Trading EUR/JPY

The Euro and Japanese Yen (EUR/JPY) is one of the most popular and volatile crosses traded in the world today. But before you start investing on the EUR/JPY exchange rate, use this guide to understand how to forecast future prices using live online charts, the latest news and technical analysis. We’ll also look at the history of both currencies, plus other top trading tips.

EUR/JPY Trading Brokers

-

Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

-

XTB provides access to 70+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

-

FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

-

Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

-

IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

-

FxPro offers 70+ currency pairs but no minors and stands out with its ultra-fast execution speeds and tight spreads averaging 0.45 pips on EUR/USD. Forex traders can also build test and deploy short-term trading strategies on the industry-leading MT4 software, with expert advisors (EAs) for algo trading.

-

IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

-

FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

-

Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

-

PrimeXBT offers forex trading on over 50 majors, minors and exotics with margin opportunities and zero commissions. The forex platform is fast, reliable and feature-rich based on our latest tests with 3 charts, 10 timeframes, and 91 technical studies - ideal for active trading strategies.

-

Plus500 provides forex trading through CFDs, featuring narrow spreads across an impressive selection of over 60 currency pairs. During testing, spreads came in as tight as 0.6 pips on the EUR/USD, which is notably lower than many alternatives.

-

City Index is one of the most trusted forex brokers, providing an above-average selection of 80+ currency pairs alongside tight spreads from 0.7 pips, trading alerts, and terrific insights into FX markets, with 99.99% of trades successfully executed.

-

Markets.com offers 43 major, minor and exotic currency pairs. The range is around the industry average, though spreads are fairly competitive, starting from 0.6 pips for EUR/USD. There’s also an excellent range of tools and education, including forex calculators and trading videos.

-

NinjaTraders supports the trading of popular currencies including the EUR/USD. The software also offers advanced features to streamline the trading experience, including complex order types like market if touched (MIT) and one cancels other (OCO).

-

Axi’s 70+ currency pairs is its strongest market offering and beats out rivals like AvaTrade, which offers only 50+. Combine this with an elevated MT4 offering through the NextGen add-on, and Axi remains an excellent broker for forex traders.

-

IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

-

Videforex offers trading on 35 currency pairs through leveraged CFDs with spreads from 0.1 pips. Alternatively, traders can use binaries to speculate on upward/downward price movements with payouts up to 98%. Integrated technical analysis, economic calendars, and market news, all available within the platform, help support FX trading decisions.

-

An above-average selection of 55 currencies are available with reasonable spreads averaging 0.9 pips on EUR/USD during peak hours. Aspiring traders can continuously hone their forex strategies by switching between demo mode and their live account any time, with full access to the broker's 100+ technical indicators.

-

Focus Option offers 22 forex pairs tradeable via binary options, including a selection of majors and minors. FX pairs are also available to trade with margin on Focus Option's mobile app, which offers high leverage up to 1:50 and spreads from 1 pip.

-

Established in 2024 and headquartered in Seychelles, Bullwaves is a MetaTrader-only broker offering access to a modest collection of 250+ assets including forex, metals and indices. Traders can choose from three accounts; Classic, VIP and Elite, catering to different experience levels and budgets.

-

RedMars strongest investment category is forex with more than 50 currency pairs, from majors to minors and exotics. Spreads start from 0.0 pips, catering to active currency traders, and leverage can reach 1:500. However, there are no forex heatmaps or research tools to support aspiring forex traders.

-

UnitedPips supports trading on over 40 major, minor and exotic currency pairs. To help inform trading decisions, it offers daily market analysis with fundamental and technical insights into prominent currency pairs like AUD/USD and EUR/USD.

-

Capitalcore offers a modest selection of around 35 currency pairs, which is very limited compared to CMC Markets' 300+ pairs. Spreads are lowest on the VIP account (0.4 pips on EUR/USD), but become less competitive in Classic and Silver accounts (1.5 pips on EUR/USD), and there aren't any zero spreads.

-

OspreyFX offers more than 50 major, minor and exotic currency pairs. Spreads start from just 0.1 pips on the EUR/USD and the broker provides a suite of forex trading education for beginners, including partnering with Forex Squad for fresh insights.

-

CloseOption offers binaries on 25+ forex pairs, including majors like EUR/USD and a few minors like AUD/JPY. Payouts vary by currency, with decent typical payouts of 75% for GBP/USD.

-

Amega offers an unusually large selection of currency pairs for an unregulated broker with 70+ forex CFDs, alongside up to 1:1000 leverage, zero commissions and competitive spreads from 0.8 pips. FX traders also have access to MT5 – the faster, more advanced version of MT4.

-

Errante traders can access 50+ forex pairs with leverage up to 1:500 (location dependant). The broker offers fast execution and tight spreads, especially to clients with VIP and Tailor-Made accounts.

-

Coinexx offers an excellent selection of 70+ major, minor and exotics currency pairs, presenting diverse opportunities with a forex calculator to aid trading decisions. It’s also one of a select few brokers to support forex trading on the ActTrader platform, alongside MT4 and MT5.

-

Ingot Brokers offers forex trading on a modest suite of 30+ currency pairs with raw spreads on the MT5 platform. There are also no restrictions on short-term trading strategies, including hedging, scalping and the use of Expert Advisors (EAs).

-

Trade a small selection of 25 major and minor pairs. Spreads from zero on the pro account, micro-lot trading, and very high leverage make up for the limited range of currencies. The MetaTrader software is also a well-regarded platform for forex trading.

-

Go long or short on over 50 currency pairs with spreads from 0.6 pips on EUR/USD. Traders can access interactive tools on the forex industry’s most popular software, MetaTrader 4, with customizable charts, one-click trading and Expert Advisors (EAs) for algo trading.

-

World Forex offers CFD and digital contract trading on 53 forex pairs, including EUR/USD and GBP/EUR. High leverage is available for CFDs, which can be accessed with competitive spreads on certain account types.

-

FinPros offers 80+ forex pairs, which is one of the more diverse offerings available. Traders benefit from ultra-low latency, MT5 support and very tight spreads and low commissions on the RAW+ account.

-

IQCent traders can access CFDs or binary options on 45+ forex pairs. CFD spreads start from 0.3 pips and binary options payouts are decent up to 95%. This is competitive compared to Pocket Option, for example, offering forex payouts up to only 81%.

-

Trade 50+ forex pairs including popular majors and minors with very high leverage available up to 1:1000. Gold, silver, palladium and platinum pairs with USD are also available.

-

RaceOption offers 25+ major and minor currency pairs on a no-frills, web-accessible platform with 30+ indicators and built-in copy trading opportunities for a hands-off investment approach.

-

Scope Markets offers 40+ major, minor and exotic currency pairs. Although the range is average, experienced traders can access very high leverage up to 1:2000. Additionally, the broker’s proprietary terminal delivers advanced analysis tools, including a live forex heatmap.

-

Trade 50+ forex pairs, including popular major, minor and exotic pairs. This is a decent selection, but traders will have a choice between the attractive MT4, MT5 or IRESS platforms and regulatory cover from ASIC. The VPS will also suit automated forex trading strategis.

-

Anzo Capital offers 45+ forex pairs including majors, minors and exotics with fast execution and spreads starting from zero. High leverage up to 1:1000 is available with a margin call at 80% and a stop out level at 50%.

-

I think the range of 60+ major, minor and exotic currency pairs is fairly competitive, especially with spreads from 0 pips in the Pro account. Experienced traders can also access high leverage up to 1:500 in the popular MT4 platform.

-

Rock Global clients can access 50+ currency pairs via CFDs with leverage up to 1:500, world class liquidity and fast execution on the MT4 or TWS platforms. The tight spreads from 0.9 with no commission are a particularly attractive feature.

-

VT Markets offers an average selection of 40+ forex pairs with up to 1:500 leverage. Forex spreads in the ECN account are highly competitive, starting from 0.0 pips, although the 1.2-pip minimum quotes in the Standard account are a little higher than the likes of Pepperstone or IC Markets.

-

Binary and OTC options can be purchased on 40+ currency pairs, with 55+ currency pairs available if you deposit $1000. Typical payouts are reasonable at 81% and the $1 minimum trade makes the broker accessible to new forex traders. There is also access to the MT4 and MT5 platforms for experienced forex traders.

-

Exinity offers 150+ forex pairs to trade on a very competitive ECN pricing model, with spreads from zero and low commissions of $4 per round turn. Traders can access the powerful MT4 and MT5 platforms and trade with no restrictions on popular trading strategies.

-

xChief supports spot foreign exchange trading on all account types for 40+ major, minor and exotic currency pairs. Trading takes place on the leading MT4 and MT5 platforms, which offer dozens of in-built technical tools for short-term forex strategies.

-

PU Prime clients can trade 40+ forex pairs via the MT4 and MT5 platforms with dynamic leverage up to 1:500. Spreads start from near zero on Prime accounts, which also charge a $7 commission per lot, and a zero-commission Standard account with wider spreads is also available.

-

With 100+ currency pairs including all majors plus many minors and exotics tradeable on the MT4 platform with 1:2000 leverage, SuperForex lives up to its name as a great choice for forex traders. The ForexCopy system is also useful for newer traders.

-

AdroFx's strongest offering is its 60+ currency pairs, which can be traded with very high leverage up to 1:500. The broker also offers competitive forex spreads starting from 0.4 pips and charges no commission. Additionally, traders have access to MetaTrader 4, which was built for forex trading and offers excellent support for technical analysis and algo trading.

-

Start trading on dozens of currencies at RoboMarkets with powerful analysis tools and pattern recognition technology. 35+ currency pairs are available with tight spreads from 0 pips and rapid market execution. You can also utilise the broker's forex news alerts and economic calendar.

-

Trade 7 major, 21 minor and 29 exotic forex pairs with high leverage and a choice between STP or ECN accounts. Support is available around the clock and the TradeLocker forex software is provided.

-

M4Markets offers 45+ currencies with zero pip spreads. The low latency and 30-millisecond execution speeds makes the broker a decent choice for forex traders. Additionally, there are no restrictions on trading strategies, including scalping.

-

MultiBank FX offers trading on 50+ major, minor and exotic currency pairs. Spreads are tighter than many competitors and the broker offers higher leverage than most alternatives. Automated trading strategies are also permitted.

-

I’m happy with Tradeview’s strong range of 60+ currency pairs spanning majors, minors and exotics with competitive spreads from 0 pips in the $1000 ILC account. Traders can choose from several platforms, but I was particularly impressed with the feature-rich Currenex platform which is designed specifically for currency trading.

-

Global Prime traders can access 48 forex pairs including majors, minors and exotics with tight spreads from 0.9 with no commission or from 0 with a $7 round turn. Forex is traded via the leading MT4 platform, micro lots are available and latency is low via a New York-based server.

-

Trade Nation offers over 30 of the most popular forex pairs with variable spreads. Traders can access a slick proprietary platform or MetaTrader 4, with real-time forex market updates and insights via 'Smart News'.

-

As well as a competitive selection of 55+ forex pairs, traders can access high leverage up to 1:300. You can also enjoy advanced analysis from Trading Central with easy integration into MetaTrader 4.

-

Traders can access a decent range of 60+ major, minor and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders.

-

4xCube offers 60+ currency pairs with competitive trading conditions. We like that all trading strategies are permitted including scalping and hedging.

-

ActivTrades offers its lowest fees in the forex department, with excellent spreads on majors like the EUR/USD from 0.5 pips and zero commissions, keeping pricing simple. Improvements to the ActivTrades platform, alongside access to the industry-leading MetaTrader 4, also give traders the tools they need to navigate the FX market confidently.

-

BlackBull offers 64 currency pairs with excellent pricing through its ECN accounts, with the Standard commission-free spread starting from 0.8 pips. BlackBull also ensures its rapid execution carries through to MT4, which still stands as the industry’s most popular platform with active forex traders.

-

RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

-

Swissquote offers compelling conditions for active forex traders, with an extensive range of 80+ currency pairs, plus ultra-fast execution speeds averaging 9ms and access to the industry’s favorite MT4 software.

-

SimpleFX provides a comprehensive selection of around 60 currency pairs, from majors like GBP/USD to exotics like CHF/PLN. Forex trading fees are competitive, averaging 0.9 pips on EUR/USD during testing, while MetaTrader 4, available on desktop, web and mobile, was built specifically for trading currencies online.

-

EagleFX facilitates short-term trading on over 50 major, minor and exotic currency pairs with competitive spreads as low as 0.1 pips, plus the industry-leading MT4 platform, which delivers a host of charting tools for traders, including 9 timeframes and over 30 indicators.

-

FXDD continues to offer a leading selection of 90+ currency pairs with ECN pricing. Spreads are decent, coming in at 0.4 pips for EUR/USD during testing. That said, these quotes aren’t as narrow as top competitors like Pepperstone.

-

Trade on 45+ majors, minors, crosses and exotics, with competitive pricing, ultra-fast execution and no requotes. Newer traders can access zero-commission trading. Experienced forex traders can operate with no trading restrictions and benefit from an ECN account and a VPS service.

-

FXTrading clients can access 70+ forex pairs with high leverage up to 1:500, fast execution averaging 80ms, excellent liquidity and spreads from zero. A good selection of minors and exotics are available as well as all the majors. New users can start trading forex in 4 easy steps.

-

With over 190 forex spot pairs, EZ Invest outperforms many rivals in terms of access to the currency markets. Users can also choose between desktop software, a webtrader plus a solid mobile app. On the negative side, spreads aren't the tightest on entry accounts.

-

FXGiants offers a strong suite of 70 currency pairs, spanning major, minor and exotics. Forex can be traded through CFDs, offering long and short opportunities with leverage.

-

Trade 50+ forex pairs via the MetaTrader 4 and MetaTrader 5 platforms with leverage up to 1:500, immediate execution, deep liquidity and tight spreads.

-

Fortrade offers 60+ currency pairs including a good selection of majors, minors and exotics. Trading takes place via MT4 or Fortrade's proprietary, low-latency terminal, and spreads on the USD/GBP pair average a reasonable 2 pips.

-

FP Markets stands out as an excellent option for forex traders, boasting a selection of over 70 currency pairs covering a wide range of currencies, especially since expanding its choice of exotics. With average spreads of just 0.1 on the EUR/USD in its Raw account, the broker provides competitive pricing for traders.

-

IronFX continues to offer a strong selection of 80 currency pairs. You can trade through the market-leading MT4 platform with a range of forex market research tools. That said, commission charges in the zero-spread accounts are high, starting from $13.50 per lot.

-

Trade 80+ major, minor and exotic forex pairs. This is a very competitive range of currency pairs with 50+ exotics to choose from, and traders will benefit from fast execution and support from extra features including a pip calculator. The MetaTrader 4 software was also designed for online forex trading.

-

NordFX offers a modest range of 30+ major and minor forex pairs. Disappointingly, there are no exotic pairs, though traders do benefit from tight spreads from 0.0 pips and low commissions from 0.0035% per side. It also provides insightful weekly forecasts covering key forex assets like EUR/USD.

-

HYCM offers 40+ forex pairs, with most available to trade on either the MT4 or MT5 platform. The maximum leverage on offer is 1:30 in accordance with regulations, and tight spreads start from 0.2 on the Raw account and from 1.2 on the commission-free Classic account.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Trade 45 major, minor and exotic forex pairs. This is an average range, but the broker offers attractive and very competitive tight floating spreads from 0.3. Useful features including a news feed set the broker apart from many rivals and can help plan forex strategies.

-

Hantec Markets offers a limited range of 30+ forex pairs – less than most top brands, including Pepperstone with 100+. That said, market execution is rapid based on tests, and spreads are competitive starting at just 0.2 pips. This, combined with access to the popular MT4 platform with 30+ technical indicators, ensures a relatively complete trading experience for short-term currency traders.

-

Speculate on popular currency pairs with flexible leverage up to 1:500 and zero-pip spreads in the GO Plus account. Commission-free trading is available with micro, mini and standard forex contract sizes.

-

Tier 1 liquidity on an impressive range of 189 currency pairs and spot metals, plus 130 forwards, from 0.4 pips.

-

Trade on 60+ forex pairs with no commission and competitively tight spreads from 0.6 on major pairs such as EUR/USD. This is a good selection of forex pairs and excellent pricing for commission-free trading, well below the industry average.

-

ThinkMarkets offers 46 currency pairs, which is around the industry average. Forex traders can benefit from tight 0.0-pip spreads for EUR/USD during peak market hours. Additionally, the ThinkTrader proprietary platform offers an impressive 125+ technical indicators - ideal for complex forex strategies.

-

OANDA offers 68 currency pairs, which is above the industry average. You can speculate on majors, minors and exotics, with spreads from 0.8 pips on popular pairs. There are no commissions and leverage is available up to 1:200. Average execution speeds are fast based on tests, at 12 milliseconds.

-

CMC presents an extensive array of 300+ forex pairs characterized by tight spreads and rapid executions, surpassing the offerings of many competitors in terms of currency diversity. Forex indices also present a fairly unique and holistic way to speculate on the value of key currencies like the USD, EUR and GBP.

-

FXTM stands out with a strong selection of over 60 currency pairs, surpassing many competitors like AvaTrade. It also stands out with its six currency indices for traders aiming to diversify their forex portfolios, while the ECN account offers ultra-competitive spreads starting at 0 pips on majors, along with low commissions of just $3.50 per lot.

-

Trade FX pairs with tight spreads & leverage.

-

easyMarkets offers 60+ major and minor currency pairs but no exotics. Forex traders will appreciate the access to the industry’s leading software MT4, paired with the broker’s fixed spreads from 0.7 pips on EUR/USD, offering a degree of price certainty.

-

Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

-

Trade 24 forex pairs via binary options. Such a small range of currency pairs is not that unusual among binary options brokers, and BinaryCent's high payouts up to 95% compensate for the lack of range.

-

Trade around 50 major, minor and exotic currency pairs with ECN pricing that’s geared towards active traders or fixed spreads with no dealing desk intervention and a low starting deposit of just $1.

-

FXCM offers an average range of 40+ currency pairs, although there are no commissions and spreads are competitive from 0.78 pips for EUR/USD. The broker also offers 3 forex baskets covering USD, Yen and emerging markets benchmarks.

-

InstaForex's range of 100+ currency pairs is among the largest we have seen. ECN spreads are also available from 0.0 pips with zero commissions. Minimum deposits start from $1 making the broker accessible for beginners. You can also access market-leading forex analysis and insights.

-

Trade 200 CFD forex pairs with DMA pricing and tight spreads, ultra low latency and high leverage up to 1:1000. The range of forex pairs available and pricing model are among the most attractive in the African market.

-

Capital.com offer a long list of forex CFD pairs for trading. All have competitive spreads. The firm also ensures negative balance protection

-

Trade over 180 major, minor, and exotic forex pairs on the Trading 212 platform, featuring floating spreads and leverage up to 1:30. It’s important to note, though, that the forex broker has a history of adjusting margin requirements without providing adequate notice. As a result, CMC Markets is a better pick for forex traders with more currency pairs and a cleaner record.

The EUR/JPY Explained

EUR/JPY is the forex pair quote representing the currency exchange rate between the Euro and the Japanese Yen. The base currency, EUR, is quoted against the counter currency, JPY, which means you need a certain amount of JPY to buy one EUR.

Due to high levels of volatility, the EUR/JPY pairing represents around 3% of all daily transactions and is the seventh most-traded currency pair on the market.

To fully understand the price movements of the pair, below we analyse the origins of the two currencies and what historical factors have affected the EUR/JPY price.

The Euro

Compared to the Japanese Yen and many other currencies, the Euro is relatively new. Originally released as an invisible currency in 1999, it was not until 2002 when coins and banknotes were launched to the public. This became the biggest cash changeover in history, taking place in 12 EU countries.

Despite its infancy, the Euro has seen high volatility due to political and economic events at the start of the century, including the 2008 financial crisis. From 2013 to 2015, the Euro fell heavily again as debt problems emerged in Portugal, Spain, Greece and Italy.

The Japanese Yen

The Japanese Yen is the third most-traded currency in the world and is the fourth reserve currency behind the US Dollar, the Euro and the Pound Sterling.

The Yen was officially created in 1871 by the Meiji government and was steadily boosted in value due to Japan’s strong industrial economy. After losing much of its value after World War II, the Yen was then fixed at 360 JPY per 1 USD in order to stabilise the Japanese economy.

When this system was abandoned in 1971, the Yen became undervalued and was allowed to float. Throughout the 1970s and 1980s, the Yen fluctuated in value due to government intervention in the ‘dirty float’ scheme and the Plaza Accord. Since that time, the price of the Yen has gradually decreased.

Pros Of Trading EUR/JPY

- Volatility – High volume and volatility products like EUR/JPY can result in good trading opportunities from upward price movements.

- Stronger trends – As EUR/JPY is a cross pair, it generally develops stronger trends compared to major currency pairs. You can easily see this in action on a realtime or 1-hour price chart.

- Diversity – Intraday traders also enjoy a range of EUR/JPY trading options, such as ETF products, futures and forward instruments, and more.

- Technical analysis – Today, any trading system can offer an abundance of technical and fundamental analysis tools. This includes daily forex candlestick chart analysis and tools which allow you to access real-time economic news.

- Spreads – As one of the most popular traded pairs, you should be able to find a low bid-ask spread for EUR/JPY at most forex brokers.

Cons Of Trading EUR/JPY

- Volatility risk – Whilst high volatility can be profitable, it can also result in heavy losses if you do not have appropriate risk management tools in place.

- Leverage – Leveraged trading is often misunderstood, especially by new traders. Remember that you can lose more than you initially put down, so make sure you understand this concept before committing to a trade.

- Commitment – Due to its volatility, the current price action of EUR vs JPY is dynamic and constantly moving. This means UK traders will need to monitor market conditions and stay on top of historical data downloads in order to successfully execute a trend forecast.

What Factors Affect EUR/JPY?

European Factors

For today’s UK traders, there are a number of factors that influence the movement of the Euro, namely economic, political and financial. A notable example is monthly reports released by the European Central Bank (ECB), which can give traders an indication of where the Euro is heading.

Current employment rates and job creation is often another factor that can see the Euro go up or down. This data is also readily available to the public and is worth keeping an eye on to monitor the strength of an economy.

Other factors include monetary policy, inflation and the Consumer Price Index, confidence and sentiment, plus GDP. Experts suggest that now that Brexit has occurred, France and Germany now account for nearly 50% of the Eurozone’s GDP. These are therefore the best places to start if you’re looking for economic reports.

Japanese Factors

The same kinds of economic, political and financial factors also affect the spot Euro and Yen exchange rate, in addition to the high rate of import and export trading in Japan.

Another major factor is the current rate of natural disasters in the region. Because Japan is a small country, natural events can cause the currency’s value to fluctuate hugely.

Interest rates and government intervention initiatives also play a huge role in affecting the direction of JPY. The Bank of Japan, for example, has maintained a consistent zero interest rate policy for decades.

How To Trade EUR/JPY

If you’re considering day trading on EUR/JPY, you can check out the best platforms to use in some of our online broker reviews. Before you start, it’s worth getting to know the various strategies and considerations associated with the pair.

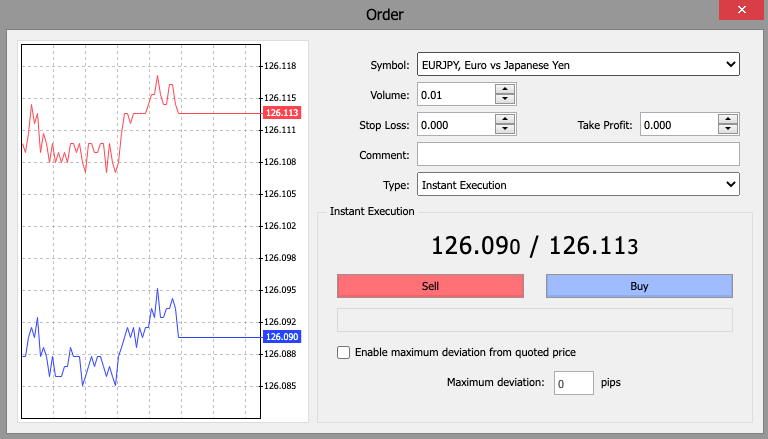

EUR/JPY Forex Trading MT4

Technical Analysis

For many traders, technical analysis is an essential base for any trading strategy. Technical analysis is the study of historical data on realtime price chart movements, which allow you to make a prediction on future forex trends.

Support and resistance levels, for example, can be used to indicate the high and low price points on a graph, at which the price will stop and reverse. These can also be used to analyse the average daily range pip movement of EUR/JPY, or to complement a breakout strategy. You could also use an indicator to map out bullish and bearish trends on an hourly chart, such as Elliott Wave analysis or daily Pivot Points.

Live streaming price charts are not only used for short-term forex analysis, as some can also facilitate a long-term chart forecast with timeframes spanning years. Moving averages, for example, work well on yearly charts, as they can show you the overall direction of price over time. You could also use a simple moving average on a 5 or 15 minute chart if you want to build your scalping strategy.

Fundamental Analysis

Whilst you can get a reasonable daily outlook from technical studies and indicators, these should also be combined with fundamental analysis. This involves monitoring any news reports and global events that might affect the EUR to JPY daily or weekly forecast.

Some of the most popular resources include Bloomberg, Forex Factory, Reuters, Yahoo Finance, Google Finance and CNBC. It’s also worth looking out for any economic news calendars, market sentiment tools or blogs within your trading platform.

Automated Trading

Some platforms also offer automated and algorithmic trading functionality, including Expert Advisors (EAs), which can be used for short-term or long-term strategies. For example, you could use a scalping strategy with an EA to make quick profits on EUR/JPY.

You can also use automated signals, where you can subscribe to another trader’s account and get their deals automatically copied into yours. This is a good option if you’re short on time or unable to monitor trades regularly.

You can easily apply a daily forex signal on EUR/JPY in the MetaTrader platform, for example, by exploring the vast range of providers in the Signals tab. Clicking on an individual provider will take you through to their success rates and monthly profit charts.

Note that automated trading isn’t for everyone and it will take practice to find the solution that suits you. If you encounter any issues, the community forum is an excellent place to get an initial prognosis, advice and recommendations.

Correlation

A simple EUR/JPY forex trading strategy that you can use to forecast the future price, is the positive currency correlation with both EUR/USD and USD/JPY. A positive currency correlation is when the values of the currency pairs move in tandem.

With this in mind, traders will avoid buying or selling EUR/JPY when EUR/USD is going up and USD/JPY is going down. Similarly, they will avoid trading the cross when EUR/USD is going down and USD/JPY is going up.

Therefore, the optimum conditions at which to buy EUR/JPY would be when both EUR/USD and USD/JPY are hitting the support level and rallying. Conversely, if you want to sell EUR/JPY, make sure the other two pairs are hitting resistance and coming down.

Note that the EUR/JPY and CHF/JPY also have a positive correlation. This is due to the close relationship between the Swiss Franc and the Euro.

Risk Management

Remember that the strategy above should be protected with stop loss and take profit barriers. These will ensure that your account automatically closes trades when prices hit a set level.

To determine your stop-loss price, you can employ technical analysis tools such as support and resistance, pivot points and trendlines. If you’re buying EUR/JPY, your stop-loss closing price should always be placed below the currency market price and if you’re selling, it should be placed above.

You can use an online calculator to determine how much you can risk per trade and make sure to check out any tips and advice online.

Session Times

Although FX markets operate around the clock, there are optimum session times for EUR/JPY where UK day traders can generate more profits from greater volatility.

Some sources suggest that the best time to trade EUR/JPY is when the London and New York trading sessions overlap, between 12:00 and 16:00 GMT. Swing traders may also want to keep an eye on EUR/JPY on Thursdays, when average daily volatility is highest.

Final Word On EUR/JPY

EUR/JPY is a volatile and exciting pair to trade, with plenty of analysis options available for day traders. Whether you’re scalping on a daily live chart, or long-term investing on 1 or 5 year charts, make sure to stay updated with the latest analysis and economic developments in Japan and Europe.

The technical and fundamental analysis tools mentioned above should also provide the basis of your research into trading EUR/JPY. Nonetheless, it’s ultimately up to you to decide on the best strategy to help you achieve your target.

Find out more about forex trading.

FAQ

What Does EUR/JPY Mean?

EUR/JPY is the currency pair that represents the Euro (EUR) to Japanese Yen (JPY) exchange rate. The pair determines how many units of JPY, the quoted currency, is needed to buy 1 Euro, the base currency. EUR/JPY is the seventh most-traded currency pair on the forex market.

How Do I Trade EUR/JPY?

To start trading, you will need access to a EUR vs JPY live chart which will indicate the historical rate of price action over multiple timeframes. You can then use chart indicators to analyse trends and forecast future movements. You can also implement other tools such as Expert Advisors or trading signals to boost your strategy.

What Is The Best Time To Trade EUR/JPY?

The best time to trade EUR/JPY is when the London and New York trading sessions overlap, between 12:00 and 16:00 GMT. Note that the trading hours available in the trading platform may depend on the timezone of your broker.

Where Can I Get News On EUR/JPY?

You should keep on top of economic, political and financial developments in both regions by following governmental reports and other news outlets such as Reuters and Bloomberg. Note that the Japanese Yen is also affected by natural disasters in the region.

Should I Trade EUR/JPY?

The EUR/JPY pair is a popular product due to its volatility and potential to generate profits. If you’re beginner, you may want to start with the easiest and most stable currency pair, EUR/USD, before moving on to minors like EUR/JPY.