FXFlat Review 2025

|

|

FXFlat is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to FXFlat |

| FXFlat Facts & Figures |

|---|

FXFlat offers several asset classes on the MetaTrader 4 & MetaTrader 5 platforms. |

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, ETFs |

|---|---|

| Demo Account | Yes |

| Min. Deposit | €200 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | BaFin |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade with leverage across financial markets. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 0.9 |

| Oil Spread | 0.03 |

| Stocks Spread | Variable |

| Forex | Trade over 50 online forex pairs at FXFlat. |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.8 |

| Assets | 50+ |

| Stocks | Close to 20 stock indices are available for trading at FlatFX. |

| Cryptocurrency | Trade cryptos against the US Dollar and Euro. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FXFlat is a popular broker with access to a wide range of tradable assets, leading trading platforms, a competitive CFD fee structure and lots of safety features. In this review, we will outline our experts’ findings when analysing FXFlat’s suitability for UK investors. This includes details on how FXFlat works, its market access, available trading tools, fees, funding methods and whether the broker is worth signing up with.

Our Take

- FXFlat has an impressive 1.5 million assets on its list of available investment products, which is great for those looking for diversification opportunities and more than almost any other broker

- Clients can access a wide range of easy-to-use and advanced trading platforms good for a variety of investing styles

- We think the broker is best for experienced investors looking to expand their portfolios and implement multifaceted strategies

- FXFlat does not support GBP deposits or hold a license with the FCA which may deter British traders

Market Access

FXFlat beats almost every other broker when it comes to market access. The firm provides access to a huge 1.5 million tradable securities from over 135 global stock exchanges, including the NASDAQ. This rivals some of the biggest UK-based brokers like eToro and IG Index.

With a CFD Account, users can invest in stock, index, commodity, ETF, cryptocurrency, forex, futures and bond CFDs products. Conversely, the Brokerage Account supports stocks, options, futures, forex, commodities, bonds, ETFs and mutual funds.

Stocks from over 100 markets and 26 countries are available, including the US, the UK and Germany. International securities markets can be traded on 24/6. There are also options contracts from 17 countries, with several strategies supported, including cash-secured puts and covered calls. Users can open options contracts on European stocks, indices, commodities, currencies and futures.

Futures products from over 17 countries are also available, including contracts on indices, currencies, commodities and cryptocurrencies. 24 different currencies can be used to form forex pairs with FXFlat. For example, we found 28 different forex pairs supported when we opened an account. These included all major pairs and many minor and exotic pairs, including GBP/USD, GBP/NZD, EUR/CHF and AUD/JPY.

Several metal and energy commodities, including Brent crude oil, natural gas, spot gold and spot silver, are supported via CFD products. With these, traders gain access to wholesale prices provided by IB and LBMA, with a minimum quantity of one troy ounce on the London Bullion Market. Several bonds, including both corporate and government bonds, are supported, including US bond products and German bunds.

Exchange-traded funds (ETFs) can also be speculated upon, with funds from 28 exchanges in 14 different countries. This breadth leads to a huge range of available ETFs, including the ProShares Bitcoin Strategy, ST S&P 500 VIX Series B, US National Gas Fund, iShares Russell 2000 and CurrencyShares Euro Trust.

Clients can also invest in mutual funds; the brokerage account gives access to more than 40,000 mutual funds from across the world, including from well-known investment groups like Allianz, Invesco, Fidelity and PIMCO.

Overall, our experts were very impressed by the sheer volume of available markets and asset types. This broker gives traders access to near-unparalleled levels of variety, providing great opportunities for diversification, international speculation and complex, multi-faceted trading strategies.

Fees

As a result of FXFlat’s large asset selection, ranging from over 135 exchanges, the fee structure can be very complicated. This means that it is not trivial to navigate the platform and understand the cost and risk implications of different positions, though we have outlined the key details below.

CFD Account

Fees for the CFD account are simpler than those for the Brokerage account. Users do not pay any fees beyond the forex or asset spreads. There are no commissions, account management charges, data feed costs or inactivity fees. Furthermore, deposits and withdrawals are completely free of charge, with only external costs applied in some cases.

This structure is very competitive, with our experts commending the complete lack of non-trading charges, which some other firms choose to levy.

CME and EUREX futures CFDs do charge a fee per contract per page (half-turn). These vary between contracts, ranging from £0.70 for EUREX Micro Futures and £5.00 for CME Micro Bitcoin Contracts. Margin also varies, ranging from £26 for CME Micro Contracts to £2,740 for EUREX Future FDAX.

Brokerage Account

Each asset type available on the Brokerage Account has its own fee structure, with different exchanges charging different fees.

Shares & ETFs charge an order fee, with a minimum and maximum cost. Some exchanges also charge specialist fees, clearing & transaction levies and stamp duties.

For example, investing in UK shares and ETFs will cost a £7.00 order fee for positions under £50,000. Orders above this threshold will be charged £7.00 + 0.05% x volume. UK exchanges also charge a stamp duty of 0.5%.

Options & Futures cost flat commissions per contract, though some exchanges charge additional fees, like the UK’s stamp duty of 0.5%.

For example, futures and options contracts from the USA cost £2.50 in commission per contract.

CFDs on the brokerage account cost additional commission rates. These range between asset types, with indices charging 0.01%, shares between 0.05% and 0.2% depending on the country and forex varying between 0.01% and 0.1%. Minimum commissions also apply to all assets, though these vary significantly.

Forex positions cost a 0.2 basis points x volume fee per transaction. All currencies also charge a minimum commission (e.g. GBP has a minimum commission of £3.50).

Warrants & certificates from Frankfurt charge a 0.10% order fee and a minimum fee of £3.30. Those from Stuttgart charge an order fee of 0.12% with a minimum charge of £3.30.

Interest Rates when credited are the IBKR Benchmark – 1%, while debited rates cost the IBKR Benchmark + 3%. These are calculated daily and incorporated at the beginning of each calendar month.

Other fees are also incurred on the brokerage account. While the first payment per calendar month is free, further payments through SEPA charge £0.80 and bank transfers cost £6.80.

A daily exposure fee is imposed for having very high worst-case loss risk exposure. Corporate customers need to pay for a legal entity identifier number, which costs £50 for registration and £65 annually.

An inactivity fee based on account equity (though at least £0.78) is also charged for clients with under £780 in account capital. Telephone orders also cost £25 per order. However, these vary depending on the currency used for the transaction.

FXFlat Accounts

Our team found that FXFlat offers one type of CFD account and two Brokerage accounts available to UK investors. We like this as it keeps things simple for derivatives traders while providing tailored services and functionality for securities investors. Below we have highlighted the key differences.

CFD Account

- Minimum Financial Requirements – Sufficient resources

- Minimum Deposit – No minimum

- Assets – CFDs, futures, spot forex

- Leverage – Available up to 1:200

- Negative Balance Protection

- Short Selling – Available

- Margin Call – 100%

Cash Account

- Minimum Financial Requirements – Sufficient resources

- Settlement Periods – Up to 3 business days

- Minimum Deposit – No minimum

- Leverage – No margin trading

- Short Selling – Not available

- Assets – Shares, Options

- Minimum Age – 18

Margin Account

- Settlement Periods – Up to 3 business days (credits are immediate)

- Minimum Financial Requirements – Sufficient resources

- Minimum Deposit – £1,700

- Short Selling –Available

- Assets – All securities

- Leverage – Available

- Minimum Age – 21

Corporate Accounts are also available to institutional investors. Unfortunately, our research has shown that FXFlat does not offer Islamic or Swap-free trading accounts. This means that there are no Sharia-compliant account types for those of the Muslim faith.

How To Open An FXFlat Account

On a positive note, we didn’t run into any issues at the registration stage. Basic information and identity documents need to be provided, similar to other reputable brokers.

- You will be asked to choose your account: CFD or Brokerage

- You will then need to fill out the application form

- Enter your contact details, personal details and read the regulatory information

- You will then need to provide some identification and proof of address for the KYC check. This can include uploading a passport, utility bills and driver’s license

- Once approved, you will be given the details of your account through email

- Log in on the FXFlat website, deposit and you can begin trading

Funding Options

FXFlat’s main funding methods are bank transfers, with several bank transfer solutions supported. These include MasterCard, Maestro, VISA, PayPal, Skrill, iDeal, GiroPay and Sofort.

On the negative side, all deposits must be in Euros, possibly incurring conversion fees for UK traders hoping to deposit in GBP. UK-based companies like Plus500 and FXCM are much more accessible in this regard, supporting GBP accounts for free.

The broker does not charge any deposit or withdrawal fees when transferring to the CFD account. Deposits to a Brokerage account are free, although a £0.80 charge is added from the second withdrawal using SEPA and withdrawing via bank transfer incurs a £6.80 charge.

Payments can take up to three business days to process, which is slower than many alternatives, though our experts found that higher account levels process credits instantly.

Regulation

While not regulated by the UK’s FCA, the broker is overseen by the German Federal Agency for Financial Services Supervision (BaFin), one of several respected regulators. The broker has been supervised by the BaFin since 1998 with ID: 10109603.

BaFin is quite a high-quality regulator, with many requirements to be licensed. Brokers must follow anti-money laundering rules, provide VideoIDs, perform KYC checks, disclose trading conditions, be transparent and provide the German Deposit Guarantee Act cover. This deposit protection and investor compensation can reach as high as £85,500. Beyond this, the broker implements its own deposit protection of up to £850,000 per customer.

Overall, we are comfortable the firm is trustworthy, even if it isn’t regulated in the UK.

Trading Platforms

CFD Account

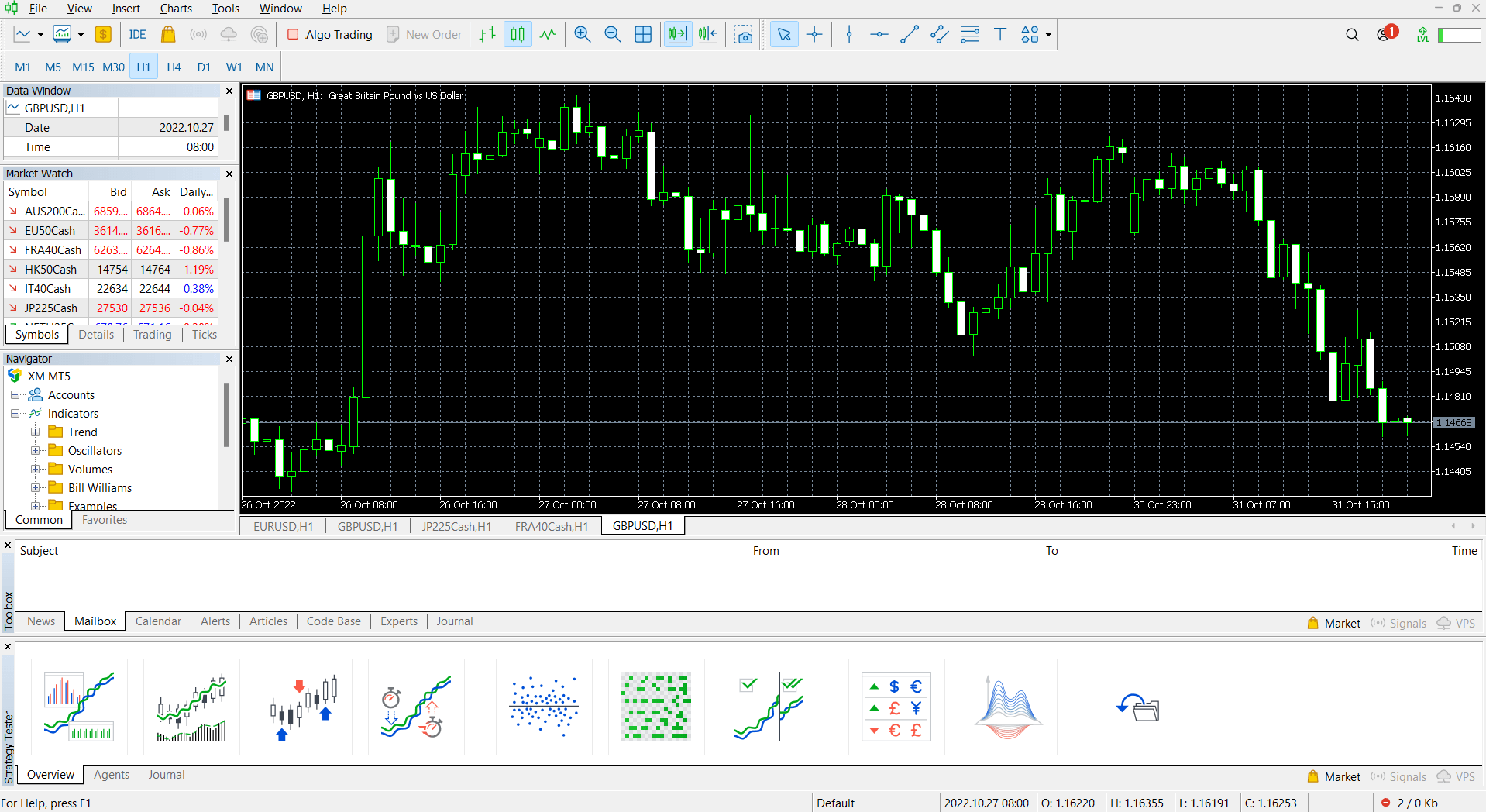

The CFD account lets users speculate via the MetaTrader 4 and MetaTrader 5 platforms. These are some of the most popular online analysis and trading toolsets, providing a range of powerful technical tools and high levels of customisability thanks to its bespoke programming language. Because of its popularity, there are countless guides and tutorials online to help new traders learn to use the platform properly.

MT4 supports nine timeframes, four order types, 31 graphical objects and 30 technical indicators, while MT5 supports 21 timeframes, six order types, 44 graphical objects and 38 technical indicators.

Our team of experts recommends that experienced traders start with MetaTrader 5 because of its improved built-in features and more advanced analysis tools.

We also rated that FXFlat offers extra MetaTrader add-ons. For example, Stereotrader is offered for free, providing four different analysis modes, isolated strategies and historical trades. AgenaTrader is also available at no extra cost.

MetaTrader 5

MT4 and MT5 both offer desktop download clients, online web trading and mobile trading, making the platform highly accessible for those with a consistent base or regularly on the move.

Brokerage Account

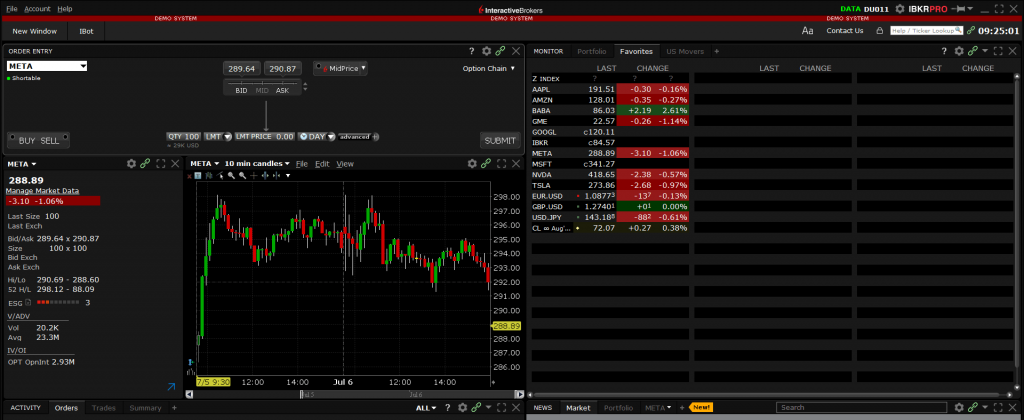

Several trading platforms are available with the brokerage account. These are the Client Portal, Trader Workstation Desktop, IBKR Mobile, IBOT and IBKR API. FXFlat provides much of its investment services through Interactive Brokers’ Trader Workstation platform.

Each platform offers a different set of assets and trading functions.

The Trader Workstation is the most compatible platform as it gives clients access to all assets and functions, such as advanced orders, algorithmic trading, conditional orders, backtesting, customisation and IB SMART routing. Advanced analysis tools are also available, including options analysis, full charting, lots of technical tools, scanners, Bloomberg TV and Level II Market Data.

Trader Workstation

This is the most powerful offering, providing the widest range of assets and tools to trade. We recommend this platform to more seasoned traders because of its advanced offerings. However, its intuitive design makes it easier for newer traders to pick up as well.

The Client Portal is an intuitive, easy-to-navigate software package that allows users to place orders, check quotes, see major performance indicators and manage their accounts. This platform is designed for newer, less experienced traders looking for an easier way to analyse the markets and speculate on different products. The platform has fewer features in exchange for its ease of use, though we recommend this toolset for those looking for a clean, convenient way to access their investing accounts.

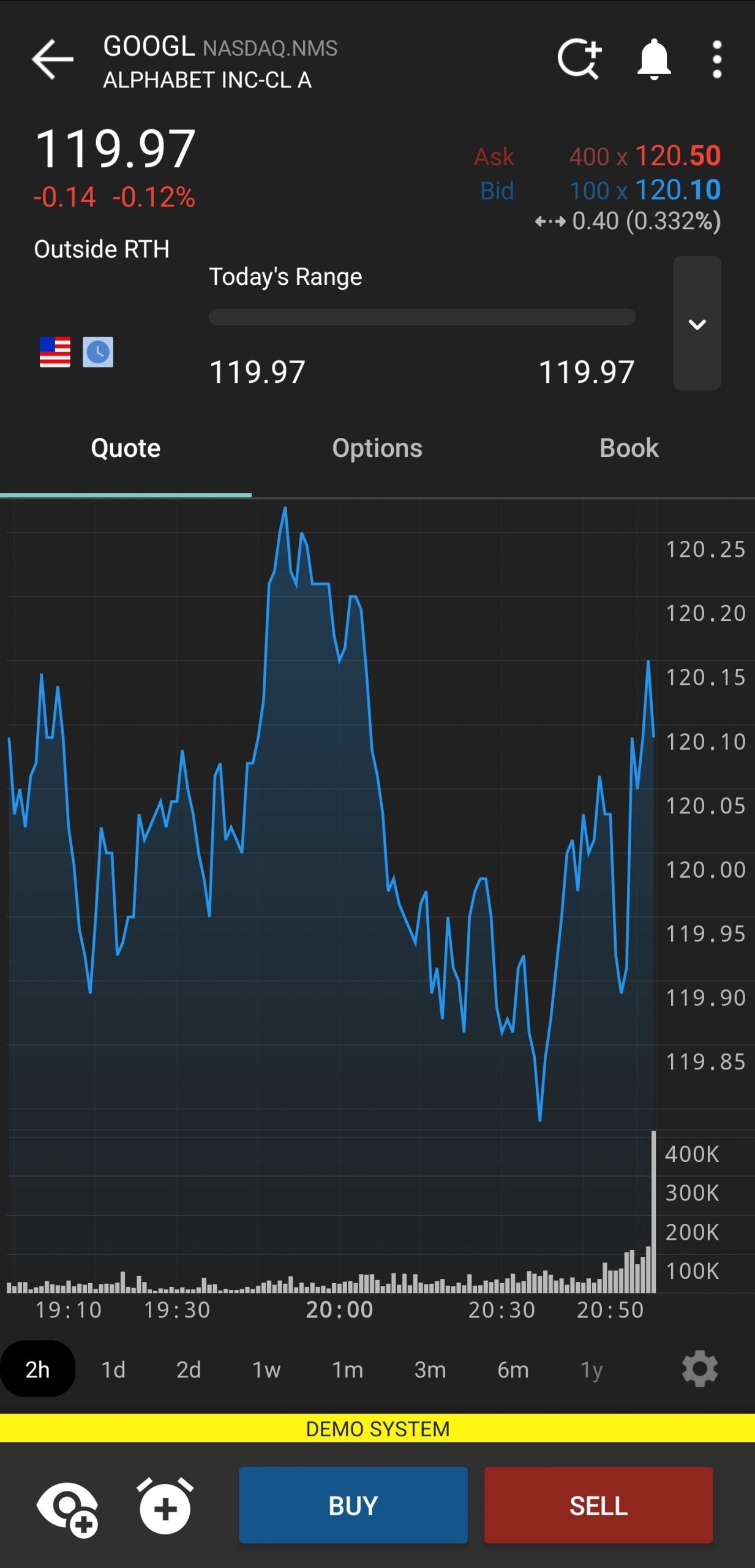

Mobile traders can use the IBKR Mobile App to monitor their accounts while on the go and place new position orders. This application is available on both the iOS App Store and Google Play Store. It is an intuitively designed platform that provides all the tools users need to invest while away from a workstation. Features include a huge range of technical indicators, full charting, watchlists, alerts and one-tap trades.

FXFlat also lets users program their own trading platforms through APIs. Clients can use both Excel and FIX APIs for MetaTrader platforms, while the TWS API comes with presets to help newer users ease into this style of trading. Automated trading software can be programmed to perform trades with no management, simply following a predefined trading algorithm.

Overall, we were impressed with the trading platforms offered. The popular MetaTrader platforms are available alongside a host of other platforms for varying skill levels and investment goals, making this broker suitable for a wide variety of investors.

How To Place A Trade With FXFlat

While using FXFlat, I didn’t have any problems navigating the straightforward order placement process:

- Login to your chosen desktop trading platform or webtrader

- Choose the asset you would like to trade from the symbol/asset lists

- You will need to bring up the order window (usually by hitting the New Order button but this can vary by platform)

- Input the details of your trade (volume, price, stop loss, take profit, order type, etc.)

- When you are ready, click the Buy or Sell button to place your trade

Mobile App

The broker ranks highly for its mobile trading offering.

FXFlat’s MetaTrader 4 and MetaTrader 5 both have supported mobile applications available on Apple and Android devices. Furthermore, the IBKR Mobile app is also available for Brokerage account holders.

All three of these platforms feature slick, modern designs while still providing key account management and order placement functionality. This includes technical analysis tools, graphical objects, customisable charting, alerts, watchlists and one-click trading.

Trader Workstation Mobile

FXFlat Leverage

Leverage varies between assets and account types. The CFD account has specified leverage available for each asset class, while brokerage accounts have variable leverage limits depending on the account’s capital and allocation of the portfolio. As such, the leverage available depends on the individual user for brokerage accounts.

CFD Account Leverage

Below, we detail the maximum leverage rates available for each CFD asset class.

- Oils – 1:10

- Gold – 1:20

- Metals – 1:10

- Interests – 1:5

- Futures – 1:135

- US Stocks – 1:5

- Spot Forex – 1:200

- Minor Forex – 1:10

- Major Forex – 1:30

- German Stocks – 1:5

- Minor Indices – 1:10

- Major Indices – 1:20

- Cryptocurrencies – 1:2

Margin is normal on the weekend and the margin close-out is at 100%.

Demo Account

We were reassured to find that FXFlat offers free demo accounts to traders for the MetaTrader 4, MetaTrader 5, AgenaTrader, MT Plus, VPOK and Trader Workstation trading platforms and add-ons.

These are great ways for investors to become accustomed to the broker’s platforms, understand the fee structure and practise risk management and trading strategies.

The demo account gives traders full access to the trading platforms and available assets, with a EUR 100,000 account limit.

How To Open A Demo Account

It only took me a couple of minutes to register for an FXFlat simulator account:

- Go to the FXFlat website

- Click the Test Demo Account button at the top of the screen

- Fill out the resulting form

- Choose which trading platform and account type you want

- Fill personal details (name, email, mobile phone number)

- Send the request and you will be redirected to a page to download your chosen trading platform

- Download the platform, install it and log in (if needed)

- You can now begin demo trading

Bonus Deals

Our team was unable to find information on any promotional bonuses or financial incentives for signing up with FXFlat.

Fortunately, we don’t consider this a drawback – we don’t recommend choosing a brokerage based on bonuses as these can be misleading and encourage over trading.

Extra Tools & Features

FXFlat offers an impressive range of additional tools, all available for free. These range from educational webinars, seminars, market news, MetaTrader add-ons, trade fairs and events, business calendar tools, and videos.

FXFlat’s educational events take place several times a week. Webinars can be registered for free, with an archive uploaded to the FXFlat YouTube channel. Unfortunately for some UK traders, these educational resources are only provided in German.

The newsboards and newsletter releases can be accessed on the broker’s website or through some trading platforms, providing information on current economic events and helping users keep up with the changing markets. Furthermore, the calendar help traders plan for future events and trade fairs and events can be attended, although these are more localised and can be difficult to reach.

While we were impressed by the range of information and topics provided, UK traders may struggle to take full advantage of the firm’s extra features and services due to geographical and language differences.

Company Details & History

FXFlat was founded in 1997 and is headquartered in Ratingen, Germany. The broker has been supervised by BaFin since 1998 and has been a securities trading bank since 2015.

The broker has won various awards throughout the years, including “Best Online Broker” awards from several reviewers, such as the German Customer Institute (DKI), Fuchsbriefe and Deutsches Kundedinstitut, Euro am Sonntag and Borse am Sonntag.

The broker also has social commitments, contributing to multiple regional projects and charities, like the Action Mesch and It’s For Kids.

Customer Service

The broker has several contact avenues that can be used if any problems arise or you need to ask any questions. Traders can use the online chatbot, contact phone numbers, online contact forms, email address and social media accounts to get in touch with the customer support team. Telephone lines and live chat sessions are available from 22:00 GMT Sunday to 22:00 GMT Friday.

- Email Address: service@fxflat.com

- Social Media: @fxflat @fxflatbankag

- UK Telephone Number: +44 2077 1056 95

Overall, the broker provides a range of convenient contact methods for UK clients; our team was particularly impressed by the UK-specific phone number. However, we would prefer to see 24/7 customer service options to ensure that users always have help on hand if they need it.

Security

Being under regulation by the BaFin, FXFlat must have strong security measures in place. These include strong encrypted site navigation and trading, plus anti-money laundering checks.

The broker also segregates clients’ funds from its own operating funds and has deposit protection of up to £850,000 per customer is in place.

Overall, our experts are happy with the security of investing with FXFlat. The broker has built a strong reputation and is supervised by one of the world’s respected regulators.

Trading Hours

Trading hours vary greatly depending on the asset class and underlying exchange in question. For example, Eurex futures products are available from 23:15 GMT Sunday to 08:00 GMT Friday. However, some US Futures CME can be traded from 22:00 GMT Sunday to 09:00 GMT Friday, while others trade from 00:00 GMT Monday to 06:20 GMT Friday.

You can check the open and close times of all assets on the contract specification page of your chosen investing account on the FXFlat website. Most assets are available throughout the week, Monday to Friday, but not on the weekends.

Should You Trade With FXFlat?

We were impressed that FXFlat provides an enormous number of tradable assets, a good selection of top platforms and competitive CFD trading fees. However, the brokerage account’s fee structure can get very complicated and the firm’s accessibility for UK clients is limited by the lack of GBP deposits and accounts, as well as a lot of the educational resources being available only in German.

Ultimately, our experts think that FXFlat is a very commendable brokerage, though suggest that UK investors will find a more convenient and comfortable trading experience with an FCA-regulated firm.

FAQ

Does FXFlat Offer Good Trading Software?

FXFlat offers a superb range of trading platforms, including MetaTrader 4, MetaTrader 5, Trader Workstation, APIs, IBKR Mobile and the Client Portal. This provides plenty of options for a range of traders, particularly experienced investors looking for advanced analysis features.

Is FXFlat Regulated In The UK?

FXFlat is a relatively secure broker regulated by the BaFin. This is a well-renowned financial regulator, suggesting that FXFlat is legit. However, our experts always prefer to see FCA regulation, which is specifically tailored to protecting UK clients.

Where Is FXFlat Based?

FXFlat is a German online broker with headquarters in Ratingen.

How Many Assets Does FXFlat Offer?

With access to over 150+ markets in 35 countries, the broker offers over 1.5 million tradable securities. This is an impressive offering that is almost unmatched in the retail trading space.

Is FXFlat Good For UK Investors?

FXFlat accepts international clients from many countries, including the UK. However, it is key to note that the broker’s accounts are all based in euros, meaning GBP deposits may have conversion fees applied. The brokerage is also not regulated by the FCA.

With that said, traders willing to overlook these elements for access to over 1.5 million assets may still choose FXFlat.

Article Sources

Top 3 FXFlat Alternatives

These brokers are the most similar to FXFlat:

- GO Markets - GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

FXFlat Feature Comparison

| FXFlat | GO Markets | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | - | 3.9 | 4 | 4.7 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, ETFs | CFDs, forex, indices, shares, energies, metals, cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | €200 | $200 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | BaFin | ASIC, CySEC, FSC of Mauritius | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | 1:30 | 1:500 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | FXFlat Review |

GO Markets Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| FXFlat | GO Markets | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | No | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

FXFlat vs Other Brokers

Compare FXFlat with any other broker by selecting the other broker below.

Popular FXFlat comparisons: