Forex Trading With MetaTrader 4

Forex trading with MetaTrader 4 (MT4) software is popular among UK traders due to the reliability and powerful tools on offer. The platform supports a variety of forex trading strategies, with its vast library of indicators and Expert Advisors (EAs). This guide will provide some tips on how to start forex trading with MetaTrader 4, plus a tutorial on charts, signals and more.

Start Forex Trading With MetaTrader 4

Find A Forex Broker

To start trading, you need to find a good online broker that offers forex trading with MetaTrader 4. The broker is the intermediary between you and the interbank market, where you can trade through their platform and they earn a commission for facilitating trades.

There’s a wide range of brokers offering the MT4 platform and other tools. You can take a look at some of our best forex trading broker reviews here.

Top UK Forex Brokers with MT4

-

Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

-

FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

-

Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

-

IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

-

FxPro offers 70+ currency pairs but no minors and stands out with its ultra-fast execution speeds and tight spreads averaging 0.45 pips on EUR/USD. Forex traders can also build test and deploy short-term trading strategies on the industry-leading MT4 software, with expert advisors (EAs) for algo trading.

-

IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

-

FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

-

City Index is one of the most trusted forex brokers, providing an above-average selection of 80+ currency pairs alongside tight spreads from 0.7 pips, trading alerts, and terrific insights into FX markets, with 99.99% of trades successfully executed.

-

Markets.com offers 43 major, minor and exotic currency pairs. The range is around the industry average, though spreads are fairly competitive, starting from 0.6 pips for EUR/USD. There’s also an excellent range of tools and education, including forex calculators and trading videos.

-

Axi’s 70+ currency pairs is its strongest market offering and beats out rivals like AvaTrade, which offers only 50+. Combine this with an elevated MT4 offering through the NextGen add-on, and Axi remains an excellent broker for forex traders.

-

OspreyFX offers more than 50 major, minor and exotic currency pairs. Spreads start from just 0.1 pips on the EUR/USD and the broker provides a suite of forex trading education for beginners, including partnering with Forex Squad for fresh insights.

-

Errante traders can access 50+ forex pairs with leverage up to 1:500 (location dependant). The broker offers fast execution and tight spreads, especially to clients with VIP and Tailor-Made accounts.

-

Coinexx offers an excellent selection of 70+ major, minor and exotics currency pairs, presenting diverse opportunities with a forex calculator to aid trading decisions. It’s also one of a select few brokers to support forex trading on the ActTrader platform, alongside MT4 and MT5.

-

Ingot Brokers offers forex trading on a modest suite of 30+ currency pairs with raw spreads on the MT5 platform. There are also no restrictions on short-term trading strategies, including hedging, scalping and the use of Expert Advisors (EAs).

-

Trade a small selection of 25 major and minor pairs. Spreads from zero on the pro account, micro-lot trading, and very high leverage make up for the limited range of currencies. The MetaTrader software is also a well-regarded platform for forex trading.

-

Go long or short on over 50 currency pairs with spreads from 0.6 pips on EUR/USD. Traders can access interactive tools on the forex industry’s most popular software, MetaTrader 4, with customizable charts, one-click trading and Expert Advisors (EAs) for algo trading.

-

World Forex offers CFD and digital contract trading on 53 forex pairs, including EUR/USD and GBP/EUR. High leverage is available for CFDs, which can be accessed with competitive spreads on certain account types.

-

Scope Markets offers 40+ major, minor and exotic currency pairs. Although the range is average, experienced traders can access very high leverage up to 1:2000. Additionally, the broker’s proprietary terminal delivers advanced analysis tools, including a live forex heatmap.

-

Trade 50+ forex pairs, including popular major, minor and exotic pairs. This is a decent selection, but traders will have a choice between the attractive MT4, MT5 or IRESS platforms and regulatory cover from ASIC. The VPS will also suit automated forex trading strategis.

-

Anzo Capital offers 45+ forex pairs including majors, minors and exotics with fast execution and spreads starting from zero. High leverage up to 1:1000 is available with a margin call at 80% and a stop out level at 50%.

-

I think the range of 60+ major, minor and exotic currency pairs is fairly competitive, especially with spreads from 0 pips in the Pro account. Experienced traders can also access high leverage up to 1:500 in the popular MT4 platform.

-

Rock Global clients can access 50+ currency pairs via CFDs with leverage up to 1:500, world class liquidity and fast execution on the MT4 or TWS platforms. The tight spreads from 0.9 with no commission are a particularly attractive feature.

-

VT Markets offers an average selection of 40+ forex pairs with up to 1:500 leverage. Forex spreads in the ECN account are highly competitive, starting from 0.0 pips, although the 1.2-pip minimum quotes in the Standard account are a little higher than the likes of Pepperstone or IC Markets.

-

Binary and OTC options can be purchased on 40+ currency pairs, with 55+ currency pairs available if you deposit $1000. Typical payouts are reasonable at 81% and the $1 minimum trade makes the broker accessible to new forex traders. There is also access to the MT4 and MT5 platforms for experienced forex traders.

-

Exinity offers 150+ forex pairs to trade on a very competitive ECN pricing model, with spreads from zero and low commissions of $4 per round turn. Traders can access the powerful MT4 and MT5 platforms and trade with no restrictions on popular trading strategies.

-

xChief supports spot foreign exchange trading on all account types for 40+ major, minor and exotic currency pairs. Trading takes place on the leading MT4 and MT5 platforms, which offer dozens of in-built technical tools for short-term forex strategies.

-

PU Prime clients can trade 40+ forex pairs via the MT4 and MT5 platforms with dynamic leverage up to 1:500. Spreads start from near zero on Prime accounts, which also charge a $7 commission per lot, and a zero-commission Standard account with wider spreads is also available.

-

With 100+ currency pairs including all majors plus many minors and exotics tradeable on the MT4 platform with 1:2000 leverage, SuperForex lives up to its name as a great choice for forex traders. The ForexCopy system is also useful for newer traders.

-

AdroFx's strongest offering is its 60+ currency pairs, which can be traded with very high leverage up to 1:500. The broker also offers competitive forex spreads starting from 0.4 pips and charges no commission. Additionally, traders have access to MetaTrader 4, which was built for forex trading and offers excellent support for technical analysis and algo trading.

-

Start trading on dozens of currencies at RoboMarkets with powerful analysis tools and pattern recognition technology. 35+ currency pairs are available with tight spreads from 0 pips and rapid market execution. You can also utilise the broker's forex news alerts and economic calendar.

-

M4Markets offers 45+ currencies with zero pip spreads. The low latency and 30-millisecond execution speeds makes the broker a decent choice for forex traders. Additionally, there are no restrictions on trading strategies, including scalping.

-

MultiBank FX offers trading on 50+ major, minor and exotic currency pairs. Spreads are tighter than many competitors and the broker offers higher leverage than most alternatives. Automated trading strategies are also permitted.

-

I’m happy with Tradeview’s strong range of 60+ currency pairs spanning majors, minors and exotics with competitive spreads from 0 pips in the $1000 ILC account. Traders can choose from several platforms, but I was particularly impressed with the feature-rich Currenex platform which is designed specifically for currency trading.

-

Global Prime traders can access 48 forex pairs including majors, minors and exotics with tight spreads from 0.9 with no commission or from 0 with a $7 round turn. Forex is traded via the leading MT4 platform, micro lots are available and latency is low via a New York-based server.

-

Trade Nation offers over 30 of the most popular forex pairs with variable spreads. Traders can access a slick proprietary platform or MetaTrader 4, with real-time forex market updates and insights via 'Smart News'.

-

As well as a competitive selection of 55+ forex pairs, traders can access high leverage up to 1:300. You can also enjoy advanced analysis from Trading Central with easy integration into MetaTrader 4.

-

Traders can access a decent range of 60+ major, minor and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders.

-

4xCube offers 60+ currency pairs with competitive trading conditions. We like that all trading strategies are permitted including scalping and hedging.

-

ActivTrades offers its lowest fees in the forex department, with excellent spreads on majors like the EUR/USD from 0.5 pips and zero commissions, keeping pricing simple. Improvements to the ActivTrades platform, alongside access to the industry-leading MetaTrader 4, also give traders the tools they need to navigate the FX market confidently.

-

BlackBull offers 64 currency pairs with excellent pricing through its ECN accounts, with the Standard commission-free spread starting from 0.8 pips. BlackBull also ensures its rapid execution carries through to MT4, which still stands as the industry’s most popular platform with active forex traders.

-

RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

-

Swissquote offers compelling conditions for active forex traders, with an extensive range of 80+ currency pairs, plus ultra-fast execution speeds averaging 9ms and access to the industry’s favorite MT4 software.

-

SimpleFX provides a comprehensive selection of around 60 currency pairs, from majors like GBP/USD to exotics like CHF/PLN. Forex trading fees are competitive, averaging 0.9 pips on EUR/USD during testing, while MetaTrader 4, available on desktop, web and mobile, was built specifically for trading currencies online.

-

EagleFX facilitates short-term trading on over 50 major, minor and exotic currency pairs with competitive spreads as low as 0.1 pips, plus the industry-leading MT4 platform, which delivers a host of charting tools for traders, including 9 timeframes and over 30 indicators.

-

FXDD continues to offer a leading selection of 90+ currency pairs with ECN pricing. Spreads are decent, coming in at 0.4 pips for EUR/USD during testing. That said, these quotes aren’t as narrow as top competitors like Pepperstone.

-

Trade on 45+ majors, minors, crosses and exotics, with competitive pricing, ultra-fast execution and no requotes. Newer traders can access zero-commission trading. Experienced forex traders can operate with no trading restrictions and benefit from an ECN account and a VPS service.

-

FXTrading clients can access 70+ forex pairs with high leverage up to 1:500, fast execution averaging 80ms, excellent liquidity and spreads from zero. A good selection of minors and exotics are available as well as all the majors. New users can start trading forex in 4 easy steps.

-

With over 190 forex spot pairs, EZ Invest outperforms many rivals in terms of access to the currency markets. Users can also choose between desktop software, a webtrader plus a solid mobile app. On the negative side, spreads aren't the tightest on entry accounts.

-

FXGiants offers a strong suite of 70 currency pairs, spanning major, minor and exotics. Forex can be traded through CFDs, offering long and short opportunities with leverage.

-

Trade 50+ forex pairs via the MetaTrader 4 and MetaTrader 5 platforms with leverage up to 1:500, immediate execution, deep liquidity and tight spreads.

-

Fortrade offers 60+ currency pairs including a good selection of majors, minors and exotics. Trading takes place via MT4 or Fortrade's proprietary, low-latency terminal, and spreads on the USD/GBP pair average a reasonable 2 pips.

-

FP Markets stands out as an excellent option for forex traders, boasting a selection of over 70 currency pairs covering a wide range of currencies, especially since expanding its choice of exotics. With average spreads of just 0.1 on the EUR/USD in its Raw account, the broker provides competitive pricing for traders.

-

IronFX continues to offer a strong selection of 80 currency pairs. You can trade through the market-leading MT4 platform with a range of forex market research tools. That said, commission charges in the zero-spread accounts are high, starting from $13.50 per lot.

-

Trade 80+ major, minor and exotic forex pairs. This is a very competitive range of currency pairs with 50+ exotics to choose from, and traders will benefit from fast execution and support from extra features including a pip calculator. The MetaTrader 4 software was also designed for online forex trading.

-

NordFX offers a modest range of 30+ major and minor forex pairs. Disappointingly, there are no exotic pairs, though traders do benefit from tight spreads from 0.0 pips and low commissions from 0.0035% per side. It also provides insightful weekly forecasts covering key forex assets like EUR/USD.

-

HYCM offers 40+ forex pairs, with most available to trade on either the MT4 or MT5 platform. The maximum leverage on offer is 1:30 in accordance with regulations, and tight spreads start from 0.2 on the Raw account and from 1.2 on the commission-free Classic account.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Trade 45 major, minor and exotic forex pairs. This is an average range, but the broker offers attractive and very competitive tight floating spreads from 0.3. Useful features including a news feed set the broker apart from many rivals and can help plan forex strategies.

-

Hantec Markets offers a limited range of 30+ forex pairs – less than most top brands, including Pepperstone with 100+. That said, market execution is rapid based on tests, and spreads are competitive starting at just 0.2 pips. This, combined with access to the popular MT4 platform with 30+ technical indicators, ensures a relatively complete trading experience for short-term currency traders.

-

Speculate on popular currency pairs with flexible leverage up to 1:500 and zero-pip spreads in the GO Plus account. Commission-free trading is available with micro, mini and standard forex contract sizes.

-

ThinkMarkets offers 46 currency pairs, which is around the industry average. Forex traders can benefit from tight 0.0-pip spreads for EUR/USD during peak market hours. Additionally, the ThinkTrader proprietary platform offers an impressive 125+ technical indicators - ideal for complex forex strategies.

-

OANDA offers 68 currency pairs, which is above the industry average. You can speculate on majors, minors and exotics, with spreads from 0.8 pips on popular pairs. There are no commissions and leverage is available up to 1:200. Average execution speeds are fast based on tests, at 12 milliseconds.

-

CMC presents an extensive array of 300+ forex pairs characterized by tight spreads and rapid executions, surpassing the offerings of many competitors in terms of currency diversity. Forex indices also present a fairly unique and holistic way to speculate on the value of key currencies like the USD, EUR and GBP.

-

FXTM stands out with a strong selection of over 60 currency pairs, surpassing many competitors like AvaTrade. It also stands out with its six currency indices for traders aiming to diversify their forex portfolios, while the ECN account offers ultra-competitive spreads starting at 0 pips on majors, along with low commissions of just $3.50 per lot.

-

easyMarkets offers 60+ major and minor currency pairs but no exotics. Forex traders will appreciate the access to the industry’s leading software MT4, paired with the broker’s fixed spreads from 0.7 pips on EUR/USD, offering a degree of price certainty.

-

Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

-

FXCM offers an average range of 40+ currency pairs, although there are no commissions and spreads are competitive from 0.78 pips for EUR/USD. The broker also offers 3 forex baskets covering USD, Yen and emerging markets benchmarks.

-

InstaForex's range of 100+ currency pairs is among the largest we have seen. ECN spreads are also available from 0.0 pips with zero commissions. Minimum deposits start from $1 making the broker accessible for beginners. You can also access market-leading forex analysis and insights.

-

Trade 200 CFD forex pairs with DMA pricing and tight spreads, ultra low latency and high leverage up to 1:1000. The range of forex pairs available and pricing model are among the most attractive in the African market.

-

Capital.com offer a long list of forex CFD pairs for trading. All have competitive spreads. The firm also ensures negative balance protection

We highly recommend that you try before you buy with a demo MT4 account. The simulator within MT4 allows traders to trial the platform without risking real capital.

Install & Set Up

Once you’ve registered for an account, your broker will provide you with details on the MT4 download process for Windows or Mac PCs.

Alternatively, you can trade forex directly through an internet browser, with the MetaTrader 4 WebTrader, or the MT4 mobile app.

Exploring The Platform

Once you have registered and logged in, you can start browsing the user-friendly terminal which provides everything you need on one screen.

The left-hand Market Watch window indicates all the currency pairs available, which can be hidden if preferred. Above the main chart window, you can find a selection of technical studies and drawing tools.

Along the bottom of the terminal, your forex orders will be displayed in detail, showing the order size, price and profit of each entry. Across the top, you will find additional features, such as the economic calendar and news, signals and the MetaTrader Market.

Orders

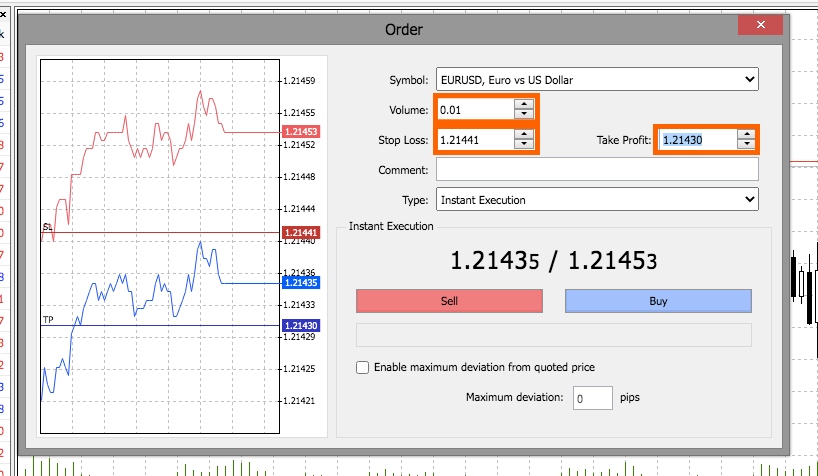

In MT4, you can set either an instant order or a pending order by clicking on the ‘New Order’ in the standard toolbar at the top. A dialogue box will appear, where you can select a currency pair from the drop-down list and select other parameters such as order type and position size.

Volume is expressed in standard lot sizes. A standard lot is worth 100,000 units, so if you want to buy 1,000 units of EUR/USD, for example, you would enter 0.01 in the volume field.

You can then set your stop loss (SL) and take profit (TP) levels, which help you manage your risk and prevent your FX trades reaching margin call. SL and TP essentially define the price levels for when a position should be closed, to either minimise losses or to lock in your profits.

You can always modify your order later, which we will cover below.

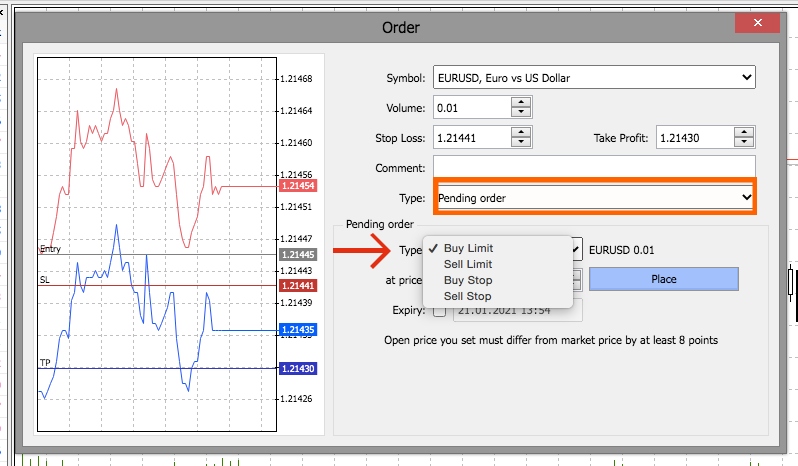

If you want to enter a forex trade via a pending order, follow the same steps but select ‘Pending Order’ in the Type drop-down. You will then be presented with 4 pending order options:

- Buy Limit – Taking a long position at a lower level than market price

- Sell Limit – Taking a short position at a higher level than market price

- Buy Stop – Taking a long position at a higher level than market price

- Sell Stop – Taking a short position at a lower level than market price

Once you’ve selected the type of order, enter the price you wish to enter the market, your position size and SL and TP fields. You can also set an expiry date on a pending order.

To modify a trade, simply right click on your order and select ‘Modify or Delete’ to open up the dialogue box again. Then adjust your SL and TP to the desired levels and click ‘Modify’, which will confirm your order.

To close an open trade, right-click on the trade and select ‘Close Order’. Once you close, your balance will adjust and will be reflected in the profit field in your order window.

Forex Trading With MetaTrader 4 EAs

Expert Advisors (EAs) are forex trading robots which are programmed to automatically place trades once a certain criterion has been met. Automated forex trading is ideal if you don’t have time to manually monitor trades yourself, but be aware that not all EA programmes are trustworthy and reliable.

You can find a vast portfolio of thousands of forex robots for automated trading in the Market section of the MetaTrader 4 platform. Simply select one to install onto your PC and look for the trading robot in your navigator panel in the MT4 Terminal.

Forex Trading With MetaTrader 4 Indicators

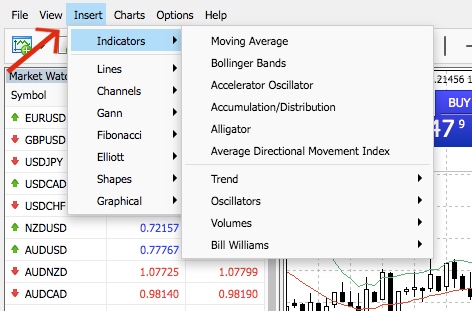

When forex trading, you can enhance your strategies on MT4 using the 30 pre-included indicators and 24 graphical objects for technical analysis.

One of the best features of MetaTrader 4 is the customisable charts, which allow you to add multiple indicators and objects in various colours. To access these, click on ‘Insert’ in the top toolbar and choose from the selection in the drop-down.

Once you’ve selected the one you want to use, a dialogue box will appear where you can set the parameters of the indicator. Trading forex with indicators like the Moving Average Convergence Divergence (MACD) and Bollinger Bands, is also popular among traders.

Moving Average Convergence Divergence identifies moving averages which are indicating a new trend, consisting of two converging lines and a histogram to indicate the difference. Bollinger bands indicate the market’s volatility by measuring the variation of prices over time, creating a band with a simple moving average (SMA) in the middle.

You can see how these two studies can be overlaid onto the standard candlestick chart below.

If you want to start trading forex with divergence on MT4, you can access a number of useful guides online, including the Jim Brown downloadable PDF.

MetaTrader also offers thousands of custom forex indicators within the MetaTrader Market and CodeBase.

Additional Features

News & Education

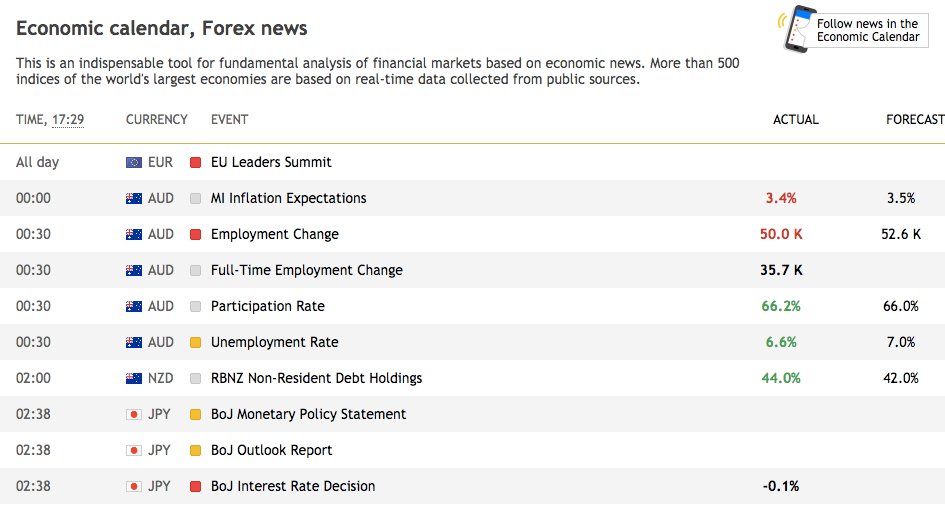

To assist your fundamental analysis, the pre-included economic calendar collates real-time data from public news sources. The calendar can also be filtered by date, event importance and countries.

From the top menu, you can also access information for forex trading strategies, tips and education, including published articles and a MetaTrader 4 community forum.

Forex Trading With MetaTrader 4 Market

The Market page not only contains thousands of indicators and EAs, but also utilities, which includes risk management, analysers and even forex trading games.

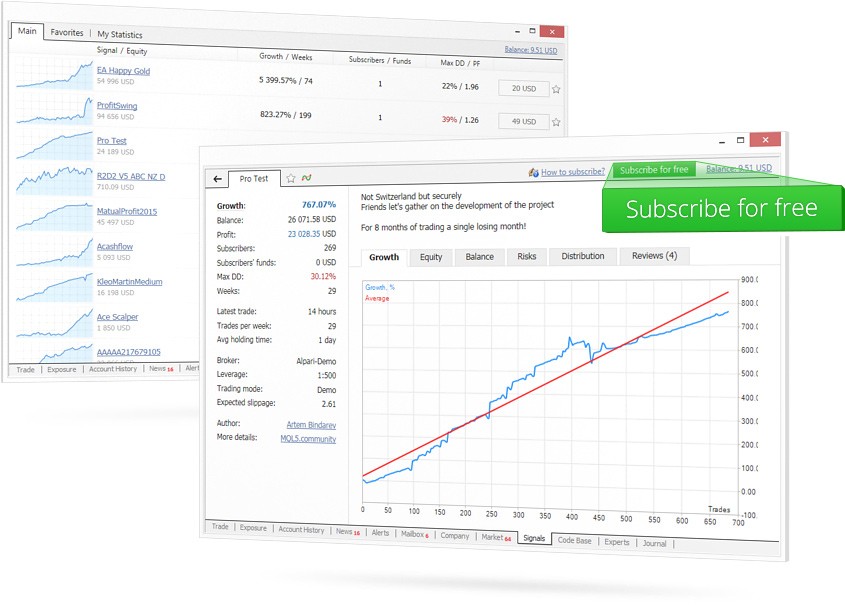

Copy Trading & Signals

MetaTrader 4 also offers FX trading signals, which allows traders to automatically copy another provider’s trades. Copy trading can boost efficiency if you have limited time, but it can also be a great strategy-learning tool for beginners.

To choose a provider, click on Signals in the top menu bar and browse the available options. Clicking on one will take you through to the provider’s performance stats.

Note that not all providers are reliable and you do have to pay a monthly fee to subscribe. It’s worth spending time researching a few forex providers before choosing.

Final Word On Forex Trading With MetaTrader 4

Forex platforms like MetaTrader 4 are a top choice among traders, offering a powerful interface with customisable charts, indicators and education tools. For beginners still learning how to trade forex in MT4, there’s also a forex demo account and a community forum. To start trading forex with MT4 today, head to your chosen broker to register.

FAQ

How Do I Start Forex Trading Using MetaTrader 4?

To begin forex trading with MT4, you will need to sign up with an online MT4 forex broker. Once you have registered for a live or demo account, you can then download the platform, or access it straight from your internet browser.

Is Forex Trading With MetaTrader 4 Easy?

The software used in MT4 is user-friendly and easy to navigate, though implementing technical studies and forex analysis will take some practice. We highly recommend you sign up to a demo tutorial in MetaTrader 4 (MT4) and make use of the forum and resources, before trading in a live account.

Is Forex Trading With MetaTrader 4 Safe?

The MetaTrader 4 platform meets the highest security standards, including a Secure Sockets Layer (SSL) encryption system to protect data exchange between servers. MT4 also supports the use of RSA digital signatures. Make sure to check that your broker also offers robust security features

What Forex Trading Features Are Included In The MT4 Platform?

For traders of any level using MT4, there is an array of powerful tools and useful features on offer. Features include over 30 technical indicators and 24 graphical objects, with thousands of custom indicators and EAs available in the Market. There are also 3 chart types and 9 time frames, plus educational articles, a forum, signals and an economic calendar.

When Can I Trade Forex In MetaTrader 4?

Standard forex trading hours typically run from Sunday night to Friday night GMT but due to international overlapping timezones, it is possible to trade 24 hours a day. You can access forex trading hours indicators in the MT4 Market, which will indicate all market sessions in one view.