Exinity Review 2025

|

|

Exinity is #89 in our rankings of CFD brokers. |

| Top 3 alternatives to Exinity |

| Exinity Facts & Figures |

|---|

Exinity provides flexible low-cost trading in FX, commodities, indices and equities alongside unique education and support provided by teams located across the world. Now operating in the Middle East, through regulation from the Financial Services Regulatory Authority in Abu Dhabi and the Financial Services Commission of Mauritius, Exinity provides a range of services to traders and investors looking for new opportunities in the financial markets. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, Stock CFDs, Forex, Commodities, Indices |

| Demo Account | No |

| Min. Deposit | $20 (World), $100 (Trader), $10,000 (Trader Pro) |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSRA, FCA, FSC, CMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes - MT4 / MT5 and Analyst Sentiment |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, indices, energies and metals with fast execution and variable leverage. Spreads are tight and commission-free trading is available on some assets. |

| Leverage | 1:2000 |

| FTSE Spread | Variable |

| GBPUSD Spread | 1.9 |

| Oil Spread | Variable |

| Stocks Spread | Variable |

| Forex | Exinity offers 150+ forex pairs to trade on a very competitive ECN pricing model, with spreads from zero and low commissions of $4 per round turn. Traders can access the powerful MT4 and MT5 platforms and trade with no restrictions on popular trading strategies. |

| GBPUSD Spread | 1.9 |

| EURUSD Spread | 1.3 |

| GBPEUR Spread | 2.8 |

| Assets | 150+ |

| Stocks | Exinity clients can speculate on shares from US and Hong Kong companies. Traders can choose between trading stock CFDs or directly buying stocks in large firms commission-free. On the negative side, there are no equities from European and UK markets. |

Exinity is the primary brokerage of parent company Exinity Group, specialising in forex, CFD and equity investing services. With over 20 years of experience in the online trading business, Exinity Limited is a truly global platform, serving over 150 countries. This 2025 review explores the UK subsidiary and its offerings, detailing crucial information such as markets, leverage and payment methods. Read on to find the answers to key questions like whether Exinity Ltd is regulated by the FSC and what its minimum deposit limit is.

About Exinity

The Exinity Group operates several brokers around the world, such as FXTM, Alpari and Exinity, as well as payment service AcruPay. Beginning in 1998 as a singular MetaTrader broker, the company has since expanded to locations as diverse as Limassol, Kenya, Mauritius and Dubai, plus a dedicated London office.

Through this network, the firm serves over two million clients with forex, CFD, and share investing products. The broker is regulated in several jurisdictions, holding licences from the FSRA in the UAE, FSC in Mauritius and CMA in Kenya. While there is no FCA regulation, traders from the UK are still welcome.

The meaning of the Exitnity name is a fusion of the words exchange and infinity, reflecting the platform’s belief in the limitless potential of trade.

Markets

Exinity provides a varied range of capital and speculative markets to its users, with offerings for long term investors, swing traders, arbitrageurs, scalpers and everyone in between.

Forex

The broker supports more than 150 currency pairs, spoiling its clients for choice amongst major, minor and exotic instruments. Spreads start at 0.0 pips on selected major pairs, though these are variable and subject to change throughout the trading day. A commission charge of $4 per round lot is levied on all forex trades, though positions can be held open for up to seven days with no swap fees.

Indices

Index CFDs are a popular method to speculate on the fiscal value of a particular region or sector. Exinity boasts more than 30 indices, including the UK FTSE 100, S&P 500 and Hong Kong Hang Seng. In addition, several currency indices track major global currencies, offering a holistic approach to value rather than a specific currency swap.

The broker promises tight spreads and zero commissions on its index CFD markets. To this end, minimum spread values for major global indices stand at 1.0 pips, though typical values sit between 2.0 and 4.0 pips.

Equities

For risk-averse investors that prefer simple stock trading, the Exinity World platform allows clients to purchase top stocks from the US and Hong Kong exchanges. With no commission or trading fees, alongside fractional shares support of as low as 1%, investing with this broker is clear and straightforward.

The firm applies a variable spread to stock purchases in lieu of commission. Typical values range from 1.0 to 111.0 pips, depending on the asset.

Shares CFDs

Leveraged speculation on stock prices is also available through Exinity via its share CFD offerings. As with the equities investments, the broker offers US and Hong Kong shares with the option of going both long and short.

There is zero commission on US stocks but a 0.4% commission per round turn on Hong Kong-based equities. As with the forex markets, there is a swap-free trading allowance, though this is limited to three days.

Commodity CFDs

Due to their volatility, metals and energies are popular speculative instruments and Exinity traders can take advantage of these markets with the firm’s commodity CFDs. Fuel spot markets include UK Brent oil, US WTI crude oil and US natural gas, while gold and silver instruments are provided for precious metal speculation.

Spreads start at 0.0 pips for the gold/USD market but remain competitive for all commodities. There is a $4 per round lot commission for metals trading, though this is waived for fuel markets. While metal markets have a seven-day swap-free period, there is no such benefit for energies.

Trading Platforms

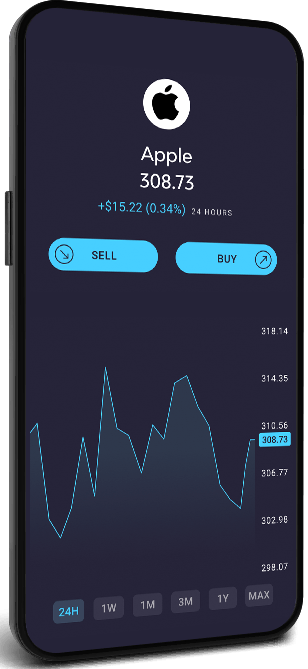

Exinity clients can access different trading platforms with different account options. World account holders are restricted to the firm’s proprietary mobile app, which is supported on both Apple (iOS) and Android (APK) devices. This application features handy tools like a built-in analyst sentiment indicator and integrated market research tools. However, advanced charting features and custom indicators are not available.

Exinity Mobile App

Users with Exinity Trader accounts can also access the MetaQuotes MT4 and MT5 platforms. These execution systems add forex markets and more advanced trading and analysis tools. This includes a wide range of timeframes, over 30 built-in indicators and a wide range of customer-built indicators and tools. MetaTrader platforms also support expert advisor automated trading capabilities and an impressive range of graphical objects.

Exinity Account Types

Exinity World

The world account is aimed at beginners and investors, requiring just $20 as a minimum deposit. That being said, the account also offers CFDs on energies, indices and shares, with leverage rates reaching up to 1:1,000 and the broker’s easy-to-use mobile application as its trading platform.

Exinity Trader

With more experienced, short-term traders in mind, this account adds forex trading support and both MT4 & MT5. With a minimum deposit of $100, the barrier to entry is a little higher but clients are rewarded with leverage rates as high as 1:2,000.

Swap-Free Account

The broker also offers a swap-free account for those who cannot pay or earn interest due to religious beliefs. While many assets already have a set period over which no overnight swap fees are levied, this account replaces all such charges with flat account management charges.

Demo Account

A risk-free demo account is available through the Exinity app, MetaTrader 4 and MetaTrader 5. Clients are supplied with $5,000 of practice funds and are free to experience the forex and CFD markets first-hand with no risk to their capital.

Leverage

While many UK brokers operate with limited leverage due to FCA regulations, Exinity’s licences do not restrict the margin capabilities it can offer its clients. World account customers can utilise massive leverage of up to 1:1,000 on selected markets, while Trader account holders can extend this to a whopping 1:2,000.

These margin trading capabilities exceed almost all competitors in the forex and CFD trading space, though speculating with leverage this high carries significant risk to capital.

Trading Fees

Other than the commission on some assets, there are no additional trading fees with Exinity. Financing charges apply once the free overnight holding period expires, though these will differ from instrument to instrument. Sporadic traders will be pleased to learn that no inactivity fees are applied to the capital on dormant accounts.

Payment Methods

Several payment methods are available for funding an Exinity account. These include credit or debit card payments, bank transfers and the e-wallet services Skrill and Neteller. Notably excluded are PayPal, crypto deposits and ACH transfers.

Deposit clearing times range from instant with Skrill and Neteller up to 1-3 working days with bank transfers. Withdrawals need to be approved but should clear quickly once this process is complete.

There are no minimum deposit or withdrawal limits, though each account requires a set minimum initial deposit upon creation. All deposits and withdrawals are entirely free of charge.

Educational Content

The educational content section of the broker is called Exinity Edge and features written articles on key terms and concepts in the trading and investing realms, such as CFD fundamentals and trading styles. There is also a blog with market insights from industry experts, though new posts appear to have ceased.

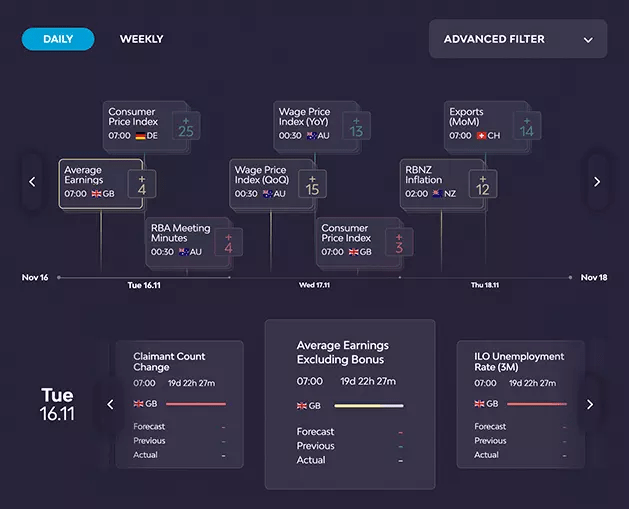

Exinity Economic Calendar

Safety & Regulation

Strong regulation goes a long way to reassure investors of a broker’s legitimacy. While Exinity Group holds several regulatory licences in various jurisdictions around the world, including the Financial Services Regulatory Authority in Abu Dhabi, unfortunately, UK clients only have protection from the Mauritius FSC. That being said, the firm seems legitimate and is trusted by millions of global users.

In terms of safety measures, the firm holds client funds in segregated, tier 1 bank accounts. Separate login details for the MetaTrader 4 and 5 platforms also adds a layer of security to your account. While there is no official negative balance protection, the broker’s website states that traders are not required to pay back any negative balances.

Customer Support

Users have several options to access help from Exinity customer service. The first port of call is the FAQs section, where clients in need can access answers to common issues and queries, such as automatic risk management settings and demo trading.

Bespoke assistance solutions are also available from the global customer support team. Clients can access the integrated live chat feature 24/5 and during limited hours on weekends. Email ticket help is also available, though there is no UK contact number for support, with the only phone line based in the UAE.

Advantages

- Demo trading

- Regulated broker

- Swap-free support

- Wide range of assets

- Very high leverage rates

- Popular trading platforms

- Free deposits and withdrawals

- Investing and trading supported

Disadvantages

- No crypto assets

- Limited payment methods

- Commissions on some assets

- Not all features available to UK clients

Trading Hours

Exinity’s trading hours depend on the specific market. Forex and CFD markets run 24/5, while stocks are traded within their local exchange opening times. The broker does not support out of hours trading.

Clients are free to access their accounts via the client hub or Exinity app and make transactions at any point.

Exinity Verdict

Exinity Group is a major player on the world trading stage and its primary brokerage, Exinity Limited, offers an impressive range of assets and significant leverage capabilities. The broker distinguishes itself from many of its competitors by offering standard investing provisions in addition to its forex and CFD speculation. More cautious traders may prefer a UK FCA regulated platform and others may desire crypto CFD trading support. However, the support for both a beginner-friendly proprietary trading app and the MT4 and MT5 platforms ensures there is something for everyone.

FAQ

What Leverage Does Exinity Offer?

Exinity World clients can utilise leverage rates of up to 1:1,000, while Exinity Trader account holders are eligible for margins of up to 1:2,000.

Is Exinity Based In The Middle East?

While a recent expansion has seen Exinity open an office in Dubai and obtain an FSRA regulatory licence in the UAE, the platform remains a global company and it also has a London office address.

Is Exinity A Regulated Broker?

Exinity Limited is regulated by the FSC in Mauritius to provide trading services to clients in Europe and the UK.

Is Exinity Limited Affiliated With FXTM?

Both Extimity Limited and FXTM are part of Exinity Group.

Does Exinity Accept UK Clients?

Yes, traders from the UK and Europe are among those welcome to open an Exinity account.

Top 3 Exinity Alternatives

These brokers are the most similar to Exinity:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Exinity Feature Comparison

| Exinity | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 3.4 | 4 | 4.8 | 4 |

| Markets | Stocks, Stock CFDs, Forex, Commodities, Indices | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $20 (World), $100 (Trader), $10,000 (Trader Pro) | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FSRA, FCA, FSC, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:2000 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Exinity Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| Exinity | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Exinity vs Other Brokers

Compare Exinity with any other broker by selecting the other broker below.

Popular Exinity comparisons: