ETFs vs ETNs

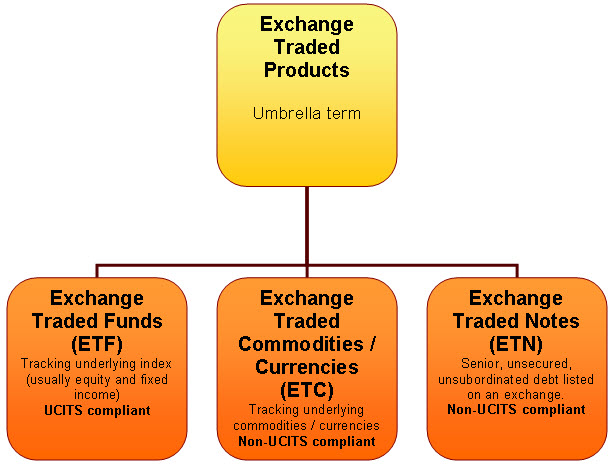

ETFs stand for Exchange Traded Funds, while ETNs stand for Exchange Traded Notes. These two instruments are sometimes confused with each other and lumped together under the same category of investment instruments. These are two instruments which are traded on stock exchanges such as the NASDAQ and offer good liquidity. But this is where the similarity between ETFs and ETNs end. You may say that this where the ‘ET’ in both instruments’ abbreviations end, and this is where the difference between the “F’ and the “T” begins.

There are indeed, very key differences between both classes of instruments on many fronts and in this article, we will try to separate the ETFs from the ETNs so that this confusion is put to rest.

The differences in ETFs and ETNs will be classified under the following headings:

a) Type of instruments

b) Taxation issues

c) Risk factors/attributes

d) Differences in ownership structure

Type of Instrument

ETFs are more like index funds while ETNs are actually debt instruments that operate more like bonds. An ETF is an index fund that may have as part of its investment strategy, a direct investment in cash in the assets that it tracks. In contrast, the ETN does not invest in any asset, but only tracks the asset performance.

Taxation Issues

ETNs have been known to give generous reliefs on taxes as far as investments are concerned. The tax benefits from an ETN investment outweigh those of ETFs. ETNs can only be taxed at a capital gains tax rate of 16%, and this taxation only occurs when the trader sells the exchange traded note. In contrast, an ETF is subject to a double tax known as the 60/40 rule. This rule states that investors holding an ETF are subject to taxation of 60% of any gains on long term holdings on an ETF, as well as taxation on 40% of short terms gains without recourse to the holding period.

Risk Attributes

In terms of risk, the ETN is more risky than an ETF. An ETF investment is a holding. The investor actually owns the asset and in case of a downturn, can decide to hold on to his investment until better fortunes cause the index fund to recover ground that has been lost. So as long as the investor in the ETF does not sell his holding, he has theoretically not lost anything and any losses are at best, unrealised losses. In contrast, an ETN investment is not a holding. All that the ETN trader has is a promise from the issuer of the ETN debt instrument to pay back when the exchange traded note matures. Any adverse event on the issuer’s finances will automatically affect the repayment on the note and it is possible for the investor to lose everything in an instant.

Ownership and Management Structure

The exchange traded fund itself that tracks the underlying assets constituting the ETF basket are not owned by the investors but by a separate institution acting as the custodian. This puts a level of protection on the ETF, ensuring that it does not go down with the issuer should such an event occur. The structure of the ETN is such that the asset issuer’s state of financial health will have a direct impact on the ETN itself since the asset is owned by issuer. This is also the reason why ETNs are considered more risky than ETFs.

From this discussion, we can clearly see that there are differences between ETFs and ETNs. Do these differences make one investment bad and the other one good? Certainly not, as this is not a case of a good instrument versus a bad instrument, otherwise we would not be seeing the volumes of cash pouring into both investment vehicles. Rather, it is a case of the investor knowing which of the two investments will suit him more. Some investors do not mind the risk as long as they can enjoy tax advantages, while some may sleep better investing in something in which they actually have holdings, irrespective of the cost of maintaining such an investment. So it is up to the investor to note the differences between ETFs and ETNs, and decide on which of the two investments he can put his money on.