FXCL Review 2025

|

|

FXCL is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to FXCL |

| FXCL Facts & Figures |

|---|

FXCL is an offshore brokerage registered with the VFSC. The firm uses ECN execution to offer spreads from 0.0 pips. There are no deposit or withdrawal fees and access to reliable trading tools, including MetaTrader 4. Several promotions are also available including demo contests with cash prizes and deposit bonuses. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Cryptos, Commodities |

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Min. Trade | 0.01 Lots |

| Regulated By | SVG FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | FXCL offers 100+ contracts for difference spanning forex, indices and crypto. Traders get 24/5 customer support alongside fast execution speeds and a low minimum deposit of $1. |

| Leverage | 1:2000 |

| FTSE Spread | 130 |

| GBPUSD Spread | 0.4 |

| Oil Spread | 5 |

| Stocks Spread | N/A |

| Forex | FXCL clients can trade more than 40 major, minor and exotic currency pairs with regular and ECN execution models on the MT4 platform. Spreads on currencies start from 0.1 pips. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.4 |

| Assets | 43 |

| Cryptocurrency | FXCL supports trading on three cryptos (BTC, ETH and LTC), pegged against the US dollar. However, this is a very limited selection that doesn't rival the best crypto brokers. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FX Clearing (FXCL) Markets Ltd, is an established online forex and CFD broker, founded in 2006. The broker offers the popular MT4 platform alongside copy trading features and a range of accounts. This review will examine the broker’s regulatory status, available markets, fees, and more. Our experts also offer their verdict on whether FXCL is worth signing up with.

Our Take

- FXCL caters to both beginners and pros, with Cent and ECN accounts that offer competitive fixed and floating spreads

- The broker offers a range of demo contests, rewards and promotions for new and existing clients

- FXCL’s offshore status and lack of a regulatory license from the FCA is a major drawback

- The poor selection of payment methods and non-GBP base currency is a disadvantage for UK traders

Market Access

FXCL offers a selection of only 60 assets across 4 markets. This is one of the smallest ranges we have seen offered by any broker. It is also disappointing that stocks are not available.

Only if you’re looking to mainly trade forex pairs is FXCL really a suitable option.

- Forex: 40 forex pairs, including EUR/GBP, GBP/JPY, and AUD/CAD

- Indices: FXCL offers 8 global indices, including UK 100, Japan 225, and France 40

- Commodities: US Crude oil, natural gas futures, silver, and gold

- Cryptocurrencies: Choose from Bitcoin, Litecoin or Ethereum

FXCL Fees

Commissions & Spreads

FXCL offers fixed and variable spreads with commissions on certain assets and accounts.

Across the 8 different account types, we found the tightest spreads in the ECN Pro account, starting from 0.1 pips for the EUR/USD pair. With that said, this account includes commissions at $3 per lot on forex, metals and indices. This is in line with top brands such as Pepperstone.

The broker’s fixed spread accounts offer a 1 pip spread for EUR/USD in the Cent account, with no commissions. In the Standard account, you can also expect fixed spreads of 1 pip for the same pair, with no commissions. Again, these are decent for fixed spread accounts.

Our team rated that FXCL offers a wide range of account types to suit traders of all experience levels and requirements. For example, the ECN Pro account is ideal for scalpers, whilst beginners may want to start with the Cent account.

We have pulled out the key pricing information for all accounts below:

Fixed Spread

- Cent: Fixed spread from 1 pip (EUR/USD), no commission

- Standard: Fixed spread from 1 pip (EUR/USD), no commission

Floating Spread

- Start: Floating spread from 1.6 pips for (EUR/USD), no commission

- Interbank Cent: Floating spread from 1.1 pips for (EUR/USD), no commission

- Interbank Standard: Floating spread from 1.1 pips for (EUR/USD), no commission

- ECN Pro: Floating spread from 0.1 pips for (EUR/USD), commissions on forex, metals, and indices at $3 per lot, crypto at 0.15% per lot

Special

- Live Contest: Floating spread from 1.6 pips for (EUR/USD), commissions on forex and metals at $1.5 per lot

- Volume Cash: Floating spreads, commissions for forex and metals at $1.5 per lot

Other Fees

Deposits are free for up to $500 deposited per month, whilst withdrawals are free for up to $100 withdrawn per month. These are disappointingly low limits, especially for withdrawals.

In contrast, leading UK brokers like CMC Markets and XTB do not impose unreasonable funding limits.

It is also a shame to see that FXCL charges tiered inactivity fees on traders with live accounts that have been left dormant for 32 days or more:

- $25 for inactivity from 32 to 90 days

- $50 for the inactivity from 91 to 180 days

- $75 for inactivity from 181 to 365 days

- $100 for inactivity for over 365 days

Again, these are much higher inactivity fees than most top brokers charge.

Accounts

We were impressed to find 8 account types at FXCL, all catering to varying needs. Minimum deposits for the accounts are $1, which is highly accessible for new traders.

The main let-down is that none of the account base currencies includes GBP, though we were pleased to see that instant and market execution are supported.

Cent

- Base Currency: US cent, EU cent, MYR cent, THB cent

- Leverage: up to 1:1000

- Margin call/Stop out: 30%/10%

- Execution: Instant

- Position size: 0.01 – 200.00 lot (micro lots are 1/100th of a standard)

- Max. number of open positions: 150

- Commission: None

Standard

- Base Currency: USD, EUR, MYR, THB, NGN

- Leverage: up to 1:500

- Margin call/Stop out: 30%/10%

- Execution: Instant/Market

- Position size: 0.01 – 2.00 standard lot

- Max. number of open positions: 100

- Commission: None

Start

- Base Currency: USD, MYR, THB

- Leverage: up to 1:2000

- Margin call/Stop out: 70%/50%

- Execution: Market

- Position size: 0.01 – 1.00 standard lot

- Max. number of open positions: 50

- Commission: None

Interbank Cent

- Base Currency: US cent, MYR cent, THB cent

- Leverage: up to 1:500

- Margin call/Stop out: 60%/40%

- Execution: Market

- Position size: 0.01 – 500.00 lot

- Max. number of open positions: 150

- Commission: None

Interbank Standard

- Base Currency: USD, MYR, THB, NGN

- Leverage: up to 1:500

- Margin call/Stop out: 40%/20%

- Execution: Market

- Position size: 0.01 – 5.00 standard lot

- Max. number of open positions: 150

- Commission: None

ECN Pro

- Base Currency: USD

- Leverage: Forex, metals: up to 1:300, Indices: up to 1:100, Crypto: up to 1:10

- Margin call/Stop out: 100%/80%

- Execution: Market

- Position size: Forex, metals: 0.01 – 50.00 standard lot, Indices: 0.1 – 50.00 standard lot, Crypto: 0.01 – 10.00 standard lot

- Max. number of open positions: 300

- Commission: $3 per lot (FX, metals and indices), 0.15% per lot (crypto)

Live Contest

- Base Currency: USD

- Leverage: up to 1:1000

- Margin call/Stop out: 70%/50%

- Execution: Automatic Market Execution

- Position size: Forex, metals: 0.01 – 3.00 standard lot

- Max. number of open positions: 50

- Commission: $1.5 per lot (FX and metals)

Volume Cash

- Base Currency: USD

- Leverage: up to 1:1000

- Margin call/Stop out: 70%/50%

- Execution: Automatic Market Execution

- Position size: Forex, metals: 0.01 – 3.00 standard lot

- Max. number of open positions: 50

- Commission: $1.5 per lot (FX and metals)

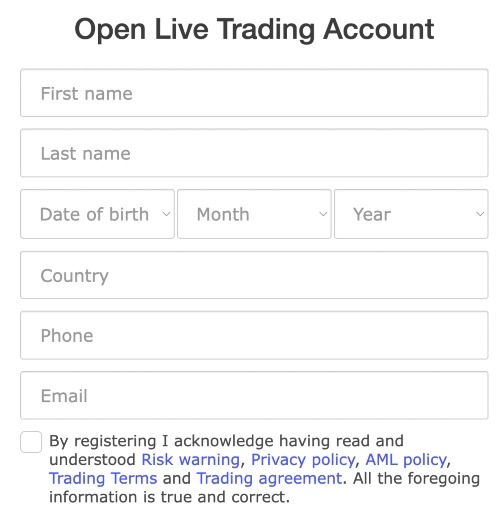

How To Open A Live Account

I could sign up for a live FXCL account in a few minutes by following these steps:

- Enter your full name, email address, phone number, and date of birth in the application form

- Enter the verification code sent to your email address and choose a password

- Choose an account type, preferred trading currency (GBP is not available on any accounts but FXCL state they do not charge any currency conversion fees), and a maximum trading leverage

Funding Methods

Online and instant bank transfers via PayTrust and H2P are possible with FXCL, but the broker only uses banks that are local to Malaysia, Indonesia, or Vietnam, which is disappointing.

The following are available to UK traders.

- AlphaPo: Automatically converts Bitcoin and Tether to USD or EUR for withdrawals and instant deposits

- Perfect Money: Allows wire transfers or e-currency payments via exchanges for withdrawals and instant deposits

We were pleased to see that withdrawals take 1 business day to process, though we weren’t thrilled to see that deposits can be delayed for up to 48 hours. This is a noticeable drawback as most reputable brokers offer near-instant account funding.

Overall, FXCL’s payment options for UK customers rank poorly compared to other brokers. For example, AvaTrade accepts Skrill, Neteller, bank cards and several other payment options with fast processing and zero fees.

How To Make A Deposit

- Log in to the client cabinet via the FXCL website

- Select ‘Deposit and Withdrawal’ and then ‘Deposit’ from the left menu

- Choose the live account to fund, the deposit method, and the amount

- Follow the steps on-screen for your chosen payment method

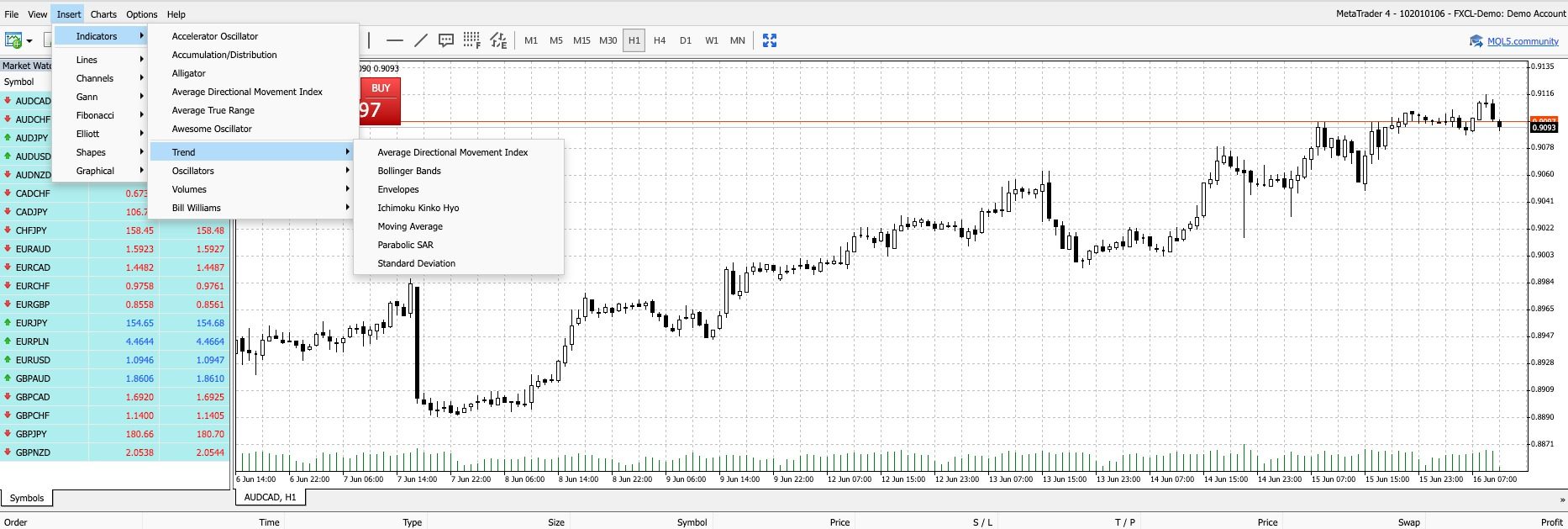

Trading Platform

MetaTrader 4 (MT4)

FXCL only offers prospective clients the MetaTrader 4 (MT4) platform. It’s a shame that traders aren’t given a choice, but thankfully, MT4 is trusted by millions of online traders. We are confident that beginners and more experienced traders will be satisfied.

MetaTrader 4 is a popular forex and CFD trading terminal, famed for its user-friendly design and suite of advanced tools. The charting objects in MT4 are comprehensive and include an excellent range of indicators and graphical features that help traders analyse in-depth price movements.

MT4 also uses a programming language called MQL4, which allows users to create their own indicators, scripts, and Expert Advisors. I think this is particularly useful if you have a decent programming knowledge.

There are also built-in Expert Advisors (EAs), which are automated trading strategies created using MQL4. Traders can import existing bots to automatically execute trades based on specific rules. I like that there is also a backtesting feature that allows users to test their trading strategies using rich historical data.

Alongside the web terminal and downloadable desktop app, MT4 is available to download as a mobile app. Traders can easily switch between their devices, allowing them to stay connected and take advantage of trading opportunities even when they are away from their computers.

Leverage

FXCL is an unregulated broker and therefore can offer very high leverage limits up to 1:2000 in the Start account. These limits vary depending on the account type and asset traded.

Leverage essentially allows you to gain a larger position in the market by borrowing funds from the broker and only using a small amount of your own capital. Whilst this can increase potential profits, it can also maximise losses.

UK traders should be very careful if trading with such high limits and we recommend using risk management tools like stop losses.

Demo Account

We were pleased to see an MT4 demo account available at FXCL with a maximum of $10,000 in virtual funds. The account is the perfect environment for new or experienced traders to browse the platform’s features and test out their strategies before risking any real funds.

How To Open A Demo Account With FXCL

To open a demo account, you will need to follow the same initial registration steps as a live account.

- Click ‘Open Live Account’ on the broker’s website

- Enter your details and follow the account verification steps

- After verification go back to the homepage and select ‘Cabinet’

- Select ‘Manage my accounts’, then ‘Open demo account’ from the left menu

- Choose your demo account details including account type, currency (we were only offered USD), leverage, and the initial deposit

- Check your email for your demo username and password

- Download MT4 and login

Regulation

FXCL Markets Ltd is regulated by the Financial Services Authority of St Vincent and the Grenadines (SVGFSA), with registration number 1637. It has been registered since mid-2018.

Traders should be aware that the SVGFSA is not considered a top-tier authority like the Financial Conduct Authority (FCA), so client protection is very limited.

Ultimately, the SVGFSA oversees non-bank financial institutions and has the power to intervene in the affairs of a registered entity to protect customers. With that said, it is known for its relatively relaxed joining and compliance requirements so caution is advised.

Bonus Deals

As is common at unregulated brokers, FXCL offers several bonuses to clients. When we used FXCL, we were offered a 100% welcome bonus when you trade 20% of the bonus amount, a ‘Birthday’ Bonus of 100% + your age, promo codes for Cent and Interbank Cent accounts, and a refer a friend scheme.

However, it is worth noting that bonuses are not allowed for ECN Pro or Live Contest accounts and multiple active bonuses cannot be used on the same account at the same time.

Traders should also be cautious when signing up for bonus deals and always read the bonus terms and conditions thoroughly.

Extra Tools & Features

FXCL offers an average range of educational resources, including a glossary encompassing over 150 trading terms.

In addition, our experts found an up-to-date economic calendar with significant dates and a frequently updated trading blog. The blog offers news updates, general trading advice, and insights into trading psychology. The Analysis Theory section may be particularly beneficial for beginners, offering basic explanations of fundamental and technical analysis.

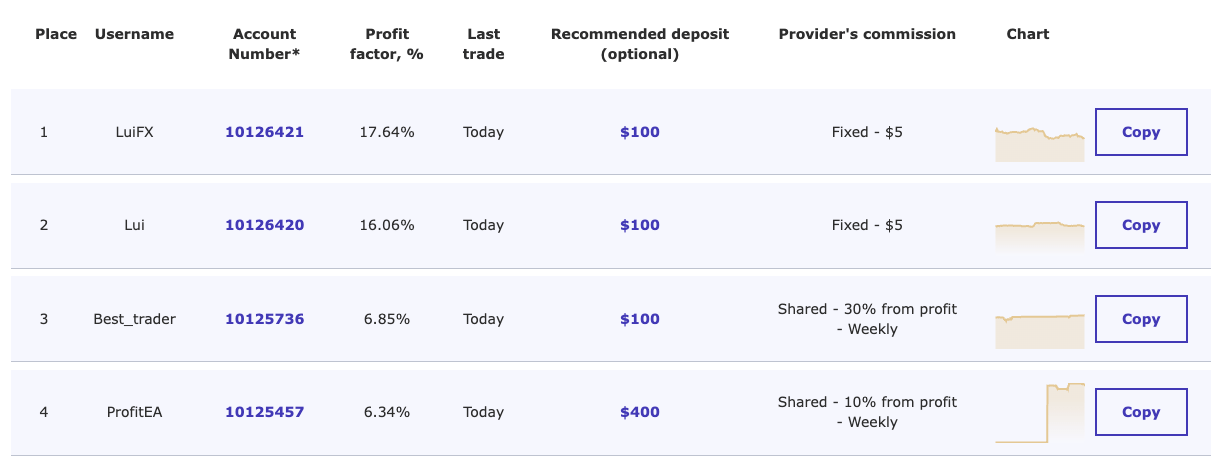

There is also a copy trading function at FXCL, where traders can follow and replicate the trades of other users. Again, this could be suitable for beginners looking to observe trading strategies in real time, or for pros who want to earn a commission.

Copy Trading Leaderboard

Overall, FXCL’s resources and tools are a little underwhelming compared to other brands. It would be nice to see some more comprehensive education materials available to all traders.

For example, XM offers an extensive learning centre with live education, webinars, podcasts and more.

Customer Service

FXCL’s customer support is a little limited, only available via email and live chat. The live chat is at the bottom right of the home screen. The email address is: support@fxclearing.com.

Reliable telephone support is often favoured by traders so it’s a shame that a contact number isn’t offered. Excellent examples of brokers with multi-channelled support include XTB and IG Index.

Company Details & History

FXCL Markets Ltd was founded in 2006. It is regulated by the Financial Services Authority of St Vincent and the Grenadines and has been registered since 2018.

Unfortunately, there is limited information on the company’s background and business operations. This was a concern for our team, raising questions about the legitimacy and trustworthiness of the firm.

Should You Trade With FXCL?

FXCL offers trading on the popular MT4 platform. The range of accounts with competitive pricing means that various strategies and experience levels can be catered to.

However, the range of instruments and absence of FCA regulatory oversight is disappointing. In addition, with the lack of UK-supported payment methods, FXCL wouldn’t be our top pick. Instead, consider leading brokers.

FAQ

Is FXCL Legit Or A Scam?

FXCL has been in operation since 2006 and has been registered with the SVGFSA since 2018. But while a long track record is usually a good sign of legitimacy, the brokerage does not operate with authorisation from the FCA in the UK. Our team also had concerns about the lack of transparency surrounding the company’s background and management. So while it may not be a scam, it doesn’t have a high trust score.

Is FXCL Good For Muslim Traders?

Yes, FXCL offers Islamic-friendly trading conditions on its profiles. An Islamic account can be requested from the customer support team via email or live chat.

Does FXCL Have A Free Demo Account?

FXCL does offer a free MT4 demo account. Prospective clients must follow the same registration steps as a live account. Once you have gained initial access to the client portal, you can open a demo account from there.

Is FXCL Trustworthy?

FXCL is registered with the regulatory body of St Vincent and the Grenadines – the Financial Services Authority (SVGFSA). This is not a strict financial regulator and therefore your funds may not be adequately protected. This is especially true for British traders who may not be protected by the FCA’s rules and regulations.

Does FXCL Charge An Inactivity Fee?

Yes, there are inactivity fees for those that have a live account with FXCL but have not opened any trades for more than 32 days. The fees start from $25 a month, which is much higher than many alternatives. As such, FXCL is not a great option for casual or infrequent traders.

Article Sources

SVGFSA List of Registered Entities (registration number 1637)

Top 3 FXCL Alternatives

These brokers are the most similar to FXCL:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

FXCL Feature Comparison

| FXCL | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 1.8 | 4 | 4 | 4.8 |

| Markets | CFDs, Forex, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $1 | $1,000 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVG FSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:2000 | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | FXCL Review |

Swissquote Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| FXCL | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

FXCL vs Other Brokers

Compare FXCL with any other broker by selecting the other broker below.

Popular FXCL comparisons: