Identification must also be provided.

Thankfully, GCI does not charge any funding fees but the associated bank or payment method may charge third-party fees.

UK Regulation

GCI Financial is an unregulated broker. This means that the firm has no oversight over its business handling, and thus is not forced to protect traders to the same degree that licensed brokers are. GCI is also not required to submit any revenue data or annual financial statements for auditing, which is concerning. With that said, the broker assures clients that funds are segregated in top-rated bank accounts.

For peace of mind, we recommend traders invest with brokers regulated by top financial institutions like the FCA. These agencies enforce strict fund protection measures including leverage limits, negative balance protection and compensation schemes.

Trading Platforms

I was impressed to find that GCI offers two popular trading platforms: ActTrader and MetaTrader 4 (MT4). Both these platforms are feature-rich and designed to ease strategy implementation.

ActTrader

ActTrader is a user-friendly, customisable trading platform that has user preference at its core. I found the layout of the platform highly flexible, featuring a floating window system that allowed me to set up my interface as per my preferences. The platform is well-structured and easy to navigate, making it ideal for newer traders.

I was pleased with ActTrader’s range of technical features:

- Automated trading plus backtesting functionality

- User-friendly, intuitive design

- ActFX scripting language

- 30+ technical indicators

- 11 timeframes

ActTrader

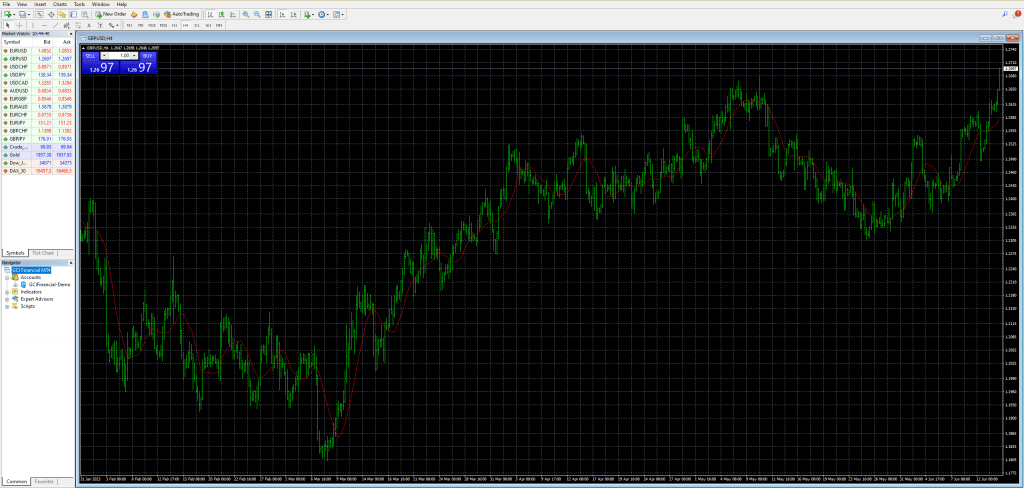

MetaTrader 4

For those seeking a more comprehensive trading experience, MT4 is one of the most popular online trading platforms for traders of all experience levels.

The platform provides a vast selection of tools for traders to use to develop detailed trading strategies, including scalping and swing trading.

It also offers its own programming language (MQL4) to allow traders to write their own scripts for bots. Expert Advisors (EAs) and additional indicators can be added through the scripting language.

I was impressed by the vast amounts of online resources to help traders navigate the platform, as well as free plug-ins and tools to add via the marketplace.

Features include:

- 30 technical indicators and 31 graphical objects

- Automated trading through Expert Advisors

- MQL4 programming language

- Compatible with plug-ins

- 4 pending order types

- 9 timeframes

MT4

Overall, we are happy with the trading platforms offered. The ActTrader platform provides newer traders with a powerful, easy-to-navigate interface, whilst MT4 is ideal for implementing complex trading strategies.

We would have liked to see a proprietary solution offered by GCI to give traders an even wider choice.

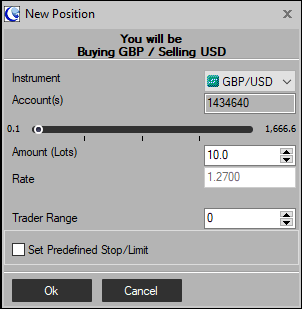

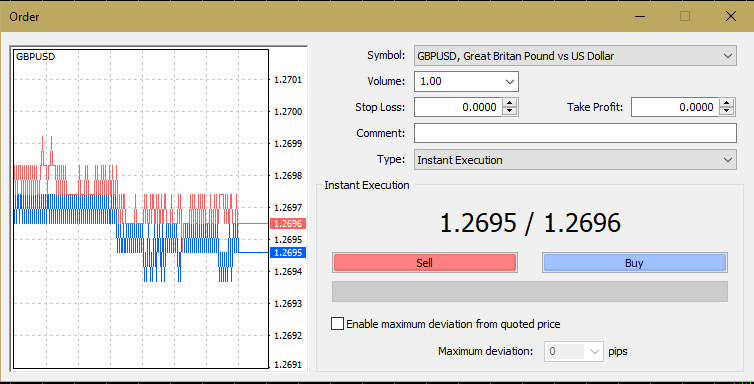

How To Place A Trade

- Login to your chosen platform

- Choose the asset you would like to trade

- Perform analysis to determine the best time to open an order

- Click the ‘New Order’ (MT4) or ‘Sell’/’Buy’ (ActTrader) buttons to open the order window

- Input the details of the trade including volume, stop loss and take profit

- Click the ‘Sell’/’Buy’ (MT4) or ‘OK’ buttons to place the order

ActTrader New Order

MT4 New Order

Mobile App

It is good to see that both ActTrader and MetaTrader 4 offer mobile apps available on Apple iOS and Android devices. The apps are free to download from each mobile device’s app store.

When testing both, I was able to access similar features as their desktop counterparts, allowing me to track markets, perform analysis and place trades on the go. I also like that they both can facilitate price alerts via push notifications.

Overall, I think they are both strong applications, though MT4 is still my favourite for its comprehensive analysis features. It also feels somewhat less clunky than the ActTrader app.

GCI Financial Leverage

GCI offers leveraged trading on its assets, allowing traders to increase their buying power if they cover the margin requirement. Forex instruments have leverage up to 1:400 while shares have 1:20. This is much higher than the 1:30 leverage allowed at FCA-regulated brands, so risk management is advised.

Individual assets may vary, with all margin requirements detailed on the GCI website.

Demo Account

We were happy to see that GCI Financial allows traders to open free $50,000 demo trading accounts for either trading platform, with up to 1:500 leverage.

We recommend traders make use of simulator accounts to experience the trading platforms and fees before investing real capital. It also gives traders a risk-free way to test their trading strategies before employing them in live conditions.

Once a demo is opened, traders can download their preferred platform and practice in their account for at least 30 days.

Bonus Deals

At the time of writing, we were offered a 50% bonus margin upon deposit at GCI Financial. This bonus is applicable for deposits over 10,000+ USD/EUR. We also found a 25% bonus margin for deposits smaller than this amount.

It is always worth thoroughly read the terms and conditions of any bonuses before committing, especially at unregulated brokers. We often find difficult to meet volume requirements that make withdrawals challenging.

Extra Tools & Features

GCI Financial offers a small range of educational tools and resources to help clients ease into trading.

Features include forex news articles, trading signals, an economic calendar, educational articles and user manuals for the trading platforms. Topics include strategies such as moving averages and support and resistance, risk control, and platform guides.

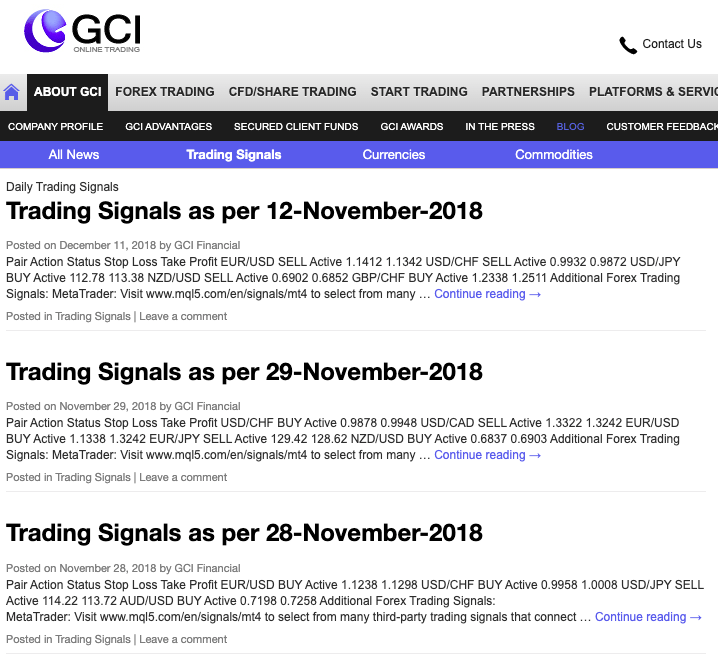

Unfortunately, our experts found that many of the articles in the forex news and trading signals sections were outdated, last being updated in 2020 and 2018, respectively.

On the plus side, the user manuals for each platform are detailed and easy to read, perfect for new traders wanting to learn the basics. The economic calendar is also up-to-date and great for keeping up with important financial events.

Overall, the education section is disappointingly outdated and bare, providing little value for traders.

Company Details & History

GCI Financial is an online CFD broker that was founded in 2002. The broker is based in Saint Lucia and has received several awards across the years. These include accolades from ForexExpo, IFM and ForexRating.

Unfortunately, there is limited information on the company’s ownership, employees or background on the website. This is a serious concern for us, as reputable brands publish details on their management team and structure.

Customer Service

We were pleased to see that GCI offers several avenues for customer support, including multilingual 24/5 live chat and telephone support, as well as account managers (only for certified, high-value traders).

On the negative side, while using GCI Financial, we found that customer service was rather slow.

To get in contact:

- Contact Telephone Number: +1 800 604 2457

- Online Support: available on the GCI website (gcitrading.com)

- Email: info@gcitrading.com (general enquiries) or techsupport@gcitrading.com (technical support)

- Office Address: GCI Financial Ltd, 1st Floor, The Sotheby Building, Rodney Village, Rodney Bay, P.O. Box 838, Castries, St. Lucia

You can also find FAQs and a feedback form on the broker’s website.

The brokerage also has an out-of-date social media presence. They can be found on Facebook and Twitter under the handle @GCIFinancial. Unfortunately, it seems they have not posted since 2017, further adding to the lack of reliability.

Security

GCI is an unregulated broker with limited safety features or financial oversight. Despite this, GCI does claim to provide their own security features to ensure traders are protected.

This includes securing traders’ funds at top-rated banks, separate from its own operating capital. The broker also claims to maintain a balance sheet with net capital above most regulators’ minimum requirements.

In terms of security, the broker’s site is fully encrypted, and the trading platforms offered also provide their own encrypted transactions.

Overall, the security measures provided are not enough to protect traders sufficiently. Traders should be cautious if considering this broker.

Trading Hours

Trading hours vary by asset class and the instrument being traded. A rough guide for asset classes is given below, but some instruments may vary:

- Forex: 24/5

- Commodities: 10:00 pm Sunday to 8:00 pm Friday (GMT)

- Forex Futures: 9:00 pm Sunday to 8:00 pm Friday (GMT)

- US Shares: 1:30 pm to 8:00 pm, Monday to Friday (GMT)

- EU Shares: 7:00 am to 3:30 pm, Monday to Friday (GMT)

- Asia-Pacific Shares: 12:00 am to 6:00 am, Monday to Friday (GMT)

- Stock Market Indices: Dependent on the underlying market. For example, the FTSE 100 is open from 7:00 am to 8:00 pm, Monday to Friday (GMT)

Should You Trade With GCI Financial?

GCI Financial offers traders a decent range of assets and two powerful platforms. However, the broker falls far behind competitors in many aspects, including disappointing payment methods and lacklustre education tools. Furthermore, the broker is unregulated and does not support GBP deposits. As such, we recommend considering alternatives.

FAQ

Is GCI Financial Trustworthy?

GCI Financial is not regulated by any financial agency, including the UK’s FCA. The broker is based offshore in Saint Lucia with limited external oversight of its business activities. As such, trader funds and interests may not be protected and we urge potential clients to exercise caution.

Does GCI Financial Offer Low Fees?

We found spreads at GCI Financial not the most competitive, averaging around 1 pip for the EUR/USD pair and 2 pips for GBP/USD. With that said, there are no commissions on any products, nor any charges for deposits or withdrawals, which helps to keep costs down.

Is GCI Financial Good For Beginners?

We were happy to see demo accounts on both the ActTrader and MetaTrader 4 platforms, which are ideal for novices looking to browse the platform’s features and practise their skills risk-free.

With that said, GCI Financial’s educational resources and trading services are sub-par. We would recommend looking elsewhere if you require comprehensive trading resources and tutorials. For example, eToro is a market-leading one-stop shop for trading resources and tools for beginners.

Is GCI Financial Good For UK Traders?

UK traders can open an account and trade with GCI Financial. However, the broker does not support deposits in GBP, which means traders may be subject to currency conversion fees. In addition, many popular transfer methods are not available, which further adds to the broker’s inaccessibility for UK traders. Add in the lack of FCA oversight and British traders may want to think twice.

Which Trading Platform Should I Choose At GCI Financial?

The ActTrader and MetaTrader 4 platforms at GCI Financial both facilitate market analysis using customisable charts and intuitive technical tools. With that said, we recommend ActTrader to newer traders due to its more user-friendly design, whilst MT4 would suit those looking to implement more complex strategies, or those seeking comprehensive analysis tools.

Article Sources

Top 3 GCI Alternatives

These brokers are the most similar to GCI:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

GCI Feature Comparison

| GCI | Swissquote | IG Index | IronFX | |

|---|---|---|---|---|

| Rating | 2.3 | 4 | 4.7 | 3.8 |

| Markets | Forex, CFDs, indices, shares, commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) |

| Minimum Deposit | $500 | $1,000 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CySEC, FCA, FSCA, BMA / Bermuda |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, ActTrader | MT4, MT5 | MT4 | MT4 |

| Leverage | 1:400 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | GCI Review |

Swissquote Review |

IG Index Review |

IronFX Review |

Trading Instruments Comparison

| GCI | Swissquote | IG Index | IronFX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

GCI vs Other Brokers

Compare GCI with any other broker by selecting the other broker below.

Popular GCI comparisons: