DupliTrade

DupliTrade is an automated copy trading platform that is partnered with some of the top brokers in the UK. Over a dozen audited strategy providers are available and new traders can get started in four straightforward steps. This DupliTrade review and tutorial unpacks minimum deposits, fees, MetaTrader 4 (MT4) integration, mobile apps, and more. Our experts have also ranked the best DupliTrade brokers in 2025.

DupliTrade Brokers UK

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, FSA, CMA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30

Users can link their DupliTrade copy trading account with their brokerage account and MT4 platform. There are no registration fees but most DupliTrade brokers require a deposit of £2000+. Strategy providers are experienced investors that have passed an evaluation process.

Company Details

DupliTrade is an Isreali-based copy trading platform, established in 2017 by former Signal Trader COO, Jonathan Hirshber. The brand is operated by DT Direct Investment Hub Ltd, a registered Cyprus Investment Firm (CIF), regulated by the Cyprus Securities and Exchange Commission (CySEC).

The vision of the brand is to connect retail investors with proven traders whom they can copy and learn from. DupliTrade hosts a selection of successful strategies from ‘professional’ traders, selected based on their previous trading history and performance record. Users can monitor their performance in real time and retain full control over their funds.

How Does DupliTrade Work?

To access the firm’s strategy providers, you will need to open a trading account with a DupliTrade partner broker. You can then link your DupliTrade copy trading profile to your live investing account through popular platforms, such as MetaTrader 4 (MT4).

All trading activities including new positions and modifications are automatically reflected in your live investing account. No intervention is required. With that said, retail traders can control positions or manually amend them if required.

To get started:

- Register with DupliTrade via their website

- Open an account with a partner broker

- Review and select strategy providers to follow

- Copy the positions of master traders and track your account performance

Strategy Providers

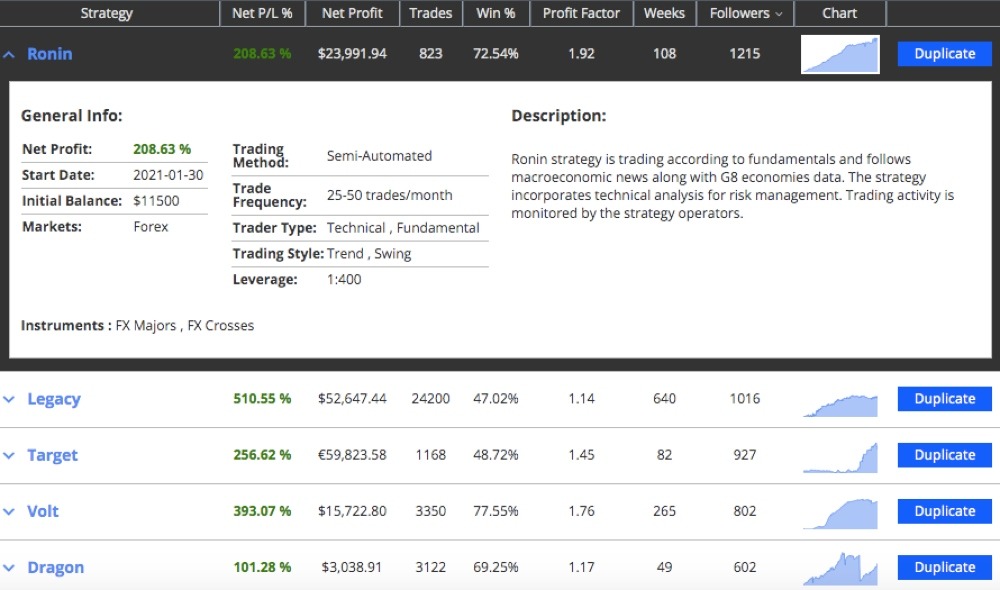

DupliTrade’s strategy providers, also known as master traders, are experienced investors with proven track records. Individuals are required to complete a comprehensive evaluation process, including months of live trading authentication and monitoring, interviews to determine credibility, and participation in stress-testing simulations.

It is worth noting that the investment history of strategy providers is based on live trade executions, with all trades made using real capital. DupliTrade then uses an algorithm-based listing method to rank the best-performing strategy providers on the community list.

To find a suitable master trader for your financial goals and risk appetite, you can compare strategy providers across a number of metrics:

- Trading style

- Initial balance

- Leverage used

- Trading start date

- Trading frequency

- Net profit achieved

- Trading market speciality

How To Copy Traders

It is quick and easy to start copying trades at DupliTrade brokers:

- Review the list of strategy providers using the performance metrics

- Click the blue ‘Duplicate’ icon next to the master trader’s registered name

- Use the slider tool to allocate funds by strategy provider (you can distribute funds between 12 master accounts)

- Select the ‘Save Changes’ button at the bottom to confirm the allocation

- Monitor your account performance and manually close positions if needed

Note, regardless of an expert trader’s past performance, profits are not guaranteed. Never risk more than you can afford to lose.

DupliTrade Fees

While using DupliTrade, our expert team found there are zero registration fees or ongoing charges. The firm makes money from partner brokers through an Introducing Broker (IB) fee. The broker then pays profitable strategy providers based on the number of successful positions executed.

Importantly, retail investors are not required to pay a commission to master traders. With that said, standard spreads and commission fees may apply to trades, though this varies between DupliTrade brokers.

It is also worth noting that the majority of DupliTrade brokers require a fairly high minimum deposit of at least £2000 to use the tool, including AvaTrade and Vantage.

Platform

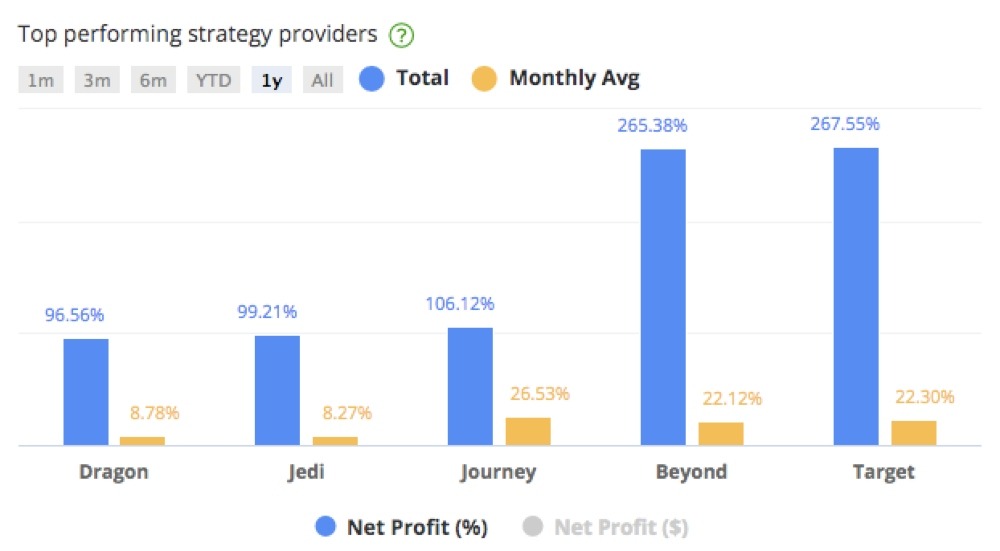

We found the DupliTrade copy trading platform easy to use with an intuitive design. It is straightforward to navigate to the list of strategy providers and view in-depth performance analytics and historical data on win ratios, net profit, the number of trades executed, and the number of followers. It is also easy to select, modify and remove strategies at the click of a button.

On the downside, the DupliTrade copy trading platform is available via web browser only. There is currently no desktop software or proprietary mobile app.

Demo Account

DupliTrade offers a 30-day free trial via its official website. The demo solution provides simulated real-time conditions with live positions being executed by traders. The paper profile is good for getting to grips with the master trader data available and for practising copying positions risk-free.

Users can register by selecting the green ‘Sign Up’ icon on the website and entering their basic contact details.

Note, as these paper profiles are not linked to DupliTrade brokers, execution speeds may vary.

Simulator

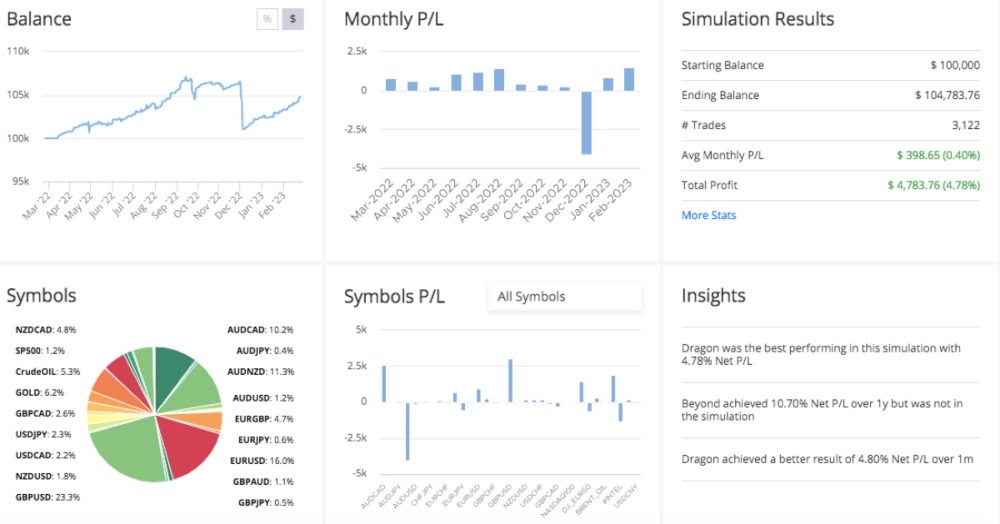

A simulator tool is also available on the DupliTrade website. The programme allows users to back-test strategy providers’ trades. Essentially it can be used to understand profit potential based on the historical performance of master traders. Users can input a virtual investment balance of up to £500,000 and a simulation time frame of up to one year.

DupliTrade Simulator Results

To set it up:

- Visit the DupliTrade website (duplitrade.com)

- Click the ‘Trading Simulator’ icon in the top menu

- Toggle the slider bar to choose a virtual balance and click ‘Next’

- Use the dropdown menu to choose a simulation period and click ‘Next’

- Allocate funds between the strategies using the slider bar

- Select ‘Simulate Now’ once ready

- Review the trade performance dashboard for strategy insights and monthly P&L

Customer Support

DupliTrade customer support is available 24/5, similar to popular partner brokers. Contact methods include an online enquiry form, an email address (support@duplitrade.com), and a live chat function. When we used the live chat service we received a fast response within a few minutes. Our experts were also pleased to see a detailed FAQ section and glossary of key terms for useful self-help.

There is also a useful blog-style page available on the DupliTrade website. It provides simple reads on copy trading and automated investing using its tool. This includes how to get started, the features of the simulator, and what to consider before signing up for an automated investment profile.

Importantly, the best DupliTrade brokers can also provide user guidance and support if needed.

Regulation

DupliTrade is controlled and operated by DT Direct Investment Hub Ltd, a registered Cyprus Investment Firm (CIF). The company is regulated by the Cyprus Securities and Exchange Commission (CySEC), registration number 347/17. This is a top-tier regulatory authority with stringent rules that members must comply with.

For extra peace of mind, sign up with DupliTrade brokers that hold a license with the UK’s Financial Conduct Authority (FCA). This will provide the best protection for British traders.

Safety

DupliTrade is a secure copy trading solution for online investors. The firm takes a robust approach to data privacy, fund safety, login security, and audits of strategy providers.

DupliTrade also only partners with regulated brokers to protect against scams and fraudulent activity. This is important as the firm does not hold client funds. Instead, all deposits are made directly and held by partner brokers, though withdrawals can be made at any time.

Bottom Line On DupliTrade Brokers

DupliTrade is a popular copy trading platform suitable for retail investors of all experience levels. The programme is easy to use and can be integrated directly into partner brokerage accounts. Strategy providers also undergo an in-depth evaluation process, meaning only the best master traders are listed on the leaderboard.

Sign up with one of the best DupliTrade brokers to get started.

FAQ

Is DupliTrade Legit?

DupliTrade is a legitimate automated copy trading platform, operated by a CySEC-regulated firm. The brand follows a robust master trader audit process and only partners with regulated brokers. DupliTrade also has many positive user reviews online.

Is DupliTrade Good For Beginners?

DupliTrade is a good tool for beginners, providing access to experienced investors’ trading ideas and strategies. The solution integrates with the live investing accounts of DupliTrade’s registered partner brokers. No prior investment experience is required and users can duplicate trades at the click of a button.

Also, only traders with a demonstrable track record will pass the evaluation process and users can compare strategy providers across a number of metrics, including trading style, starting balance, leverage, frequency, net profit, and market speciality.

Is DupliTrade Regulated?

The firm that operates DupliTrade, DT Direct Investment Hub Ltd, is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 347/17. This is a well-regarded financial authority with strict protocols for member firms. DupliTrade brokers must also be regulated by a reputable financial watchdog.

Which Are The Best DupliTrade Brokers In The UK?

Among the best DupliTrade brokers for UK investors are AvaTrade, Pepperstone, and IC Markets. Alternatively, see our full list of DupliTrade brokers to find a suitable firm for your goals.

Does DupliTrade Have A Demo Mode?

Yes, new users can access a 30-day free trial on the DupliTrade website. The automated copy trading platform also provides a simulator tool whereby you can test the profit potential of strategy providers using historical performance data.