FairMarkets Review 2025

|

|

FairMarkets is #92 in our rankings of CFD brokers. |

| Top 3 alternatives to FairMarkets |

| FairMarkets Facts & Figures |

|---|

FairMarkets is a multi-regulated trading broker with MT4 and MT5. Low fees, flexible leverage and analysis from Trading Central make it a solid all-round broker. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Stocks, Forex, Commodities, Indices, Cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Use leveraged CFDs to go long or short on a range of financial markets with low fees. |

| Leverage | 1:30 (Aussie Retail), 1:500 (Aussie Pro), 1:1000 (Global) |

| FTSE Spread | 1.2 |

| GBPUSD Spread | 0.4 |

| Oil Spread | 0.3 |

| Stocks Spread | Variable |

| Forex | Trade popular currency pairs with tight spreads and competitive commissions. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.8 |

| Assets | 40+ |

| Stocks | Speculate on major global companies via stocks or trade index CFDs. |

| Cryptocurrency | Trade Bitcoin and other key cryptos against the USD with 1:2 leverage. |

| Coins |

|

| Spreads | From 20.0 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FairMarkets is a CFD broker that offers leveraged trading on multiple assets through the powerful MetaTrader 4 and MetaTrader 5 platforms. The broker aims to provide a comprehensive trading experience with tight spreads, though we think its lack of FCA regulation and fees may put some UK traders off. In this review, we explore the key features, security framework, and overall user experience offered by FairMarkets.

Our Take

- FairMarkets offers 500+ instruments including UK stocks and shares

- Responsive customer service is available 24/5 through live chat

- Relatively high commissions and initial deposit limits are required to access the tightest spreads

- The lack of FCA authorisation reduces the firm’s safety and security rating for UK traders

Market Access

FairMarkets offers more than 500 instruments in total, and although the range of asset classes is good, other brokers offer far more depth with thousands of assets in total, including leading firms like CMC Markets and Pepperstone.

On a lighter note, the broker provides access to UK equities plus the FTSE. Available instruments include:

- Forex – trade on major, minor and exotic currency pairs

- Stocks – trade stock CFDs from a range of UK, US and European countries

- Indices – trade Index CFDs from global share baskets including the S&P 500 and Dow Jones

- Commodities – trade both hard and soft commodities with CFDs such as oil, gold and silver

- Cryptocurrency – trade crypto with currency crosses that include the USD

Fees

Overall, FairMarkets offers tight spreads, but we found their fees and minimum deposit restrictions to be high in some cases.

Spreads start as low as 0.0 with the Raw Zero account. With other accounts, spreads range from 0.6 pips (VIP Variable Account) to 1.0 (Standard Fixed Account) to 1.2 (Standard Variable Account).

The accounts with the most attractive spreads come with additional limits or charges. The VIP Variable Account has a minimum deposit of $5,000, which will be beyond most beginners. There are also commissions charged on the Raw Zero account of $10 per lot, which is relatively expensive compared to alternatives.

One thing we did appreciate about FairMarkets is that they charge no inactivity fees.

Accounts

We felt that the range of account types offered by FairMarkets is great at accommodating traders of all abilities and experience levels. All accounts give traders access to all markets, which we were also impressed with.

The broker offers a Standard account with a commission-free pricing structure with spreads starting from 0.6, no minimum deposit and safeguards such as negative balance protection.

It also offers a Premium account, which offers spreads starting from zero, a $2 commission per round lot and no commission on some forex pairs. This is an appealing fee model that will be attractive to active forex traders.

On the downside, there is no Halal account for Muslim traders.

How To Open A FairMarkets Account

I found it easy to register an account with FairMarkets by following these steps:

- Enter your name, email address, and phone number on the sign-up form

- Choose a username and password

- Download the MT4 or MT5 platform or open the WebTrader

- Select your account type

- Provide your personal information

- Verify your identity

- Fund your account

Once you have opened an account, you can start trading on the available markets.

Funding Methods

Our experts found that the funding methods offered by FairMarkets are adequate, and it is good that the broker does not charge any deposit or withdrawal fees, but the options are fairly limited. You can make deposits to your trading account using bank transfer, credit card, debit card, and the Skrill e-wallet. The same options are available for withdrawal.

While this should be enough for most traders, we were sorry to see just one e-wallet option and no PayPal. It would also have been good to have the opportunity to make deposits using cryptocurrencies.

Note that you can only withdraw using the same method you did to deposit, as part of the broker’s anti-money laundering policy.

How To Deposit Funds

To deposit funds into your FairMarkets account:

- Go to the deposit page and select the relevant account from the list of your active trading accounts

- Select your preferred funding method

- On the payment screen, confirm your payment type and amount

- Confirm the transfer

We found that the credit or debit card option was the fastest in terms of funds being displayed in the account, (usually instant).

Regulation

FairMarkets is an Australian-based broker that is overseen by the country’s regulatory body, ASIC, holding AFS license number 424122 ACN 159166739.

The broker also has an offshore branch which is regulated by the Mauritius Financial Services Commission, under the licence number GB21026295. They also hold a Mauritian Investment Dealer License.

This means that they comply with Mauritius laws and regulations, however it is not considered a tier-one financial regulator, so it is not as safe as oversight from the FCA in the UK.

Trading Platforms

We were pleased to see that FairMarkets supports both the MetaTrader 4 and MetaTrader 5 platforms. These intuitive and powerful trading platforms have become market leaders since their release in 2005 and 2010, respectively, and it is excellent to have a choice between the two.

Both platforms offer a wide range of features, including technical analysis tools, advanced charting, and order execution. However, there are some key differences between the two platforms.

MT4 is a more lightweight platform than MT5, making it faster and easier to use. MT4 also has a larger user base with more resources available online, such as tutorials.

MT5, on the other hand, offers more advanced features, such as hedging and more powerful algorithmic trading. MT5 also supports a wider range of financial instruments.

Ultimately, the best platform for you will depend on your individual needs and preferences. If you are a beginner trader, MT4 may be a better choice due to its simplicity. If you are an experienced trader looking for a more advanced platform, MT5 may be the best option.

How To Place A Trade

To place a trade on FairMarkets, follow these steps:

- Create an account and deposit funds

- Choose the asset you want to trade by selecting it from the trading terminal’s drop-down list

- Select the order type: market, limit, or stop. A market order is executed immediately at the best available price. A limit order is executed only if the asset reaches a specified price. A stop order is executed when the asset reaches a specified price or lower.

- Enter the amount you want to trade by entering the number of shares or the dollar amount

- Click ‘Place Order’ to confirm your trade

FairMarkets App

Although FairMarkets does not have its own app, traders can access markets on the go using the MT4 and MT5 mobile apps and we are confident these will suit almost any trader.

The apps are available for free on iOS and Android devices and support most of the functions of the MT4 and MT5 desktop terminals.

In fact, we sometimes recommend using the MetaTrader apps over brokers’ own applications, as these are often limited in terms of features and functionality. They may also not be as user-friendly.

Overall, the MetaTrader apps are a good choice for traders who are looking for powerful and versatile mobile platforms with a range of features and benefits.

Leverage

FairMarkets is limited by local regulatory restrictions and offers retail traders a maximum of 1:30 leverage, with lesser amounts available for more volatile instruments. We think this will suit most traders, particularly casual ones, who will have the chance to increase their trading power without the increased risks that much higher leverage brings.

Traders who meet a set of criteria based on their trading experience and volume traded can apply for a ‘Professional’ account with higher leverage, but they will lose the protections the broker offers retail traders if they do so, such as negative balance protection.

Demo Account

We were pleased that FairMarkets offers a demo account, as these bring many benefits beyond just testing out the platform before you sign up:

- You can learn how to trade without risking real money

- You can test different trading strategies and see how they work

- You can practise trading in different market conditions

- You can get a feel for the platform and the tools that are available to you

- You can build confidence before you start trading with real money

Overall, a demo account is a great way to learn about online trading and get started without any risk.

Bonus Deals

FairMarkets offers a ‘Learn and Earn’ programme. This allows traders to improve their skills by answering a series of quiz questions correctly. If the quiz is solved correctly, traders win a 100 USD tradable bonus. There is a range of quizzes to choose from, so you can choose to be quizzed on your most confident topic.

Overall, we found this to be an excellent addition to the platform given that you do not have to deposit real funds in order to earn it.

Extra Tools & Features

We were disappointed by the extra features offered by FairMarkets, which are lacking compared to most major rivals. There is no copy-trading functionality and although the website has an FAQ section with some useful basic information and e-books with more advanced trading content, there is no dedicated ‘academy’ section with video or other content.

On a lighter note, it was good to see a VPS service offered to qualifying clients, and there are a couple of other decent extras:

- Economic Calendar – FairMarkets offers an economic calendar where traders can view indicators, forecasts and announcements on financial reports

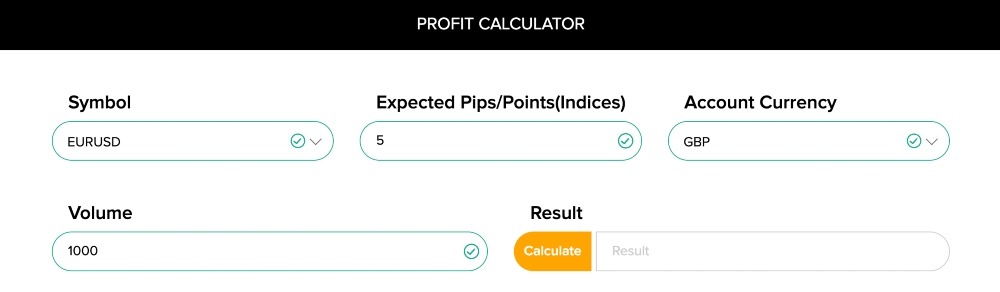

- Price Calculators – There are three kinds of calculators offered by FairMarkets: a margin calculator, a profit calculator and a currency converter. These are easy to use and work quickly with examples, which we found to be useful.

Customer Service

Their customer service operates 24 hours a day, 5 days a week, which is satisfactory given that this matches the times that most markets are open. Support is available via call, live chat or email.

While live chat is not available on the weekend, we found it to be highly responsive during the week.

Customer service can be obtained in 9 languages, which is also impressive.

Company Details & History

FairMarkets is an Australian broker that goes under FairMarkets Trading Pty Ltd, which is regulated by ASIC.

The offshore branch (Fairmarkets International Ltd) is based in Mauritius and operates as an authorised financial services provider there.

Established in 2021 by Netherlands-based company Trive Investment B.V., they have been offering trading services ever since.

Security

FairMarkets is a member of the investor compensation scheme, which helps to keep client funds safe in the event that the broker goes under. It employs standard security practices with a secure client area. And, as an ASIC-regulated broker, clients can trust that they operate to good standards.

The broker also offers a VPS, a private computer that helps them keep client data completely secure, although this is only available with certain account types.

Trading Hours

The forex market is active 24 hours per day on weekdays, so traders can use FairMarkets during these hours. Note that holidays may affect these hours. Other assets will trade according to the hours of the relevant exchange.

Should You Trade With FairMarkets?

FairMarkets is a good broker with some nice features, and traders will rate the choice of account types, transparent pricing and fast execution speeds. It is also good to find MT4 and MT5.

However, the asset list is mediocre and the broker does not have anything outstanding to offer traders. The lack of an FCA license is another key drawback for UK traders.

FAQ

Is FairMarkets Trustworthy?

FairMarkets is not regulated by the Financial Conduct Authority (FCA). This lack of regulation raises concerns about the platform’s transparency in the UK, but it does have an ASIC-regulated branch.

Does FairMarkets Provide Strong Customer Support?

FairMarkets claims to offer exceptional customer support and the team were on-hand and helpful upon testing. Customer service is also available in 9 languages, which is a plus.

What Can I Trade At FairMarkets?

FairMarkets offers a diverse selection of financial instruments, including stocks, currencies, commodities, and cryptocurrencies. However, there is limited depth with 500 instruments compared to 1000+ on some rival brokers.

Is FairMarkets A Good Or Bad Broker?

FairMarkets is worth a look for its diverse account types and pricing that fares well against the competition, though many traders would prefer an FCA-regulated alternative. The lack of strong educational resources may also deter beginners.

Article Sources

FairMarkets Mauritius FSC License

Top 3 FairMarkets Alternatives

These brokers are the most similar to FairMarkets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

FairMarkets Feature Comparison

| FairMarkets | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | - | 4 | 4 | 4.8 |

| Markets | CFDs, Stocks, Forex, Commodities, Indices, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $1,000 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FSC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 (Aussie Retail), 1:500 (Aussie Pro), 1:1000 (Global) | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | FairMarkets Review |

Swissquote Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| FairMarkets | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

FairMarkets vs Other Brokers

Compare FairMarkets with any other broker by selecting the other broker below.

Popular FairMarkets comparisons: