Errante Review 2025

|

|

Errante is #59 in our rankings of CFD brokers. |

| Top 3 alternatives to Errante |

| Errante Facts & Figures |

|---|

Errante is a Cyprus-based and regulated forex and CFD broker with leveraged trading on multiple assets, tiered accounts including a zero-spread option, and copy trading support. The broker offers leveraged trading up to 1:30 under its CySEC-regulated branch and 1:500 from an offshore branch, and supports the MetaTrader 4 and MetaTrader 5 platforms. Errante's asset list is relatively limited but it does offer fast execution and low latency, and it is a trustworthy brand. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Errante customers can trade stocks, indices, commodities and cryptocurrencies with leveraged CFDs. The level of leverage available depends on regulatory oversight, with 1:30 the maximum allowed in the EU though this varies by asset. |

| Leverage | 1:500 |

| FTSE Spread | From 1.5 pips (Standard Account) |

| GBPUSD Spread | From 1.5 pips (Standard Account) |

| Oil Spread | From 1.5 pips (Standard Account) |

| Stocks Spread | From 1.5 pips (Standard Account) |

| Forex | Errante traders can access 50+ forex pairs with leverage up to 1:500 (location dependant). The broker offers fast execution and tight spreads, especially to clients with VIP and Tailor-Made accounts. |

| GBPUSD Spread | From 1.5 pips (Standard Account) |

| EURUSD Spread | From 1.5 pips (Standard Account) |

| GBPEUR Spread | From 1.5 pips (Standard Account) |

| Assets | 50+ |

| Stocks | Errante offers CFDs on 58 stocks of some of the world's largest companies. Trade big names like Alibaba, Amazon and Apple with low fees. Traders also benefit from top-tier liquidity and fast execution, but note that as these are CFDs, you cannot buy and own physical shares. |

| Cryptocurrency | Errante clients can speculate on price movements of 26 crypto tokens, all paired with USD. CFDs allow for leveraged trading, but note that you will not directly own the assets traded. |

| Coins |

|

| Spreads | From 1.5 pips (Standard Account) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Errante is a multi-asset broker regulated by the CySEC. UK investors can trade forex, stocks, commodities, indices, and cryptos on a choice of third-party platforms, including MT4, MT5, and cTrader. This Errante review examines the broker’s account types, funding methods, trading fees, welcome bonuses, and leverage. Our team also explain how to sign up and start trading.

Errante is a good broker for beginners with an education centre and copy trading. Whilst the firm doesn’t hold a license with the FCA in the UK, oversight from the CySEC is a good sign that the brokerage is legitimate and trustworthy.

Market Access

Over 100 instruments are available at Errante. Whilst not as extensive as the selection at some brokers, retail investors can speculate on popular global markets, including:

- Cryptos – Trade 20+ cryptocurrencies including Bitcoin, Ethereum, Ripple, and Litecoin

- Indices – Speculate on the price of 10 leading indices such as the FTSE 100, DE 30, and the S&P 500

- Forex – Trade 50+ major, minor, and exotic currency pairs including EUR/GBP, GBP/JPY, and AUD/CAD

- Stocks – Invest in UK, EU, and US company shares such as Apple, Goldman Sachs, Procter & Gamble, and Air France

- Commodities – Trade soft commodities including cotton, sugar, and coffee plus hard commodities like natural gas, crude oil, and gold

Account Types

Errante offers four live trading accounts; Standard, Premium, VIP, and Tailor Made. Swap-free versions are also available.

The main difference between the profiles is the price structure, though access to trading tools and education also differ slightly. Aside from this, each account offers access to all instruments, with a minimum trade size of 0.01 lots and no maximum order limit.

On the downside, all accounts except the Standard profile are steep to get started with, requiring a minimum payment of €1000+.

Standard Account

- €50 minimum deposit

- Spreads from 1.5 pips

- Access to free webinars

- Trade with expert advisors

Premium Account

- €1000 minimum deposit

- Spreads from 1 pip

- Personalised customer service

- Enhanced educational materials

VIP Account

- €5000 minimum deposit

- Spreads from 0.8 pips

- Free access to VPS

- Enhanced educational materials

Tailor Made Account

- €15,000 minimum deposit

- Raw spreads from 0 pips

- Enhanced educational material

- Custom-made trading solutions available upon request

How To Open An Errante Account

You can open a live trading account in a matter of minutes.

- Complete the online application form and agree to the terms & conditions

- Select ‘Continue’

- Verify your email and follow the link to sign in to the client portal

- Complete the questionnaire on the client dashboard

- Upload identity verification and proof of address documents

Fees

Trading fees vary between account types but are competitive if you opt for a premium profile.

All accounts, except for the Tailor Made account, offer commission-free trading. The Standard account integrates floating spreads from 1.5 pips, Premium from 1 pip, and VIP from 0.8 pips.

When we used Errante’s Standard profile, we were offered spreads of 1.5 pips on the USD/GBP and 1.6 pips on the GBP/EUR forex pairs. Unfortunately, this is slightly more expensive than equivalent accounts at alternative brokers.

Additional Charges

It is worth noting that an inactivity charge applies after five months of no activity. This is a one-off account maintenance charge of $15, followed by $5 per month or until the free account balance reaches zero.

Our experts also found a clause in the terms and conditions page, indicating a 5% penalty fee for withdrawal requests if there has been no trading within the first three months of an account being opened. This was disappointing to see and worth keeping in mind for new traders.

Deposits

The minimum deposit requirement to open an Errante Standard account is €50 or equivalent currency. This is relatively low and means beginners can get started fairly easily. Our team were also pleased with the choice of funding methods and zero fees.

- Credit/Debit Card – Instant processing, Visa/MasterCard

- Bank Wire Transfer – Two to four-day processing, SWIFT or SEPA transactions

- E-Wallets – Instant processing, Neteller/Skrill/Sticpay/Perfect Money/Advcash

- Cryptocurrency – Typically processed within two hours, Bitcoin/Ethereum/Ripple/Tether

On the downside, GBP payments are not accepted (EUR or USD only), meaning currency conversion fees may apply to UK traders.

How To Make A Deposit To Errante

- Log in to the Errante client portal

- Select ‘Funds’ from the side menu and then ‘Deposit Funds’

- Choose a live trading account to add money to

- Complete payment details in the following window

- Review and confirm the payment

Withdrawals

Withdrawals must be made back to the original payment method.

Errante processes withdrawals during standard business hours, Monday to Friday 9 AM to 6 PM (GMT +2), however processing times vary between methods.

It was a shame to see that fees apply for some methods, though this is similar vs eToro (£5 fee per transaction) and Interactive Brokers (£7 fee for bank wire transfers after one free transaction per month).

- E-Wallets – Within one working day processing, 1% fee, minimum $20 withdrawal

- Credit/Debit Card – One to two-day processing, no fees, minimum $20 withdrawal

- Bank Wire Transfer – Two to four-day processing, no fees, minimum $100 withdrawal

- Cryptocurrency – Within one working day processing, fees between $1 and $5, minimum $50-$100 withdrawal

Leverage

Due to regulations, UK investors will be able to access a maximum of 1:30 leverage. This means for every £100 invested, you can trade with £3,000.

All accounts feature a 20% stop-out level and 100% margin call.

Trading Platforms

Errante offers industry-leading platforms in MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

The platforms are available for download to desktop devices or can be used as web terminals and mobile apps.

Although down to personal preference, our experts found MT4 easier to use than cTrader – the interface is simpler and offers clearer navigation, albeit a slightly more outdated design.

Nonetheless, these are all popular third-party terminals, renowned for their reliability and top-tier functionality. All platforms offer one-click trading, algo bots, and custom charting.

cTrader

cTrader

- 6 chart types

- 9 order types

- Level II pricing

- 28 timeframes

- 55+ in-built indicators

- Live market sentiment data

- Unlimited watchlist creation

MetaTrader 4

- Access to EAs

- 23 drawing tools

- 9 timeframes

- 3 chart types

- 30 in-built indicators

- 4 pending order types

MetaTrader 5

- Access to EAs

- 44 drawing tools

- 21 timeframes

- 6 pending order types

- MQL5 programming language

- Integrated economic calendar

- 38 in-built technical indicators

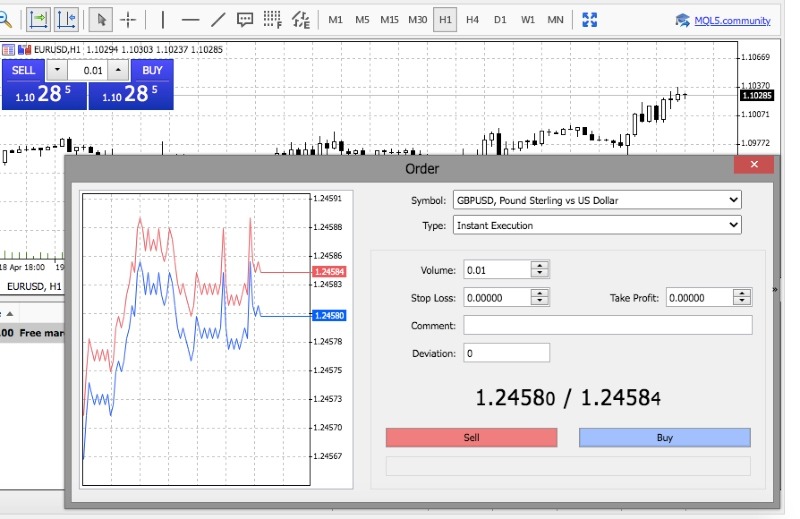

Making A Trade On MetaTrader

- Open the MT4/MT5 trading platform and login

- Select the ‘New Order’ symbol from the toolbar along the top of the screen

- Select the instrument to trade from the dropdown menu

- Add the order details including trade volume, order type, and risk parameters

- Click ‘Buy’ or ‘Sell’ to place the trade

CopyTrade

The Errante CopyTrade tool allows customers to duplicate the positions of more experienced traders. This is ideal for beginners or those with limited trading experience.

You can manually input strategy details such as risk parameters and let the tool do all the work for you.

The broker provides performance profiles of registered investors with details of return yields, average daily profits, and current equity.

To use CopyTrade:

- Sign in to the Errante client terminal

- Select ‘CopyTrade Providers’ from the side menu

- Use the search function to choose a trader to follow

- View performance statistics and data using the filters

- Initiate trade copying and set parameters including stops and limits

- Monitor your copied positions

Is Errante Regulated?

UK residents will trade with the Errante EU subsidiary; Notely Trading Limited. This entity is regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 383/20.

This is a reputable authority, similar to the UK’s Financial Conduct Authority. The financial body ensures that, amongst other measures, brokers provide retail traders with negative balance protection and segregated funds.

Errante Resources

The broker offers some basic educational content and analysis.

For beginners, there are three courses of integrated YouTube videos with a total of 66 lesson topics. This includes an introduction to forex trading.

There are also separate videos for all the main functions of the MT4/MT5 terminals which we found particularly useful. Details include how to access your trading history and how to login to your account.

This service is mirrored for more experienced traders, though covering more complex topics. However, we were disappointed to see that a £300 deposit is required to access this content. Nonetheless, there are weekly outlooks, market analysis, and articles available to all users via the website. Live webinars are also available weekly.

Finally, an economic calendar and trading calculator can be accessed from the client portal menu.

Demo Account

Errante offers a free demo account loaded with up to £100,000 in virtual funds. The simulated profile provides access to all the MetaTrader and cTrader functions so you can practise trading with no risk. You can choose EUR or USD currency and leverage up to 1:500.

We liked that there is no expiry time, though inactive accounts will be disabled after 90 days. We were also impressed with access to all the account types meaning you can get a feel for the trading conditions of all profiles.

How To Sign up

- Select ‘Try Demo Account’ from the broker’s homepage

- Complete the online registration form and select ‘Create Demo Account’

- Login credentials will be sent to the registered email address

- Sign in to the client portal and select ‘Open Demo Account’ from the dashboard interface

Note, a questionnaire must be completed to access all trading features including the demo profile.

Errante Bonus

Due to regulations, UK traders are not offered any financial incentives when trading with Errante. This includes a welcome bonus or a no-deposit bonus for new customers.

Although this is disappointing, it is standard across all EU and UK-registered broker-dealers. Instead, we would encourage making use of the educational content and copy trading tools to give you an edge.

Customer Service

Errante offers 24/5 customer support, ideal for guidance and help during standard trading hours.

It was reassuring to see a UK-based phone number, with English support. Other contact methods include email, live chat, and an online contact form.

Our experts were impressed with the responsiveness of the chat function. We got a response from a human advisor almost immediately.

- Telephone – +44 203 519 4635

- Email – support@errante.com

- Live Chat – Available bottom right of the broker’s webpages

- Online Contact Form – Available from the ‘Contact Us’ webpage

- Registered EU Address – Spyrou Kyprianou 67, Limassol 4042, Cyprus

Traders can also access a comprehensive FAQ list. There is a wealth of information to be found here, organised into various categories.

Company Details

Errante was established in 2019.

For UK traders, the broker operates under the EU subsidiary, Notely Trading Limited, regulated by the Cyprus Securities and Exchange Commission (CySEC). The brand also has an office presence in Cyprus and is reported to have over 20,000 registered clients worldwide.

Accolades include the Best ECN/STP Broker at the 2022 UF Awards and the winner of the Fastest Growing Broker at the Ultimate Fintech Awards 2021.

Opening Hours

Errante trading sessions are Monday to Friday, though trading hours vary by instrument.

Forex can be traded between 12:05 AM to 11:55 PM (GMT+3). Equities, on the other hand, are available between 4:30 PM and 11 PM or 10 AM to 6:30 PM (GMT +3) depending on the listed stock exchange. Cryptocurrency offers the most flexibility in terms of opening hours, being available to trade 24/7 with no market closures.

Should You Trade With Errante?

Errante provides a good base for online trading with a choice of third-party platforms, multiple asset classes, and regulatory oversight. For beginners, there is plenty of educational content, unlimited access to a demo account, and an integrated copy trading tool. Just don’t get caught out by the withdrawal penalty if you deposit funds and don’t make any trades.

FAQ

Is Errante A Safe Broker For UK Traders?

Despite not being authorised by the FCA, Errante does hold a license from the CySEC, which is reassuring. The company also offers negative balance protection and segregates client funds from business money. In addition, all trading platforms are well-regarded for their security measures.

Is Errante A Good Broker?

Errante is a regulated broker offering competitive fees, a choice of platforms, copy trading tools, and educational content. On the downside, the list of assets is fairly limited vs competitors and the minimum deposit with the premium accounts is fairly high.

Overall, Errante scores relatively high in our broker rankings and is worth a try.

Does Errante Offer Good Funding Methods For UK Traders?

UK investors can deposit to an Errante trading account via credit/debit card, bank wire transfer, e-wallets such as Skrill and Neteller, or cryptocurrencies. However, GBP transactions are not accepted so you may be liable for currency conversion fees to an accepted base (USD or EUR).

Is Errante A Regulated Broker?

Yes, the Errante EU entity is authorised and regulated by the Cyprus Securities & Exchange Commission (CySEC). This is a well-respected financial authority with stringent compliance rules, including negative balance protection and a ban on misleading advertising and welcome bonuses.

Article Sources

Top 3 Errante Alternatives

These brokers are the most similar to Errante:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Errante Feature Comparison

| Errante | FP Markets | Pepperstone | Vantage FX | |

|---|---|---|---|---|

| Rating | 4 | 4 | 4.8 | 4.7 |

| Markets | CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Minimum Deposit | $50 | $40 | $0 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, FSA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, FSCA, VFSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:500 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Errante Review |

FP Markets Review |

Pepperstone Review |

Vantage FX Review |

Trading Instruments Comparison

| Errante | FP Markets | Pepperstone | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Errante vs Other Brokers

Compare Errante with any other broker by selecting the other broker below.

Popular Errante comparisons: