Trading Chinese Yuan (Renminbi)

The Chinese economy has been rapidly growing for decades, now sitting as the second largest in the world, trailing only the USA. This growth in economic prominence and the resulting importance of its currency, the Chinese yuan (renminbi), is exciting for many forex traders. Today’s geopolitical climate, particularly between China and the US, provides further volatility and opportunity for investment and speculation in the forex markets. This volatility is, however, limited to some extent by the Chinese government, which intervenes with the natural market of the renminbi’s exchange rates. Find out more about forex trading economics and how to start investing in the Chinese yuan today.

Chinese Yuan Trading Brokers

-

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower -

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Vantage provides over 55 currency pairs, exceeding the industry norm, giving traders ample opportunities. With a robust liquidity pool, forex spreads start at 0.0 pips on the ECN account, often beating other options. Additionally, there are no commissions, deposit fees, or hidden charges.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.0 0.5 Total Assets FCA Regulated Platforms 55+ Yes ProTrader, MT4, MT5, TradingView, DupliTrade -

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView -

Eightcap provides over 50 currency pairs, matching the industry norm but falling short of leaders like CMC Markets, which offers more than 300. Nonetheless, Eightcap distinguishes itself with institutional-quality spreads starting from 0.0 pips on major pairs such as EUR/USD. The broker's competitively low commissions at $3.50 per side further enhance its appeal. Eightcap also equips traders with comprehensive forex data, including essential fundamentals, bullish and bearish signals, and a calendar monitoring significant foreign exchange market events.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.1 0.0 0.1 Total Assets FCA Regulated Platforms 50+ Yes MT4, MT5, TradingView -

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime

Safety Comparison

Compare how safe the Trading Chinese Yuan (Renminbi) are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Trading Chinese Yuan (Renminbi) support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Trading Chinese Yuan (Renminbi) at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ |

Beginners Comparison

Are the Trading Chinese Yuan (Renminbi) good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Trading Chinese Yuan (Renminbi) offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Trading Chinese Yuan (Renminbi).

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Vantage FX | |||||||||

| Forex.com | |||||||||

| Eightcap | |||||||||

| IG |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring traders with a slick design and over 80 technical indicators for market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

The Renminbi & Yuan

While the official currency is called renminbi, and has the symbol RMB, the unit is a yuan, pronunciation ‘yoo-an’, and this is the more common name. The Chinese yuan has a similar symbol or logo to the Japanese yen sign, but with two lines across the Y.

Things get more complicated when trading the Chinese yuan in forex as there are two distinct markets. The yuan is traded both onshore and offshore, due to restrictive capital controls from the Chinese government that prevent the currency leaving China. The onshore market, traded in mainland China, is given the forex symbol CNY (the CH denoting China and the Y denoting yuan).

The offshore market was introduced in Hong Kong, with the abbreviation CNH (H for Hong Kong). The yuan market has since spread, now including many offshore markets such as the London and Taiwan denominations with the codes CNL and CNT, respectively.

The onshore market is heavily controlled by the Chinese government and mostly driven by corporate bodies who buy RMB against foreign currencies for business purposes and settlements between banks. This provides some trading possibility for those within the borders of China.

Any trading done on the renminbi beyond the Chinese borders is done with CNH, or other offshore Chinese yuan markets. The CNH markets are much less controlled by the government, instead being driven primarily by the supply and demand of the currency in the forex markets. This makes the currency ripe for speculation, hedging and investment. It is important to note, however, that the People’s Bank of China (PBOC) still manages the offshore market somewhat.

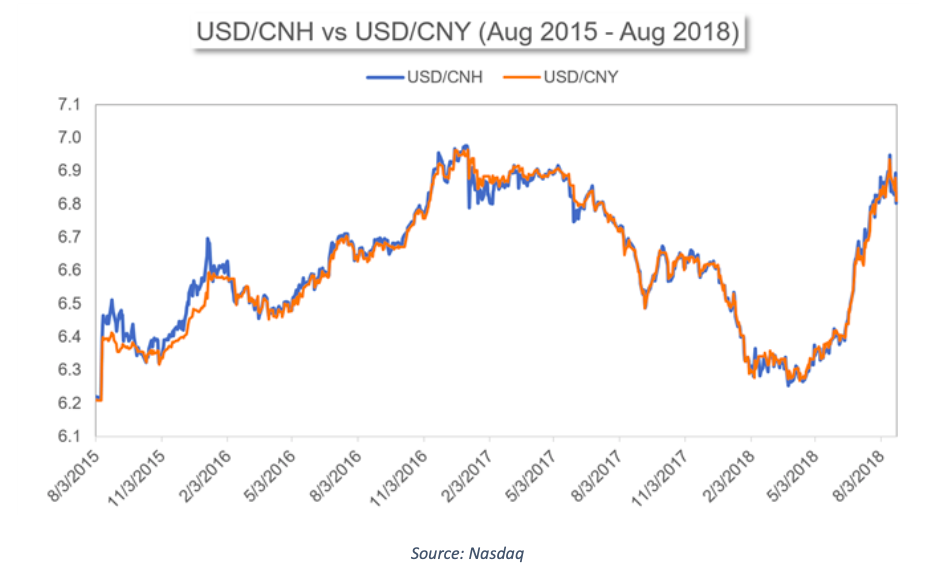

The differences in driving forces for the two markets mean that the CNY and CNH often have different prices, however, there tends to be strong correlation in curves and trends. Generally, the CNH is more volatile in its reactions to certain events as the government intervenes in the CNY market to match economic policies. Disparities between the two can be indicative of capital outflows, with lower levels of outflow correlating to a stronger relative level of the CNH.

The government has a lot of control over the Chinese yuan price levels through PBOC and state banks. Policy makers fix the Chinese yuan at a target value each day based on economic policies, the previous day’s closing rates and the valuation of a basket of other currencies. Once this target, or midpoint value, is set each morning, the CNY trades within 1 percent either side of this midpoint. If the price goes beyond this band, the PBOC will buy or sell some currency as required.

An additional control, the countercyclical factor, was introduced in 2017. This helps to mitigate large swings in either direction, resulting in a more stable currency that is more attractive to foreigners.

Currency Regimes

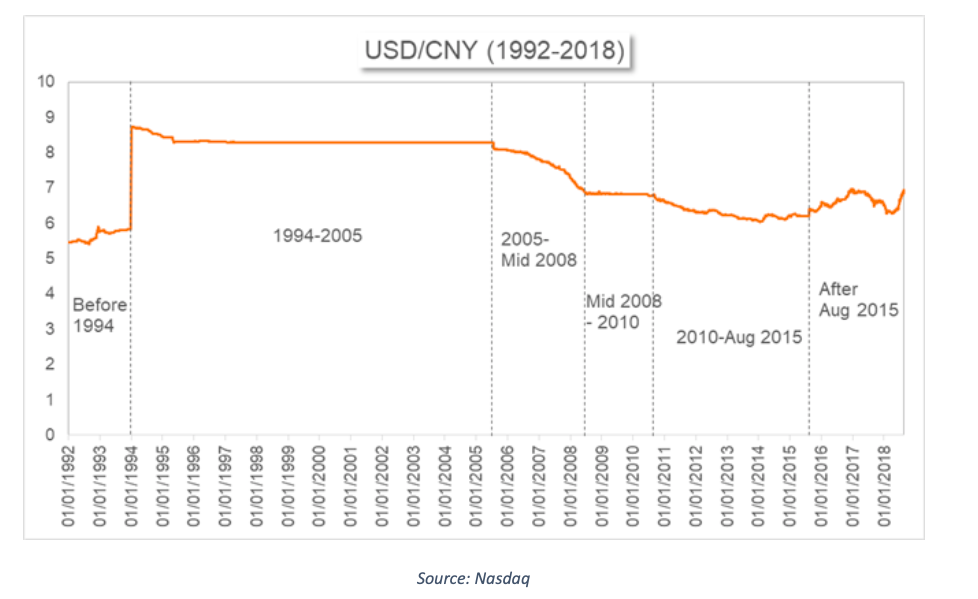

The Chinese currency market has had many regimes over the past few decades, each with varying levels of intervention from the government. From a dual-track system before 1994, a quasi-fixed rate was established for 11 years, settling at 8.28 USD/CNY. After 2005, the flexibility of the currency was increased to a manage-floating exchange rate system that pegged the yuan against a basket of currencies, instead of just the US dollar.

The Chinese yuan was re-pegged following the 2008 crisis to a restricted range of 6.81 to 6.85 against the USD to protect international trade. After the crisis, in 2010, the liberalisation of the currency was resumed, and the Chinese yuan trading band grew from 0.5% to 2% over four years. In 2018, the CNY was re-set against a basket of currencies and the managed-floating regime is still used today. Below is a price chart showing the history of the Chinese yuan’s exchange rate against the US dollar since 1992.

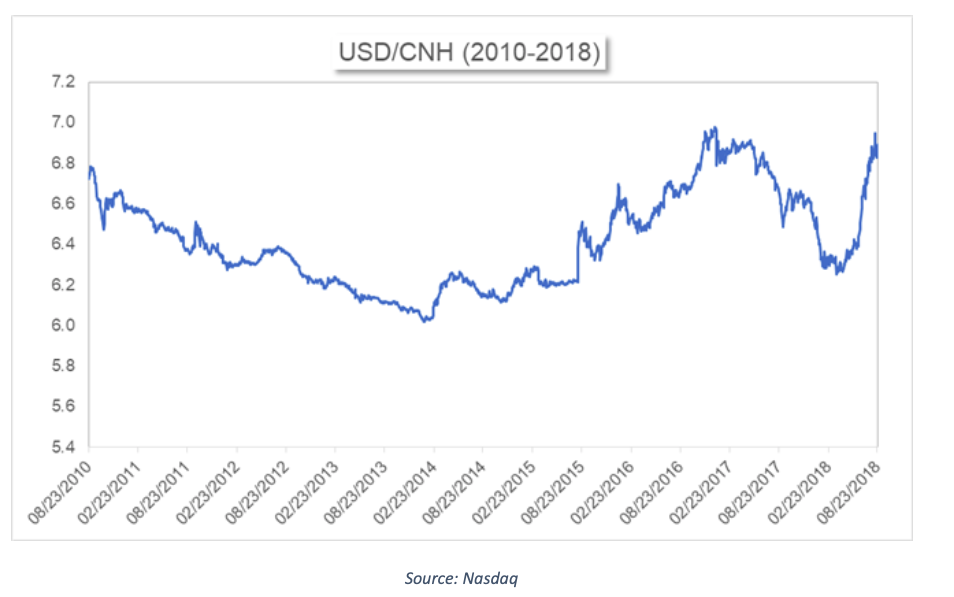

The CNH is a much newer currency, with preparation for its release beginning in 2004, when Hong Kong began to introduce business in RMB. On 23 August 2010, the Chinese yuan (CNH) currency was launched and the first quote for USD/CNH was released. The picture below shows the CNH’s exchange rates up to 2018.

The Next Top World Reserve Currency?

The Chinese government has aims to internationalise their currency through development of offshore RMB markets, increased use in cross-border investment and expansion in foreign trade settlements (now the second largest currency after USD).

The Chinese government demonstrated their commitment to these aims through the establishment of the Contingent Reserve Arrangement and the Asian Infrastructure Investment Bank (AIIB). In 2013, the government also made economic reforms that led to the International Monetary Fund (IMF) elevating the Chinese yuan to a global reserve currency. The reserve currencies joined by the Chinese yuan include the USD, EUR, GBP and JPY. The rankings of reserve currencies have historically followed those countries with the highest incomes. Therefore, many believe that China will eventually rise to the top of the reserve list, taking the title away from the US.

The reserve status of the RMB means that central banks outside of China hold significant quantities of the currency for foreign exchange. This allows more frequency and volume for international trade and transactions as well as economic benefits for China. The status also implies a level of stability of the currency, improving investor confidence.

The Trade War

In 2018, geopolitical events resulted in the US government imposing import tariffs up to $60 billion. This prompted a trade war between the two superpowers, with closer to $600 billion in tariffs having been implemented by the US government, and $185 billion by the Chinese government by the end of 2020.

The market most affected by these events is the USD/CNH, although the impacts will filter down through almost all global markets, from the euro-yuan market to company stocks and commodity prices. The trade war has primarily manifested itself through the volatility of the above forex pair, with CNH dropping to 6.235 in March 2018, lower than it had been since 2015, then shooting up to 7.195 in September 2019, the highest the yuan had ever been.

The two countries reached some level of agreement in January 2020 when China agreed to boost US imports by $200 billion and the US agreed to halve some of their tariffs. However, the trade war is ongoing, with tariffs still imposed and no sign of the Biden administration intending to resolve the issue.

In terms of the trade war’s impacts on the value of the Chinese yuan to the US dollar, there are several possibilities. One option is for China to offset the impacts of the US-imposed tariffs, as they only import from the US a third of what the US imports from China. This offset can be carried out through devaluation of the Chinese yuan such that the percentage influence on imports was reflected in a percentage drop of the Chinese yuan exchange rate.

Alternatively, the two countries could hit an impasse that lasts a long time, with no significant effects on either currency and the Chinese government maintaining the strength of the yuan so as not to incur further tariffs. If, however, a trade deal were to be finalised, the yuan may appreciate slightly. This is likely to be limited, though, as there will probably be clauses that remove the possibility for significant future depreciation.

Indicators & Impacts

The country’s government retains a strong hold over the valuation of the Chinese yuan coins and banknotes in the forex markets, keeping it permanently undervalued for international competitiveness. This contributes to a low trading volume in the forex markets, as speculation is more difficult and the PBOC can intervene, increasing risks of loss. While some experienced traders like this level of volatility and risk, there may be profit opportunity for others when control is released, as the currency may appreciate.

The health and performance of the Chinese economy has a major impact on the price of the currency. The GDP reports released by the Chinese National Bureau of Statistics are a good indicator of the economy’s growth and has good links to the fiscal and economic policies the government enacts. The reports are delayed by 45 days after the reference period and provide both year-on-year and quarter-on-quarter statistics.

Industrial production figures, also released by the Chinese National Bureau of Statistics, are another indicator of economic performance. These statistics give production levels in different sectors of the economy, adjusted for inflation.

China also releases purchasing managers indexes (PMIs), both on manufacturing and non-manufacturing sectors. These survey companies for business conditions and are demonstrative of expansion or contraction in the relevant sectors and economic areas.

Alternative Ways To Invest In CNH

Beyond speculating on forex pairs involving Chinese yuan, or other renminbi tickers, there are several options for investing in the currency. Futures are offered on some exchanges, including the CME, which involve speculating on the change in exchange rate of the Chinese yuan from today’s quote to a specified date in the future. Futures can be leveraged, as with forex pairs, though usually to a lesser level.

Another approach is to invest in exchange traded funds (ETFs), like the Chinese Yuan Dim Sum Bond Portfolio Fund or exchange traded notes (ETNs) that are designed to match the performance of the Chinese yuan or economic interest rates. These will not only appreciate with the currency, but also pay out dividends.

Alternatively, HSBC and other banks offer Chinese yuan savings accounts and time deposit accounts that can be opened with local currencies but are denominated in renminbi. This essentially allows you use money like the UK’s pound sterling to buy Chinese yuan as cash and hold it in these accounts so that invested funds appreciate with the currency, though withdrawals must also be made in different currencies and may incur a conversion fee.

Final Word On Chinese Yuan

It is very difficult to predict the future of the Chinese yuan, as it is with most currencies. However, the outlook is generally positive thanks to the continued growth of the Chinese economy, the rise in prominence of its currency, gaining reserve status, and the likely liberalisation of the yuan’s management. However, the ongoing trade war’s influence on the volatility of the renminbi may put some traders off.

While some may find the Chinese yuan an exciting trading opportunity, the continued intervention of the People’s Bank of China will keep the currency from reaching the popular trading volumes of major free market currencies.

Find out more about forex trading.

FAQ

What Currencies Can I Trade Against The Chinese Yuan?

With the advent of the offshore market for the renminbi, all convertible currencies can be traded against the Chinese yuan, such as the Pakistani (PKR) and Indian rupees (INR), Australian (AUD) and Hong Kong dollars (HKD), Vietnamese dong (VND) and South African rand (ZAR).

How Can I Predict The Performance Of The Yuan?

The tools listed in our article are some of the key indicators of China’s current economic status, making them useful for trading the Chinese yuan. Further information can be found online, including the latest 2026 news, index charts, graphs and bank forecast reports.

Can You Trade The Chinese Yuan Digital Cryptocurrency?

The digital yuan, known as the DC/EP (digital currency electronic payment) is often mistaken for a crypto coin, though it is technically just a digital currency as it is controlled by a central bank. The DC/EP cannot yet be traded as it is still in its development and early trial stages.

Is The Chinese Yuan Backed By Gold?

The Chinese economy does not use the gold standard, so the renminbi is not directly backed by gold. Instead, the country’s government plays a more prominent role in the price and value of the currency.

How Much Is A Chinese Yuan Worth Today?

The conversion rate today for buying Chinese yuan with USD or Euro can be found in live investing charts. Buying conversation rates and converters are offered by most online forex brokers and show how much Chinese yuan equals 1 USD.