Dsdaq Review 2025

|

|

Dsdaq is #111 in our rankings of UK brokers. |

| Top 3 alternatives to Dsdaq |

| Dsdaq Facts & Figures |

|---|

Dsdaq specialises in crypto trading through its accessible mobile app & low deposit. |

| Instruments | Cryptocurrencies, forex, indices, commodities, ETFs |

|---|---|

| Demo Account | Yes |

| Min. Deposit | 0.001 BTC/BCH/LTC |

| Mobile Apps | Yes |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Commodities |

|

| Forex | Trade on a modest collection of FX pairs. |

| GBPUSD Spread | 5.5 |

| EURUSD Spread | 2.5 |

| GBPEUR Spread | N/A |

| Assets | 7 |

| Stocks | Trade on 150 stocks at Dsdaq including Google & Tesla. |

| Cryptocurrency | Trade on a collection of crypto cross pairs with up to 1:100 leverage. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | Yes |

| Crypto Staking | No |

| Auto Market Maker | No |

Dsdaq is an online cryptocurrency exchange that offers easy digital currencies trading alongside forex and CFD speculation on a range of prominent global markets. Finding a legit broker in an unregulated space like crypto is essential, so this 2025 trading review will cover the important aspects of Dsdaq, such as safety measures, payment options, account types and trading fees.

About Dsdaq

Founded in late 2019, Dsdaq is a recent addition to the online trading industry. Based in the Cayman Islands, the Chinese firm Spring Field Holdings Limited owns the company, which has also received investment from influential crypto advocate Tim Draper.

The firm claims to act as a bridge between traditional finance and cryptocurrency due to its token collateral system that allows traders to use their crypto investments to back leveraged forex and CFD trading.

The company serves over 200,000 active traders worldwide and boasts an average daily trading volume of over £40,000,000. Due to the nature of crypto exchanges, the broker does not have any global regulations to adhere to and is not licensed by any regulatory body.

Dsdaq Coin

Like many exchanges, Dsdaq has created a proprietary governance token named Origin D or “OD”. While the company’s claims that the token is “the next Bitcoin” are as yet unfounded, the coin plays an essential role in the broker’s ecosystem.

Investors can take part in Origin D crypto mining for free by registering an account, referring friends, promoting the site or even just trading on the platform. Owning the token allows clients to earn free airdrop tokens from staking and vote on governance polls.

Those not interested in these roles can take advantage of Dsdaq’s pledge to buy back 70% of the total circulation of Origin D over the platform’s lifespan.

Markets

In addition to operating a traditional crypto exchange, the firm offers over 300 CFD instruments from several global markets such as stocks, indices and commodities.

Dsdaq Exchange

Over 60 crypto coin trading pairs are offered through the Dsdaq exchange, including ETF tokens with up to 1:3 long or short leverage. Bitcoin spreads can reach as low as 1.0 pips due to the nature of peer-to-peer exchange trading.

In addition, clients can invest in more than 20 futures contract products, such as ETH/USDT and SOL/USDT perpetual futures. Investors can utilise these instruments to take advantage of funding rate arbitrage or as pure investment vehicles.

OTC Crypto Transactions

Dsdaq allows clients to purchase digital currencies directly using fiat currency through its OTC credit and debit card system. For example, investors can buy five tokens, including Bitcoin, Ethereum and USDT using GBP at a small markup from current exchange rates.

Staking

An alternative to crypto mining for long-term investors is staking, a system in which tokens are locked into a crypto network for a set period in exchange for financial compensation. Dsdaq clients can earn up to 5.4% APY interest through staking coins such as USDT, ETH and BTC.

Forex & CFD Trading

The Dsdaq offering that sets the exchange apart from competitors is the ability to trade forex and CFDs using crypto as collateral. The broker provides over 150 major US, Asian and European stocks, 18 global ETFs, four indices, four commodities and several forex pairs for speculation.

Traders can choose between using coins held in their Dsdaq crypto account as collateral or depositing USDT onto the stock platform and trading in USD. Average spreads on EUR/USD are around 2.5 pips, quite high, even for a zero-commission service.

Leverage

As the broker has no regulations to limit the leverage it can offer clients, Dsdaq is free to set its own margin levels.

For digital currencies, the broker offers 1:3 leveraged ETF tokens long or short on selected coins. In CFD markets, clients can utilise flexible leverage between 1:10 and 1:100 on all provided instruments.

The broker makes a margin call on stock accounts when available capital falls below 150%. This is far higher than many other services due to the volatile and fast-moving nature of the crypto markets. The Dsdaq stop-out level on leveraged positions is 50%, at which point some trades will be automatically closed.

Account Types

Dsdaq provides two account types. These are the crypto exchange service, requiring a Dsdaq Global account, and CFD trading, needing a Dsdaq Stock variant.

Dsdaq Global

The Dsdaq Global account requires no initial minimum deposit, though there are no fiat base currency options like GBP. Clients can choose between the web platform and a proprietary app exclusively for crypto trading.

Dsdaq Stock

As with the Global account, there is no minimum deposit on the Dsdaq Stock account. However, clients can either use crypto balances in Bitcoin, Ethereum or other supported coins to provide trading margin or deposit USDT to the platform and trade with USD as a base currency.

Leverage of up to 1:100 is available, though access to the CFD markets is restricted to a mobile app only, with no web-based trading platform available. Additionally, no swap-free Islamic account variant is provided for clients who cannot pay overnight interest due to their religious beliefs.

Demo Account

For those who wish to preview trading with Dsdaq before committing to a live account, the broker offers a practice variant of its Stocks account. The demo account is funded with $10,000 to allow prospective clients to familiarise themselves with the platform.

Trading Platforms

Three trading platforms are available to Dsdaq users, with two providing access to the crypto exchange and one exclusively for forex and CFD trading.

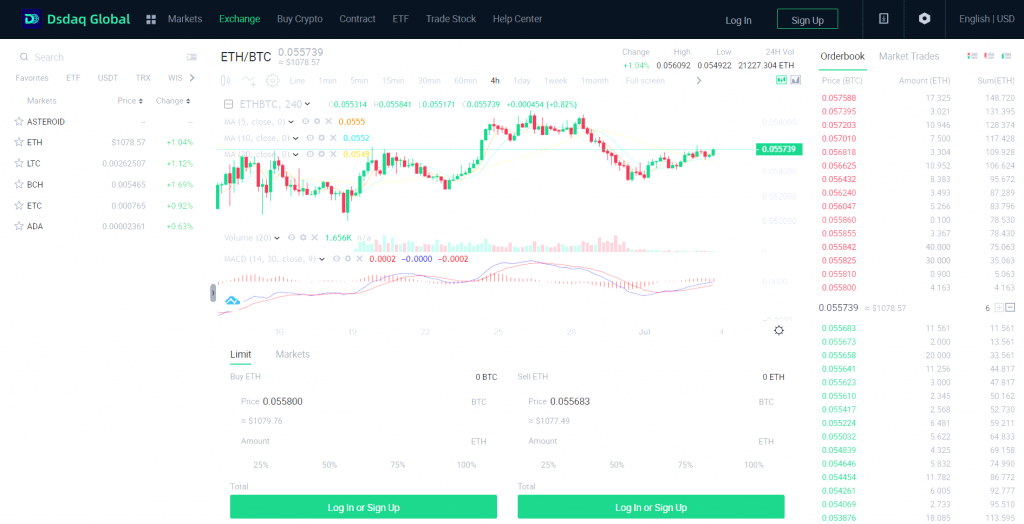

Exchange Web Platform

The Dsdaq exchange web platform allows traders to view and trade coin pairs like BTC/USDT, ETH/BTC, LTC/USDT and many more.

Graphing powered by TradingView allows clients to choose between nine time frames and seven charting types, as well as view the full order books for each asset. Technical analysis is aided by over 100 built-in indicators and logarithmic, percentage and index chart scaling options.

When exchanging crypto, users have the option of either limit or market orders, while perpetual futures markets additionally support advanced stop orders. This platform is available on the Dsdaq website as a browser-based solution.

Exchange Mobile Platform

Dsdaq investors can also download the mobile app exchange platform to manage their cryptocurrency positions on the go. However, this software is only in closed beta testing on iOS and has to be downloaded as an APK file on Android, lacking the verification and automatic updates of a fully supported app.

Stocks Mobile Platform

To trade forex and CFDs with Dsdaq, clients must use the stocks mobile platform, with no desktop or browser-based software provided for this type of speculation. Traders can utilise five time frames and five technical indicators for speedy research. However, a more capable platform is recommended for more thorough analysis.

The Dsdaq stocks trading app is available on Android and iOS devices through the respective app stores of each mobile ecosystem.

Payment Methods

Dsdaq provides crypto and fiat payment options to make transactions using the exchange platform, while the Stock account is limited to deposits and withdrawals in USDT (Tether). The minimum deposit and withdrawal amounts imposed by the broker vary depending on the asset. However, traders will be pleased to learn that these requirements start from as low as 1 USDT – roughly £0.80.

Investors can deposit any coin supported by the broker onto the exchange platform using the integrated wallet address provided to each account. Clients must fill in a short form to ensure that the broker can process the deposit quickly and accurately.

Alternatively, traders can add funds in various fiat currencies, including GBP, using the Dsdaq OTC service to receive crypto in several supported coins instantly.

Withdrawals of supported tokens from the exchange are allowed to any crypto wallet address through the web platform and mobile app.

Clients are limited to USDT as a supported currency for the stock account, with no fiat currency options. USDT funds are then converted into USD, a process that can take up to 12 hours for deposits and withdrawals.

Deposit & Withdrawal Fees

While the broker does not levy fees on crypto wallet deposits and withdrawals, transactions may be subject to network charges. These fees can often be fairly substantial on networks like Ethereum. Hence, the firm recommends adding USDT as a TRC20 or BEP20 token to avoid unnecessary costs.

For fiat deposits, a processing fee of 4.5% is applied by the payment provider MoonPay, with a minimum £3.99 charge guaranteed.

Trading Fees

Trading charges are often a priority for traders who wish to keep as much of their profits as possible. The fee structure is of even greater importance in fast-moving exchange environments such as the crypto markets.

Exchange Fees

On the Dsdaq exchange, a 0.1% fee is levied on spot crypto trading by the broker. In comparison, trading in perpetual contracts is subject to a 0.075% charge for the contract taker and 0.025% for the maker.

In late 2021, the firm announced its intention to launch a VIP program where clients can pay trading fees in Origin D tokens. However, this scheme is still in development.

Stock Fees

There are no fees for dealing in the forex and CFD markets on the Dsdaq Stock platform, with the broker earning its expenses from the substantial markup on its trading spreads. Additional charges, such as inactivity fees are not applied, though a financing fee of 0.015% per night is applied to overnight positions.

Security & Regulation

The crypto market is a largely unregulated space that is notorious for its scams, so choosing a trusted broker is vital to staying safe.

With no oversight or regulations whatsoever, Dsdaq offers no guarantees of its legitimacy. To make matters worse, its status as a relatively new player in the crypto space and some poor translations in the website text do not give the best impression to prospective clients.

There is no fund protection policy to guard against company insolvency, nor negative balance protection to prevent clients from losing more than they have staked on the forex and CFD markets.

This being said, the broker claims to keep 98% of its crypto assets in cold storage, safe from online attacks from hackers. Additionally, the broker employs two-factor authentication (2FA) on all its proprietary platforms for additional security on its client login portals and payment systems.

Customer Support

Receiving fast and efficient help can be the difference between profit and loss when encountering a trading issue. To this end, Dsdaq provides a dedicated email address with 24/7 support from several worldwide teams. However, the broker offers no live chat support or support phone number for immediate assistance.

- Email Address: help@dsdaq.com

The firm does provide an online help centre with over 50 articles that give quick solutions to common questions on areas such as using the supported payment options, trading on the Stock app and trading fees.

Educational Content

In addition to a quick overview of some crypto concepts, such as perpetual contracts in the help centre, the broker has several videos on its Dsdaq academy analysing different US equities and explaining terms such as spot trading and the difference between a coin and a token.

However, crypto newbies should look elsewhere for a more complete and holistic introduction to the market.

Advantages Of Dsdaq

- 2Fa support

- Crypto staking

- 20+ perpetual futures

- Free native token rewards

- Solid range of crypto coins

- No fees on forex and CFD trades

- Innovative token-based collateral system

Disadvantages Of Dsdaq

- Unregulated

- High CFD spreads

- No live chat support

- Relatively inexperienced

- USD only stocks account

- Limited trading platforms

Promotions

Dsdaq runs frequent promotions for its clients, rewarding actions such as high volume trading, staking and winning trading contests. These programs are open to new and existing clients and are paid out in a range of crypto tokens depending on the specific bonus scheme.

Additional Features

Many brokers offer clients additional features such as an economic calendar and VPS access to enhance their trading experience.

While Dsdaq does not provide any additional forex and CFD trading tools, the company has integrated a copy trading service for its crypto exchange. This allows clients to copy the performance of top traders automatically in exchange for a small commission on profits.

Trading Hours

The Dsdaq platforms run 24/7 alongside the continual trading of the crypto markets. However, forex and CFD instruments run on a separate, 24/5 schedule, with stocks and indices following reduced local exchange hours.

Clients can access their accounts via the web or mobile platforms at any time to make deposits and withdrawals.

Dsdaq Verdict

This Dsdaq review has found the broker to offer an innovative approach to forex and CFD trading with a solid crypto exchange platform. However, it is hard to overlook safety concerns around a completely unregulated trading company. A substantial range of crypto coins and contracts on top of OTC crypto purchase facilities may tempt some traders to the firm. However, despite implementing security measures such as two-factor authentication, it is not easy to label an unproven service like Dsdaq as a trustworthy broker.

FAQ

What Is The Dsdaq Coin?

Dsdaq’s governance token is called Origin D and is awarded to clients for actions such as trading, referring friends and promoting the broker.

Does Dsdaq Have Live Chat Support?

Unfortunately, Dsdaq does not have a live chat support feature. Instead, clients must reach out to the support team via the email address above.

Is Dsdaq Trustworthy?

A lack of regulation paired with the relative youth of the broker makes it challenging to call the company definitively safe.

What Payment Options Does Dsdaq Support?

Exchange clients can deposit and withdraw crypto tokens of all supported coins to their Dsdaq wallet or purchase crypto with GBP using the OTC purchase service. However, stock account holders can only use USDT to make payments.

Does Dsdaq Have An App?

Dsdaq provides separate apps for its Stock and Exchange services. The Stock app is available to download on Android and iOS. In contrast, mobile traders must install the Exchange app via an APK file or through the iOS Beta testing platform.

Top 3 Dsdaq Alternatives

These brokers are the most similar to Dsdaq:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Dsdaq Feature Comparison

| Dsdaq | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 0.5 | 4.8 | 4.8 | 4.7 |

| Markets | Cryptocurrencies, forex, indices, commodities, ETFs | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | 0.001 BTC/BCH/LTC | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5, cTrader | - | MT4 |

| Leverage | - | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

69% of retail CFD accounts lose money. |

||

| Review | Dsdaq Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Dsdaq | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Dsdaq vs Other Brokers

Compare Dsdaq with any other broker by selecting the other broker below.

Popular Dsdaq comparisons: