Dove Options Review 2025

|

|

Dove Options is #11 in our rankings of binary options brokers. |

| Top 3 alternatives to Dove Options |

| Dove Options Facts & Figures |

|---|

Dove Options offers binary options and copy trading. |

| Instruments | Forex, Stocks, Cryptos, Commodities |

|---|---|

| Demo Account | No |

| Min. Deposit | $500 |

| Mobile Apps | No |

| Payments | |

| Min. Trade | $1 |

| Regulated By | CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| Forex | Take leveraged positions on popular currencies. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.8 |

| Assets | 25+ |

| Stocks | Take positions on global stocks and shares, including Meta. |

| Cryptocurrency | Speculate on Bitcoin with low margin. |

| Coins |

|

| Spreads | Fixed |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | Dove Options offers multiple digital options products, including one touch and ladder assets. |

| Payout Percent | 81 |

| Ladder Options | Yes |

| Boundary Options | No |

Dove Options is a binary options provider that offers standard payouts of up to 81%. This 2025 review will cover the broker’s supported trading programs, the strategy types facilitated, minimum deposit and withdrawal requirements and any bonus promotions offered. Read on to discover if you should request a Dove Options account today.

About Dove Options

Dove Options claims to be a top binary options provider, offering high payouts and several types of BO contracts to trade with. Real-time market data for all asset groups is streamed to its proprietary trading platform live from provider Thomson Reuters.

However, there is very little information online about Dove Options, especially compared to major competitors. Firms often provide information about their daily trading volume and a detailed timeline of their journey up to now. In addition, there is no record of the firm having the CySEC licence that it claims, which is highly suspicious.

Due to these factors, this review recommends trading with a more above-board company.

Binary Options Variants

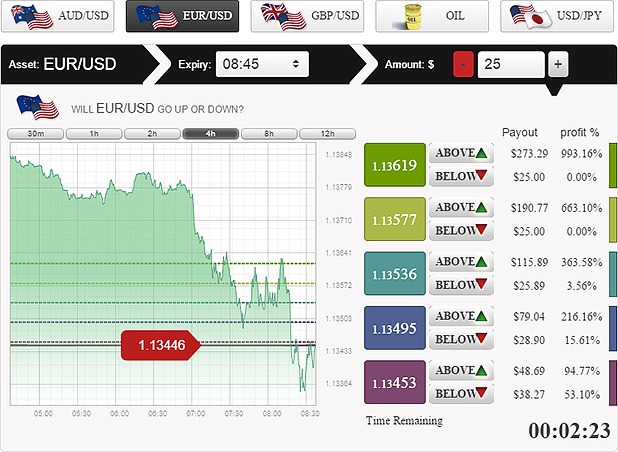

Dove Options offers four forms of binary options contract: standard, one touch, ladder and 60 seconds.

Standard binary options allow investors to select a custom expiry time and choose either call or put based on whether they believe the asset will finish above or below the current (strike) price at expiry. 60-second binary options are a rapid-fire variant suited to volatile markets and strong intraday momentum price movements.

One-touch contracts are more complex than standard binary options, as traders must predict a specific price level that an asset will reach or fall to before expiry. However, this added difficulty allows speculators to earn up to 550% payouts from this variant.

The highest payouts available to clients come from ladder contracts. This recent and innovative form of BO contract allows clients to extend or hedge their positions at five preset levels – the “rungs” on the ladder. Clients can make a whopping 1500% profit if the highest rung on the ladder is reached.

Ladder Options

Markets

There are more than 4,500 total instruments supported by Dove Options, spanning several markets. These include over 80 forex currency pairs, major global indices, top shares from the UK, USA and EMEA jurisdictions, multiple commodities and a selection of crypto assets.

Account Types

Five account types are available to prospective clients, each with its own perks and features.

Classic Account

The Dove Options Classic account is available to clients that make an initial deposit of £420 or more. This tier entitles clients to a 25% deposit match welcome bonus, the most basic level of trader education and access to a junior broker for assistance.

Bronze Account

For an initial deposit of £840 or more, Bronze account holders upgrade their welcome bonus to 35% and gain access to level two educational content. The broker also adds an hour-long one-on-one market training session, access to an executive broker and general trading signals.

Silver Account

The middle-tier account level ups the deposit match welcome bonus to 50%, entitles clients to three hours of advanced one-on-one training and adds three risk-free trades. The minimum initial deposit amount is £3,000 and the third level of educational content is also unlocked.

Gold Account

Depositing £8,400 or more when opening a Dove Options account earns investors the Gold account perks. These are a 75% deposit match bonus, five risk-free trades, personalised trading signals and seven hours of one-on-one training with a market analyst. In addition, traders gain access to level four educational content.

Platinum Account

The Platinum tier is the highest account level, including all of the broker’s perks for a £12,500+ initial deposit. Traders can claim a 100% welcome bonus and ten risk-free trades on top of unlimited one-on-one analyst training sessions. In addition, full access to the Dove Options education centre is provided.

Demo Account

Many prospective clients request a demo account before committing to a new broker to trial their trading conditions. Unfortunately, the firm does not provide a risk-free demo account for traders to practice on.

Trading Platforms

As the only interface between you and the markets, having a trading platform option that suits your needs and experience level is vital.

Dove Options provides a very basic trading platform, which lacks many of the advanced chart and analysis features required to make informed price predictions. While very beginner-friendly, extensive asset price history and trading volume are not included. Users can integrate automated trading software into the platform but a 7.6% fee is applied to all trading profits.

The platform is browser-based rather than a standalone program for Mac, Linux or Windows, which adds to its accessibility but restricts its power.

Mobile App

Many brokers are turning to mobile apps in line with the increasing popularity of trading on the go.

Dove Options does not have a mobile app for Android or iOS devices. However, limited functionality is possible by accessing the web-based platform from a mobile device.

Payment Methods

The five supported payment methods for funding a Dove Options account are debit card, credit card, wire transfer, Western Union and MoneyGram. UK investors will be pleased to learn that GBP deposits and withdrawals are fully supported.

There is a £420 minimum deposit requirement and a far more reasonable £100 minimum withdrawal amount.

The broker continues its lack of transparency by not disclosing deposit and withdrawal times. Standard industry times range from instant deposits and withdrawals through e-wallets and card payments to 3-5 working days for wire transfers.

Deposit & Withdrawal Fees

Dove Options does not levy any charges on deposits. Withdrawals made via credit and debit cards are also fee-free. This starkly contrasts the astronomical £420 wire transfer withdrawal fee.

To make matters worse, when clients create their first withdrawal, they must purchase a withdrawal permit and broker permit to unlock their account. Together, these documents cost over £1,000, which is unusual and a red flag to new clients. Many traders will rightly not accept these charges and opt for a broker without hidden fees such as these.

Trading Fees

Reducing trading fees wherever possible is a priority for many modern traders. To this end, the broker charges no commissions on trades, save for a 7.6% fee on profits made using automation tools or robots.

Spreads on forex pairs start at 0.8 pips and values for UK stocks are as low as 1.0 pips. Registered clients can access a more comprehensive price list within the trading platform.

There is no information regarding inactivity fees for dormant accounts. However, given the firm’s other hidden fees, this by no means guarantees the absence of a change.

Security & Regulation

The best way to avoid scams in the trading space is to find a well-regulated broker with advanced security measures such as two-factor authentication.

While Dove Options claims to be licenced by CySEC to operate in EMEA jurisdictions, further investigation reveals that their supposed licence number belongs to a completely unrelated firm. In effect, the broker is unregulated, with essential safety features such as fund protection programs and two-factor authentication absent.

Customer Support

The USA-based customer support team is available to contact via a form on the website or by paying a visit to their address in California. Unfortunately, no phone number is supplied to call customer service, nor can clients contact the broker on Facebook or other social media.

The lack of an FAQ section means that traders must send off a support request even when faced with simple issues such as their password not working or wanting a guide for the broker’s fees.

Educational Content

One of the main selling points of the higher account tiers is access to more comprehensive educational content. There is some free educational content on the Dove Options website, with how to trade the different types of binary options available briefly explained with example pictures.

The broker has no videos on YouTube or its website, with all content delivered in written form.

Advantages Of Dove Options

- Copy trading

- GBP base currency

- 4,500+ instruments

- Cryptocurrency trading

- Range of binary option types

- Automated trading integration

Disadvantages Of Dove Options

- No demo account

- No mobile platform

- Basic trading platform

- Limited customer service

- Unconfirmed CySEC licence

- Predatory initial withdrawal charges

Promotions

Many brokers use welcome bonuses, fee rebates or giveaways to encourage clients to sign up and trade on their platforms.

Dove Options operates a welcome bonus program where clients can receive a deposit match bonus of between 25% and 100%. While this offer sounds lucrative, claimants must wager bonus funds by 30x before they can be withdrawn as cash.

Additional Features

Additional features such as an economic calendar or profit calculator can help investors plan and execute their trading strategy effectively.

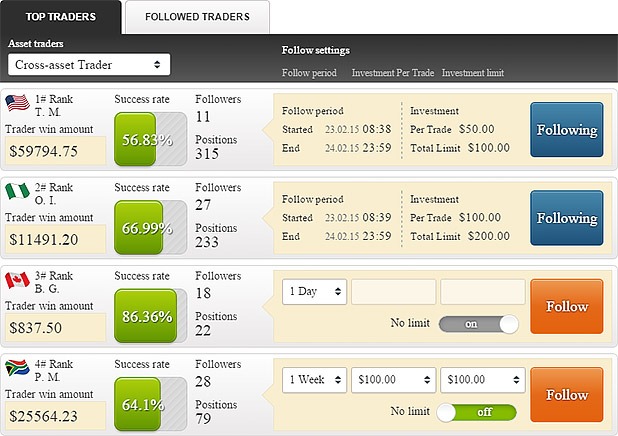

While the firm does not support either of these perks, its iFollow copy trading service allows clients to automatically emulate the trades of other traders. Through a dedicated section of the proprietary platform, users can compare the win amounts, success rate and the number of open positions of leading speculators.

iFollow Platform

Trading Hours

Dove Options allows clients to create positions at any time throughout the week. However, asset values will be far more volatile during the trading day for their specific markets.

Dove Options Verdict

Throughout this Dove Options review, we have found inconsistencies, such as with the supposed CySEC regulation and hidden fees like the £1,000+ first withdrawal charge. Despite a great range of products, copy trading and GBP account support, the broker does not seem to be fully above board, so we recommend caution when considering opening an account.

FAQ

What Is The Dove Options Maximum Payout?

Simple binary options pay up to 81%, while variants such as one touch and ladder options pay up to 550% and 1500%, respectively.

What Are The Dove Options Withdrawal Fees?

Credit and debit card withdrawals are fee-free, though wire transfer payments carry a huge £420 charge. Additionally, more than £1,000 of charges are required to make the first withdrawal through any supported method.

Does Dove Options Have A Support Phone Number?

Unfortunately, Dove Options does not supply clients with a phone number for help. The only support option is a form on the broker’s website.

What Trading Program Does Dove Options Use?

Dove Options has its own proprietary trading platform. Traders can integrate automated trading programs for a small commission per profitable trade.

Is Dove Options Part Of A Larger Group?

Very little is disclosed about the owner or operation of Dove Options, which may cause clients to be suspicious of the service.

Top 3 Dove Options Alternatives

These brokers are the most similar to Dove Options:

- World Forex - World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Grand Capital - Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

- Pocket Option - Established in 2017, Pocket Option is a binary options broker offering high/low contracts on forex, stocks, indices, commodities and cryptocurrencies. With over 100,000 active users and a global reach, the platform continues to prove popular with budding traders.

Dove Options Feature Comparison

| Dove Options | World Forex | Grand Capital | Pocket Option | |

|---|---|---|---|---|

| Rating | 1.3 | 4 | 3.9 | 4.2 |

| Markets | Forex, Stocks, Cryptos, Commodities | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options | Binary Options, Currencies, Commodities, Stocks, Indices, Cryptos |

| Minimum Deposit | $500 | $1 | $10 | $50 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | $1 |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | CySEC | SVGFSA | FinaCom | MISA |

| Bonus | - | - | - | 50% Deposit Bonus |

| Education | No | No | No | No |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Leverage | - | 1:1000 | 1:500 | - |

| Visit | ||||

| Review | Dove Options Review |

World Forex Review |

Grand Capital Review |

Pocket Option Review |

Trading Instruments Comparison

| Dove Options | World Forex | Grand Capital | Pocket Option | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | Yes | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | No | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Dove Options vs Other Brokers

Compare Dove Options with any other broker by selecting the other broker below.

Popular Dove Options comparisons: