Execution Speed

Trade execution speed relates to the time between placing an order on your platform and it being filled in the market. Brokers with high execution speeds help reduce slippage, ensuring you get the desired price. This comparison of best order execution brokers ranks the platforms with the fastest trading speeds. Our team also explain how to speed up execution times.

Best Execution Speed Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Markets.com is a respected broker, offering multi-asset trading opportunities through CFDs or spread betting (UK only). Established in 2008, the brand has an impressive 4.3 million registered customers and is overseen by trusted regulators, including the FCA, ASIC and CySEC. 79.1% of retail accounts lose money.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

PrimeXBT is a multi-asset platform offering highly leveraged trading in forex, indices, commodities and cryptocurrencies. The company launched in 2018 and now has over 1 million users from more than 150 countries. With no minimum deposit, copy trading features and low commissions, the broker remains a popular option among crypto trading novices.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

FinPros is an offshore broker that provides CFD trading on 400+ instruments with high leverage up to 1:500. This is a reliable bet for traders seeking offshore options, with strong security measures, negative balance protection and segregated client funds. The extra features including trading tools and commission-free stocks make this a good choice for beginners, and experienced traders will appreciate tight spreads.

-

RockGlobal is a New Zealand based and regulated CFD broker. They offer competitive spreads from 0.1 pips and a large range of trading assets, trading platforms and educational services, with up to 1:500 leverage. Operating in a Tier 1 regulated environment, RockGlobal offers peace of mind and excellent customer support.

-

OspreyFX is an ECN broker headquartered in St. Vincent and the Grenadines. Established in 2019, the firm offers 120+ forex and CFD assets with high leverage up to 1:500, tight spreads from 0.1 pips and round-the-clock customer support. OspreyFX also stands out for its funded trading accounts where traders can keep up to 70% of profits.

-

Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

-

Global Prime is a multi-regulated trading broker offering 150+ markets. Traders can get started with a $200 minimum deposit and trade with leverage up to 1:100. The firm also has a high trust score and a good reputation with a license from the ASIC.

-

ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

HYCM is an online broker with authorization from four international bodies including the FCA and CySEC. The broker offers short-term CFD trading on forex, shares, commodities, indices, ETFs and Bitcoin, and supports the MT4 and MT5 platforms, as well as Trading Central analysis.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

-

FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

-

Capital.com offer CFDs on a range of markets with competitive spreads and zero commissions. The broker also offers the Investmate app, negative balance protection and leveraged trading.

What Is Order Execution Speed?

Order execution speed refers to how quickly a trade is processed and completed after it is submitted.

When you place an order with a forex broker, for example, it usually has to be matched with another trader or company before it can be filled.

Trading execution speed is measured in milliseconds (ms). A score below 100 is good, anything higher than 200 is bad and may result in slippage.

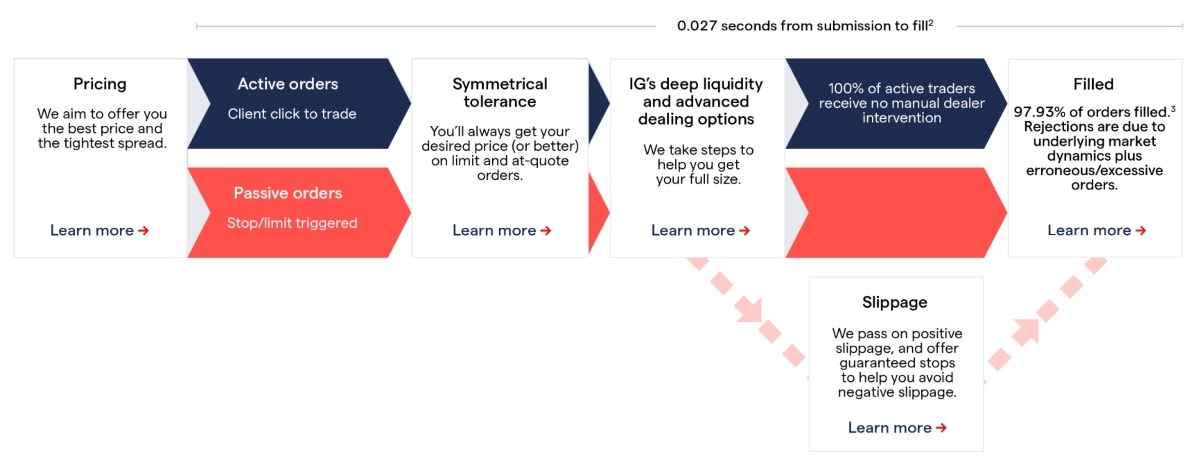

The fastest brokers normally advertise the average time taken to complete trades. For example, Pepperstone completes most orders in less than 0.03 seconds. IG Index completes 97.93% of all orders in 0.027 seconds or less:

IG Order Flow

Why Is High Execution Speed Important?

Good trade execution speeds prevent slippage.

Slippage is the difference in price between the quote you see when you place the order and the amount you pay once the order is complete.

Imagine you are trading BAE Systems stock that is currently priced at £9.34 per share and you decide to open a buy order for 1000 shares. By the time the order is filled, you find out that you have paid £9.44 per share. The slippage in this instance would be £100 (1000 x £0.10).

The importance of trade execution speed will vary depending on your strategy. If you are investing infrequently and with a long-term view, a trade execution speed of less than 100 milliseconds may not be that important in the long run.

On the other hand, if you are day trading with a scalping strategy or automated setup in a volatile market, execution speeds can make a big difference. If significant, it can be the difference between making a profit or a loss.

To demonstrate why low slippage is important, consider the following example.

Analysis of NatWest stock indicates that there is potential for a sharp bullish trend. To capitalise on the upcoming opportunity, you place a buy order for 1000 NWG shares that are currently trading at £2.67 per share. With a fast execution speed broker, the trade is filled at £2.67. However, a slow broker may fill at £3.00.

The price of NatWest stock then climbs to £4.00. Now with the fast execution speed broker, your profit is £1,330 (1000 x (£4.00 – £2.67)). Yet with the slow execution speed broker, your profit is £1000 (1000 x (£4.00 – £3.00)). You miss out on £330 (£1,300 – £1000) by trading with the slow broker.

Ultimately, execution times can make a big difference in fast-moving markets, and the brokers with the best execution speeds are particularly important for active, high-volume traders.

Order Quality

Alongside trade execution speed, you should also consider order quality. This refers to several factors besides execution speed that relates to how well the broker has filled the order.

Order quality is arguably a better measure given that execution speeds can vary based on multiple factors, from location, time of day and connection speeds, to market conditions and order size, which can have a particularly big impact.

To help ensure that order quality is as high as possible in the UK, the Financial Conduct Authority (FCA) banned Payment For Order Flow (PFOF), a model in which brokers received commissions from market makers for completing client orders, and introduced best-execution regulatory requirements.

The FCA’s best-execution regulatory requirements say that brokers must account for the following factors when processing an order, placing a priority on price and additional costs:

- Price – How close the true price of the asset is to the order price

- Costs – Limit any extra costs to the client

- Speed – How quickly the trade is completed

- Likelihood of execution and settlement – Ensure the order has the best chance of being processed and completed

- Size – How much of the order will be filled

These requirements were introduced to uphold the integrity of financial markets with the aim that brokers must operate in their customers’ best interests. This is because the PFOF model raised a conflict of interest for brokers, who could, in theory, earn higher commissions for using market makers that provided poor order quality for clients.

Factors That Effect Trade Execution

Below are the key factors that can affect trade execution quality and speed:

Business Model

There is a range of models for how brokers connect clients with counterparties. These can generally be split into dealing desk (DD) and non-dealing desk (NDD).

DD brokers are often market makers and do not rely on sending their clients’ orders through to other firms or exchanges to fill the order. Instead, the broker can form the counterparty. Because of this, trade execution speeds can be fast.

However, the broker may also seek out other parties on its order book to be the counterparty. This means you may see a slow execution speed if you trade in an asset that your broker does not hold enough of.

NDD brokers, on the other hand, connect clients with liquidity providers to complete trades. There are two main models they use to do this:

- Straight-Through Processing (STP) – STP brokers receive information from clients regarding their orders and send the details electronically to a hub where liquidity providers can view open orders. Liquidity providers are usually companies such as banks, hedge funds and exchange houses. This is often a quick method as many providers can be the counterparty to a trade. For example, the STP broker City Index boasts an average trade execution speed of 0.05 seconds.

- Electronic Communication Network (ECN) – ECN brokers allow buyers and sellers to connect directly to complete trades, using the most recent and best-priced unfilled buy and sell orders to create bid-ask spreads which are relayed to investors. The difference between STP and ECN brokerages is that STP brokers connect you to a hub that includes many liquidity providers, whereas ECN brokers act as the hub. Despite this difference, ECNs still facilitate quick trade executions, with Pepperstone executing most orders in 0.03 seconds or less. Alongside fast execution speeds, ECN brokers help to ensure a high order quality through market transparency.

Generally, NDD brokers are recommended for high-quality trade execution and faster speeds, though there are some good market maker brokers.

Liquidity

Liquidity is a crucial factor affecting the speed and quality of order execution. Liquidity relates to the availability of finding purchasing and selling parties in the market and how much the asset can be traded without causing a large change in its value.

If there is high liquidity, an asset can be traded easily and often without causing large swings in its price. A low-liquidity asset can be harder to trade; for example, if you are selling a low-liquidity stock, you may have to wait a longer time to find a buyer willing to complete your order.

You can avoid trade execution quality problems due to liquidity by trading popular assets – major forex pairs such as GBP/USD, for example, are far more liquid than exotic pairs such as GBP/PLN.

Price

In line with FCA requirements, UK brokers must quote as close to the order price as possible while also minimising additional costs. If there are no matching orders at the price of your buy or sell order or close to it, you may need to wait longer for a counterparty to be found.

Traders often use level 2 market data to minimise any impact on trade quality. This information shows the current bid and ask orders for an asset, not just the best orders that are currently unfilled. Using this data, you can gauge where to place strike prices for buying and selling so that your orders are filled quickly.

Order Type

The type of order you use can impact trade execution speeds. The two main types of orders are market orders and limit orders.

Market orders are designed to be filled as quickly as possible at the current market price, meaning that the trader does not specify a price when placing the order.

The opposite is true of limit orders, in which the trader specifies the maximum or minimum price for the buy/sell order and waits for the order to be filled. This can take anything from seconds to days, depending on how far off the market price you set your order.

Certain brokers such as IG Index allow clients to include execution guarantees in their orders. These ensure, for a fee, that your order will only be filled at the exact strike price you set.

Order Size

The size of the order can have an impact on execution speeds as it can take longer to find a counterparty for larger volume orders, particularly for smaller brokers.

Put simply, if you place a buy order for 1000 shares in a company but the only matching sell order has 750 shares, your order can only be partially filled until another investor with 250 shares sells their position.

To help speed up execution times and keep trade quality high, you can use order book level 2 data to find the current orders at each price level and evaluate a suitable order size. If only small-size orders are listed, you may need to adjust the size of your order for it to be filled promptly.

Some brokers with fast execution speeds impose maximum limits on the order size to maintain order quality.

Time Of Day

Trade execution speed and quality can vary according to the time of day as volumes ebb and flow. There is more activity during core market hours than during pre-market or after-hours trading, and the level of activity also tends to vary even during those core hours.

There are likely to be more orders and therefore a better chance of your buy or sell order being filled at a high quality during peak times, though brokers occasionally become overloaded with orders during particularly busy times.

To help account for this, you should be aware of the key hours for the markets you are trading in. With stocks, the first one or two hours after the market opens tend to be the busiest, but it is worth checking the data on the exchange you trade.

Forex is 24 hours, but currency pairs are usually busiest during the business hours of the relevant countries, especially when there is a ‘crossover’ of trading hours. The GBP/USD pair, for example, is often at its busiest during the afternoon when the US market begins trading.

With some global markets such as cryptocurrency that are traded 24/7, it can be difficult to pin down peak hours, however, there will often be a pattern to trading volumes, which will usually spike when markets that favour these assets begin their trading day. You can expect cryptos to be busy at the times of day when East Asia, the US and Europe begin trading.

Market Volatility

During periods of high market volatility, fluctuations in an asset’s price are common and can be large. Because of this, it can be difficult for brokers to fill orders quickly while ensuring it is of high quality.

This is particularly true of volatile markets, such as cryptocurrencies. It is also worth noting that slippage can go both ways, positive and negative.

Internet Speed

A slow network can affect the trade execution quality. If your internet connection is slow or frequently has downtime, it will take longer for your broker to be notified and send the order to liquidity providers, lowering the execution speed.

This can also be impacted by the broker you choose and their server location. As a UK investor, your latency may be better if you are using a broker with a server in London, for example.

Alternatively, consider upgrading your internet package to a faster connection, particularly if you share it with numerous devices in your household. Aim for 25 Mbps as a minimum and 100 Mbps for scalping setups.

Your Device

Computing power and processing speed can also affect your executions, depending on how well your device handles the software and programs you are using to complete analysis and execute trades.

For instance, if you use the MetaTrader 4 (MT4) platform, most computers and mobile device should comfortably meet the hardware requirements to ensure fast, seamless trading. With that said, it’s worth noting that MetaTrader 5 (MT5) is faster with 64-bit processing vs 32-bit processing with MT4.

If you are experiencing issues with your computer, check the hardware requirements or recommendations for your trading platforms. They may indicate which parts of your device need upgrading so you can ensure higher trade execution speeds. Also, make sure you periodically clean up your system and delete unused apps.

Bottom Line On Execution Speed

The best execution speed brokers help reduce slippage, meaning the price you pay is close to the price of your buy or sell order. However, it is important to also look at execution quality. This includes other factors such as price accuracy, costs to the client, order size and the likelihood of the trade being completed.

FAQ

How Do You Define Trade Execution Speed?

You can measure trade execution speed as the amount of time that elapses between the moment you submit an order on your trading platform or app and when the order is filled in the market. Trading execution speeds are measured in milliseconds (ms).

Why Is A Fast Execution Speed Important?

A fast trade execution speed can help reduce slippage, which is the difference in price between when you place the order and the price when the order is filled. Slippage can have a large impact on the profitability of trades, particularly for high-volume short-term traders.

What Is A Good Trading Execution Speed?

Less than 100 ms is good while anything higher than 200 ms is poor and could result in slippage or failure.

Which UK Broker Has The Best Execution Speed?

Our experts have compiled a list of the fastest execution speed brokers. Among the best brokers for execution speed and quality in the UK are Pepperstone, XTB, and AvaTrade. Alongside fast execution times, the firms are all regulated by the UK’s Financial Conduct Authority and provide access to global markets, including forex and stocks.

What Effects Trade Execution Speed?

Many factors can impact trade execution speeds, from the time of the day and asset to the liquidity present in the market and size of your order. The broker’s business and revenue model will also play a role.

A basic way to improve execution speeds is to upgrade your hardware and internet connection, but you can also trade during periods with good liquidity and use secondary market data to trade in suitable volumes, as this will affect how the brokerage routes your order.

Article Sources

IG Index order execution policy