Best Brokers and Trading Platforms UK 2025

We review and list the best UK brokers in 2025 in our large annual test of all the trading platforms that accept British traders. The UK is one of the financial capitals of the world making it a hotspot for online brokers, not all of which are safe to trade with. To find the best online broker for you, see our list of the highest rated and most recommended UK trading platforms below.

Top Rated UK Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

Interactive Investor are a hugely respected, FCA-regulated investing firm. The trading platform is easy-to-use while the sign-up and deposit process is straightforward for new investors. ii also has a long track record and a string of industry awards under its belt.

-

Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

-

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

-

Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

Established in 2017, Pocket Option is a binary options broker offering high/low contracts on forex, stocks, indices, commodities and cryptocurrencies. With over 100,000 active users and a global reach, the platform continues to prove popular with budding traders.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Founded in 2008, NordFX is an offshore CFD broker offering forex, stock, commodities, indices and crypto trading to over 1.7 million clients in 190 countries. Traders access markets through the MT4 and MT5 platforms and benefit from low commissions, spreads from zero and decent extra features. Minimum deposits start from just $10 and very high leverage is available up to 1:1000.

-

IQCent is an offshore binary options and CFD broker based in the Marshall Islands. The brand continues to offer a range of unique account types with bonuses and perks, including payout boosts, TradeBacks and free rollovers. With 100+ assets, around-the-clock trading and 98% payouts, the firm is popular with aspiring short-term traders.

-

BitMEX is a crypto exchange and derivatives trading platform, launched in 2014. The firm offers a fiat–crypto onramp, spot trading, and crypto derivatives including perpetual contracts, traditional futures and quanto futures. BitMEX offers amongst the largest market liquidity of any cryptocurrency exchange.

-

Markets.com is a respected broker, offering multi-asset trading opportunities through CFDs or spread betting (UK only). Established in 2008, the brand has an impressive 4.3 million registered customers and is overseen by trusted regulators, including the FCA, ASIC and CySEC. 79.1% of retail accounts lose money.

-

FXCM is a respected forex and CFD broker, established since 1999. The British-headquartered broker has won multiple awards and operates in various jurisdictions, including the UK and Australia. With zero commissions, over 400 assets, and a range of analysis tools, FXCM remains a popular choice for traders. The broker is also regulated by top-tier authorities including the FCA, ASIC, CySEC, FSCA, BaFin.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

EagleFX is an ECN/STP broker that offers spot forex and CFD trading on a small collection of 170+ assets to active traders worldwide. The catch is that it’s registered in the weakly regulated jurisdiction of the Commonwealth of Dominica, providing limited safeguards.

-

Founded in 2015, VT Markets maintains its position as a top Australian multi-asset CFD broker. With 1000+ tradeable instruments and support for the MetaTrader 4 and MetaTrader 5 platforms, this broker delivers a wide range of trading opportunities to over 200,000 clients worldwide. VT Markets is regulated by the ASIC, FSCA, and FSC.

-

Tradeview is an offshore forex and CFD broker based in the Cayman Islands and regulated by CIMA. Traders can access over 5000 instruments with a minimum deposit of $100. There are several third-party platforms on offer, including MetaTrader 4 (MT4) and cTrader.

-

OKX is a respected cryptocurrency firm, established in 2017, that offers a large suite of products, from mining pools to NFTs. Traders can access over 400 crypto tokens via OTC trading and derivatives. With an excellent web platform, developer tools and dynamic charts, OKX is a popular choice for technical traders.

-

Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from four accounts (Classic, Silver, Gold, VIP) with lower spreads and larger bonuses as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees, though these don’t compensate for the weak oversight from the IFSA and paltry education and research.

-

PrimeXBT is a multi-asset platform offering highly leveraged trading in forex, indices, commodities and cryptocurrencies. The company launched in 2018 and now has over 1 million users from more than 150 countries. With no minimum deposit, copy trading features and low commissions, the broker remains a popular option among crypto trading novices.

-

FXDD is an established forex and CFD broker founded in 2002. Regulated in Malta, Mauritius, Peru and Malaysia, the broker provides secure trading platforms, competitive ECN spreads and reliable 24/7 customer support. Competitive pricing and ultra-low latency is also offered via the broker's Direct Market Access execution model and tier 1 aggregated liquidity.

-

FXTrading.com is global broker offering highly leveraged CFDs on 10,000+ assets, including forex, stocks, indices, commodities and cryptocurrencies. Competitive prices with raw spreads and low to zero commissions are available. Traders can use the popular MetaTrader 4 platform and will have access to a suite of additional analytical tools and other resources. The multi-regulated brokerage is authorized by the ASIC and VFSC.

-

M4Markets is an award-winning broker regulated by the CySEC, FSA and DFSA. Although relatively new, the broker continues to improve its offering with a range of innovative tools, platforms and accounts. Beginners can start with just $5, whilst experienced investors can access leverage up to 1:5000.

-

Founded in 2010, ThinkMarkets is a reputable CFD and forex broker with regulation from several top-tier bodies including the FCA and ASIC. The broker provides services to over 450,000 accounts from 11 global offices. Traders can use a bespoke platform, MT4 or MT5 to access a wide variety of assets including 3500+ stocks and ETFs, 46 forex pairs and over 20 cryptocurrencies.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Webull is a multi-regulated trading app that offers stocks, options, forex, cryptos, ETFs, fractional shares and more. The firm is authorized by the SEC, FINRA and FCA and continues to uphold a strong trust rating. Low fees, no minimum investment and generous welcome bonuses have made the discount broker popular with online investors.

-

Trade.com is a trustworthy online broker with a global presence. The broker offers 2,100+ CFDs in major markets, as well as futures, options and more. The broker offers best-in-class platforms and superior analysis tools for experienced traders. The broker is also regulated by top-tier authorities including the FCA and CySEC.

-

CloseOption is a Georgia-headquartered broker with over a decade in the trading industry. The brand offers high/low binary options trading on forex and crypto markets, with decent payouts, welcome bonuses, 24/7 customer support and intuitive trading software.

-

Amega is an offshore STP broker offering CFD trading fon forex, stocks, indices and commodities with very high leverage up to 1:1000 and a zero-commission pricing structure. Traders access markets through the MT5 platform and can test the broker's services through a demo account.

-

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

-

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

-

Ingot Brokers is a multi-regulated brokerage established in 2006. The broker offers CFD trading opportunities on 1000+ instruments including forex, stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers both raw spreads and commission-free account options.

-

SageFX is an offshore, unregulated CFD broker that offers highly leveraged trading on forex, stocks, commodities, indices and crypto via the TradeLocker platform. Traders can access commission-free trading or an ECN account with tight spreads. While the broker's regulatory status is weak, it does provide segregated accounts and two-factor authentication.

-

InstaForex is a forex and CFD broker founded in 2007. The broker offers diverse market coverage to millions of clients, spanning traditional assets like currencies and shares, as well as other interesting opportunities such as IPOs.

-

FinPros is an offshore broker that provides CFD trading on 400+ instruments with high leverage up to 1:500. This is a reliable bet for traders seeking offshore options, with strong security measures, negative balance protection and segregated client funds. The extra features including trading tools and commission-free stocks make this a good choice for beginners, and experienced traders will appreciate tight spreads.

-

Uphold is a digital asset platform offering a range of services, from crypto trading and staking to payment cards that provides rewards and easy multi-currency payments. The company was established in 2015 and has enabled $4+ billion in transactions. Uphold is now active in 180+ countries and deals in 200+ crypto and fiat currencies.

-

Scope Markets offers trading and investing in multiple spot and CFD instruments. The group of brokers is regulated in several locations, including Belize, Kenya and South Africa. Users get competitive trading conditions, a range of payment methods, strong support and can get started in a few straightforward steps.

-

4xCube is an online forex and CFD broker registered and licensed in the Cook Islands. Clients can trade on popular financial markets and choose between three accounts based on their capital and trading strategy.

-

FXGiants is a global CFD broker with FCA and ASIC regulation and hundreds of products available with STP or ECN execution. We like that the broker boasts several useful features, supporting always-on, ultra-fast automation via its dedicated fibre-optic VPS.

-

Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

-

Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

-

RockGlobal is a New Zealand based and regulated CFD broker. They offer competitive spreads from 0.1 pips and a large range of trading assets, trading platforms and educational services, with up to 1:500 leverage. Operating in a Tier 1 regulated environment, RockGlobal offers peace of mind and excellent customer support.

-

xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

-

eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

-

Kwakol Markets is a Nigerian headquartered broker with strong regulatory oversight in Australia and Canada. A great selection of trading assets are available, including synthetic products that simulate realistic market activity. Clients can trade on the MT4, MT5 and cTrader platforms, as well as a copy trading solution whereby a fee is only paid on profitable trades.

-

GoFX is an unregulated CFD and forex broker that covers instruments from currency, stock, index, commodity and crypto markets. Traders can sign up to a variety of account types with deposits as low as $1 and will trade using the popular MetaTrader 4 platform. Exceptionally high leverage up to 1:3000 is offered on the standard account, while traders with the low-spread account can access leverage up to 1:1000.

-

Freetrade is a London-headquartered investing platform that offers zero-commission trading on thousands of UK, European and US stocks and ETFs through a beginner-friendly platform. Open a standard investment account, a self-invested pension or a stocks and shares ISA and start building a portfolio from as little as £2.

-

Focus Option is an offshore broker that specializes in binary options as well as CFDs. Binary options trading on forex, cryptos and three commodities is done through the broker's simple web-based platform with average payouts between 70% and 95%. The broker also offers a mobile app for trading CFDs, with 300+ tradeable instruments.

-

OspreyFX is an ECN broker headquartered in St. Vincent and the Grenadines. Established in 2019, the firm offers 120+ forex and CFD assets with high leverage up to 1:500, tight spreads from 0.1 pips and round-the-clock customer support. OspreyFX also stands out for its funded trading accounts where traders can keep up to 70% of profits.

-

Errante is a Cyprus-based and regulated forex and CFD broker with leveraged trading on multiple assets, tiered accounts including a zero-spread option, and copy trading support. The broker offers leveraged trading up to 1:30 under its CySEC-regulated branch and 1:500 from an offshore branch, and supports the MetaTrader 4 and MetaTrader 5 platforms. Errante's asset list is relatively limited but it does offer fast execution and low latency, and it is a trustworthy brand.

-

Coinexx is an unregulated broker that provides leverage up to 1:500 on forex, commodities, indices and cryptocurrencies with deep liquidity, pure ECN spreads and negative balance protection. The broker uses crypto as base currencies and has low minimum deposit requirements of 0.001 BTC.

-

LonghornFX is a forex and CFD broker offering over 150 instruments with leverage up to 1:500. The firm is registered in Saint Vincent and the Grenadines and was launched in 2020. Clients can access a strong selection of cryptos, alongside forex, indices, commodities and stocks. With ECN/STP processing, this offshore broker promises tight spreads and fast execution.

-

Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

-

Baxia Markets is an offshore CFD broker that offers trading on forex, commodities and indices with tight spreads on a straight-through processing model with ultra-low latency. Trade on MetaTrader 4 or MetaTrader 5 with leverage up to 1:500 and no restrictions to scalping or hedging strategies. Users also benefit from third-party copy trading services.

-

Revolut has emerged as the most downloaded financial app in 11 countries with over 45 million users and more than $23 billion held in customer balances. It facilitates commission-free trading on over 2000 stocks and commodities, alongside 185 cryptos with a minimum investment of just $1. The mobile trading experience remains market-leading for casual investors seeking low, transparent fees.

-

TMGM is an ASIC-regulated forex and CFD broker with a vast range of tradeable assets covering forex, stock, index, crypto and commodity markets. The account types on offer provide a flexible choice between no commission or zero spreads, with competitive pricing all-round.

-

Anzo Capital is an offshore broker that offers leveraged CFDs on 100+ instruments including forex, stocks, indices and metals. The MetaTrader 4 and MetaTrader 5 platforms are supported, and traders can choose between an STP account with spreads starting from 1.4 pips and zero commission, or an ECN account with a $4 round-turn commission and spreads from zero. A decent range of payment methods are accepted, including crypto deposits.

-

Switch Markets is a multi-asset CFD brokerage, regulated by ASIC and SVGFSA. The new brand offers trading on the MT4 and MT5 platforms and leverage up to 1:500. The broker boasts over 2000+ instruments, with some additional tools including copy trading services and free VPS hosting.

-

Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

-

Pacific Union Prime is an FSCA and offshore-regulated multi-asset broker offering competitive fees and direct market access on forex, commodities, stocks, bonds and indices. The broker supports the popular MetaTrader 4 and MetaTrader 5 platforms and a proprietary mobile app. Fees vary by account type with no commission and spreads from 1.9 pips on the Standard account and $7 commission per lot and spreads from 0.4 pips on the Prime account.

-

Nexo is a centralized crypto exchange founded in 2018 in Bulgaria and today operates across some 200 jurisdictions from its base in Switzerland. It provides services including spot trading, futures trading, peer-to-peer loans, cold wallet storage and fiat-on ramps to buy crypto tokens. The crypto firm is registered with some respected financial authorities, such as the ASIC, and offers some fairly unique additional services including a credit card.

-

Pionex is a crypto trading platform that specializes in trading robots, offering a variety of ready made bots and strategies to traders as well as integrated AI to help customize a strategy or come up with your own. These can be used on spot crypto markets as well as crypto futures.

-

AdroFx is an offshore ECN/STP broker that has offered CFD trading since 2018. The firm supports 100+ tradable assets on the popular MetaTrader 4 platform as well as a web trader, Allpips. Eight live accounts are available with no restrictions on trading strategies.

-

RoboMarkets is a Cyprus-based forex, CFD and stock broker aimed at traders from Europe. The broker offers thousands of instruments across six asset classes and provides access to four leading platforms, including MetaTrader 4. With ECN pricing, Cent accounts and algorithmic trading tools, RoboMarkets caters to a range of trading strategies and investing styles.

-

Established in 2012, Hong Kong-based Bitfinex is a formidable player in the crypto industry. It boasts a powerful proprietary platform, 180 cryptocurrencies and more than 430 market pairs available for spot or perpetual swaps derivatives trading. With new payment methods, lower entry barriers and fresh products like crypto futures, Bitfinex is attracting a wider range of active crypto traders.

-

Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

-

Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

-

MultiBank FX is an established broker offering forex and CFD products since 2005. With 20,000+ instruments, plenty of local payment methods and 24/7 multilingual customer support, the broker is a popular choice among traders globally. New clients can also access a variety of bonus offers and access the hugely popular MT4 and MT5 trading platforms.

-

Global Prime is a multi-regulated trading broker offering 150+ markets. Traders can get started with a $200 minimum deposit and trade with leverage up to 1:100. The firm also has a high trust score and a good reputation with a license from the ASIC.

-

ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

SimpleFX is an online broker specializing in CFD and cryptocurrency trading, with multi-currency accounts, STP execution, low pricing and no minimum deposit. Bringing innovation and gaining recognition at numerous industry events since 2014, SimpleFX now caters to retail traders from over 190 countries, boasting a client base exceeding 200,000 active users.

-

EZ Invest is a CySEC-licensed broker, launched in 2008, that offers trading on popular financial markets through leveraged CFDs. Traders can choose between multiple respected platforms, including MetaTrader software and a user-friendly in-house app. The reliable multilingual customer support team are also on-hand to support new users.

-

Fortrade is a multi-asset, multi-regulated broker with branches regulated by the FCA, CySEC and ASIC among others. The brand offers trading opportunities on a wide range of instruments including stocks, bonds, commodities, forex, indices, cryptocurrencies and ETFs, with competitive fees and support for MetaTrader 4 and a proprietary platform.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

HYCM is an online broker with authorization from four international bodies including the FCA and CySEC. The broker offers short-term CFD trading on forex, shares, commodities, indices, ETFs and Bitcoin, and supports the MT4 and MT5 platforms, as well as Trading Central analysis.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

-

Hantec Markets was established in Hong Kong in 1990. Initially, the company concentrated solely on the Chinese and Taiwanese markets. In 2008, the broker rebranded and expanded its presence in the UK, Australia, Japan, and various other countries, before enhancing its footprint in Latin America in 2022. Hantec now stands as a multinational brokerage with 18 offices across Europe and Asia.

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

-

Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

-

Established in 2013, SuperForex is an offshore CFD and forex broker offering highly leveraged trades on 400+ instruments via the popular MetaTrader 4 platform. The broker has gained clients in over 150 countries and is regulated by the Belize IFSC. With a range of STP/ECN account types, including swap-free, micro and zero spread, this broker continues to suit traders with different styles and setups. SuperForex also offers a range of welcome bonuses and trading contests.

-

Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators.

-

Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

-

BinaryCent is an unregulated binary options broker that offers 24/7 trading on forex, cryptos and stocks with payouts up to 95%. Despite its lack of regulation, this broker takes client security seriously and stores client funds in European banks. The broker also offers CFDs with very high leverage up to 1:500.

-

World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

-

FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

-

RaceOption is a binary options broker operating from the Marshall Islands. With over 1,500 clients, the broker aims to offer fast funding, low fees and a secure trading environment. Traders can access over 100 binary options and CFDs, plus copy trading and weekly prizes.

-

Binance is one of the best-known crypto exchanges. The company is available in more than 180 countries with over 120 million registered customers. The platform offers a suite of crypto trading products, from staking and NFTs to derivatives.

-

FXCentrum is an offshore broker that offers highly leveraged, commission-free trading on diverse instruments with tight spreads. Traders can access forex, equity and commodities markets via MetaTrader 5 or the proprietary FXC platform and use the award-winning ZuluTrade platform for copy trading.

-

Vault Markets is an award-winning brokerage headquartered in Namibia. It is an accessible direct-market-access CFD broker with affordable minimum deposits, flexible funding methods and high leverage. This broker offers a very large range of forex pairs as well as commodities and indices through MetaTrader 4 or MetaTrader 5.

-

Exinity provides flexible low-cost trading in FX, commodities, indices and equities alongside unique education and support provided by teams located across the world. Now operating in the Middle East, through regulation from the Financial Services Regulatory Authority in Abu Dhabi and the Financial Services Commission of Mauritius, Exinity provides a range of services to traders and investors looking for new opportunities in the financial markets.

-

FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

-

Capital.com offer CFDs on a range of markets with competitive spreads and zero commissions. The broker also offers the Investmate app, negative balance protection and leveraged trading.

-

Trading 212 is a European and UK-regulated CFD broker that also offers stock investing and ISAs. It’s best known for its commission-free trading model and beginner-friendly app, which has helped it attract 2.5 million users and £3.5 billion in client assets.

-

LegacyFX is a multi-asset broker offering an MT5 download & free signals.

Trading Platforms

The best online brokers in the UK will provide a trading platform that is both easy to use and intuitive. We’ve listed the main options you’ll find on the market below.

MetaTrader 4 and 5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular third-party platforms in the forex world. They were created by the developers MetaQuotes, who’ve been in the online trading market since 2005. There are over 150 online brokers in our list that offer the software, including top names such as Pepperstone, CMC Markets and Avatrade. It is free to download and use, you’ll just need to set up an account with your chosen broker and login with the credentials they provide upon sign up.

MT4 and MT5 are popular for a number of reasons, but there are two stand-out benefits that forex traders love:

- Breadth Of Analytical Tools – MT4 has 30 built-in indicators, 24 analytical objects and 9 time-frame charts. It is designed for traders who love to do their research, making it the top choice for some of the most successful global forex traders. MT5, the most recent software release, goes even further, with 38 indicators, 44 analytical objects and 21 time-frames.

- Customisability – But even better than its built-in tools, MetaTrader platforms are famous for their flexibility. There are 2000 free custom indicators, plus 700 that can be purchased from the Codebase.

Analytical Objects in MetaTrader 5

Proprietary Platforms

A proprietary platform is one that is owned and created by the broker. Sometimes, these can be lacking in the required functionality so online brokers may offer this option alongside MT4 for traders who need access to a variety of tools. However, some of the best online brokers in the UK use proprietary software, which tends to be much more user-friendly and intuitive. They’re ideal for traders that have a certain strategy in mind and require a platform tailored to this.

Top platforms for:

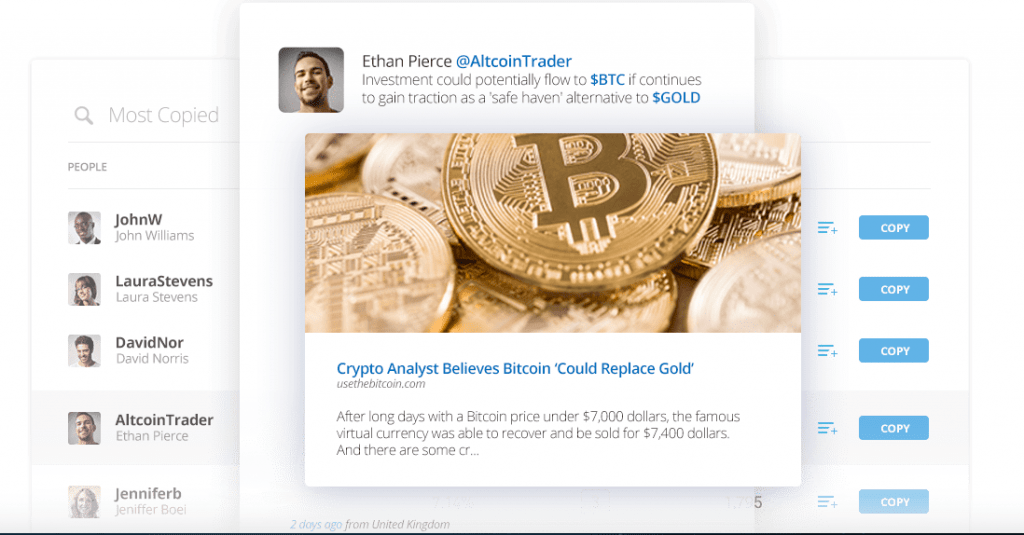

- Social Trading – eToro is a social trading broker that offers its own platform. It’s perfect for those keen to share tips and tricks with their fellow traders. It has a Tipranks Research Tab that allows you to gain insights from the most successful on its books, including those from top institutions. Plus, you can also review other’s trades and choose to copy or ‘mirror’ them if you’re a fan of their strategy.

- Mobile Trading – While MT4 and MT5 do have mobile apps, deep analysis is best completed on your desktop. If you’re looking to trade on the go, there are many top trading apps in the UK offered by online brokers that specialise in making trading simple from a small screen. Trading 212 is perhaps the most popular for stocks, while XTB’s xStation Mobile is great for CFDs, with over 1,500 instruments as well as news and insight available at the touch of a button.

- Asset Variety – For one of the largest selections of assets offered by online brokers in the UK, check out Plus500. It has over 2000 tradable instruments available on its in-house platform and boasts real-time quotes as well as round the clock customer support for all customers.

- Professional Traders – Interactive Brokers is an online broker that is favoured by professional traders. It has an excellent proprietary platform and ECN links to top exchanges that are perfect for day trading. However, high minimum deposit thresholds price some small-time investors out of the market.

eToro’s Copy Trade Function

eToro’s Copy Trade Function

Tools

There is a huge selection of tools out there to help you with your trade analysis, many of the best online brokers in the UK will offer these for free to clients.

News & Insights

Fundamental analysis is the study of economic factors that can influence an asset’s value. Macroeconomic factors, such as the Bank of England’s interest rate, the UK inflation rate and British public policy are all factors. Microeconomic factors include a company’s management, strategy, and P&L. These can all be gleaned by following business news closely. Many of the top online brokers in the UK offer blog posts, opinion insights and news articles as part of their service.

Education

Whether you’re a beginner looking to learn the ropes, or a veteran seeking out the latest strategy, most online forex and stock investors will benefit from access to education. How-to videos and tutorials from a broker are a fantastic way to learn new tips and tricks that may also be relevant to the trading platform you use. Online brokers in the UK that offer this type of resource are a definite advantage.

EAs & Bots

Automated trading is popular among those who prefer a hands-off approach to trading. Therefore, online brokers in the UK that offer access to trading robots (also known as Executive Assistants) are increasingly popular. There are some specialised brokers that offer bots created in-house, but those that provide access to MT4 and MT5 have a much broader selection, as the MetaTrader Codebase hosts thousands that are both free and available to purchase. Always remember to test your bot on a demo account before you trade with real money since there is no guarantee that EAs will be profitable.

Demo Account

A demo account allows you to trade with virtual currency before you take the plunge into the live trading environment. Most online brokers offer this service, which is vital for anyone new to the trading platform. You can use it to practice strategy or trial the features and functionality of the platform.

Fees & Commission

Online discount trading brokers have the cheapest fees of all services in the UK. But there’s a lot of variability depending on the asset traded. We’ve listed the most commonly found fees and what they mean below:

- Spreads – Most online forex brokers charge a fee through ‘spreads’. Spreads are the difference between the buy and sell price of an asset. They’ll either be fixed or variable. Fixed spreads tend to be slightly higher but have the benefit of being constant. Variable spreads change with market volatility.

- Commission – Stocks bought through an exchange are usually charged through commission. Often, this is a fixed amount per trade, e.g £8 or 0.2% of the value. Some online brokers will offer ‘commission-free stocks’, in this case, they usually charge a spread instead.

- Account Fees – Some companies charge just for keeping your account open. While this is rare with online brokers in the UK, it’s one to look out for.

- Rollover Fees – When trading CFDs, rollover fees apply if you keep positions open overnight. Day traders should have no issues, but those looking to invest long term should be aware.

Look out for hidden costs in online brokers offering their services for free. It’s more likely that the asset will be quoted marginally above market rate to cover their running costs. When using online brokers, cost comparison is key to profitability. Check out our online brokers list above for recommendations.

Leverage

The top 10 online brokers in the UK will all offer the opportunity to trade with leverage. Leverage allows you to maximise the results of a trade by multiplying by a chosen factor. For example, if you have a £100 deposit and you trade with leverage 1:5, you can open a position with a value of £500.

All FCA regulated brokers in the UK are limited to what leverage they can provide. They’re capped at between 1:30 and 1:5 depending on the volatility of the asset traded. Forex trading is usually between 1:20 and 1:30, whereas stocks are slightly lower, at around 1:10.

Unregulated online brokers in the UK sometimes offer higher leverage limits. However, we recommend you select a regulated firm as the limits are in place to protect retail traders from undue risk. Leverage amplifies losses as well as profits, so risk management is vital.

Operational Structure

Online brokers operate primarily with one of two trading models: dealing desk or non-dealing desk. A dealing desk broker, or ‘market maker’ creates liquidity on its order book by taking the other side of a trade. For example, if you’re looking to sell Google stocks, but there is no trader on its books willing to buy them, the broker will buy them instead. This ensures that orders are always filled, but it does mean that market makers are trading against you and other clients. If you lose money, they benefit, creating a conflict of interest.

A non-dealing desk broker (or ECN broker) connects to other institutions through an electronic network. This creates a larger order book, making it easier to find another investor willing to take the trade.

Both models are popular with online brokers, and neither is right or wrong. However, some traders prefer to limit the conflict of interest by selecting an ECN broker where possible.

Customer Support

If things don’t go as planned and you need help, an online broker with strong customer support is vital. Look out for a phone number or live chat service, these are key indications that they’ll be on hand when you need them. An email address or ‘contact us’ page is not sufficient. If you ever need it, there’s no doubt you’ll be wishing you’d selected a broker that puts this service as a high priority.

How UK Brokers Are Regulated

In the UK, any firm offering financial services must be regulated by the Financial Conduct Authority (FCA). The FCA was created in 2013 with the aim of managing risk as a result of the 2008 financial crisis. It currently regulates around 51,000 businesses in the UK. FCA regulation is a good indication that the trading broker can be trusted.

The FCA places a number of requirements on online brokers in the UK, which encourages transparency with retail traders. You may not have realised, but the following policies are FCA mandated:

- Risk Disclosure – Online brokers offering CFDs must disclose the percentage of retail traders that lose money with this instrument.

- Negative Balance Protection – When margin trading, it is possible to lose more than your deposit amount since the results of a trade are multiplied. Negative balance protection aims to prevent this by issuing a margin call. All traders regulated by the FCA will provide this.

- Limits On Leverage – As mentioned above, there are limits on how much leverage a broker can offer depending on the volatility of the instrument provided. This is capped at a maximum of 1:30. Online brokers offering higher leverage than this are unregulated and potentially scammers.

- Ban On Excessively Volatile Instruments – In 2020, the FCA banned the sale of crypto-derivatives. Their volatile nature was deemed to cause excessive risk to retail traders. Similarly, following the European Securities and Markets Authority’s (ESMA) temporary ban in 2018, the FCA permanently restricted the sale of binary options in 2019.

- Segregated Funds – If your brokerage fails, you’ll want to know that your trading funds are protected and will be returned to you. The FCA makes it mandatory for online brokers to keep customer funds in a separate account from those used by business operations. This means if their finances are lacking, they can’t use yours to top them up.

- Bonuses – Traders looking for online brokers with the best welcome bonuses should be cautious. The FCA has banned all types of cash bonuses from UK-based online trading brokers, since they entice traders to deposit funds for all the wrong reasons. Sometimes they even have unfair terms and conditions attached to them, like those that restrict profit withdrawal.

Final Word On Online Brokers In The UK

Since online brokers in the UK must be regulated, many will have similar policies. This includes a broker’s leverage limits, provision of negative balance protection and even restricts their instrument list. However, there are a few factors that will vary between firms. Look for online brokers that provide you with an intuitive trading platform with all the functionality you need. Plus, assess their fee structure, educational tools and customer support before taking the plunge.

FAQ

What Are The Best Online Brokers For UK Expats?

Expats can still use online brokers that are registered in the UK as long as the company offers the service to their current jurisdiction. However, be aware that regulatory protections may not apply to your location. Therefore, the best online brokers in the UK can usually be used by expats too, but the tax obligations will vary.

Do Online Brokers In The UK Need To Be Regulated?

Yes. It is mandatory for companies providing financial services in the UK to be regulated by the FCA. Before Brexit, it was sufficient for a broker to be registered with an ESMA approved European authority. This made regulators such as CySEC (Cyprus Securities and Exchange Commission) a commonly referenced industry figurehead. However, since leaving the EU, this no longer applies and online brokers must be regulated by the FCA.

How Can I Find The Best Online Brokers In The UK?

We’ve compiled a list of the top ten online brokers in the UK with a review of each and every one. Check out our UK brokers list and read the article to find the key factors to look for in a broker. This will help you choose the right service for you.

What Are The Best Online Trading Brokers For Beginners?

Beginners should ensure they select a broker that offers a trading platform that is intuitive and easy to use. Many of the charts, graphs and limit orders can be difficult to grasp initially. Before you try and grapple with this, start with the basics. Secondly, online brokers should always offer the opportunity to trial the platform through a demo account. See our list of the best brokers for beginners where we have rated the brokers most suited to beginner traders.

How Do You Start To Buy Stocks Through An Online Broker?

First and foremost, consider which broker offers you the stock you need for a sensible fee. Then, consider how you’ll be trading. For example, if you’re looking to buy stocks for long term investment, a platform isn’t required. However, if you want to make a profit from trading, you’ll need one that provides all the functionality you need. Once you’ve selected your top choice, sign up and follow the broker’s instructions to purchase.

Compare Online Brokers

In the list of UK Online Brokers above, a few key factors are displayed for each firm. But if you are looking for a much more detailed broker comparison we have dedicated pages for that. You can also compare a firm with other online brokers in the individual reviews. Below are some of the most popular comparisons.

- FXPro vs Plus500

- Plus500 vs Avatrade

- Plus500 vs CMC Markets

- Plus500 vs Degiro

- Plus500 vs eToro

- Plus500 vs IG

- Plus500 vs IQ Option

- Plus500 vs Saxo Bank

- Plus500 vs Trading212

- Plus500 vs XM

- eToro vs Coinbase

- eToro vs Degiro

- Trading212 vs eToro