Fidelity Review 2025

|

|

Fidelity is #112 in our rankings of UK brokers. |

| Top 3 alternatives to Fidelity |

| Fidelity Facts & Figures |

|---|

Fidelity is a popular financial services firm that provides investment accounts and pensions with access to thousands of stocks, ETFs and mutual funds to clients based in the US, Europe and Asia. Fees vary by asset and account country, but are generally competitive, with zero-commission trading available on US stocks. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | ETFs, Mutual Funds, ISAs, Pensions, Stocks, Indices |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | Fil Mobile App |

| Payments | |

| Min. Trade | £25 |

| Regulated By | FCA, SEC |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Signals Service | None |

| Islamic Account | No |

| Stocks | Trade thousands of US stocks with no commission with the US branch and low commissions internationally. Global stocks from the LSE and other exchanges are also available. We found the stock and fund screener particularly useful for identifying suitable investments. |

Fidelity is a global investment management company that provides trading accounts, ISAs and SIPPs to UK customers. Fidelity is an established brand that offers a good range of assets with a transparent fee structure. However, is it the best platform for UK investors? This Fidelity review will examine the products offered and the benefits and drawbacks of investing with this company. It will also provide a guide to signing up and investing with Fidelity.

Fidelity is a reputable investment management platform. However, Interactive Investor is a better option for UK investors with a smoother sign-up process, plus deposits and withdrawals. Alternatively, CMC Markets and IG Index offer long-term investment products in addition to short-term trading opportunities.

Products & Services

Fidelity offers several investment solutions to UK residents:

- Investment Account: Invest in stocks, funds and investment trusts with low service fees.

- Stocks and Shares ISA: Invest up to £20,000 per year in funds, shares, and investment trusts, and benefit from the UK’s Independent Savings Account rules allowing tax-free capital gains.

- Self-Invested Personal Pension: Save from as little as £20 per month in Fidelity’s SIPP and benefit from a 25% top-up from HMRC.

- Junior ISA: Make savings of up to £9,000 per year for your child’s future and pay no income tax or capital gains tax.

- Junior SIPP: Start building up your child’s retirement nest egg early with up to £2,880 per year and benefit from 25% bonus payments from HMRC.

Clients with a portfolio worth at least £250,000 are also eligible for wealth management services, which includes personalised investment advice and portfolio management.

Market Access

When we used Fidelity, we found a relatively competitive list of financial instruments:

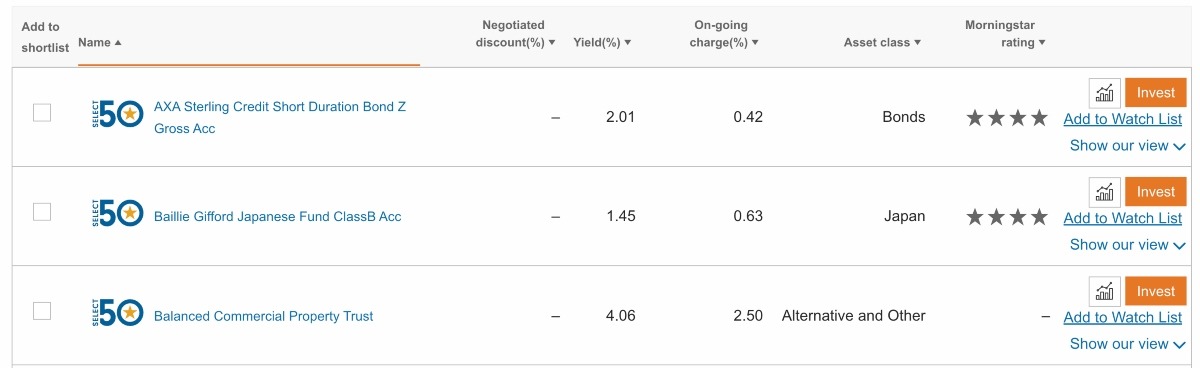

- Funds: Fidelity offers a wide range of funds, including actively managed funds and index funds. These cover a range of asset classes, including equities, fixed income, and alternatives.

- Stocks & Shares: Fidelity customers can trade shares on UK, US, and European stock exchanges. They also offer access to international markets through their global trading platform.

- Investment Trusts: Fidelity offers access to a range of investment trusts, which are closed-end funds that invest in a diversified portfolio of assets.

- ETFs: Fidelity provides a range of ETFs, which are passive investment products that track the performance of a specific index.

There is an impressive list of 180 investment trusts, and Fidelity clients can indirectly access a much broader range of assets by investing in these or in funds that cover specific sectors or foreign markets.

On the downside, Fidelity does not offer direct investing in bonds, though these can be accessed through funds and ETFs.

Ultimately, this is primarily a service for mid- to long-term investors. The brand does not offer forex trading or derivatives like CFDs, futures, and options.

Which Account Type Is For Me?

Fidelity’s different account types each have their own uses and will suit different types of investors.

For many UK investors with cash to invest, a Stocks & Shares ISA is an attractive option. Those looking to put money away for retirement could invest in a SIPP to benefit from the tax-efficient account with government top-ups. Parents can take advantage of similar benefits for their children with the two Junior Accounts.

Fidelity’s Investment Account is a good option if you want more control over your positions. However, it does not have the tax-efficient benefits of the other account types.

You can also open several different accounts with Fidelity, allowing you to distribute your annual savings to benefit from what each profile has to offer.

Though Fidelity has an impressive range of assets and products on offer, it is really geared toward longer-term investors and those looking to buy and sell assets frequently are better served elsewhere.

Some brokers that offer ISA accounts, such as CMC Markets and IG Index, also have derivative products and a wide range of international stocks available, making these a good bet for more active traders.

Fidelity Fees

Our experts found that Fidelity is transparent about its fees and does not charge for setup, closing your account, fund switching, fund transfers, exit fees or annual fees. This puts Fidelity above some competitors who often charge for some or all of these. Up to £500 of exit fees are also covered for investors who decide to switch their existing investment accounts over to Fidelity.

Fidelity UK’s fees vary depending on the specific investment product or service being used. Key charges to be aware of:

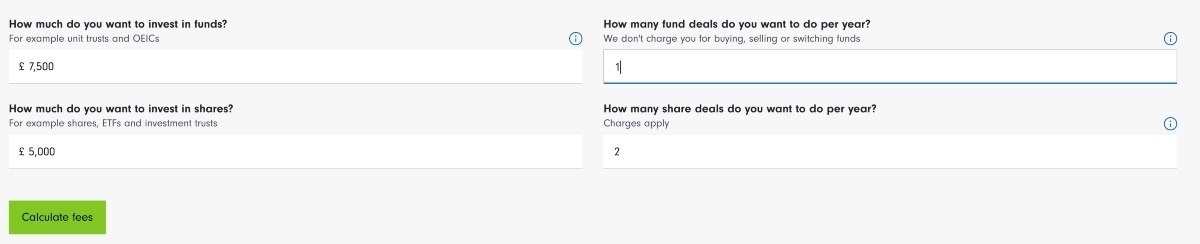

- Service Fee: Fidelity’s service fee for investors on a regular savings plan typically starts at 0.35% of the total value of investments in an account, charged annually. This fee goes down to 0.2% for investors with a portfolio worth more than £250,000. Clients with a portfolio worth more than £1 million will pay 0.2% on the £1 million and nothing for assets over that amount.

- Non-Saving Plan Service Fee: Clients who don’t have a regular savings plan in place will pay a flat £90 per year (£7.50 per month) service fee.

- Investment Charges: Ongoing fund charges start from 0.05% although some funds have a performance fee, a fund manager charge or a bid-offer spread which is applied when you buy or sell.

Platform Features

Fidelity UK offers a reliable online platform for investors, which includes a range of tools and resources:

- Portfolio Tracker: Users can track the performance of their investments in real-time with the portfolio tracker, which also provides performance analysis and risk profiling tools to help make informed investment decisions.

- Investor Finder: This tool takes users through various types of investments including ETFs, shares, mutual funds and trusts, telling you the features of each so you can find the one best suited to you.

- Research Tools: A range of research tools are available, including market news and analysis, research reports, and stock and fund screeners.

- Educational Resources: Clients can access educational resources to learn about investing and financial planning, including articles, videos, webinars, and interactive tools.

- Customer Service: Customer support is available through phone, email, and live chat. Fidelity International also has a comprehensive FAQ section on its website.

- Mobile App: While using Fidelity’s app, we found it to be secure and easy to use, with two-factor and biometric authentication at the online login.

User Guide

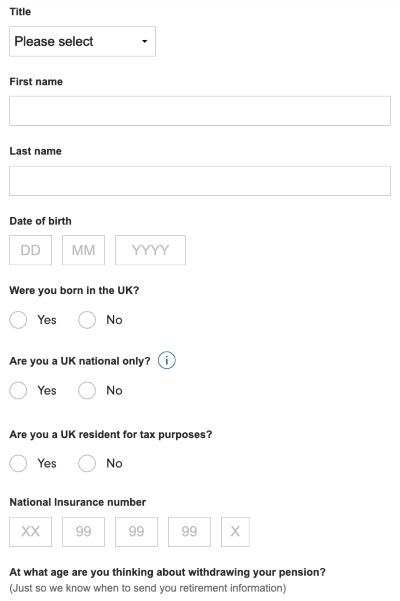

Opening a Fidelity account is relatively time-consuming and requires your National Insurance number and either your card or bank details depending on whether you are investing once or setting up a direct debit.

- Determine your investment goals: Before investing with Fidelity International, you need to determine your investment goals and risk tolerance. This will help you choose the appropriate investment products and account type.

- Choose an account type: Fidelity International offers a range of account types; choose the one that best suits your investment goals and needs. Use the account finder tool if you need help with this.

- Open an account: Once you have chosen an account type, open a profile with Fidelity International on the company’s website by providing your personal information and necessary documents.

- Fund your account: After opening an account, fund it by transferring money from your bank account or another investment account. Note that customers who fund with a regular saving plan will benefit from a 0.35% fee and may avoid higher costs.

- Choose your investments: Once you have funded your account, you can start investing. Fidelity International provides a range of tools and resources to help you make informed decisions, including research tools and educational resources.

- Monitor your investments: It’s important to regularly monitor your investments and adjust your portfolio as needed to ensure it aligns with your financial goals and risk appetite.

- Manage your account: Fidelity International provides online account management tools that allow you to view your portfolio, track your investments, and make trades. High net-worth clients can also benefit from personalised wealth management.

Is Fidelity Regulated?

Fidelity UK is regulated by the Financial Conduct Authority (FCA), which provides oversight and protection for British investors.

In line with its commitments to client security, the firm uses a range of security measures, including encryption, firewalls, and multi-factor authentication.

Pros

- ISAs, SIPPs & investment accounts

- Reputable investment group

- Online banking transfers

- Thousands of instruments

- Strong market research

- £0 minimum deposit

- World index funds

- FCA-regulated

- Intuitive app

Cons

- Not suitable for short-term trading

- Slow deposits and withdrawals

- High fees for some products

- Complex sign-up process

Company Background

Fidelity International is a global investment management company that provides a range of investment solutions and services to individuals, financial advisors, and institutional clients. The company was founded in 1969 and is headquartered in London, UK, with operations in 25 countries including India, Canada, and Germany.

The brand is known for its strong research capabilities, and its investment professionals conduct extensive research to identify investment opportunities and monitor market trends. The company has a long history of delivering strong returns to its clients, and it has won numerous industry awards for its investment products and services.

Overall, Fidelity International is a reputable and trusted investment management company that provides a competitive suite of investment solutions and services to help clients achieve their financial goals.

Customer Support

Fidelity has a strong customer support system in place that offers various channels for investors to get in touch and receive assistance.

Their website includes a help and support section, which includes a range of resources such as FAQs, video tutorials, and guides. The website also includes an online chat feature that allows investors to chat with a customer service representative in real-time.

Investors can contact customer support via their contact number or email, and Fidelity International provides international phone numbers for customers based outside the UK.

Our experts found that Fidelity’s telephone customer support team was helpful and easy to reach, with only a short waiting time to be connected to a human assistant. The team could advise on various queries, from opening hours to investing forums.

Should You Invest With Fidelity?

Fidelity UK offers a decent range of investment products and services, competitive fees, a user-friendly platform and tools, plus a commitment to security and customer service. These factors make Fidelity UK a strong choice for investors looking for a reputable investment management company in the UK.

Yet despite the positives, Interactive Investor is a better pick for British residents. The account opening process is smoother, and the deposit and withdrawal process is easier.

Alternatively, consider brands like CMC Markets and IG Index, which offer long-term investment solutions like ISAs, as well as short-term trading instruments.

FAQ

What Investment Products Does Fidelity Offer?

Fidelity International offers a range of investment products, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, investment trusts, and more.

Is Fidelity A Good Investment Platform?

Fidelity is a well-regarded investment management company. Fees are competitive and the platform is relatively secure and trustworthy. With that said, Fidelity offers limited short-term trading opportunities and the account sign-up process is time-consuming. As a result, consider alternatives.

What Is Fidelity International’s Investment Philosophy?

Fidelity International’s investment philosophy is based on fundamental research, active management, and a long-term investment approach. The company’s investment professionals conduct research to identify investment opportunities and monitor market trends to help clients achieve their financial goals.

Is Fidelity Safe & Trustworthy?

Fidelity offers a secure investment platform. Its strong track record, history and regulatory oversight also mean that the firm is relatively trustworthy. With that said, investing is risky so do not invest more than you can afford to lose.

Does Fidelity Offer Financial Planning Services?

Yes, Fidelity offers financial planning services to help clients achieve their goals. The company’s financial advisors work with clients to develop personalised investment strategies based on their needs and objectives.

Does Fidelity Provide Good Customer Support?

Fidelity offers various channels for investors to get in touch, including a help and support section on their website, an online chat feature, telephone numbers, and email support. The company’s customer service representatives are knowledgeable and helpful and can assist with account opening and management, investment guidance, technical support and other queries.

Article Sources

Top 3 Fidelity Alternatives

These brokers are the most similar to Fidelity:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Fidelity Feature Comparison

| Fidelity | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 3.5 | 4.3 | 4 | 4.7 |

| Markets | ETFs, Mutual Funds, ISAs, Pensions, Stocks, Indices | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | £25 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA, SEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Fidelity Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| Fidelity | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

Fidelity vs Other Brokers

Compare Fidelity with any other broker by selecting the other broker below.

Popular Fidelity comparisons: