FxGrow Review 2025

|

|

FxGrow is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to FxGrow |

| FxGrow Facts & Figures |

|---|

FxGrow is a forex and CFD broker founded in 2008 and regulated in Cyprus and Vanuatu. The brokerage offers 500+ trading instruments on the MetaTrader 5 platform, with ECN accounts and commission-free trading. Since it launched, the broker has gained over 80,000 clients and more than 10 industry awards. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, futures |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Go long or short on a range of CFDs, including on futures with up to 1:100 leverage. On the downside, commissions are higher than many alternatives in the ECN Plus account, at $8 per lot. |

| Leverage | 1:30 |

| FTSE Spread | Not offered |

| GBPUSD Spread | 0.5 |

| Oil Spread | Floating |

| Stocks Spread | Floating |

| Forex | FxGrow offers a decent range of 60+ forex pairs with competitive spreads from 0.3 pips on the EUR/USD. With that said, spreads are relatively wide in the starter account at 1.1 pips. |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.5 |

| Assets | 60+ |

| Stocks | FxGrow offers trading on the world's largest stock indices. This includes major US, European, Asian and Australian exchanges like the S&P 500 and FTSE 100. |

FxGrow is a Cyprus-based CFD brokerage that operates exclusively through the popular MetaTrader 5 (MT5) trading platform. The forex, crypto, commodity and index trading firm boasts several awards, offers 24/5 customer support and is regulated by CySEC and the VFSC. This 2025 FxGrow review explores key aspects of the broker, such as available leverage, minimum deposit requirements, fees, commissions and demo account support.

FxGrow Headlines

Founded in 2008, FxGrow has expanded from a small team to employing over 50 staff members under parent company Growell Capital. The broker provides access to hundreds of forex and CFD instruments for more than 80,000 registered clients from its Cyprus headquarters.

CySEC and the Vanuatu-based VFSC regulate the firm, although it holds additional licences with major European regulators, including the UK FCA.

Markets

FxGrow provides over 160 trading products to clients spanning several asset classes.

The broker offers more than 60 forex instruments with a substantial selection of major, minor and exotic currency pairs. Forex spreads start from 0.2 pips. Also available are 17 cash indices, 40+ commodities products and several crypto CFD instruments. However, it is unclear whether these cryptocurrency derivatives are available to UK clients.

Unfortunately, the FxGrow website is very sparse on specific information regarding its trading instruments. Clients must instead browse the MT5 platform to view which particular assets are supported.

Leverage

While the broker advertises leverage rates of up to 1:100, UK and EU FxGrow clients are restricted to FCA approved margin levels. Available leverage is as follows:

- 1:30 on major forex pairs

- 1:20 on non-major forex pairs, major indices and gold

- 1:10 on minor indices and all non-gold commodities

The margin call and stop out levels for leveraged positions stand at 50% on all accounts.

Account Types

There are three account types available with FxGrow, all of which use ECN execution. Unfortunately, there is no GBP base currency option, with clients restricted to EUR, PLN or USD.

The first account is the simple ECN variant, which seems to reflect STP trading conditions as a commission-free account with spreads starting at 1.1 pips. This account requires an initial deposit of £100.

The ECN-Plus account represents typical ECN trading conditions, with tight spreads starting at 0.2 pips and a commission of £8 per round traded lot. However, clients must adhere to an initial minimum deposit requirement of £1,000.

Those with significant capital to invest can open an ECN-Elite account, which reduces trading commissions to £5 per round lot for a £100,000 initial minimum deposit. Spreads remain tight and start from 0.2 pips.

There are no restrictions on trading methods with any FxGrow account, with hedging, netting and scalping all allowed. Additionally, investors who cannot pay interest due to religious reasons can opt for a swap-free Islamic version.

Demo Account

A demo account is an essential tool for prospective clients to test-drive the trading conditions of a particular broker and provides utility to existing clients looking to practise new strategies or test a new expert advisor. Happily, FxGrow delivers a demo account through its MT5 platform, with clients able to use a demo login for risk-free paper trading.

Trading Platforms

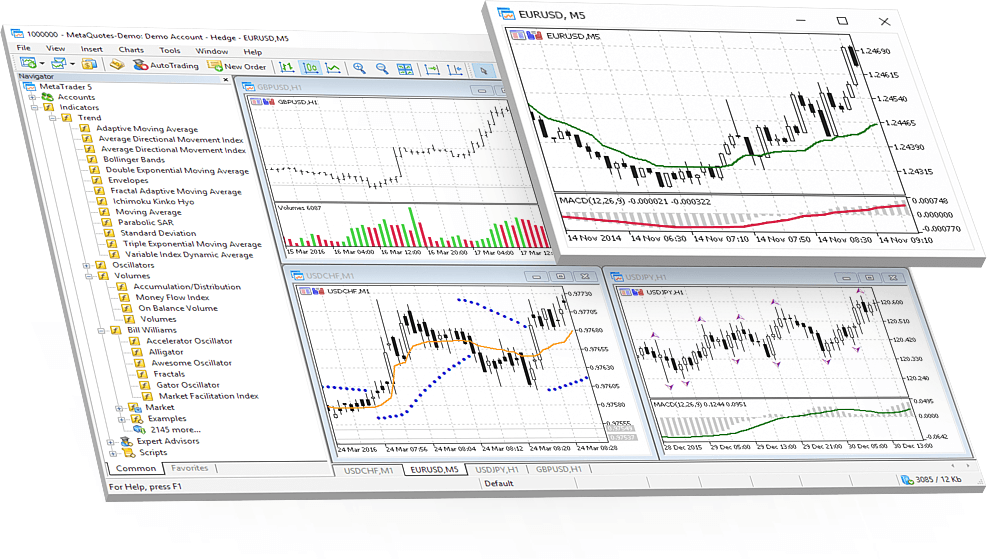

One trading platform is available to FxGrow users: MetaTrader 5 (MT5).

MetaTrader 5 features several upgrades over the MT4 platform, such as an updated MQL5 coding language, native hedging support and an advanced browser-based WebTrader variant.

21 time frames, 38 built-in indicators and a live news feed for each asset facilitate precise market analysis. Moreover, class-leading expert advisor integration allows users to seize opportunities 24-hours a day.

MetaTrader 5

As a result, MT5 is an excellent choice for beginner and veteran traders alike. The platform is available to download for Windows, Mac, Linux, as well as online.

Mobile Apps

For traders who like to monitor and open positions on the go, FxGrow supports the MT5 mobile app for account access from anywhere. The app supports the complete set of standard indicators and order types available on the web platform.

However, the broker does not have a proprietary app, so account management tasks, including deposits and withdrawals, must take place on the desktop or mobile website.

Payment Methods

FxGrow supports several methods to make deposits and withdrawals. Credit and debit card payments, bank wire transfers and e-wallets Neteller and Skrill are all available.

Card and e-wallet payments are subject to a minimum deposit amount of only £1 and are processed instantly. However, bank wire transfers require a £100 minimum deposit and take 2-5 days to process.

The minimum withdrawal amount for bank wire transfers is also £100, with a £10 requirement on all other methods. Bank wire withdrawals take 2-5 days to process, while all other methods can be processed instantly.

Supported transfer currencies are USD and EUR, with no GBP option. As a result, payments from GBP accounts may be subject to unfavourable exchange rates and additional forex fees.

Deposit & Withdrawal Fees

While most online brokers do not charge fees for deposits, FxGrow levies a commission of between 1.9% and 2.9% on card deposits. E-wallet deposits are not subject to fees from the firm but both Skrill and Neteller have their own charges. Bank wire deposits are likewise subject to bank fees that depend on the specific provider.

A £2 flat fee is applied to card withdrawals, while Neteller takes an eye-watering 3.9% cut of any withdrawals. Skrill withdrawal commission is 2.9% and bank wire transfer fees depend on the bank.

Trading Fees

FxGrow provides several account types to its clients, each with different minimum spreads and commission rates. For example, investors using the standard ECN account pay no commission but face higher spreads. ECN Plus and Elite users can trade with spreads starting from 0.2 pips, while commissions sit at £8 per round traded lot and £5 per round traded lot, respectively.

While FxGrow does not state whether it applies an inactivity charge to dormant accounts, clients report that the broker does not. Overnight fees vary from asset to asset and can be found via the MT5 trading platform.

Security & Regulation

As well as regulation in its home jurisdiction of Cyprus by CySEC, FxGrow holds limited regulation from the Vanuatu Financial Services Commission (VFSC).

Regulation from a major body can provide traders with confidence. However, organisations such as CySEC and the VFSC do not provide equivalent protection to top-tier regulators. Moreover, while the broker holds additional licences from several European regulators, such as the FCA and CNMV, this should not be confused with full regulation.

FxGrow client capital is protected up to £20,000 in case of insolvency and client funds are held in segregated bank accounts. Unfortunately, the broker does not provide the option of two-factor authentication to secure its client portal.

Customer Support

Clients with issues or queries about FxGrow have several options to contact the support team, which operates 24/5. The broker’s website offers a live chat feature for fast help, while those with more detailed questions can call or email the team directly.

Unfortunately, the broker has no UK support number, so UK-based clients will be subject to international call charges. However, support is also available over Skype at fxgrow.support to aid global customers.

- Phone Number: (+357) 2521 1707

- Support Email Address: support@fxgrow.com

- Enquiries Email Address: info@fxgrow.com

The broker also has an FAQ section on its website with additional help and useful tips. However, some of this information appears out of date.

Educational Content

FxGrow provides clients with educational content that spans technical analysis, market mechanisms and the intricacies of forex. Using these articles and videos, beginners can learn about trading fundamentals and experienced traders can brush up on their knowledge.

In addition, the broker has partnered with Trading Central, a major research and analytics firm that provides trading plans and in-depth educational content to its subscribers. Trading Central also offers a daily newsletter with forecasts for the trading day ahead.

Advantages Of FxGrow

- MT5 access

- NDD broker model

- Competitive spreads

- 24/5 customer support

- Demo & Islamic accounts

- Good educational content

Disadvantages Of FxGrow

- Limited leverage rates

- No GBP base currency

- £100 minimum deposit

- Lack of clarity on website

- Deposit and withdrawal fees

Additional Features

To give its clients an edge in the markets, FxGrow provides several extra services. For example, the broker’s website has an integrated trading calculator and an economic calendar with important dates, such as upcoming dividends and news releases.

Investors with over £50,000 of capital can take advantage of the FxGrow portfolio management service. Through this, the broker supplies licensed portfolio managers and highly adaptable investment strategies. Investors can also opt into a VPS service for 24/5 automated trading through the MT5 platform for an additional monthly fee.

Trading Hours

FxGrow follows the standard 24/5 forex market opening hours, though index trading is restricted to within respective local exchange hours.

Clients can manage their accounts and make deposits and withdrawals at any time via the website client hub.

FxGrow Verdict

FxGrow offers UK clients benefits that include a robust range of accounts, 24/5 customer support and ECN execution. Investors can also take advantage of solid educational content and helpful additional features, such as an economic calendar, calculator and wealth management solutions. However, weak regulation on top of inconsistencies and missing information on its website may put some prospective clients off. Additionally, the lack of a GBP account and high initial minimum deposits on low-spread accounts could cause UK traders to look elsewhere.

FAQ

Does FxGrow Support MT4?

FxGrow is an MT5-exclusive platform. Though there is evidence on the website that the broker used to support MetaTrader 4, MT4 users will have to download the newest offering from MetaQuotes or use the browser-based WebTrader.

Is FxGrow Regulated?

FxGrow is regulated by CySEC and the VFSC, holding non-regulatory licences with the FCA and several other European bodies.

Does FxGrow Offer A No Deposit Bonus?

FxGrow does not offer any promotions or bonus schemes to new or existing clients, including a no deposit bonus.

Is There A Minimum Deposit With FxGrow?

Initial minimum deposit amounts range from £100 to a substantial £100,000 requirement, depending on the specific account. However, subsequent deposits of as little as £1 are accepted.

Does FxGrow Provide A Demo Account?

FxGrow offers a free MT5 demo account login for investors to trial the broker’s trading conditions and practise new strategies. The firm also offers a swap-free Islamic account to those who cannot pay interest for religious reasons.

Top 3 FxGrow Alternatives

These brokers are the most similar to FxGrow:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FXPro - Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

FxGrow Feature Comparison

| FxGrow | Swissquote | IG Index | FXPro | |

|---|---|---|---|---|

| Rating | 2.7 | 4 | 4.7 | 4.4 |

| Markets | Forex, CFDs, futures | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Minimum Deposit | $100 | $1,000 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, CySEC, FSCA, SCB, FSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | FxGrow Review |

Swissquote Review |

IG Index Review |

FXPro Review |

Trading Instruments Comparison

| FxGrow | Swissquote | IG Index | FXPro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | No |

FxGrow vs Other Brokers

Compare FxGrow with any other broker by selecting the other broker below.

Popular FxGrow comparisons: