DIF Broker Review 2025

|

|

DIF Broker is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to DIF Broker |

| DIF Broker Facts & Figures |

|---|

DIF Broker was founded in 1999, with a vision to offer personalized brokerage services via innovative technology. The broker offers services to thousands of clients in over 20 countries, and is regulated by the Portuguese CMVM. Traders can access thousands of CFD instruments to trade on a powerful proprietary platform. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, ETFs, indices, shares, energies, futures, options, bonds |

| Demo Account | Yes |

| Min. Deposit | €2000 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CMVM, CNMV |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | DIF Broker offers an impressive total of 30,000+ CFD instruments, which is far more than many brokers I review. That said, I think it's a shame that there's no additional tools or resources on offer for CFD traders. |

| Leverage | 1:30 |

| FTSE Spread | 1 |

| GBPUSD Spread | 3 |

| Oil Spread | 0.05 |

| Stocks Spread | Variable |

| Forex | I was particularly impressed to see a huge range of 180 major, minor and exotic currency pairs at DIF Broker. I was able to access sensible leverage up to 1:30 and no commission fees. Average spreads are OK but not the most competitive, coming in at around 1 pip for EUR/USD and 1.1 pip on GBP/USD. |

| GBPUSD Spread | 3 |

| EURUSD Spread | 3 |

| GBPEUR Spread | 3 |

| Assets | 180+ |

| Stocks | You can trade 1000+ OTC and CFD stocks listed on US and European exchanges. I found that experienced traders, in particular, will benefit from the lowest commission fees for trade volumes over €5000 (0.09% for German and French stock CFDs). |

DIF Broker is an online brokerage that provides UK traders with access to a wide range of markets, including forex, stocks, indices and commodities. This 2025 review seeks to establish whether you should register with this company. We will evaluate DIF Broker’s fees, payment options, customer support and more.

Our Take

- There is only one payment option, though GBP accounts and deposits are supported

- A high minimum deposit and limited educational material restrict DIF Broker’s suitability for beginners

- Our team found the broker to have responsive customer support, though a UK-specific contact method would be better

- We think this broker is best for experienced investors looking for diverse portfolios and access to less common stock exchanges

Market Access

We were most impressed by the breadth of instruments available at DIF Broker. With 30,000 assets and access to over 40 stock exchanges, this broker provides many more choices than the vast majority of competitors. There are also less widely available stock exchanges, such as the Spanish Stock Exchange, which is the umbrella group for markets in Madrid, Barcelona, Bilbao and Valencia.

The broker’s instruments include CFDs on forex, stocks, indices and ETFs, as well as access to futures, bonds and investment funds.

Our team has summarised the supported investment vehicles below:

- Bonds, including UK and US bonds

- Forex, including GBP/USD and EUR/GBP

- Metals, including XAU/USD and XAG/USD

- ETFs, including the Vanguard FTSE 100 ETF

- Indices, including the FTSE 100 and S&P 500

- Stocks, including Barclays, BAE Systems and Tesco

- Commodities, including wheat, sugar and soybeans

- Funds, including products managed by JP Morgan and Fidelity

Fees

We found trading fees at DIF Broker to be less competitive than those at other brokers, such as eToro.

Clients can expect average spreads of 2.0 pips on GBP/USD, which is fairly high. Stock fees depend on whether one trades the equity itself or a CFD, as well as varying with each underlying exchange. If taking ownership of the equity (rather than a CFD), US stocks have a 0.1% commission (minimum £8), if the price is above £16. This includes stocks that trade on the NYSE and Nasdaq. The £8 minimum commission makes this broker more expensive for low-capital traders.

Other costs may also apply, including interest on leveraged positions and currency conversion costs if the currency of the asset is different to your account’s base currency, such as GBP.

Custody fees may also apply to certain instruments.

Accounts

Our team found that UK investors can open individual, joint or corporate accounts with DIF Broker. However, within each category, only one main live account type is available. We usually prefer to see a variety of accounts, such as STP and ECN options, to allow better access for beginners and discounted fees for high-capital investors. Instead, clients at this firm must work with trading conditions that are designed to be somewhat suitable for a wide range of client types.

On a lighter note, our experts were pleased to see that GBP is available as a base currency, alongside EUR, USD and PLN. This may help UK investors to reduce currency conversion fees and gain faster, more efficient access to supported instruments.

How To Sign Up For An Account

The process of signing up for an account at DIF Broker takes around ten minutes. Although this is longer than some brokers, this firm takes its verification checks seriously and requires ID, proof of address and proof of taxpayer number (if not included in your ID). This level of integrity is reassuring. A mobile phone is also required to complete the identity verification video call.

We have listed the steps required to open a real account below.

- Click Open Account on the broker’s website

- Input your personal details and click Next

- Enter the verification code sent to your email address

- Follow the on-screen instructions and fill in the remaining information

Payment Methods

We were disappointed to see that wire transfers are the only transaction method available at DIF Broker. It is rare for brokers to only offer one payment option; many other companies offer credit/debit card options and sometimes e-wallets.

There is no cost on transfers below £100,00 and the minimum deposit limit is £1,700. I found this disappointing as it will likely exclude many beginner traders who cannot meet this requirement. Popular alternatives like CMC Markets have $0 minimum deposit.

Regulation

DIF Broker is supervised by the CMVM – the Portuguese Securities Market Commission. The role of the CMVM is to regulate securities and other financial instruments within Portugal, as well as the activities of all those who operate within these markets.

We were reassured to find that this broker is a participant in the Investor Compensation Scheme, which is linked with the CMVM and may provide compensation of up to £25,000 if the broker is not able to meet its obligations. However, our experts stress that this is £60,000 less than is available with the UK FSCS. And importantly for British traders – the firm is not regulated by the Financial Conduct Authority.

In addition to the CMVM, DIF Broker holds a license with the AFM in the Netherlands, as well as being supervised by other European regulators within their jurisdictions.

Trading Platform

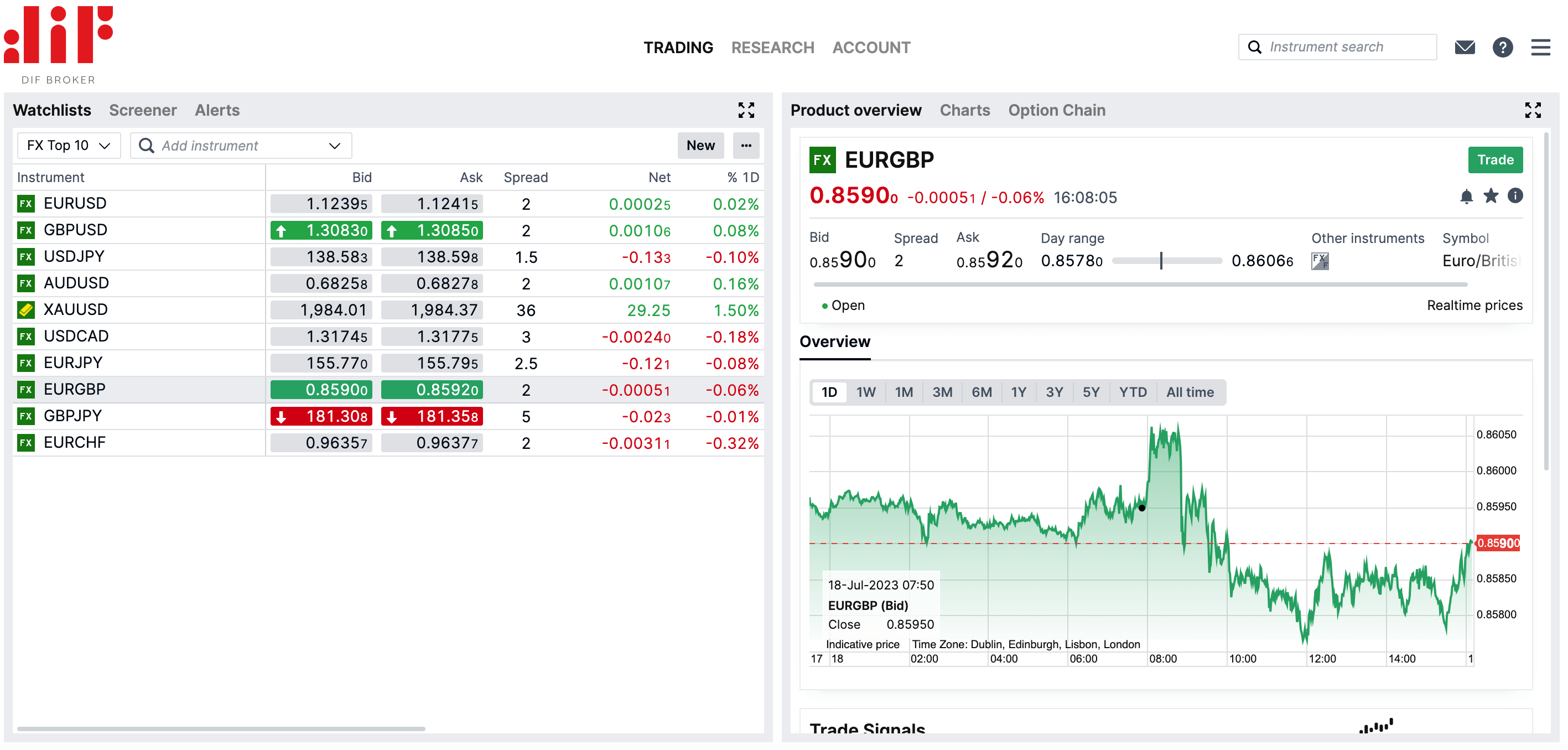

When we used DIF Broker, we found that investors only have access to a proprietary platform – external platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are not available.

Whilst we prefer to see brokers offering popular commercial packages like MetaTrader due to their advanced capabilities, we think that the proprietary platform is user-friendly and enables the use of sufficient technical analysis through its varied provision of indicators and timeframes.

The platform can be installed for free onto a Windows PC or Mac. Alternatively, those looking to avoid the need to download new software can operate it directly through a web browser.

Our team have pulled out some of their favourite features below.

- Alerts

- Intuitive layout

- Stock screening

- Nine chart types

- Custom watchlists

- Customisable timeframes

- Over 40 technical indicators

- Easy-to-use instrument search box and filter

DIF Trading Platform

How To Make A Trade

- Search for the relevant instrument

- Double-click on the instrument name or click on the bid/ask price

- Enter your desired trade details, including quantity and order type

- Click Place Order and then Confirm (a quick trade option is also available)

Mobile App

Investors wanting to trade with a live account from anywhere in the world can do so with the DIF Broker mobile app, which allows investing to take place on the go. This application can be downloaded for free from the Apple App Store and Google Play Store.

When our team trialled the app, they reported that it retains the intuitiveness of the desktop version and includes the ability to make fast trades, add instruments to watchlists and see a clear summary of your account.

Leverage

We were pleased to see investors given the option to invest using leverage at DIF Broker. Forex major pairs support up to 1:30 leverage, which is the norm for European-regulated brokers. This gives users viable scope to magnify any profits with a given amount of capital, although our experts warn that the risk of larger losses is also magnified.

Other markets and products have lower maximum leverage rates. For example, major indices like the FTSE 100 can access up to 1:20. We recommend that only confident and experienced traders use leverage due to the risk involved.

However, we were reassured that the broker has negative balance protection, which may catch most cases of debt incurred by significant volatility when investing with leverage.

Demo Account

Although demo accounts are fairly standard amongst reputable brokers, we were still pleased to see that DIF Broker provides one with up to £100,000 in virtual funds. The demo account is much quicker to access than a live account as it has a simpler registration process.

Disappointingly, our experts found that the use of the demo account is limited to just 15 days, which is a significant drawback as many like to use the demo account to practise new strategies throughout their investing journey.

Many major UK and European brokers, such as Plus500 and IG Index, offer indefinite demo accounts with customisable setups.

How To Open A Demo Account

- Navigate to the broker’s online homepage

- At the top, where it says Open your free simulation account…, fill in your details

- Click I want a demo

- Check your email inbox for login details

- Click on the link

- Enter your login details

- Follow the on-screen instructions

Bonuses Deals

We found no details of any bonuses or promotions at DIF Broker. Although this may be disappointing for those that want opportunities to earn additional trading credits and bonuses, such financial incentives at other brokers often have stringent terms and conditions attached, often locking away valid deposits until these have been met.

The lack of promotions at this broker is also not surprising given that the company is regulated in Europe and, therefore, has less regulatory freedom.

Extra Tools & Features

We were pleased to see that DIF Broker clients have access to an economic calendar and market news feed directly within the trading platform, which is updated regularly.

However, our team was unable to find any educational material, which is useful for beginners to learn the ropes and make informed investment decisions with their money. Similarly, we were unable to find a blog or forum where traders could interact with each other and provide guidance.

On a more positive note, our review of DIF Broker found that the firm offers integrated trading signals via autochartist.com, which means that those who lack experience or time can follow the positions and advice of seasoned traders.

Company Details & History

DIF Broker was founded in Portugal in 1999 and expanded to Spain in 2004 and Poland in 2009. Since 2016, the broker has acquired Saxo Bank’s subsidiary in Uruguay and become part of BiG – Banco de Investimento Global. BiG is a financial services institution and member of Euronext.

The broker has won multiple awards and claims that it is focused on innovation and personalised service.

Pedro Lino is DIF Broker’s CEO.

Customer Service

DIF Broker offers both email and telephone customer support options, although we were disappointed to see that there is no UK phone number. UK-based companies like XM and FXCM have helpful and responsive, English-speaking customer service options tailored to UK clients.

We tested the email address twice and received prompt responses on both occasions. The customer support advisor helpfully answered all our queries.

- Telephone – +351 211 201 595

- Email – suporte@difbroker.com

In addition to the options above, there is a chat service within the trading platform. The broker also has social media accounts, although much of the information is dated.

DIF Broker has YouTube channels but none are in English.

Trading Hours

Trading hours at DIF Broker depend on the instrument and market in question. Check online to see if the market is open before you attempt to open or close a position.

Remember that some markets are more liquid at certain times of the day, so take this into account in any strategies.

Safety

Whilst we expect robust encryption measures from reputable brokers, no details are provided by DIF Broker as to their protocols. However, the brokerage has a long history and our experts could find no details of any hacks or leaks affecting this broker. Nevertheless, we prefer firms that clearly outline their security features so investors can be confident that their money and data are safe.

One security feature we did identify was automatic logouts from the trading platform.

Should You Trade With DIF Broker?

We think DIF Broker is quite a good broker, providing access to an excellent range of instruments and supporting UK investors via GBP accounts and British equity products. We also found the customer support to be responsive and the broker’s relatively long history to be reassuring.

However, our experts stress that there are some notable drawbacks, such as the limited range of payment options and the total lack of educational material. We also think that the high minimum deposit will be a problem for many beginners.

Overall, we feel that DIF Broker offers a decent service to those with some experience that are looking for a very diverse range of assets, though most would be better off with a top UK broker.

FAQ

Is DIF Broker Regulated?

DIF Broker is regulated by CMVM, which is a Portuguese authority. The broker is also a participant in the Investor Compensation Scheme, which operates jointly with the CMVM. Other regulators also supervise and/or license this broker in further jurisdictions.

On the negative side, the broker is not regulated by the UK Financial Conduct Authority (FCA).

Does DIF Broker Have A Demo Account?

Yes. DIF Broker has a free demo account that offers a virtual balance of £100,000. However, its use is disappointingly limited to 15 days, which we find restrictive, holding clients back from the opportunity to develop new strategies.

Is DIF Broker Legit And Safe?

DIF Broker has a relatively long track record, dating back to 1999, and is regulated in Europe. However, we were disappointed by the lack of detail about any security measures it has implemented.

Is DIF Broker A Good Broker For UK Investors?

DIF Broker has an excellent range of instruments, good customer support and a trading signals service. However, it limits users to a simple proprietary platform, it supports only one payment method and its fees are higher in many markets than at most UK brokers.

Is DIF Broker Accessible To Beginners?

Although DIF Broker has a demo account, it has a high minimum deposit and we did not find any educational materials, which is particularly disappointing when compared to brokers like DEGIRO, which have extensive learning resources.

Therefore, we do not believe this broker is particularly suitable for beginners.

Article Sources

Top 3 DIF Broker Alternatives

These brokers are the most similar to DIF Broker:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

DIF Broker Feature Comparison

| DIF Broker | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3 | 4.7 | 4 | 4.3 |

| Markets | Forex, CFDs, ETFs, indices, shares, energies, futures, options, bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | €2000 | $0 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CMVM, CNMV | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5 | - |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | DIF Broker Review |

IG Index Review |

Swissquote Review |

Interactive Brokers Review |

Trading Instruments Comparison

| DIF Broker | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

DIF Broker vs Other Brokers

Compare DIF Broker with any other broker by selecting the other broker below.

Popular DIF Broker comparisons: