FTX Review 2025

See the top 3 alternatives to FTX or the best UK brokers list for options.

|

|

FTX is #83 in our rankings of crypto brokers. |

| Top 3 alternatives to FTX |

| FTX Facts & Figures |

|---|

FTX is a cryptocurrency exchange that offered a vast array of derivatives products and digital tokens. However, the company collapsed and filed for bankruptcy on November 11, 2022 after a wave of withdrawals revealed that the firm has mismanaged client funds and did not have sufficient liquidity. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos, Futures, Options |

| Demo Account | No |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Cryptocurrency | FTX supports crypto trading on hundreds of major tokens by way of spot trades and derivatives contracts. This includes access to popular cryptos like Bitcoin, Ethereum and Litecoin. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | Yes |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | Yes |

The FTX exchange is one of the fastest-growing crypto trading services of 2022. The platform offers a considerable asset variety and a range of derivative and investment options, such as leveraged tokens, staking features and perpetual futures contracts. This 2025 FTX exchange review will cover all you need to know about the company, including any exchange fees, the integrated NFT marketplace, the FTX token (FTT) and yield farming capabilities.

About FTX

FTX was launched in 2019 by owners Sam Bankman-Fried and Gary Wang. Each founder is still with the company, acting as CEO and CTO, respectively. Shortly after its foundation, the company acquired the cryptocurrency portfolio management app Blockfolio, integrating its technology into the FTX platform. The company headquarters was moved from Hong Kong to the Bahamas in late 2021, though the firm operates offices around the globe.

Significant marketing investment has seen the platform rise to prominence, with high profile sponsorships with the MLB, Mercedes F1 team and esports team TSM cementing its place as a widely recognised crypto broker. FTX has funding from several significant investors, such as SoftBank and Third Point Management, while a recent valuation placed the platform’s net worth at $32 billion.

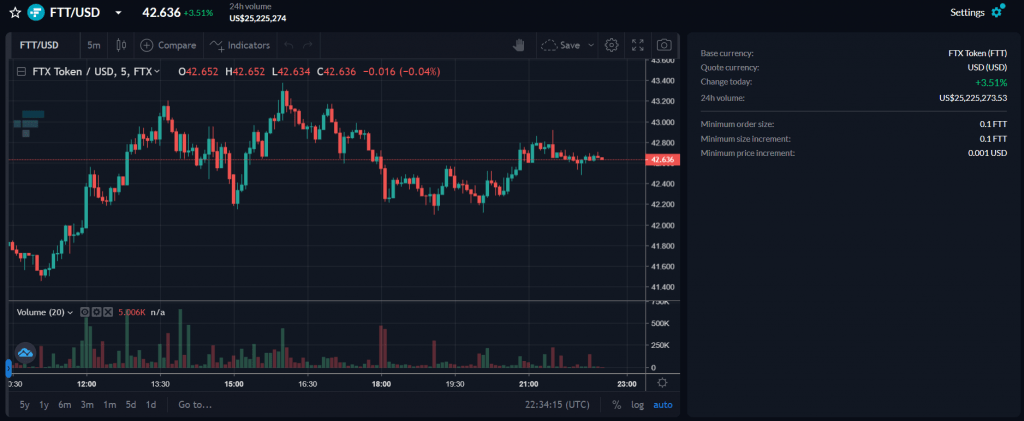

FTX Platform

FTX operates a browser-based trading platform powered by TradingView that allows clients to view live quotes and trade on the crypto markets. There is no desktop app currently available, with the browser-based platform and FTX Pro mobile app used to manage a traders’ wallet and account.

Trading Platform

With graphs featuring historical data of up to three years, traders can use over 80 indicators, such as the zig-zag tool and Bollinger bands, to conduct technical analysis and predict price trends. In addition, clients can view graphs in 13 temporal intervals with a choice of scale options, including logarithmic and percentage change, and multiple assets can be added to the same chart to compare performance.

FTX Web Platform

Order books provide live quotes from the markets while a range of buy and sell options are available, such as limit orders, take profit prices and stop-loss levels. Experienced traders can create advanced trading strategies in the FTX quant zone, which automates trading based on user-defined rules.

Mobile App

The FTX Pro app is available on both Android and iOS devices to provide access to the FTX platform when away from the computer. The app offers all of the browser-based platform’s trading functionality, featuring live quotes from the same markets and assets. Additionally, traders can login to the app and manage their accounts, update KYC information, add tokens to the FTX staking program or make fast deposits and withdrawals.

Markets & Assets

The FTX exchange provides a competitive range of crypto instruments, going far beyond the standard range of spot products. These include crypto futures, leveraged tokens, volatility tokens and event predictions. However, as the FCA has banned the sale of crypto derivatives to UK markets, these are not available to UK traders.

Spot Trading

A favourite of long term or low-risk investors, the spot markets form the staple of any crypto exchange, allowing clients to purchase or sell crypto tokens with other traders. FTX provides over 250 crypto trading pairs, with USD and EUR pairs available for direct fiat-to-crypto trading. Supported tokens range from well-known coins like BTC, ETH and XRP to smaller market cap altcoins like YGG and PRISM

Stock Tokens

Tokenised stock trading allows clients to purchase shares, ETFs and futures of major US companies through the FTX platform. Many of the biggest global tickers, such as TSLA, AAPL and FB, are available, with the added benefit of out-of-hours trading. If requested, spot tokens can be exchanged for underlying shares, while futures markets are cash-settled upon expiry.

In addition to USD pairs, users can exchange limited crypto pairs, such as TSLA/BTC and TSLA/DOGE, through FTX. To deal in tokenised stocks, users must be at least KYC level 2.

Fiat Exchange

FTX also provides a range of currency pairs that allow traders to exchange USD with several fiat and digital currencies, including the USDT stablecoin. Pairs such as GBP/USD and CAD/USD allow clients to swap from deposits in their local currency to the platform’s accepted USD at competitive rates or to speculate on the forex markets for profit.

OTC Trading

FTX also offers an over-the-counter (OTC) trading facility for instant crypto dealings. In an OTC transaction, you buy directly from FTX, with the broker taking the other side of your trade, rather than purchasing from other traders.

Based on your volume and current market price, the broker will provide clients with a quoted price for a trade that remains valid for 15 seconds. Once a transaction is complete, clients are free to sell, stake or hold their crypto as they wish.

FTX Services

Staking

Staking is a popular method of yield farming, which involves gaining interest from lending out crypto tokens either to the blockchain network to help verify transactions or as a loan to a third party. FTX operates its staking program through the former method and facilitates this for four tokens: FTT, SOL, SRM and RAY.

Clients that stake their Solana will receive a yield paid in SOL tokens of around 6% APY, while SRM stakers receive 4% APY and staking RAY can earn you up to 20% APY. Yield can be increased further by staking your rewards and compounding this interest.

Things are a little different for FTT. Purchasing and staking certain amounts of this token entitles clients to benefits when trading on the FTX platform. These benefits include rebates on trading fees, tickets to IPOs (new listings on the exchange) and an increased number of free ERC20 and Ethereum token daily withdrawals.

FTX Card

FTX plans to bring a debit card to market for traders worldwide, allowing users to use their crypto wallet balance to make purchases with millions of merchants. Crypto will be exchanged into fiat currency on-demand, free from administrative or processing fees. However, the method of calculating exchange rates from crypto to fiat is not specified.

While the FTX card is available in the US, interested parties in the UK, EU and the rest of the world must sign up to the waitlist to receive notification of when the card is available in their region.

NFT Marketplace

The FTX NFT marketplace provides traders with the opportunity to bid on collections and singular NFTs. However, NFTs available on the international FTX platform are limited, while the US broker offerings are far more substantial, featuring well-known creations such as the Bored Ape Club and Coachella Keys. In addition, depositing and minting NFTs is also limited to the US platform.

Borrowing & Lending

FTX offers clients access to both sides of the margin lending market. Traders can make their assets available for borrowing or enable margin trading to borrow funds automatically when trading beyond your account balance. Traders set up minimum lending rates when loaning out tokens but receive the highest interest level if loaned successfully.

Along with fiat currency and crypto tokens, stock tokens can be borrowed or lent out to traders. Rates are set by the exchange rather than fixed and can be volatile for lower volume tokens, so ensure that you stay on top of interest requirements if borrowing. A range of non-USD collateral options is available, although different assets will entitle traders to borrow at different margin levels.

Quant Zone & API Access

The FTX quant zone allows clients to set instructions for automated trading through the existing platform. For those who wish to use customised programs to trade, FTX offers complete REST, WebSocket and FIX APIs to suit your algorithmic trading needs. These APIs offer live access to the FTX exchange, NFT markets, historical data for backtesting and account information.

FTX Token

In addition to benefits earned from staking FTT, simply holding the token in your FTX wallet entitles you to further privileges. Account tiers are based on the USD value of a clients’ FTT holdings, with fee rebates on either exchange trading fees or OTC purchases, depending on where the tokens are held.

A discount of up to 60% on exchange fees is available in the highest tiers and traders with less substantial FTT holdings are also reasonably rewarded. Clients with over $2.5 million in FTT also qualify for the VIP program, while an FTT balance of over $5 million entitles clients to the second tier of the VIP program with even lower fees.

Trading Fees

Trading fees are an integral part of any platform, with many prioritising low charges when choosing an online exchange. There are no account management or futures settlement fees with FTX. In addition, move tokens may be subject to fees based on the margin borrowing rates of the underlying spot market.

While there are no fees for FTX OTC transactions, exchange trading is subject to maker and taker fees, starting at 0.02% and 0.07%, respectively. These charges are competitive and beat many other exchanges, even at this basic level. This said, owning or staking FTT, meeting trading volume requirements or qualifying for a VIP or market maker program can reduce these fees.

FTT Rebates

Traders can earn a discount on these trading fees based on the amount of owned or staked FTT tokens in their wallets. For example, holding FTT in a trading wallet entitles you to holistic exchange fee discounts of up to 60%, while staking only 25 FTT enables a 0% maker fee.

Account Tiers

FTX operates with six tiers of account levels that determine exchange maker and taker fees, as well as a VIP and Market Maker program for the most active market participants.

Account tiers are based on trading volume, though most retail clients will not qualify for a higher account level, with a tier 2 minimum volume of $2 million over 30 days. Account tiers range from the basic level at tier 1 to up to tier 6, which has a 0% maker fee and 0.04% taker charge.

To reduce taker fees further, traders must qualify for VIP tiers that require a contribution of over 0.5% of the total exchange volume. This level sees taker fees reduced to 0.03%, which can fall to 0.025% in VIP tier 3. Additionally, VIPs also receive exclusive benefits, such as a personal account manager, access to VIP meet-ups and input into new FTX projects.

The market maker program provides rebates on maker fees, financially compensating qualifying traders for providing liquidity to the FTX market. Taker fees are not affected by this program.

FTX Mobile Platform

Leverage

UK FTX clients cannot access leveraged tokens or manually leverage their trades by borrowing a margin from other clients as the FCA restricts the practice.

Pros Of FTX

- OTC markets

- Competitive fees

- Tiered fee rebates

- Wide range of assets

- Native token rewards

- Crypto borrowing & lending

- Round-the-clock stock tokens

- Advanced automated trading & API support

Cons Of FTX

- No demo account

- Limited staking support

- Some larger tokens missing

- No GBP or EUR crypto pairs

- Possible high withdrawal fees

Deposits & Withdrawals

FTX clients can fund and empty their trading accounts via wire transfers, instant interbank transfers and credit card payments. Deposits are supported in a range of fiat and crypto pairs, including USD, EUR, GBP, AUD and CAD. Other currencies can be converted to USD using the exchange rates offered by the FTX wallet or through the platform’s forex pairs.

There is no minimum deposit limit, though withdrawals must be more than $100. There is no limit on crypto withdrawals.

Transfer Fees

FTX does not charge deposit fees on fiat transfers and allows one free withdrawal per week. Additionally, those that stake more than 25 FTT tokens receive another free withdrawal. However, significant withdrawal charges apply on subsequent transfers under $5,000. Traders in the UK must pay £75 to withdraw GBP, though EUR and USD withdrawals are significantly cheaper at €32 and $25, respectively.

There are no deposit or withdrawal fees for crypto transfers other than Ethereum network withdrawals of ETH or ERC20 tokens, in which FTX passes on the gas fee to clients. However, FTT staking tiers entitle traders to additional free daily Ethereum network trades.

Security & Regulation

FTX prides itself on the security of its platform, with KYC protocols stringently enforced to protect traders from fraud and a mandatory two-factor authentication (2FA) setup on all accounts to enhance client safety. Moreover, traders can safelist withdrawal methods to prevent fraudulent withdrawals to other addresses. At the same time, significant account modifications, such as a password or 2FA change, are monitored by the broker, which can suspend withdrawals upon noticing suspicious activity.

The exchange is regulated in its home jurisdiction by the Securities Commission of the Bahamas and also licensed by the Gibraltar Financial Services Commission. FTX holds a licence in Switzerland to provide its tokenised stocks service, with underlying assets provided by CM-Equity and DAAG.

Customer Support

FTX provides a comprehensive support section that features an abundance of articles on everything from sign up and registration, trading fee structures and non USD collateral weighting to negative USD balance allowances. The platform also runs a YouTube channel, complete with guides and podcasts from leading traders and staff.

Support is also available directly from customer service by creating a support ticket via either the main website or the help site. Communication is made via email so that traders that are unable to log into their account or those that do not yet have an account can access help.

Trading Hours

The FTX exchange and OTC services operate around the clock, seven days a week. Tokenised stocks also trade on the platform outside of market hours, a feature that will be welcome to many traders.

Charitable Ventures

FTX has pledged that 1% of all net fees will be donated to charities through the FTX Foundation, which aims to distribute funds between the most effective charitable organisations worldwide. Over $18 million has been collected through this scheme so far, comprising fee allocation and trader donations, which FTX will match, up to a daily limit.

FTX also operates a climate-specific arm of its foundation, pledging at least $1 million per year to help solve climate-related issues. The platform has achieved carbon neutrality and allocates funds towards solar energy initiatives and carbon removal programs.

FTX Verdict

FTX is an attractive platform for crypto traders, offering a wide range of cryptocurrencies and stock tokens. Competitive exchange fees and algorithmic trading support will entice regular traders, while clients that would like to pay for everyday items with their crypto holdings will undoubtedly be interested in the upcoming FTX debit card. However, a limited international NFT marketplace may drive traders to the US platform, while a lack of native non-USD stock and crypto pairs may put others off.

FAQ

Is FTX A Good Exchange?

The FTX exchange has many positive aspects, such as competitive fees, plenty of assets and automated trading capabilities. However, there are also negatives to consider, such as limited free withdrawals.

Is FTX A Good Investment?

Despite a significant range of crypto spot markets for investment, limited staking options mean that traders looking to earn interest from long-term holdings may want to look elsewhere.

Is SpaceX Sponsored By FTX?

There are no plans for FTX to sponsor SpaceX, nor can its stock be traded through FTX, due to its private ownership.

Does FTX Offer A Demo Account?

Unfortunately, FTX does not offer a demo account to practice trading.

Is FTX A Decentralised Exchange?

FTX operates as a centralised exchange, though there are plans for the company to build a decentralised exchange on the Serum platform.

Top 3 FTX Alternatives

These brokers are the most similar to FTX:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

FTX Feature Comparison

| FTX | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 0.3 | 4.3 | 4 | 4.7 |

| Markets | Cryptos, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $1 | $0 | $1,000 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | FTX Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| FTX | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

FTX vs Other Brokers

Compare FTX with any other broker by selecting the other broker below.

Popular FTX comparisons: