Gann Markets Review 2025

|

|

Gann Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Gann Markets |

| Gann Markets Facts & Figures |

|---|

Gann Markets is a forex and CFD broker founded in 2018 and based in Montenegro. The broker offers Standard and ECN accounts with access to 150+ instruments. Registered offshore in St. Vincent and the Grenadines, Gann Markets aims to offer straightforward tools and fast funding for both novices and experienced traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Commodities, Cryptos, Stocks, Indices |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Access 5 asset classes via CFDs with commissions of $7 per round lot in the ECN account. Traders can enjoy fee-free deposit and withdrawals, ideal for active traders. Users also get reliable trading software. |

| Leverage | 1:400 |

| FTSE Spread | 17 |

| GBPUSD Spread | 7 |

| Oil Spread | 25 |

| Stocks Spread | From 1 |

| Forex | Trade a reasonable selection of 38 currency pairs with typical spreads from 1 pip. Standard account users can start with a $0 minimum deposit and very high 1:400 leverage. |

| GBPUSD Spread | 7 |

| EURUSD Spread | 1 |

| GBPEUR Spread | 7 |

| Assets | 38 |

| Stocks | Gann Markets offers a small range of 35+ international stocks including Amazon and Facebook. You can keep ahead of the stock markets using MT4's smart price alerts and automation tools. |

| Cryptocurrency | Trade 10 of the world's most popular digital assets including BTC/USD. Beginners can also replicate other crypto positions using the platform's copy-trading feature. |

| Coins |

|

| Spreads | From 147 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Gann Markets is an offshore CFD broker that was founded in 2018 and inspired by the well-known Gann theory on price movements. This review will evaluate the tradeable markets, fee structure, trading platforms, regulations, bonuses and more to give traders the key advantages and disadvantages of trading with Gann Markets.

Our Take

- Gann Markets offers the powerful and reliable MetaTrader 4 platform

- High leverage is available up to 1:400 with a choice of accessible accounts

- The education and market research offering does not compete with the top UK brokers

- We are concerned by the lack of FCA authorization and lapsed registration with the Financial Commission, which raises serious safety concerns

Market Access

Gann Markets has weak coverage of markets with around 150 different CFD assets ranging from forex to commodities. Considering that there are popular competitors such as Pepperstone that offer thousands of markets across a diverse range of asset classes, this is a very light offering.

Assets offered include:

- Forex: 38 forex pairs, including GBP/USD, EUR/CAD and AUD/JPY

- Commodities: 7 commodity CFDs, including silver, gold, palladium, platinum, US oil, UK oil, and natural gas

- Cryptocurrency: 14 crypto tokens, including Bitcoin (BTC), Ethereum (ETH) and Dogecoin (DOGE)

- Stocks: 37 stock CFDs, including popular companies like Tesla, Pfizer, Uber and Apple

- Indices: 7 index CFDs – S&P 500, Nasdaq 100, Dow Jones 30, DAX 30, FTSE 100, CAC 40 and the US dollar index (DXY)

Fees

Fees vary depending on the account type and assets being traded, but while using Gann Markets, we found them to be a relatively expensive broker.

Commission-free trading is available on the Standard Account, with the main fees lying in the spreads of each asset. While the brokerage promises spreads as low as 0.7 on majors like EUR/USD on this account, the average spreads offered are closer to 1.5 pips.

The ECN Account offers tighter spreads at the cost of a commission per lot traded, and this comes to 7 USD (£5.50), which is higher than competitors like IC Markets with its £3.50 charge.

Both accounts also come with swap fees, charging for positions held overnight. However, swap-free versions of both account types are available and we were happy to see these halal trading accounts for Muslim traders.

We were not so pleased to find that accounts which have been inactive for over 100 days must pay a 10 USD (8 GBP) maintenance fee.

Gann Markets Accounts

We like the simplicity of Gann Markets’ two account types, the Standard Account and ECN Account, and we are happy to see that both beginners and seasoned traders will have suitable options. The major difference between these accounts is the fee structure.

Our team have pulled out the key differences between the accounts below.

Standard Account

Best for beginners

- Initial Deposit: £0

- Spreads: From 0.7

- Commission: £0

- Order Volume: 0.01–30

- Leverage: Up to 1:400

- Swap-Free Option: Yes

ECN Account

Best for active traders

- Initial Deposit: $500/£400

- Spreads: From 0.1

- Commission: $7 (£5.50)

- Order Volume: 0.01–400

- Leverage: Up to 1:200

- Swap-Free Option: Yes

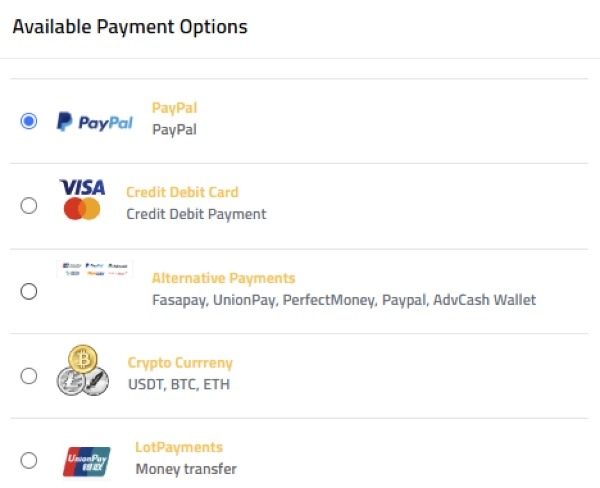

Funding Options

We were pleased to see Gann Markets offer a wide range of payment methods to traders, including bank wire transfers, credit/debit cards, cryptocurrency transfers, and several alternative solutions like PayPal and UnionPay.

While the broker does not charge deposit or withdrawal fees directly, the payment system may include a third-party cost. For example, UnionPay charges a 5% commission, PayPal charges 1.99%, and Airtm charges 1%. Fortunately, Gann Markets will refund all fees on deposits, which was a bonus for us.

Transfer speeds are instant for most payment methods. Withdrawals are usually processed within the same business day, which is competitive vs alternatives.

It is worth noting that withdrawals can only be completed via the same method that was used to deposit.

How To Deposit Funds

- Login to the Gann Markets client portal

- Ensure you have completed the KYC procedure

- Click the “Fund Account” tab

- Input the trading account and amount details

- You may be redirected to the payment methods page

- Fill in the required details and choose your payment option

- After providing your payment information, the transfer will be processed

- Transfer the funds to your desired account

- Begin trading

Trading Platforms

Gann Markets offers MetaTrader 4 (MT4), and though we are big fans of this platform it would have been nice to see a wider selection on offer.

Nevertheless, this is one of the most popular online trading platforms, providing a range of built-in tools and features to help implement trading strategies and investing techniques.

MT4 has many useful features including:

- 30 technical indicators

- 9 timeframes

- 31 graphical objects

- MQL4 programming language

- Automated trading bots (Expert Advisors)

- Plug-ins and customisability

- Mobile application

MT4 is offered because of its usability, popularity and availability. However, we are disappointed that this is the only software option. Top CFD brokers offer several platforms for users to choose from, such as MetaTrader 5 and TradingView.

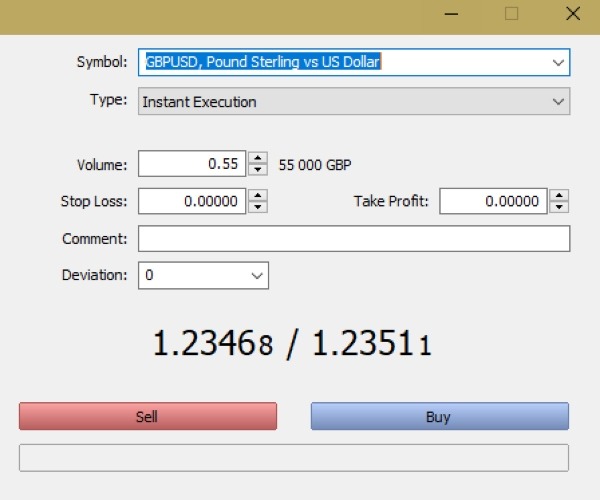

How To Place An Order

I thought the process to open a trade was straightforward:

- Log in to your Gann Markets account in MetaTrader 4

- Choose your asset and analyse price movements on the chart

- When ready to open an order, click the “New Order” button in the top hot bar

- Fill in the details of your trade (symbol, type, volume, stop loss, take profit, etc.)

- Click the “Sell (by market)” or “Buy (by market)” button to complete your trade

Leverage

Gann Markets allows margin trading on all its accounts, and the high leverage available from this offshore brokerage will attract certain traders.

The Standard Account provides leveraged trading up to 1:400, while the ECN Account facilitates up to 1:200. All assets have a stop level of 20%.

For instance, if you have £100 in your Standard Account and would like to invest in GBP/CHF, you can trade on 1:400 leverage, essentially turning your buying power into £40,000 (£100 x 400). On the downside, this greatly increases risk and loss potential, and we urge all traders but especially beginners to treat leverage with great care.

This is especially true since this offshore broker does not provide the same safeguards as brokers overseen by top-tier regulators like the FCA, which provide negative balance protection for example. This measure prevents losses on leveraged trades from putting a client in debt to their broker, but it is not offered by Gann Markets.

Gann Markets Demo Account

We were happy to see that Gann Markets allows traders to open as many demo accounts as they want through the MT4 terminal.

Paper trading accounts are great ways for traders to get accustomed to the platform and Gann Markets’ trading conditions. Demo trading accounts can also be accessed through the MT4 mobile app.

Mobile App

MetaTrader 4 has a mobile app available for free from the iOS and Android app stores.

This application gives much of the base capabilities of the full desktop program. You can track asset and fund performance on the go, as well as place orders or perform analysis. We particularly rate the sleek design and intuitive feel, making it easily accessible for new and experienced traders alike.

UK Regulation

We were concerned by Gann Markets’ regulatory status, as we were unable to find this entity on the Saint Vincent & the Grenadines Financial Services Authority’s website despite their statement that they are registered under licence number 336 LLC 2020.

Furthermore, this authority does not regulate forex trading firms in the first place, thus implying that Gann Markets is not properly regulated.

The broker also claims to be a member of The Financial Commission. This would mean that traders are protected from malpractice with up to 20,000 EUR (£17,000) worth of compensation per dispute case. However, our checks revealed that the membership seemingly ended in 2022 and the broker is not currently a member, meaning that traders will not be covered.

Furthermore, as VerifyMyTrade is affiliated with The Financial Commission, it is unclear whether the broker’s execution quality continues to be confirmed by VerifyMyTrade.

Overall, we are disappointed by the regulatory oversight of Gann Markets. The broker is essentially unregulated, bringing heightened risks to potential traders. We advise traders against signing up with weak or unregulated brokers due to the inherent risk and lack of safety features provided.

The best CFD brokers in the UK are regulated by top financial regulators like the Financial Conduct Authority.

Bonus Deals

The broker offers several enticing promotional bonuses, ranging from loss covering, trading challenges and competitions, to deposit bonuses. For example, at the time of writing, there is a 40 USD (£30) welcome deposit bonus for traders that deposit over 100 USD (£80).

Active bonuses and promotions can be found on the Gann Markets website. Importantly, we recommend reviewing terms and conditions before opting in as our experts found some tough withdrawal stipulations.

Extra Tools & Features

Gann Markets has some additional education content, but its offering is very lightweight and nowhere near the same league as larger competitors like AvaTrade.

The broker’s website features an “Education” tab with trader tools and e-books. The tools include a trading glossary and a “How To Trade Forex” video guide. The trading glossary covers 29 keywords and phrases, while the video guide has 11 episodes covering topics ranging from risk management to technical analysis. A single, downloadable e-book is also offered covering the fundamentals of trading.

These educational resources are a place to start for new traders, but don’t provide enough to comprehensively help beginners. Furthermore, the lack of popular tools, such as an economic calendar or profit calculators, brings a dampener to the broker’s offerings.

Customer Service

Gann Markets offers 24/7 customer support through several contact avenues. These are an online contact form, email, phone number, live chat or physical mail. On the downside, we didn’t find responsive support when we tested Gann Markets, which will deter newer traders.

- Phone number: +44 141 628 7809

- Email address: info@gannmarkets.com

- Contact Us form: found on the website

- Live chatbot: found in the bottom right of the website

- Mail address: GannMarkets Corp. LLC, First Floor, First St. Vincent Bank Ltd Building, P.O Box 1574, James Street

The broker can also be contacted on several social media platforms, including Instagram, Twitter, Facebook and Youtube. The broker uses the @GannMarkets handle.

Company History & Overview

Gann Markets was founded in 2018 and is based in St. Vincent & the Grenadines.

It boasts several awards on its website, including the Best Execution Broker 2020 by Mena Dubai Fx Show and Best Online Brokers 2021 by Global Forex Awards.

Security

We found it difficult to judge Gann Markets’ security measures, as there is very little publicly available information. However, we are not impressed by its regulatory cover as we discussed above, and this may indicate relatively lax security.

On a lighter note, the MetaTrader 4 terminal is a safe platform with encrypted data transfers to ensure trades are secure. This is extended to the mobile trading platform, which can also be set up with features like multi-factor authentication and Face ID/biometric scans.

Trading Hours

Gann Markets trading hours are Sunday 22:05 to Friday 21:55 GMT/UTC + 0.

However, each asset’s trading times vary depending on the underlying market. For example, the FTSE 100 will be available during UK trading hours (8:00 am to 16:30 pm GMT Monday to Friday).

Should You Trade With Gann Markets?

Gann Markets provides traders with access to a range of tradable CFDs in several different asset classes and markets. Trades are performed through the popular and versatile MetaTrader 4 platform, with a range of account types that will appeal to the majority of traders. Plenty of payment methods are available, making this broker easily accessible to investors.

However, the unregulated nature of the broker coupled with its loss of FinaCom membership means we cannot recommend this broker to UK traders. Its lack of education, research and extra trading tools are also significant drawbacks.

FAQ

Is Gann Markets Safe?

Gann Markets is an unregulated broker. It was formerly a member of The Financial Commission, providing traders with third-party handling of disputes and compensation. However, this is no longer the case and raises serious safety concerns.

Does Gann Markets Offer A Good Platform?

Gann Markets only offers the MetaTrader 4 trading platform. This is a highly versatile and respected online platform that provides a great number of tools to traders. This includes dozens of charts, indicators and various order types. The MT4 platform is also available on Apple and Android devices.

What Can I Trade With Gann Markets?

Gann Markets offers five different asset classes, forex, commodities, cryptocurrencies, stocks and indices. Importantly, products are traded through CFDs, which means you can go long or short on popular markets and boost your potential profits and losses by trading on margin.

Does Gann Markets Have A Mobile App?

Your trading account can be accessed remotely through the MetaTrader 4 application available on both Apple and Android devices. The app features many of the tools found on the desktop terminal and allows you to monitor, analyse and trade assets on the go.

On the downside, we were disappointed to see no proprietary mobile trading software which is offered by leading UK brands like XTB.

Does Gann Markets Offer Halal Trading?

Both the Standard and ECN account can be opened with a swap-free solution. This removes the overnight interest charge which is often considered Haram. Swap-free accounts can be requested upon sign-up.

Article Sources

Gann Markets Financial Commission

Top 3 Gann Markets Alternatives

These brokers are the most similar to Gann Markets:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Gann Markets Feature Comparison

| Gann Markets | FP Markets | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.8 | 4.8 |

| Markets | CFDs, Forex, Commodities, Cryptos, Stocks, Indices | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $100 | $40 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:400 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Gann Markets Review |

FP Markets Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| Gann Markets | FP Markets | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Gann Markets vs Other Brokers

Compare Gann Markets with any other broker by selecting the other broker below.

Popular Gann Markets comparisons: