ForexStart Review 2025

|

|

ForexStart is #11 in our rankings of binary options brokers. |

| Top 3 alternatives to ForexStart |

| ForexStart Facts & Figures |

|---|

ForexStart is a multi-asset broker with joining bonuses, low deposits and MT4. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Binary Options, Stocks, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $0.10 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.0001 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade a range of CFDs with high leverage and transparent fees. |

| Leverage | 1:500 |

| FTSE Spread | 1 |

| GBPUSD Spread | Variable |

| Oil Spread | 0.25 |

| Stocks Spread | Variable |

| Forex | Trade FX with fixed or variable spreads on MT4 and MT7 |

| GBPUSD Spread | 0.0003 (Fixed) |

| EURUSD Spread | 0.0002 (Fixed) |

| GBPEUR Spread | 0.0004 (Fixed) |

| Assets | 40+ |

| Stocks | Trade CFD stocks on major global stocks including Tesla and Netflix. |

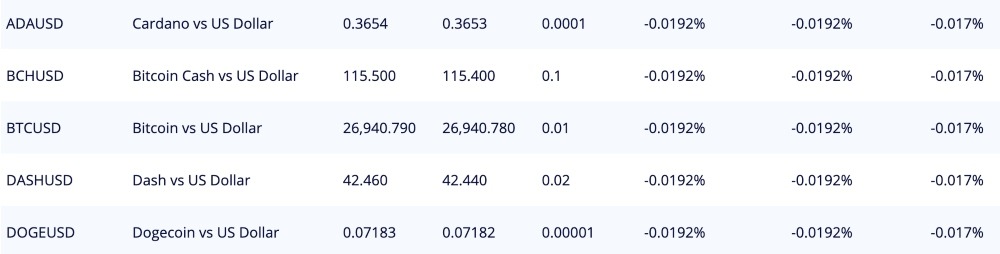

| Cryptocurrency | Trade 10 leading cryptos against the US Dollar. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | Forexstart offers American and Chinese binary options with high payouts and short-term expiries. |

| Expiry Times | 30 seconds - 5 minutes |

| Payout Percent | 100% |

| Ladder Options | No |

| Boundary Options | No |

ForexStart is an online broker that went from providing financial education to offering trading on a range of assets. The company promises competitive trading conditions, including tight spreads, fast order execution, and access to various analytical tools. In this review, I uncover my experience with ForexStart, from the usability of the platform and app to the level of leverage and any safety concerns.

Our Verdict

I appreciated how easy it was to open a ForexStart account and the low deposit of just $0.10. I also liked the convenient payment methods.

However, the lack of FCA oversight and GBP base currency, plus weak customer service and a sometimes glitchy platform dampened the trading experience. As a result, ForexStart doesn’t compete with the best UK brokers in my opinion.

Market Access

ForexStart offers access to several popular markets, however I found the range is far behind many competitors. The best forex brokers offer 50+ currency pairs, as well as an extensive list of stocks and commodities, but ForexStart doesn’t match this.

With that said, the brand is unusual in that it provides binary options, which offer an up/down bet on the value of underlying assets with a fixed payout. The derivative is particularly popular with short-term traders due to the fast timeframes.

Tradable instruments include:

- Forex – 40 currency pairs including majors like EUR/USD

- Metals – gold and silver, available against EUR and USD

- CFDs – over 50 with a choice of indices, commodities and stocks including Amazon, Apple and Disney

- Binary options – up to 100% payouts with American and Chinese style contracts

- Crypto – 10 including Bitcoin and Ethereum

Supported Cryptos

Fees

I thought the fees at ForexStart were higher than some competitors.

However, the bonus of having one account is that the pricing model is easier to follow, with variable spreads plus a commission that depends on the asset (0.3 pips on CFDs, forex and metals and 0.6 pips on Forex ECN). There are also fixed spreads on some currency assets which provide more price certainty.

I was pleased that there weren’t any deposit or withdrawal fees. However, the downside for UK traders is that a currency conversion fee may apply when you deposit funds into the broker’s supported currencies – RUB or UAH.

ForexStart Account

I appreciated how quick and easy it was to open a ForexStart account, taking just a couple of minutes. Yet, this is because the broker does not request verification or personal information – a feature that, while convenient, has notable drawbacks. KYC and other identity verification checks are in place with regulated brokers for a reason.

The single trading account does make it easy to get started, but experienced traders may prefer a broker with more flexibility in terms of account tiers, which can offer various benefits, from tighter spreads to free trading tools and priority customer support.

With that said, there is a loyalty program that pays out based on the volume of your trades and tier (silver to platinum).

Payment Methods

ForexStart has a very low minimum deposit of $0.10, which will appeal to new investors with less capital. I also liked that instant deposits are available, meaning you can get started trading in just a few minutes.

There is a wide range of deposit methods available including Visa, Mastercard, e-wallets like QIWI, Skrill and PayPal, as well as a range of cryptocurrencies like Ethereum and Bitcoin. These can also be used as withdrawal methods. For UK traders, therefore, depositing money will not be an issue.

With that said, because the broker doesn’t offer GBP as a base currency, there may be fees to pay while managing your account and trading activity is less convenient.

Trading Platforms

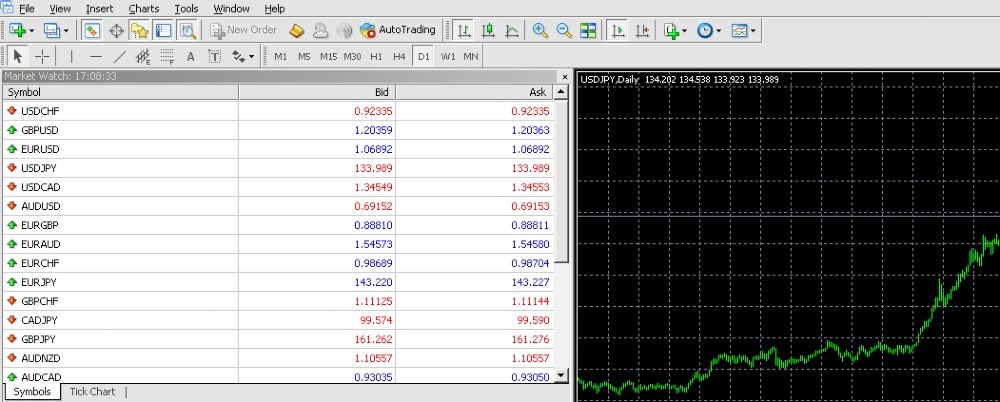

I was impressed with the platforms on offer, which include the popular MetaTrader 4 as well as the less common Mobius Trader 7. Ultimately MT4 is my preferred platform but it was interesting to explore Mobius Trader 7.

Mobius Trader 7

Mobius Trader 7 is designed for retail forex traders and gives a reasonable user experience similar to some of the more popular platforms like MT4 or MT5.

It also offers real ECN trading and even more chart options than MT4, making it a good option for technical analysis. I also liked that Mobius Trader 7 supports trailing stop orders, one-click trading, and automated trading systems.

On the downside, I don’t think it matches the capabilities of MetaTrader 4. Traders already familiar with MT4 will probably want to stick with the software they know, which still offers an excellent suite of charts, drawing tools, and add-ons from the MetaTrader market.

Mobius Trader 7 is available on Windows, MacOS, Linux, iOS, Android, and in a WebTerminal solution.

MetaTrader 4

MT4 is one of the most widely used trading platforms in the forex industry. MT4 offers an excellent range of features and tools that are designed to make trading easier and more efficient. It is also highly customisable, allowing traders to create their own indicators, trading bots, and scripts, which is a key bonus for me.

Additionally, MT4 has a large and active community of users who develop and share their own tools and strategies, which can be beneficial for traders looking to improve their skills and knowledge.

Ultimately, I found MT4 to be a better option than MT7.

How To Place A Trade

- Log in to your ForexStart.com account

- Navigate to the trading platform and select the financial instrument you wish to trade

- Choose the trade size (volume/lot size) you want to use

- Decide whether to buy (long) or sell (short) the financial instrument

- Set your stop loss and take profit levels to manage your risk and potential profits

- Click on the “Trade” button to open the position

ForexStart App

I was disappointed to see that ForexStart lacks its own mobile app, but you can access the brokerage on your mobile device by using the mobile version of its website. Open your mobile or tablet browser and go to ForexStart.com, and you will be redirected to the mobile solution. From there, you can log in to your account and access all the trading features offered by ForexStart.

Additionally, you can use the MT4 or Mobius 7 mobile apps to access your ForexStart.com account and trade on the go. Whilst I wouldn’t use them for in-depth technical analysis, they do offer user-friendly interfaces, advanced charting tools, real-time price quotes, and the ability to manage trades and orders remotely.

Leverage

I found that ForexStart provides leverage of up to 1:1000 which is noticeably higher than leading alternatives. The FCA requires that UK-regulated brokers do not offer more than 1:30 to retail clients, and even that is only allowed on less volatile assets. This is because while leverage can increase potential profits, it also increases the risk of losses.

On a more positive note, I was reassured to find that ForexStart offers negative balance protection, which mitigates some of the risks of heavily leveraged trades by preventing me from becoming indebted to the broker.

Demo Account

ForexStart offers a demo account for traders who want to try out the broker before investing real money, and I recommend that prospective clients take advantage of this feature.

The demo account is free and provides users with virtual funds to trade within a simulated market environment. This allows traders to gain experience and confidence in their trading skills without risking any real capital. It is also a useful tool for new users who have doubts about the safety and legitimacy of a brand, giving you a way to try before you buy.

UK Regulation

My biggest criticism is the lack of regulatory oversight. ForexStart.com is not regulated by the Financial Conduct Authority (FCA) in the UK, significantly reducing the brand’s trust score and fund security for British traders.

Clients from the UK may struggle to resolve issues should they encounter problems. It also means that traders aren’t protected by the Financial Services Compensation Scheme, which can pay out up to £85,000 per client should a member firm go bankrupt.

Bonuses

Initially, I was attracted by the 500% deposit bonus, which is very high vs alternative brokers. However, conditions state that the funds can be withdrawn after completing a ‘certain number’ of transactions which is vague and does not readily inform me of what I have to achieve to claim the money.

ForexStart also offers competitions and other deals with cash prizes available. Winning criteria vary from taking photos with the firm’s logo to achieving the highest profits in your trading account.

Extra Tools & Features

The key extra feature offered by ForexStart is education, and as a former purveyor of trading courses before opening its doors as a broker, I felt that this is their strongest advantage.

The broker provides access to a range of educational materials including articles, video tutorials, webinars, and a comprehensive FAQ section to help traders improve their skills and knowledge about the financial markets. I also liked that these resources are available to all clients, including those who have signed up for a demo account.

Seasoned traders using automated strategies may also be pleased to see a forex VPS service. There are multiple levels available depending on your requirements and budget. The only criticism I have is that some top brokers like Vantage offer a free VPS when you meet volume thresholds.

Customer Service

I was not impressed by the customer service at ForexStart, which was not as strong as competitors.

The live chat is advertised as being 24/7, and while on some occasions, I can get an instant response, after trying it multiple times at different points of the day I have found that often messages do not get a response at all which is very poor.

Moreover, the only phone line available is in a foreign country code and UK traders will need to pay to call it, so I do not recommend using that option.

Alternatively, traders can submit a technical support form which will get a response by email.

Company Background

ForexStart is a Russian forex broker that was established in 2007 in Moscow and is a representative of Tim Group Limited.

The company began life as a service providing traders with information about the global financial markets and top brokers, as well as courses showing traders methods for forex trading and Russian stock trading.

In 2011, ForexStart launched a forum allowing traders to ask questions about the markets and learn in a more tailored way.

Since 2014 they have offered 27 currency pairs to clients to trade with, making this latest full broker offering a relatively new operation.

Security

Other than offering segregated accounts, I could verify little information on safety for ForexStart – a red flag as far as I am concerned. I didn’t find any security or anti-fraud measures upon signing up and there is no two-factor authentication.

Paired with the lack of regulation, I cannot conclude that this is a safe broker to use.

Trading Hours

The trading hours vary by market. The forex market is open 24 hours per day from Sunday to Friday and is therefore unrestricted in that sense. Other markets such as stocks and commodities have specific trading hours. Public closures and holidays can also be viewed in the trading terminals.

Should You Trade With ForexStart?

ForexStart is an online brokerage that provides traders with user-friendly trading platforms, a range of markets, and a variety of educational and analytical tools.

However, these features are available from most regulated and secure brokers, and particularly in terms of forex pairs this broker lags behind the competition. With the added poor customer service, ForexStart isn’t my first choice.

FAQ

Is ForexStart Regulated In The UK?

ForexStart is not regulated by any financial authority, including the UK Financial Conduct Authority (FCA). This is a major drawback for British traders who may receive better fund protection from authorised firms.

Does ForexStart Offer Deposit Options For UK Traders?

ForexStart offers various funding methods, including bank wire transfers, credit/debit cards, and electronic payment systems, such as Skrill, PayPal, and Perfect Money. As a result, traders in the UK can fund a ForexStart account without difficulty.

With that said, British traders may have to pay a fee to convert GBP into one of the accepted account currencies – RUB or UAH. This is a real nuisance and can be avoided by signing up with alternative brokers.

Does ForexStart Offer A Demo Account?

Yes, ForexStart offers a demo account for traders to practice their skills before opening a live account. The demo account is free and comes with virtual funds to trade with. It is also a good way to trial the brokerage before risking real money.

What Is ForexStart?

ForexStart is a Forex and CFD broker based in Russia that provides online trading services to traders from around the world. It offers various trading instruments, including forex, commodities, stocks, and cryptocurrencies, with the popular MetaTrader 4 (MT4) and Mobius Trader 7 (MT7) platforms.

Does ForexStart Offer Competitive Trading Accounts?

ForexStart offers only one kind of trading account which comes with leverage of up to 1:1000 and allows hedging, scalping, and Expert Advisors through the MT4 platform.

But while beginners may like the straightforward account choice, seasoned traders may prefer a firm that offers advanced tools and perks in return for trading in higher volumes.

Article Sources

Top 3 ForexStart Alternatives

These brokers are the most similar to ForexStart:

- Grand Capital - Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

- World Forex - World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- AZAforex - Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

ForexStart Feature Comparison

| ForexStart | Grand Capital | World Forex | AZAforex | |

|---|---|---|---|---|

| Rating | 2 | 3.9 | 4 | 3.4 |

| Markets | CFDs, Forex, Binary Options, Stocks, Commodities, Cryptos | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Minimum Deposit | $0.10 | $10 | $1 | $1 |

| Minimum Trade | 0.0001 Lots | 0.01 Lots | 0.01 Lots | 0.0001 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FinaCom | SVGFSA | GLOFSA |

| Bonus | - | - | - | - |

| Education | No | No | No | No |

| Platforms | MT4 | MT4, MT5 | MT4, MT5 | - |

| Leverage | 1:500 | 1:500 | 1:1000 | 1:1000 |

| Visit | ||||

| Review | ForexStart Review |

Grand Capital Review |

World Forex Review |

AZAforex Review |

Trading Instruments Comparison

| ForexStart | Grand Capital | World Forex | AZAforex | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | No |

| Futures | Yes | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | Yes | No | Yes |

ForexStart vs Other Brokers

Compare ForexStart with any other broker by selecting the other broker below.

Popular ForexStart comparisons: