Earn2Trade Review 2025

Earn2Trade provides funded trading accounts to users that pass the evaluation challenges. Up to 80/20 profit splits are available, alongside educational resources. This 2025 review of Earn2Trade explains how the service works, including funding options, account rules, daily loss limits, withdrawals, and customer service. Find out if Earn2Trade is the best funded account provider for UK traders.

Key Takeaways

- Earn2Trade offers funded trading on the biggest futures exchange – Chicago Mercantile Exchange (CME)

- The company offers excellent educational materials and trading platforms to support aspiring investors

- Funded traders benefit from a competitive 80/20 profit split

- Futures trading only – alternative markets are not supported

How Earn2Trade Works

Earn2Trade was founded in 2016 by Ryan Masten, a well-known but controversial online trader. The company is based in Wyoming in the USA and is registered with FINRA as an educational platform rather than a broker-dealer.

Earn2Trade essentially offers customers the chance to learn about futures trading with educational resources, expert help and hands-on demo trading experience. Through its training and experience, the firm offers a “career path” into trading for a living.

If investors pass the Earn2Trade exams and demonstrate consistent results while demo trading futures, they can progress to a funded account. Two proprietary affiliate brokers, often referred to as “prop firms”, supply the funds: Helios and Appius.

With further positive results, Earn2Trade users can progress up to a $400,000 funded account with a fixed drawdown. Traders get to keep 80% of their profits, with the prop firm taking 20% commission in exchange for supplying the funds. This is competitive vs the payouts and fees charged by alternatives.

Instruments

Earn2Trade allows users to trade futures contracts on the CME, CBOT, Nymex and Comex exchanges. Thus, thousands of futures trading assets are available for speculation, spanning global indices, metals, soft commodities, fuels, stocks and currencies. Also available are micro contracts, which count towards 1/10 of a standard contract.

It is worth noting that Earn2Trade does not allow its traders to speculate on the crypto markets. This is due to the volatility and unpredictability of these assets. In addition, there are some prop firms which offer a wider range of instruments and tradable markets beyond futures.

Courses & Fees

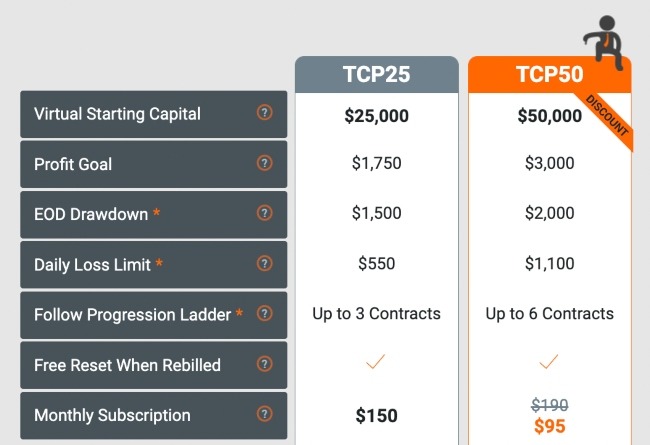

Earn2Trade offers two variants of its Trader Career Path course. Investors can choose between Trader Career Path 25 (TCP25) and Trader Career Path 50 (TCP50).

Trader Career Path 25

The TCP25 allows investors to use $25,000 of paper funds to demo trade with. This Trader Career Path Course costs $120 per month.

After learning about futures trading using the provided educational resources, traders will get the chance to take the TCP25 exam. This exam consists of simulated trading using demo funds, and traders must demonstrate their prowess over a 15-day period.

To pass the TCP25, the prop firm has several rules:

- An end-of-day drawdown limit of $1,500

- A daily loss limit of $550

- Maximum of 3 open contracts

- No single day can account for over 30% of your total PnL

To progress from the TCP25, investors must earn $1,750 or more over a 15-day period. If a trader fails due to any of these rules, Earn2Trade resets these parameters at the start of the next billing period.

Trader Career Path 50

As with the TCP25, the Earn2Trade Trader Career Path 50 is a program that aims to help investors hone their futures trading skills and achieve a funded account. The TCP50 course is available at a discount rate of $95, reduced from $190, and cheaper than alternative firms.

Investors are given a $50,000 funded demo account – double that of the TCP25. As a result of the additional funds, the trading rules and goals are tweaked. Over 15 days, traders must:

- Adhere to a $2,000 end-of-day drawdown limit

- Not have a daily loss of over $1,100

- Trade using a maximum of 6 active contracts

- Not derive more than 30% of their total PnL from one day

To pass the TCP50 exam, traders must exceed $3,000 in profit over this period.

The Gauntlet Mini

The third course offered by Earn2Trade is the Gauntlet Mini. This course focuses on intraday futures trading and has four levels of virtual funding to choose from.

Upon passing the Gauntlet Mini, investors receive access to a funded trading account of the same capital level.

$50,000 Account

The $50,000 virtual account requires investors to make a $3,000 profit. The end-of-day drawdown is $2,000, while the daily loss limit is $1,100.

Investors start off with a 2-contract limit, but upon exceeding $1,500 in profit, this changes to 4 contracts, which upgrades again if profit reaches $2,001+.

Note that profit levels can both increase and decrease – investors will need to keep track of their profits and contract allowance or they will fail the examination.

The Earn2Trade $50,000 account subscription costs $136 a month, a discount of $34 from the total rate of $170.

$100,000 Account

There is a $6,000 profit goal for the Earn2Trade $100k account, with a $3,500 end-of-day drawdown and a $2,200 daily loss limit.

For investors with a total profit of up to $1,500, a maximum of 3 open contracts are allowed. For between $1,500 and $3,000, this doubles to 6, then up to $4,500, this increases to 9. For traders with over $4,500 of current profit, 12 simultaneous contracts are allowed.

This Earn2Trade account costs $252 per month, down from $315.

$150,000 Account

For a $280 monthly subscription, discounted from $350, investors can access the $150,000 Earn2Trade Gauntlet Mini account.

With a profit goal of $9,000, traders must comply with a drawdown limit of $4,500 and a daily loss limit of $3,300.

For every $1,500 a trader is in profit, they can access additional concurrent open contracts. This starts at 4 contracts, then to 6, then 9, and tops out at 15 for traders in $4,500+ profit.

$200,000 Account

The highest level of virtual capital available in an Earn2Trade Gauntlet Mini account is $200,000.

For a monthly fee of $440 (reduced from $550), traders must achieve a profit goal of $11,000 to progress. Their rules are $6,000 of drawdown and a $4,400 daily loss limit.

Clients start with a maximum of 5 concurrent futures contracts, but this rises to 7, 10 and 16 maximum contracts with each $1,500 of earned profit.

Funded Accounts

If all of the Gauntlet Mini, TCP25 or TCP50 conditions are met, Earn2Trade clients will achieve funding from a prop firm.

For both the TCP25 and TCP50 accounts, investors are able to make a withdrawal of any profits without it affecting their bottom line. Regardless of withdrawals, investors progress to the next stage when their total profit goal is met. Earn2Trade prop firms Helios and Appius take 20% commissions on profits, with a profit split of 80/20 in the traders’ favour.

In the previous section, we outlined what happens when you pass the Gauntlet Mini exam. However, there is a further progression for the TCP25 and TCP50 ladder…

Junior Accounts

After achieving prop firm funding, investors can opt for a Junior Live Account or Junior LiveSim Account. These are each funded with $25,000 when following the TCP25, or $50,000 when following the TCP50.

The Junior Live Account uses real funds and allows inventors to withdraw profits. After meeting their funding goal, investors can move up to the next level of account.

While there is no Earn2Trade subscription charge once funded, live accounts must pay $105/month/exchange data fees to access market data. On the downside, this is more expensive than some alternative providers.

The Junior LiveSim account uses virtual funds, and investors cannot withdraw profits. However, the funded account rules and upgrade capabilities are the same as the Junior Live account. The benefit of this Earn2Trade account is that there are no data fees to pay.

Intermediate Accounts

The next step up the Earn2Trade account ladder is the Intermediate Live account. This account is funded with $50,000 and $100,000 respectively for TCP25 and TCP50 graduates.

- The TCP25 account has a trailing drawdown of $2,000 and a daily loss limit of $1,100.

- The TCP50 account has a trailing drawdown of $3,500 and a daily loss limit of $2,200.

Advanced Accounts

Advanced accounts are funded with $100,000 and $200,000 of prop firm funds for TCP25 and TCP50 graduates respectively.

- The TCP25 trailing drawdown is $3,500 and the daily loss limit is $2,200.

- The TCP50 drawdown is now fixed and stands at $194,000. The daily loss limit is $4,400.

Senior Accounts

The Senior account is the highest account tier offered by Earn2Trade. Investors are provided with either $200,000 or $400,000 of funds, depending on their training program. This is notably more funding than is provided by other prop firms.

- The TCP25 account drawdown is also now fixed and stands at $194,000. The daily loss limit is $4,400.

- The TCP50 account drawdown is also fixed at $380,000. The daily loss limit is upped to $8,800.

Deposits & Withdrawals

Earn2Trade offers several options when it comes to making payments. Investors must pay course fees when in the training program, and data fees when trading using real funds. Note that fees for using trading platforms are paid directly to the platform provider.

Available payment methods include bank cards and popular e-wallets like PayPal.

When it comes to withdrawing your trading profits, this is done via the prop firm rather than Earn2Trade. All withdrawals are processed via the online international payment provider, Deel.

There is a minimum withdrawal amount of $100, with withdrawal fees of $10 applied to withdrawals of under $500. For withdrawals exceeding $500, the charges are waived. Again, this is an advantage over other funded account providers.

Platforms & Tools

There is a considerable range of Earn2Trade trading platforms available to both trainees and funded account traders.

The firm recommends the proprietary NinjaTrader and offers this platform free during the Gauntlet Mini and TCP exams. Earn2Trade also offers Finamark for free during their training programs and a 90-day live trading licence for graduates.

R Trader and R Trader Pro are available for free to both simulated and funded account holders, while Earn2Trade provides a 60-day licence for Overcharts to new users.

Additional supported platforms include Inside Edge Trader, Investor RT, MultiCharts, Bookmap, ScalpTool and Trade Navigator. On the downside, MetaTrader 4 and MetaTrader 5 are currently not supported by Earn2Trade.

Security & Regulation

As Earn2Trade is an educational firm rather than a broker, the company does not hold a regulatory licence with any authority. However, the firm is registered with FINRA as an educational resource provider.

This is a promising sign that the funded account provider is legitimate, though UK traders may be disappointed to see no oversight from the FCA.

Trustpilot reviews also score Earn2Trade at 4.7 out of 5. However, this should not be used as a definitive rating as many companies pay for false reviews on such sites.

Customer Support

In addition, to support from Earn2Trade’s expert traders, users can seek help from several avenues. In addition to a comprehensive FAQ section and trader blog, clients can network with other traders on the Earn2Trade Facebook page and member-only Discord channel.

Customer support is offered via email, WhatsApp, Telegram and a live chat on the Earn2Trade website.

Those with queries about courses like the Gauntlet Mini or who wish to learn the profit targets for the TCP50 course progression levels can email the firm at support@earn2trade.com.

Pros Of Earn2Trade

- Lucrative profit split on Funded Accounts

- Great choice of trading platform options

- Another chance to pass your exam every month

- Withdrawn profits still count towards ladder progression

- High drawdown amounts at upper levels

- Guidance from expert traders

Cons Of Earn2Trade

- Exams are difficult to pass due to rules

- Futures only, with crypto markets excluded

- Lack of transparency around funded account ladder progress

- Course and data fees can be hefty

- Steep $10 withdrawal fees

Trading Hours

Earn2Trade apply strict limits to the trading hours its customers can operate within when on the Trader Career Path 25, Trader Career Path 50 or Gauntlet Mini exams.

For most markets, Earn2Trade allows investors to begin trading at CME market open, which is 5 pm CT (11 pm GMT). Positions must be closed by 3:50 pm CT (9:50 pm GMT), though some markets are subject to earlier closing times.

Should You Apply For A Funded Account With Earn2Trade?

Getting funded by a prop firm through Earn2Trade can seem like a win/win. Clients can trade with another company’s capital, meaning that they have no personal liability, while withdrawing profits in an 80/20 payout split. However, passing the Earn2Trade Gauntlet Mini and Trader Career Path exams is hard due to their strict requirements. In addition, data fees and course charges need to be factored in, on top of a $10 withdrawal fee.

Overall, Earn2Trade is a good fit for aspiring traders looking for educational support alongside the opportunity to receive funding from a prop firm. Budding investors can also get funded in just 15 days while the company offers multiple discount codes and promos to reduce joining fees.

FAQ

Does Earn2Trade Offer A Good Range Of Trading Tools?

Earn2Trade supports an impressive selection of 20 official platforms, including NinjaTrader, Finamark, Bookmap and Jigsaw Trading. If not on the list, investors can request to use their own favourite platform via customer support.

Does Earn2Trade Offer A Decent Profit Split?

Earn2Trade funded accounts are provided by Helios and Appius, which take a 20% commission on trading profits. This equates to an 80/20 profit split for traders and is competitive vs other prop firms.

What Is The Earn2Trade Trader Career Path?

The Earn2Trade Trader Career Path courses offer investors the chance to learn futures trading from educational materials and market experts. After meeting profit goals, clients receive funds from prop firms to trade futures with.

Is Earn2Trade Good For Crypto Trading?

Unfortunately, Earn2Trade does not allow crypto futures to be traded in its courses. In the funded account rules, the prop firms also do not allow cryptocurrency trading. As a result, Earn2Trade is not the best fit for aspiring crypto traders.

Do Earn2Trade Charge For Data Fees?

While taking the Gauntlet Mini and Trader Career Path Exams or trading on a LiveSim account, there are no data fees for clients to pay. However, one of the Earn2trade funded account rules is that there is a $105/exchange/month data fee for investors to pay, which is higher than some competitors.