FXTrading Review 2025

|

|

FXTrading is #36 in our rankings of CFD brokers. |

| Top 3 alternatives to FXTrading |

| FXTrading Facts & Figures |

|---|

FXTrading.com is global broker offering highly leveraged CFDs on 10,000+ assets, including forex, stocks, indices, commodities and cryptocurrencies. Competitive prices with raw spreads and low to zero commissions are available. Traders can use the popular MetaTrader 4 platform and will have access to a suite of additional analytical tools and other resources. The multi-regulated brokerage is authorized by the ASIC and VFSC. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, VFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | FXTrading offers CFDs on a wide range of assets, including forex, stocks, commodities, indices and cryptocurrencies. Commodities include a selection of softs as well as metals and energies, and the eight indices offered include the US30, US500 and UK100. Flexible leverage is available with excellent risk management tools. |

| Leverage | 1:500 |

| FTSE Spread | Floating from 0.5 points |

| GBPUSD Spread | Floating from 0 pips |

| Oil Spread | Floating from 1 pip |

| Stocks Spread | Variable |

| Forex | FXTrading clients can access 70+ forex pairs with high leverage up to 1:500, fast execution averaging 80ms, excellent liquidity and spreads from zero. A good selection of minors and exotics are available as well as all the majors. New users can start trading forex in 4 easy steps. |

| GBPUSD Spread | Floating from 0 pips |

| EURUSD Spread | Floating from 0 pips |

| GBPEUR Spread | Floating from 0 pips |

| Assets | 70+ |

| Stocks | FXTrading offers clients CFDs on 10,000+ global company shares from a list that includes all major and emerging stock exchanges on an institutional trading platform. Prices are competitive with a floating spread and leverage of 1:10 is available. |

| Cryptocurrency | FXTrading offers CFDs on 11 cryptocurrencies in 17 pairs, with six large cryptos including Bitcoin, Ethereum and Litecoin available to trade against USD or AUD. All other cryptos trade in USD pairs. Decent leverage of 1:10 or 1:20 is available depending on the crypto. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FXTrading is a high-leverage CFD broker that supplies clients with speculative instruments in over 10,000 online markets. The firm holds licences with the Australian regulator ASIC, the Vanuatu Financial Services Commission and is trusted by over 50,000 clients worldwide. This 2025 review covers all you need to know to decide whether to start trading with the company. Read about the supported platforms, payment methods, mobile apps, trading fees and commissions below.

About FXTrading

FXTrading has been operating for eight years from its Sydney-based head office. However, for most of this period, the company traded as RubixFX. The broker uses a no-dealing-desk (NDD) model, which means that all positions are passed directly to liquidity providers. As a result, clients can choose from ultra-low spreads or commission-free trading and freely swap between account types.

The broker places significant emphasis on creating a safe and easy trading experience for forex and CFD traders. To this end, two regulators licence the company – ASIC and the VFSC.

Markets

Boasting over 10,000 instruments, FXTrading supports many markets, including forex, indices and crypto CFDs.

Forex

Forty-four forex instruments are supported by the firm, encompassing a solid range of major, minor and exotic currency pairs. Spreads are variable and start from 0.0 pips through the Alpha account and 1.0 pips with the standard account.

Indices

FXTrading clients can speculate on seventeen major European and global indices, such as the UK FTSE 100, US S&P 500 and Dow Jones 30. However, all supported indices are cash-based markets, with no futures indices available.

Spreads start from 0.0 pips on the NASDAQ, though the lowest average spread stands at 19.2 pips on the Dutch AEX 25.

Commodities

A small selection of commodity CFDs is available, spanning ten soft commodities, three spot metals and three energies markets. Brent and WTI oil and natural gas instruments are on the list, as well as copper, gold and silver USD pairs.

Spreads begin at 0.0 pips on gold and silver, with average spreads on XAG/USD sitting at 0.9 pips.

Share CFDs

Over 10,000 equities from more than 20 exchanges make up the bulk of the products offered by FXTrading. However, stock CFDs are only available through the IRESS Viewpoint platform, with these instruments unavailable through MetaTrader 4 and 5.

Crypto CFDs

Finding a reputable and safe broker that offers crypto CFDs to UK traders can be tricky. Fortunately, this brokerage offers a total of 35 crypto derivative instruments.

Bitcoin (BTC) and many popular altcoins like Ethereum (ETH), Polkadot (DOT) and Uniswap (UNI) are supported. In addition, several pairs come with a range of base currency options, including GBP, USD and EUR.

Leverage

Leverage offers investors the chance to multiply their position gains, though this is paired with the potential for more significant losses. FXTrading provides flexible leverage rates that reach up to 1:500. The margin system on forex and gold operates dynamically, with maximum rates based on a client’s overall account balance:

- £0 – 16,000 – 1:500

- £16,000 – 40,000 – 1:300

- £40,000 – 80,000 – 1:200

- £80,000+ – 1:100

Leverage is fixed on all other asset classes, with margins of up to 1:100 available on metals, energies and share CFDs, 1:50 on soft commodities and up to 1:20 on crypto CFDs.

FXTrading enforces a margin call on leveraged positions at 100%, while the stop-out level on trades is 50%.

Account Types

FXTrading caters to investors who thrive in diverse trading conditions by offering a low-spread “Alpha” ECN account and a zero-commission standard account. UK traders will be pleased to learn that GBP is one of seven base currency options supported by the broker.

The standard account utilises STP execution to facilitate zero-commission trading, while spreads start from 1.0 pips. Minimum and maximum trade sizes per order stand at 0.01 and 100 lots, respectively, though indices speculators can up this to 250 lots. All trading styles are allowed, in addition to expert advisor (EA) automated orders.

FXTrading’s Alpha account provides raw spreads from 0.0 pips – the broker makes money from trading commissions instead. All other trading conditions are identical to the standard version, such as minimum and maximum trade sizes and a lack of trading style restrictions.

Unfortunately, the company does not offer a swap-free Islamic account to those who cannot pay interest due to religious beliefs.

Demo Account

Demo accounts are a valuable tool in a trader’s arsenal to test new strategies, explore a new market or trial trading with an unknown broker. FXTrading allows prospective clients to open an obligation-free demo account and trade risk-free for 30 days through the MetaTrader 4 and 5 platforms.

Trading Platforms

There are three trading platforms available to FXTrading users, with traders given a wider choice than with many of its competitors. These options are MetaTrader 4 (MT4), MetaTrader 5 (MT5) and IRESS Viewpoint.

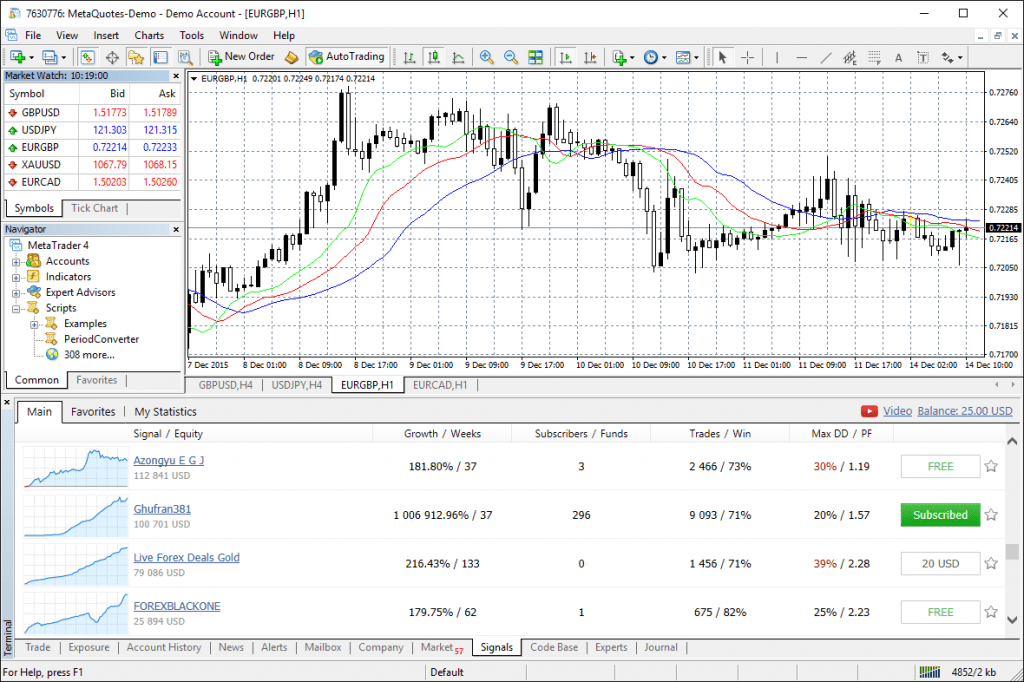

MetaTrader 4

MetaTrader 4, often abbreviated to MT4, burst onto the forex CFD scene in 2005 and remains the most popular retail trading platform more than fifteen years after its release.

Charting is made easy with 30+ standard indicators and nine timeframes, while the platform also supports custom indicators and analysis tools. Perhaps the program’s best feature is its simple and intuitive automated trading system that uses expert advisors (EAs). Traders can either purchase EAs from the MQL4 marketplace or create custom programs.

MetaTrader 4

MetaTrader 4 is available to download on Windows, Mac and Linux or as a mobile app for iOS and Android devices. Alternatively, FXTrading clients can use the legacy browser-based MT4 WebTrader integrated into the broker’s website.

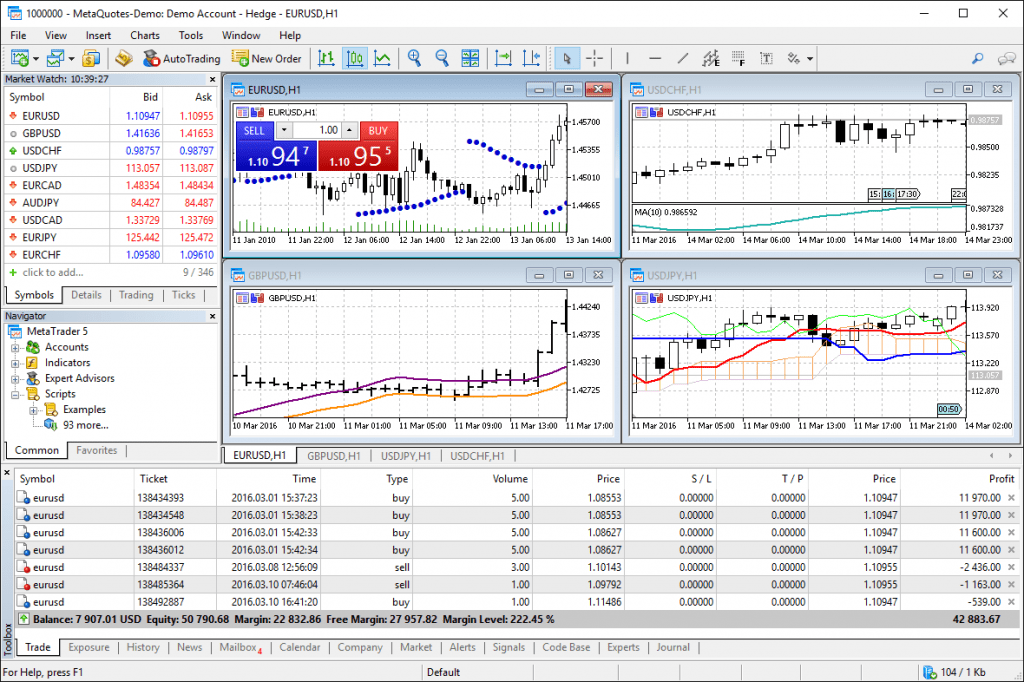

MetaTrader 5

Launched in 2010 with several key improvements over its predecessor, MetaTrader 5 is the latest platform offered by MetaQuotes. MT5 is built upon the solid foundation of MT4, adding support for additional instrument types and enhanced trading tools for CFD markets.

Thirty-eight standard indicators and 21 time frame options help users analyse the online markets efficiently and accurately. The platform also features upgraded strategy backtesting and a new MQL5 coding language to make creating custom tools easier.

MetaTrader 5

MetaTrader 5 can be downloaded on Windows, Mac, Linux or as an iOS or Android app. The platform is also available in a browser-based WebTrader format.

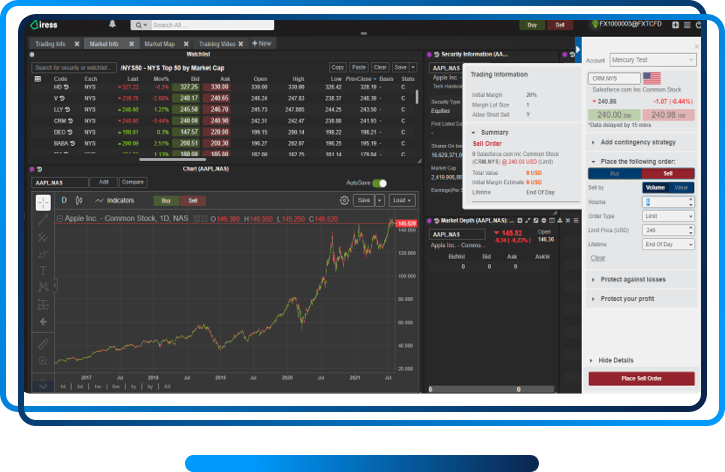

IRESS ViewPoint

The final system supported by FXTrading is IRESS ViewPoint. This direct market access (DMA) platform allows clients to trade stock CFDs with over 50 charting instruments, 59 indicators and advanced market depth data support.

However, unlike the MetaTrader platforms, ViewPoint requires users to create a separate trading account with unique account types and fee structures:

- Silver Account – £6,000 minimum deposit, £35 per month platform fee and a £10 per round traded lot commission

- Gold Account – £30,000 minimum deposit, £35 per month platform fee and £7 per round traded lot commission

- Platinum Account – £60,000 minimum deposit, no platform charge and £5 per round traded lot commission

IRESS ViewPoint

IRESS ViewPoint is available on Windows and Mac devices and through the IRESS Mobile app for Android and iOS.

Payment Methods

Fast and safe payment methods ensure that investors can start trading quickly after making a deposit and cash out any earnings securely. FXTrading supports six GBP funding options: Visa, Mastercard, PayPal, Neteller and international bank wire.

The minimum deposit amount for GBP payment methods is quite steep at £80. Processing times range from instant for card and e-wallet transfers to 2-3 business days with an international wire payment.

The minimum withdrawal amount is also £80, which is fairly typical for an online broker. Processing times are within 24 hours through most supported methods, with funds taking an additional 3-5 business days to reach your bank or card.

Deposit & Withdrawal Fees

For traders that make frequent deposits and withdrawals, a broker that levies a fee on transactions is highly undesirable.

Thankfully, FXTrading covers all fees on every supported payment method, other than internal wire transfers. This charge depends on the specific bank but usually costs between £20 and £30.

Trading Fees

As with transaction costs, trading charges and commissions soon add up, so finding a firm with low fees should be a priority.

ECN commissions on all markets other than share CFDs are highly competitive at £2 per side per lot. In contrast, stock CFD commissions are between £10 and £5 per round traded lot, depending on the IRESS ViewPoint account level.

Clients who wish to trade equities through ViewPoint must pay a monthly platform fee of £35 unless they qualify for the highest tier of account. Furthermore, quote data from each supported exchange requires a cost of up to £20 per country.

Swap fees vary from asset to asset, with detailed breakdowns available on the FXTrading site and MT4 and MT5 platforms. The broker does not mention whether an inactivity fee is levied on dormant accounts but several client reviews claim it does not.

Security & Regulation

One of the most effective ways that traders can protect themselves from fraud is to register with a regulated broker. To this end, FXTrading is licensed by both the primary Australian regulator, ASIC, and the Vanuatu Financial Services Commission, VFSC.

However, the ASIC regulation only covers Australian traders, with UK clients protected by the less effective VFSC. Furthermore, while client funds are held in segregated tier 1 bank accounts, there is no mention of the broker’s participation in a fund protection scheme.

Additionally, some clients may be disappointed by the lack of two-factor authentication (2FA) support to help provide maximum security to the client login portal.

Customer Support

Whether you are trying to open a new account, having issues with payments or want more information on the provided trading platforms, FXTrading offers several support options to help you start trading on the online markets again.

Clients can contact the broker on an Australian phone number, a dedicated email address, physical mail or a live chat feature for instant help. Note that, for UK traders, international call charges will apply.

- Phone Number – (+61) 280 397 366

- Email Address – service@fxtrading.com

- Postal Address – Level 27, 25 Bligh Street, Sydney NSW 2000, Australia

The broker has also created an FAQ section on its site with information on various common topics, including payment methods, trading platforms and regulators.

Educational Content

An area where FXTrading excels is its educational content. Everyone from complete trading beginners to experienced investors can gain value from the wealth of free videos, ebooks and interactive courses provided by the broker.

Advantages Of FXTrading

- Crypto CFD trading

- Autochartist Access

- Large leverage rates

- 10,000 + stock CFDs

- Competitive trading fees

- Several top-tier platforms

- GBP base currency accounts

- External transaction fees covered

- Wide range of educational content

Disadvantages Of FXTrading

- Mid-tier regulation

- Limited commodities

- £80 minimum deposit

- Separate equity CFD accounts

- IRESS ViewPoint platform fees

Promotions

Like many online forex and CFD brokers, FXTrading offers several bonus schemes to encourage clients to start trading through its platform.

The first welcome bonus program offers new clients up to a 25% rebate on losses from their initial deposit. To qualify, users must deposit over £160, with repayments calculated at the end of each calendar month.

An alternative welcome bonus promotion is also available, boosting deposits of £160 or less by 50% and additional capital above £160 by 10%, up to a total bonus fund amount of £480. Once traded, investors can withdraw profits. However, withdrawing funds before the entire bonus is wagered will significantly impact retaining bonus funds.

Existing clients are not left out, receiving a 10% boost on all deposits, paid out in bonus funds. However, this promotion is subject to challenging wagering requirements, with bonus funds converted to real cash at £1.60 per traded lot.

Unfortunately, all FXTrading promotions are only available to standard account customers.

Additional Features

FXTrading provides a range of additional features to help its investors thrive in the online markets.

The first is a market news and analysis section, where users can find recent articles on upcoming financial events. To further help clients spot trading opportunities, the firm gives access to Autochartist software that automatically scours the markets for technical analysis formations in real-time.

For round-the-clock MT4 automated trading, eligible clients can also take advantage of free VPS hosting. Additionally, the broker operates a copy trading system that allows users to emulate the positions of its most successful and consistent traders.

Trading Hours

The FXTrading market hours follow the standard industry opening times, operating 24/5 through its three supported platforms. However, indices and share CFDs follow their local exchange hours.

Clients can manage their accounts and make deposits and withdrawals at any time through the FXTrading client portal.

FXTrading Verdict

FXTrading is one of Australia’s biggest trading firms and provides an enticing brokerage service to investors. Low commissions and spreads on top of free deposits and withdrawals may be enough to convince cash-conscious clients to register. At the same time, high-stakes speculators will doubtless appreciate the firm’s high leverage capabilities.

However, questions remain around the broker’s VFSC regulation and the lack of a fund protection scheme for UK traders. Additionally, having to register on an entirely separate (and expensive) platform to trade share CFDs is a hassle some prospective clients may not put up with.

FAQ

Is FXTrading Safe?

FXTrading is a reputable and experienced firm, with thousands of client reviews testifying to its legitimacy. However, the broker’s regulation is not the strongest and the firm lacks a fund protection scheme that would protect traders from company insolvency.

Which Platforms Does FXTrading Support?

FXTrading supports three trading platforms, MetaTrader 4, MetaTrader 5 and IRESS ViewPoint, with the latter used exclusively for share CFD trading.

Does FXTrading Have A Mobile App?

FXTrading does not provide a proprietary mobile app. However, all three of its supported trading platforms offer a mobile app variant available on Android and iOS devices.

How Many Payment Methods Does FXTrading Support?

Clients can use Visa and Mastercard credit and debit cards, PayPal, Neteller and bank transfers to make deposits and withdrawals in GBP.

Does FXTrading Offer Any Additional Charting Tools?

As well as the highly customisable charting abilities within MetaTrader 4, MetaTrader 5 and IRESS ViewPoint, FXTrading clients can use Autochartist to automatically identify potential trading opportunities.

Top 3 FXTrading Alternatives

These brokers are the most similar to FXTrading:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- GO Markets - GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

FXTrading Feature Comparison

| FXTrading | FP Markets | Pepperstone | GO Markets | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.8 | 3.9 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, forex, indices, shares, energies, metals, cryptocurrencies |

| Minimum Deposit | $200 | $40 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, VFSC | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSC of Mauritius |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:500 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | FXTrading Review |

FP Markets Review |

Pepperstone Review |

GO Markets Review |

Trading Instruments Comparison

| FXTrading | FP Markets | Pepperstone | GO Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

FXTrading vs Other Brokers

Compare FXTrading with any other broker by selecting the other broker below.

Popular FXTrading comparisons: