xChief Review 2025

|

|

xChief is #53 in our rankings of CFD brokers. |

| Top 3 alternatives to xChief |

| xChief Facts & Figures |

|---|

xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | You can trade a competitive range of CFDs encompassing crypto, indices, energies and metals, with very high leverage up to 1:1000. ECN pricing is available, with spreads from 0.0 pips and low commissions from $2.50. A Cent account is also available for those on a smaller budget. |

| Leverage | 1:1000 |

| FTSE Spread | 70 |

| GBPUSD Spread | 0.9 |

| Oil Spread | 12 |

| Stocks Spread | 50 |

| Forex | xChief supports spot foreign exchange trading on all account types for 40+ major, minor and exotic currency pairs. Trading takes place on the leading MT4 and MT5 platforms, which offer dozens of in-built technical tools for short-term forex strategies. |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.9 |

| Assets | 40 |

| Stocks | xChief offers 100 US company stock CFDs for MT4 DirectFX and Classic+ account holders. Alongside popular multinationals like Apple and Coca-Cola, you can also speculate on several major stock indices with spreads from 2. |

| Cryptocurrency | xChief’s range of 5 cryptocurrencies paired with USD is smaller than most competitors. In addition, the average BTCUSD spread of 30 pips is not the cheapest. That said, the broker does offer some useful crypto trading guides for beginners. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

XChief is an offshore straight-through-processing (STP) broker-dealer. UK investors can trade 100+ forex and CFD instruments spanning commodities, stocks, currency pairs, and cryptocurrencies on the MT4 and MT5 platforms. The broker has also devised a bespoke aggregation tool permitting a reduction in spreads and slippage.

This review of xChief will analyse account types, minimum deposit requirements, welcome bonuses, sign-up conditions, and more. Find out if our experts recommend opening an account.

xChief offers highly leveraged trading on popular financial markets with a low minimum deposit. However, the broker is not regulated by the FCA and welcome bonuses come with steep turnover requirements.

Company History & Overview

xChief Ltd was established in 2014 (previously ForexChief). The company has head offices in Indonesia and Nigeria, as well as a presence in various other countries, including the UK.

Although the broker does not hold a license with the FCA, xChief offers competitive trading conditions from five global server locations including one in London, providing top-tier liquidity connection speeds. The broker is also a licensed Securities Dealer by the Vanuatu Financial Services Commission (VFSC).

Markets & Instruments

xChief offers a full range of instruments spanning five asset classes. With that said, the list of 100 tradable assets is noticeably shorter than many competitors, some of which offer thousands of stocks and dozens of indices, for example.

- Indices – 11 global stock index CFDs including the FTSE 100, CAC 40 and DAX 40

- Forex – 40 major and minor currency pairs such as the GBP/USD and EUR/GBP

- Stocks – 100 worldwide company share CFDs such as JP Morgan, Procter & Gamble, PayPal, and McDonald’s

- Commodities – Two precious metals and USD contracts and three energies including Brent Crude Oil and Gold vs USD

- Cryptocurrencies – Five popular digital currencies via CFDs including Bitcoin vs USD and Ethereum vs USD

Platforms

UK investors can access the MetaTrader 4 and MetaTrader 5 platforms. Both are well-known and available as free downloads to desktop devices or compatible with major web browsers.

Users benefit from a wealth of analytical features and tools, custom charts, plus live price quotes, meaning you can take hold of market opportunities as they arise. Additionally, MetaQuotes has developed a copy trading plugin, so you can follow signals.

When we used the platforms, we found that both MT4 and MT5 were stable, reliable and powerful trading tools. Our experts also liked the various customisation capabilities. On the downside, the platforms are not as sleek or modern as some third-party alternatives, such as TradingView.

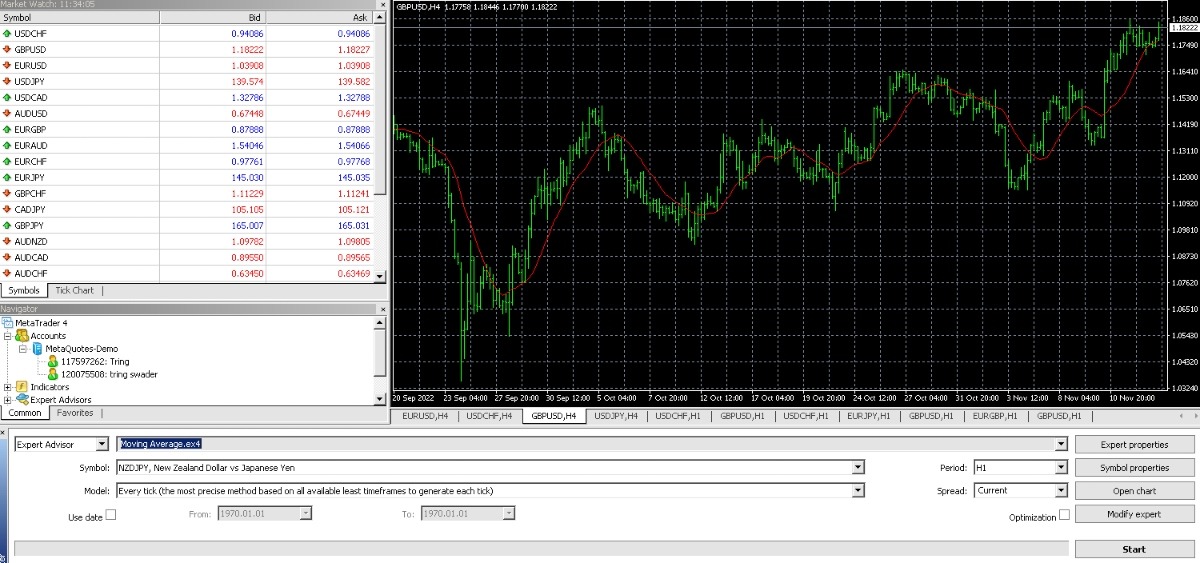

MetaTrader 4

MT4 is a simplified version of MT5, though it still offers a catalogue of powerful features. As well as 30 integrated technical indicators and 24 analytical objects, users can access an extensive archive of free indicators, advisers, and scripts.

The one-click trading function is also highly regarded, meaning you can enter positions with the click of a button. You can also view charts across nine timeframes, full trading history, and review real-time price quotes in the Market Watch window.

MetaTrader 4

MetaTrader 5

MT5 offers a range of useful features including an integrated economic calendar, strategy backtesting, and the MQL5 programming language. The strategy tester allows you to review the efficiency of technical indicators or scripts in five test modes with optimisation and custom visual tools.

Traders can also make use of 21 timeframe views, four execution modes, two pending orders, 38 in-built technical indicators, and 44 analytical objects.

How To Open & Close A Trade

The easiest way to open a trade in the MetaTrader terminals is via the ‘New Order’ window in the top toolbar menu. Alternatively, you can use the F9 keyboard shortcut to open the same page. The process is relatively similar between both platforms:

- Enter the trade size (in lots) in the ‘Volume’ section

- Select the order from the ‘Type’ section, e.g. market execution

- Choose a stop loss or take profit if desired

- Add a comment (optional)

- Sell ‘Buy’ or ‘Sell’ to confirm the order

To close a position, select the ‘Trade’ icon within the terminal window. This will display all positions that are currently open. Right-click on the order you want to close and select ‘Close Order’. You will need to confirm the request in the pop-out by using the yellow ‘Close’ icon.

Fees & Charges

xChief uses a floating spread model with commissions. This means fees vary depending on market conditions, including volume and liquidity. Fees also vary depending on the account you open.

All Direct accounts offer raw spreads from 0 pips while Classic profiles start from 0.3 pips. We were offered a spread of 0.9 pips on the GBP/USD and 1.9 pips on the GBP/JPY. Also be prepared to pay a commission on top of the spread, which when combined, means the broker doesn’t stand out as a low-cost broker.

MT4

- Cent-MT4.Classic+ – No commission

- Cent-MT4.DirectFX – Forex and metals £15 per Mio

- MT4 DirectFX – Forex, metals, commodities and indices £15 per Mio. Stocks and cryptocurrency 0.1% fee

- MT4 Classic+ – Forex, metals, commodities and indices commission-free. Stocks and cryptocurrency 0.1% fee

- Pamm-MT4.DirectFX – Forex, metals, commodities and indices £15 per Mio. Stocks and cryptocurrency 0.1% fee

- Pamm-MT4.Classic+ – Forex, metals, commodities and indices commission-free. Stocks and cryptocurrency 0.1% fee

MT5

- Cent-MT5.Classic+ – No commission

- Cent-MT5.DirectFX – Forex and metals £15 per Mio

- MT5 DirectFX – Forex, metals, commodities and indices £15 per Mio. Cryptocurrency 0.1% fee

- MT5 Classic+ – Forex, metals, commodities and indices commission free. Cryptocurrency 0.1% fee

- Pamm-MT5.DirectFX – Forex, metals, commodities and indices £15 per Mio. Cryptocurrency 0.1% fee

- Pamm-MT5.Classic+ – Forex, metals, commodities and indices commission-free. Cryptocurrency 0.1% fee

xChief Mobile App

Traders can make use of a mobile view of the client dashboard. You can access all the basic functions of the personal area including bonuses, deposits and withdrawals, plus account updates and changes.

The app can be downloaded for free to Android (APK) or Huawei devices from the relevant app store. On the downside, the application isn’t available on Apple devices, a notable drawback vs many competitors.

MetaTrader 4 and MetaTrader 5 are also available as mobile apps. These applications can be downloaded to Android (APK) devices only. Apple is currently restricting MT4 and MT5 downloads to iOS devices.

MetaTrader mobile users can access a complete set of orders, view full trading history and analyse interactive charts. Clients can effectively trade anytime, anywhere whilst the markets are open and have complete control over their trading accounts.

Payment Methods

Deposits

xChief offers a low minimum deposit of just £10, making it easy for beginners to get started. The broker also accepts various payment methods, though it was disappointing to see that not all are available in GBP, meaning a conversion fee may apply.

Deposit methods that process GBP payments:

- Neteller – Instant processing time, no commission fee

- Advanced Cash – Instant processing time, no commission fee

- Credit/Debit Cards – Instant processing time, no commission fee

- Cryptocurrency – Up to 8 hours processing time, no commission fee

How To Make A Deposit

- Log in to the ForexChief client dashboard

- Select ‘Deposit And Withdrawal’ from the side menu and then ‘Deposit Funds’

- Choose the payment method from the dropdown menu

- Select the processing currency and amount to deposit

- Choose the trading account to add funds to from the drop-down menu

- Click ‘Continue’

- Complete the relevant payment details and press ‘Submit’

Withdrawals

Withdrawals must be made back to the original payment method. Fees and processing times vary between methods but are in line with most of the industry.

Accepted GBP withdrawal methods:

- Neteller – One working day processing time, 1.9% fee, minimum £1

- Advanced Cash – One working day processing time, 1% fee, minimum £1

- Local Bank Wire Transfer – Two to seven working day processing time, no fees

- Credit/Debit Cards – Two to seven working day processing time, 2% fee, minimum £5

- Cryptocurrency – One working day processing time, minimum £1 fee and maximum £35 charge

- SWIFT Bank Wire Transfer – Three to five working day processing time, 1% fee, minimum £50 and maximum £160 charge

Note, users are permitted to deposit and withdraw up to £2000 only until identity verification is complete. Documents can be submitted via the ‘My Profile’ tab in the client dashboard.

Demo Account

In line with most top brokers, xChief offers a free demo account on the MetaTrader 4 and MetaTrader 5 platforms. You can practise trading with 1:1000 leverage and £10,000,000 in virtual funds.

The demo profile is a great way to learn all the functions and icons within the platform interface. As you don’t have to add personal funds, it is a completely risk-free way to practise opening and closing positions. You can apply indicators, test strategies, and view your performance in real-time.

xChief Bonuses

As an offshore broker, there are no strict restrictions on bonuses and financial rewards.

xChief regularly offers a £100 no-deposit bonus and a £500 welcome deposit bonus to new clients. However, when our experts reviewed the terms and conditions, they found that a minimum volume requirement must be satisfied before a withdrawal can be requested. This is calculated as the welcome bonus x 50,000. This is pretty steep – an investor that received a £100 welcome bonus would need to meet a turnover of £5 million.

There are also turnover rebate incentives and trading credit opportunities, though similar to the joining bonus, beginners may struggle to satisfy the criteria. Instead, they are geared towards active traders.

UK Regulation

xChief is licensed as a Securities Dealer by the Vanuatu Financial Services Commission (VFSC). This is an offshore regulator and is not renowned for its credibility vs the Financial Conduct Authority (FCA) for example. With this in mind, it is worth noting that access to compensation schemes such as the FSCS is not available.

Fortunately, the brokerage does segregate traders’ capital from company funds.

Account Types

xChief offers several trading accounts for UK retail investors; Direct, Classic, and Cent profiles specific to the MT4 or MT5 terminals.

There is a low £10 minimum deposit requirement for all account types, suitable for beginners. There is a minimum order size of 0.01 lots. Scalping and hedging are also permitted across all profiles, plus access to expert advisors is allowed.

PAMM accounts are also available, though GBP account denomination is not permitted.

MT4.Direct FX And MT5.Direct FX

- 100 lot maximum order size

- Floating spreads from 0 pips

- Commissions apply on all instruments

- 500 maximum number of open orders

- Access to all trading instruments on MT4 and 60+ instruments on MT5

cent-MT4.Direct FX And cent-MT5.Direct FX

- Floating spreads from 0 pips

- Access to forex and metals only

- 1000 lot maximum order size

- 200 maximum number of open orders

- Commissions apply on all instruments

MT4.Classic+ And MT5.Classic+

- 100 lot maximum order size

- Floating spreads from 0.3 pips

- 500 maximum number of open orders

- Commissions apply on stocks and cryptocurrency only

- Access to all trading instruments on MT4 and 60+ instruments on MT5

cent-MT4.Classic+ And cent-MT5.Classic+

- Commission-free

- Access forex and metals only

- Floating spreads from 0.3 pips

- 200 maximum number of open orders

- 1000 lot maximum order size on MT4 and 100 lots on MT5

A swap-free version of the Classic and Direct profiles is available, suitable for Islamic traders.

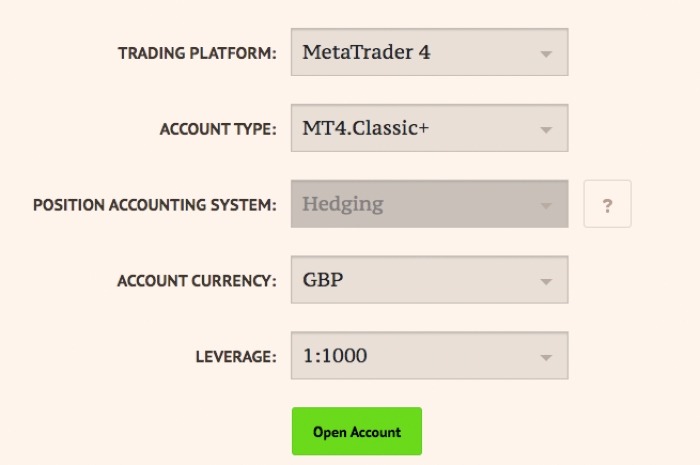

How To Open A Live xChief Account

It is a relatively quick process to open a live trading account with ForexChief:

- Click the ‘Visit’ button in this xChief review

- Complete the online registration form

- Log in to the client area with the credentials displayed on the following page

- Select ‘My Accounts’ and then ‘Open A Trading Account’

- Choose the account features such as platform, account currency, and leverage

- Select ‘Open Account’

Note, identity verification is required to access the full suite of features and trading functions.

Leverage

xChief offers substantial leverage to UK investors, up to 1:1000. This is considerably higher than FCA-regulated brokers.

However upon review, our experts found leverage varies by instrument and customer account equity. The leverage ratios automatically decrease as specified levels of account equity are reached.

For example, retail traders with account equity between £0 to £2999 can utilise leverage up to 1:000 on major forex pairs. Those with an account balance between £3000 and £19,999 are permitted to use leverage up to 1:500 on the same instruments. This decreases to 1:40 with an account equity of £100,000 or more.

All accounts have a 30% stop-out level.

Extra Tools

When we used xChief, we weren’t pleased with the narrow selection of additional trading tools. There are several articles and some educational content, however, most of this information is outdated and will be of limited value to experienced traders.

For beginners, interesting topics include the best forex trading indicators, the history of trading, and how to get started with investing.

Additionally, traders can access live currency charts and trade size calculators.

Opening Hours

Trading hours vary by instrument. The London Stock Exchange, for example, is open for trading between 8 AM and 4:30 PM (GMT).

Note, the broker’s server time operates in Eastern European Time (EET). This is UTC+2 or UTC+3 in summer hours.

Customer Service

xChief provides reliable customer support in English, with the live chat service available 24/7. This is advantageous vs AvaTrade and CMC Markets, for example, which offer help 24/5. Other contact methods include telephone and email:

- Email – info@forexchief.com

- Telephone – +65 3159 3652 (Singapore) or +234 903 079 5364 (Nigeria)

It is worth noting that there is no UK head office address or telephone number, though we did receive a response via the live chat almost immediately. There is also a basic FAQ section available on the broker’s website though the information is limited.

Client Safety

While using xChief, we did not feel fully assured of suitable security measures. There is limited publicly available information on transaction safety protocols or login features, such as two-factor authentication (2FA).

The broker does comply with standard KYC requirements. Identity verification is required to access all trading services and maximum deposit and withdrawal limits. The MetaTrader platforms also use reliable encryption technologies.

Should You Trade With xChief?

XChief is not the safest broker-dealer for UK investors. The trading firm does not provide the same levels of regulatory protection as brokers with FCA oversight. Additionally, bonus terms and conditions will make it difficult for most traders to withdraw any profits generated with promotional capital.

On the plus side, xChief’s customer support team is available 24/7, plus the broker offers a free demo account and access to both MetaTrader 4 and MetaTrader 5.

FAQ

Is xChief A Legit Broker?

xChief is a legitimate broker-dealer established in 2014. The company is licensed as a Dealer in Securities by the Vanuatu Financial Services Commission (VFSC). The broker offers financial services on a global scale, including in the United Kingdom.

Is Customer Support At xChief Reliable?

xChief offers 24/7 customer support, which is good news for beginners. Although there are no UK telephone numbers, our experts had no issues receiving an almost instant response from the broker’s live chat service. Email and telephone support are also provided, in addition to an FAQ portal.

Does xChief Offer Good Bonuses?

xChief offers several welcome bonuses and no deposit schemes for new clients. Although this is good to see, when our experts reviewed the terms and conditions, the minimum volume thresholds were unrealistic for many retail traders. As a result, traders should not expect to be able to withdraw the funds or associated profits easily.

Is xChief Safe To Trade With?

xChief is regulated offshore by the Vanuatu Financial Services Commission (VFSC) and does not provide access to compensation schemes or negative balance protection. These are notable drawbacks and may deter many UK traders who will prefer to sign up with FCA-regulated brokers. There are also some negative user reviews online.

Does xChief Offer Reliable Trading Platforms?

UK investors can trade on the MetaTrader 4 and MetaTrader 5 platforms. These are powerful and reliable third-party terminals used by hundreds of brokers worldwide. Multiple execution modes, order types, indicators, analysis tools, and automated trading functions make MT4 and MT5 firm favourites with retail traders.

Although the brokerage does not offer any proprietary platforms or tools, there is a bespoke client dashboard app available.

Top 3 xChief Alternatives

These brokers are the most similar to xChief:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

xChief Feature Comparison

| xChief | FP Markets | Pepperstone | Swissquote | |

|---|---|---|---|---|

| Rating | 3.9 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Metals, Commodities, Stocks, Indices | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $10 | $40 | $0 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | xChief Review |

FP Markets Review |

Pepperstone Review |

Swissquote Review |

Trading Instruments Comparison

| xChief | FP Markets | Pepperstone | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

xChief vs Other Brokers

Compare xChief with any other broker by selecting the other broker below.

Popular xChief comparisons: