FinPros Review 2025

|

|

FinPros is #48 in our rankings of CFD brokers. |

| Top 3 alternatives to FinPros |

| FinPros Facts & Figures |

|---|

FinPros is an offshore broker that provides CFD trading on 400+ instruments with high leverage up to 1:500. This is a reliable bet for traders seeking offshore options, with strong security measures, negative balance protection and segregated client funds. The extra features including trading tools and commission-free stocks make this a good choice for beginners, and experienced traders will appreciate tight spreads. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs on Stocks, Indices, Forex, Commodities, & Cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, indices, commodities and cryptos with high leverage up to 1:500 on the no-commission ClassiQ account. The raw spread account options have low commissions from $4 round-turn and offer lower maximum of leverage of 1:200 or 1:400, which is still competitive. |

| Leverage | 1:500 |

| FTSE Spread | From 0.0 |

| GBPUSD Spread | From 0.0 |

| Oil Spread | From 0.0 |

| Stocks Spread | From 0.0 |

| Forex | FinPros offers 80+ forex pairs, which is one of the more diverse offerings available. Traders benefit from ultra-low latency, MT5 support and very tight spreads and low commissions on the RAW+ account. |

| GBPUSD Spread | From 0.0 |

| EURUSD Spread | From 0.0 |

| GBPEUR Spread | From 0.0 |

| Assets | 80+ |

| Stocks | With 300+ stock CFDs from a variety of global exchanges, traders can choose between some of the world's biggest blue chip companies. FinPros charges no commission fees for shares trading, making this a competitive offering although not as diverse as some alternatives. |

| Cryptocurrency | Trade leveraged CFDs on eight of the most popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin and Ripple, in pairs with USD, EUR and JPY. The wider variety of fiat pairs make this an attractive offering, even if there is only a mediocre selection of crypto tokens to trade them with. |

| Coins |

|

| Spreads | From 0.0 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FinPros is a CFD broker that facilitates trading on several asset classes through the world-leading MetaTrader 5 platform. This review will offer a brief introduction to the broker and provide details on its asset offering, account types, pros, cons and anything else UK investors should know before opening an account.

About FinPros

Launched in 2020, FinPros prides itself on fast trade executions, low costs and near-instant account activation. Using 10 Gbps cross-connect, the broker can facilitate 10,000 trades per second via ultra-low latency routers. FinPros also uses the Equinix LD4 data centre based in Slough, England, which means even faster trades for UK-based investors.

New users can start investing in less than a minute, while account holders benefit from multi-currency deposit options and low-cost trading accounts with commission-free stocks.

Operated by Finquotes Financial Ltd, the online brokerage holds a license with the Financial Services Authority of Seychelles.

Instruments & Markets

FinPros clients can trade over 400 CFDs on a range of popular financial markets:

- Metals: Five metals including gold and silver

- Forex: 80 currency pairs including 15 with GBP

- Indices: Nine global indices including the FTSE100

- Energy: Brent crude oil, TWI crude oil and natural gas

- Stocks: 310 stocks listed on the New York Stock Exchange and Nasdaq

- Cryptocurrency: Eight crypto tokens such as Bitcoin, Ethereum and Cardano

Clients can access leverage up to 1:500, though this varies by asset and account. The stop-out level is 30%.

FinPros Fees

The fees charged by FinPros are related to the trading account. Clients either pay through spreads or commissions per trade. This helps to accommodate different traders and their strategies, from scalpers to longer-term investors. For example, the EUR/GBP is available from 0.0 pips and the FTSE is offered at 0.8 points (Raw+ account).

Importantly, our experts found that FinPros does not charge any fees for share dealing, making investing in stocks an attractive option. FinPros does, however, impose a swap fee, which is interest paid on overnight positions. The exact amount varies according to your CFD position (long vs short) and the underlying asset.

There is also an inactivity fee of £15 per month if you go 90 days without any trading activity.

Trading Platform

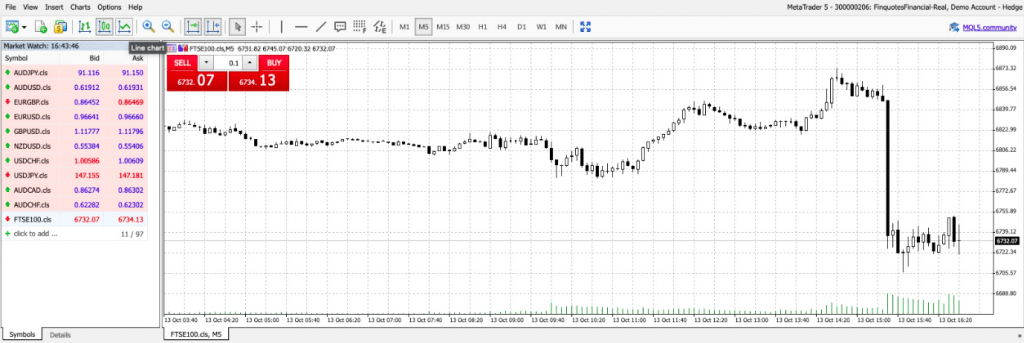

Clients can use the MetaTrader 5 platform to complete analysis and execute trades. MT5 is one of the world’s top platforms with a range of helpful features and customisation options. Time frames range from one month down to one minute, supporting everything from short-term day trading to longer-term swing trading strategies.

To help with technical and fundamental analysis, the platform also comes with 38 built-in indicators that can be overlaid on top of price history charts, plus a detailed economic calendar. Other benefits include one-click trading and expert advisor support, plus documentation, guides and a market of MQL5-created bots.

MetaTrader 5

Accessibility

Investors can download the MetaTrader 5 platform to desktop devices (Windows or macOS) or use the web-based terminal via all major browsers.

Alternatively, MT5 is available as a mobile app. The mobile application is available to download on both Android and iOS devices and you can find links on the broker’s website.

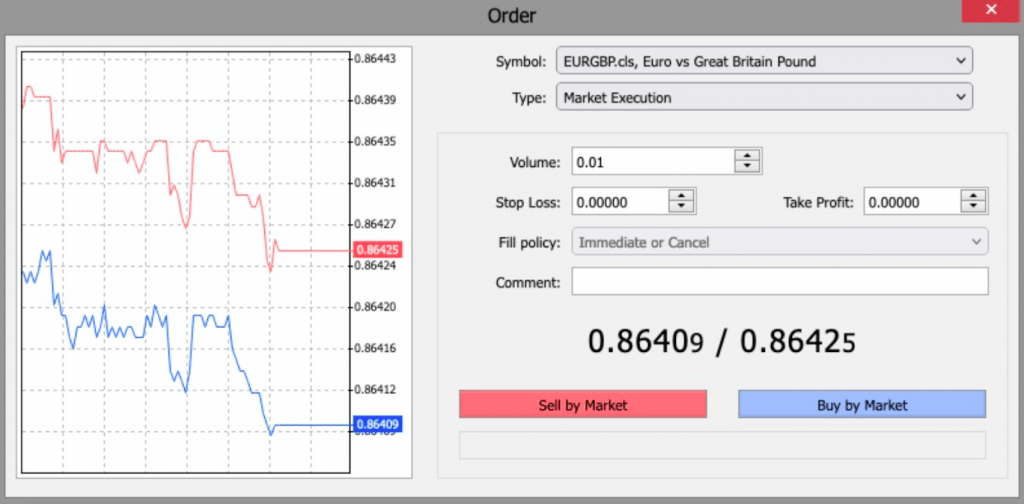

How To Place A Trade

- Load the trading platform and sign in

- Click the ‘New order’ button on the trading platform (icon with a white page and cross in a green circle)

- Select the underlying asset from the drop-down list, for example, the FTSE

- Choose either market execution or pending order

- Input the trade volume as well as stop loss and take profit orders

- If you are opening a market execution, click either buy to go long or sell to go short

- If you are opening a pending order, you will also need to input the strike price, the type of order (buy or sell limit, buy or sell stop or buy or sell stop limit), plus the expiration

- Confirm the order

Order Screen

FinPros Accounts

Our experts found that FinPros offers four live trading accounts.

The profiles have different pricing models and offer unique features, meaning you can find an account that suits your trading style and strategy. With that said, all accounts offer minimum positions from 0.01 lots, maximum orders of 50 lots, market execution, plus one-click trading.

Edge

- Spreads from 0.4 pips

- Zero commissions

- Minimum deposit of £800

- Maximum leverage of 1:400

- Suitable for scalpers & day traders

Raw+

- Spreads from zero pips

- Minimum deposit of £800

- Maximum leverage of 1:400

- £2 per lot per side commission

- Suitable for scalpers & day traders

Vantage

- Spreads from 1.6 pips

- Zero commissions

- Minimum deposit of £800

- Maximum leverage of 1:200

- Islamic-friendly option

- Suitable for swing & position traders

ClassiQ

- Spreads from 1.5 pips

- Zero commissions

- Minimum deposit of £100

- Maximum leverage of 1:500

- Suitable for beginners

How To Create An Account

While using FinPros, we were pleased with how fast and easy it is to register for a new account. New profiles can be activated in as little as 60 seconds.

To open a live account, select the ‘Start Now’ logo on the top right of each web page. Complete the online form and upload the verification documents such as a passport or a driving license. The broker uses AI technology to verify documentation, allowing clients to start trading straightaway.

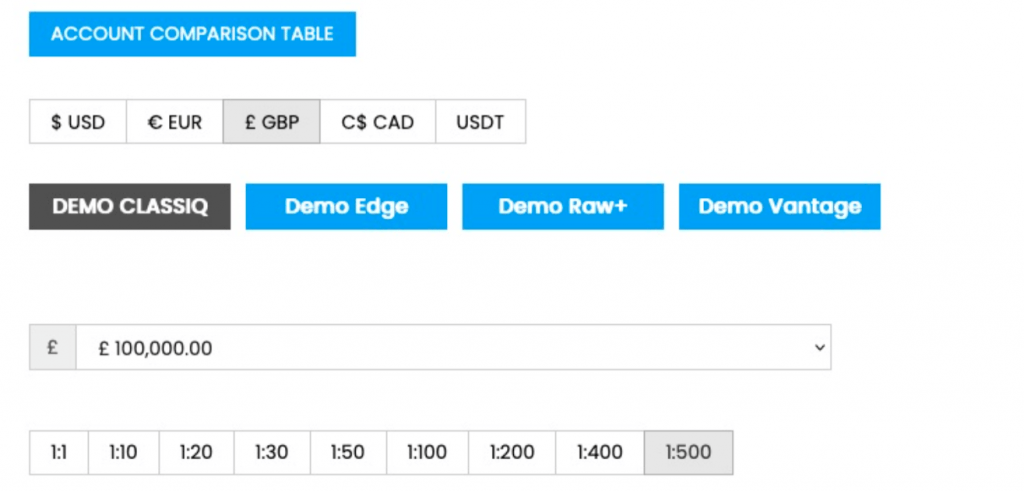

Demo Account

Investors can also register for a free demo account to practise trading CFDs with FinPros on the MetaTrader 5 platform. You can choose a simulated version of each of the four live accounts so you can decide which account is best for you.

When we used the FinPros demo profile, we had to follow the registration process as if opening a live profile. You can then switch between a practice account and a live account within the client dashboard.

Demo Account Registration

FinPros Deposits & Withdrawals

Funding

To deposit funds to a FinPros account, UK investors can use bank wire transfer, Skrill, Neteller and debit and credit cards issued by Visa and Mastercard.

The broker aims to process deposits within one working day. Minimum deposit amounts vary by account type, the lowest being £100 under the ClassiQ profile.

While the broker does not impose any fees for deposits, the client is liable for any third-party charges or intermediary bank costs.

Withdrawals

All payment methods available for deposits can also be used at the withdrawal stage. The only difference is that the processing time for withdrawals may be longer. Bank transfers can take between three and five working days for funds to clear, and credit and debit cards can take up to seven business days. E-wallets often provide the quickest fund processing, with withdrawals typically cleared the same day.

Note that you need to have up-to-date identification and proof of address documents for a withdrawal request to be accepted. For instance, if your passport has expired then a withdrawal may not be accepted. Also, withdrawals must be completed using the same method as your deposit. So, if your deposit was made through a bank transfer, you cannot use an e-wallet or credit or debit card to withdraw profits.

The minimum bank transfer limit is £200, but for the other methods, FinPros does not impose a minimum requirement.

UK Regulation

FinPros is regulated by the Financial Services Authority of Seychelles with license number SD087.

Whilst it is not regulated by the UK Financial Conduct Authority, the broker does offer some client safeguarding measures, such as negative balance protection correction, meaning the broker will cover any deficit if your account goes into the red. Whilst rare, this may happen if you have highly leveraged positions on volatile assets.

Benefits Of Trading With FinPros

- 1:500 leverage

- MetaTrader 5 platform

- Negative balance protection

- Save up to 53% in trading fees

- Trades are executed up to 27% faster

- Accounts activated in under a minute

- Adheres to KYC policies and requirements

- No dealing desk model for faster executions

- Four live accounts to suit different trading strategies

- High frequency trading supported via 25 Gbps SmartNIC ASIC network cards

Drawbacks Of Trading With FinPros

- No copy trading tools

- No stocks listed on the LSE

- Not licensed by the UK Financial Conduct Authority

- High minimum withdrawal limit for bank transfers (£200)

Customer Support

The FinPros customer support team is open between 7 AM and 5:30 PM GMT Monday to Friday. UK-based traders can receive help in English through the following methods:

- Online contact form

- Live chat on the website

- Email at supportpros@finpros.com

- Call the helpline phone number +357 25 263 263

- Social media accounts on Instagram, Facebook, LinkedIn, YouTube and Twitter

Should You Trade With FinPros?

FinPros is a high-quality broker that UK investors interested in trading forex, cryptos, stocks, indices and commodities should review. Ultra-fast trade executions, low costs, and straightforward account activation make it a serious contender. On the other hand, the high minimum deposits on three of the accounts plus the lack of FCA regulatory oversight may deter some investors. For prospective traders unsure whether to register for an account, you can try the demo trading profile for free.

FAQ

Is It Safe For UK Investors To Trade With FinPros?

FinPros is a legitimate broker that is regulated by the Financial Services Authority of Seychelles. While you can rest assured that it is a genuine brokerage, trading CFDs is a high-risk activity. It is important that you adopt risk management strategies and only risk what you can afford to lose.

Who Owns FinPros?

FinPros is run by Finquotes Financial Ltd, which has its head office in Limassol, Cyprus. The online brokerage was launched in 2020.

What Payment Methods Are Accepted By FinPros?

FinPros accepts deposits made using Visa and Mastercard debit and credit cards, bank transfers and e-wallets including Skrill and Neteller. To make a deposit, you must complete the verification process. If you attempt to make a deposit but it was denied, check your account verification status. If you receive any payment error messages or accounting problems, contact the support team.

Does FinPros Offer Leveraged Trading?

FinPros offers leverage up to 1:500, though this varies by account. The Edge and Raw+ accounts offer 1:400 leverage, the Vantage account offers 1:200 leverage, and the ClassiQ account offers 1:500 leverage.

Top 3 FinPros Alternatives

These brokers are the most similar to FinPros:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

FinPros Feature Comparison

| FinPros | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4.8 | 4 | 4 |

| Markets | CFDs on Stocks, Indices, Forex, Commodities, & Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $0 | $1,000 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | FinPros Review |

Pepperstone Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| FinPros | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

FinPros vs Other Brokers

Compare FinPros with any other broker by selecting the other broker below.

Popular FinPros comparisons: