FlowBank Review 2025

|

|

FlowBank is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to FlowBank |

| FlowBank Facts & Figures |

|---|

FlowBank is a regulated bank and trading broker with a wide range of instruments including forex, funds, cryptos and thousands of stocks, that offers direct and high-leverage CFD trading on the MetaTrader 4 and MetaTrader 5 platforms. Traders benefit from ultra-tight spreads, low or no commissions and a free stock joining bonus. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Stocks, ETFs, Funds, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Trading App |

The FlowBank trading app offers advanced technical and fundamental analysis features, over 50 forex pairs, plus instant and pending orders. Traders can download the app to Apple and Android devices. |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FINMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade 4500+ CFDs with tight spreads and no commission except stocks. Choose between 4 different trading platforms and apps, including MT4, MT5 and proprietary options. The broker also sometimes offer joining promotions. |

| Leverage | 1:200 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 0.7 |

| Oil Spread | 0.03 |

| Stocks Spread | 0.02¢ commission |

| Forex | Trade 50+ major, minor and exotic pairs with spreads form 0.5 pips, no commissions and leverage up to 1:200. Importantly, the heavily regulated broker also provides a relatively secure forex trading environment. |

| GBPUSD Spread | From 0.0 |

| EURUSD Spread | From 0.0 |

| GBPEUR Spread | From 0.0 |

| Assets | 50+ |

| Stocks | Invest in Swiss stocks with zero commission or stocks from the US, UK and EU markets for commissions of 0.1% or minimum 6.5 EUR. Stock CFDs are also available, offering exposure to rising and falling prices with leverage. |

| Cryptocurrency | Speculate on crypto markets via 10 crypto/USD pairs as well as ETPs, ETNs, ETF, tracker certificates and closed-end funds. This range of derivatives offer diversified exposure to digital markets that aren't found at many alternatives. |

| Coins |

|

| Spreads | From 0.3 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FlowBank is a Swiss bank and broker that provides CFD trading on diverse markets including stocks, commodities and crypto. In this FlowBank review, we lay out the key information about trading with the brand, including the broker’s pros and cons, as well as the lowdown on instruments, payment methods, customer service, trading platforms and more.

FlowBank is a regulated Swiss broker with an excellent variety of assets and several high-quality platforms. However, it accepts very few payment methods and does not provide negative balance protection. FlowBank is also lacking FCA authorisation for UK traders.

Market Access

We consider FlowBank a good choice when it comes to the range of assets available. The broker’s roster has more than 50,000 instruments, including 4500+ CFDs.

We felt the variety of stocks and ETFs available was especially strong vs Swissquote, for instance, with access to 22 major stock exchanges from the UK, US, EU and Switzerland. We also think FlowBank has done well by offering traders the chance to request off-list assets via telephone.

Supported instruments include:

- 4500+ CFDs on forex, equities, crypto, commodities and indices

- 29 crypto CFDs including Bitcoin, Ethereum and Litecoin

- 50+ forex pairs including EUR/USD and GBP/USD

- 13,000 stocks and ETFs

- 15 index future CFDs

- 2000+ funds

Accounts & Fees

We felt that FlowBank’s fees generally stack up well against the competition, but traders who are interested in non-Swiss stocks may find better deals elsewhere.

The broker does have some low trading fees and offers commission-free trading on some assets, though, with the exact rate depending on which of FlowBank’s two account types you open – Classic or Platinum.

Classic

We liked that there was no minimum deposit for the Classic account, making it the best option for beginners.

There are no commission fees for Swiss stocks, but we were disappointed to find a minimum commission of 6.50 USD or 25 GBP (0.15%) on US and other stocks. On a lighter note, forex can be traded from 0.0 pips on the EUR/USD.

Fees by asset start from:

- Swiss stocks – 0%

- US & other stocks – 0.15% (min 6.50 USD)

- ETFs – 0.15% (min 6.50 USD)

- Funds – 0.15% (min 8 CHF)

- Futures/Options – 3 USD/EUR/CHF/GBP + exchange commission

- Bonds – 0.35% (min 50 CHF)

- CFDs index – Spreads from 0.8

- CFDs stocks – Commissions from 0.02 USD per share or 0.10%

- CFDs forex – ECN spreads from 0.0

- CFDs metals – Spreads from 0.2

- CFDs crypto – Spreads from 0.3%

Platinum

The platinum account offers some useful benefits, but with a minimum deposit of 100,000 CHF (almost 90,000 GBP), it will price out many retail traders.

Swiss stocks still come with 0% commission fees but US and other stocks have a minimum of 0.10%. Additionally, there are other perks such as reduced commissions on bonds (from 0.20% compared to a minimum classic account price of 0.35%) and lower cost of futures/options contracts (1.5 USD compared to a classic account price of 3 USD).

We have pulled out the full run-down:

- Swiss stocks – 0%

- US & other stocks – 0.10% (min 6.50 USD)

- ETFs – 0.10% (min. 6.50 USD)

- Funds – 0.15% (min 8 CHF)

- Futures/Options – 1.50 USD/EUR/CHF/GBP + exchange commission

- Bonds – 0.2% (min 50 CHF)

- CFDs index – Spreads from 0.8

- CFDs stocks – Commissions from 0.02 USD per share or 0.10%

- CFDs forex – ECN spreads from 0.0

- CFDs metals – Spreads from 0.2

- CFDs crypto – Spreads from 0.3%

Non-Trading Fees

We were pleased to find no account maintenance or inactivity fees, which is a big plus. However, there is a quarterly custody fee of between 10 and 50 CHF (0.1% of assets + VAT), which we are happy to report is capped to protect the investor.

FlowBank offers a range of optional extras including real-time data subscriptions, which are one of my favourite features and available for monthly prices ranging from 1.50 USD for CBOE Options to 125 USD for ICE EU Commodities.

How To Open A FlowBank Account

Whilst the registration process took our experts longer than some alternatives, it was fairly straightforward:

- Create a FlowBank profile by adding in the required details (e.g. name and email)

- Confirm your email address

- Complete the application form including adding required information (such as address, occupation and tax information) and confirming your ID (should take approximately 10 minutes to complete)

- Verify your identity with a short video selfie and ID document as well as proof of address

- Submit your documents and wait for account confirmation

Funding Methods

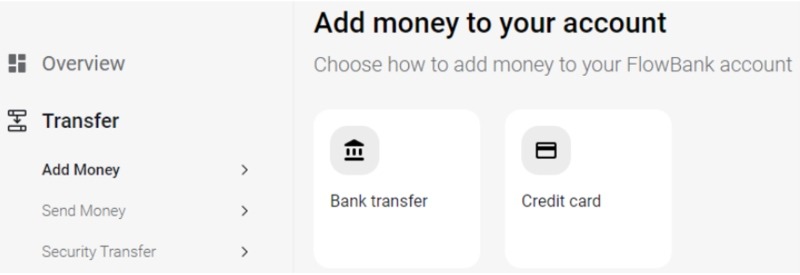

Our team considered the limited deposit options as one of the biggest negatives when we used FlowBank. The broker only accepts credit/debit cards and wire transfers with no support for PayPal or other e-wallets. This means traders potentially face delays of up to four days to fund their account if they don’t want to pay by card and instead wire the money.

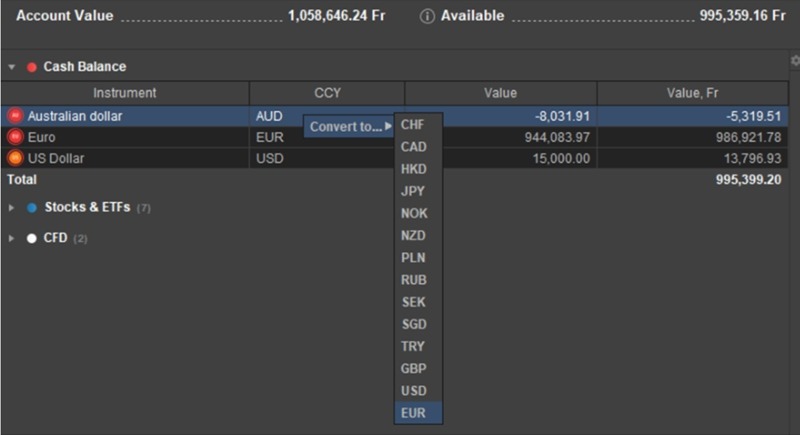

On a more positive note, it was good to see that FlowBank accepts a long list of currencies including GBP, USD, EUR, AUD, and HKD, though we were less impressed by the commission fee of 0.5% for each currency conversion through the FlowBank app (iOS and APK).

To convert currencies:

- Login to your FlowBank Pro account on your desktop

- Right-click on the currency you want to convert

- Click the ‘convert to’ icon and select the currency you want to convert to

How To Make A Deposit With FlowBank

- Log in to your FlowBank account online

- Click the ‘Transfer’ tab

- Click the ‘Add Money’ icon and choose your payment method (bank wire or credit card)

- Choose the currency you wish to make the deposit in (e.g. GBP)

- Enter your bank details/card details

- Click ‘Deposit’

We found it quick and easy to deposit funds using the app, by simply tapping the ‘Add Funds’ tab on the homepage menu, choosing a payment method and the amount to deposit, and confirming the transaction.

How To Make A Withdrawal From FlowBank

- Log in to your FlowBank account online

- Click the ‘Transfers’ tab

- Click the ‘Send Money’ icon

- Select your withdrawal method – ‘domestic’ to a Swiss bank account, ‘international’ to a non-Swiss account or ‘subaccount’ for an internal transfer between FlowBank accounts

- Confirm your withdrawal

UK Regulation

Our team considers this broker trustworthy due to the Swiss regulation. However, investors should be aware that it is currently only under the regulation of one governing body and does not hold licenses with the FCA in the UK or with other regulators. There is also no negative balance protection, which would prevent you from losing more money than is in your account.

The Swiss Financial Market Supervisory Authority is the only regulator of FlowBank. This regulatory body is the authority of all financial groups within Switzerland and is known for its high standards.

Swiss deposit protection is available up to 100,000 CHF due to FlowBank’s regulation as a Swiss bank meaning traders could receive compensation if the company becomes insolvent.

The mobile app is also a secure trading platform with two-factor authentication required to log in to your account.

Trading Platforms

We were happy to see FlowBank offering four different trading platforms, including its own proprietary software and mobile app as well as the hugely popular MetaTrader 4 and 5.

The variety of platforms on offer makes this broker a good choice for investors at any level of experience and allows for trading on the move. With that said, it is worth calling out that only CFD trading is available on the third-party MT4 and MT5 platforms.

FlowBank App

The FlowBank mobile app impressed us with its easy access and flexibility, allowing traders to analyse and open positions on the go with real-time market graphs. Our team liked the app’s simple, straightforward interface with useful features such as the customisable trading watchlist.

The FlowBank app is available on both iOS and Android mobile devices from the relevant app stores.

FlowBank Pro

The desktop FlowBank trading platform is not as straightforward as the mobile app, but our team feels it will work well for more experienced traders thanks to the range of features including 14 timeframes, 35 technical indicators, plus a ‘basket trader’ tool that allows investors to place stock, ETF, simple and complex options, and futures orders on a single trade ticket.

How To Make A Trade On FlowBank Pro

- sign in to your account on the FlowBank Pro platform

- Click on the ‘order’ tab from the menu at the top of the page

- Select the asset you want to trade and drag it to the order module page

- Select the order duration and type

- Click the ‘Buy’ or ‘Sell’ icon depending on your trade

MetaTrader

There are good reasons why MetaTrader 4 is the most popular third-party platform for online forex and CFD brokers.

We were pleased to see that FlowBank allows trading on all 4500+ of its CFDs using this platform with spreads from 0.5 pips on EUR/USD, 1:200 leverage and 24 analytical tools.

MT4 users can also access four types of pending orders: buy limit, buy stop, sell limit and sell stop. We also like that prospective FlowBank clients can try out the broker under real trading conditions using a demo account.

MetaTrader 5 offers FlowBank traders the same number of instruments, leverage and demo account options as MetaTrader 4. The main difference is that MT5 is a better pick for active traders with more timeframes, order types, analytical tools, and faster processing.

Both platforms are also well-known for their powerful automated Expert Advisor trading robots.

Leverage

FlowBank offers leverage up to 1:200, which is significantly higher than the 1:30 typically available at FCA-regulated brokers.

There is cryptocurrency trading with leverage up to 1:10. Indices and gold are the high-leverage options with 1:200, while oil can be traded with 1:100 leverage and other commodities with 1:50 or 1:20 depending on the asset. Equities are traded with leverage of 1:20.

Risk-averse traders should note that higher leverage can substantially increase the risk of losses. FlowBank will issue a margin call if you do not maintain a sufficient level of account equity.

Demo Account

While using FlowBank, our traders were happy to see a demo account available for the MetaTrader 4 and 5, though we feel it is a shame the same feature is not available for Flowbank App or FlowBank Pro.

Simulator accounts essentially allow traders to test out platforms and strategies without any financial risk, so they are a great way for rookies to build up experience or for experienced traders to sharpen their skills. They can also be used to gauge whether a broker is a good pick or not.

How To Set Up A Demo Account

- Click ‘Platforms’ on the FlowBank homepage menu

- Click either MetaTrader 4 or MetaTrader 5 on the drop-down menu

- Click ‘Demo account’ at the top of the page

- Enter the required details (name, number and email address) and agree to the data policy

- Use the download link attached to an email sent to your registered email address

- Download the program and click ‘Get Started’ to create a demo account

FlowBank Bonuses & Promos

We thought that it was a nice touch that FlowBank will cover transfer fees up to $750 when you switch from another broker to FlowBank.

Previously the broker had bonuses including a free stock for traders who deposit a minimum of 1000 CHF as well as a refer a friend bonus.

Check the FlowBank website for details of new bonus schemes.

Extra Tools & Features

One of my favourite features on FlowBank is the range of educational resources. These include a blog full of useful educational articles, a newsletter and Flow TV (a YouTube channel where the broker uploads market insights and useful interviews).

The blog is well-organised with a wide range of materials and popular themes, and we are sure it will suit traders of differing experience levels. My favourite section was ‘Market Insights’, which includes several blogs per week giving clearly written, in-depth information on current market conditions. Events and webinars are also advertised by FlowBank on its website.

We were also impressed by FlowBank’s market analysis resources such as LiveWire live market updates and asset allocation tools, all of which users can subscribe to.

Customer Service

Our team approves of the accessibility of FlowBank’s customer service team, which is available 24/6. Help is available in English, French and German and simple queries can be answered using the support centre found on the broker website. Our experts found that the most convenient way to contact the team is via the live chat box available on the FlowBank website.

Emails to the customer support address support@flowbank.com will be answered by the Swiss-based client service team 24/5. Email addresses for private client sales and institutional sales are also listed on the broker’s website.

Phone lines are open Monday to Friday 7:00 until 22:00 CET and Saturday 9:00 until 18:00. The general enquires line is +41 (0) 22 888 66 00 and the sales line is +41 (0) 22 888 61 30.

Company Background

FlowBank was launched in 2020 by Swiss founder and CEO Charles Henri Sabet. Sabet’s experience managing online trading began in 2004 with his banking company Synthesis which was subsequently sold to Saxo Bank in 2007.

FlowBank’s team is made up of over 100 people with an office based in Geneva. CoinShares is a major shareholder in the broker.

One of Flow Bank’s main aims is to allow customers to quickly and easily open an account that offers flexibility and security to access the global financial markets. It has a particular interest in sponsoring Swiss tennis.

Opening Hours

FlowBank’s trading hours vary depending on the asset and market you want to trade. Cryptocurrency trading is available 24/7, while forex trades from 22:00 Sunday to 23:00 Friday. Commodities, equities and futures trading hours will depend on the exchange they are traded on; check the official website for the latest details.

Note, the broker’s office is based in Switzerland (GMT +2).

Should You Trade With FlowBank?

We feel FlowBank is a good option compared to the competition thanks to its slick website, very wide range of assets, competitive fees and support for MT4 and MT5 as well as proprietary options.

With that said, traders might find a better range of payment options available elsewhere, and they may also find cheaper fees for the specific asset they want to trade. UK traders may also prefer a broker regulated by the local FCA.

FAQ

Does FlowBank Have A Low Minimum Deposit?

There is no minimum deposit required to open a Classic account, making FlowBank accessible to beginners. However, to open a Platinum account a 100,000 CHF minimum deposit will be requested.

Does FlowBank Have Negative Balance Protection?

Negative balance protection is not available with this broker. Negative balance protection prevents investors from losing more money than they have in their trading account if a leveraged trade takes a bad turn. This is a notable drawback of FlowBank vs alternatives.

Is FlowBank A Halal Broker?

FlowBank does not offer an Islamic trading account. This is a disadvantage since many brokers today offer halal trading accounts.

Is FlowBank A Good Broker For UK Investors?

FlowBank offers several benefits for traders in the UK, including an extensive product list of 50,000+ instruments, reasonable fees and high leverage. However, the broker is not regulated by the FCA nor does it offer negative balance protection, which are noticeable drawbacks.

Is FlowBank Safe?

FlowBank is a relatively secure broker with regulatory oversight and Switzerland. In our opinion, the broker is trustworthy with a legitimate background, transparent pricing and good safety ratings.

Article Sources

Top 3 FlowBank Alternatives

These brokers are the most similar to FlowBank:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

FlowBank Feature Comparison

| FlowBank | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Stocks, ETFs, Funds, Commodities, Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FINMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:200 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | FlowBank Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| FlowBank | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | No |

| Options | Yes | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

FlowBank vs Other Brokers

Compare FlowBank with any other broker by selecting the other broker below.

Popular FlowBank comparisons: