Fortrade Review 2025

|

|

Fortrade is #77 in our rankings of CFD brokers. |

| Top 3 alternatives to Fortrade |

| Fortrade Facts & Figures |

|---|

Fortrade is a multi-asset, multi-regulated broker with branches regulated by the FCA, CySEC and ASIC among others. The brand offers trading opportunities on a wide range of instruments including stocks, bonds, commodities, forex, indices, cryptocurrencies and ETFs, with competitive fees and support for MetaTrader 4 and a proprietary platform. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, DMAs, ETFs, bonds |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Trading App |

The Fortrader mobile app can be used to trade 60+ currency pairs. Clients can also access daily market insights and manage deposits and withdrawals via the application. The forex trading app is available from the Apple App Store and Google Play. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, CySEC, NBRB, FSC, CIRO |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Fortrade's list of leveraged CFDs covers a wide range of asset classes including forex, stocks, bonds, indices, commodities and cryptocurrencies. Traders can access leverage up to 1:30 and will trade with zero commission, fast execution and low latency on MetaTrader 4 or the bespoke platform. |

| Leverage | 1:30 (varies by entity) |

| FTSE Spread | 2 |

| GBPUSD Spread | 2 |

| Oil Spread | 0.04 |

| Stocks Spread | Variable |

| Forex | Fortrade offers 60+ currency pairs including a good selection of majors, minors and exotics. Trading takes place via MT4 or Fortrade's proprietary, low-latency terminal, and spreads on the USD/GBP pair average a reasonable 2 pips. |

| GBPUSD Spread | 2 |

| EURUSD Spread | 2 |

| GBPEUR Spread | 3 |

| Assets | 60+ |

| Stocks | Fortrade offers leveraged CFDs on a wide range of stocks from the UK, US, Hong Kong, Australia and a range of European companies with variable spreads and no commissions. CFDs are derivative contracts that do not entail ownership of the underlying stock. Professional traders can also access a decent list of Direct Market Access stocks. |

Fortrade is an online broker that facilitates CFD trading through its own desktop software and mobile app, plus MT4. Multiple payment methods are supported and new clients can get started in three steps. But is Fortrade.com a good broker for UK traders? This 2025 Fortrade review uncovers the pros and cons of creating a live account, from spreads and fees to minimum deposits, no deposit bonuses, withdrawals, safety ratings, and more.

Fortrade is an FCA-regulated CFD broker with its own trading platform and no limitations on trading styles and strategies. The firm also offers some non-standard instruments, including bonds and ETFs. On the downside, spreads are wider than some alternatives and there is no copy trading.

Company History & Overview

Launched in 2013, Fortrade Ltd was created with the aim of improving access for individuals who want to invest in a range of international markets, including stocks, forex and commodities. Alongside powerful trading technology, the brokerage offers a good range of educational materials to help beginners get started with the financial markets.

The brand has grown to become a popular choice for traders across the globe with offices in Australia, Belarus, Canada, Cyprus, and Mauritius in addition to the London headquarters. The current group CEO is Chris Warburton.

Fortrade is regulated by the FCA and is a member of the FSCS.

Markets & Instruments

Fortrade offers a wider range of trading assets than many competitors. Account holders can speculate on:

- Stocks – 350 stocks from various global exchanges, including 74 from the London Stock Exchange

- Forex – 50+ major, minor and exotic currency pairs, including nine with GBP

- Indices – 18 indices such as the FTSE 100 and the NASDAQ 100

- Energies – Brent crude oil, West Texas crude oil, heating oil, gasoline and natural gas

- Agricultural – Corn, cotton, soybeans, sugar and wheat

- Metals – Gold, silver, platinum, palladium and copper

- US Treasuries – US5Y note, US10Y note and US30Y bond

- ETFs – TQQQ, SQQQ and USO oil fund

On the downside, cryptocurrency trading is not available to UK traders.

Leverage

As per regulations laid out by the FCA and ESMA, Fortrade is limited in terms of the maximum leverage it can offer to UK traders:

- For the majority of commodities, leverage is limited to 1:10, except for gold which is 1:20

- For many indices, the maximum leverage is 1:10, whereas trades on some indices such as the FTSE 100 are capped at 1:20

- The maximum leverage limits for the majority of major, minor and exotic forex pairs are 1:30, 1:20 and 1:5, respectively

- Clients can leverage stock and ETF trades up to 1:5 unless they are DMA stocks, in which case trading on margin is not permitted

- Positions on US Treasures assets can be leveraged up to 1:10

These are standard rates among UK-regulated brokers.

Trading Platforms

Our experts were pleased to see Fortrade offers its own trading platform as well as the popular MetaTrader 4.

Fortrader

Fortrade launched a proprietary platform that is available to all clients for free. It is a slick and well-made terminal that comes with two types of trade execution, both with stop loss and take profit orders.

It is easy to navigate the platform and find the instrument you want to trade using the drop-down list on the left-hand side of the screen. From here, clicking on the asset brings up its price history chart and you can use a range of trend, oscillator, volatility and volume indicators to conduct technical analysis. For example, MACD, Bollinger Bands and moving averages.

It is also easy to customise the platform to suit your style and strategy with time frames ranging from one minute up to one month.

How To Place A Trade

- Sign in and go to the Fortrade platform

- Find your chosen asset from the drop-down list

- Click on either the ‘Buy’ or ‘Sell’ button to open an order tab

- Select either ‘Trade’ for market execution or ‘Order’ for a pending order

- If market execution, specify the amount, direction and whether to include stop loss and take profit orders

- If pending order, you must also include the direction and the price that the order will be trigged at

- Confirm the trade using the button at the bottom of the tab

- You can monitor your position in the ‘Open Trades’ section at the bottom of the platform

- To close a trade, click on the ‘X’ connected to the order and confirm

MetaTrader 4

MetaTrader 4 is a world-leading platform created by Meta Quotes. It is one of the most popular terminals for strategising as it comes with over 50 analytical objects and indicators in addition to 2,000 downloadable tools from the MetaTrader Market.

For extra help, the platform comes with in-built economic alerts and news so you can stay up-to-date with anything that could impact your portfolio. Other benefits of using MT4 include one-click trading, trading robots as well as instant, request and market execution options.

Spreads & Commissions

Fortrade receives an average rating in terms of costs, with more competitive fees on popular assets available at alternative brokers, such as Plus500 and eToro.

The brokerage primarily makes its money through spreads, which is the difference between the bid and ask price of an asset and which changes throughout market trading hours. All clients have access to floating spreads of one pip and above. To see the average spread for each asset and market, view the trading product details page on the Fortrade website.

Additionally, Fortrade charges for swaps and rollovers, which are fees placed on positions held overnight. These can vary depending on the direction (long vs short), instrument and the day of the week (Wednesday night is three times the normal rate). Fortrade essentially closes and reopens positions, so you will need to cover the spread.

Finally, there is a dormancy fee of £10 if an account is inactive. This begins after six months of no trades being made and is charged every month until a position is opened.

Fortrade Accounts

Fortrade offers only one live account and so every client has access to all features and tools available on the website at no extra cost. There is also the option to register for a demo account, which uses simulated funds rather than real money and so provides a risk-free way to practise trading with Fortrade.

To begin investing with Fortrade, you will need to provide information such as employment status, annual income and source of funds. You will also need to submit documents showing proof of identity and address to be reviewed by the customer support team, a process that can take several hours.

On the downside, high-volume traders may be disappointed to see that the broker does not offer multiple account tiers with fee rebates, personalised support, and exclusive events typically available for VIP traders.

How To Open An Account With Fortrade

- Follow the ‘Visit’ button at the top or bottom of this Fortrade review

- Input your name, email address and phone number and click ‘Next’

- Type in your home address

- Specify the currency (GBP available), password and your date of birth

- Confirm you want to open an account

Payment Methods

Deposits

To deposit funds to Fortrade, there are several available methods. This includes credit and debit cards, online bank transfers, Bitcoin and e-wallets Skrill, PayPal and Neteller. The support for crypto payments in particular is good to see, and not available at all brokers.

For all methods except bank transfer, the first deposit must be at least £200 and all subsequent must be £100 or more. The bank transfer minimum deposit is £250 and can take up to seven business days to complete. It is worth noting that the minimum deposit requirement is higher than some other brokers, which may deter beginners.

If you use an e-wallet or Bitcoin, you will need to take a screenshot as proof and send it to the Fortrade customer support team to confirm the deposit. Once the deposit has been reviewed and confirmed by the team, the funds will show up in your online trading account. While it will not be instant, this process should be completed within a day. If you instead use a credit or debit card, the deposit is processed immediately.

Fortrade does not charge any fees for deposits.

How To Make A Deposit

- Sign in to your Fortrade account on either the mobile app or the homepage

- Click on the ‘Add Funds’ button in the top right corner

- Select the deposit method, such as a debit card

- Specify the amount you wish to deposit, noting the £200 minimum requirement

- If using a credit or debit card, input the payment information. For all other methods, there will be a pop-up taking you to the page of your chosen method, where you confirm the payment request

- Wait for the funds to transfer

Withdrawals

Fortrade mandates that clients must use the same withdrawal method and account that they used for their deposit. To request a withdrawal, you will need to email the support team and tell them the amount you wish to withdraw and the account ID that it will be deposited to. When we used Fortrade, we were disappointed that there is no automated withdrawal system – you have to email the customer service team.

If you withdraw funds using a bank transfer, you will need to wait up to five business days for the funds to be withdrawn. For credit and debit cards this can take 15 days and for e-wallets and Bitcoin, the process will take a few days. This is much slower than some competitors who offer same-day withdrawals.

Fortrade does not charge withdrawal fees and if you experience any withdrawal problems, contact the customer support team immediately.

Fortrade Mobile App

There are mobile apps available for both the Fortrade platform and MT4 with download links to the Apple App Store and Google Play Store on the website. But while the Fortrade app is available on both iOS and Android devices, MT4 is only available on Android.

The Fortrade app offers identical functionality as the desktop software and webtrader, meaning customisable charts and graphs, advanced order types, plus one-click trading. The broker’s own application also has low memory and latency, ensuring fast and reliable trade executions. Importantly, while using Fortrade’s app, we didn’t experience any technical issues or crashes.

Fortrade Android App

FCA Regulation

Fortrade holds a license with the Financial Conduct Authority (reference number 609970), which demonstrates that it is a legit broker and not a scam. Because of this, clients have access to protections such as the ability to claim compensation from the FSCS of up to £85,000 if the broker becomes insolvent.

Traders also benefit from negative balance protection and segregated client accounts. These measures mean traders cannot lose more than the capital in their accounts and that the company does not hold client and firm money in the same bank account.

Customer Service

There are several contact options if you need help from the Fortrade customer service team. If you have an enquiry or experience issues such as the app not working, you can seek support through:

- Live chat on the website

- E-mail support@fortrade.com

- Call the phone number at +44 2039 664506

- Social media accounts on Facebook, Twitter and YouTube (latest company news)

- Contact form

- FAQ section

When we tested the live chat support, we received a response within a couple of minutes. Support staff were also knowledgeable about the broker’s range of trading tools and accounts.

Extra Tools & Features

To help aspiring investors, Fortrade runs several support programmes. This includes daily and weekly market analysis reports and overviews to offer insight from experts and experienced investors. A free economic calendar is also available.

In addition, there is an academy with online seminars covering topical information as well as foundational knowledge that could prove useful to traders of all experience levels. For example, both beginner and advanced trading courses. Moreover, there are free eBooks you can read in your own time that discuss topics such as forex, commodities and CFDs.

On the downside, we would have liked to see increasingly popular tools like copy trading. This would bring the broker in line with top-tier trading firms in the UK.

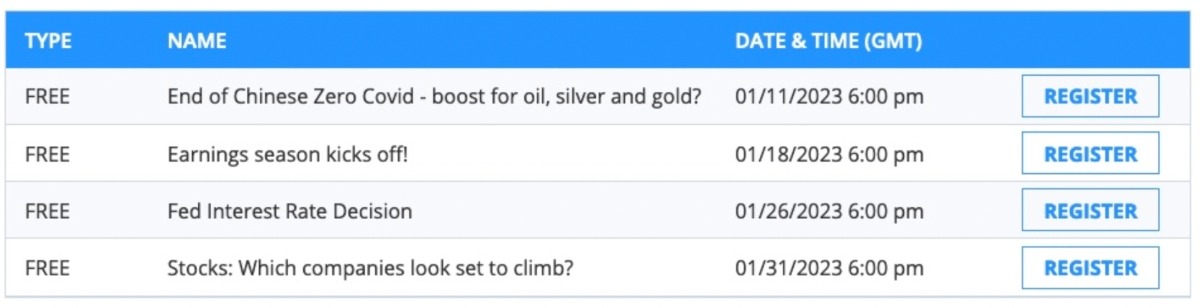

Webinars

Trading Hours

Fortrade trading hours relate to the market and instrument you are investing in. For instance, almost all forex can be traded between 9:01 PM Sunday and 20:59 PM Friday. Whereas, stocks will depend on the exchange. For example, stocks on the LSE can be traded between 8:01 AM and 4:29 PM while the NYSE is open between 10 AM and 20:59 PM.

For the breakdown of opening hours for all markets and exchanges, see the Fortrade.com website. All times are quoted in GMT.

Should You Sign Up With Fortrade?

Fortrade is a high-quality FCA-regulated brokerage. With both MT4 and the broker’s own trading platform, investors can open trades and monitor positions using a computer application, mobile app or web trader. With a wide range of instruments and assets, Fortrade also makes it easy for UK- based investors to speculate on global markets. Finally, an extensive education and training section provides various tutorials and helpful tips to further boost clients’ investing knowledge.

To improve its rating further, we would like to see the broker introduce copy trading, more competitive spreads, and speed up withdrawal timelines.

FAQ

Is Fortrade Legit Or Is It A Scam?

Fortrade is a legitimate online investment broker with positive user opinions and ratings. The company is regulated by the FCA and offers negative balance protection. You can rely on it to process your trades and withdraw funds when you submit a withdrawal request form.

Be sure not to get mixed up with clones such as Fortrades Ltd by checking the logo and name of any correspondence, website or app.

Does Fortrade Offer Islamic Trading?

Yes, investors can open a swap-free account that aligns with Sharia law. After you complete the account registration process, simply email the Fortrade support team to request an Islamic account. Note that certain instruments are wider by at least four pips.

Is Fortrade A Good Broker?

Fortrade is a good broker. It offers a wide range of markets from forex and commodities to stocks, indices and bonds that can be traded on both MetaTrader 4 and the broker’s proprietary platform. To form your own opinion, sign up for a demo account with $10,000 in virtual funds.

How Do I Close My Fortrade Account?

To delete your Fortrade account, contact the customer support team by email. You may need to provide your Fortrade.com login information. Also be sure to close any open positions and withdraw any funds beforehand.

Is Fortrade A Regulated Broker?

Yes, the Fortrade Limited London branch holds a valid license with the Financial Conduct Authority, reference number 609970. This means the trading firm is relatively safe and secure. Account holders also get access to the Financial Services Compensation Scheme (FSCS), which can reward clients with up to £85,000 should the company go under.

How Can I Deposit Funds To Fortrade?

Fortrade accepts deposits made using credit and debit cards, bank transfers, e-wallets and cryptos. Credit and debit cards are the best options as funds are transferred immediately. All other payment methods take longer as you need to submit proof of the deposit to the customer service team.

Top 3 Fortrade Alternatives

These brokers are the most similar to Fortrade:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Fortrade Feature Comparison

| Fortrade | IG Index | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4.7 | 4 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, DMAs, ETFs, bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $0 | $1,000 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, CySEC, NBRB, FSC, CIRO | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 (varies by entity) | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Fortrade Review |

IG Index Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| Fortrade | IG Index | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Fortrade vs Other Brokers

Compare Fortrade with any other broker by selecting the other broker below.

Popular Fortrade comparisons: