Eurotrader Review 2025

|

|

Eurotrader is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Eurotrader |

| Eurotrader Facts & Figures |

|---|

EuroTrader is a CySEC-regulated CFD broker, established in 2018. The brand aims to empower and educate traders of all abilities, offering bespoke software including a copy trading app. EuroTrader customers can also trade on MT4 and MT5, with VPS connectivity, market insights and trading calculators. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Commodities |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, FINMA, FSCA, FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | EuroTrader offers leveraged CFDs on a large suite of 2000+ instruments with MT4/MT5 access. Trade with high leverage up to 1:500 and choice of pricing models, alongside 24/5 customer support. |

| Leverage | 1:500 |

| FTSE Spread | 6 |

| GBPUSD Spread | 0.7 |

| Oil Spread | 3 |

| Stocks Spread | Variable |

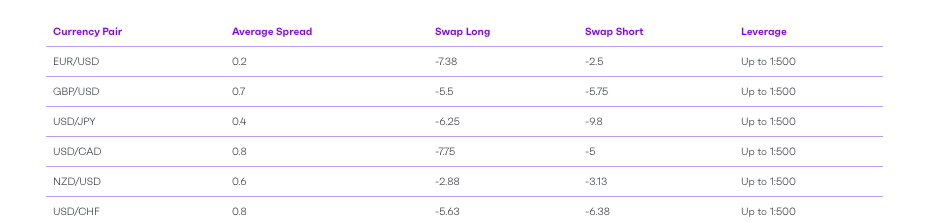

| Forex | Trade 50+ major, minor and exotic currency pairs including EUR/USD and USD/JPY. Invest commission-free on the Micro Account with average spreads of 1.2 pips and a low $50 minimum deposit. |

| GBPUSD Spread | 0.7 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.6 |

| Assets | 59 |

| Stocks | Speculate on 2500+ stock CFDs with zero commissions regardless of the account type. Popular stocks such as Coca Cola, Amazon and Netflix can also be traded as fractional shares. |

| Cryptocurrency | Trade 17 cryptocurrency CFDs including Bitcoin and Ethereum with a 50% margin rate. Commission fees apply from 0.5%, which are reasonable but now the lowest. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Eurotrader is a regulated CFD broker that offers competitive fees on 2000+ instruments via MT4 and MT5, plus additional tools like copy trading. In this UK review, we evaluate Eurotrader’s key services and features, including fees, instruments, deposit methods, security and more, to give prospective traders everything they need to know before signing up.

Our Take

- Holds multiple regulatory licenses, including from the FCA, and has a strong reputation

- Good all-around broker with an extensive list of assets, a copy-trading platform and tight spreads

- Account options include a beginner-friendly Micro account and a Zero account with flexible pricing models

- Funding methods are limited with just one e-wallet and a $50 minimum deposit

Market Access

Eurotrader’S instrument list is very competitive, covering five major asset classes with thousands of tradeable assets. There is a particular focus on stocks with 2500+ shares from global exchanges as well as 11 indices. The forex offering is also quite strong, if not near the top of the class.

- Indices – 11 global stock index funds such as FTSE 100, S&P 500, ES 35 and DE 30

- Cryptocurrency – 17 digital currency coins including Bitcoin, Ethereum, Dash, and Litecoin

- Commodities – 11 soft and hard commodities including gold, silver, wheat, and UK Brent Oil

- Forex – 50+ major, minor, and exotic currency pairs including EUR/GBP, GBP/CHF, AUD/CAD, and USD/JPY

- Stocks – 2500+ global company shares and fractional share CFDs such as Danone, Aviva, BP, GlaxoSmithKline, and Lloyds Banking Group

Note that trading is via CFDs only.

Accounts

Eurotrader offers three live account types, suited to different investing styles and access to initial funding. Joint and Islamic accounts are also available.

Pricing conditions vary between the profiles, but we appreciated that all profiles offer a GBP account base currency, which is good news for UK traders, making it easier to manage trading accounts.

Our team have pulled out the key differences between the profiles below.

Micro Account

Best for beginners

- No commission fees

- $50 minimum deposit

- 10 lot maximum trade size

- Average spreads 1.2-1.4 pips

Zero Account (Zero Spread Option)

Best for active traders looking for zero spreads

- $500 minimum deposit

- Average spreads 0.1 pips

- 40 lot maximum trade size

- $5.50 commission fee on forex

Zero Account (Zero Commission Option)

Best for active traders looking for zero commissions

- No commission fees

- $500 minimum deposit

- 40 lot maximum trade size

- Average spreads 0.7-0.9 pips

Hero Account

Best for high-volume traders with lower fees

- $25,000 minimum deposit

- Average spreads 0-0.1 pips

- $4 commission fee on forex

- 1000 lot maximum trade size

Eurotrader Fees

Eurotrader fees vary by account type and instrument, including minimum deposit requirements, but overall we think this broker has a competitive offering. It is especially good to see the range of account types allowing for various trading styles, including a ‘Micro’ account that, unlike some competitors, has fairly tight spreads.

For the Micro account, spreads average between 1 and 1.2 pips with no commission charges and a $50 minimum, making it an ideal choice for beginners or those who trade with smaller amounts. With that said, this isn’t the cheapest Micro account we have seen, since brokers like XM offer Micro account spreads from 0.6 pips with no commissions and just a $5 minimum deposit.

The Hero profile, on the other hand, is suitable for investors looking to trade frequently, incurring raw spreads and a $4 commission fee on forex trades. We are pleased to see the broker offers commission-free trading on all accounts for stocks.

The Zero account concept is fairly unusual, with a choice of no spreads or no commissions. A more expensive commission applies vs the Hero profile for forex trades at $5.50 but spreads are offered as low as 0 pips if you choose the no spreads option. The commission-free solution provides competitive spreads averaging between 0.7-0.9 pips.

We were pleased to see no inactivity fees, which can often range between £5 and £15 per month with alternative brands.

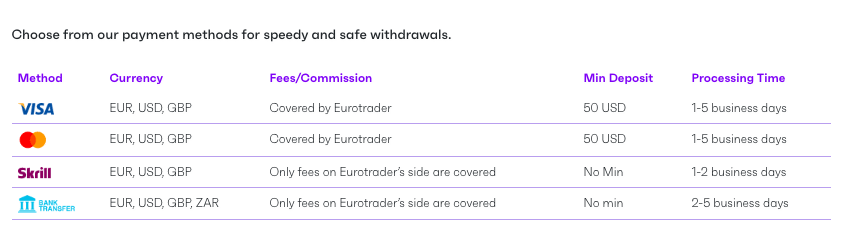

Funding Methods

We think Eurotrader’s accepted payment methods – credit/debit cards, bank wire transfers, or Skrill – are fairly limited and we would like to see more e-wallet options added.

We also think the $50 minimum deposit applied for credit/debit card and Skrill transactions and $500 for wire transfers may be a little high for some traders. However, Eurotrader does not charge deposit fees which is advantageous.

We were pleased to see that Skrill and credit/debit cards offer instant processing times. Bank wire transfers will take the longest with a one-to-five-day processing time, so don’t use this if you want to get started quickly.

You must withdraw back to the original payment method, which is standard practice.

We liked that there is no minimum withdrawal amount for Skill and wire transfers. A $50 minimum applies for credit/debit cards. Skrill offers the fastest processing time of one to two working days.

How To Make A Payment

The account funding process is relatively straightforward:

- Login to the My Eurotrader client portal

- Select ‘Deposit’ from the menu

- Choose a payment method and add the amount to fund

- Follow the on-screen instructions depending on the method

- Submit the payment. A confirmation will be sent to your registered email address

Trading Platforms

Eurotrader offers an excellent range of platforms, with its own proprietary terminal for copy trading alongside MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Both third-party platforms are available for free download to desktop devices or can be used as a web-based platform or mobile app.

The MetaTrader platforms are best-in-class solutions and are user-friendly with robust functionality. You can be assured of fast execution speeds and secure data transmissions.

Note, the broker offers MT4 with forex trading compatibility only. To trade all markets, you will need to use MT5.

MetaTrader 4

- Hedging permitted

- Four pending order types

- Single-thread strategy tester

- Three chart types with nine timeframe views

- 30 in-built technical indicators and 31 graphical objects

MetaTrader 5

- Depth of market data

- Six pending order types

- Multi-thread strategy tester

- MQL5 programming language

- Hedging and netting permitted

- Three chart types with 21 timeframe views

- 38 in-built technical indicators and 44 graphical objects

How To Make A Trade

We found it easy to open and close positions on both terminals, although MT5 has a few extra features. Nevertheless, you will benefit from powerful trade functions on either platform.

- Open the MetaTrader web trader or download the platform to a desktop device

- Sign in with your registered credentials

- Double-click on the instrument to trade from the ‘Market Watch’ window

- Add trade details to the ‘New Order’ screen including order volume, order type, stop loss/take profit price, and a comment

- Select ‘Buy’ or ‘Sell’ to open the position

Mobile Apps

MetaTrader 4 and MetaTrader 5 have free mobile apps for either iOS or Android (APK) devices. We found the applications easy to use and we thought navigation was much simpler than the desktop software, with mobile-optimised features such as small-screen charting and zoom functions.

We also liked that you can set custom price alerts and sound notifications. Additionally, you can view your full order history, access free financial news, and connect with the community of peer investors via the MQL5 community trader terminal.

Eurotrader Leverage

Eurotrader has an offshore branch that offers generous leverage ratios up to 1:500. However, as UK traders will be investing under the FCA-regulated entity, you will be able to trade with a maximum of 1:30.

Though this is more limiting, the restrictions are in place to protect retail investors against significant losses using borrowed funds and we recommend that traders stick to the FCA-sanctioned limit.

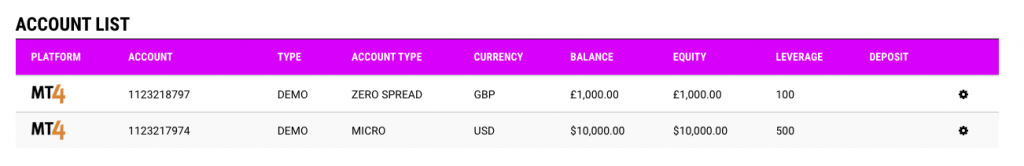

Demo Account

You can practise trading risk-free, with unlimited virtual funds and access to live market conditions, which we see as an strong feature for a good broker.

We liked that you can trade all instruments in demo mode, and put strategies to the test without the risk of losing your own capital.

When we signed up, we were able to choose GBP account base currency, or EUR and USD. We were also able to open multiple demos without restrictions.

How To Sign Up For A Demo Account

The registration process is quick, so you can get started with practice trading in a matter of minutes:

- Click ‘Trade’ from the main menu on the Eurotrader website and then select ‘Demo Account’

- Select the blue ‘Demo Account’ icon

- Complete the online registration form (name, email, country of residency, and telephone)

- Choose an account base currency (GBP, EUR, or USD) and create a password

- Agree to the T&Cs and select ‘Join’ to complete the demo account request

UK Regulation

Eurotrader has reputable financial watchdog oversight by the UK’s Financial Conduct Authority (FCA), license number 777162. Customers will benefit from negative balance protection and segregated client funds from business money.

Additionally, thanks to FCA regulation, you may be entitled to FSCS protection up to £85,000 in the event of business insolvency.

We are assured that Eurotrader is not a scam, with no historical security breaches and reputable registration with the FCA. Other customer reviews are also generally positive, but always be vigilant when trading online.

Bonus Deals

Eurotrader does not offer any bonuses or financial incentives, aligned with FCA regulations. There is a 111% deposit bonus published on-site, but this is not available to UK customers.

Don’t let this put you off though, as there are plenty of additional tools and educational content to get you started.

Extra Tools & Features

VPS

We were impressed that Eurotrader offers a free Virtual Private Server (VPS). The tool provides 24/7 connectivity to the financial markets, regardless of internet dropouts or server issues.

You can integrate the VPS solution to keep automated strategies running. Other benefits include low latency, fast execution speeds and 24/5 VPS customer support.

We wouldn’t recommend using a VPS if you are new to trading, or planning on placing orders infrequently. However, it is a good feature for higher-frequency traders who are familiar with MetaTrader’s Expert Advisor trading robots.

Copy Trading

We were impressed by Eurotrader’s proprietary copy trading app, which is available to customers for free download to iOS and Android (APK) devices.

The mobile app is easy to navigate, with a comprehensive yet user-friendly user interface, comparable with market leaders like eToro. It is also easy to choose a ‘pro’ trader by reviewing the useful leaderboard arranged by past profit.

We also rate that you can connect with other users via chat messenger to discuss trade insights and suggestions of who to copy. The app is easy for beginners to use, and you have the option to publish your copied trade portfolio, or go incognito. You maintain full access to your trades, with the ability to close positions manually if required.

Note that while it is free to sign up for a copy trading account, some signal providers may charge a fee.

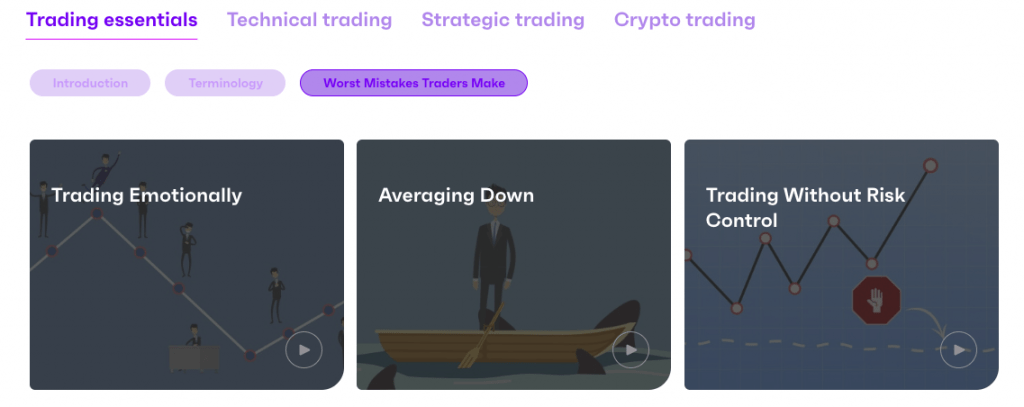

Education

Eurotrader offers a reasonable selection of educational content and learning materials, and we especially like that the broker offers a choice of study styles including video courses, blog forums, and e-books.

The ‘Trading 101’ section is designed for beginners, with all the basics of multi-asset trading covered before you enter the live market. One thing that stood out for us was the ability to separate online courses by asset class, so if there’s something specific you are looking to get involved with, you can filter the relevant data.

Trading Videos

Additional Tools

To assist with trading, the brand provides some useful calculators such as a pip calculator, margin, and profit and loss. We like the currency conversion calculator as it is useful for determining global monetary values for your GBP investments.

However, overall, we do think the brand lacks some of the flashier extras offered by rivals, who often bundle additional third-party software such as charting apps like Autochartist for client use.

Customer Service

We were satisfied to see Eurotrader offers 24/5 customer support, and impressed with the instant response time we received from a human agent when we tested the live chat tool.

You can also reach a customer service agent via a UK telephone number, email, and online form. The brand also suggests using social media contacts such as Facebook Messenger, Skype, and Twitter, which is a nice addition.

- Telephone – +44(0)2080047430

- Email – support@eurotrader.com

- Live Chat – Icon bottom right of the broker’s website

- Online Contact Form – Available on the ’Contact Us’ webpage

It was a shame to find no FAQ section available on the broker’s website, though given the response times on the live chat are decent, we feel reassured this shouldn’t be a major issue.

There are also some useful Q&As under some of the additional feature pages such as the copy trade app.

Company Details & History

Eurotrader was established in 2018, by CEO Dr Ozan Ozerk. The multi-asset brokerage aims to create a modern trading experience suitable for investors of all experience levels.

The UK entity has headquarters in London with an office presence and is authorised by the Financial Conduct Authority (FCA). The brand also operates two additional global subsidiaries with oversight from the Cyprus Securities and Investment Commission (CySEC) and South Africa’s Financial Sector Conduct Authority (FSCA).

Trading Hours

Eurotrader trading hours vary by instrument. Cryptocurrency offers the longest opening times, with the market available 24/7. Forex, on the other hand, is available for trading 24 hours a day, Monday to Friday. You can view opening hours by product by right-clicking on the instrument symbol via the ‘Market Watch’ window on the MetaTrader terminal.

We feel the holiday schedule webpage link published in the header of the broker’s website would be a useful addition, so we were disappointed to find it was outdated. However, a working economic calendar is available, with details of upcoming events and market closures.

Should You Trade With Eurotrader?

After testing Eurotrader, we think it is suitable for beginners as well as more experienced traders. We like the flexible pricing model offered via three account types, and the proprietary copy trading app is an intuitive and useful way for newer traders to access markets. Educational content, VPS hosting, and extra trading tools are added benefits.

FAQ

What Is Eurotrader?

Eurotrader is a globally regulated retail broker offering forex, stocks, crypto, indices, and commodities trading. The group operates three subsidiaries, including a UK-based entity. Investors can trade on the MetaTrader 4 and MetaTrader 5 platforms via three live account types and competitive fees.

Is Eurotrader Safe?

Our experts feel assured Eurotrader is relatively secure and trustworthy. The brand is FCA-regulated, with license number 777162. We are happy that retail clients receive some of the best forms of investor protection in the world, including negative balance protection and segregated client funds. Clients may also be protected under the Financial Services Compensation Scheme (FSCS) in the event the broker goes under.

Is Eurotrader Suitable For Beginners?

Eurotrader is suitable for beginners. The brand offers a demo account, plenty of educational content, and a proprietary copy trading app. The Micro account is most suited to novice investors, with a minimum deposit requirement of $50 and no commission fees.

Does Eurotrader Have Low Fees?

Overall, we found Eurotrader’s fees competitive, with spreads in the Zero account from 0.1 pips and a choice of commission or no-commission trading. On the negative side, these spreads are only accessible if you can afford the $500 minimum deposit.

We did appreciate that there are no inactivity fees or funding charges.

Does Eurotrader Have A Good Mobile App?

Eurotrader offers a competitive proprietary copy trading application, available for download to iOS and Android devices. You can follow, copy and chat with more experienced traders, and duplicate positions in real-time. You can also use the app alongside the MT4 and MT5 mobile apps, meaning you can enjoy all the broker’s features whilst on the go.

Article Sources

Top 3 Eurotrader Alternatives

These brokers are the most similar to Eurotrader:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Eurotrader Feature Comparison

| Eurotrader | Swissquote | Pepperstone | IG Index | |

|---|---|---|---|---|

| Rating | 2.8 | 4 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $50 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, FINMA, FSCA, FCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4 |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | Eurotrader Review |

Swissquote Review |

Pepperstone Review |

IG Index Review |

Trading Instruments Comparison

| Eurotrader | Swissquote | Pepperstone | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Eurotrader vs Other Brokers

Compare Eurotrader with any other broker by selecting the other broker below.

Popular Eurotrader comparisons: