Forex4you Review 2025

|

|

Forex4you is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Forex4you |

| Forex4you Facts & Figures |

|---|

Forex4you offers retail trading on a choice of top trading platforms. |

| Awards |

|

|---|---|

| Instruments | Forex, CFDs, stocks, indices, commodities |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | BVI FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Start trading on the markets with CFDs. |

| Leverage | 1:1000 |

| FTSE Spread | 1.1 |

| GBPUSD Spread | 0.3 |

| Oil Spread | 2.6 |

| Stocks Spread | Variable |

| Forex | Take positions on the FX market with leverage. |

| GBPUSD Spread | 0.3 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.3 |

| Assets | 50+ |

| Stocks | Trade on 50 company stocks and 15 stock exchanges. |

Forex4you is an award-winning forex and CFD broker that provides high-leverage online trading services across an extensive selection of markets. This 2025 review will equip traders with all the information they need to know when considering an application with the firm, such as trading spreads, minimum deposit requirements, commissions and compatible investing platforms. Read on to learn whether you should create an account with Forex4you.

About Forex4you

Founded in 2007 as a brand of E-Global Trade & Finance Group, Forex4you is currently celebrating 15 years as an online trading service. The broker is based in the British Virgin Islands and regulated by the BVI FSC. While its services are unavailable in the European Economic Area (EEA), UK investors can sign up for an account with the firm.

Forex4you has expanded its service year on year over the last decade and a half for retail and pro clients, launching projects such as the innovative Share4you copy trading software. As a result, the company now boasts over 2.5 million registered trading accounts and more than 1.2 billion successfully executed orders.

Markets

Forex4you provides over 150 CFD trading products from four main markets – forex, indices, stocks and commodities.

Forex

The firm offers a substantial selection of 50+ currency pairs, spanning major, minor and exotic forex instruments. Floating spreads start from 0.1 pips on compatible accounts, while fixed-spread, zero commission accounts offer spreads from 2.0 pips.

Indices

Despite claims on the website of 15+ indices, Forex4you supports only 14 global cash indices, including the S&P 500 and FTSE 100. There are no futures indices available through the broker.

Commodities

Five commodities CFDs are available through Forex4you, covering metals and energies submarkets. Traders can speculate on favourites such as gold, silver, WTI and Brent crude oil. However, no soft commodities products are provided.

Shares

More than 50 primary US stock instruments are provided by the firm, though no equithe ties from UK and European exchanges are available.

Leverage

While high leverage can amplify both losses and gains, having the option of a significant margin is never a bad thing.

To this end, Forex4you provides leverage of up to 1:1,000 on all products to retail clients, which is considerably higher than many EU and UK-based brokers. However, the maximum leverage rates available to clients vary depending on the equity invested into their specific trading account:

- An account balance of between £0 and £8,300 entitles traders to leverage rates of up to 1:1,000

- Traders with £8,300 to £83,000 in their account can take advantage of leverage up to 1:500

- Holding £83,000 to £210,000 in cash and assets in your Forex4you account provides leverage rates of up to 1:200

- Those with upwards of £210,000 can use leverage of up to 1:100

Forex4you activates a margin call at 100% during weekends and market holidays for traders using leverage up to 1:100 and at 500% for accounts using greater leverage. Under normal trading conditions, margin call and stop-out levels vary depending on account type (more on this below).

Account Types

There are four account types offered to prospective clients by Forex4you. These are the Cent, Classic, Cent NDD and Pro STP accounts.

Before delving into each account, it is worth mentioning that the broker does not provide a swap-free Islamic variant for any account type. Additionally, UK traders may be disappointed to learn that there is no GBP base currency option for any account type. Instead, clients must choose between EUR and USD as their account currency during their application.

Cent Account

The first account type provided by Forex4you is its Cent variant. Designed for low capital trading, one lot in a Cent account is 1,000 units, rather than the usual 100,000.

As with all of the broker’s offerings, there is no minimum deposit to open this account and leverage is available from 1:10 to 1:1,000. Spreads are fixed and start at 2.0 pips, while no trading commission is charged on forex and commodities instruments. A 0.1% commission applies to stock positions.

Cent account holders can trade a good selection of the brokers’ forex and stock products. However, only two commodities (gold and silver) are supported and indices are excluded entirely. Forex4you conducts a margin call at 50% and a stop out at 10% on this account.

Classic Account

The Classic account allows clients to enjoy the same leverage capacity and commission system as the Cent account but operates a standard lot size allocation. Fixed spreads from 2.0 pips keep costs low, while an execution speed of 0.82 seconds helps fill orders quickly.

The margin call level for the Classic account is at 100%, while stop-outs are enforced at 20%.

Cent NDD Account

The first of the Forex4you direct market access (DMA) accounts is the Cent NDD variant. Execution speeds from 0.8 seconds and a lot size of 1,000 units help clients trade easily, whatever their funding levels.

A more comprehensive selection of forex, commodities and share CFD products are available to Cent NDD account holders. Also, unlike the previous two dealing desk accounts, the indices products are included. Spreads are floating and start at 0.1 pips, while a commission of £0.08 per micro lot is levied on forex and commodities. Indices are subject to a 0.02% commission, while fees of 0.05% are charged on stock instruments.

Forex4you makes a margin call at 50% and liquidates positions with a stop out at 10%.

Pro STP Account

The final account provided by Forex4you is the Pro STP account. Despite its name, this account offers conditions very similar to a traditional ECN account, with spreads starting from 0.1 pips and trading commissions of £6.70 per lot on forex.

The Pro STP variant entitles clients to the broker’s full range of instruments, with all four markets fully supported. Commission for stocks stands at 0.05%, falling to 0.02% for indices and 0.01% for energies. Metals are subject to higher fees of £8.30 per lot.

Margin calls are made at 100%, while stop-outs are enforced at 20%.

Demo Accounts

Using a demo account has several benefits for prospective clients, such as providing risk-free trading practice and a chance to trial a broker’s proprietary platforms.

Forex4you allows investors to open a demo account version of all of its offered account types, giving traders a chance to trial micro-lot cent trading and compare the spreads and execution speeds of the different accounts.

Trading Platforms

There are three trading platforms supported by Forex4you, with the MetaTrader 4 platform added to a proprietary software offering for desktop, web and mobile.

MetaTrader 4

Most experienced CFD traders will be familiar with the MetaTrader 4 (MT4) platform, which has been a staple offering from brokers since its release in 2005.

The software’s best aspects are arguably its expert advisor (EA) support and high level of customisability, with users able to create their own EAs and indicators or download premade solutions from a densely populated community marketplace.

MT4 offers nine order types, 30 standard indicators, 31 graphical objects and nine timeframes to help investors analyse price movements. Additionally, the inclusion of custom alerts and programmable hotkeys means that traders can capitalise on opportunities in the fast-moving forex markets.

MetaTrader 4

MetaTrader 4 is available to download for Windows, Mac, Linux and as a browser-based WebTrader. There are also mobile app versions of the platform for Android and iOS users.

Forex4you Desktop & WebTrader

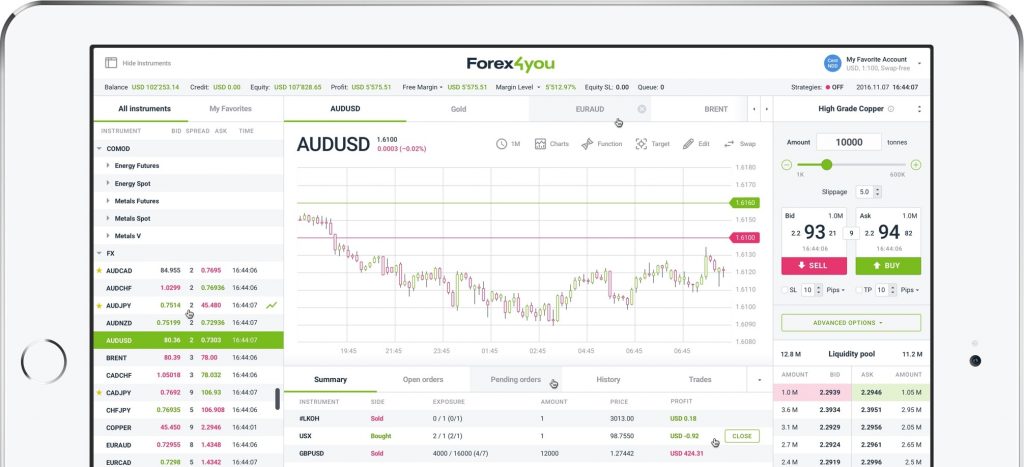

Forex4you has created a proprietary trading platform available to download on Windows and Mac devices or to be accessed as an entirely browser-based WebTrader.

Free to use for all account holders, this platform gives users a comprehensive view of an instrument’s liquidity, displaying the bids and asks from each supported provider through a fully transparent tick chart.

Forex4you Desktop Platform

Additionally, clients can take complete control over their trading conditions by using the slippage limit function and several order types such as the buy stop, sell stop and equity stop-loss orders.

Mobile Apps

As well as the MetaTrader 4 mobile platform, Forex4you has a mobile app version of its proprietary trading software. This platform is optimised for mobile devices, allowing clients to open and close positions, create stop loss and take profit levels or read the latest financial news.

This app also supports deposits and withdrawals, allowing clients to manage their funds without using the web login portal.

Forex4you Mobile Platform

Payment Methods

Forex4you supports several payment methods, though there are no GBP funding options with the broker. This means that funds deposited or withdrawn in GBP will be exchanged into either USD or EUR according to the internal broker currency rates, which may not be favourable.

Clients can make deposits and withdrawals using Visa and Mastercard credit and debit cards and have a choice of three e-wallet solutions: Skrill, Neteller and WebMoney.

All four of these payment methods can clear instantly, with the broker disclosing an average deposit processing time of around 12 minutes. Withdrawals take slightly longer to clear, with card transfers taking 2-6 working days and an average processing time of just over an hour.

While Forex4you does not enforce any minimum deposit requirements to open an account, individual funding methods have their own limits. For example, Skrill and WebMoney users must deposit over £0.83 or equivalent and Neteller has a minimum deposit of £1.66. Visa and MasterCard payment amounts must exceed £8.30.

Minimum withdrawal amounts are the same for e-wallet solutions but jump to £16.70 for card transactions. Additionally, a maximum limit of around £1,650 applies to card withdrawals.

Deposit & Withdrawal Fees

Many traders are averse to deposit and withdrawal commissions that eat into their trading funds. While Forex4you does not levy charges on deposits, the broker places a service fee of between 0.8% to 2% on e-wallet methods. Visa and MasterCard withdrawals incur a £2.10 flat fee plus a sizeable 2.5% commission.

Trading Fees

Forex4you is highly transparent when it comes to commissions and trading fees.

Commissions between 0.05% and 0.1% are applied to stock CFDs, while fees of 0.02% are charged on indices positions. There are no commissions on commodities for Cent and Classic accounts, while the NDD variants charge a 0.01%, with an £8.30 per lot fee on gold and silver.

There is no commission on forex products with a fixed spread account. However, Cent NDD and Pro STP accounts are subject to fees of £0.08 per micro lot and £6.70 per standard lot, respectively.

Overnight charges for maintaining leveraged positions through to the next trading day vary depending on the specific product. They can be found on the broker’s website or the MT4 page for each asset.

Forex4you charges a monthly inactivity fee of £8.30 per month after 12 months of an account being dormant. The broker raises this to £16.60 after 24 months of inactivity. However, this fee only applies to accounts with positive balances and ceases once a client’s funds have reached zero.

Security & Regulation

Selecting a trading broker with good reviews and strong regulation can help investors protect their funds and personal information from fraud.

Unfortunately, Forex4you only holds a licence from the BVI FSC, which does not carry out the checks or offer the protection of more reputable bodies, such as the FCA or ASIC.

As a result, it does not offer a fund insurance scheme in case of broker insolvency nor provide negative balance protection to clients. However, the broker does hold client funds in segregated bank accounts to offer limited shelter from company funding issues.

Despite this lack of stringent regulatory oversight, Forex4you does offer two-factor authentication (2FA) as an additional security measure for its web login portal and proprietary trading platforms. In addition, the MT4 platform supports single-use passwords.

Customer Support

For clients that require help with their account application, are stuck on the web login portal or have withdrawal issues, a helpful and friendly customer service team can help traders feel welcome and supported.

Investors have several options to contact the Forex4you support team, including an email address, a website live chat feature, a 24/7 UK-based phone number and a support ticket system exclusively for clients:

- Email Address – info@forex4you.com

- UK Toll Phone Number- 0330 027 182

In addition, the broker provides an FAQ section with answers to common queries and issues about the service and supported platforms.

Educational Content

Forex4you offers four levels of educational content, ranging from beginner to advanced. While some clients may be reluctant to relegate themselves to the broker’s “forex pre-school”, the content is solid. It provides information on topics that include expert advisors, hedging, technical analysis and order types.

Advantages Of Forex4you

- 2FA support

- No deposit fees

- Several trading platforms

- Transparent pricing structure

- No account minimum deposits

- Good customer support options

Disadvantages Of Forex4you

- Withdrawal fees

- No GBP account

- Weak regulation

- Limited asset range

- No Islamic accounts

- No bonuses for UK clients

Promotions

Many brokers offer an enticing welcome bonus or deposit match schemes to encourage new clients to sign up for their services. However, while Forex4you provides several such promotions to its Asian and African clients, no programmes are available for UK traders.

Additional Features

Additional features offered by brokers such as economic calendars, free VPS access and trading calculators can enhance a client’s trading experience.

As well as a comprehensive, asset-by-asset trading calculator and an economic calendar, Forex4you has partnered with Autochartist and Trading Street to provide market-leading signals and analysis.

For those that wish to delegate their trading decisions to experienced and profitable traders, the broker provides its Share4you copy trading service. In exchange for a small commission on profits, investors can automatically emulate the positions of over 1,000 leaders according to their risk profile and historical returns.

Trading Hours

Forex4you follows the standard forex market hours, which runs 24 hours a day, seven days a week. However, products such as indices and equities will often follow the trading hours of their local exchanges.

Clients can access the web login portal at any time to view their account details or make deposits and withdrawals.

Forex4you Verdict

This Forex4you broker review has found the company refreshingly transparent around spreads, commissions, execution times and account types. The complete lack of initial minimum deposit requirements when opening an account also goes in the firm’s favour. At the same time, two-factor authentication support gives clients an additional layer of security. However, the weak regulation from the BVI FSC leaves plenty to be desired, as does the lack of a fund protection scheme and negative balance protection.

FAQ

What Is The Forex4you Minimum Deposit?

Forex4you does not require a minimum deposit to open any of its four offered account types. While specific payment methods have a minimum deposit requirement, these are below £2 for all e-wallet solutions and under £10 for Visa and MasterCard.

What Spreads Does Forex4you Offer?

Forex4you provides fixed spreads from 2.0 pips on its Cent and Classic account types and floating spreads starting from 0.1 pips on its Cent NDD and Pro STP variants.

Does Forex4you Support MT4?

Forex4you supports the MetaTrader 4 (MT4) trading platform alongside its proprietary desktop, browser and mobile software.

Does Forex4you Provide An Islamic Account?

Unfortunately, traders in the UK cannot open a swap-free Islamic account with Forex4you.

Are There Any Commissions When Funding A Forex4you Account?

While Forex4you does not charge any deposit fees on any supported payment methods, commissions of between 0.8% and a £2.10 flat fee plus 2.5% are levied on withdrawals.

Top 3 Forex4you Alternatives

These brokers are the most similar to Forex4you:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Forex4you Feature Comparison

| Forex4you | IG Index | IronFX | Swissquote | |

|---|---|---|---|---|

| Rating | - | 4.7 | 3.8 | 4 |

| Markets | Forex, CFDs, stocks, indices, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $0 | $0 | $100 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | BVI FSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CySEC, FCA, FSCA, BMA / Bermuda | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4 | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (Retail), 1:222 (Pro) | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Forex4you Review |

IG Index Review |

IronFX Review |

Swissquote Review |

Trading Instruments Comparison

| Forex4you | IG Index | IronFX | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Forex4you vs Other Brokers

Compare Forex4you with any other broker by selecting the other broker below.

Popular Forex4you comparisons: