FXCentrum Review 2025

|

|

FXCentrum is #87 in our rankings of CFD brokers. |

| Top 3 alternatives to FXCentrum |

| FXCentrum Facts & Figures |

|---|

FXCentrum is an offshore broker that offers highly leveraged, commission-free trading on diverse instruments with tight spreads. Traders can access forex, equity and commodities markets via MetaTrader 5 or the proprietary FXC platform and use the award-winning ZuluTrade platform for copy trading. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, ETFs, Commodities |

| Bonus | $160 no deposit bonus |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.1 Lots |

| Regulated By | SFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade commission-free CFDs on 3000+ instruments from forex, stock and commodities markets with volumes starting from 0.1 lots, a low minimum deposit of $10 and tight floating spreads. The selection of CFDs beats most competitors. |

| Leverage | 1:1000 |

| FTSE Spread | 2.0 |

| GBPUSD Spread | 0.4 |

| Oil Spread | 0.05 |

| Stocks Spread | Variable |

| Forex | Trade 50+ forex pairs including popular majors and minors with very high leverage available up to 1:1000. Gold, silver, palladium and platinum pairs with USD are also available. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.5 |

| Assets | 50+ |

| Stocks | Trade CFDs on 134 high-market-cap US and global stocks including Alibaba, Microsoft and Pfizer. You can also speculate on broader market movements through 35 indices covering major global exchanges. |

FXCentrum is a global broker offering forex, commodities, stocks, ETFs, indices and crypto CFDs through two trading platforms. The international foreign exchange and CFD broker provides low trading rates, several account options and an accessible interface for those new to the world of finance and speculation. This 2025 broker review of FXCentrum will explore its fees, leverage, deposit and withdrawal options and more.

Company History & Overview

FXCentrum is a registered trademark of WTG Ltd. With its address in Seychelles, the broker is regulated offshore by the Financial Services Authority (FSA) Seychelles. The broker was founded in 2019 and was created by experts from the technology and finance industries. More than £500,000 has been paid so far in bonuses to traders.

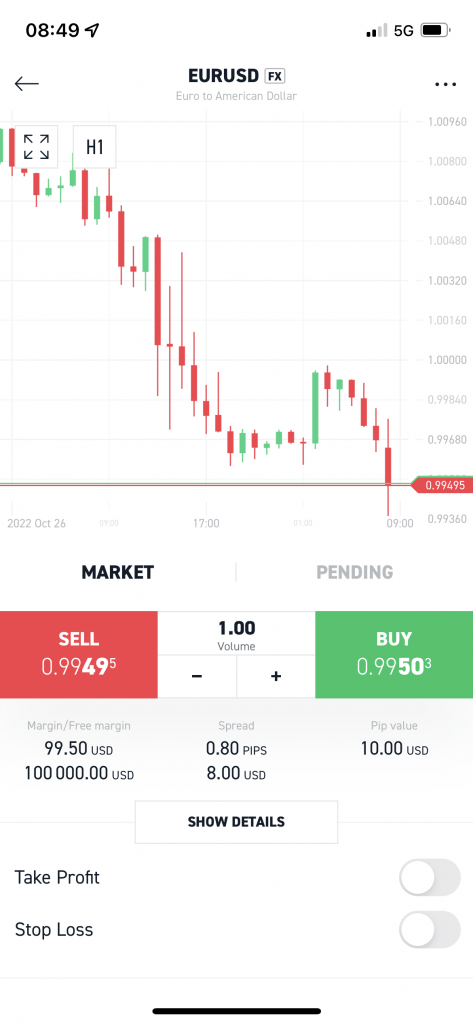

Trading Platforms

FXC Trader

FXC Trader is FXCentrum’s in-house trading platform and can function on iOS, Android, macOS and Windows systems. The webtrader version has an intuitive design and is easy for beginners to navigate, although experienced investors and pros may find it lacks the advanced technical analysis tools found on alternatives like MetaTrader 4.

Our experts reviewed the platform in more detail and found the following:

- One-click trading

- Fast order execution

- Available in 24 languages

- Multi-asset chart overlays

- Built-in economic calendar and market news

FXC Web Trader

MetaTrader 5

MetaTrader 5 is trusted by traders and brokers the world over and FXCentrum is no different. Perfect for both beginners and experienced traders, the platform has a wide range of indicators and timeframes for comprehensive analysis of the markets.

When we reviewed the platform, we found it to have the features below:

- 21 timeframes

- Real-time quotes

- Trading signals and copy trading

- News reports and economic calendar

- 80+ built-in technical indicators and analytical tools

- Algorithmic trading through expert advisors (EAs) and trading robots

- Backtesting to analyse your automated robot performance using historical data

Markets

Over 3,000 instruments are on offer through FXCentrum, including:

- 55 forex pairs

- Stocks and ETFs

- Two crypto CFDs

- 15 indices (including the UK100 and US500)

- 14 commodities (including gold and Brent oil)

Fees

There is zero commission at FXCentrum. Minimum spreads depend on the account type, although the lowest spreads start from a competitive 0.2 pips. On the ZERO Standard account, traders can expect spreads from 0.3 pips on EUR/USD, 0.5 pips on GBP/USD and 0.7 pips on gold. The minimum spread on the FTSE 100 is 2.0 pips. Cryptocurrency CFD spreads are much higher due to the volatility of this particular market. For a Bitcoin CFD, the minimum spread is 120 pips.

Swap rates start from $0.14 and are charged at a rate of 5% per year (USD) for stocks and ETFs.

Leverage Review

As an offshore broker, FXCentrum offers leverage rates of up to 1:1,000, although maximum limits depend on the market:

- Gold – 1:200

- Forex – 1:1,000

- Indices – 1:200

- Crypto CFDs – 1:10

- Stocks & ETFs – 1:10

Mobile Trading

When we used FXCentrum, we found the broker offers mobile trading through the XOH Trader app. Like the FXC web platform, the mobile app has an intuitive design and clear graphs. Investors can use the platform to analyse market sentiment, implement take profit and stop loss orders or use the built-in trading calculator.

It is worth noting that the app is more focused on trading than account management.

XOH Trader

Clients can also download and use the MT5 mobile app. This tool features most of the charting and analysis functionality of the desktop platform but with limited additional functionality, such as robot building using the MQL5 Wizard.

FXCentrum Payment Methods

Deposits

The minimum deposit at FXCentrum is £10 and most deposit methods are instant. No deposit fees are charged by the broker and the following methods are supported:

- Visa

- Kora

- Ozow

- AstroPay

- Help2Pay

- MasterCard

- OnlineNaira

- Wire transfer

- Perfect Money

Withdrawals

Traders get one free withdrawal each month at FXCentrum. There is a £10 charge for the second withdrawal and then a 2.5% charge for withdrawals thereafter. There are no limits on the amount that can be withdrawn.

The maximum processing time for withdrawals is 24 hours but investors should ensure they have uploaded all their account documents to avoid any delays.

Demo Account

While using FXCentrum, we found the online brokerage offers a £100,000 demo account that allows clients to practise their trading strategies using virtual money. Demo accounts are also useful for beginners to get to grips with the platform and learn how to open and close positions seamlessly.

Bonuses & Promotions

FXCentrum offers various promotions to entice traders, although our experts recommend always checking the terms and conditions carefully to ensure they understand the requirements to withdraw promotional funds.

The broker advertises a $160 non-deposit bonus, although this is an aggregate amount and, to get the full $160, investors are required to complete certain tasks including following the broker’s social media accounts and creating viral videos. Some of the tasks are more difficult than others so some may find it challenging to get the full amount.

We found that a 100% deposit bonus is also advertised, though half the value of the bonus is the number of lots that need to be traded to withdraw the bonus funds. Only forex and commodities are taken into account in the number of lots to be traded.

The Highway to Wealth competition puts traders up against one another to close as many profitable positions as fast as possible across a range of assets. The winners are rewarded with valuable commodities and cash prizes.

Regulation

FXCentrum is regulated by the Financial Services Authority (FSA) in Seychelles. The FSA is there to supervise, monitor and regulate licensed entities.

While the FSA does not provide the same level of consumer protection as leading global regulators such as the FCA in the UK or the Securities and Exchange Commission (SEC) in the US, it is still a safer option than opting for a completely unregulated broker.

Account Types

FXCentrum has three account types: ZERO Standard, Special Zero Retention and Micro Zero.

Our experts found that those wanting to start small should opt for the Micro Zero account as it has a low minimum open position (although it only offers 10 instruments). For most traders, we recommend the ZERO Standard account, which has a low minimum deposit and spreads. The Special Zero Retention account is more suitable for experienced traders – it has a high minimum deposit but comes with very low spreads and a Personal Storage Manager.

Further details of each account type are given below:

ZERO Standard Account

- Zero commission

- 3,000+ instruments

- £10 minimum deposit

- Islamic account available

- USD or EUR base currency

- No Personal Storage Manager

- Gold minimum spread is 0.7 pips

- Minimum open position is 0.1 lots

- GBP/USD minimum spread is 0.5 pips

- EUR/USD minimum spread is 0.3 pips

Special Zero Retention Account

- Zero commission

- 3,000+ instruments

- £5,000 minimum deposit

- Islamic account available

- USD or EUR base currency

- Personal Storage Manager

- Gold minimum spread is 0.6 pips

- Minimum open position is 0.1 lots

- GBP/USD minimum spread is 0.4 pips

- EUR/USD minimum spread is 0.2 pips

Micro Zero Account

- 10 instruments

- Zero commission

- USD base currency

- £10 minimum deposit

- Fixed and floating spreads

- No Islamic account option

- No Personal Storage Manager

- Gold minimum spread is 1.8 pips

- Minimum open position is 0.01 lots

- GBP/USD minimum spread is 2 pips

- EUR/USD minimum spread is 2 pips

How To Invest On FXCentrum

1) Open An Account

To sign up for an account, investors should click on the “Start Trading” button displayed clearly at the top of the FXCentrum website. In addition to entering their personal details, clients will need to verify their email addresses and upload their IDs.

2) Deposit Funds

Once you can login, the next step is to deposit funds. Minimum deposit amounts vary depending on the account type. Most deposit methods are instant and all are free.

3) Open A Position

Timing the opening of a position can be difficult. We recommend using a mixture of fundamental and technical analysis, depending on the market you are trading in. You should also ensure you are aware of important financial announcements and key economic indicators by using FXCentrum’s built-in economic calendar; these can greatly impact forex exchange rates and other asset prices.

The relations a company has with its investors are also important. Use educational and market analysis resources to stay on top of developments and remember that different markets have different levels of risk. For example, the crypto market is more suitable for high-risk/high-reward traders. In contrast, major stocks and indices are generally more appropriate for investors looking for a steady rate of return.

Benefits Of FXCentrum

- MT5 access

- Low spreads

- Copy trading

- High leverage

- Zero commission

- Low minimum deposit

- Good customer support

- Intuitive trading platform

- Negative balance protection

- Free deposits and withdrawals

Drawbacks Of FXCentrum

- Regulated and registered offshore

- Limited assets with the Micro Zero account

- High minimum deposit to access the lowest spreads

- Promotions come with stringent terms and conditions

Additional Features

This broker has linked up with ZuluTrade, an automated social trading platform that allows traders to follow signal providers and copy their positions. This is a free service for customers of FXCentrum and there are over 100,000 signal providers to choose from. In addition, the broker has its own free signals service.

To help investors make profitable investments, FXCentrum also provides the following:

- Education guides

- Economic calendar

- Webinars on YouTube

- Basic terminology/glossary

- Latest market news and analysis (more facts rather than opinions)

Note that this broker does not have its own forum, trading journal, quiz or podcasts.

Trading Hours

Trading hours at FXCentrum depend on the market in question, whether it be in the USA, UK or elsewhere. Stocks, for example, will generally be restricted to the hours of the exchange they trade on and investors should also watch out for public holidays. Cryptocurrencies, on the other hand, provide an opportunity for 24/7 live trading.

Customer Support

FXCentrum has multiple customer support options available and the company assures traders that it will respond to all enquiries within 24 hours. Clients can contact the broker using the following:

- Online contact form

- Phone: +44 752 0642602

- Email: support@fxcentrum.com

- Social media, including Facebook and Twitter

There is also an extensive FAQs section relating to account management and investing.

Security

FXCentrum is not a member of an investor compensation fund. This means that, in the event of insolvency, customer deposits may be at risk. It is also not clear whether the broker uses segregated accounts to separate client funds from those belonging to the firm.

3D Secure is used for all deposits and withdrawals to enhance payment method security. Traders can also enable two-factor authentication (2FA) to bolster their account security.

Should You Trade With FXCentrum?

There is always an increased risk in choosing a broker regulated and registered offshore. That said, FXCentrum is a global firm that is regulated by the FSA and provides a wide range of markets with low fees, in addition to offering MT5 and an in-house platform. The broker also offers high leverage rates, a suite of promotional offers and several useful additions, including copy trading and free transactions.

FAQ

Is FXCentrum A Scam?

Although registered and regulated offshore, FXCentrum is under the jurisdiction of the FSA and so is unlikely to be a scam, although customers will generally have fewer protections.

Does FXCentrum Allow Scalping?

No. This broker states that scalping is against its rules and does not allow it.

Why Are Spreads On Cryptocurrency So High At FXCentrum?

Floating spreads in volatile markets tend to be larger. As one of the most unstable markets, cryptocurrency spreads can be much higher than assets in other markets.

What Is The Minimum Deposit at FXCentrum?

The minimum deposit is £10. This is low compared to many other brokers and makes FXCentrum accessible to beginners.

Does FXCentrum Provide The TradingView Platform?

No. There is no integration with the TradingView platform.

Top 3 FXCentrum Alternatives

These brokers are the most similar to FXCentrum:

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

FXCentrum Feature Comparison

| FXCentrum | Vantage FX | Swissquote | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.3 | 4.7 | 4 | 4.8 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $10 | $50 | $1,000 | $0 |

| Minimum Trade | 0.1 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SFSA | FCA, ASIC, FSCA, VFSC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | $160 no deposit bonus | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | FXCentrum Review |

Vantage FX Review |

Swissquote Review |

Pepperstone Review |

Trading Instruments Comparison

| FXCentrum | Vantage FX | Swissquote | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

FXCentrum vs Other Brokers

Compare FXCentrum with any other broker by selecting the other broker below.

Popular FXCentrum comparisons: