easyMarkets Review 2025

|

|

easyMarkets is #17 in our rankings of CFD brokers. |

| Top 3 alternatives to easyMarkets |

| easyMarkets Facts & Figures |

|---|

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Demo Account | Yes |

| Min. Deposit | $25 |

| Mobile Apps | iOS & Android |

| Trading App |

The easyMarkets app is a great fit for active traders. It allows full customization, including light and dark mode, and integrates useful tools like market news, a macroeconomic calendar, and trading signals all in one app. Where it stands out is its advanced features like multiple trading ticket options (Day Trade, Vanilla Options, Pending Orders). With dealCancellation, you can also undo losing trades within 1, 3, or 6 hours. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 lots |

| Regulated By | CySEC, ASIC, FSCA, FSC, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | While the growing selection of 275+ CFDs still trails category leaders like BlackBull with its 26,000+ underlying assets, easyMarkets shines for its proprietary risk management tools. These include easyTrade which caps your risk to dealCancellation that provides a 1, 3, or 6-hour margin to cancel your order if the market moves against you. |

| Leverage | 1:2000 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 0.9 |

| Oil Spread | 1.1 |

| Stocks Spread | 0.25 (Apple) |

| Forex | easyMarkets offers 60+ major and minor currency pairs but no exotics. Forex traders will appreciate the access to the industry’s leading software MT4, paired with the broker’s fixed spreads from 0.7 pips on EUR/USD, offering a degree of price certainty. |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.0 |

| Assets | 60+ |

| Stocks | Despite introducing shares in 2019 and bolstering its range of equities, notably in 2021 and 2022, easyMarkets still only offers a modest selection of stocks from US, European and Asian markets. Its roster is tilted toward technology, finance and consumer goods based on our latest tests. |

| Cryptocurrency | easyMarkets excels for serious crypto traders, featuring 20 popular digital tokens, including Bitcoin and Ethereum, paired with the US dollar. Its introduction of a BTC account also makes for a seamless user experience for dedicated crypto traders while cutting conversion fees. |

| Coins |

|

| Spreads | 62 (BTC) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

easyMarkets is an online broker that spearheaded features like negative balance protection and guaranteed stop-loss orders. Over the years, it has remained innovative, introducing tools like ‘easyTrade’, ‘Freeze Rate’, and ‘dealCancellation’ to assist investors in risk management. But let’s see if easyMarkets offers enough to recommend it to UK traders, drawing on the findings from our exhaustive tests.

Our Take

- Despite previously using the EU’s passporting rights to provide trading services in the UK, easyMarkets is no longer authorized by the FCA.

- easyMarkets has introduced a BTC account, meaning you can trade any asset using the crypto directly, eliminating the need to convert to GBP.

- easyMarkets excels with its fixed spreads, featuring 1.3 pips on GBP/USD, providing price certainty for aspiring traders.

- There is no social community, copy trading services, or long-term investment options, trailing UK brokers like eToro.

- Overall, easyMarkets is best for active traders looking for high leverage up to 1:2000 and unique risk management features.

Is easyMarkets Regulated In The UK?

For UK traders, it’s important to be aware that onboarding typically occurs through easyMarkets’ entity based in the British Virgin Islands.

As the broker lacks regulation in the UK, this setup offers less regulatory oversight compared to FCA-regulated brokers like IG or XTB.

One significant drawback is the absence of protection from the Financial Services Compensation Scheme (FSCS), which insures funds up to £85,000 in case of company insolvency – a considerable risk for those considering larger investments.

Weighing the positives, easyMarkets is a well-established player in the brokerage scene, boasting over two decades of experience within the financial services industry.

easyMarkets is also regulated by several trusted authorities, notably the Cyprus Securities and Exchange Commission (CySEC, 079/07) and the Australian Securities and Investments Commission (ASIC, 246566), plus weaker regulators like the Financial Services Commission of the British Virgin Islands (FSC BVI, SIBA/L/20/1135), and the Seychelles Financial Services Authority (FSA, SD056).

Additionally, easyMarkets prioritises the security of clients’ funds by holding them in segregated accounts, thereby preventing the broker from accessing them.

Also, the brokerage offers negative balance protection, providing reassurance against losses exceeding account balances – a key safeguard when trading on margin.

Accounts

Live Accounts

easyMarkets offers three trading accounts, each tailored to suit different trading preferences: Standard, Premium, and VIP.

The Standard account requires a modest minimum deposit of $25. This account offers leverage ranging from 1:200 to 1:2000, with no commissions for account maintenance, funding, or withdrawals. Spread sizes vary depending on the asset, ranging from $0.05 to 2.4 pips.

While using the MT4 platform with a Standard account, I encountered instances of slippage, and noted the absence of guaranteed stop loss, both of which are exclusive features of easyMarkets’ proprietary Web Platform.

On the plus side, Standard account holders benefit from personal manager support and access to informative mailing lists featuring technical and fundamental analysis.

Moving up the ladder, the Premium account requires a higher minimum deposit of $2,000. This account type offers leverage of up to 1:400, depending on the chosen trading platform. Spread sizes range from $0.04 to 2.2 pips, offering competitive rates.

Similar to the Standard account, Premium account holders enjoy manager support, analytical mailings, and round-the-clock trading, with no additional non-trading commissions.

For those seeking elite privileges, the VIP account demands a substantial minimum deposit of $10,000. This top-tier account offers leverage ranging from 1:200 to 1:400, depending on the chosen trading platform. Spread sizes are minimised, with EUR/USD starting at 0.7 pips and GBP/USD boasting a fixed spread of 1.3 pips.

VIP account holders enjoy a suite of benefits, including expedited same-day deposits and withdrawals, alongside access to an account manager and comprehensive trading education.

Across all account types, traders have access to essential features such as account management, platform tours, and fundamental and technical analysis tools via TradingView.

Demo Account

easyMarkets offers a demo account loaded with $10,000 in virtual funds, making registration quick and easy – just an email address and password are required.

I’ve found these demo accounts to be invaluable for getting to grips with platform functionalities, trying out various strategies, and refining trading techniques without risking real money.

What sets easyMarkets apart is that their demo accounts are unlimited and never expire, unlike those of some other brokers that impose a 30-day limit, such as IC Markets and Pepperstone.

Additionally, you have the option to top up your demo account as needed, providing even more flexibility for practice and experimentation.

Funding Options

Deposits

From my experience using easyMarkets, initiating transactions such as funding your account or withdrawing funds requires account verification, which involves uploading a set of identity documents. The verification process was completed swiftly, typically within a few hours.

One aspect of easyMarkets that I particularly appreciate is their support for multiple base currencies. This flexibility allows me to invest in both GBP and USD, which not only helped reduce costs from conversion commissions but also facilitates easier account management.

What also stands out is the ability to trade any of easyMarkets’ instruments directly using Bitcoin. This feature, introduced in 2021, eliminates the need to convert crypto to fiat currency and offers all the features of the broker’s standard accounts, including instant deposits and access to a range of technical analysis tools on both the Web Platform and MetaTrader.

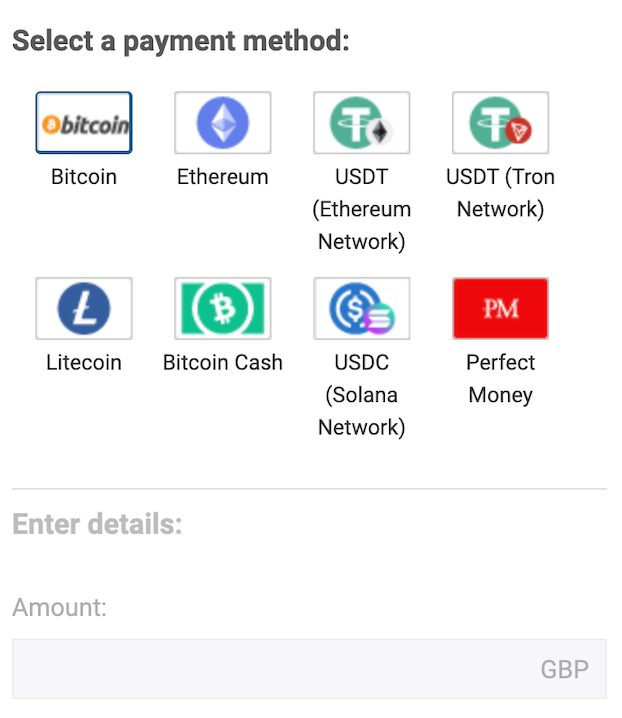

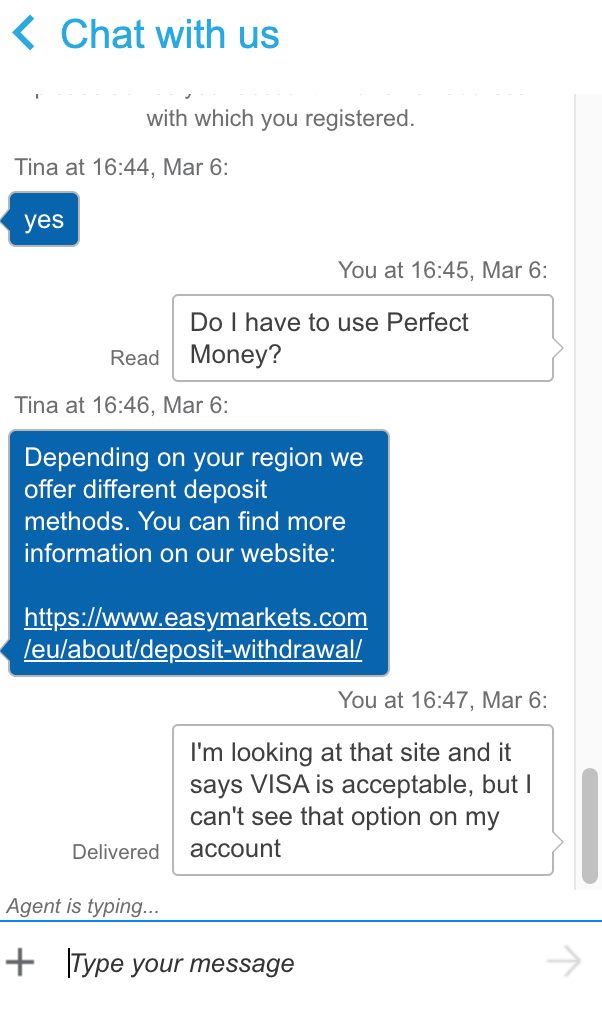

When it comes to funding options, they vary by region, but as a UK investor, you have the choice of using Perfect Money (e-wallet) or a range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Tether, and USD Coin.

Deposits using any of these options are free of charge. However, it is disappointing that there are no credit card or bank wire options, which meant I had to set up an account with Perfect Money to deposit fiat money – an unnecessary extra step in my opinion.

Funds deposited via Perfect Money typically reach my easyMarkets account within 24 hours, which is slower than the instantaneous Faster Payments system I’m used to with my other brokerage accounts.

Withdrawals

easyMarkets upholds strict compliance with Anti-Money Laundering regulations. In accordance with these standards, any non-profit funds are reimbursed to their original deposit source. Moreover, regardless of the deposit method used, withdrawing profits must be executed via the same deposit method.

Initiating a withdrawal from an easyMarkets account is straightforward. Simply log in and navigate to the fund management section.

easyMarkets typically process withdrawal requests within one business day, pending a security protocol review. Importantly, no withdrawal fees are imposed. However, in accordance with KYC regulations, you’ll be required to provide proof of identity and residential address.

Market Access

Despite expanding its suite of shares in recent years, easyMarkets still offers a narrower range and depth of tradable assets compared to similar brokers, notably IG and CMC Markets.

Fortunately, it stands out with its strong forex offering. It also excels in its choice of trading vehicles:

- easyTrade – set risk limits and time durations

- CFDs – speculate on rising and falling prices with leverage

- Vanilla options – trade the upward and downward trend of an asset

- Forwards – lock in pricing to protect trades from future market movements

You can trade the following markets on easyMarkets:

- Forex: 60+ major and minor currency pairs including GBP/USD and EUR/GBP

- Stocks: 50+ equities from the US, EU, JA and HK, but no UK shares

- Commodities: 12 including natural gas, oil, wheat and cotton

- Metals: 19 including gold and silver

- Indices: 26 stock indices including the FTSE 100, Dow Jones 30, and DAX

- Cryptocurrencies: 20 major crypto pairs including BTC/USD, SOL/USD and ETH/USD

Importantly, easyMarkets is clearly geared towards short-term traders. As a result, they do not offer long-term investment products like Individual Savings Accounts (ISAs). ETFs aren’t provided either.

Furthermore, unlike platforms like eToro or XTB, easyMarkets does not offer interest on cash balances.

Leverage

The maximum leverage varies depending on the platform, reaching up to 1:200 on easyMarkets’ Web Platform, up to 1:400 on MT4, and up to 1:2000 on MT5.

Additionally, I’ve noted that while spreads are typically fixed, they become variable when utilising the maximum leverage of 1:2000.

Pricing

easyMarkets’ accounts generally entail higher trading fees compared to similar brokers, especially the cheapest UK brokers, such as IC Markets. However, what sets them apart is that most of easyMarkets’ accounts feature fixed spreads throughout market hours, making it easier to calculate trading costs, especially for newer traders.

MetaTrader also typically offers tighter spreads compared to easyMarkets’ Web Platform. For example, the GBP/USD pair on MT4 features a spread of 1.3 pips, whereas on easyMarkets’ Web Platform, it’s 1.7 pips.

Among the account options, the VIP MT4 account offers the lowest ongoing trading costs, priced at $7 per lot of EUR/USD, which is tighter compared to other similar brokers. However, it’s important to note that this account requires a high minimum deposit of $10,000, making it a viable option for seasoned investors only. Typically, the average cost of trading one lot of EUR/USD at similar forex brokers is around $9.

While easyMarkets doesn’t charge commission fees, costs are incorporated into the spreads, and they do apply fees for holding positions overnight.

Additionally, dormant accounts face a $25 fee every 6 months after 12 months of inactivity. Eventually, accounts with zero balances will be closed. These inactivity fees align with industry standards.

Trading Platforms

easyMarkets offers four online trading platforms: their proprietary Web Platform and the renowned MetaTrader 4, MetaTrader 5, and TradingView (introduced in 2021).

All the platforms offer web-based and mobile versions, while MetaTrader can additionally be downloaded to your desktop for convenience.

The proprietary Web Platform, while not the most visually appealing or customisable, provides a user-friendly interface equipped with essential trading tools. These include technical indicators (thanks to TradingView integration), financial calendars, charts, graphs, and market news.

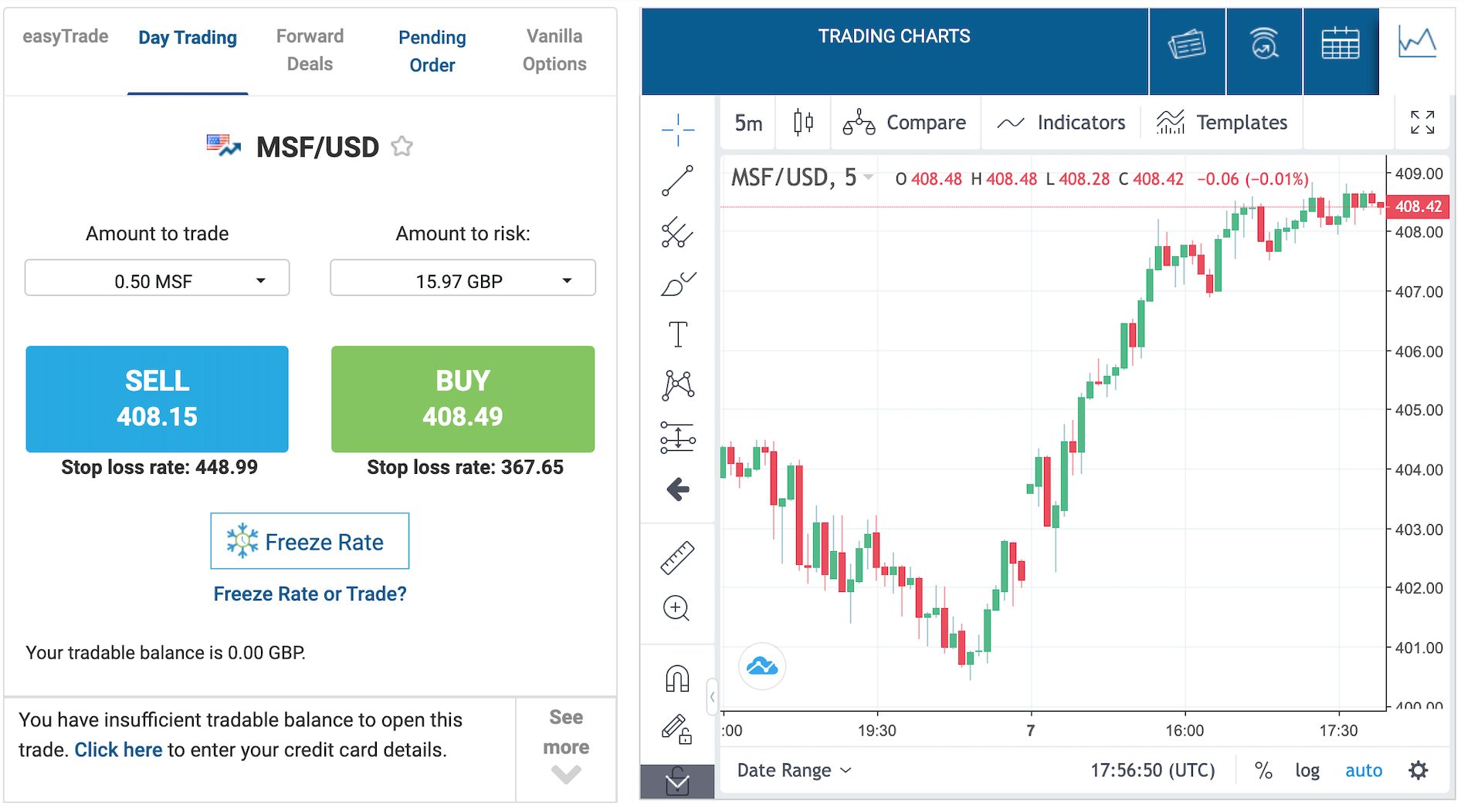

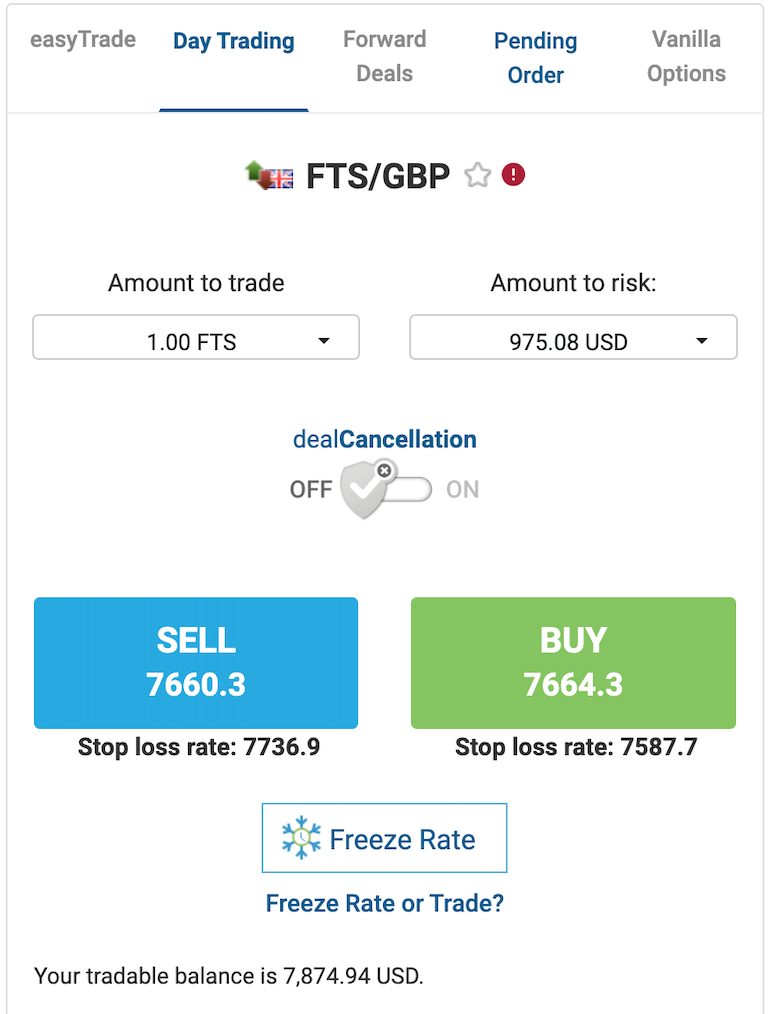

Exclusive features on the Web Platform, such as ‘easyTrade’ (allowing margin-free trading with high leverage and zero spreads for up to 20 financial instruments), ‘dealCancellation’ (enabling the undoing of a trade within 6 hours for a small fee), and ‘Freeze Rate’ (pausing a price rate to avoid market fluctuations), enhance the trading experience.

However, it’s disappointing that the Web Platform lacks support for automated trading or third-party plugins, which may be valued by advanced traders.

The easyMarkets’ MT4 and MT5 mobile apps, which I’ve used extensively, offer the flexibility to trade from anywhere.

Though they have slightly reduced functionality compared to desktop versions, including fewer charting options and timeframes, they still provide access to essential analytics. This includes technical indicators, graphical objects, a complete set of trading orders, and the ability to close and modify existing orders.

Exclusive features such as guaranteed stop loss, Freeze Rate, and easyTrade tools are only available on EasyMarkets’ Web Platform, a detail worth considering when choosing a trading platform.

Extra Tools

The broker’s website offers a range of trading support and educational resources, albeit with some limitations.

While easyMarkets provides satisfactory educational materials, I’ve been disappointed to discover the absence of advanced trading tools and comprehensive market analysis, beyond basic trading calendars and newsfeeds.

After signing up, I used the free Academy, which offers comprehensive educational courses supplemented by supporting YouTube videos.

Additionally, easyMarkets offers downloadable e-books covering topics such as understanding trading platform features, along with a complete financial terms glossary and an extensive FAQ section on their website.

While these educational resources are valuable for novice traders starting their trading journey, I can’t help but feel disappointed by the absence of complimentary seminars, webinars, or podcasts. These are value-add resources, available at brokers like IG and eToro, which can really elevate the trading journey.

Furthermore, I believe the platform could enhance the learning experience by offering more structured courses tailored to individual investing experiences.

Additionally, the lack of copy trading is a notable drawback, particularly for beginners seeking to replicate the strategies of seasoned investors.

Customer Service

While easyMarkets doesn’t specify the working hours of its support service, I’ve consistently found that I can connect with a support agent on Live Chat within seconds whenever I need assistance.

EasyMarkets also has official representatives available on social networks and messaging platforms such as Facebook Messenger, Viber, and WhatsApp, offering a broader array of contact options compared to many other brokers.

In my interactions, I’ve appreciated easyMarkets’ efforts to provide comprehensive help documentation and FAQs, as well as their willingness to seek and implement feedback from customers to enhance the quality of support services.

Should You Invest With easyMarkets?

easyMarkets is a viable option for aspiring traders, thanks to its reliability, low minimum deposit, fixed spreads, and the provision of a demo account.

For experienced traders, easyMarkets’ competitive fees, user-friendly platforms, high leverage, and advanced technical features make it suitable for active trading.

However, it’s important to note that easyMarkets’ focus on catering to active traders may mean it’s not the ideal choice for everyone. While educational resources are offered, they may not be comprehensive enough for beginners seeking thorough guidance. IG is an excellent alternative here.

Also, passive investors may find better-suited options with other brokers that cater more specifically to their investment style. eToro is a stand-out alternative here.

FAQ

Is easyMarkets Good For UK Investors?

easyMarkets is a good option for UK investors, offering trading in various asset classes such as forex, commodities, indices, and stocks. The platform provides competitive fees, fixed spreads, and a range of account options, including a VIP account with benefits including daily trading insights.

That said, the absence of FCA authorisation and certain trading features, like extensive educational tools and long-term investing options, may be drawbacks for some investors.

Can You Invest In GBP With easyMarkets?

Yes, you can invest and trade in GBP with easyMarkets. They offer trading accounts denominated in various currencies, including GBP, allowing UK investors to conveniently conduct transactions in their local currency.

Is easyMarkets Safe?

easyMarkets is considered safe for European investors as it is regulated by the Cyprus Securities and Exchange Commission (CySEC).

However, the broker is not directly regulated by the Financial Conduct Authority (FCA) in the UK. The absence of protection from the Financial Services Compensation Scheme (FSCS) leaves funds uninsured.

Can You Invest In Cryptocurrencies With easyMarkets In The UK?

easyMarkets does not provide the purchasing of cryptocurrencies directly, but you can speculate on price fluctuations of the most popular cryptos without directly owning the underlying asset.

This sets it apart from some of its main competitors, like eToro, which allows you to own popular cryptocurrencies such as Bitcoin, Ethereum, and Solana.

Article Sources

Easy Forex Trading Ltd – FCA Database

Top 3 easyMarkets Alternatives

These brokers are the most similar to easyMarkets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

easyMarkets Feature Comparison

| easyMarkets | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4 | 4.7 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $25 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, ASIC, FSCA, FSC, FSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:2000 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | easyMarkets Review |

Swissquote Review |

IG Index Review |

FP Markets Review |

Trading Instruments Comparison

| easyMarkets | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

easyMarkets vs Other Brokers

Compare easyMarkets with any other broker by selecting the other broker below.

Popular easyMarkets comparisons: