Fondex Review 2025

See the top 3 alternatives to Fondex or the best UK brokers list for options.

|

|

Fondex is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Fondex |

| Fondex Facts & Figures |

|---|

Fondex is an award-winning forex and CFD broker with industry low trading costs. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, ETFs, indices, shares, energies, metals, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA, CySEC |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Yes (cBots) |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Fondex offers leveraged CFDs on a wide range of popular financial markets. |

| Leverage | 1:500 |

| FTSE Spread | 1.8 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 3.4 |

| Stocks Spread | From 0.01 |

| Forex | Fondex offers trading opportunities on 80 currency pairs, including majors. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.45 |

| GBPEUR Spread | 0.56 |

| Assets | 80+ |

| Currency Indices |

|

| Stocks | Fondex offers access to over 500 global shares including major brands in the technology and finance space. |

| Cryptocurrency | Trade cryptocurrencies on the cTrader platform. |

| Coins |

|

| Spreads | From 0.5 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Fondex is a multi-asset CFD and forex broker that offers 600+ instruments. UK investors can trade via the reliable cTrader platform with copy trading and automated strategy support. This Fondex review will cover account types, app ratings, demo trading, and payment methods, among other key considerations.

Fondex has no minimum deposit, copy trading, and one live account, meaning straightforward access to popular financial markets. On the downside, the broker is not regulated by the FCA in the UK and crypto investing is not available.

Company History & Overview

Fondex Global Limited (Ltd) was founded in 2011. The company is registered in the Seychelles and regulated by the local Financial Services Authority (FSA).

The broker aims to offer top-tier investing services with powerful tools and competitive pricing. Spreads start at 0.5 pips while leverage up to 1:500 is available. Fondex has also been recognised with multiple awards, including for its trade execution and copy trading solution.

Markets & Instruments

Fondex offers 600+ instruments, notably more than many alternatives.

- Indices – 15 global indices including the FTSE 100, Germany 30, and US 30

- Energies – Three energy products; Brent Oil, Crude Oil and Natural Gas

- Forex – 80+ major, minor, and exotic currency pairs including GBP/USD and EUR/GBP

- Shares – 500+ stock CFDs including six major UK companies such as Barclays, BP, and HSBC

- ETFs – 18 exchange-traded funds including MSCI United Kingdom and IBOXX USD HIGH YIELD

- Metals – Four precious metal and fiat currency pairs including XAU/USD and XAG/EUR

On the downside, the broker does not offer cryptocurrency trading.

Fondex Platforms

Fondex offers just one platform; cTrader. It is available to download to desktop computers or can be used directly through major web browsers.

Created by Spotware in 2011, cTrader is ideal for both experienced and beginner investors, due to its intuitive dashboard and custom trading functions. Yet despite its lightning-fast executions and stability, the terminal is not as popular as MetaTrader 4 or MetaTrader 5. Still, when we used Fondex, we felt that the cTrader dashboard was more modern and sophisticated than MT4.

The cTrader terminal has three main functions; Trade, Copy and Automate.

Trade

The manual trading function allows retail investors to make independent trade decisions. You can enter and exit positions, review market trends, and trade with confidence using a catalogue of risk management tools.

Key features:

- Single or double-click trading

- Access to market sentiment data

- Create custom charting templates

- Performance analysis and full trading history

- 26 timeframes from one minute to one month

- Four chart types; candlestick, bar, dot and line

- Apply custom indicators from Fondex cTrader Automate

- 70+ technical analysis tools including volatility patterns and indicators

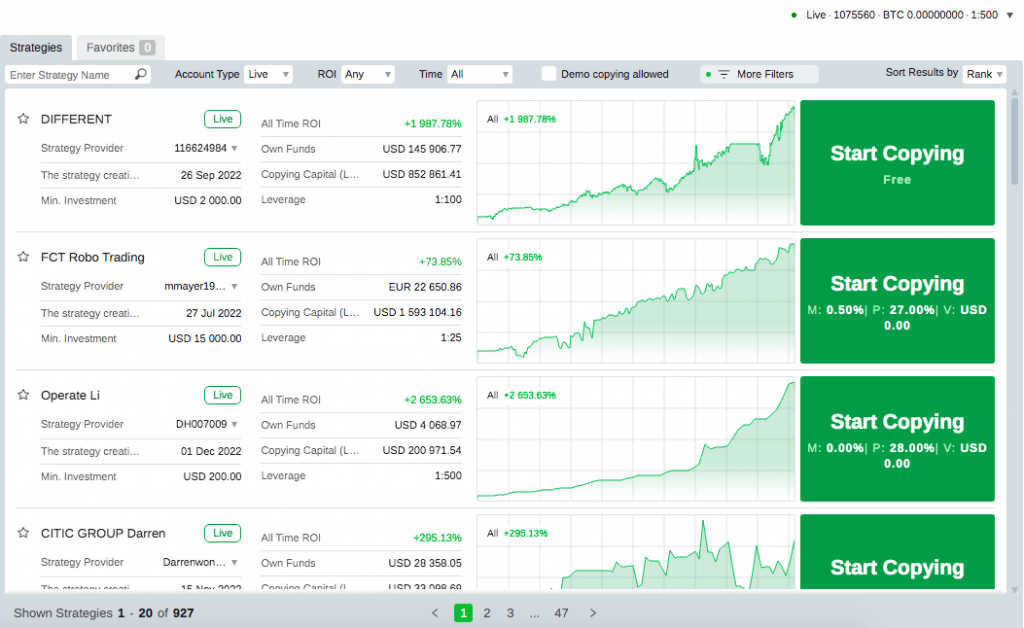

Copy

The copy trading feature allows users to mirror the trades and strategies of other clients. You can remain in full control of your account, and have the option to pause, modify or close positions when needed.

The tool will automatically calculate your reflective position sizes based on your available account balance, taking away the manual requirement. Some ‘pro’ traders will provide their strategy insights for no fees, whilst others will request a commission.

Key features:

- View trader performance history

- Apply stop losses to a copied strategy

- Advanced calculations to optimise risk exposure

- Combine copy trading with manual and automated functions

- Allocate funds and amend during trading by percentage levels

Automate

Create robots or use custom automated servers to execute trades on your behalf. The hands-off approach to investing uses a pre-programmed tool to buy or sell assets without any live input from traders.

cTrader robots can execute trades 24/7, with no downtime, meaning you can save valuable time studying the market and waiting for profitable opportunities to arise.

Key features:

- Historical market data

- Create custom bots with the in-built code editor

- Analyse market trends across simultaneous time frames

- Backtest and visualise performance before putting the bot to the test in live conditions

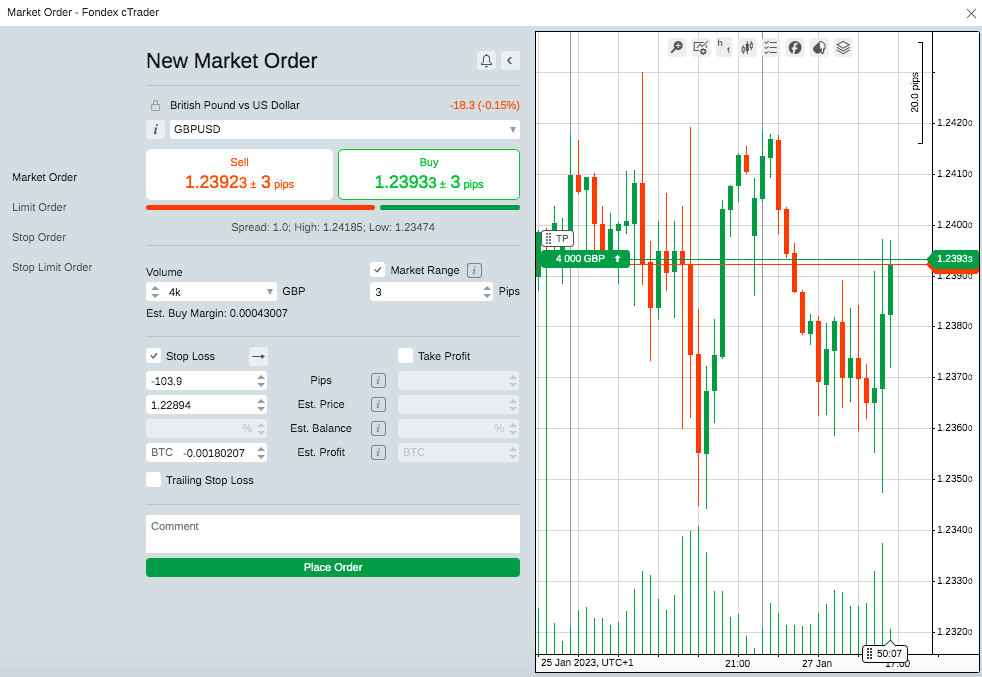

How To Place A Trade

There are several ways to open a new order on the cTrader platform:

- Log in to the client dashboard and launch the cTrader platform

- Select the ‘New Order’ icon in the top menu or press F9

- In the order window choose the instrument to trade from the dropdown menu

- Select ‘Buy’ or ‘Sell’

- Add the trade volume by using the arrow toggle

- Add a stop-loss or take profit parameter if desired

- Review the spread and fee

- Click ‘Place Order’

Alternatively, you can right-click on a symbol on the left-hand side menu and then click ‘New Order’.

Open positions will be displayed in the order window at the bottom of the interface.

Fees & Charges

The Fondex pricing schedule is simple. The broker offers tight floating spreads from 0.5 pips with zero commissions on some instruments.

While using Fondex, we were offered spreads of 0.8 pips on the GBP/USD and 1.6 pips on the GBP/JPY. Additionally, we were offered 1-point on the FTSE 100. Importantly, these are aligned with major brokers in the market.

Fondex also has a dynamic commission model with a £2.50 per 100k in trading volume (per side) fee for forex, metals, and energies. This is reduced to £1 per side for stocks and ETFs. Indices are available commission-free.

We particularly liked the pricing transparency at Fondex. In particular, the historical spreads chart. The broker provides an interactive graph of previous spreads, by instrument, in 15-minute timeframes. You can filter between assets and view pricing peaks using past data. You can find this via ‘Trading’ and then ‘Execution Transparency’ from the menu at the top of the broker’s website.

A £5 monthly inactivity fee applies after 90 days of dormancy. Swap fees also apply for positions held overnight, unless you open a swap-free Islamic profile.

Fondex App

The cTrader platform has mobile app compatibility. UK investors can download the app for free from the Apple App Store or Google Play and use it via smartphone or tablet devices.

Traders can access all three major functions, anytime and anywhere. This includes the full range of order types, account management settings, symbol watchlists, and analysis tools.

Our experts ranked the app highly due to its simple and modern design, reflective of the desktop terminal. It is also rated an impressive 4.6/5 on Google Play, which is the same as the MT4 mobile app.

Payment Methods

Deposits

There is no minimum deposit requirement when trading with Fondex, which is a key advantage for beginners or those with less starting capital. Fondex also offers a GBP account, helping to reduce conversion fees.

Traders can add funds via various payment methods including wire transfers, e-wallets, and credit/debit cards. The broker processes payments almost instantly, though allow for third-party processing times.

Fondex does not charge any commission fees to fund a live account, though external banking fees may apply.

How To Make A Deposit To Fondex

Traders can deposit to a live account via the broker’s website or directly through the cTrader terminal.

Account activation is required before funding options are available. To action, click on the ‘Activate Account’ icon in the top menu of the platform dashboard. Enter your personal details to comply with KYC requirements.

Once complete, select the deposit icon (the fourth symbol on the bottom row of the menu), select the payment method, and follow the on-screen instructions.

Withdrawals

All withdrawals must be made back to the same method used to deposit.

Withdrawal requests are processed by the broker within 24 hours though bank wire transfers can take a further 24 hours before funds are cleared to accounts. Absa payments can take up to five working days. These timelines are in line with most of the industry.

Similar to deposits, Fondex does not charge any withdrawal fees.

Demo Account

A demo version of the cTrader platform is available to new and existing traders.

You can practise trading with £100,000 in virtual funds and access all the features of the platform including live price data. Traders can also explore the charting functions and learn how the copy trading feature works, without having to risk personal capital.

How To Open A Demo Account

- Click on the ‘Try A Free Demo’ button from the top-right of the broker’s homepage

- You will need to complete some basic personal details including your email address and telephone number

- Login credentials will be sent to the registered email address

- Download the platform and login. Alternatively, open the web terminal

Bonuses & Promotions

Fondex does not offer financial incentives or rewards, which is disappointing given the limited regulatory restrictions. Instead, traders are encouraged to make use of the broker’s range of tools, including Autochartist and copy trading.

UK Regulation

Fondex is a registered trading name of TopFX Global Ltd. The broker is licensed as a Securities Dealer and regulated by the Financial Services Authority (FSA) of Seychelles, registration number 8424819-1.

Although this is not a particularly well-regarded financial agency vs the Financial Conduct Authority (FCA), Fondex does offer negative balance protection and adheres to client fund segregation. These measures mean you cannot lose more than you invested and client funds are not used to pay debts in the case of business failure.

Fondex Account Types

With just one live account, all UK investors will have access to the same conditions regardless of their starting balance and previous trading experience. On the downside, this means there are limited perks for active traders, including fee discounts.

Account features:

- One-click trading

- Hedging permitted

- Up to 1:500 leverage

- Nine base currencies including GBP

- No minimum deposit requirement

- Manual, copy and automated trading

- Micro lot trading on forex, precious metals, energies and indices

- 10+ order execution modes including trailing stop loss, good till day, and one cancels the other

A swap-free solution is also available for investors of the Islamic faith.

How To Open A Live Account

- Use the ‘Visit’ button in this Fondex review to navigate to the official website

- Select the ‘Start Trading Now’ icon found in the top right of the webpage

- Add your email address, contact number, and password creation

- Click ‘Open Trading Account’

Note, due to regulatory requirements, all new customers must upload proof of identity and residence before all trading services can be accessed. Copies of documents can be uploaded by clicking on the ‘Active Account’ icon in the top menu of the cTrader platform.

Leverage

Fondex offers leverage up to 1:500. Although not the highest vs other offshore brokers, this should provide plenty of purchasing power to boost position sizes. For every £1 invested, you can borrow £500 from the broker.

Maximum leverage does also vary between instruments. Shares, for example, can be traded with only 1:20 leverage and indices up to 1:200.

If your account equity falls below 50% of the required margin, the broker will activate a margin call. Automatic stop-out is activated at 30%.

Extra Tools

Our experts found the broker doesn’t fall short when it comes to educational materials. Investors can access a range of articles and resources to bolster their market knowledge and learn more about online trading.

It was also reassuring to see that information is not just aimed at novice traders. There is plenty of news articles and strategy ideas for experienced traders. Topics include a breakdown of the functions of the cTrader terminal, day trading strategies, and risk management tips. The broker uses ‘hashtag’ summaries for simple filtering through the available content.

You can also find a glossary of key terms, company news, and market news, though some of these posts are outdated.

Autochartist

The Autochartist analysis tool is available to retail investors. The programme can aid trading decisions by scanning and monitoring the financial markets 24/7. Autochartist signals can be generated on any timeframe and you can filter opportunities to suit various trading styles.

The solution is essentially designed to scan financial markets for the latest statistical, technical, and economic news and events in real-time, meaning you don’t have to stay in the loop at all hours of the day.

The tool can be used directly within the cTrader platform.

Opening Hours

Fondex trading hours vary by asset class. Forex, for example, is available between 22:01 and 21:59 Sunday to Friday. The FTSE 100 index, on the other hand, can be traded between 23:05 and 21:15 Sunday to Friday.

These times will be reflected in the cTrader platform and products will be unavailable for trading outside of their opening hours.

Customer Service

Fondex offers customer support 24/5 in several languages, including English. However, we were unable to access the live chat service when we tested it. This is a concern as beginners, in particular, often need reliable customer support.

- Telephone – +2484671987

- Email – support@fondex.com.sc

- Live Chat – Available via the ‘Contact Us’ webpage

- Online Contact Form – Available via the ‘Contact Us’ webpage

The broker is also active on social media channels including Facebook and LinkedIn.

Client Safety

Fondex offers a secure trading environment for UK investors. This includes using encrypted financial transactions and data privacy protocols for personal data. On the downside, cTrader does not currently integrate two-factor authentication (2FA) at the login stage.

Should You Trade With Fondex?

Fondex offers plenty of trading opportunities thanks to the cTrader platform and 600+ instruments. We were impressed with the educational resources, low entry requirements, copy trading, and full price transparency. The broker’s lack of FCA regulatory oversight is a downfall, however. Also, the lack of higher account tiers with fee discounts means Fondex is not the best pick for high-volume traders.

FAQ

Is Fondex Regulated In The UK?

No, Fondex is licensed as a Securities Dealer by the Financial Services Authority (FSA) of Seychelles. This is a legitimate license, though the authority is not as respected as the Financial Conduct Authority (FCA) due to its more lenient joining rules and less stringent business control.

Is Fondex A Good Broker For UK Traders?

Fondex is a decent broker for UK investors with competitive fees and a stable, third-party platform. There is a wide range of instruments, educational content, a demo account, no minimum deposit, and access to a mobile app. And while the broker is not regulated by the FCA, the firm does offer negative balance protection.

Is It Expensive To Trade With Fondex?

Fondex offers a transparent pricing schedule with spreads from 0.5 pips on popular assets, such as major forex pairs. The broker also offers competitive commissions, from £2.50 per 100k (per side) for forex, metals, and energies. This falls to £1 per side for stocks and ETFs. Indices are also available commission-free.

Is Fondex Suitable For Beginner Traders?

Fondex is a good pick for beginners with no minimum deposit, a user-friendly platform and app, a free demo account, plus copy trading. The single live account also offers hassle-free access to popular financial markets.

Does Fondex Offer A Good Selection Of Instruments?

Yes, Fondex offers more than 600 assets spanning stocks, indices, forex, commodities, and ETFs. Traders can create a diverse portfolio and implement various strategies. On the downside, UK investors cannot trade cryptos.

Top 3 Fondex Alternatives

These brokers are the most similar to Fondex:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Fondex Feature Comparison

| Fondex | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4.8 | 4.8 | 4.7 |

| Markets | Forex, CFDs, ETFs, indices, shares, energies, metals, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA, CySEC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | cTrader | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Fondex Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Fondex | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Fondex vs Other Brokers

Compare Fondex with any other broker by selecting the other broker below.

Popular Fondex comparisons: