Dukascopy Review 2025

|

|

Dukascopy is #11 in our rankings of binary options brokers. |

| Top 3 alternatives to Dukascopy |

| Dukascopy Facts & Figures |

|---|

Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Trading App |

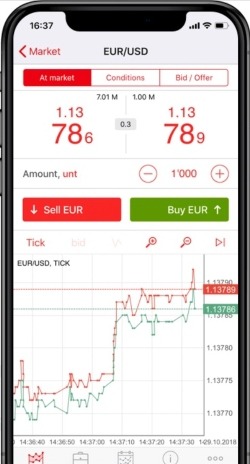

Dukascopy continues to stand out in the mobile trading arena with an easy-to-use app that offers short-term trading on popular assets, including forex, stocks, and indices. It offers trading signals, price alerts, and over 50 technical indicators, outperforming most competitors’ charting tools. With 24/7 in-app support, it’s a top choice for serious mobile traders. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FINMA, JFSA, FCMC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes (EAs & FIX APIs) |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Dukascopy offers highly leveraged CFD trading up to 1:200. A wide selection of asset classes are available, including currencies, equities, commodities, ETFs and cryptos. Spreads are tight starting from 0.1 pips and traders get 24/7 support that performed well during testing. However, the real standout is the security provided by trading CFDs through a multi-regulated broker and Swiss bank |

| Leverage | 1:200 |

| FTSE Spread | 100 |

| GBPUSD Spread | 0.1 |

| Oil Spread | 0.1 |

| Stocks Spread | 0.1 |

| Forex | With 60+ currency pairs available, Dukascopy offers ample majors, minors and exotics, complete with its tight spreads from 0.1 pips, access to MT4, plus the broker’s own JForex softwarem which shined during testing for its clean workspace and customization capabilities. |

| GBPUSD Spread | 0.1 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.4 |

| Assets | 60+ |

| Currency Indices |

|

| Stocks | Dukascopy offers stock trading on the world's largest indices and companies, from Amazon in the US to Meyer Burger in Switzerland. Trade equities spanning North America, Europe and the Pacific region with competitive commissions. The broker's superb market research tools, including its technical and fundamental analysis, trading ideas and TV channel, elevate the stock trading experience. |

| Cryptocurrency | Dukascopy facilitates trading on popular cryptos like Bitcoin against the US Dollar. You can go long or short with leverage up to 1:5. Unusually, clients of Dukascopy are also protected to the tune of CHF 100'000 in the event of brokerage insolvency. |

| Coins |

|

| Spreads | 0.1 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | Dukascopy offers binary options on currency pairs, stocks and indices, alongside powerful trading tools and market insights. User gets flexible contract sizes and deposits are protected by EU law, though the $1000 starting investment is higher than alternatives. |

| Expiry Times | 3 minutes - 1 day |

| Payout Percent | 90% |

| Ladder Options | No |

| Boundary Options | No |

Dukascopy is both a bank and broker offering ECN trading on forex, CFDs and binary options. Through the broker’s own trading platform, JForex 3, and the powerful MetaTrader 4, customers have access to eight asset classes.

This Dukascopy review will uncover the broker’s minimum deposit, leverage, live charts, withdrawals, and UK regulation. Find out the pros and cons of opening an account.

Dukascopy offers an excellent range of instruments with a GBP trading account. A choice of trading platforms and tools, plus promotions also improve its rating. On the downside, its complicated structure and lack of FCA oversight may deter UK investors. In addition, traders have to pay an extra commission to use MT4.

Company History & Overview

Founded in 2004 by current majority owners Andre and Veronika Duka, Dukascopy operates as both a bank and online broker. The headquarters of the company are based in Geneva, Switzerland and there are additional offices in Riga, Latvia, Hong Kong (HK), Tokyo, Japan and Dubai, UAE.

Since its launch, Dukascopy has grown to become a well-respected brokerage, winning 16 awards including the Best Bank Broker and Best Technical Analysis Platform.

Investors based in the UK will trade through the Dukascopy Europe IBS AS branch based in Latvia, where it is regulated by the Financial and Capital Market Commission (FCMC).

The trading firm is also registered with the Swiss Financial Market Supervisory Authority (FINMA) and the Japan Financial Services Agency (JFSA).

Instrument List

Clients of Dukascopy can trade CFDs and binary options on multiple markets:

- Stocks – Over 1,000 stocks from exchanges in Europe, North America and Asia. This includes 98 stocks from the UK such as Glencore, Aviva and BAE Systems

- Indices – 21 indices including the FTSE100, US30, DAX30, NASDAQ100, and S&P 500

- ETFs – Over 50 ETFs from France, Germany, the US and Hong Kong

- Commodities – 13 agricultural and energy commodities such as UK Brent and US Crude oil

- Cryptocurrencies – Eight cryptos including Bitcoin and Ethereum paired with USD

- Forex – 59 currency pairs, including 7 with GBP

- Metals – Gold and silver paired with USD

- Bonds – UK, US and German government bonds

The binary options offered by Dukascopy help separate it from competitors, for example, vs FXCM, Pepperstone and Interactive Brokers. Binaries allow traders to make a straightforward up/down prediction on well-known assets with the potential payout known upfront. Due to the capped risk, binaries are also popular with beginners.

Leverage

The maximum leverage you can use on a contract with Dukascopy relates to the asset and the day of the week.

- The majority of forex pairs are available up to 1:100 on weekdays and 1:30 on weekends

- Silver is available up to 1:50 on weekdays and 1:30 on weekends. Gold is 1:30 all the time

- On weekdays, indices have a maximum leverage of 1:50. On weekends this limit is reduced to 1:30

- All stocks and ETFs are limited to a maximum of 1:10, which is the same across the week

- Certain cryptos such as Bitcoin and Ethereum have a maximum leverage of 1:5 but the majority cannot be traded on margin

- Bonds are available up to 1:30 all of the time

Importantly, the broker offers higher leverage than most FCA-regulated firms, which have a 1:30 cap.

Trading Platforms

JForex 3

JForex 3 is Dukascopy’s own trading platform. This is a high-quality solution that comes with various features and tools to support clients in mapping out their trades, opening contracts and monitoring positions.

The platform comes in-built with 250 indicators and charting objects. Dukascopy also supports expert advisors. These are automated trading bots that use instructions programmed by the investor to identify assets, and then open and close contracts. Using the JForex API, clients can also create and implement their own algorithmic trading bots onto the platform.

There are downloadable applications for Windows, Linux and macOS computers. You can also find respective mobile apps on the Apple App Store and Google Play for iOS and Android (APK) devices, respectively. If you do not want to download an app, you can use the web trader solution.

To help traders get started with a potentially unfamiliar platform, the broker also provides video tutorials and a manual explaining how to get started.

JForex 3 – Forex Graphs Incl. EURUSD Chart

MetaTrader 4

If you don’t want to use the JForex platform, you can invest through MetaTrader 4. Launched by MetaQuotes in 2005, MT4 comes with over 50 analytical tools and clients can purchase more from a marketplace that has over 2,000 tools. You can then back-test any strategy that adopts these indicators using the rich historical data export available.

To customise the platform, MT4 comes with nine time frames ranging from one minute and five minutes up to one month. Additional benefits include expert advisors, one-click trading, and support for both pending orders and market execution.

You can download MetaTrader 4 on both macOS and Windows computers or as a mobile app on iPhone and Android devices. Unfortunately, you cannot use an MT4 web trader at Dukascopy. But the real downside is that if you use MetaTrader 4, you will need to pay an additional $0.5 per lot.

On the downside, MT5 is not offered.

How To Place A Trade

- Select the chosen asset from the drop-down list in the top left-hand corner of the platform

- Specify the trade volume

- Input any stop loss and/or take profit orders

- To open a conditional order, input the entry conditions and maximum slippage

- Confirm the order using the ‘Submit’ button at the bottom of the widget

Mobile App

If you want to trade with Dukascopy on the go, you can find mobile apps for the JForex 3 and MetaTrader 4 platforms. These are both available on iOS and Android mobiles and there are links to the download pages on the Apple App Store and Google Play on the Dukascopy website.

While using Dukascopy, our traders found that MT4 was the best app for beginners. The JForex 3 application is still of good quality and reliable, but it is not quite as user-friendly or intuitive as MT4 mobile.

Dukascopy App

Spreads & Commissions

Dukascopy does not offer the most straightforward pricing schedule. This is a drawback to many brokers which offer easy-to-follow and beginner-friendly fee structures.

The broker charges a commission with varying rates according to the net deposit, equity and volume. Commissions start at 35 USD per million USD for currencies and 52.5 USD per million for precious metals and non-stock and ETF CFDs. For CFDs on stocks and ETFs, the commission is 0.1% of the GBP trade value, with a minimum of 7 GBP.

If you trade gold, you will need to pay custody fees. These work out at 1.5% of the average gold balance across the year and are charged at the end of each month.

Dukascopy also charges swaps, which are fees imposed on CFD trades that are held overnight. The swap rates relate to the direction (long vs short) and the asset. For example, on the GBP/AUD forex pair, the rollover rate for a long position is -0.020 pips whereas for short it is -0.670 pips.

If your account is dormant without any trades being conducted, you may be liable for an inactivity fee. This is a minimum of CHF 500 but could be greater, depending on the cost of establishing the contract.

Dukascopy Account Types

Retail clients can choose from one of two live accounts:

Forex ECN Account

- JForex platform only

- Minimum deposit of £100

- Trade commission of $35 per million

- Live spreads from 1 pip

Forex MT4 Account

- MT4 platform only

- Minimum deposit of £1,000

- Trade commission of $10 per million

- Live spreads from 1 pip

How To Open A Live Account

- Follow the ‘Visit’ button at the top or bottom of this Dukascopy review

- Input your name, email and phone number

- The broker will send you an email asking you to provide information such as employment status, annual income and the source of funds

- You will then need to submit documents showing proof of identity and address. You may also be asked to record a video of yourself to complete the verification process

- This information will be reviewed by Dukascopy’s customer service team. If it is accepted, you can immediately deposit funds into your account and start trading

Note, no deposit bonuses are not provided.

Demo Account

Potential traders can also sign up for and login to a free 14-day demo account. This is a great way to practice using either MetaTrader 4 (MT4) or JForex 3 as there is no risk associated with the simulated funds.

When you first open the paper trading account, you can choose the currency to use, including GBP, and the amount you wish to start with. You can then download the relevant platform, app or web trader solution.

A key drawback, however, is that there isn’t an unlimited demo account

Payments

Deposits

Dukascopy offers a decent selection of deposit methods, making it easy to get started. For all payment methods, the minimum deposit is $100.

- Wire transfer: Expected to take between one and two business days to process. Deposits are free

- Debit & credit cards: Expected wait time of one to three hours. 1.5% fee for EEA cards and 2.5% fee for non-EEA cards with a maximum transfer limit of $18,000 or GBP equivalent

- Apple Pay, Skrill & Neteller: Deposits should be completed within a few hours. 2.5% fee or €1 (Neteller only)

- Crypto: Bitcoin, Ether and Tether supported. Only available for accounts that are ‘crypto-fundable’. Dukascopy does not charge for digital currency deposits. On average, deposits take a few hours to complete.

Unfortunately PayPal is not accepted.

How To Make A Deposit

- Login to your Dukascopy account via the website or mobile app

- Click on ‘Account’ and go either ‘My Account’ if on desktop or ‘Account Settings’ if on mobile

- Select ‘Deposit’

- Choose the desired transfer method

- Specify the amount, currency and input the payment account details. For example, for a credit card deposit, this includes the credit card number, expiry date and the cardholder’s name

- Confirm the request and complete any 2FA step you may have set up with the payment provider

Withdrawals

The expected wait time for withdrawals is between one and seven business days. It is worth noting that this is longer than some competitors which offer same-day processing.

- Wire transfer: £15 fee

- Debit and credit cards: €1.5 + 2.5% fee

- Skrill & Neteller: 2.5% fee or €1 (Neteller only)

- Crypto: $30 fee with the same tokens accepted as deposits

Regulation

The brokerage is registered with the Latvian Financial and Capital Market Commission (FCMC) and the Japan Financial Services Agency (JFSA).

Dukascopy is also regulated by the Swiss Financial Market Supervisory Authority, FINMA. Additionally, through esisuisse, client funds are protected if the broker were to default. In the event of insolvency, customers could submit claims of up to 100,000 CHF (approximately £90,000) in compensation.

Unfortunately the company is not licensed by the FCA, which is a notable drawback for UK investors. Still, the Swiss FINMA is a well-regarded regulator and the company’s active regulatory status is a good sign that the firm is trustworthy.

Dukascopy publishes financial reports twice a year that are publicly available. KPMG also conducts regular audits of the broker.

Customer Service

If you are experiencing any issues, you can contact Dukascopy through:

- Live chat

- FAQs in the help centre

- Contact form on the website to receive a response over email

- Phone one of the support hotlines. You can also request a callback

- Social media accounts on Twitter, Facebook, Weibo, LinkedIn and YouTube

When we used Dukascopy, we were able to get support with account and platform queries promptly.

Extra Features

Education & Trade Support

Dukascopy.com provides a strong education section. This includes detailed reviews offering ideas for trading and potential trade patterns as well as guides on how to conduct both fundamental and technical analysis. Additional tools include API documentation, pip and margin calculators and requirements, plus a sentiment index.

Furthermore, there is a regularly updated economic calendar showing important upcoming dates. Dukascopy includes their ratings for how impactful each event could be, previous values (if applicable), and sometimes a forecasted value.

Economic Calendar

Moreover, clients can export a historical data feed with time frames as small as one tick which can then be added as widgets to third-party sites. You may also be able to find a Python API created by third parties on sites such as GitHub that downloads historical data from Dukascopy.

A big part of the education service is the Dukascopy TV YouTube channel. Here, customers can watch regular webinars and streams such as live trading shows where you can follow an expert investor as they work through a trading session. Additionally, the channel hosts helpful training courses such as the Forex Course 101.

Community

Our experts were also pleased with the on-site community to discuss investments with other traders. This includes blogs and forums that encourage users to discuss news and different strategies. Beginners, in particular, may find it helpful to speak with other investors to find new ideas or ways to improve their strategy.

A key part of the Dukascopy community experience is the trading contest feature. These are regular competitions where traders can win cash prizes depending on the returns they generate over a given period of time.

The only major tools missing are copy trading and VPS services.

Trading Hours

Trading hours at Dukascopy depend on the market you are trading. For instance, assets in the UK can generally be traded between 7 AM and 3:30 PM (GMT) Monday to Friday. Whereas, US markets are open between 1:30 PM and 8 PM (GMT). Note that both of these times are for the Summer – during Winter, both the open and close times are an hour later.

As forex markets are global, they can be traded continuously from 9 PM Sunday evening until 9 PM the following Friday.

Should You Trade With Dukascopy?

Dukascopy is a well-regarded brokerage group that you can trust. Through either the proprietary JForex 3 or MetaTrader 4 platforms, planning out trades and opening positions is intuitive. Additionally, the wide range of markets you can open spot, leveraged or binary options trades on is attractive. It is also easy to register an account with verification possible within 15 minutes.

FAQ

Is Dukascopy A Good Or Bad Broker?

Dukascopy is a fairly good broker for traders in the UK. With a range of educational support and high-quality platforms, the broker provides a competitive trading environment with opportunities on hundreds of UK and global assets. A free demo account is also available to prospective traders, along with negative balance protection.

Is Dukascopy A True ECN Broker?

Yes, Dukascopy is a true electronic communication network (ECN) broker. It makes use of the Swiss FX Marketplace (SWFX) in addition to its FIX API to connect its client base to a number of different liquidity providers, ensuring fast trade executions.

Does Dukascopy Offer Islamic-Friendly Trading?

Dukascopy offers swap-free accounts that allow investors to trade in accordance with Sharia Law. Rather than pay interest on overnight positions, there are additional commission fees of 5 USD per million on forex and 7.5 USD per million on metals and CFDs.

Is Dukascopy A Market Maker?

No, Dukascopy is not a market maker. Through the Swiss FX Marketplace, customers’ orders are connected with those of other investors. Dukascopy does not provide both bid and ask orders for assets.

Does Dukascopy Offer A Good List Of Tradable Assets?

Dukascopy supports trading through CFDs on forex, stocks, ETFs, commodities, metals, bonds, indices and cryptocurrencies. You can also trade binary options on 18 forex pairs. The addition of binaries, in particular, means Dukascopy offers a wider range of instruments than most online brokers.

Top 3 Dukascopy Alternatives

These brokers are the most similar to Dukascopy:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Dukascopy Feature Comparison

| Dukascopy | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.6 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $100 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FINMA, JFSA, FCMC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:200 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Dukascopy Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Dukascopy | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Binary Options | Yes | No | No | No |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Dukascopy vs Other Brokers

Compare Dukascopy with any other broker by selecting the other broker below.

Popular Dukascopy comparisons: